Another Mixed Start For Energy Markets With RBOB Gasoline Down And ULSD Ticking Higher

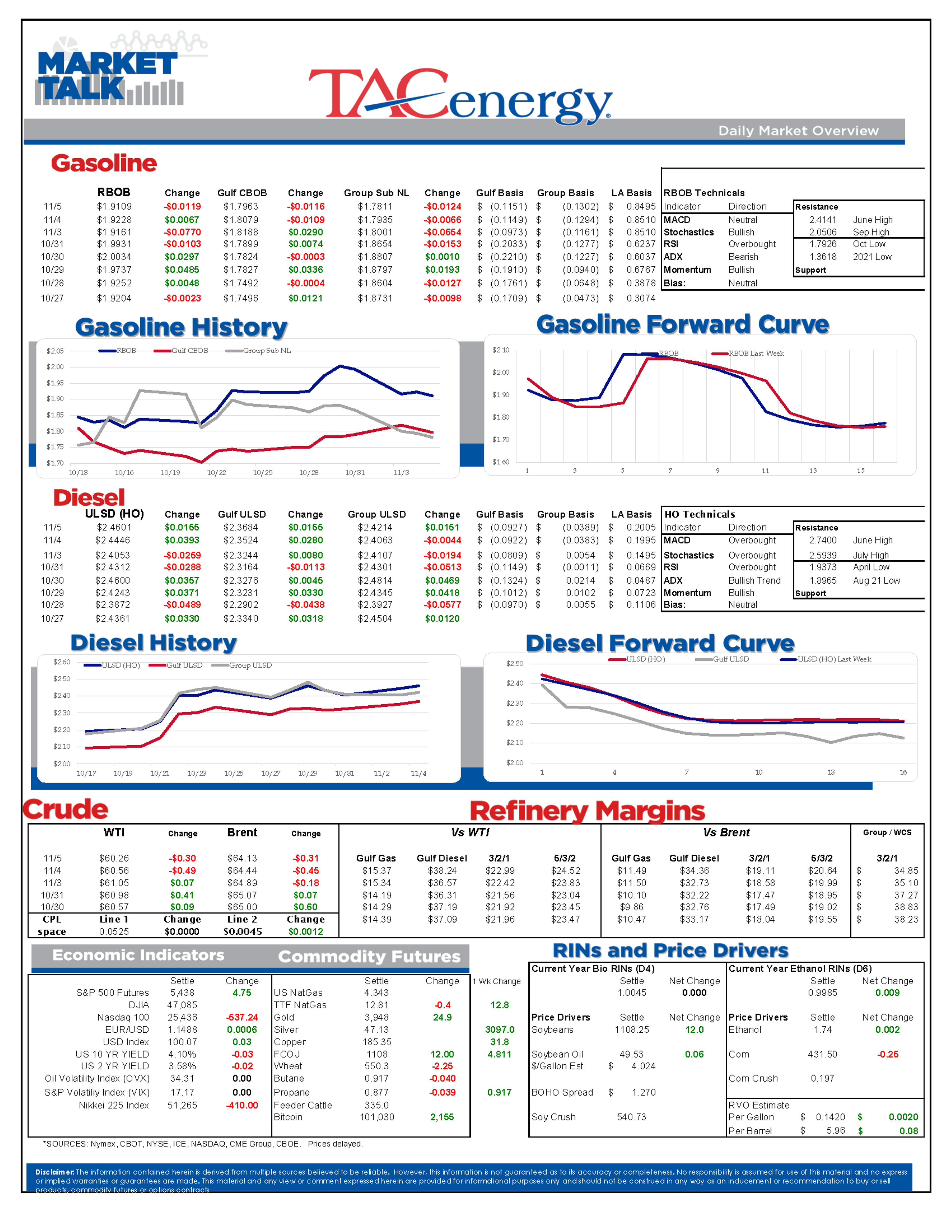

It’s another mixed start for energy markets Wednesday after a wave of selling Tuesday morning gave way to buying in the afternoon. So far this morning, RBOB gasoline futures are once again trying to lead the complex lower, and WTI prices have survived another test of support near $60, while ULSD futures are trying to continue their march higher.

The API estimated draws in refined product inventories last week while crude oil stocks built, both of which are a bit counter seasonal as we’d expect refiners to be ramping up their output after fall maintenance. Gasoline stocks were estimated to drop by 5.65 million barrels last week and diesel stocks were said to drop by 2.45 million barrels while crude oil stocks increased by 6.5 million barrels. The DOE’s weekly report is still due out at its normal time this morning despite the government shutdown as the agency continues to say it will release reports until further notice.

A Reuters report says that Russia’s Tuapse oil export facility on the Black Sea which has the capacity to handle around 150mb/day of petroleum shipments has been shuttered after attacks on the facility over the weekend, along with the neighboring refinery that has a capacity of around 240mb/day. Meanwhile, Gunvor’s CEO said that “record amounts” of oil stored on tankers at sea are both helping to alleviate supply pressures from recent sanctions, while those sanctions are also complicating the delivery of vessels with ties to Russia and Iran.

One noteworthy item from yesterday’s election for energy markets: Democrats taking the governor positions in New Jersey and Virginia likely means those states will be part of the Regional Green House Gas Initiative (RGGI) program, which is a Cap & Trade style program that focuses on electricity production in the Northeastern U.S., and has come under heavy fire recently on both a state and federal level.

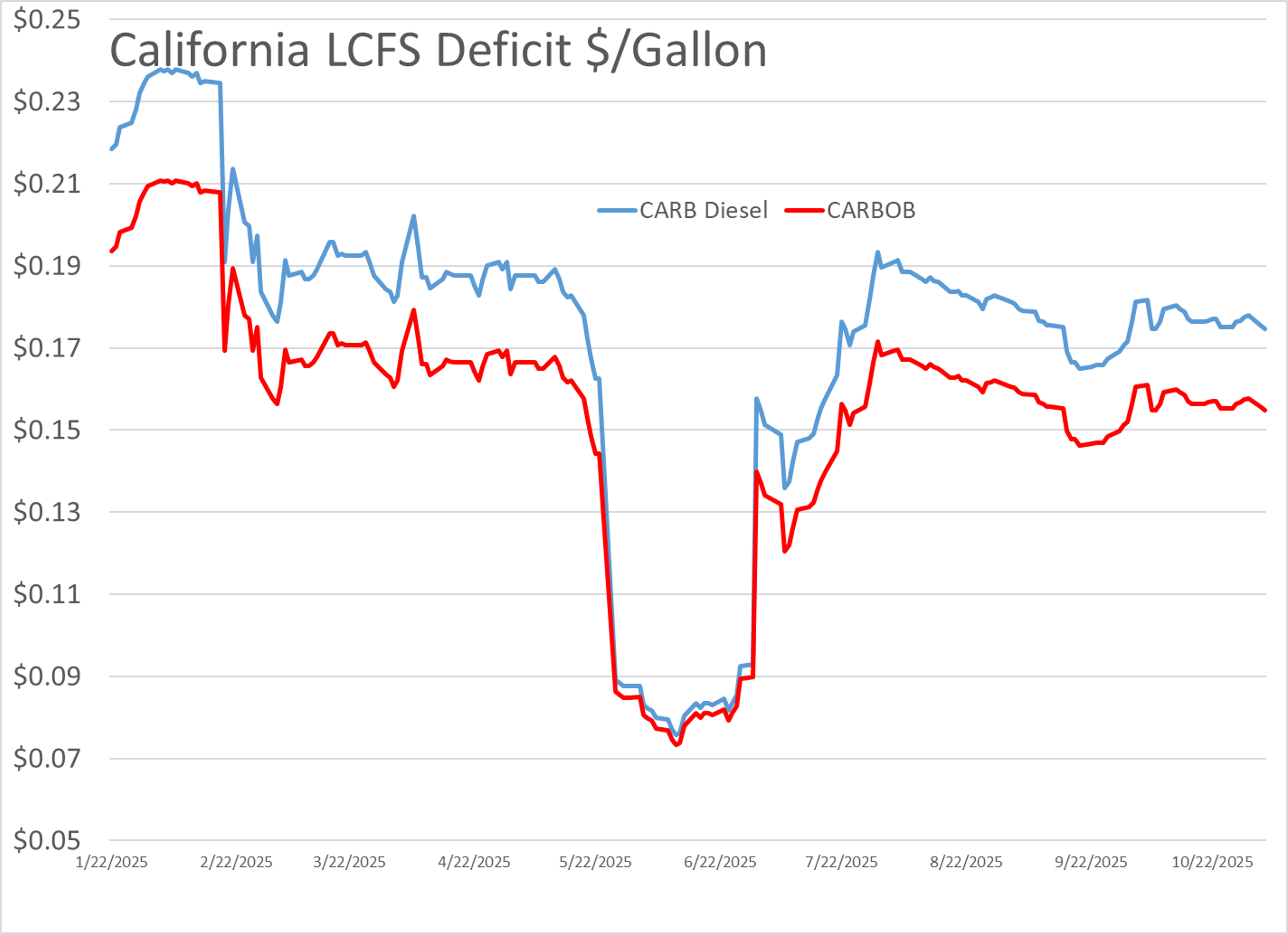

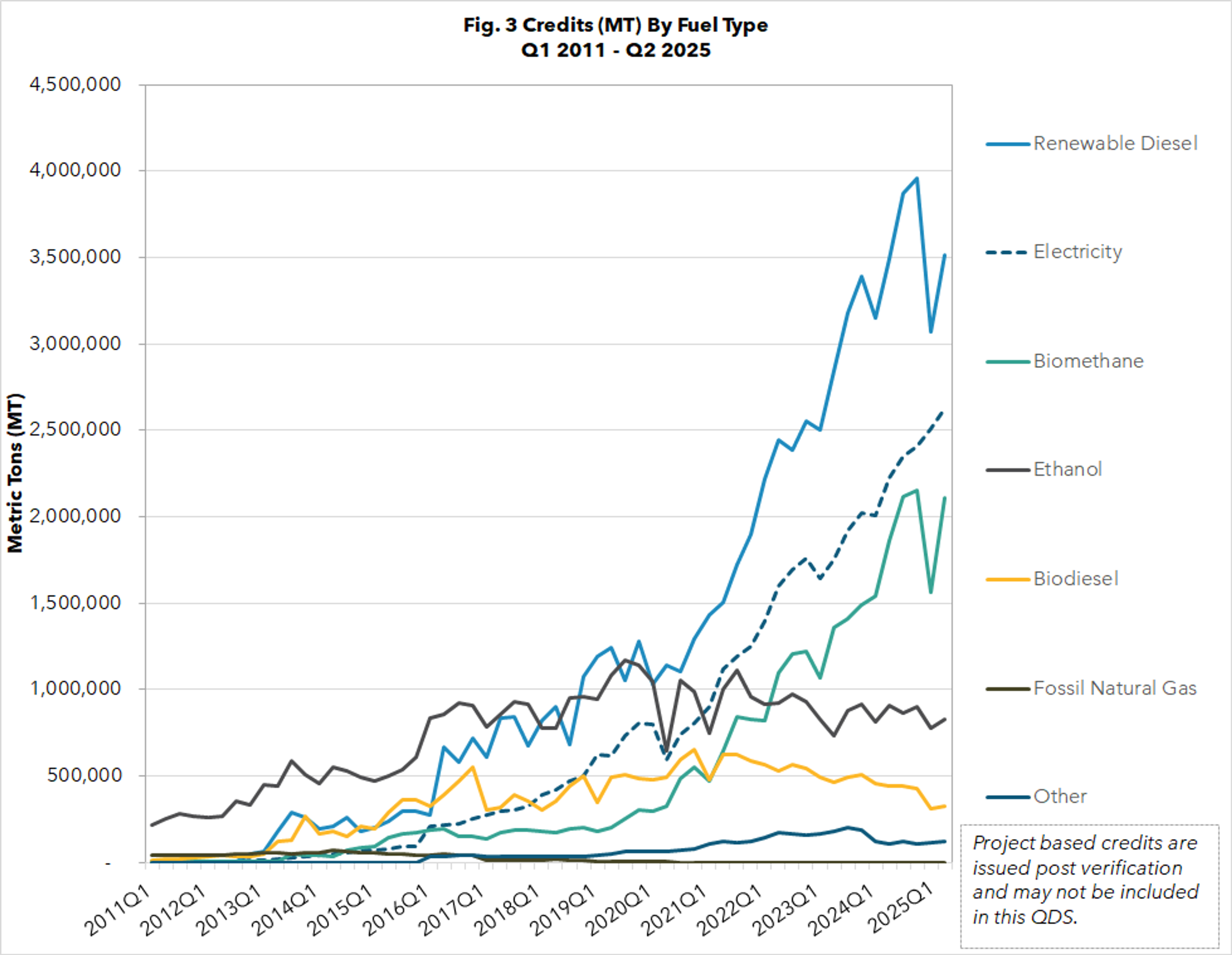

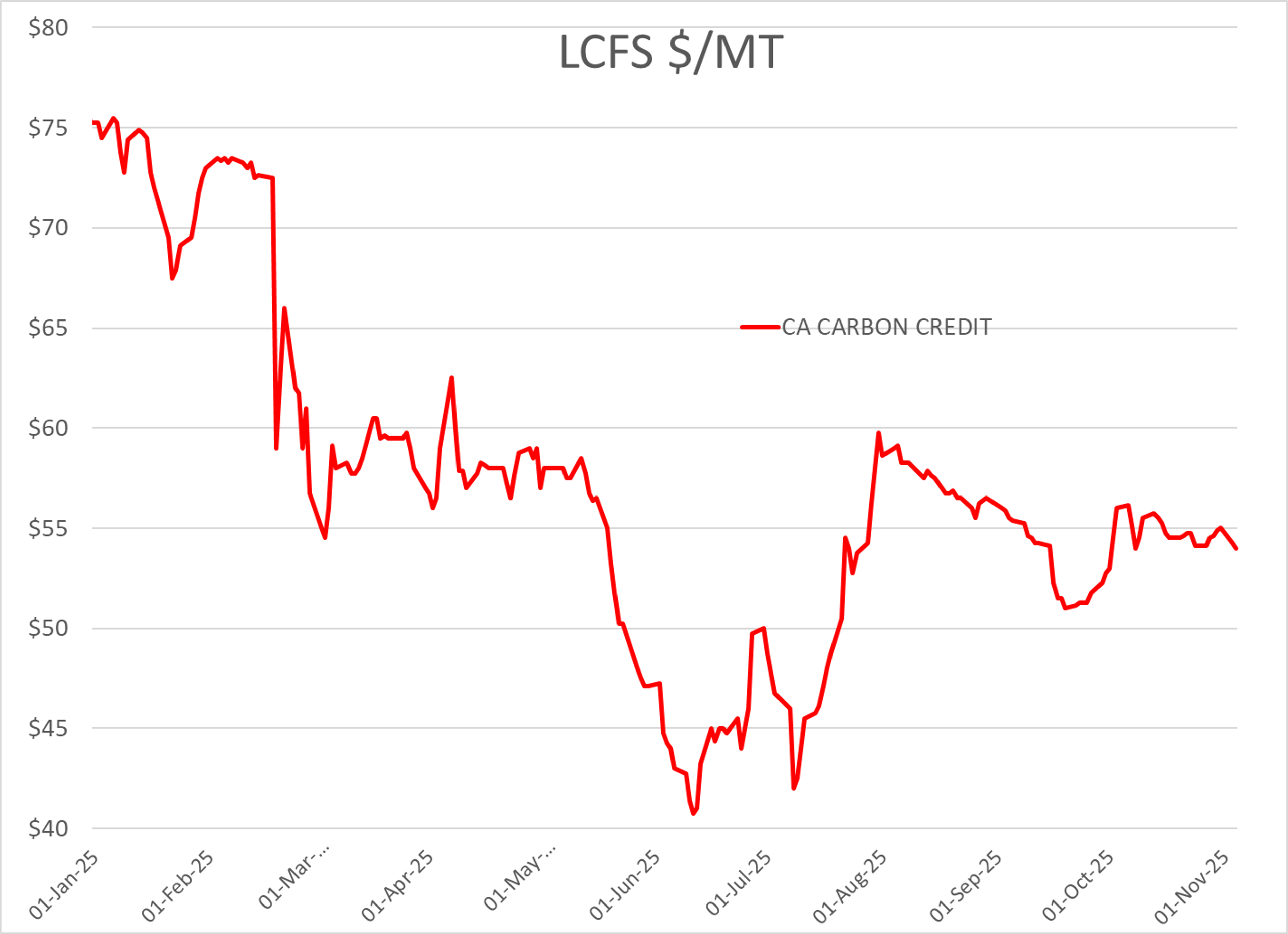

Last week California’s Air Resources Board (CARB) published its data on the state’s Low Carbon Fuel Standard (LCFS) program for Q2, which was the last quarter before the program’s more stringent rules took effect. The excess credits generated during the quarter continued to climb to a record high as Renewable Diesel, Electricity and Biomethane production all increased, offsetting a record amount of deficits created, which was partially driven by a shift back to traditional diesel by many consumers as RD became scarce and prohibitively expensive. LCFS credit values have slumped around 2% following that report, and are trading around $54/MT, which equates to roughly a 16 cent tax on gasoline sales and an 18 cent tax on diesel sales in the state.

Par Pacific reported record net earnings during Q3, more than half of which was caused by a huge gain of $200 million following the EPA’s small refinery exemption ruling for the 2019-2024 compliance years. The company also noted it is still on pace to complete construction of their renewable fuels unit at their Hawaii refinery by the end of the year.

Suncor reported strong refining earnings as its U.S. and Canadian facilities combined to hit record throughput rates while margins nearly doubled from a year ago. No mention was made of the challenges being made by environmental groups against its refinery outside of Denver or the recent settlement made with Colorado officials to keep the refinery operating in the report.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets