Gasoline Futures Attempting To Take The Energy Market Higher

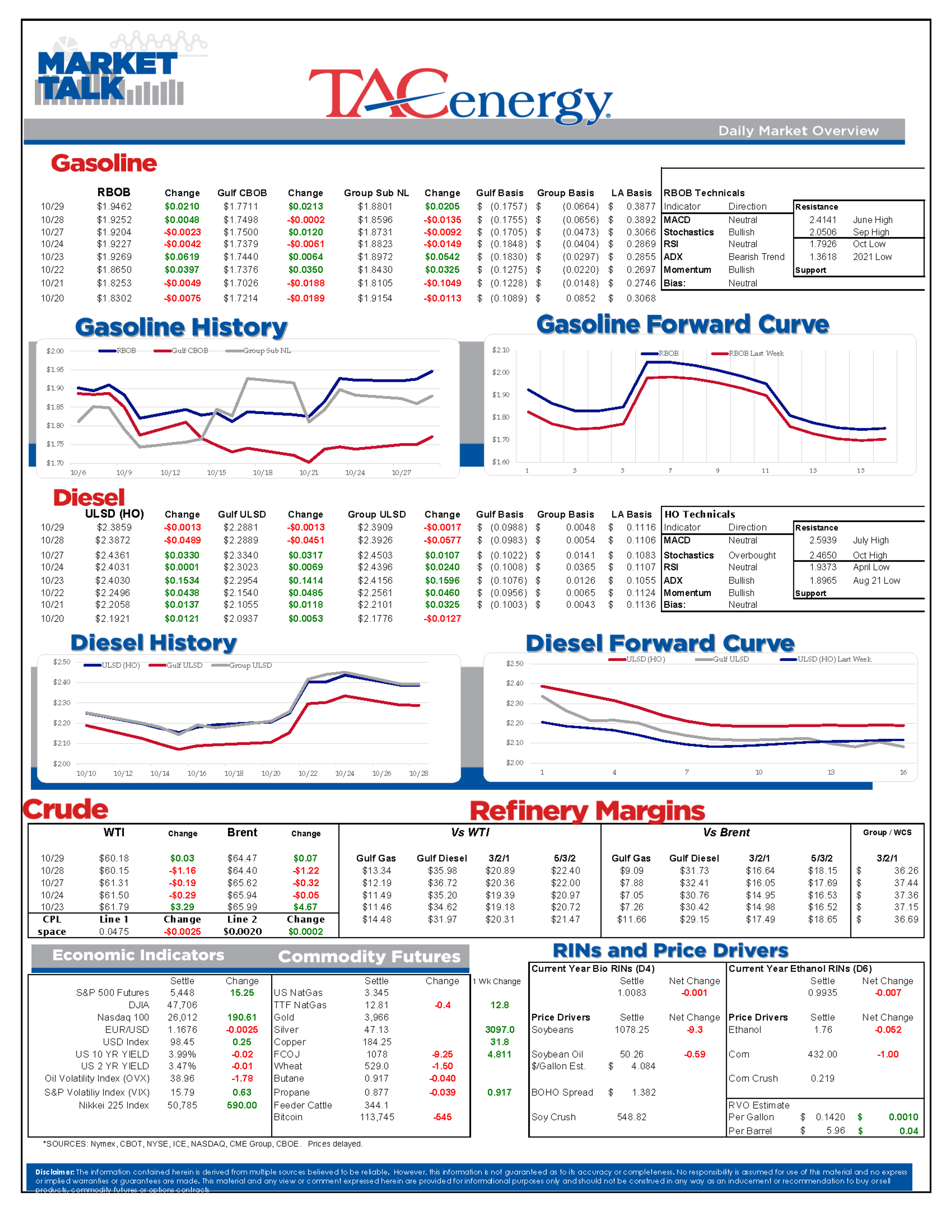

RBOB gasoline futures are taking a turn trying to lead the energy market higher Wednesday, after letting diesel prices lead the market for most of the past 2 weeks. The 2 cent move in RBOB is credited to a big draw in inventories last week that seem to be giving buyers some counter-seasonal optimism on demand.

The API was said to estimate gasoline stocks dropped by 6.3 million barrels last week while distillates dropped by 4.4 million barrels and crude oil stocks had a more modest decline of 2.9 million barrels. The drop in product inventories suggest there may have been some stockpiling downstream of the bulk supply network as prices bounced sharply after reaching multi month (diesel) and multi-year (gasoline) lows the prior week. If that’s the case, we are likely to see the reverse effect next week. The DOE’s weekly status report is still due out at its normal time today despite the government shutdown, although it’s unclear if reporting will continue in November.

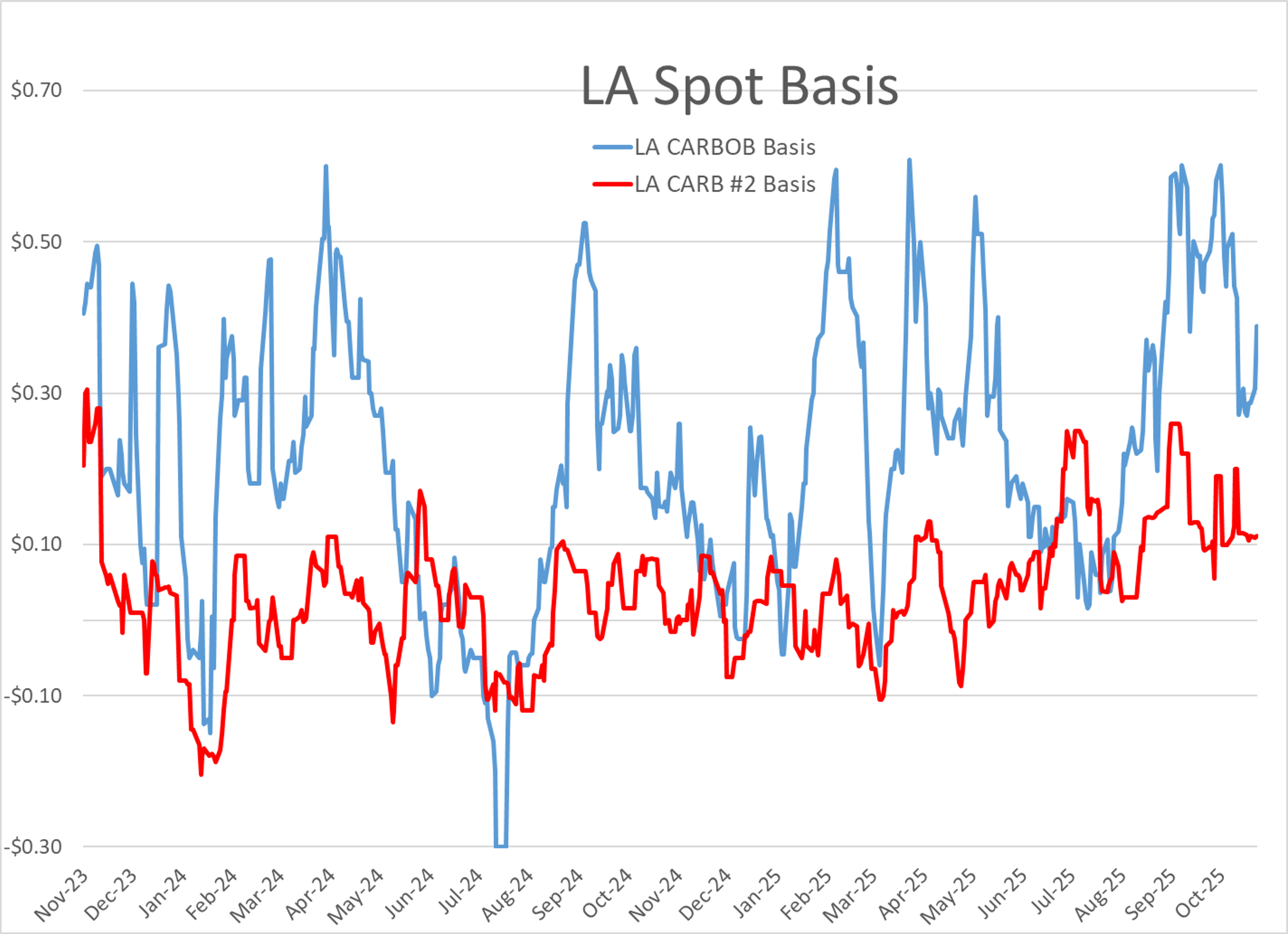

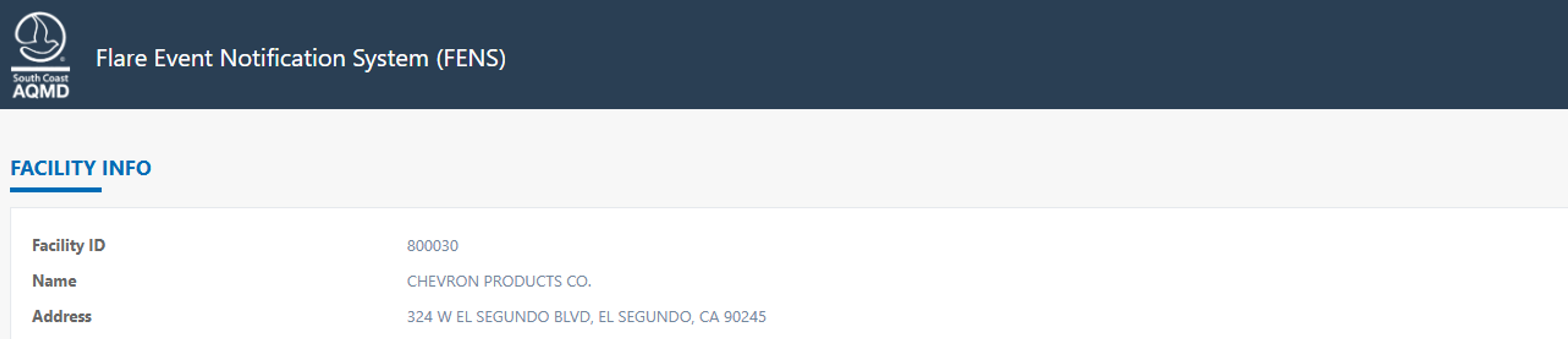

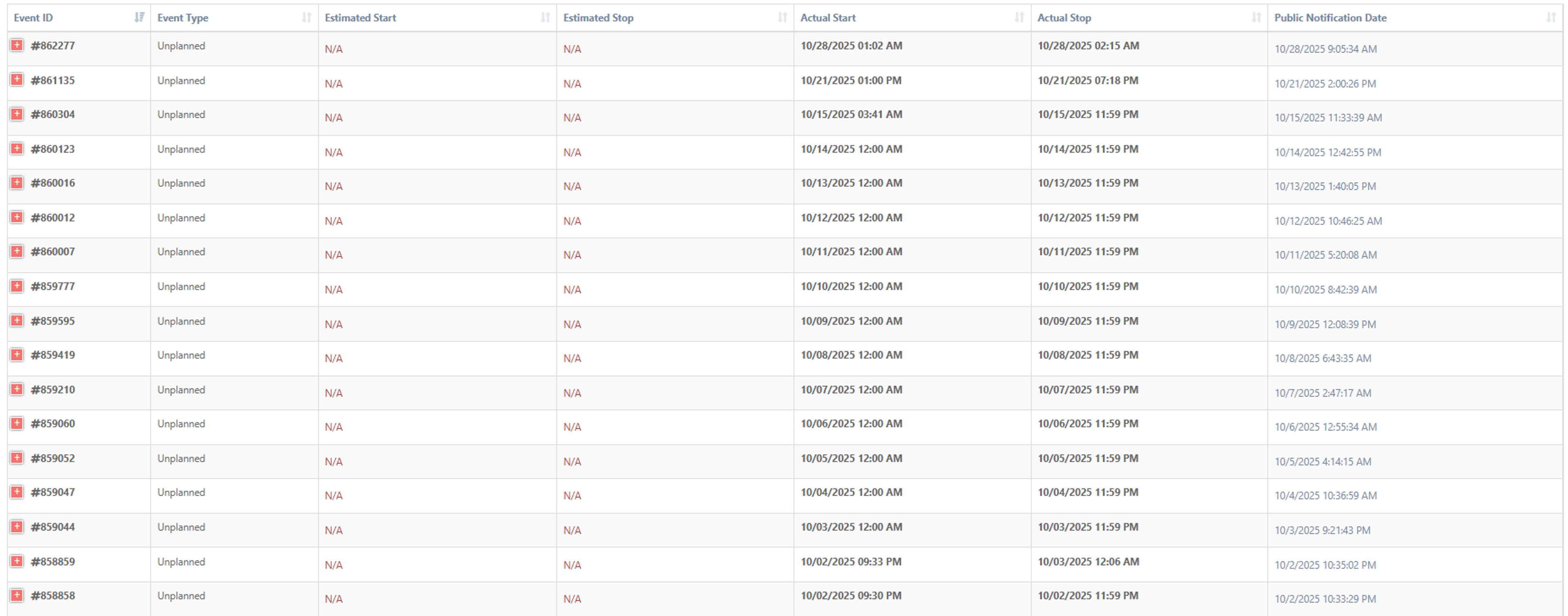

Los Angeles CARBOB gasoline basis diffs rallied again Tuesday following another unplanned flaring event reported at Chevron’s 290mb/day El Segundo refinery. That was the 17th unplanned upset reported at the facility since a fire broke out at the facility on October 2nd, but it was the first in a week after it appeared the plant was finally back to a normal run rate and clearly put the market back on edge.

An unsung hero in the big diesel rally has emerged as reports of a fire at Kuwait’s Al Zour refinery a week ago are just now surfacing after having been missed by news outlets for nearly 7 days. That huge 615mb/day facility was brought online in 2022 and quickly became a key supplemental supplier of diesel to Europe as the continent works to replace Russian barrels. It’s also worth noting that refined product exports don’t count against Kuwait’s OPEC oil quotas, which is a complex and clever way some of the richer members of the cartel have been able to ramp up their total output without violating their agreements in recent years. It’s still unclear what damage may have been done by that fire, but the 10 cent drop in prices from Monday’s high suggests that the facility may be coming back online.

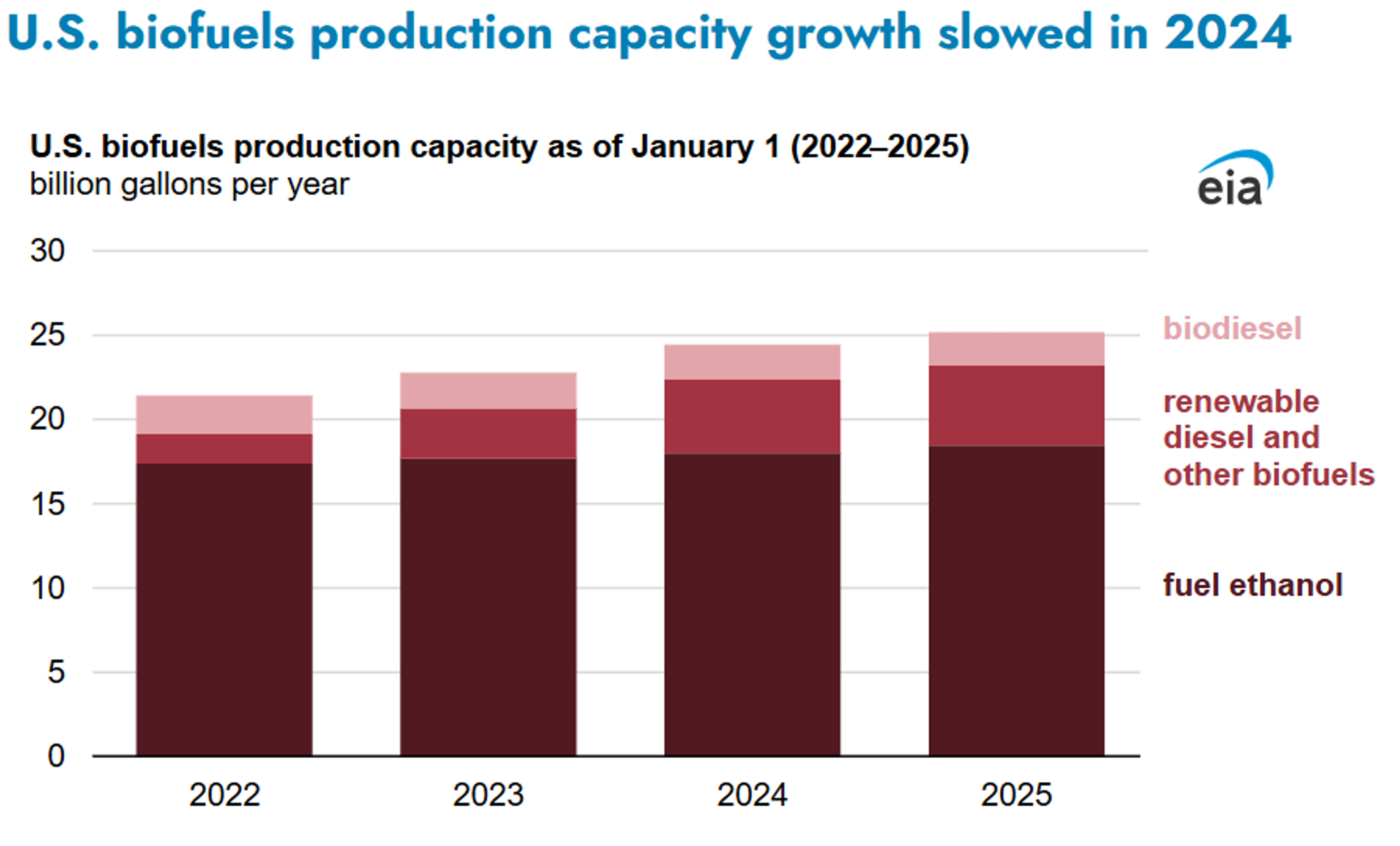

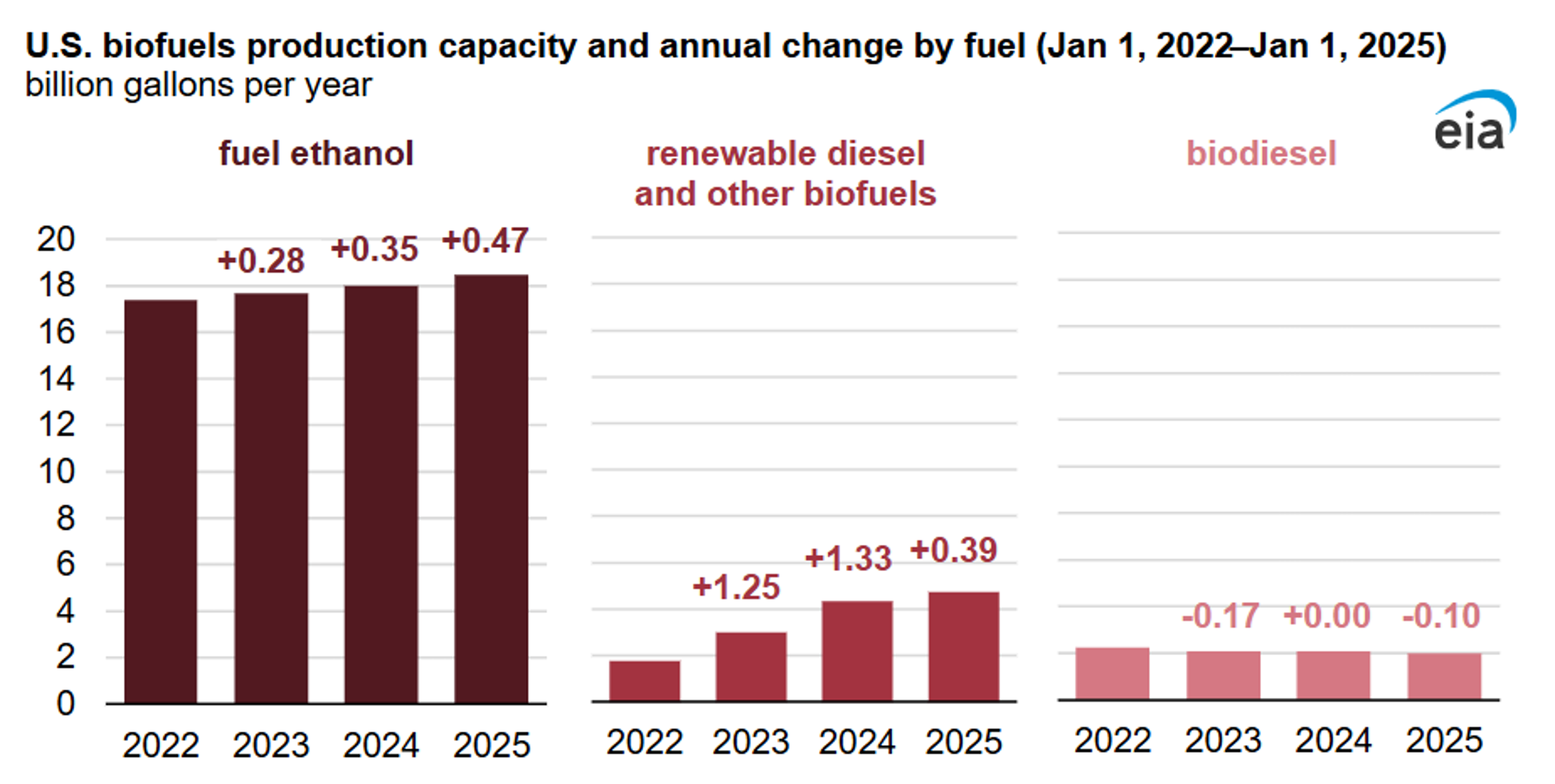

The EIA highlighted the slowdown in biofuel production growth last year as a harsh environment for BIO and Renewable Diesel production offset more growth in ethanol capacity which has been spurred on by export demand. The report specifically noted how both the Chevron El Segundo CA and Delta/Monroe Trainer PA refineries had halted their co-processing of renewables, while Vertex and Jaxon energy both closed their stand-alone renewable plants entirely. In addition, 8 different biodiesel facilities shut during the year.

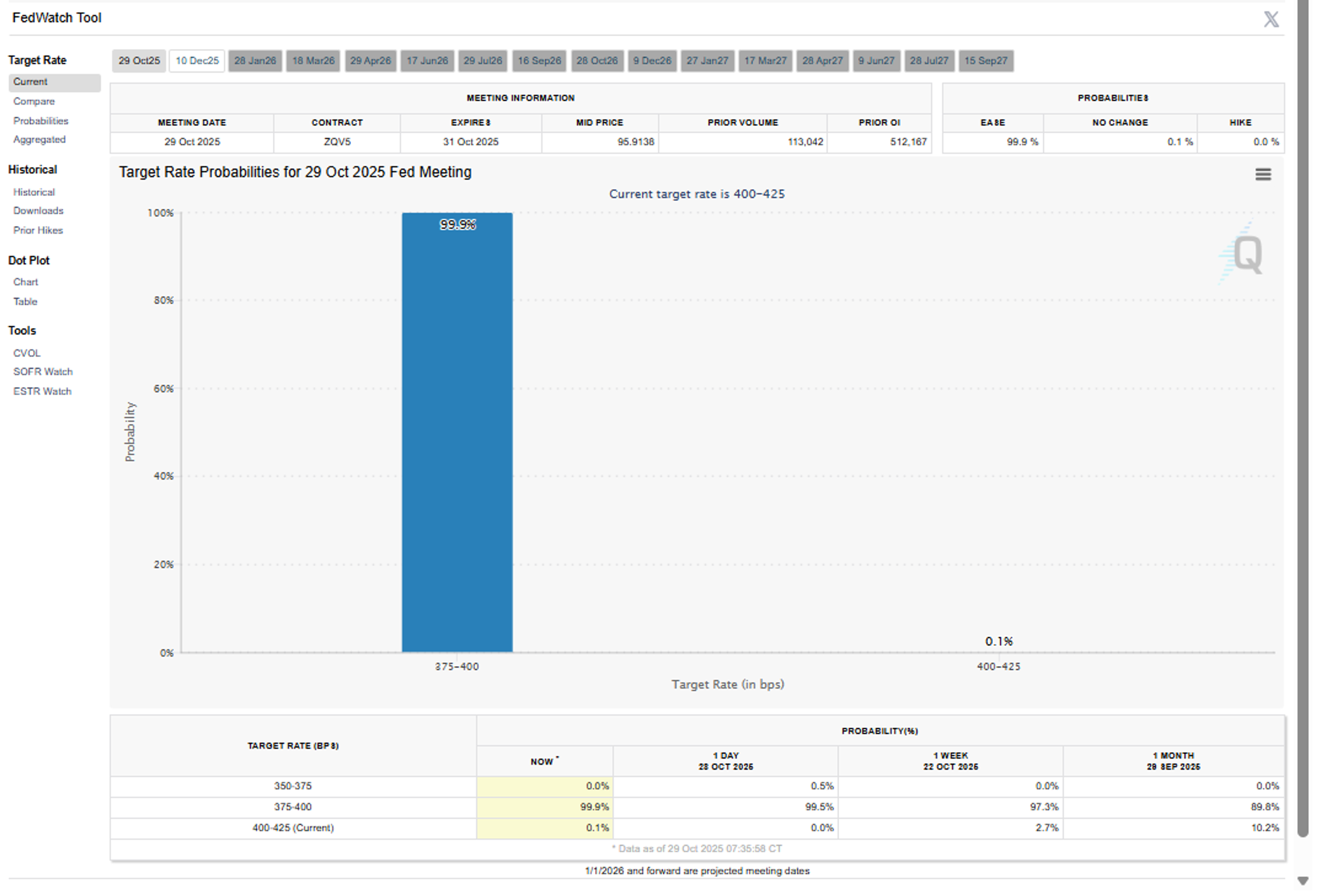

The FED’s Open Market Committee will make its next monetary policy announcement at 1pm this afternoon. Just about everyone expects another 25 point cut to the target rate, with 99.9% odds according to the CME’s Fed Watch tool, while 87% of bettors expect 1 cut today and another 25 point cut in December, despite stubbornly high inflation.

There are reports that Ukraine’s drones struck 2 more Russian refineries overnight, although the combined capacity of the two plants is only about 40mb/day.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets