Diesel Retreats, Crude Gains: Traders Shift Positions Ahead Of Fed Cut

The energy complex is trading lower to start the week with ULSD futures once again taking the reins, shedding 3.5 cents so far this morning.

Equity markets are drifting slightly higher in pre-market trading, as all eyes are trained on the Fed’s interest rate decision set for Wednesday. The CME’s FedWatch tool shows that currently almost 90% of interest rate traders are expecting a 25 point cut in this week’s announcement. While most market participants are aligned on what the decision will be, it sounds like that isn’t the case among the Committee members, with some warning of “persistent inflation” if rates are cut again so soon.

The Ukrainian President is in London today, meeting with European leaders to, presumably, progress peace talks that could bring about the end of the 3-year war with Russia. It isn’t letting up pressure in the meantime: Ukraine’s latest UAV strike damaged part of Rosneft’s 353mbd refinery in Ryazan over the weekend. This is the ninth attack at this particular plant this year, which sits just 124 miles outside of Moscow.

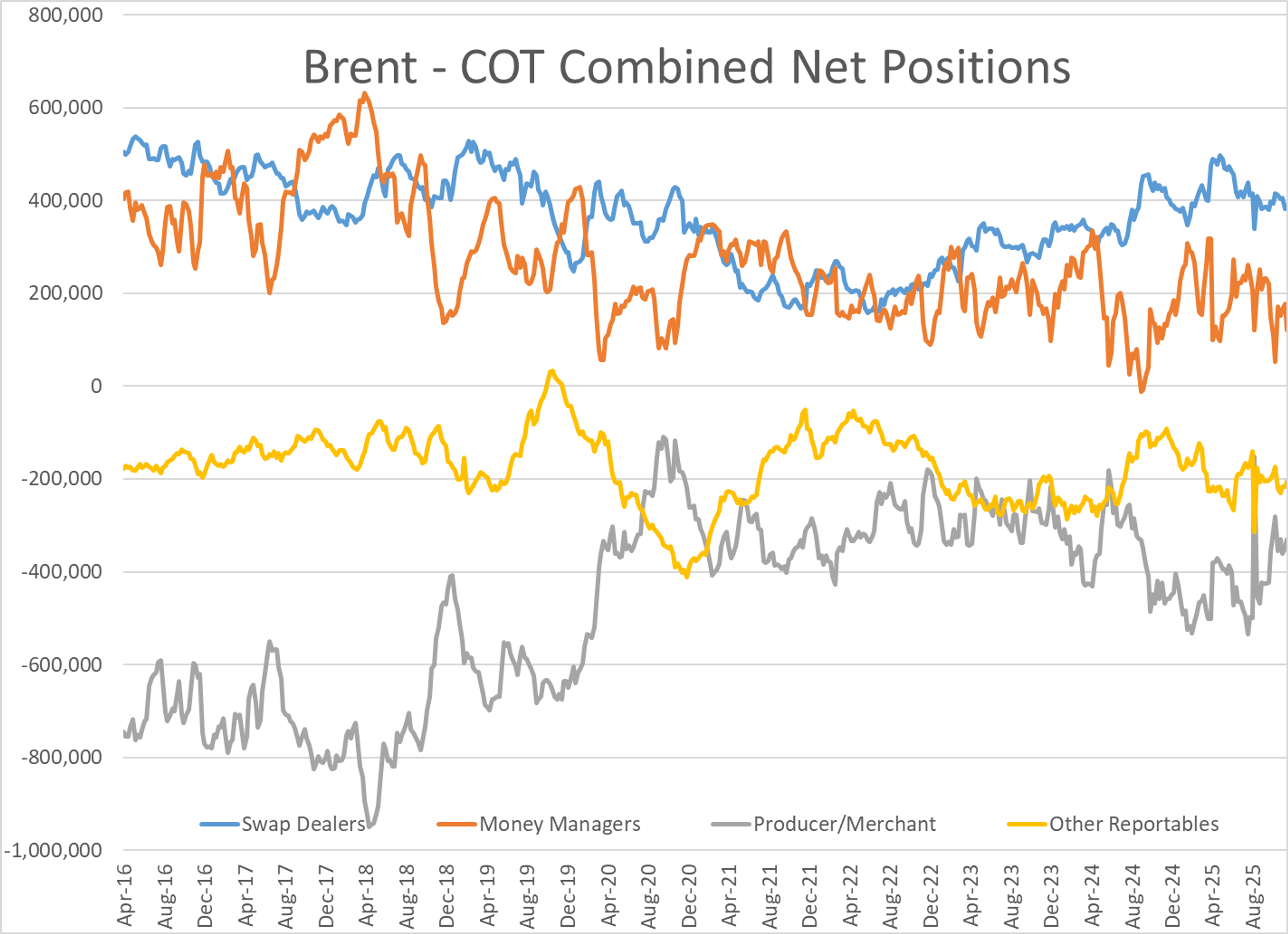

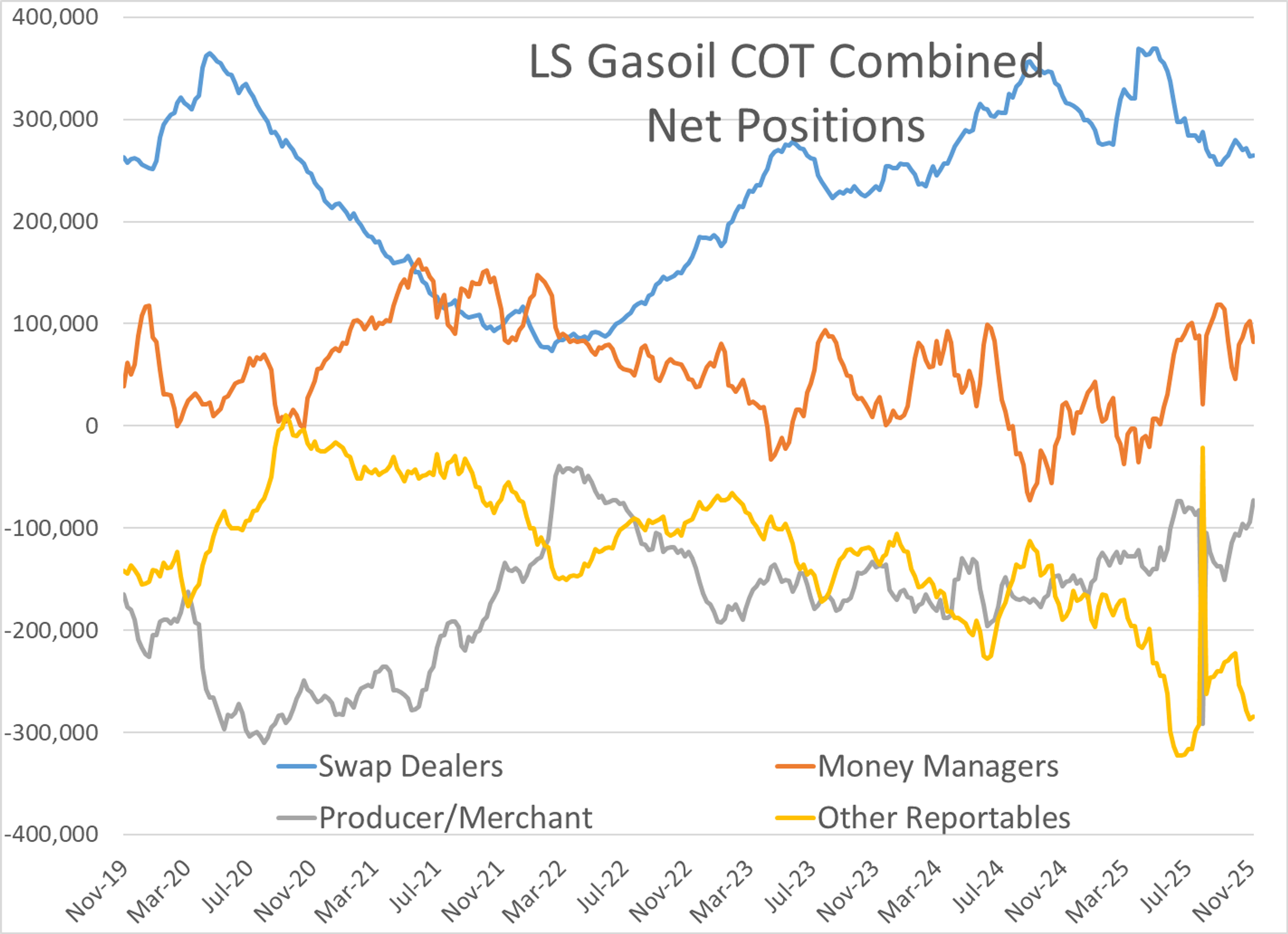

The Intercontinental Exchange showed money managers speculating in the European diesel market bail out of their long positions on higher prices last week. The ‘smart money’ slashed their net length on the distillate benchmark by 15k contracts (19%) while tacking on 19k in its crude oil counterpart. Reminder that the CFTC isn’t expected to report their Commitment of Traders report until the middle of next month.

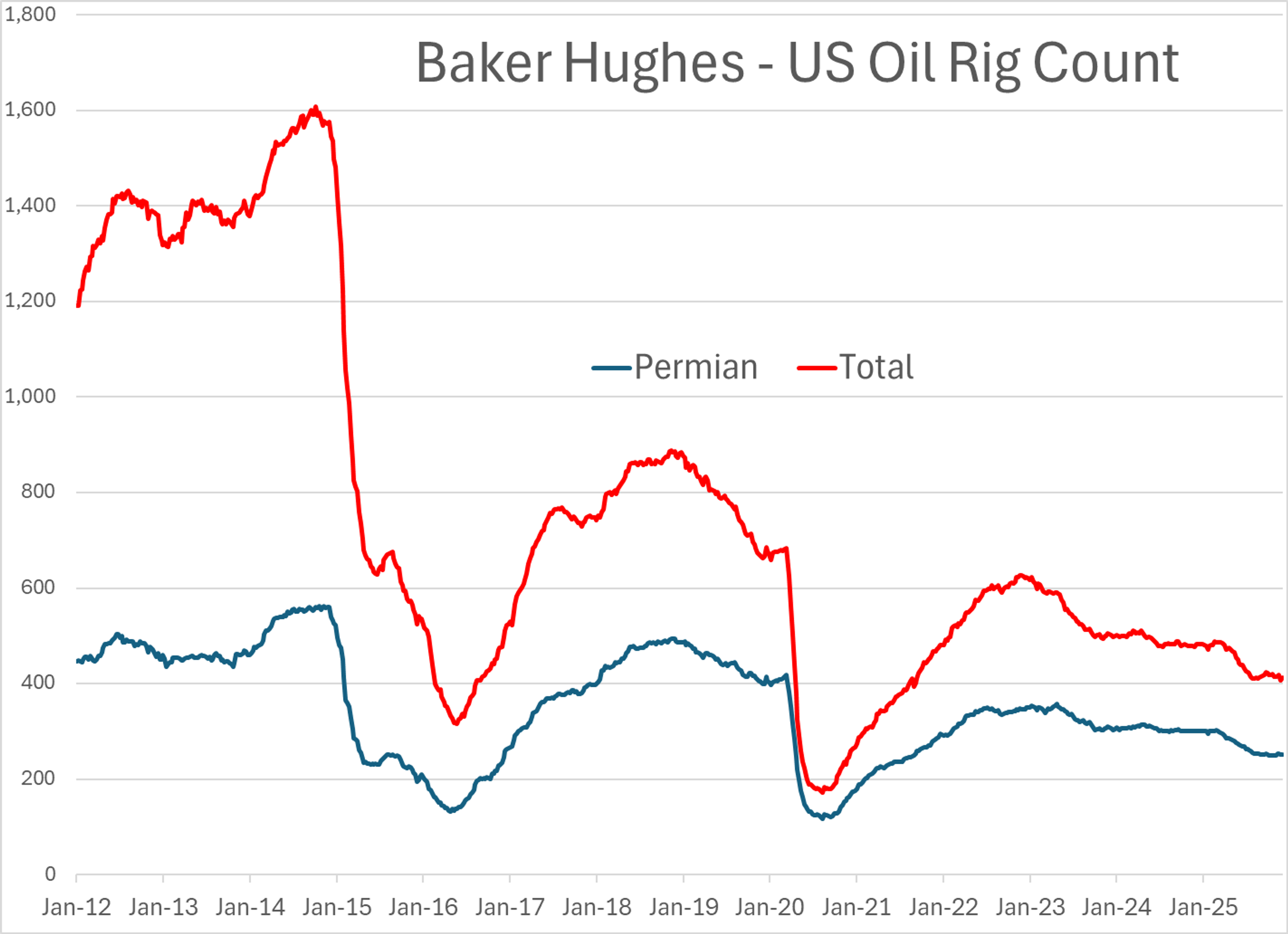

Baker Hughes reported an increase of 6 oil rigs last week, pulling the U.S. total active rig counts off a 4-year low set last week. Total oil production held steady according to the DOE last week, coming in at 13.8 million barrels per day.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets