Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

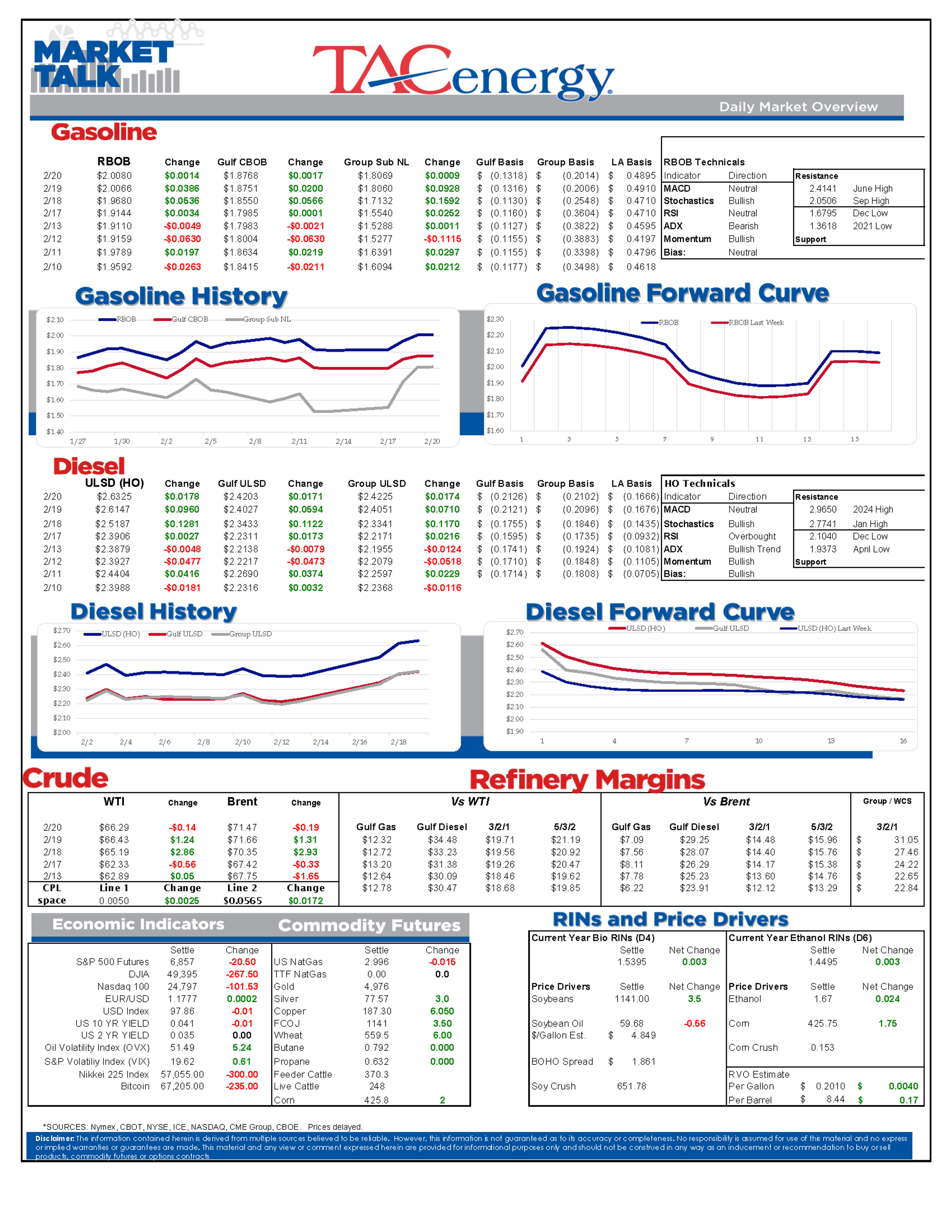

Energy markets are holding relatively steady Friday after a huge 2 day rally at the U.S. once again takes the si vis pacem, para bellum approach to diplomacy with Iran.

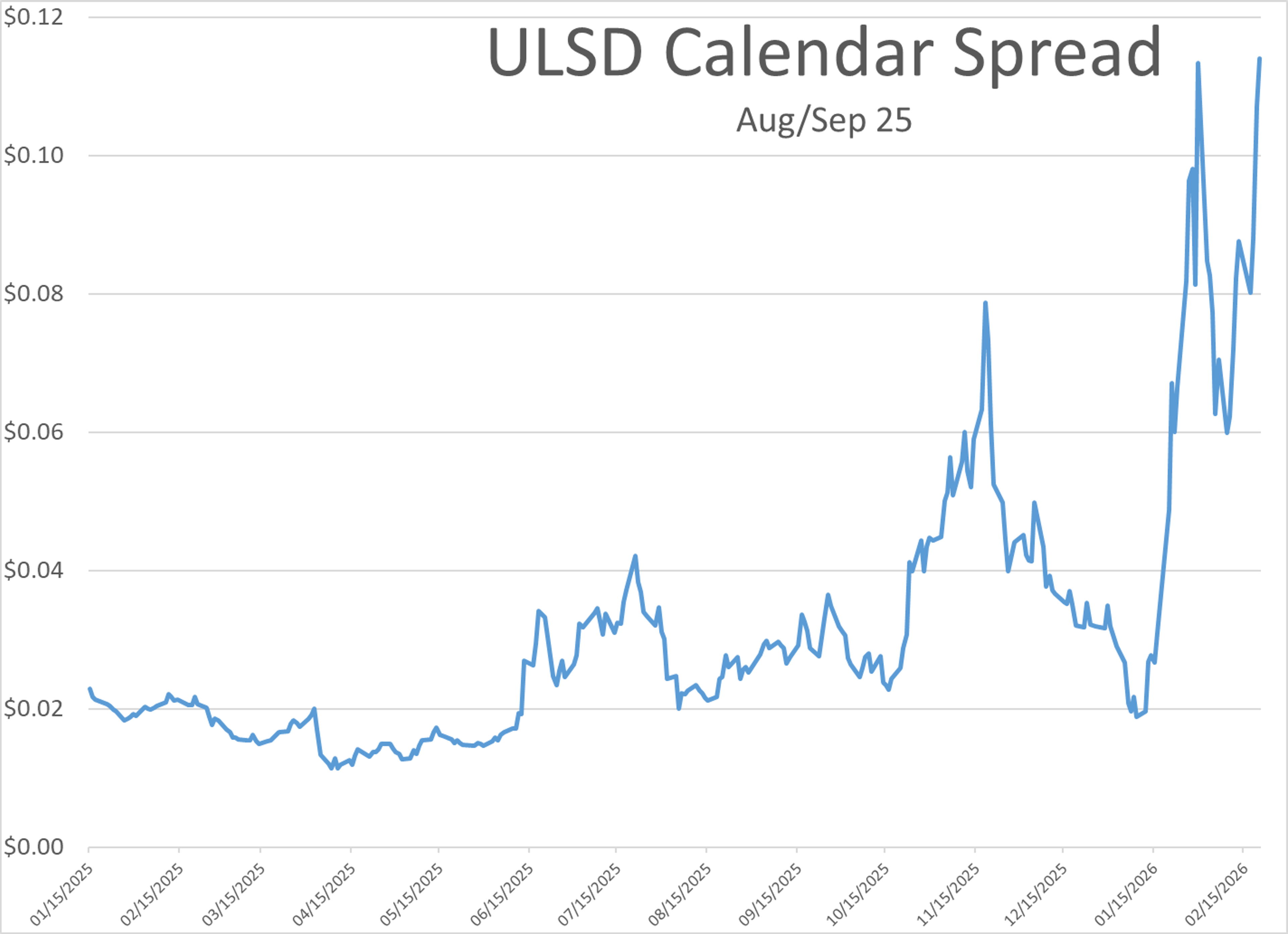

Diesel futures continue to lead the move higher, up 2 cents for the day and 24 cents for the week, with yesterday’s DOE report lending support to stronger spreads as the East Coast continues to struggle with tight supplies after the huge demand spike to start the year on top of the conflict concerns.

While oil shipments through the Strait of Hormuz are well documented, it’s also worth noting that Kuwait’s 615mb/day Al Zour refinery is on the wrong side of the channel if there is a disruption. That facility became a major player in European diesel imports after it came online with fortuitous timing in 2022, and was also a contributor to the diesel price spike we saw last fall after a fire at the plant.

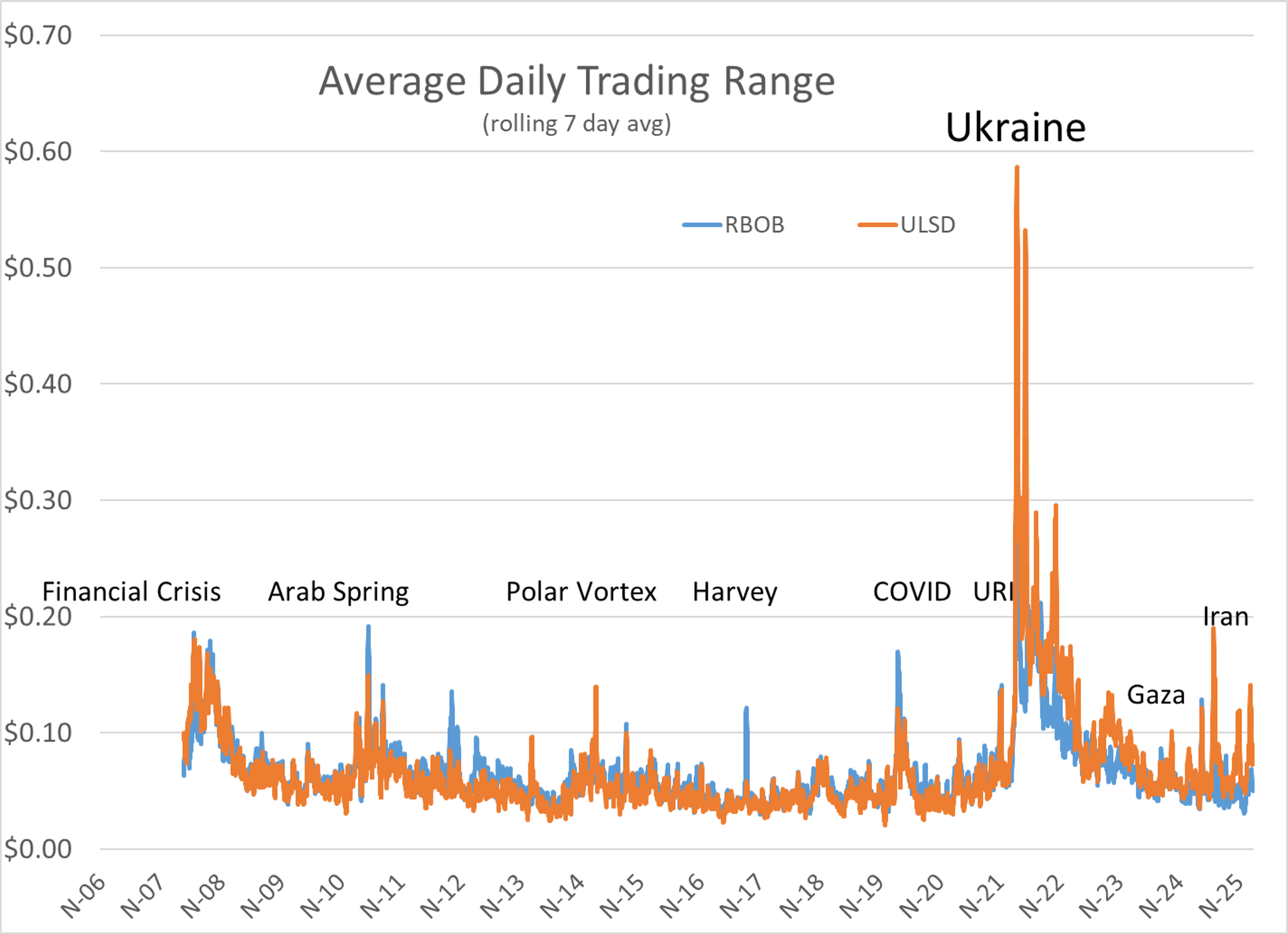

This weekend marks the 4 year mark of Russia’s full invasion of Ukraine, an event that has had the most impact on global fuel supplies since the embargos of the 1970s. While markets have stabilized significantly since the chaos of 2022, the ripple effects of that conflict continue to be a major factor in supply flows for natural gas, crude and refined products. It’s also worth noting that despite so much effort to force people to stop buying Russian oil products, several European nations are still unable or unwilling to find replacement options, which is a harsh reminder of the vital nature of these commodities that are easy to take for granted when living in the U.S..

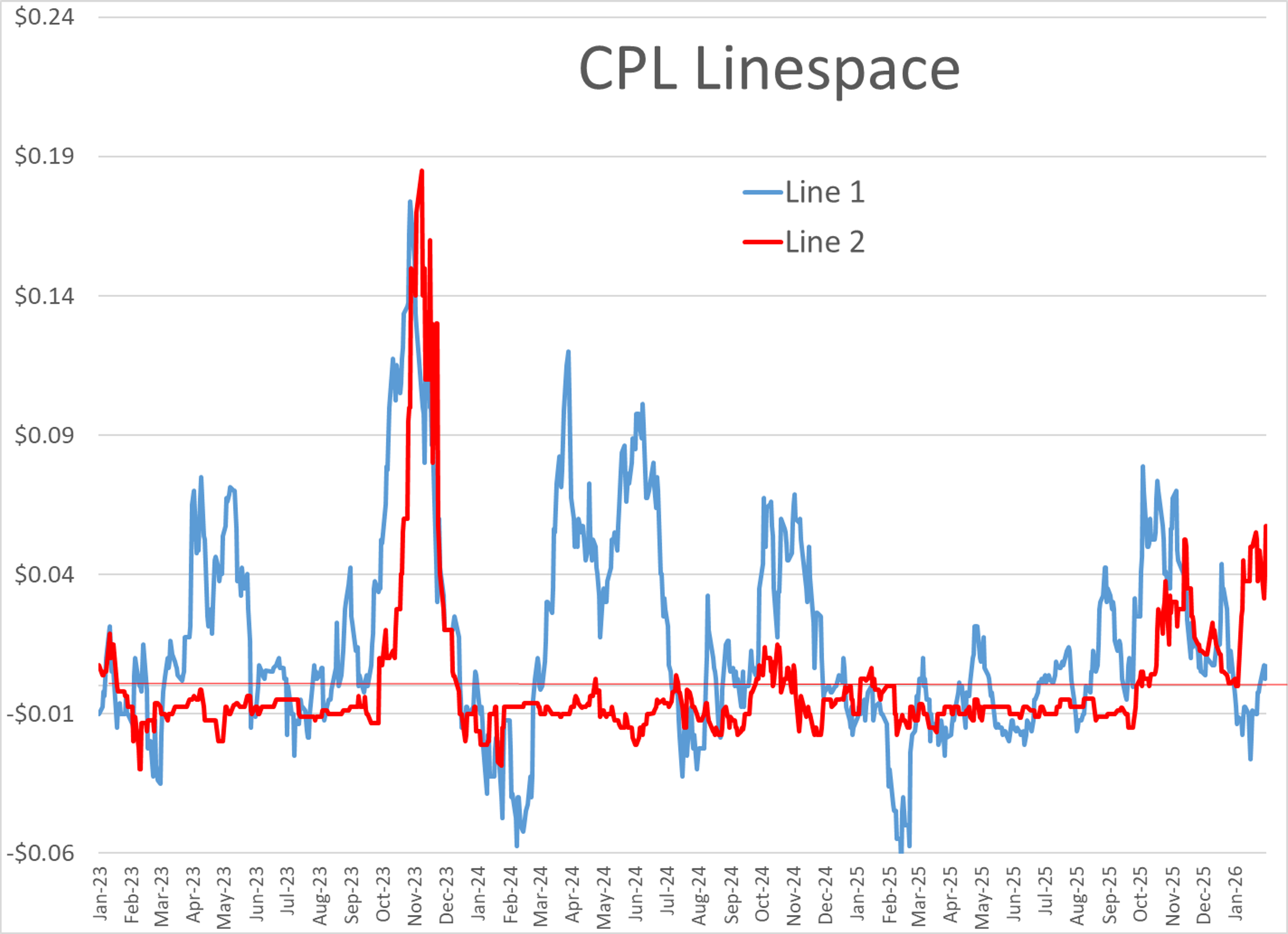

Even though NY Harbor diesel basis values have dropped to a 4 cent premium from a 22 cent premium to start February, prices to lease space on Colonial’s main diesel line (Line 2) have rallied to a 2 year high north of 5 cents/gallon as PADD 1 diesel stocks continue to dwindle in the wake of the recent winter-storm induced demand spike.

There’s yet another winter storm bearing down on the East Coast this weekend with potential for huge snowfall in parts of the major metro areas in the region, but forecast models remain conflicted on the path of this system. While the storm could bring heavy precipitation, what it will not bring is record-setting cold like we saw a few weeks ago, so it’s unlikely we see a spike in power generation and heating demand, or the disruption to operations around the harbor due to freezing that we just experienced. That said, the Coast Guard will slow traffic as the storm passes so vessel delays next week are likely for the waterborne terminals in the area.

Notes from the DOE’s weekly status report. See charts attached.

Crude stocks dropped 9 million barrels with exports ramping back up while demand for refined products hit a seasonal 5-year high. Refinery runs picked up in PADDs 1, 3, & 5 with small declines in PADDs 2 & 4. PADD 5 saw a utilization boost, but due to a drop in capacity more so than the run rate increase, as operations fully wind down at the P66 Wilmington facility. Run rates remain elevated across the country and are about 661kbd over year-ago levels in total.

Diesel stocks drew again last week as demand climbed to another seasonal high. PADD 1 accounted for the bulk of the draw, sliding about 3mb under the 5-year range. PADD 2 is still hung at the bottom end of its seasonal 5-year range while PADDs 3 & 4 are tracking well above average. PADD 5 is sitting at the bottom end of its 5-year range as well but is missing almost 4 million barrels of RD that would bring it in line with the 5-year average.

Gasoline inventories also drew on higher demand, but the country remains flush with product as PADDs 2, 3, & 4 are still running at the high end of their ranges. Total stocks are still about 8 million barrels above the seasonal average, which is at its high point for the year. As a result, import activity has slowed to fairly steady levels while exports have held above average all year.

Latest Posts

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Refined Products Erase Gains Amid Rumors Of War And Geneva Negotiations

Quiet Markets, Loud Headlines: Tracking The Next Wave Of Energy Disruptions

Diesel Jumps As Tensions Rise And East Coast Demand Stays Hot

Social Media

News & Views

View All

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap