Mixed Bag To Kick Off Halloween Trading In Energy Markets

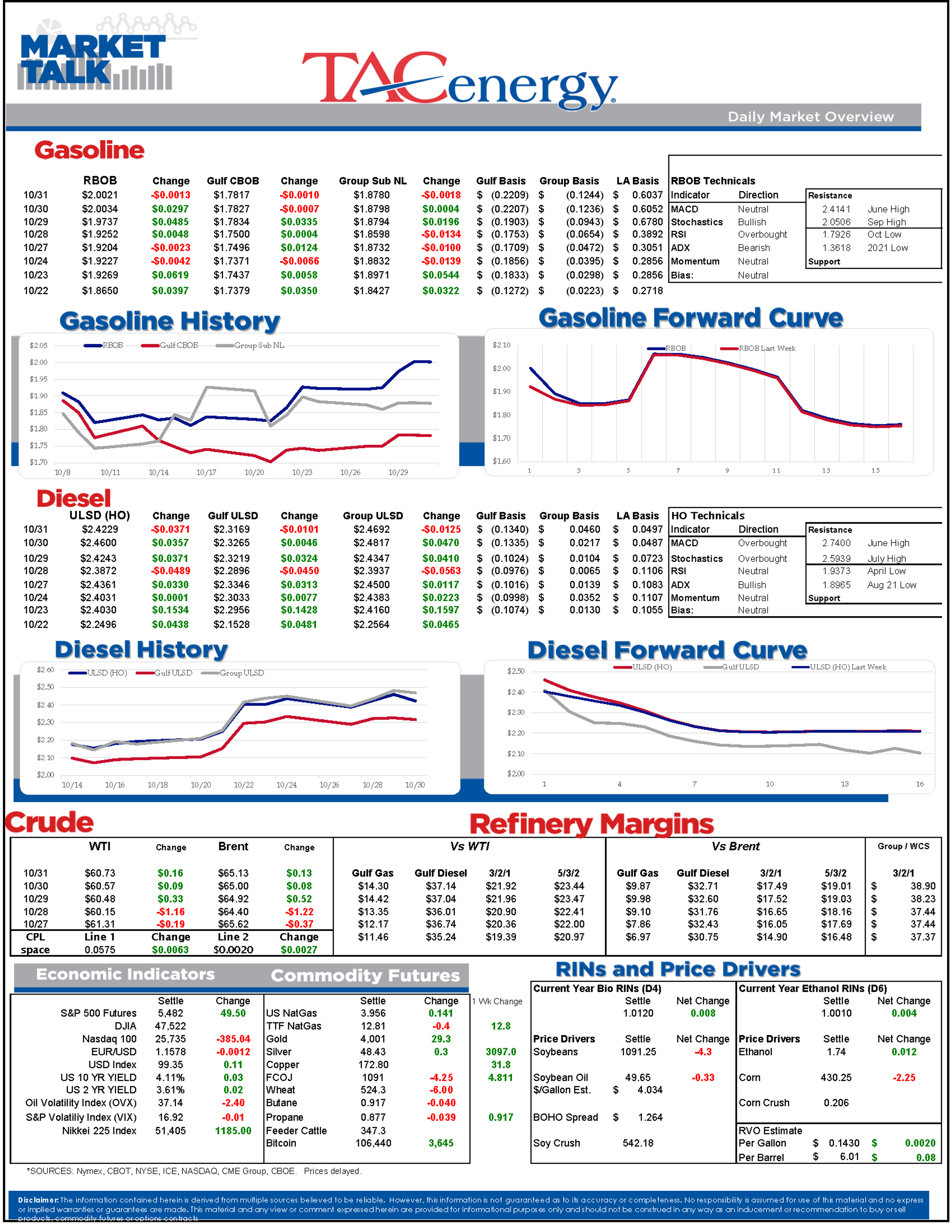

It’s a mixed bag to kick off Halloween trading in energy markets with WTI trading modestly higher, ULSD prices moving lower and RBOB gasoline futures bouncing back and forth across the breakeven line.

Today is expiration day for November RBOB and ULSD futures and in early trading the November diesel contract has decoupled from the rest of the complex, trading down nearly 4 cents/gallon while the December contract is down less than a penny. For the NYH and Group 3 markets that haven’t already rolled to pricing against December contracts, be sure to watch the RBZ and HOZ prices for direction today.

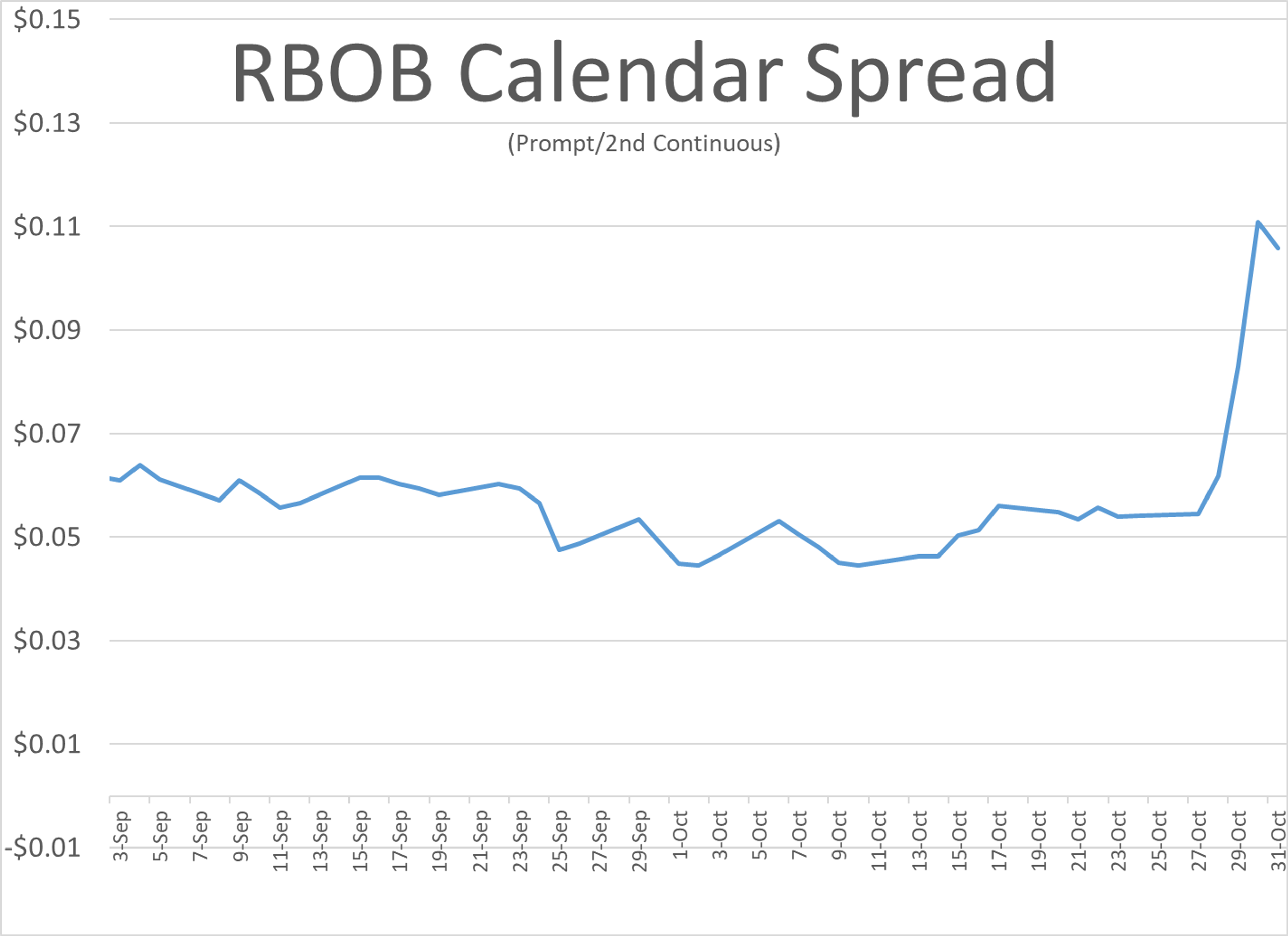

Heavy rains and strong winds continue to disrupt vessel movement in and around NY Harbor, causing multiple terminals in the region to restrict allocations to try and avoid outages. That phenomenon also seems to have contributed to a rapid strengthening in time spreads for RBOB with the expiring November contract trading some 11 cents above its December counterpart that will take the prompt role on Monday and is helping keep values for linespace on Colonial’s main gasoline line north of a nickel/gallon.

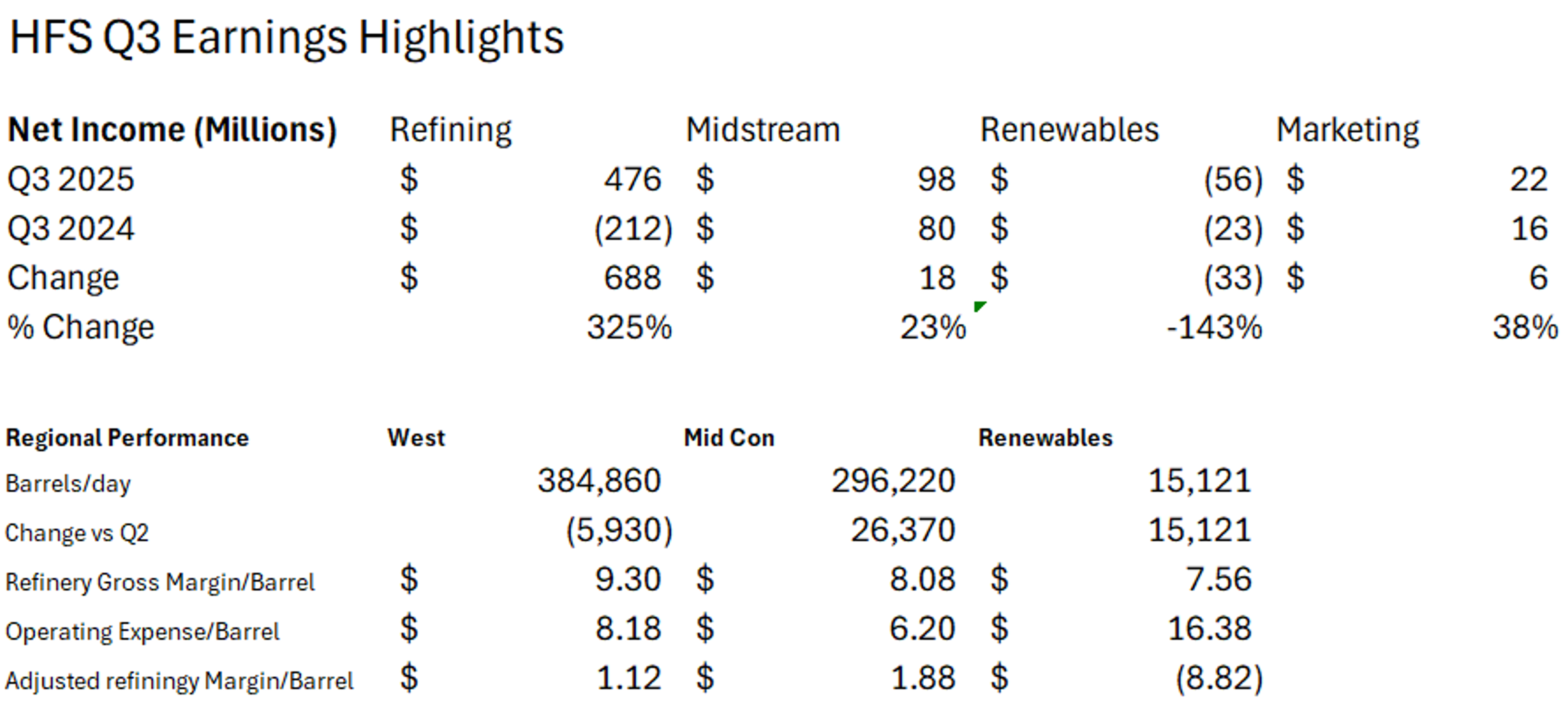

HF Sinclair released its Q3 earnings, a day after it announced it was joining the parade of U.S. companies considering pipeline expansion projects to push more barrels West. The company followed the trend of showing much improved traditional refining results compared to a year ago, while its renewables segment continued to lose money. HFS noted a large benefit from the recent granting of small refinery waivers that relieved its RIN obligations.

Another one bites the dust. CVR highlighted a huge benefit of $471 million during the quarter from the small refinery exemption approvals as it was able to erase most of its RFS obligation. The removal of that obligation also reduces the need for the company to continue producing renewable fuels at a loss, and the company announced plans to revert the converted Renewable Diesel Unit at is Wynnewood facility to traditional diesel production.

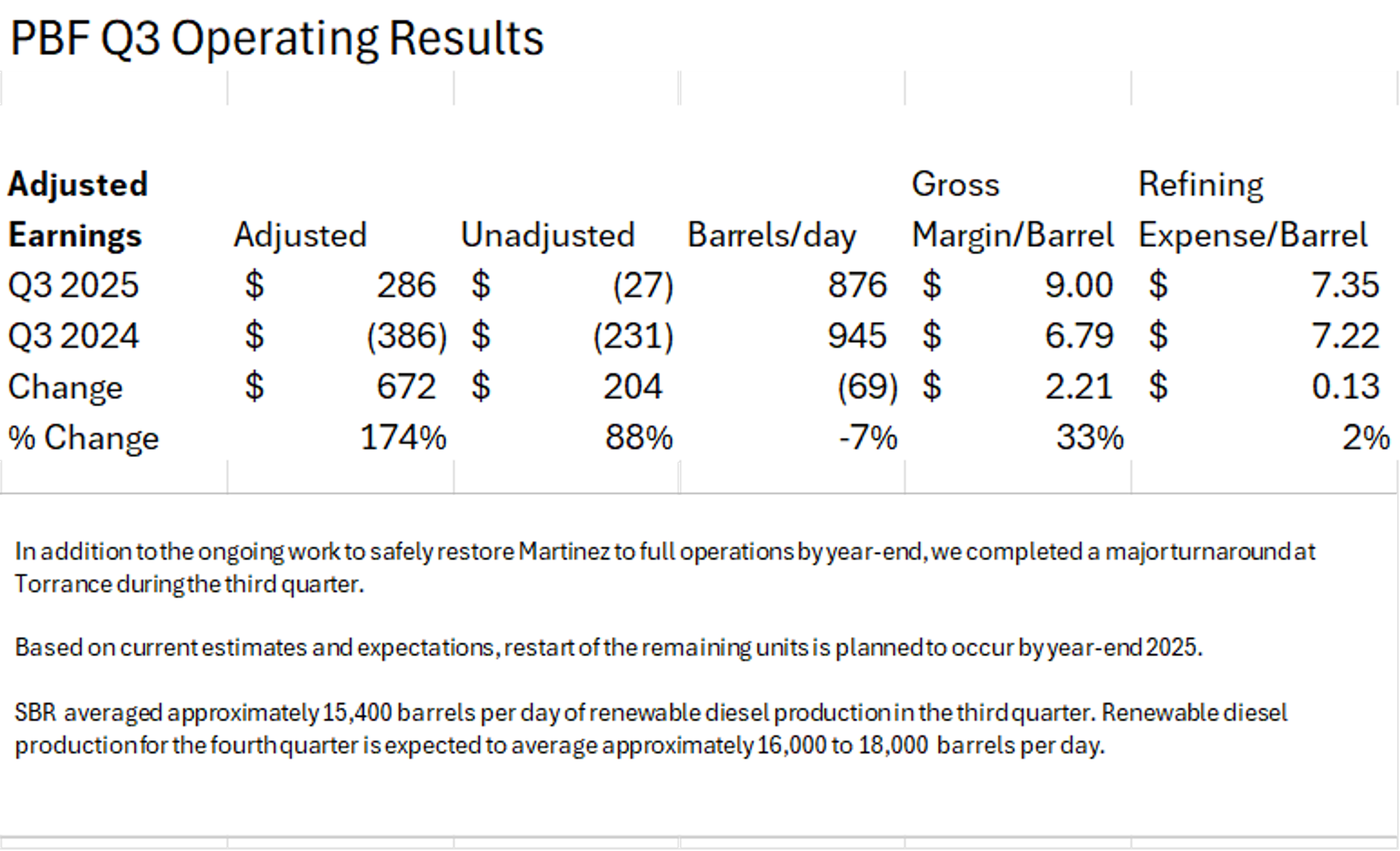

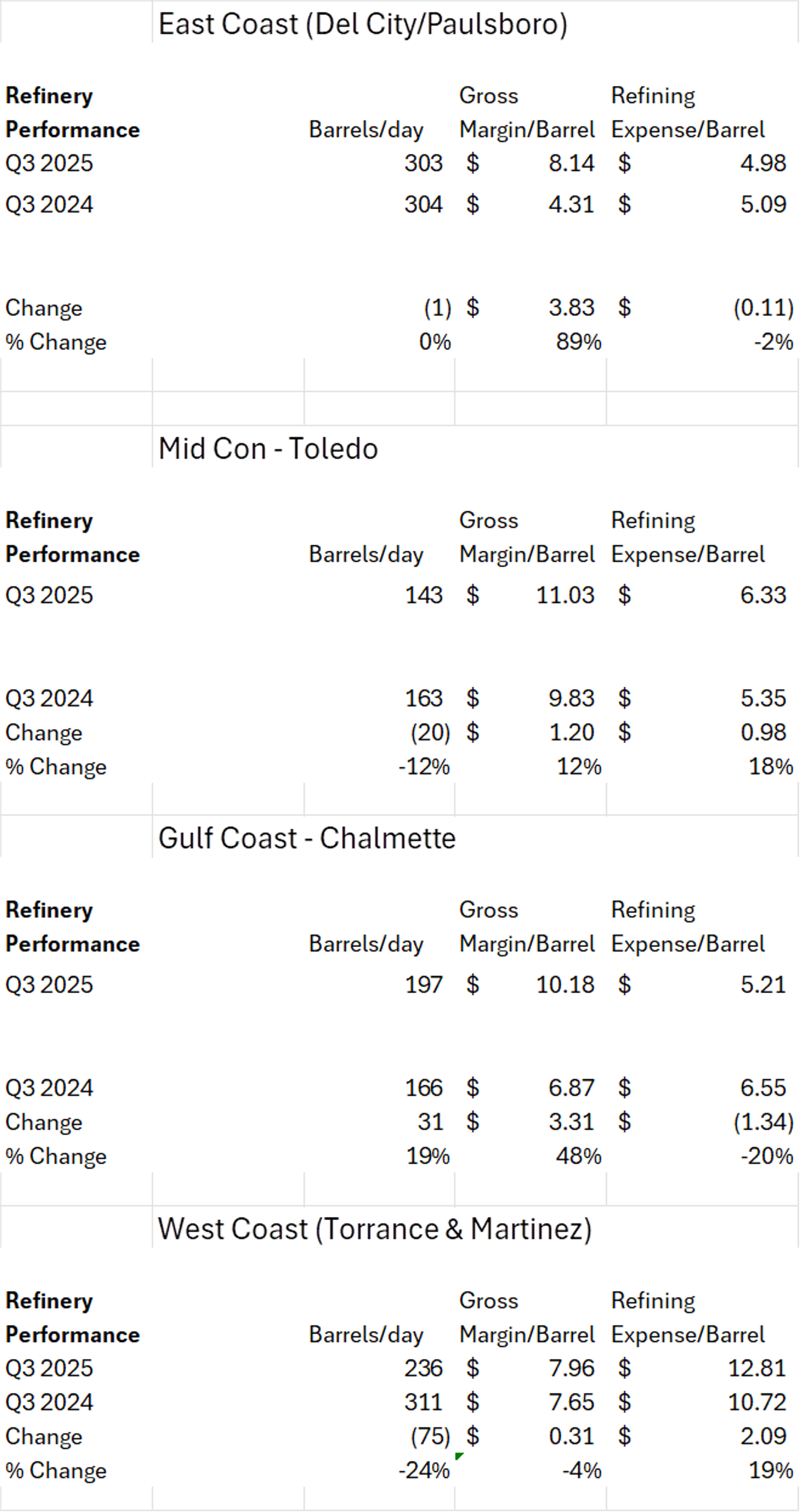

PBF announced positive earnings in its latest quarterly filing, aided by a $250 million insurance payout and a $94 million gain on the sale of its terminal assets. Without those items, the company would still have had an operating loss but is in better shape than a year ago. Despite the challenging margin environment for renewables, the company said it plans to increase rates slightly to 15mb/day at its SBR JV facility during Q4.

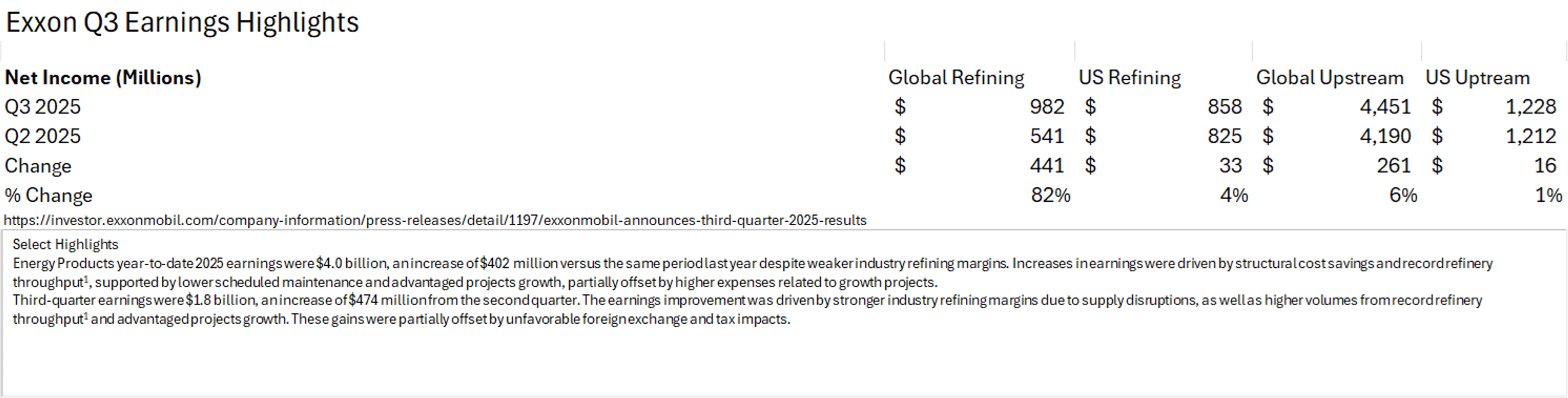

Exxon highlighted record refinery throughput rates in Q3, which was another solid quarter for the company despite lower oil prices. See tables below for more detail.

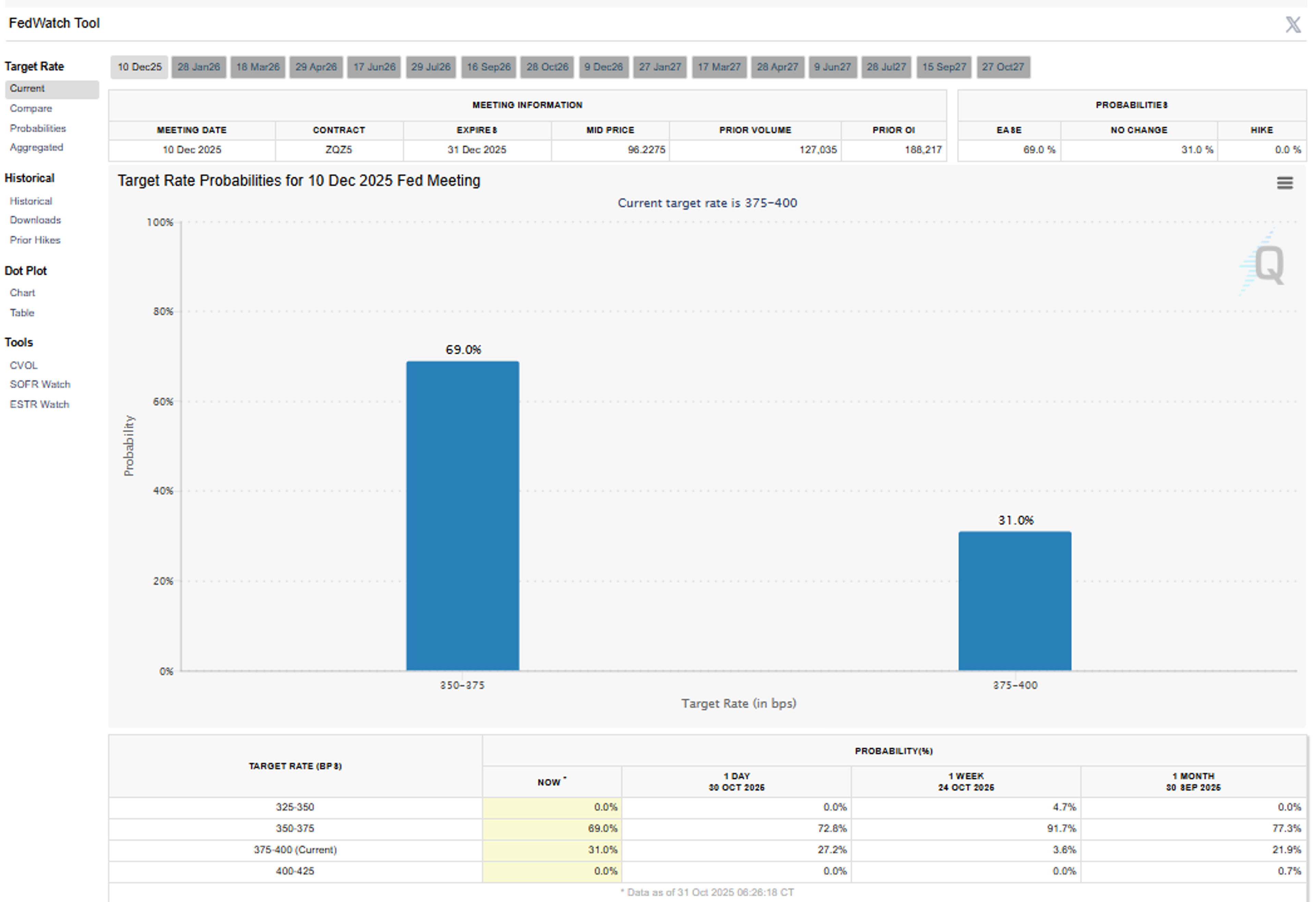

A day after the FED’s latest announcement, the CME’s Fedwatch tool shows that 69% of bettors believe the FOMC will make another rate cut in December, but that’s down from 96% odds a week ago as it appears the U.S. and other central banks are converging in more neutral territory on interest rates.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets