Energy Futures Break Out As Diesel Leads A Technical Rally

The runaway rally continues in energy futures Thursday with the March diesel contract up another nickel after surging nearly 13 cents higher Wednesday. The move has broken futures out of the sideways range that had held values for the first 2.5 weeks of February, and leaves more room to run higher on the charts. Gasoline futures continue to trail diesel, but are still seeing healthy gains and appear set to test the chart resistance around the $2 mark that repelled the last 2 rally attempts.

There’s not much in the way of headlines or fundamental news to justify the rally, which makes it appear to be more technical in nature, with funds likely positioning for the “buy the rumor, sell the news” phenomenon as tensions between the U.S. and Iran continue to rise.

Cash markets also aren’t buying the hype, with diesel basis differentials holding in negative territory in most markets, and the NY Harbor sliding to single digit premiums to futures Wednesday after starting the month with 20+ cent premiums. Local shortages across the NE terminal network persist, but are quickly healing as heating and power demand evaporates and resupply from the Gulf Coast and abroad starts to arrive.

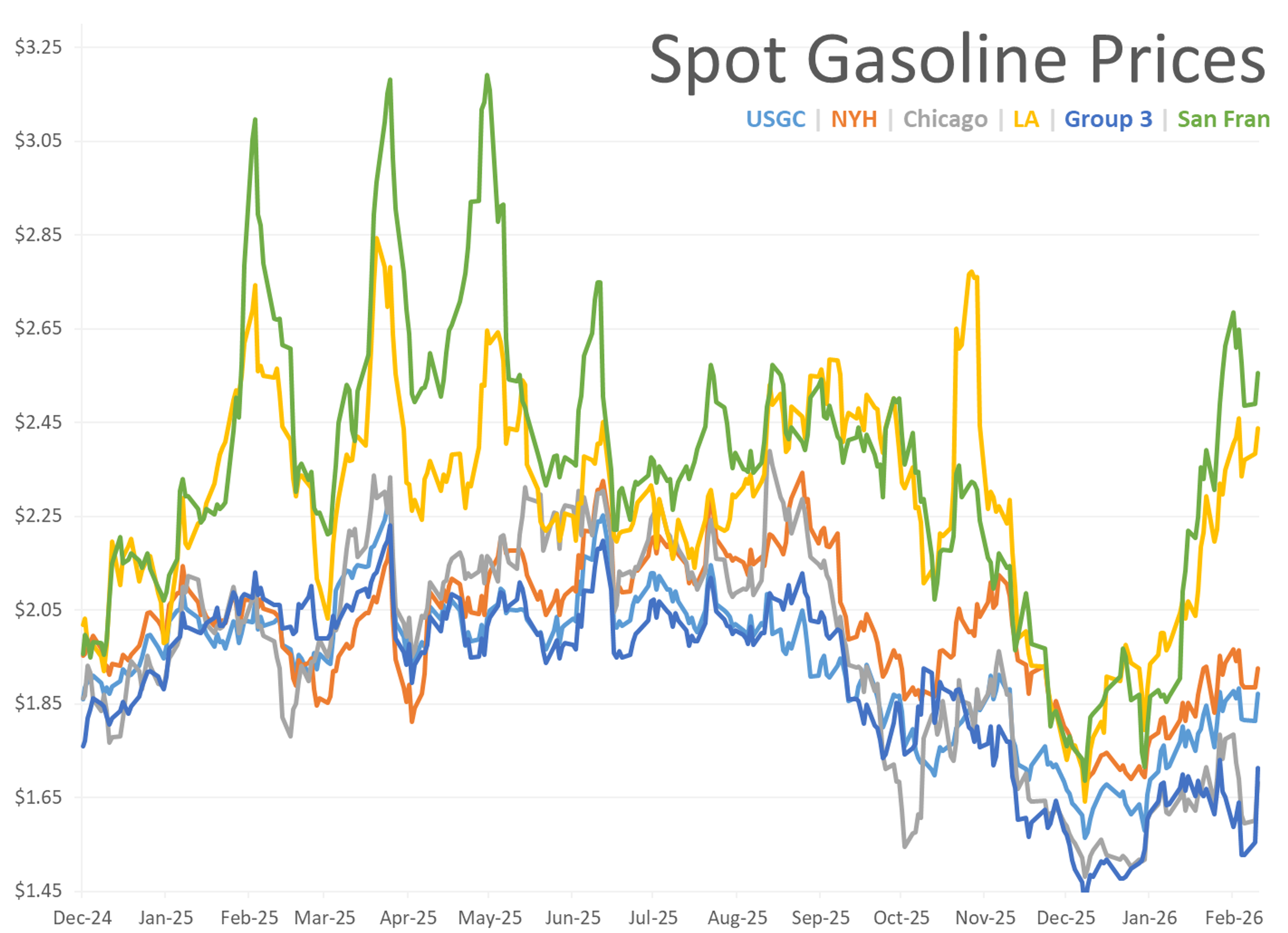

On the flip side of that coin, while RBOB futures have lagged behind the rally in diesel, we continue to see very strong basis differentials on the West Coast as suppliers try to navigate their first RVP transition without the P66 Wilmington and Valero Benecia refineries. The pacific basin has no shortage of gasoline, but the logistics to import more of that supply into the state are proving to be easier said than done so far.

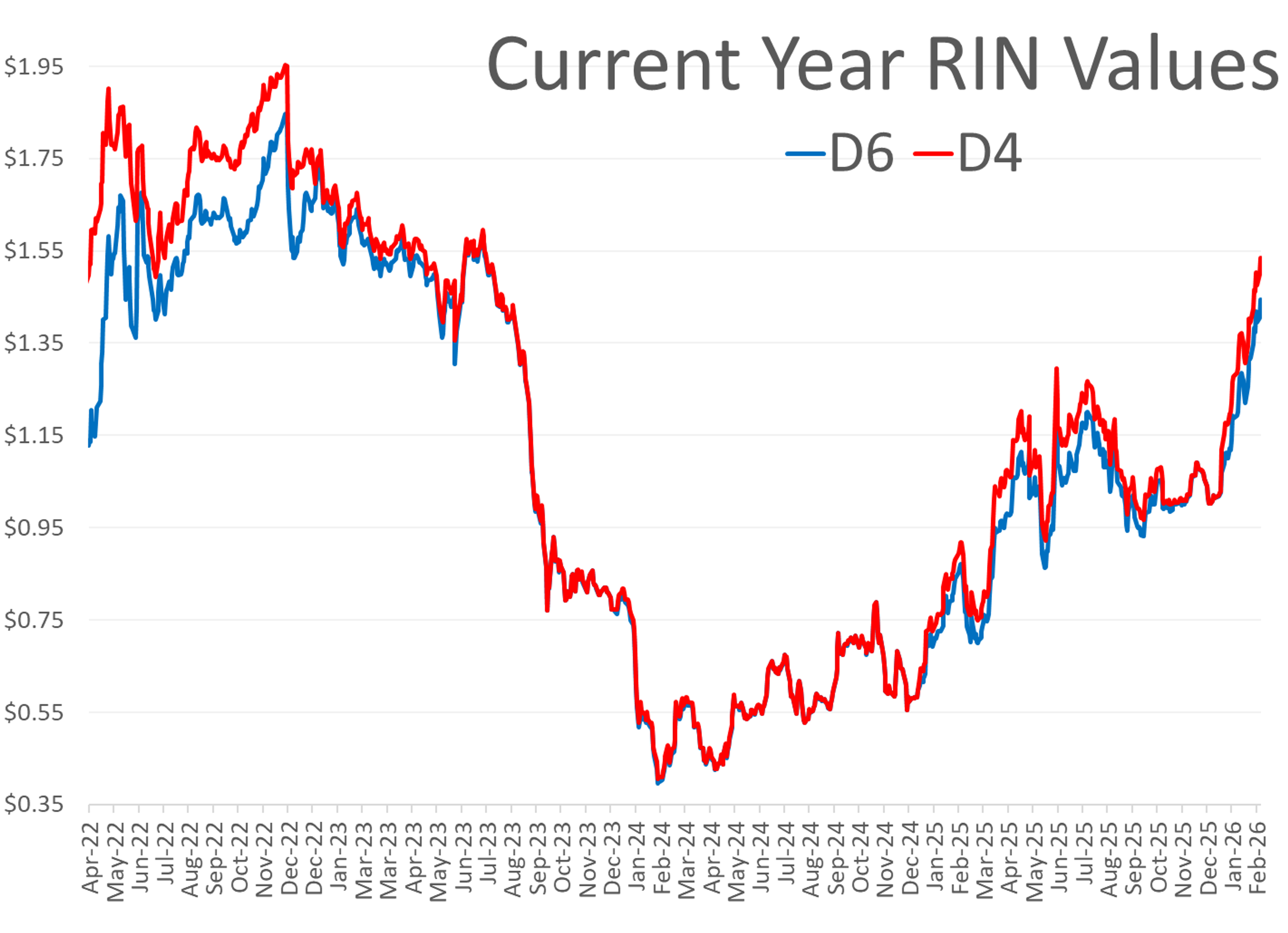

RINs continue their rally with D4 and D6 prices both hitting new 2.5 year highs this week as the industry impatiently awaits the EPA’s final rules for the Renewable Fuel Standard. The combination of stronger diesel prices and the RIN rally is very good news for beleaguered biofuel producers who are finally seeing some decent margins for domestic production as combined incentives on the West Coast get back above the $3/gallon mark for the first time in more than 2 years.

The API estimated small inventory draws last week with diesel stocks down 1.5 million barrels, gasoline down 312,000 barrels and crude down 609,000 barrels for the week. The DOE’s weekly update is due out at noon eastern today.

Today’s interesting read courtesy of FreightWaves: How the Feds are using highway funding to try and force states to crack down on CDL issuances. The legal fight over non-domiciled drivers could potentially push the industry back to days of driver shortages like we saw in 2021.

Latest Posts

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Refined Products Erase Gains Amid Rumors Of War And Geneva Negotiations

Quiet Markets, Loud Headlines: Tracking The Next Wave Of Energy Disruptions

Diesel Jumps As Tensions Rise And East Coast Demand Stays Hot

Oil Prices Slide as War Fears Fade and Supply Fears Grow

Social Media

News & Views

View All

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse