Diesel And Gasoline Futures Sink Amid Global Supply Surplus

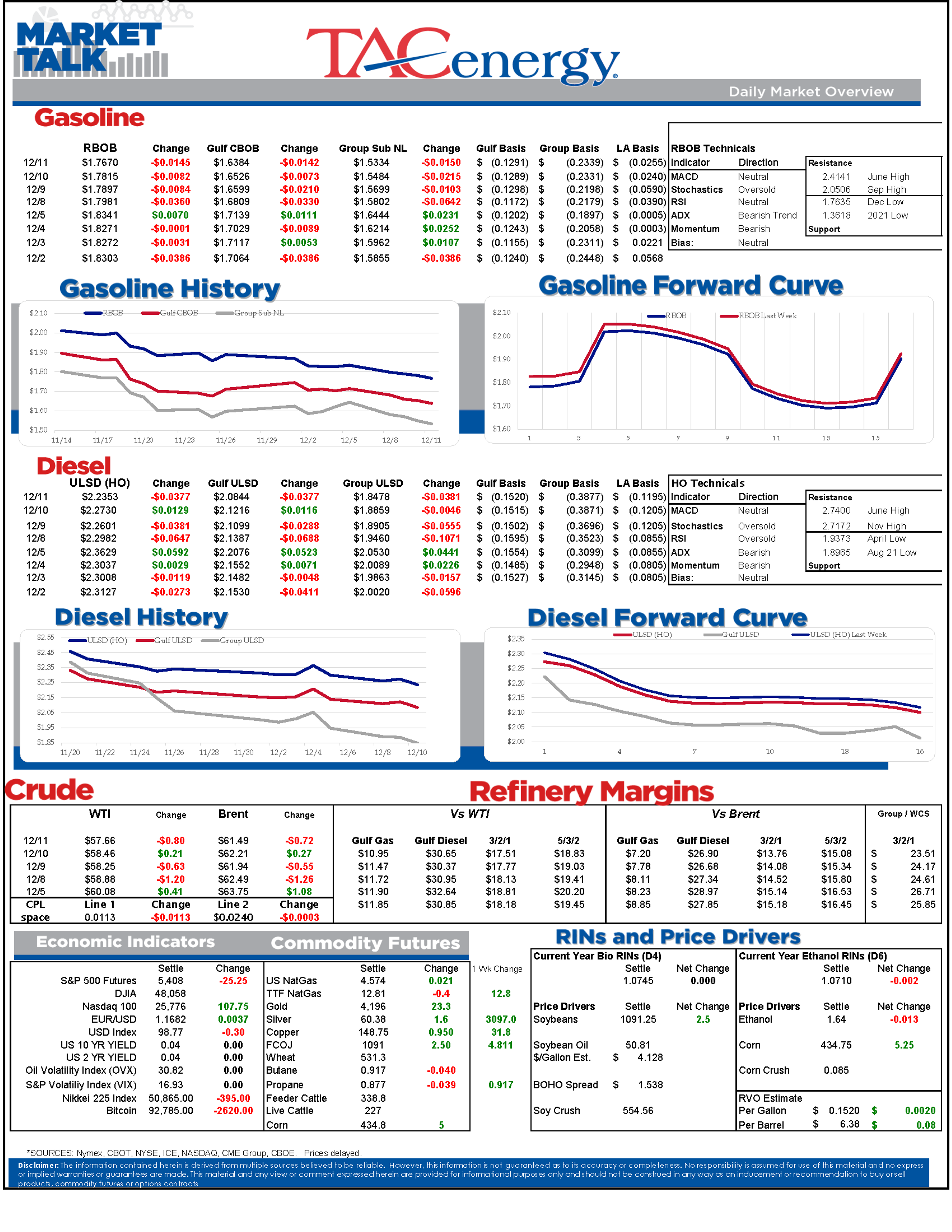

Energy markets are sliding again Wednesday as an excess of supply apparently is enough to outweigh geopolitical concerns for the time being. ULSD futures are once again leading the slide, down nearly 4 cents on the day and reaching their lowest levels since the sanctions against Russia’s Lukoil roiled markets 2 months ago, while RBOB gasoline futures are down just over a penny, hitting their lowest levels since February 2021 for a 2nd straight day.

Multiple reports in recent weeks are highlighting the huge buildup of oil at sea as sanctions make buyers for oil from Russia, Iran and Venezuela more scarce. India and China remain the big winners of the distressed supply with Indian imports set to reach a 6 month high, while China is using the opportunity to fill its SPR at attractive values.

The U.S. stepped up its attacks on Venezuela Wednesday, seizing an oil tanker it said was contributing to the country’s terrorism. Given the excess barrels already at sea having a hard time finding buyers, the loss of this supply isn’t going to create any sort of shortage.

Meanwhile, another Ukrainian drone attack reportedly hit another Russian oil tanker in the Black Sea, and a Russian oil rig was forced to halt operations in the Caspian sea due to a drone strike.

Accident or sabotage? An oil spill was reported near the 230mb/day PCK refinery in Germany which is majority owned by Russia’s Rosneft.

Notes from the DOE’s weekly status report:

Despite a boost in imports, crude slid last week with demand kicking up to a seasonal 5-year high. All PADDs except 4 are below average, leaving total U.S. crude stocks ~4 million barrels over the low mark set a year ago. When accounting for the SPR barrels that are slowly, but surely, being replenished, we’re about 24 million barrels over year ago levels, although still well below average.

Total U.S. refinery runs netted to a slight decline, although at a fresh seasonal high, while larger moves occurred at the PADD level. Healthy increases in PADDs 2 (seasonally high) and 5 (seasonally low) were wiped out by an equivalent drop in PADD 3, although Gulf Coast runs are still just ahead of last year’s chart-topping rates. Less significant increases in PADDs 1 & 2, both of which are already well above average, with PADD 1 continuing its two-month run of unusually high rates helped push total utilization to a seasonal high at 94.5%.

Diesel demand increased substantially, but a big drop in exports coupled with increased production helped turn the would-be draw into a 2.5-million-barrel build. Inventories increased significantly in PADDs 2 & 4, but changes were mild elsewhere leaving total U.S. diesel stocks wedged between the two previous years that make up the lower bands of the chart.

Across the board builds led to a 5th straight week of increased gasoline stocks. All PADDs posted strong increases but PADD 1 is still running under its 5-year range. PADD 2 showed the largest increase, jumping from the bottom of its chart to within a million barrels of average, along with PADD 5 where inventories continue running just below their 5-year average. PADDs 3 & 4 though, moved from already high levels to fresh seasonal 5-year highs to help push total U.S. stocks back into the low end of their 5-year range after spending the past 4 weeks below.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets