Diesel Futures Climb As Diplomatic Efforts Collapse

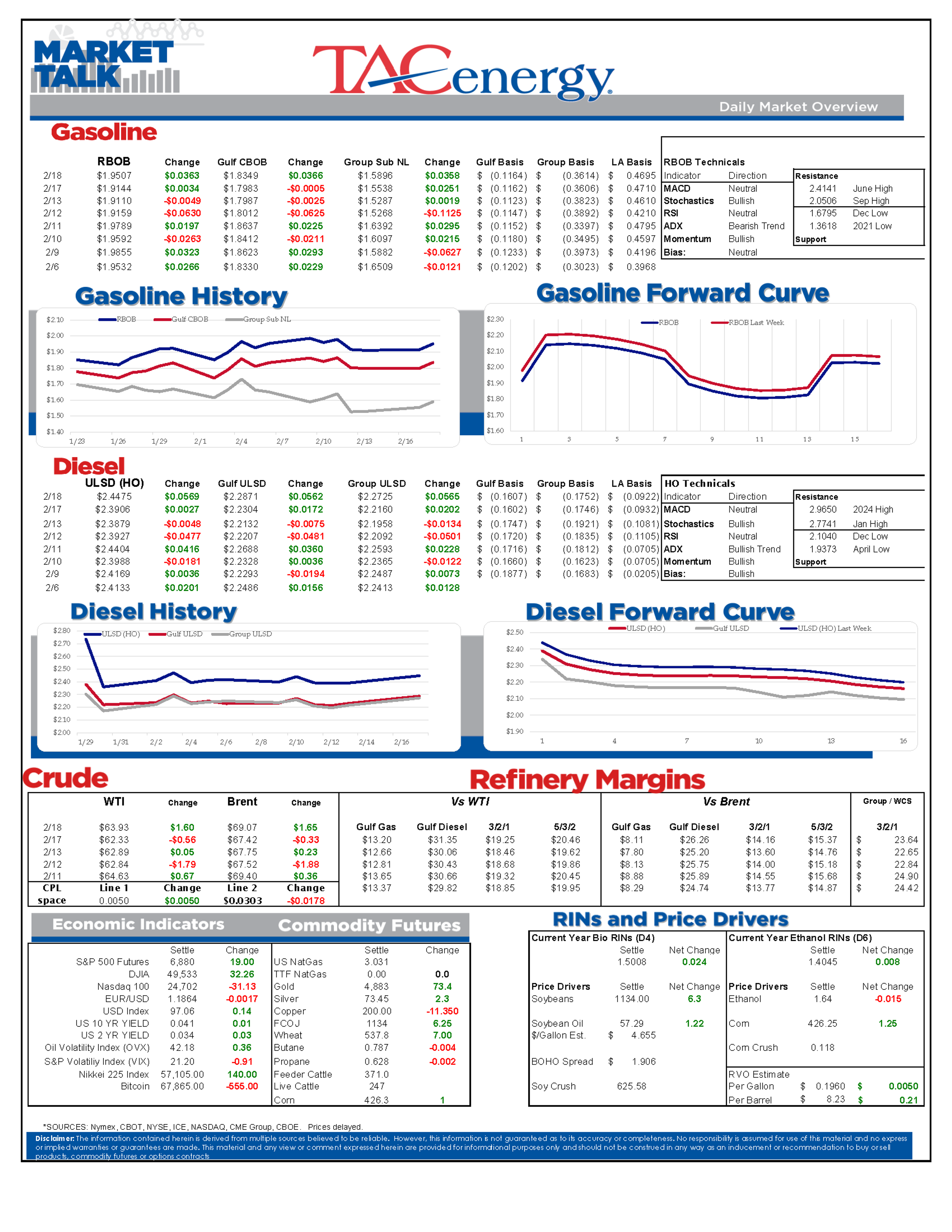

Energy markets are off to a strong start Wednesday, after the U.S. plan to negotiate an end to conflicts in both Ukraine and Iran on the same day with the same negotiators shockingly failed. Diesel futures once again are leading the moves, up around 6 cents in the early going, vs 4 cents for RBOB and around $1.60/barrel for WTI and Brent.

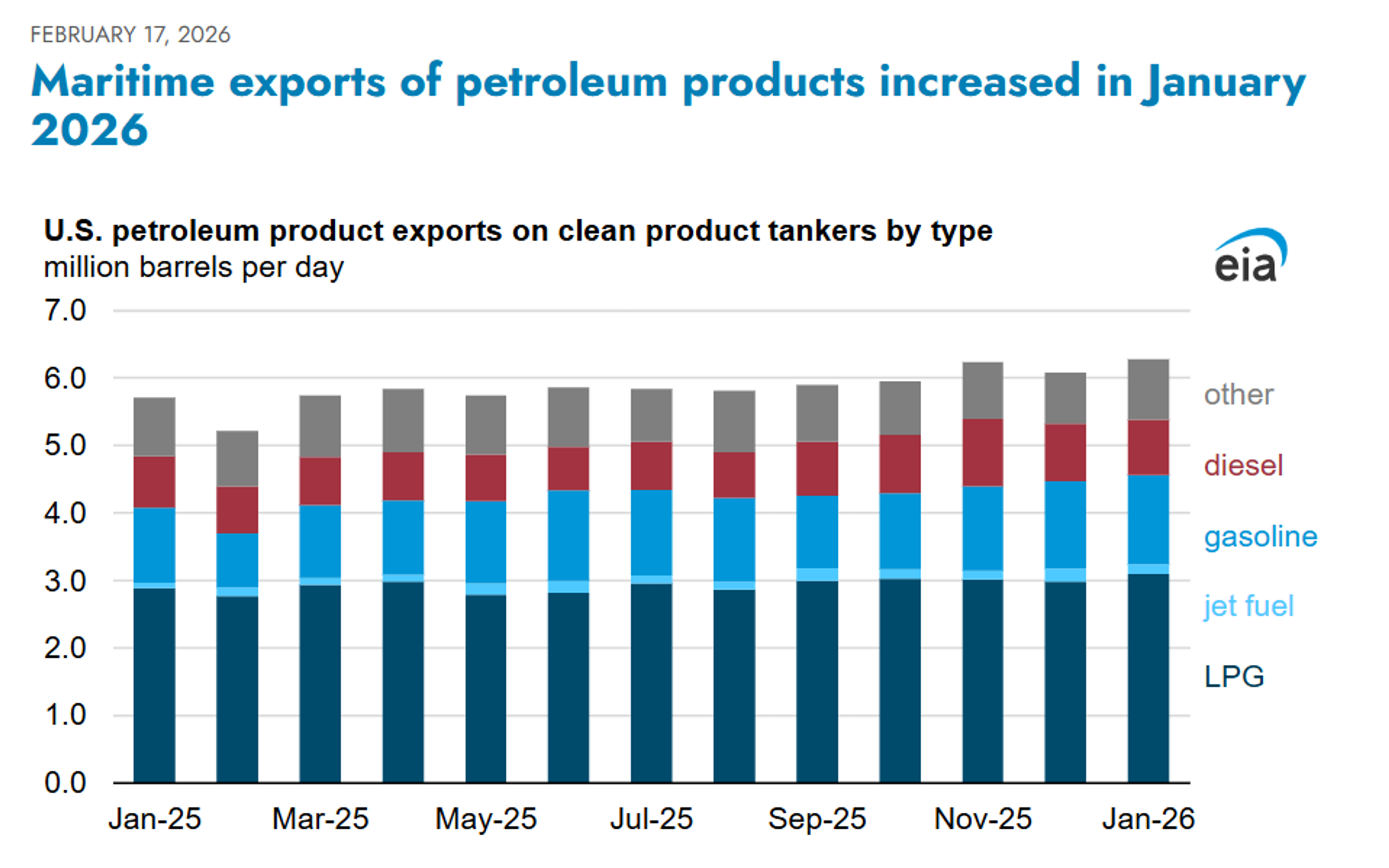

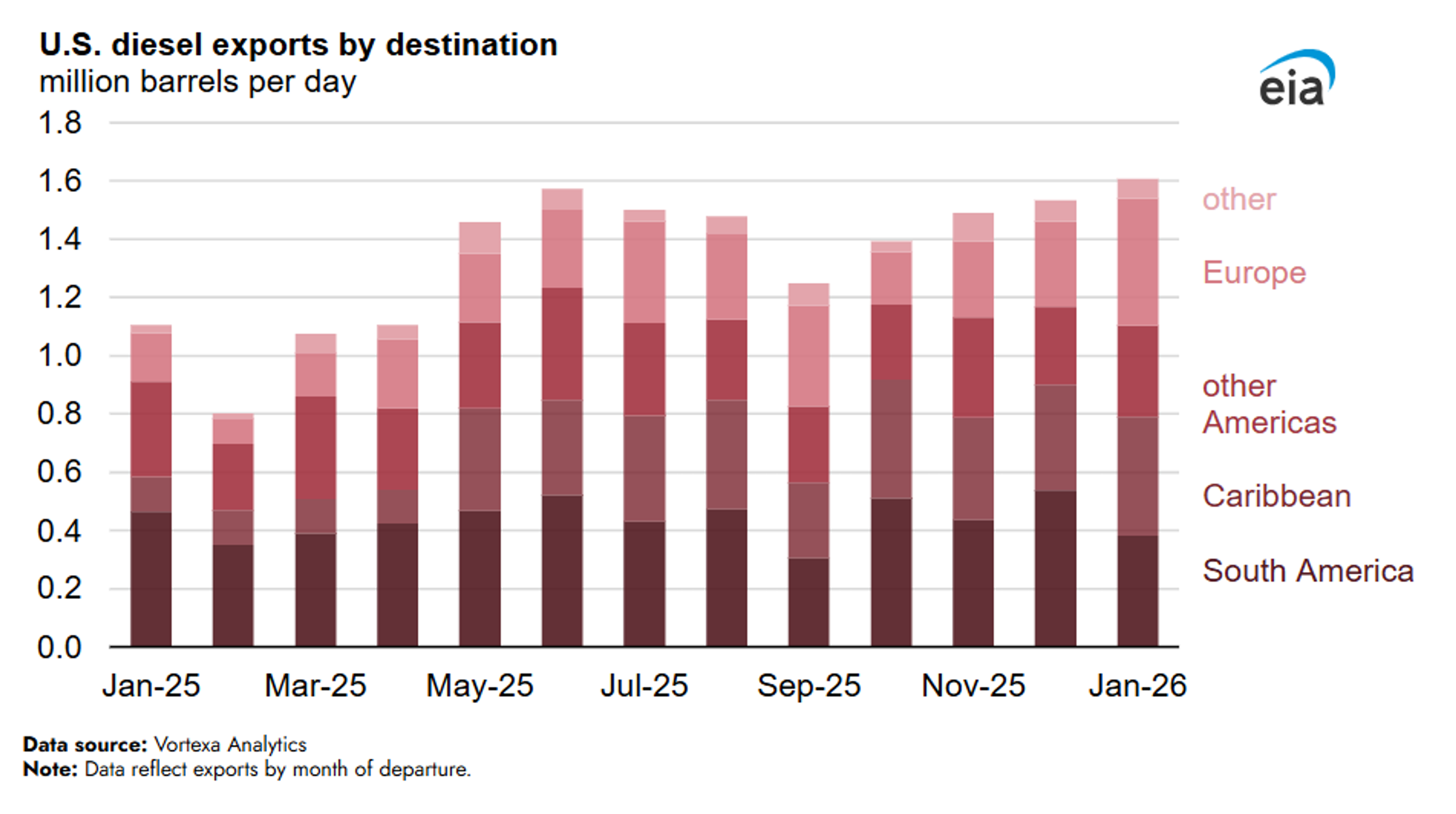

The EIA Tuesday highlighted the growth in U.S. Product Exports in January, with an average of more than 6 million barrels (252 million gallons) sent overseas every single day in January. Keep in mind that 20 years ago, the U.S. was still the largest buyer of refined products, and today we’re the largest seller by a wide. LPGs make up half of the exports as propane and butane continue driving overall growth, while diesel exports continue to increase as Europe leans more heavily on the U.S. as it continues to slowly try and break its Russian energy supply addiction.

The weekly inventory reports were delayed by the Monday holiday so the API’s estimates will be out later today, and the EIA’s figures will be released tomorrow.

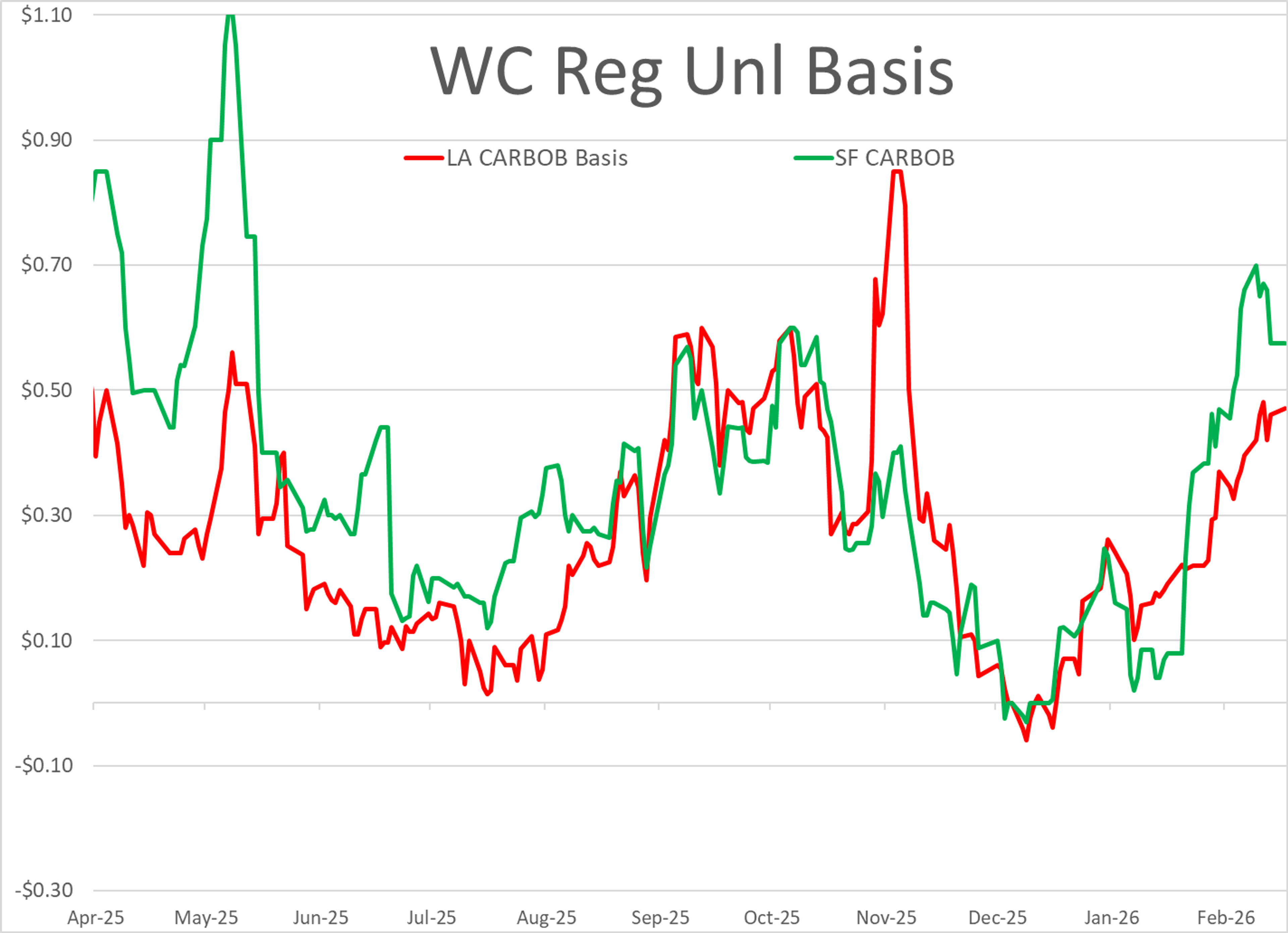

PBF reported unplanned flaring at its Torrance CA refinery overnight, but early indications are that may be related to planned maintenance and not a hinderance to operations. Gasoline basis differentials are already elevated across the state, so any upsets may be triggering to buyers as the state moves through its latest refinery closure.

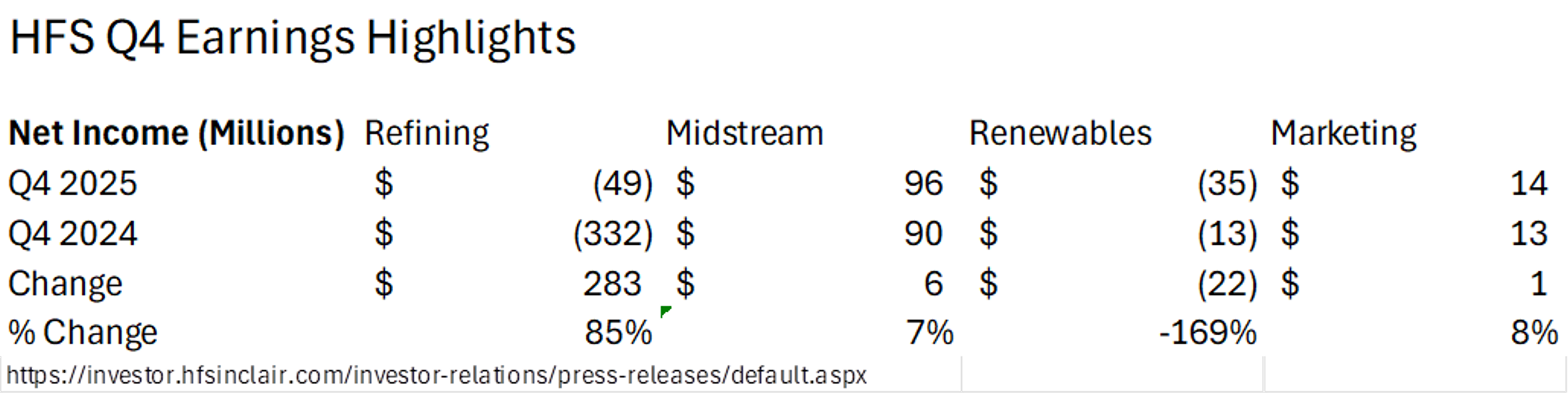

HF Sinclair reported its unaudited earnings for Q4 with a slew of news to go along with it. The company announced its CEO is taking a voluntary leave, and is being temporarily replaced by the current board Chair. That announcement also included a note that the Audit Committee of the Board is assessing the Company’s disclosure process, and will release its audited financials when that review is completed. It’s not explicitly clear that the audit issue and the CEO leave are linked, but they were both noted in the same press release and the earnings call mentioned the company would not provide any further detail at this time. The company also announced a joint venture to expand its branded presence in Colorado and New Mexico.

HFS reported a net loss during the 4th quarter which it said reflected seasonal weakness in crack spreads, the planned turnaround at its Puget Sound refinery, and an unplanned upset at its Artesia facility. While still posting negative net income for the quarter, which was a bit surprising given the strong results from other refiners thanks to the diesel price spike in October and November, the results were much better for the traditional refining group than the previous year. Renewables on the other hand continued to be challenged, losing $35 million for the quarter, compared to a loss of $13 million in Q4 of 2024. The company highlighted a $313 million gain in Q4 of 2025 due to the approvals of multiple small refinery waivers to the Renewable Fuel Standard during the year. It’s worth noting that while HFS is one of the biggest beneficiaries of the SRE’s in 2025, a proposal in front of congress to only allow SRE’s for company’s with TOTAL refining capacity of 75mb/day or less would remove this benefit in the future should that change be implemented.

Latest Posts

Refined Products Erase Gains Amid Rumors Of War And Geneva Negotiations

Quiet Markets, Loud Headlines: Tracking The Next Wave Of Energy Disruptions

Diesel Jumps As Tensions Rise And East Coast Demand Stays Hot

Oil Prices Slide as War Fears Fade and Supply Fears Grow

The Energy Complex Starts Wednesday Strong: Refined Products Outpace Crude Volatility

Week 6 - US DOE Inventory Recap

Social Media

News & Views

View All

Refined Products Erase Gains Amid Rumors Of War And Geneva Negotiations

Quiet Markets, Loud Headlines: Tracking The Next Wave Of Energy Disruptions