Oil Complex Slips As Supply Glut Fears Outweigh Trade Optimism

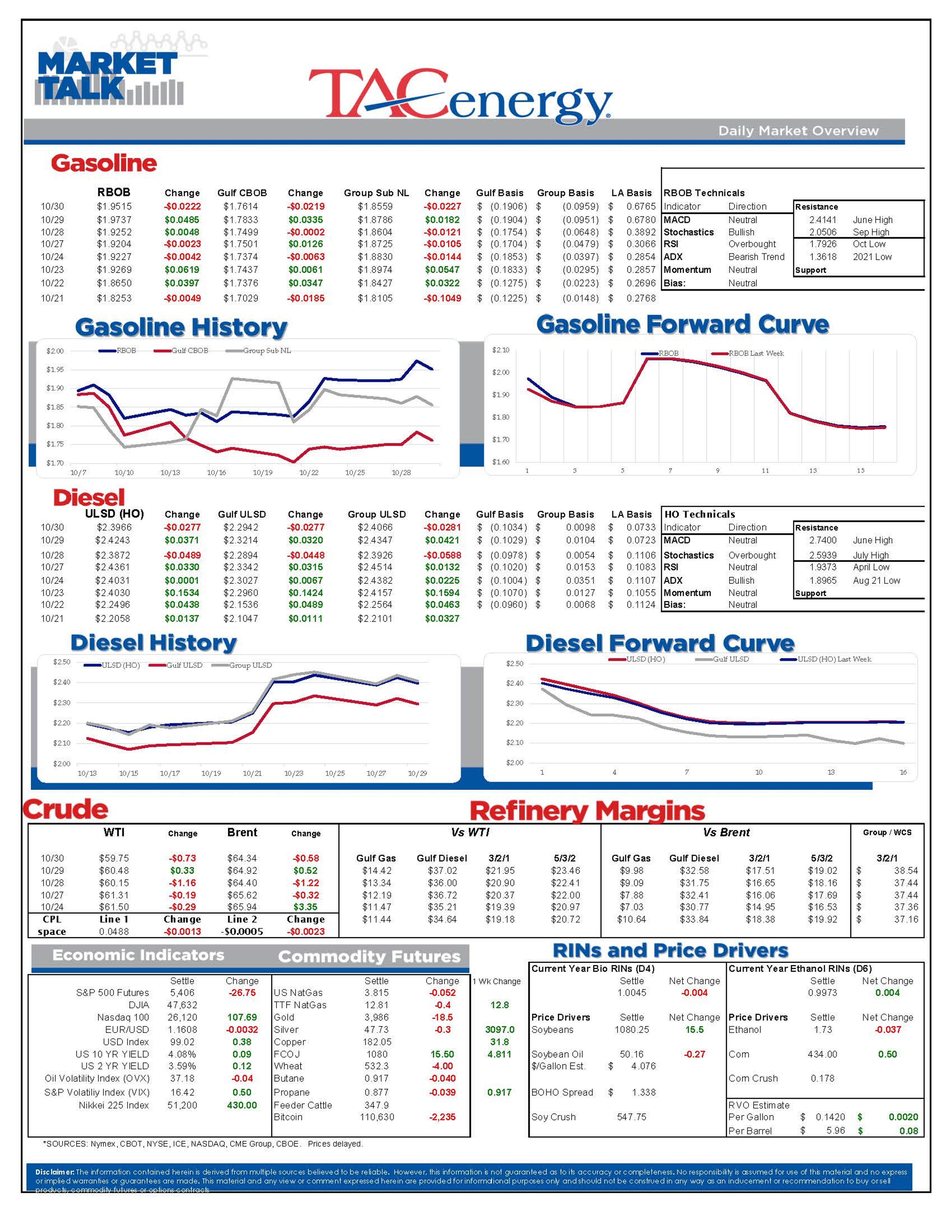

The energy complex is trading lower this morning, despite positive news on the US-China trade war and a larger-than-expected decrease in crude oil inventories according to the Department of Energy’s weekly report published yesterday. Concerns over a global oil supply glut, stemmed by strong US production and a continued increase from OPEC+, are being blamed for today’s downward pressure. HO is leading the way lower, trading nearly 1% lower than yesterday’s settlement, with RBOB and WTI trailing behind, going lower by .8% and .6%, respectively.

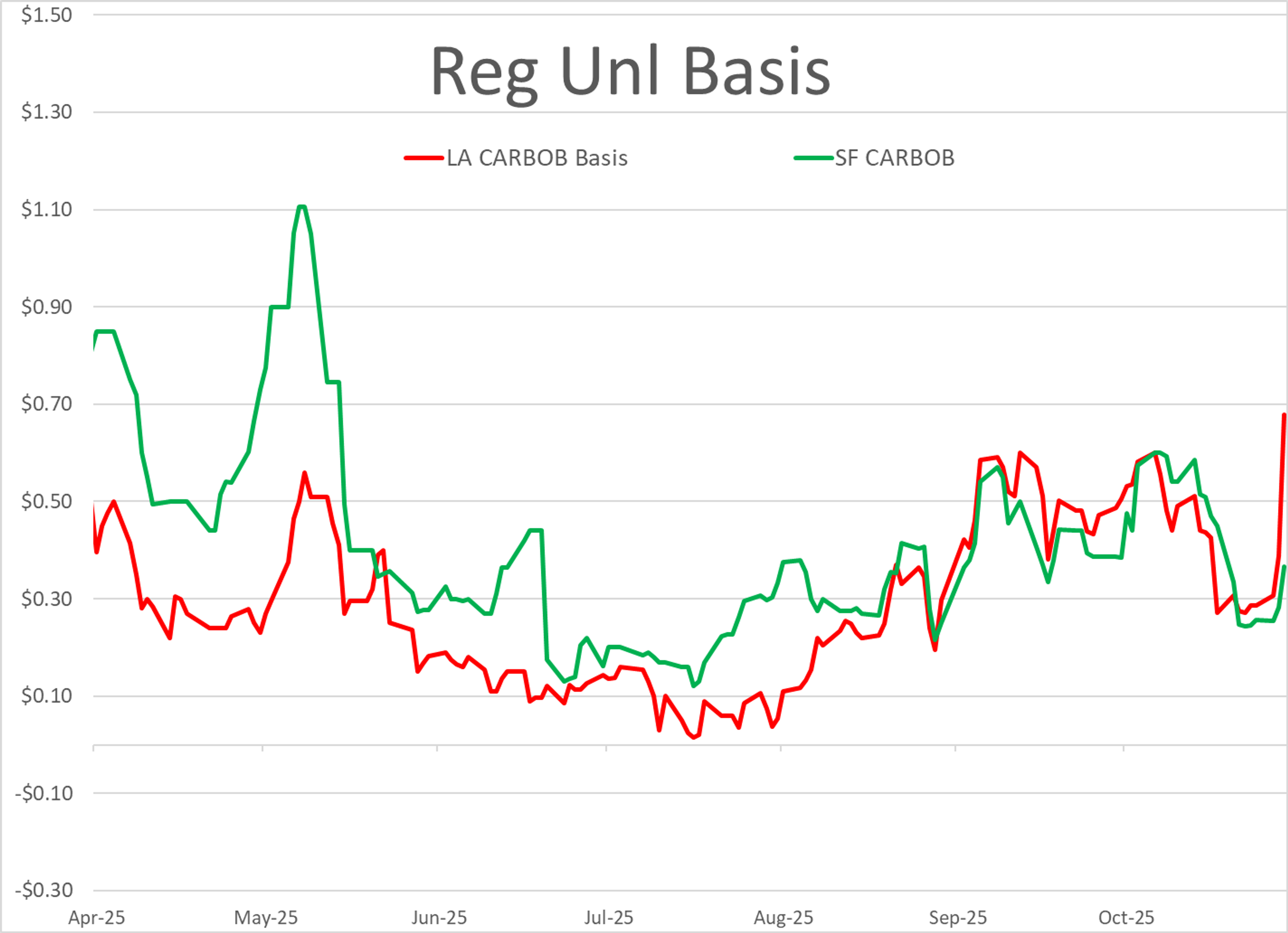

West coast CARBOB gasoline spot prices spiked again yesterday after reports of unplanned flaring at Chevron’s 247mb/d Richmond refinery, meaning both Chevron plants in the state have experienced hiccups in the last 24 hours. LA gasoline basis differentials popped to 67.75 cents as of yesterday afternoon, while San Francisco CARBOB basis ‘only’ jumped 9 cents to trade .37 cents over the NYMEX.

Valero’s Corpus Christi refinery experienced a power outage this morning, lasting (at least) long enough to trigger safety shutdown sequences at it’s West Plant. There are currently no estimates on when that portion of the refinery will be back up and running, but judging by the lack of response in the GC basis markets, it doesn’t seem like many are watching it too closely.

HF Sinclair issued a press release yesterday announcing it’s plans to expand, reverse, debottleneck, and build various pipelines, all with the goal of moving more barrels west. From the release:

Additional phases under evaluation include the following projects:

- Medicine Bow Pipeline: Expansion and reversal of HF Sinclair’s wholly-owned pipeline between Denver, CO and Sinclair, WY.

- Pioneer Pipeline: Additional expansion of the jointly-owned pipeline with Phillips 66 from Sinclair, WY to Salt Lake City, UT.

- UNEV Pipeline: Additional expansion of HF Sinclair’s wholly-owned pipeline from Salt Lake City, UT to Las Vegas, NV.

- Building a new lateral from Salt Lake City, UT to Reno, NV.

This is now the third announcement from pipeline companies planning new projects/expansions in an effort to supply the increased demand from expanding western cities: last month OneOK/Magellan launched an open season to gauge interest in their Houston-to-Phoenix pipeline project and just last week Kinder Morgan and P66 made known their plans alter their pipeline structure to bring product refined by P66 to Phoenix and on to California.

While Hurricane Melissa isn’t forecasted to cause any direct disruptions to US energy infrastructure as of now, the thunderstorms moving along the North East region are making tanker deliveries of refined products challenging.

Notes on the DOE Report:

Crude drew almost 7mm barrels with imports dropping to a 2025 low while exports rose and demand kicked back up. The drop was somewhat limited by slowed refinery runs across most PADDs while US crude production posted a new all-time high, just two weeks removed from the last high mark. PADD 4 was the lone run rate increase on the week at a negligible +4 kbd while the others pulled back, particularly PADDs 2 & 3. PADD 2 runs have dropped sharply over the past month and are sitting at not only a 2025 low, but a seasonal 5-year low. PADD 3 slid quite a bit by volume but is still comfortably above average. PADD 5 fell again to stay at week 3 of seasonal lows while PADD 1 continues along at seasonal highs, holding the US total above its 5-year average.

Despite a third week of declining demand, diesel inventories fell across all PADDs except 3 with a big increase in export activity. The largest declines were in PADDs 1 & 2 where stock levels were already low. PADDs 3-5 are all sitting above average but with the concentration in PADDs 1 & 2 combined to outweigh PADD 3’s influence, total diesel stock levels remain about 10 million barrels below their 5-year average and are trending more closely to the past two years seasonally.

Similarly to refinery runs, gasoline stocks declined across all PADDs except 4 which posted an insignificant 20k barrel increase. Drop offs in PADDs 2 & 5 coupled with inventories declining elsewhere, particularly PADD 3’s already low inventories, caused a sharp downturn in total storage back to year ago levels. Ethanol stocks remained strong despite a surge in exports as production levels continue to run along the high end of the 5-year chart.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets