Quiet Start For Energy And Equity Markets Pending Fed’s Last Monetary Policy Move Of The Year

It’s a quiet start for energy and equity markets ahead of the FED’s last monetary policy announcement of the year.

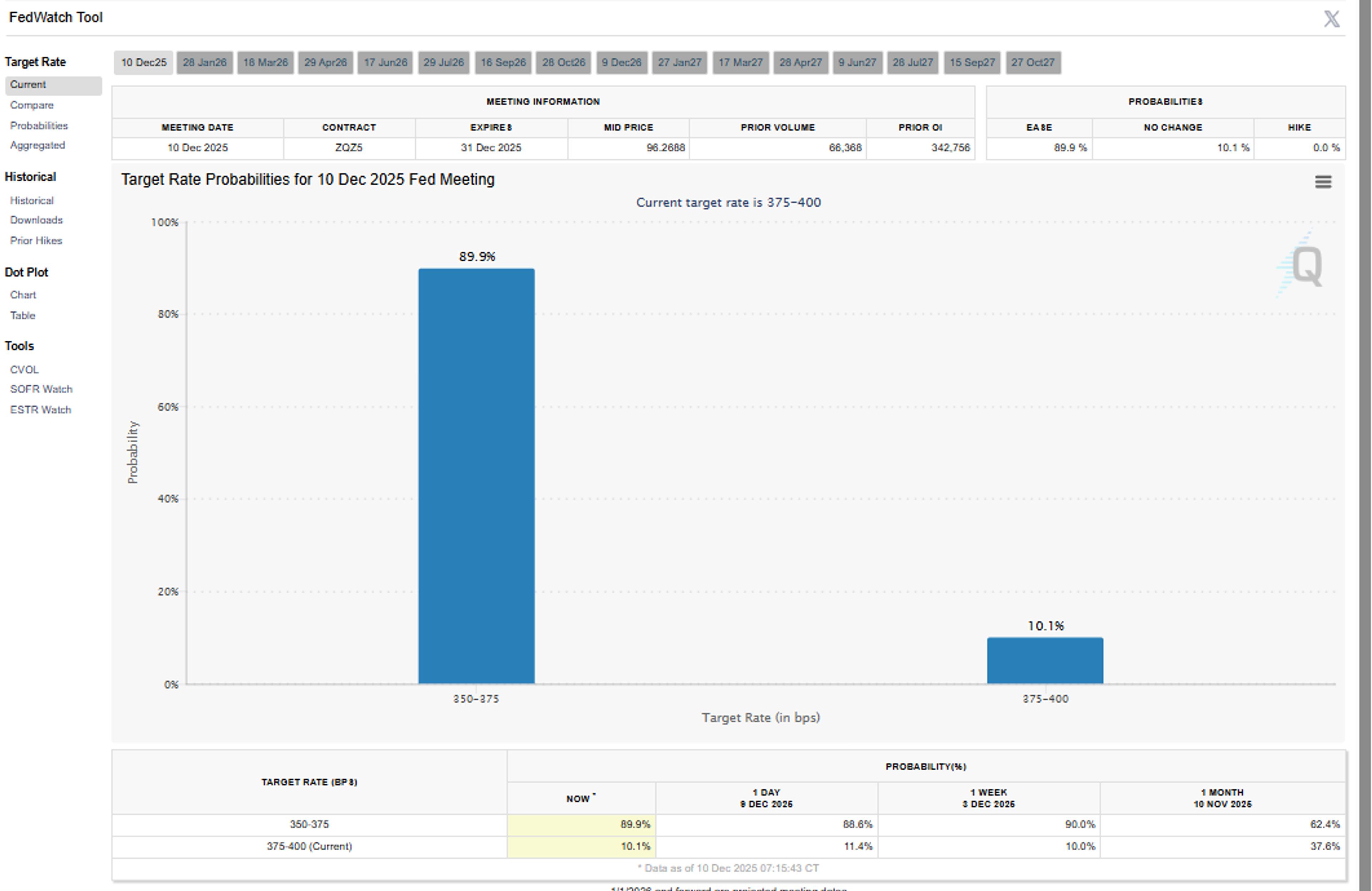

Traders are pricing in a 90% probability of a 25 point rate cut announcement today according to the CME’s FedWatch tool, but then most believe the FED will pause for at least a few months before making more changes.

Diesel prices are trying to lead the energy complex in a modest recovery bounce after falling more than a dime in the first two sessions of the week, but they’ve already pulled back 2 cents from their overnight high suggesting a lack of enthusiasm from the bargain shoppers.

RBOB gasoline futures are trading down less than a penny so far, but that’s enough to reach the lowest prices we’ve seen since February 16, 2021.

Chevron reported unplanned flaring at is 290mb/day El Segundo CA refinery overnight. LA basis values have come under heavy selling pressure as weak demand and ample imports more than offset the loss of the 139mb/day P66 refinery in Wilmington which is wrapping up its work to permanently shutter the facility. Yesterday’s report of an upset at the 365mb/day Marathon Wilmington refinery didn’t seem to convince buyers to step in, so we’ll wait and see if the Chevron news has any more impact.

Valero reported an upset in a delayed coking unit at is 430mb/day Port Arthur TX refinery, with flaring lasting 6 hours Tuesday morning. That unit was said to be brought back online so should not have any impact on USGC basis values.

The API seemed to confirm what weak cash markets across the country have been foreshadowing with a 7 million barrel build in gasoline stocks last week justifying prices approaching 5 year lows. The industry group also estimated a 1 million barrel build in diesel stocks while crude oil stocks dropped by 4.8 million barrels.

The EIA’s weekly report is due out at its normal time this morning. We’re now approaching the year-end window where TX refiners will want to keep oil inventories off-shore to avoid paying TX property tax on what they hold 12/31 so some noise in the weekly numbers is expected.

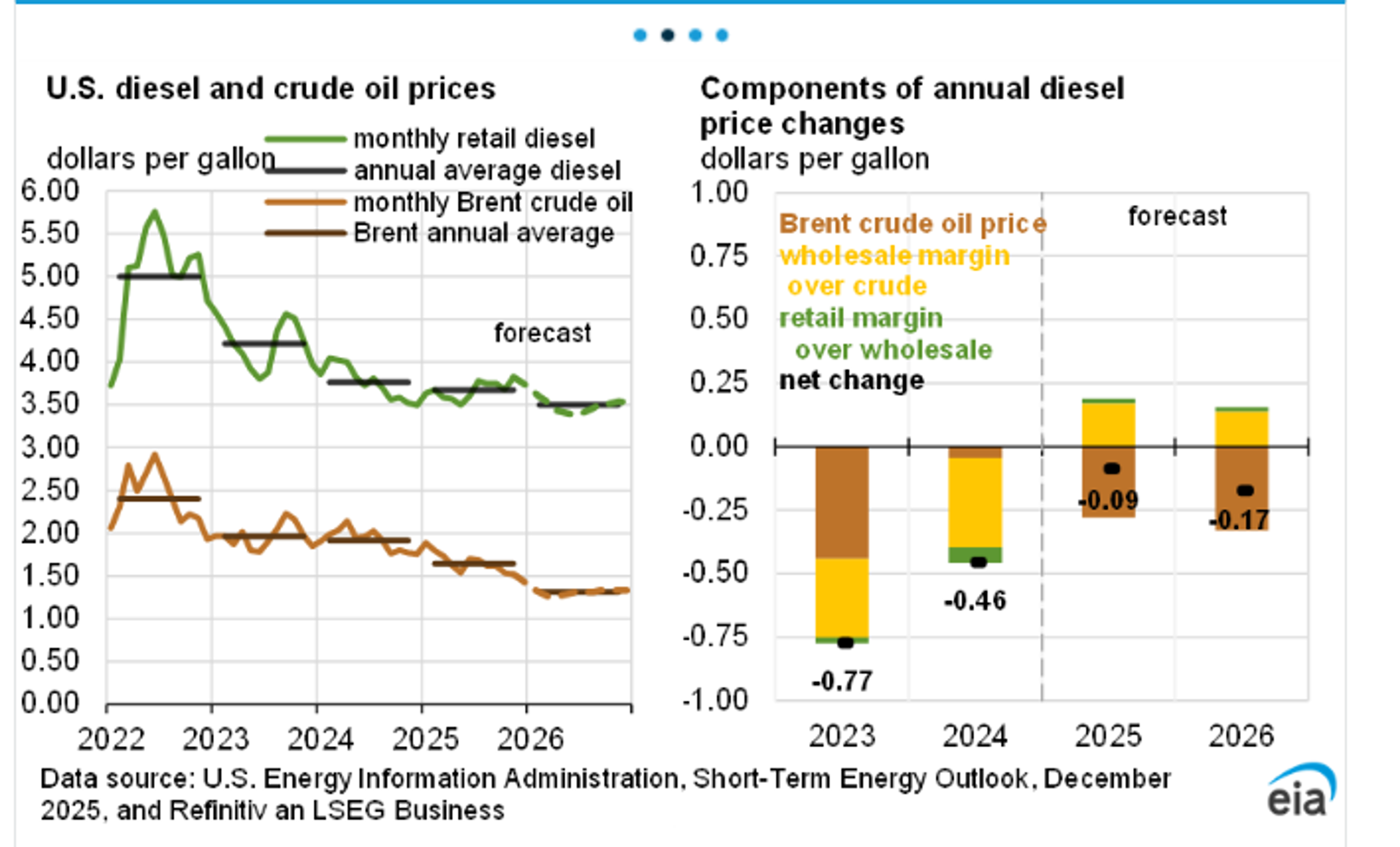

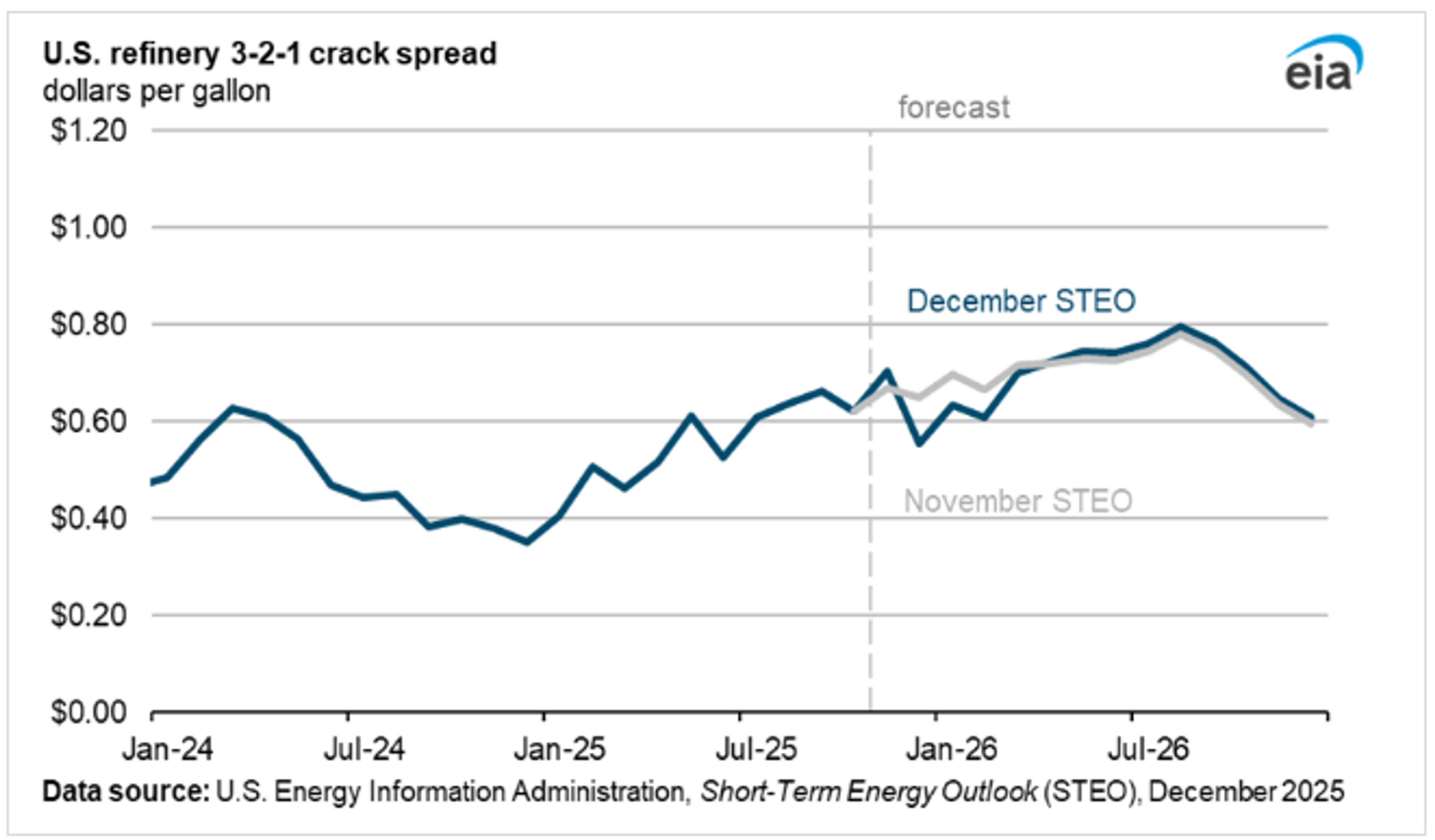

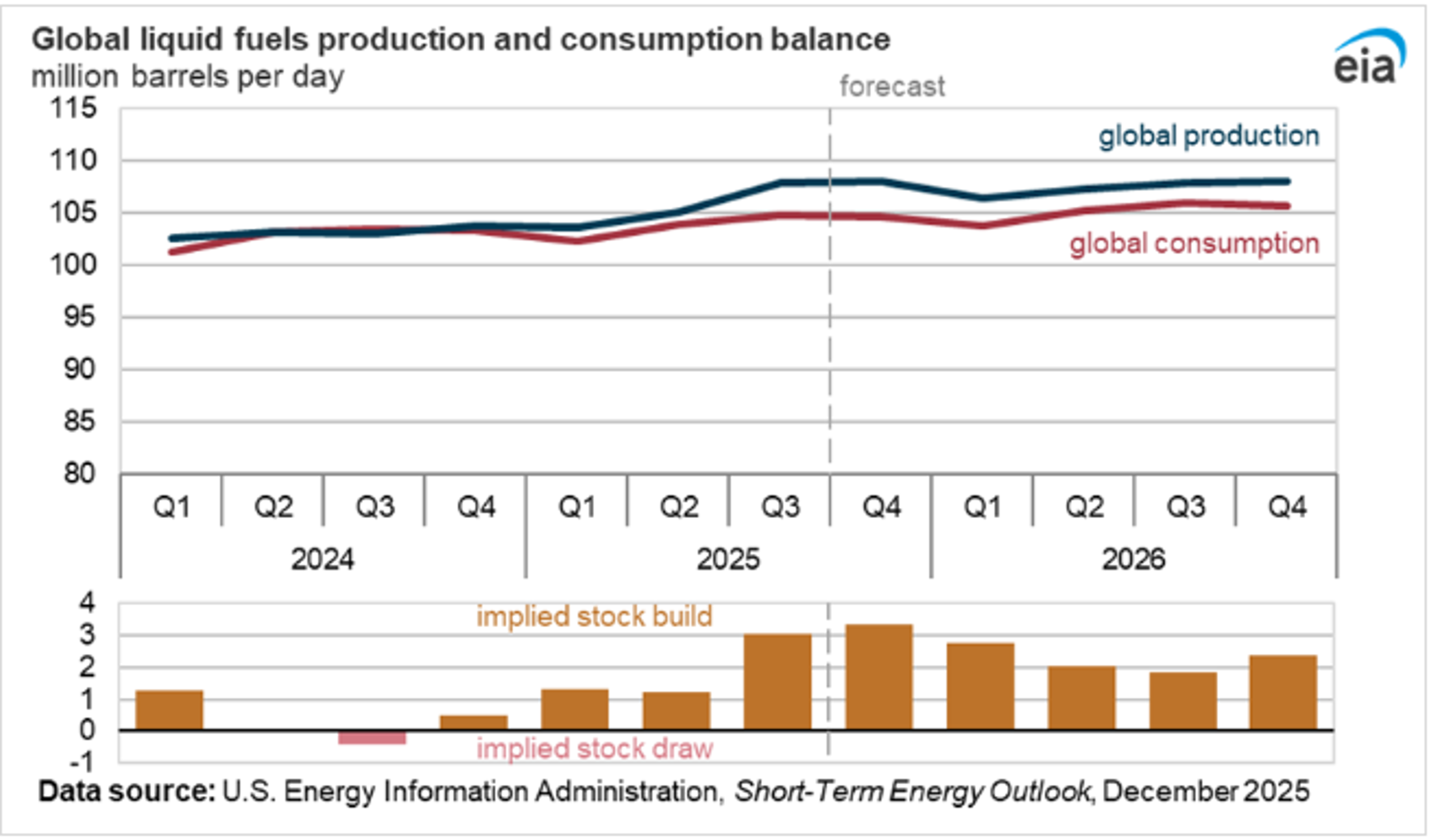

The EIA published its monthly Short Term Energy Outlook Tuesday and continues to call for lower prices with an average Brent value of $55/barrel predicted for 2026 as global output continues to outpace consumption. The agency expects 2026 refining margins to remain in healthy territory thanks to cheap crude prices and the damage done to Russian facilities.

For this winter, the report predicts a colder than average December (which has certainly proved true for the first 10 days) but a warmer than normal first quarter, which may help explain why diesel prices have remained muted through the recent cold snap.

Well done AI: After years of declines, the EIA reported that U.S. Coal consumption will increase by 9% this year as natural gas and renewables haven’t been able to keep pace with the surge in electricity demand, unwinding what had been a major victory to reduce energy emissions.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets