Energy Complex Under Pressure: Futures Fall, EPA Delays, Geopolitical Risks Mount

Energy markets are ticking quietly lower to start the week, continuing their streak of losses in unenthusiastic fashion.

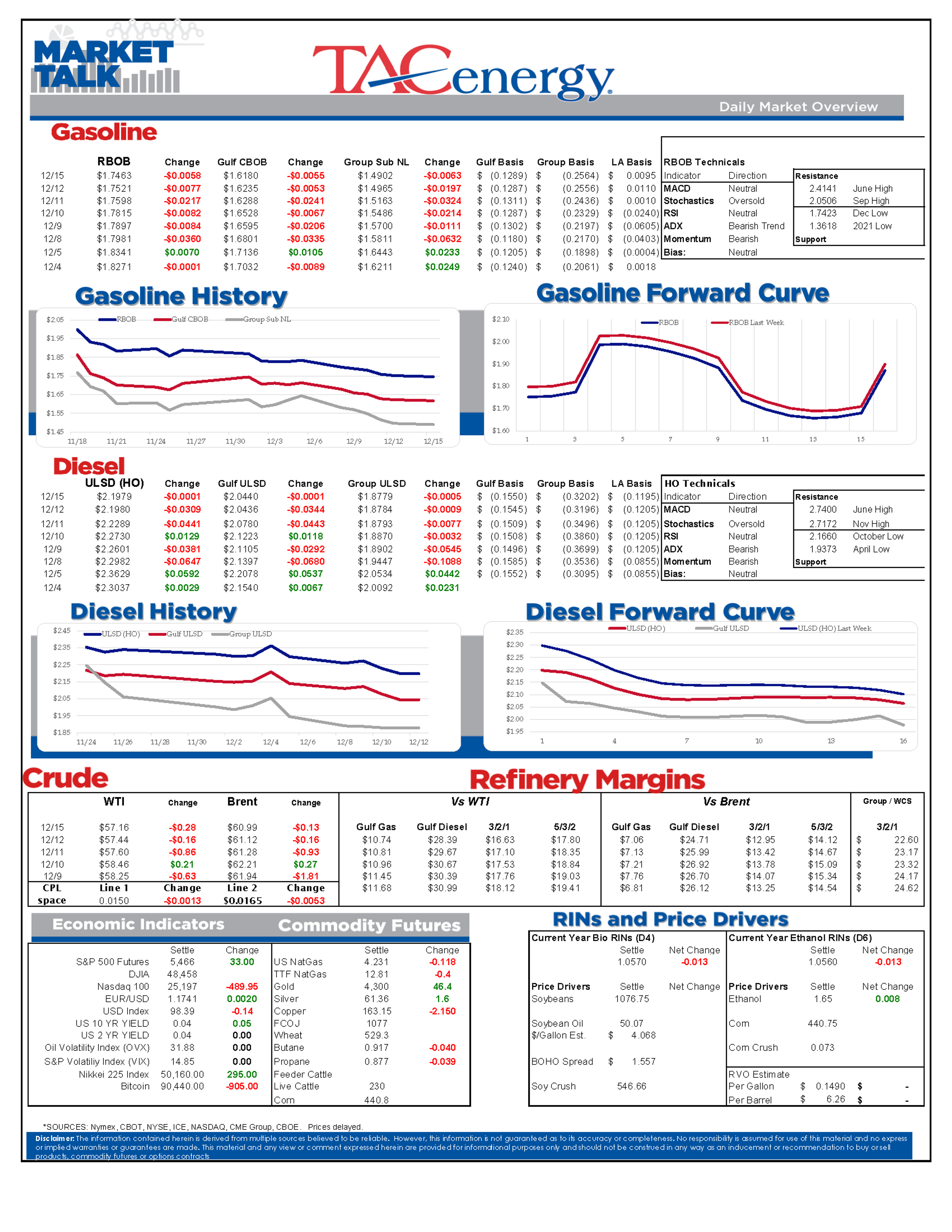

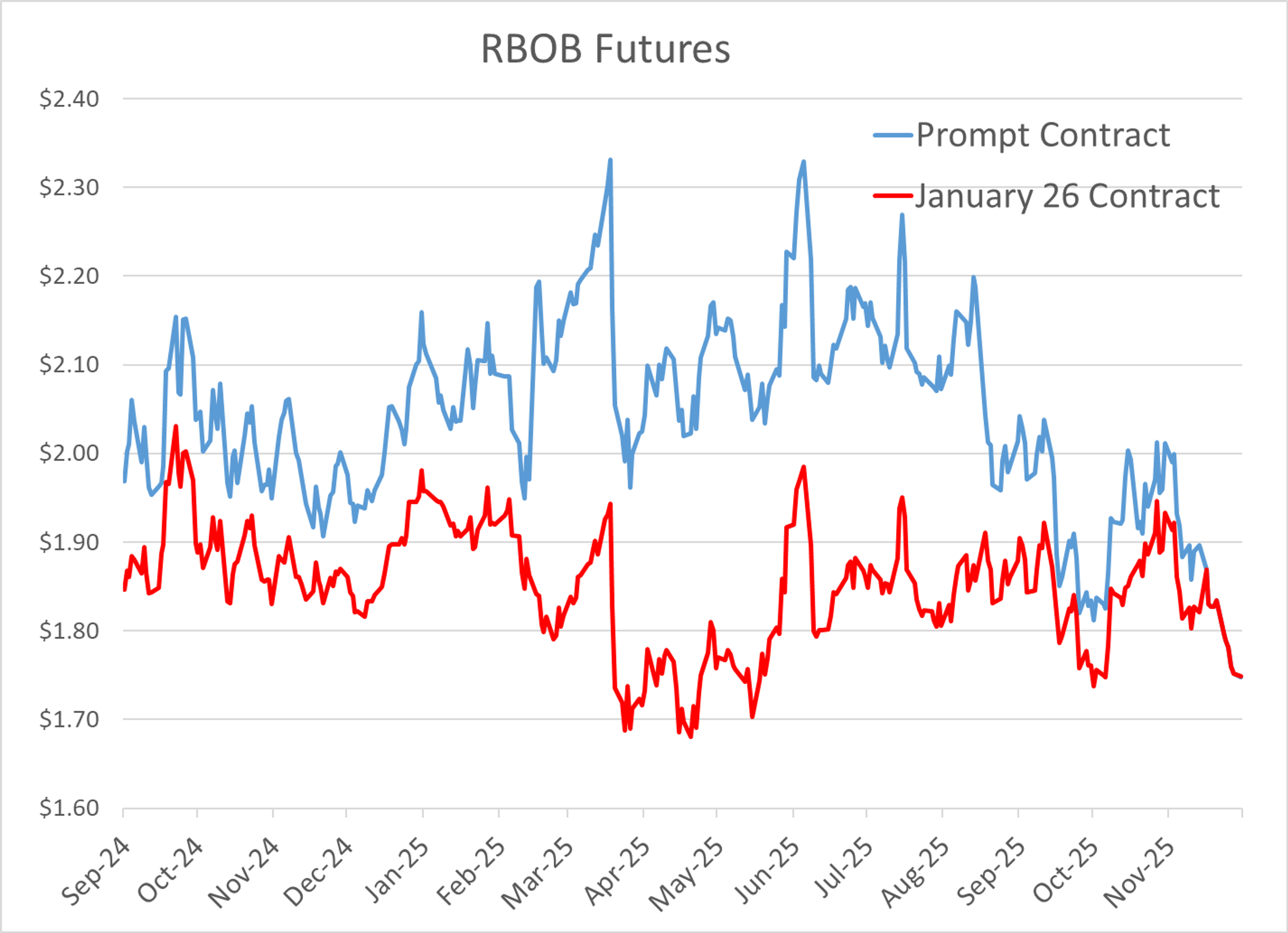

Prompt RBOB futures reached their lowest level since February 2021 for a 4th straight session this morning reaching a low of $1.7423. While that looks like the contract is poised to drop off a technical cliff targeting the $1.50 range, it’s worth pointing out that the January contract that took over prompt position 2 weeks ago was actually trading lower than this back in October. Based on the January chart, the technical trap door doesn’t come into play until prices drop below $1.70, which may help explain why the steady selling hasn’t yet started to snowball.

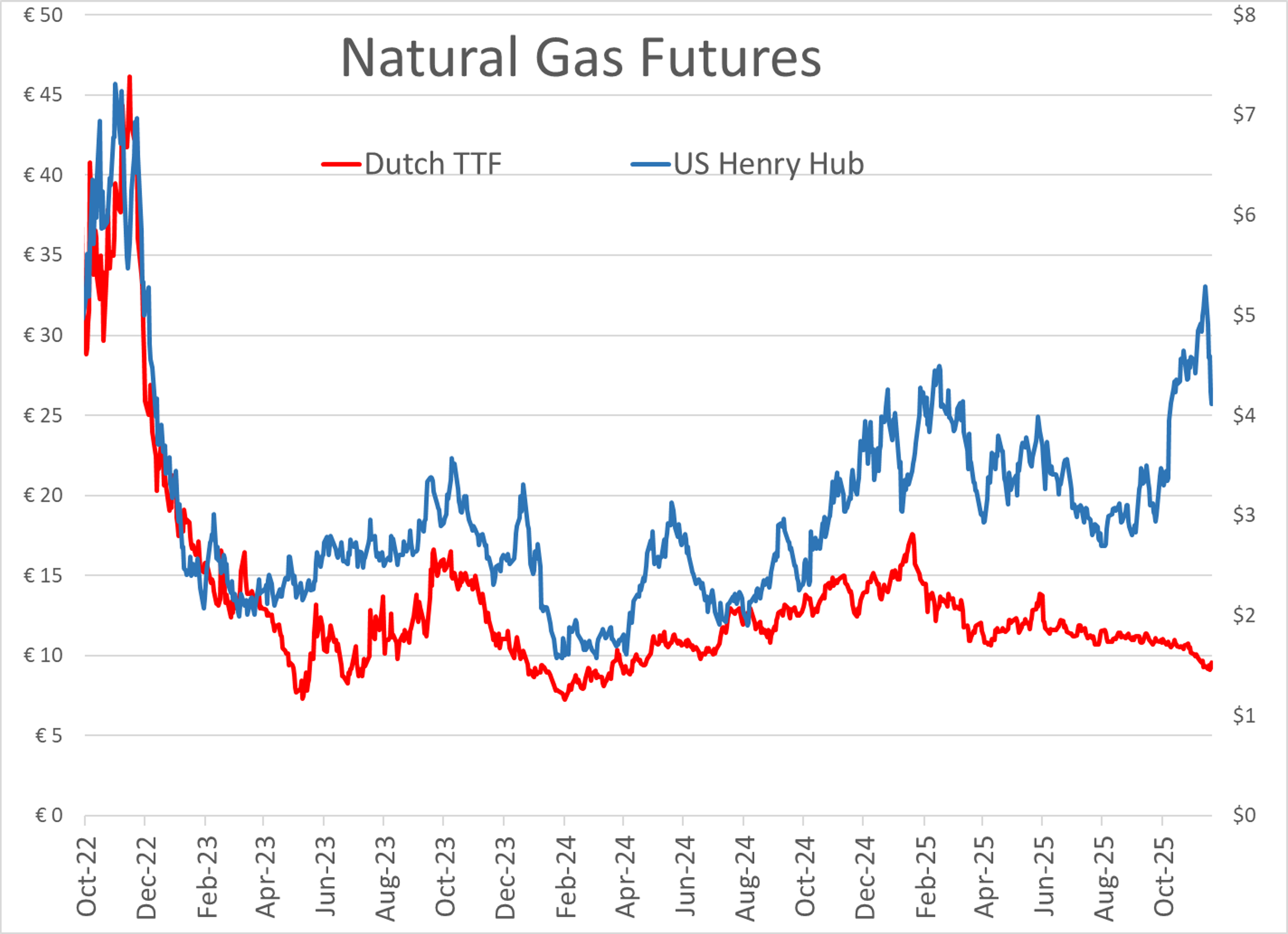

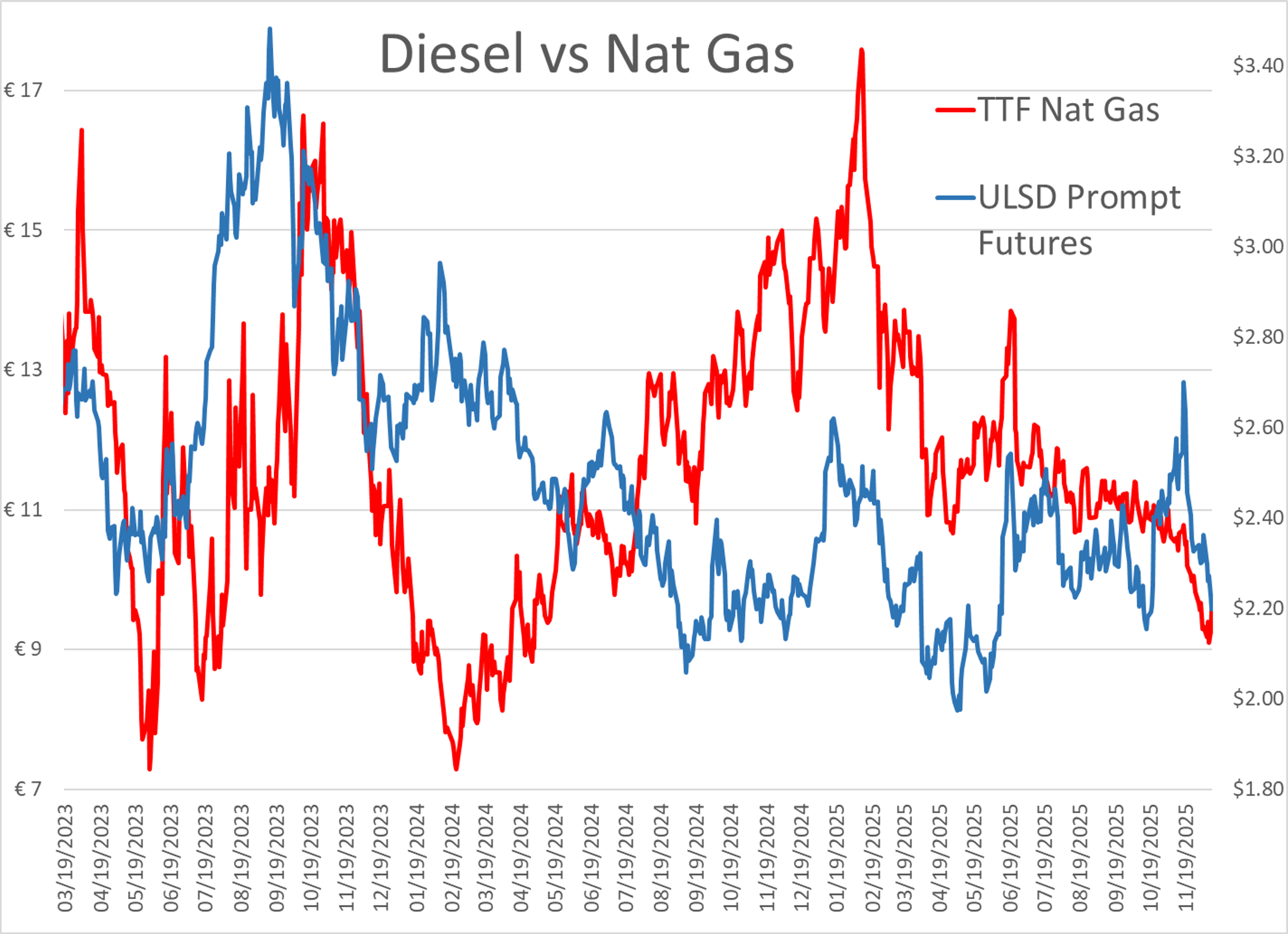

U.S. Natural Gas prices plummeted 22% last week after reaching a 3 year high at the start of December as forecasts for a warmer Q1 helped to offset concerns of a demand spike as a cold snap sweeps large parts of the country. Unlike several other spikes in U.S. natural gas prices over the past few years, this latest rally was not led by higher European gas prices, as the Dutch TTF contract has slumped to an 18 month low – despite cold temperatures - as the continent finds alternatives to Russian supply, most notably new U.S. LNG exports.

European natural gas prices have had an influence on ULSD futures over the past several years as distillates become the supplemental heating fuel, so this latest slump in European values does seem to be contributing to the 50 cent slide in diesel values over the past 4 weeks with prompt values reaching $2.1861 this morning, down from $2.7089 on November 19.

PBF reported unplanned flaring at its 160mb/day Torrance CA (LA-area) refinery over the weekend, with “emergency flaring” the only detail provided. LA basis values held at low values last week despite multiple upsets at other refineries in the area as imports continue to pour into the region.

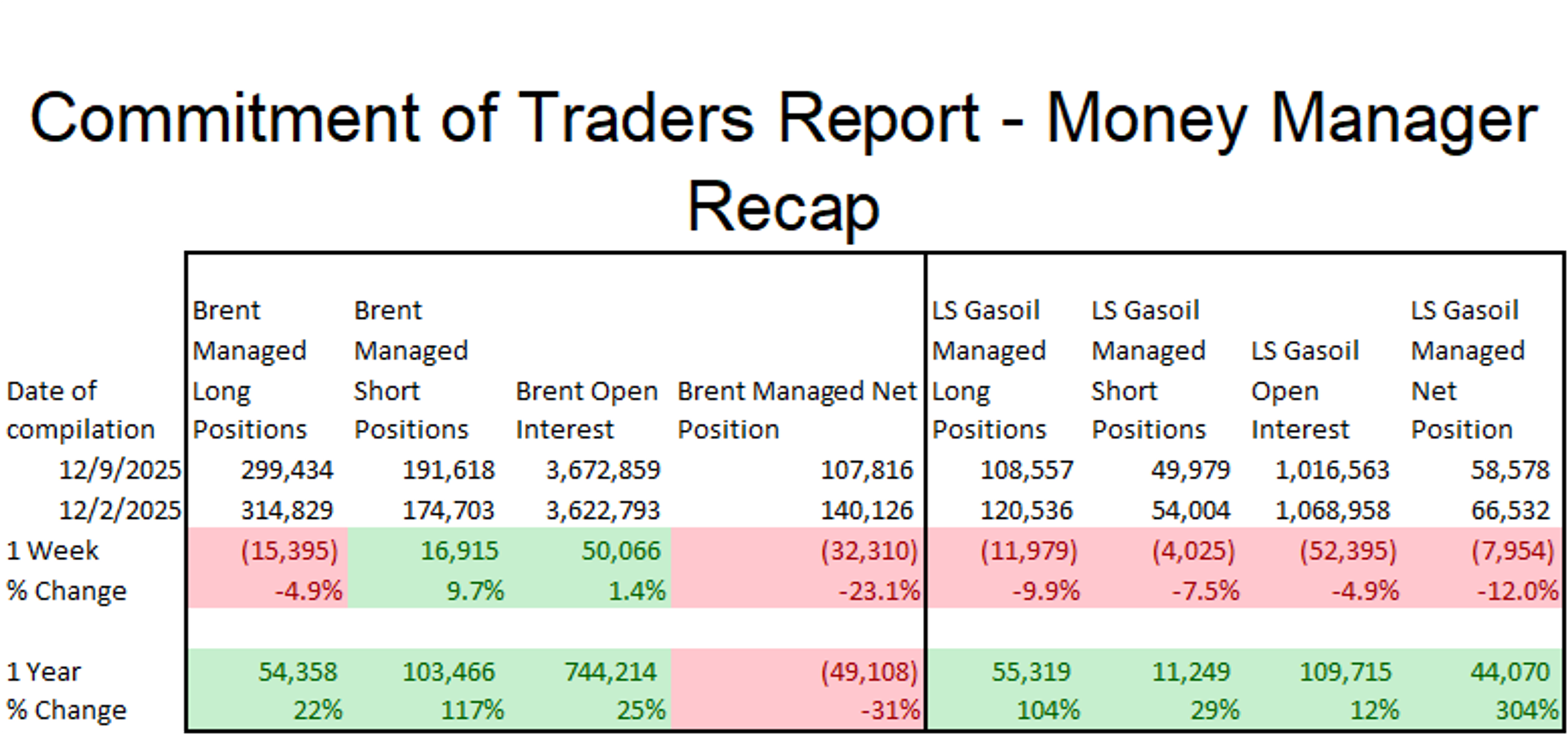

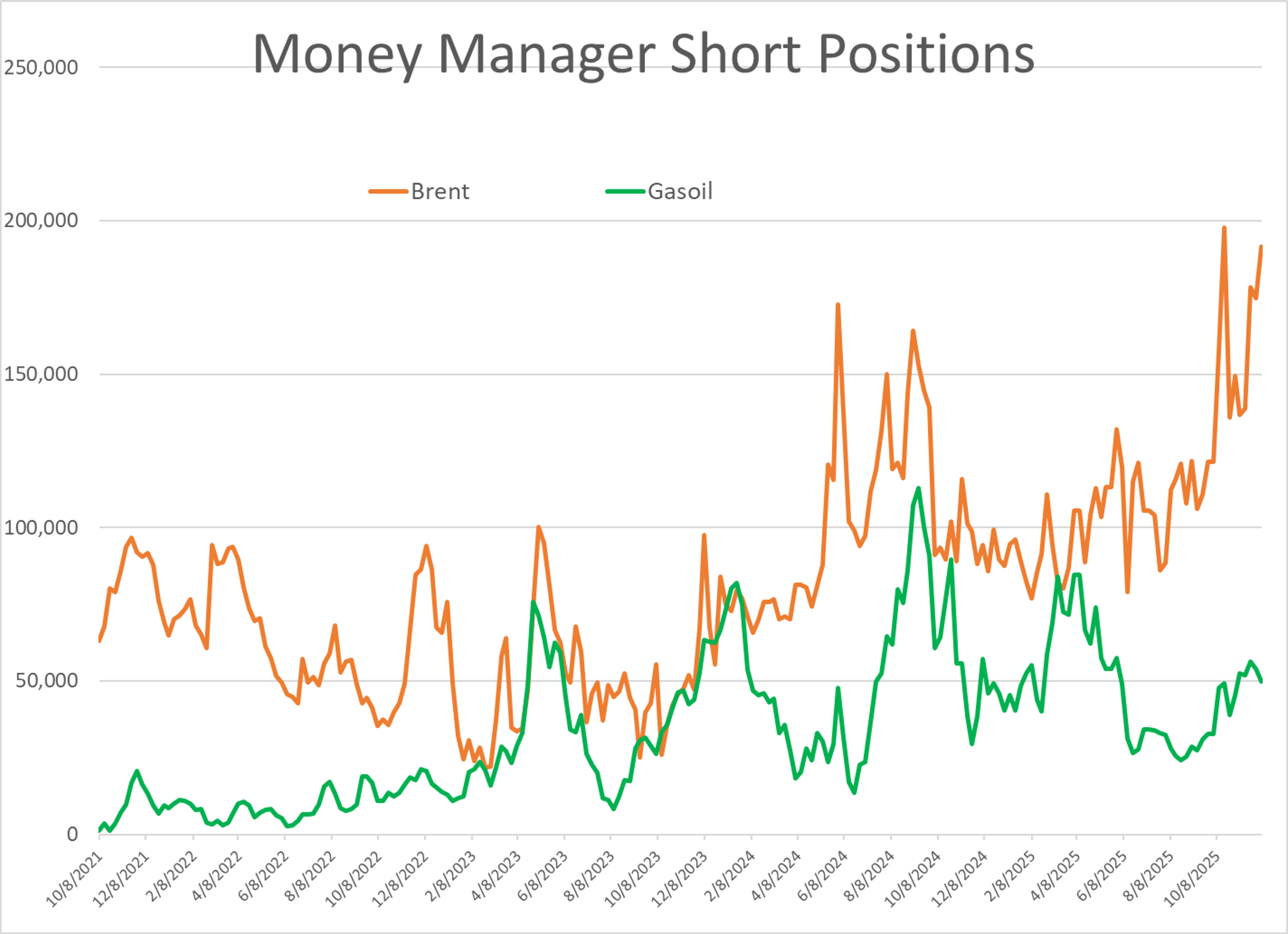

The CFTC is still working through its data backlog from the Government shutdown, and its weekly CFTC reports won’t be up to date until Mid-January. The ICE COT data shows that money managers were liquidating long positions in Brent crude and gasoil contracts last week with a decrease in net length of more than 40,000 contracts combined held by large speculators. While there’s no mistaking the bearish sentiment in the market lately, it’s worth pointing out that the speculative short interest in Brent crude now stands at the 2nd highest level on record, leaving the hot money vulnerable to a short covering rally like we saw in late October.

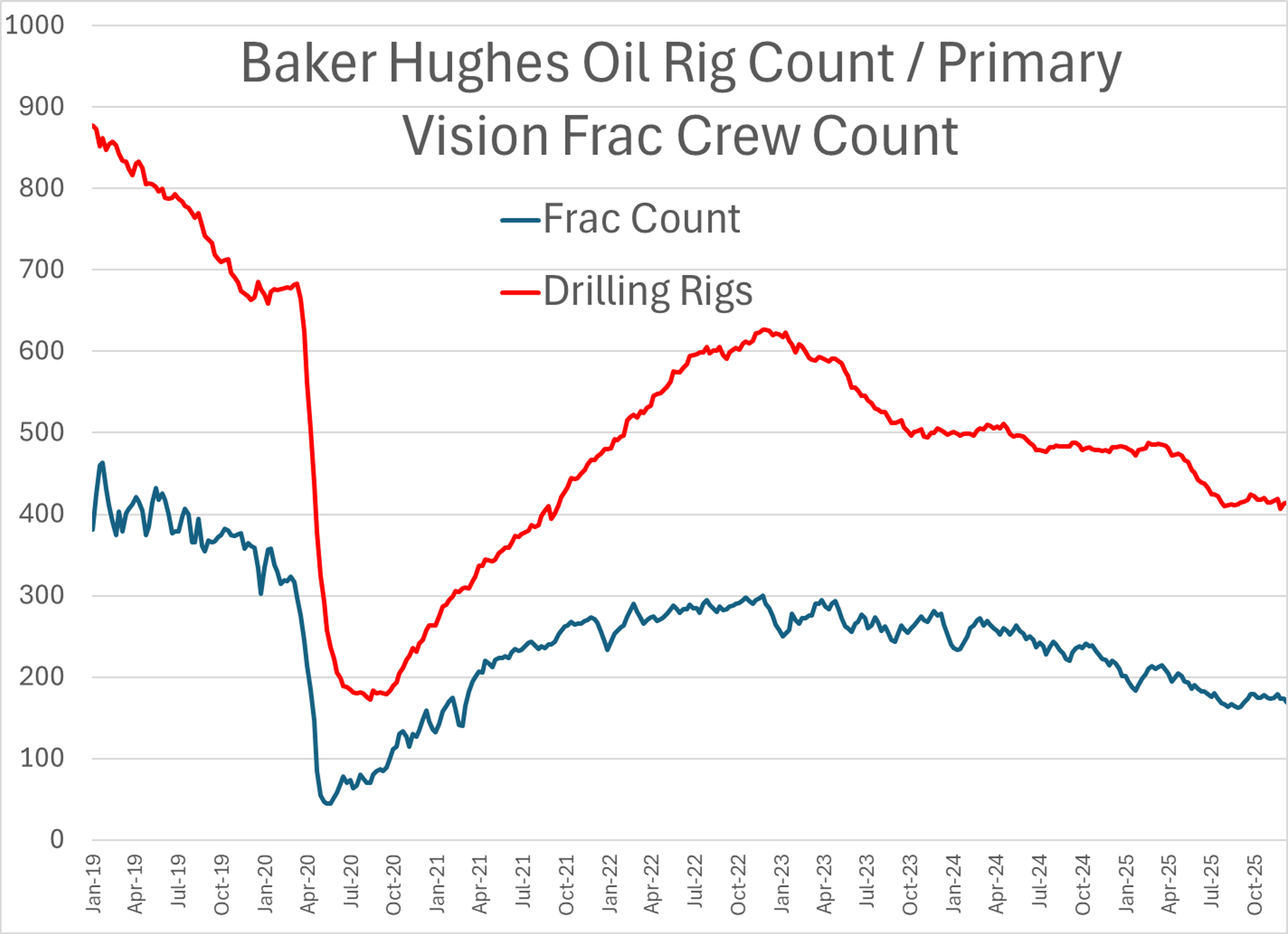

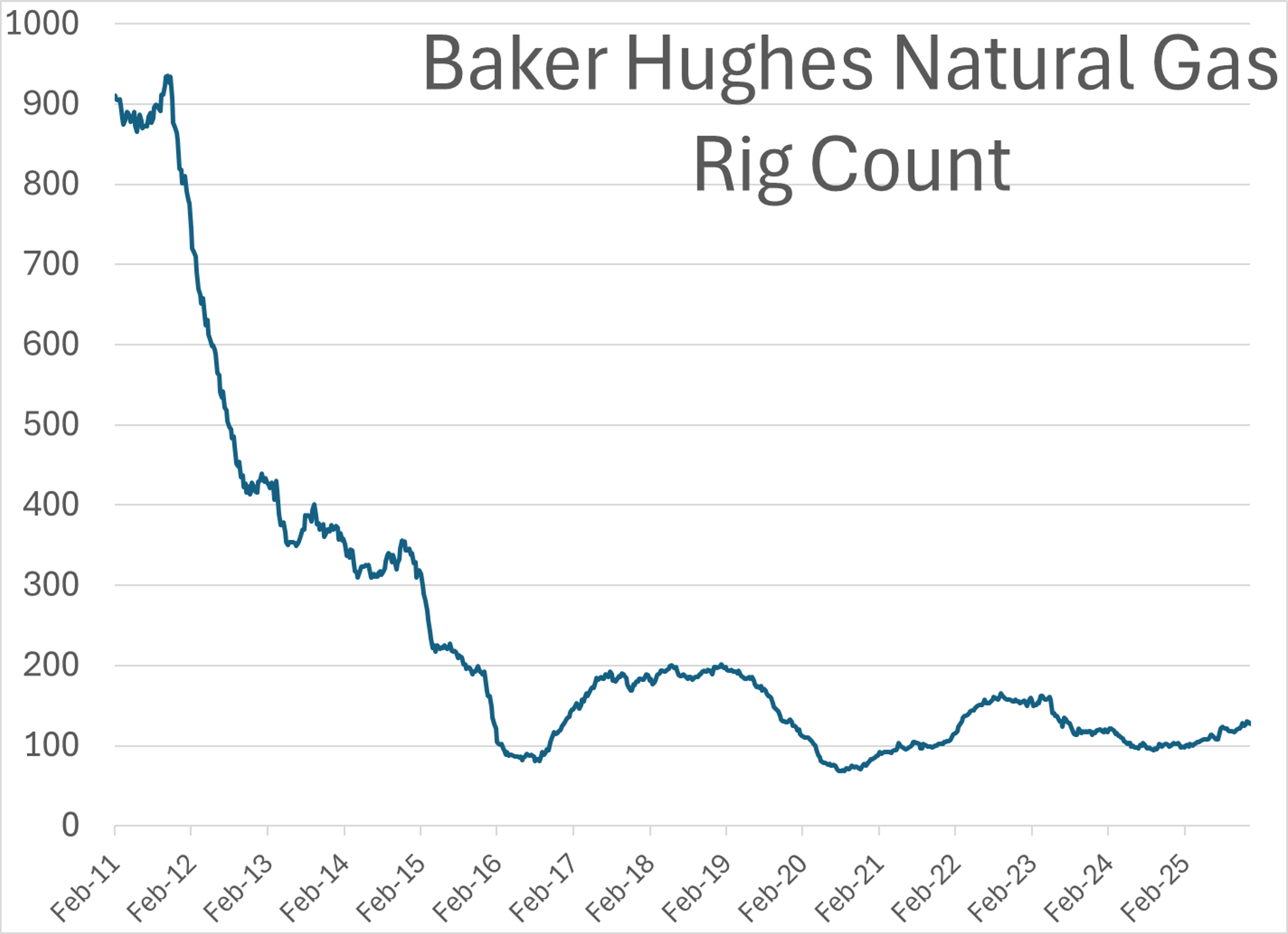

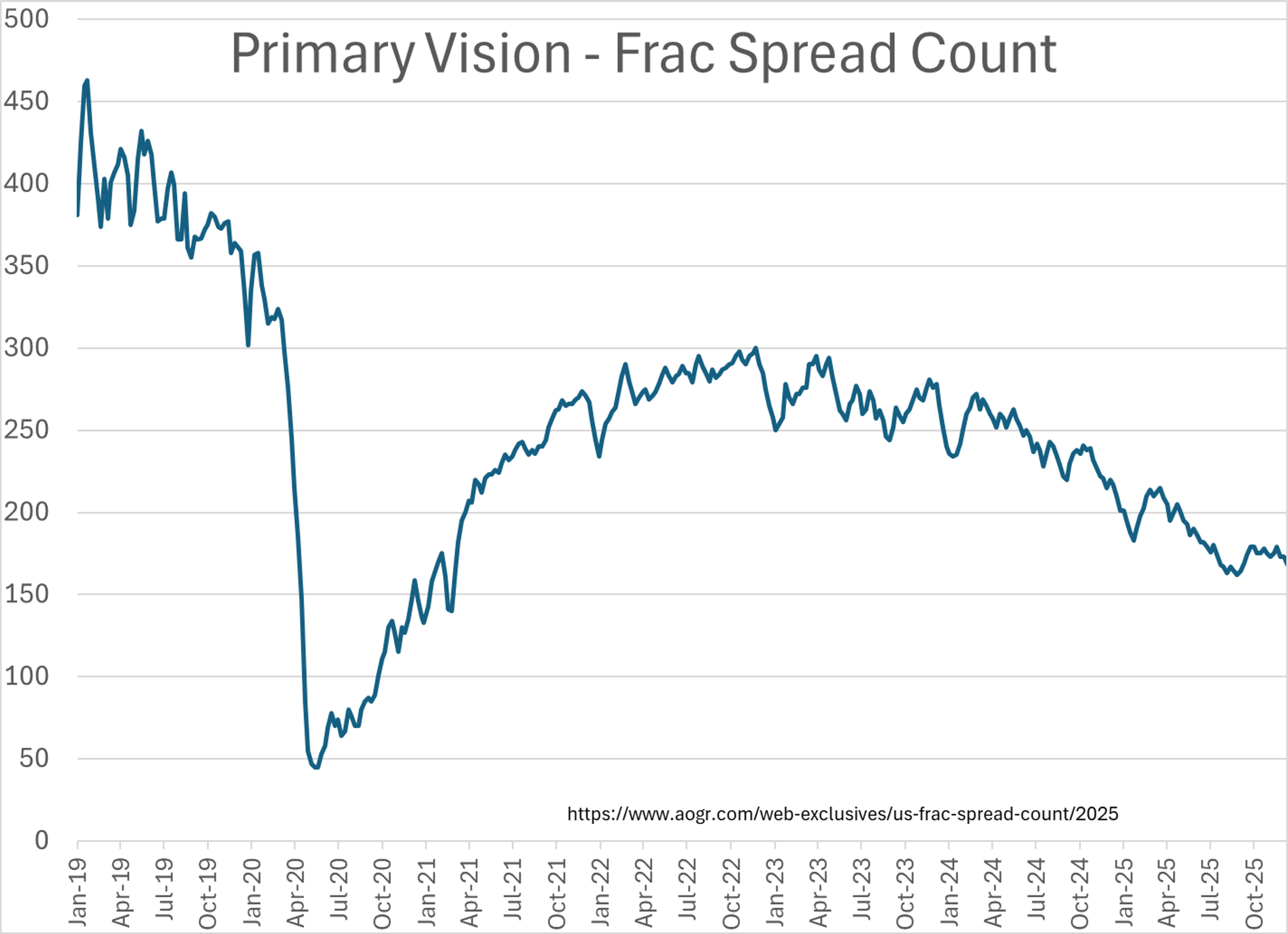

Baker Hughes reported an increase of 1 oil rig active in the U.S., which marks a 2nd week of increases after the count hit a 4 year low to end November. The Natural Gas rig count dropped by 2 on the week, marking a 2nd week of decreases after the count reached a 2.5 year high to end November. The Primary Vision Frac Crew count dropped by 5 on the week to 168 crews, the lowest level since Labor Day.

What are we doing here guys? A federal court ordered the EPA to provide a status update on the Renewable Fuel Standard plans for next year, which are already past due. Meanwhile a Reuters rumor Friday suggested the EPA won’t be finalizing those plans for 2026 until we’re in 2026, leaving the industry in limbo yet again. The biggest unknown is whether or not importers of renewable fuels and blend stocks will only qualify for 50% RINs as was proposed, or if those plans to favor domestic production may be delayed as has been rumored.

No letting up so far: Ukraine’s drones hit Russia’s 120mb/day Afipsky refinery over the weekend, with the attacks on energy infrastructure not showing any signs of letting up, even as Ukraine’s President signals a major concession in letting go of their NATO-aspirations in order to try and advance negotiations to end the war.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets