RBOB Gasoline Futures Lead Energy Markets Down

It’s a soft start for energy markets Tuesday with RBOB gasoline futures leading a slide down more than 2 cents/gallon, while WTI is once again trading below the $60 mark.

Steep backwardation on the East and West coasts continues to be a major theme for gasoline markets as we head closer to the winter demand doldrums. Los Angeles CARBOB differentials soared to an 85 cent premium to futures Monday, which is 40 cents above any other regional values in the country as that market learns to deal with the loss of the P66 Wilmington refinery that closed for good last week. The values in New York harbor have already started their slide down the curve, moving from a 13 cent premium on Friday to a 9 cent premium Monday, lessening some of the squeeze as shippers recover from last week’s weather delays.

Ukrainian drones reportedly struck the 340mb/day Lukoil refinery in the city of Kstovo overnight, along with attacks at a major petrochemical facility that lies more than 900 miles from the border as the US-aided long-range attacks continue. The day prior those drones hit the 100mb/day Saratov refinery and an oil export facility that caused both an oil spill near the Black Sea and a tanker to catch fire.

An interesting footnote to Exxon’s recent earnings call: The company is considering more refinery upgrades, similar to the major investment recently announced at its Baytown facility, to take advantage of low-cost feedstocks like Butane and Propane and take advantage of the increasing demand for base stocks and plastics and lessen its focus on gasoline output.

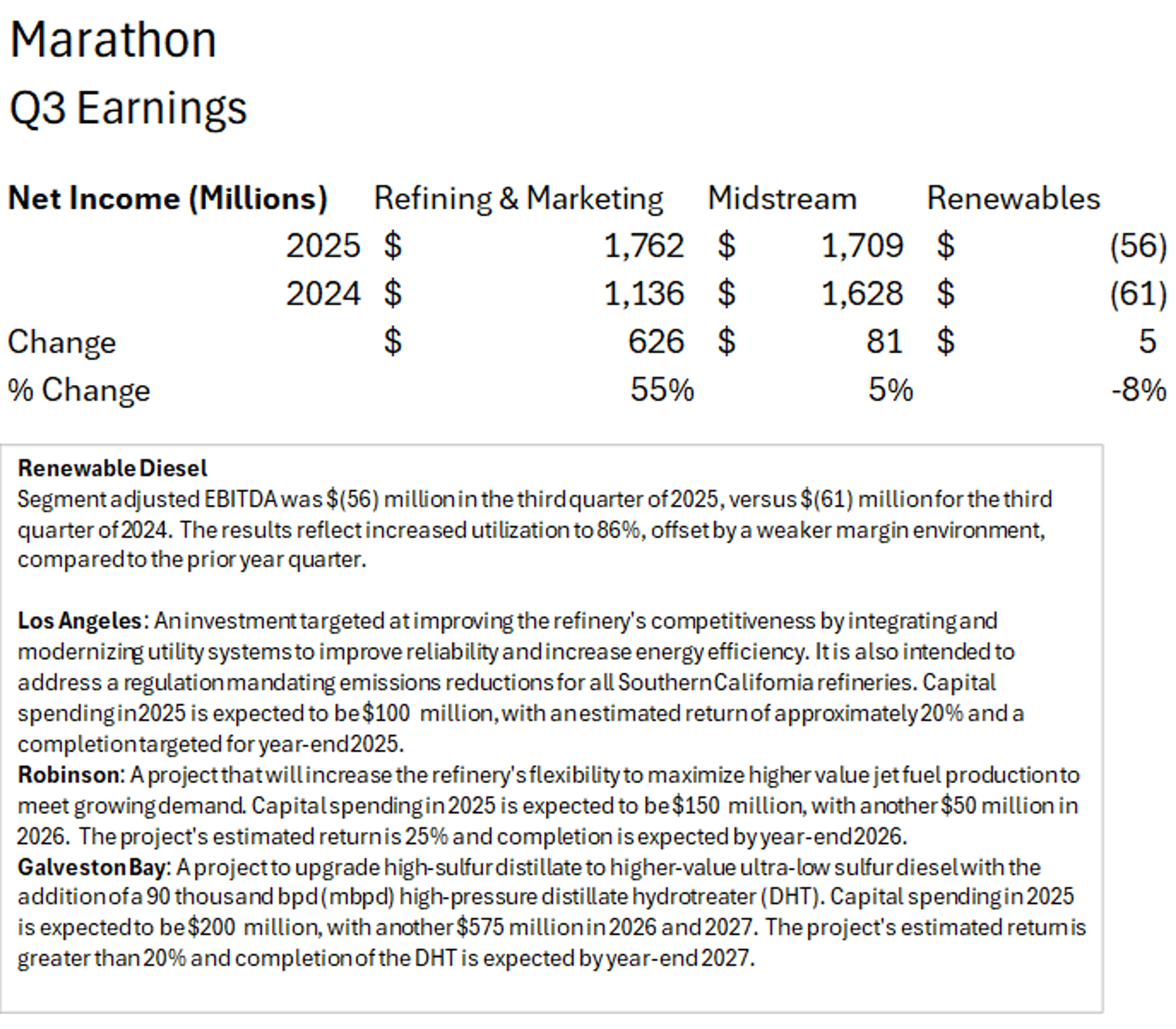

Marathon followed the pattern of other domestic refiners in its Q3 earnings release, noting a strong quarter for traditional refining operations thanks to healthy crack spreads and high utilization, while renewables continued to be a loser. The company continues to highlight ongoing efficiency projects at 3 of its refineries, and investments in a host of projects to expand their capacity to handle natural gas and natural gas liquids.

Coincidentally, Marathon also reported an unplanned flaring event at its 631mb/day Galveston Bay (FKA Texas City) refinery in a sulfur recovery unit. That upset lasted 4 hours, but so far no reports of any other units being impacted by the event.

BP also reported a solid quarter with a big improvement in crack spreads and 96% refinery utilization driving a good portion of the earnings. The company noted that it had halted its plans to build a RD refinery in Rotterdam during the quarter but was investing in Electronic Cooling solutions for AI computing systems through its Castrol unit.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets