Energy Complex Bleeds Red As Buyers Retreat From Refined Fuels

Nobody wants to buy refined products this week.

ULSD futures are once again leading the energy complex into the red after a short-lived rally attempt overnight and are currently trading 15 cents lower for the week. RBOB futures are trading just a few points below break-even at the moment, but this would mark a 5th straight day of losses if buyers don’t step in. While the damage has been minimal for gasoline, with the January RBOB contract down just 8 cents in those 5 days of selling, values have been pushed down to a nearly 5 year low and the charts suggest there could be more selling ahead.

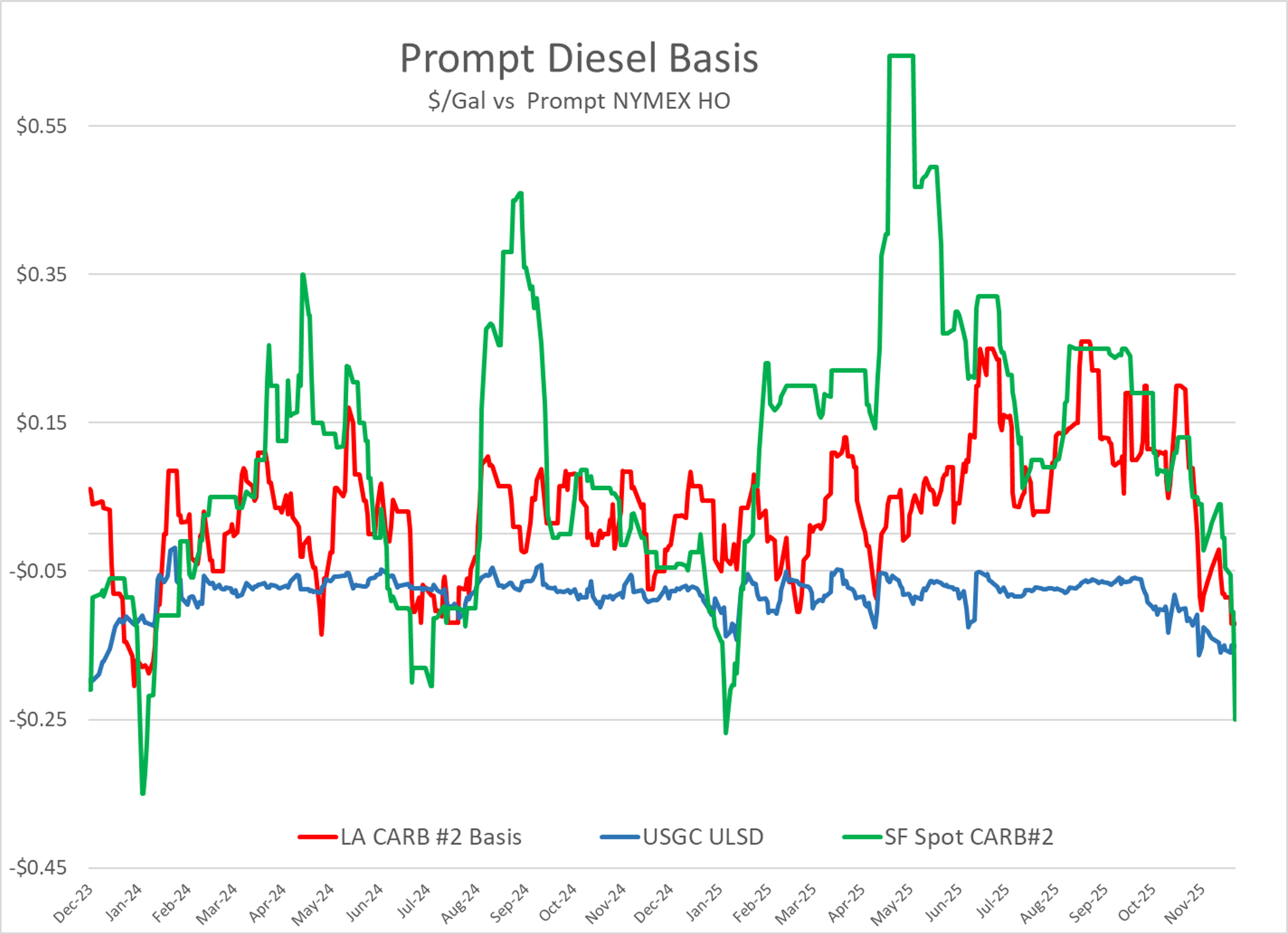

While ULSD futures are still more than 25 cents/gallon above their lows for the year, weakness in spot markets across the U.S. has pushed cash prices in a few U.S. markets to their lowest levels in more than 2 years. While the excess of supply in the Group 3 and Chicago markets during the winter months is certainly not a new phenomenon, the surprise this week is that the San Francisco spot market has joined them and is trading at a 25 cent/gallon discount to futures, after spending most of the year as the most expensive spot market in the country.

Ukrainian drones hit Russia’s 300mb/day Slavneft-YANOS refinery overnight, a day after a widespread drone attack hit multiple cities across Russia and hit a Russian tanker in the Black Sea and an oil rig in the Caspian Sea. The recent increase in attacks may be an attempt by Kyiv to gain more negotiating leverage in peace talks with U.S. and European leaders set to meet this weekend to discuss a proposal on ending the war. A Reuters report this morning estimates that Russia’s oil revenues in December will be only half of what they were this time last year due to the combination of Ukraine’s drone strikes, and sanctions from the U.S. and European countries.

Germany’s PCK refinery assured consumers that the oil spill from a pipeline attached to the facility will not materially impact its production capabilities. No official word on a cause of that pipeline spill has been announced, although sabotage is a suspected cause by some given that the facility is partially owned by Russia’s Rosneft, and multiple other Russian-affiliated refineries in Europe have had mysterious explosions and upsets in the past 2 months.

The IEA’s monthly oil market report increased its demand forecast for 2026 amidst “brighter prospects” for the global economy. The growth in oil demand is dominated by petrochemicals however, not transportation fuels, with their market share continuing to grow while traditional fuel uses are stagnating. The agency also highlighted the dual oil markets created by sanctions with “above board” oil prices hovering around $60/barrel, while the black-market values for sanctioned supplies from Russia, Irand and Venezuela are closer to $40/barrel.

OPEC’s monthly oil market report showed steady output from the cartel with increased output from Saudi Arabia and the UAE offset by declines in production from Venezuela, Iran, Nigeria and Iraq. OPEC also highlighted the strong economic growth in 2025 despite the trade drama to start the year, allowing the group to hold its demand growth outlook steady for 2026 at around 1.4 million barrels/day.

What a difference a few weeks make: Both the IEA and OPEC highlighted the recent strength in refinery margins that reached their highest levels since 2022 in November. If you’re a refinery operator, hopefully you were running during that window as those spreads have collapsed in December with several markets seeing crack spreads at their lowest levels since March.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets