Energy Markets Rally Amid Geopolitical Crosscurrents And Regulatory Uncertainty

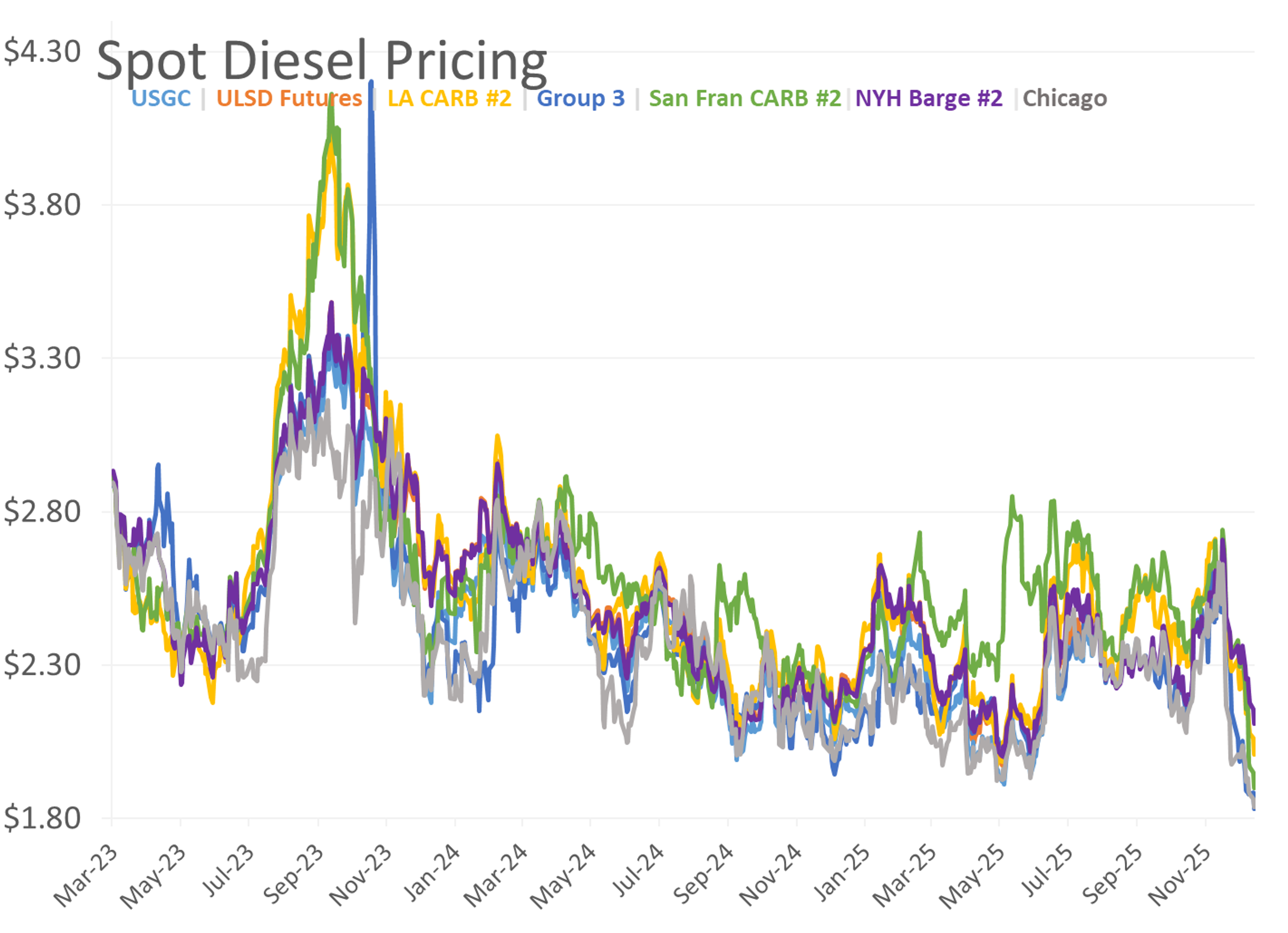

Energy markets are attempting a modest recovery rally Wednesday after 2 weeks of steady selling pushed prices near their lowest levels in 5 years. Given the duration of the sell-off, a bounce is certainly not surprising, but we’ll need to see follow through buying in the back half of the week before we can say that the bearish trend has ended as the weekly charts continue to suggest there may be more selling to come.

A U.S. Naval blockade of Venezuelan oil shipments is getting credit for some of the recovery this morning, although the chart below shows the country’s minimal output since the Chavez regime nationalized its industry – causing companies like Exxon and Conoco to leave the country and starting the decade-long lawsuits that may ultimately end with Citgo being sold to an activist hedge fund – means this will have only minimal impact on global supplies. In addition, Chevron’s output from the country is exempt from sanctions and the blockade, so it won’t impact the small volumes of around 100-200mb/day being delivered to the U.S..

Theoretically, if a regime change does occur in Venezuela, the country will be able to increase oil output as they have the world’s largest proven reserves, but those efforts would take years, and the interest from international companies may be minimal given the low price environment and political risk. I also think it’s possible that the U.S. Treasury could use Citgo’s assets as a gift to a new regime to help the country to sustain itself longer term, although that’s nothing more than a theory at this point.

Progress towards a peace agreement in Ukraine had been getting some credit for the recent sell-off, while the Russian president has given clear signs this morning that they intend to keep fighting. Meanwhile Ukraine’s attacks on Russian energy infrastructure continue with a 100mb/day refinery reportedly hit overnight.

We learned that the unplanned flaring at PBF’s 160mb/day Torrance CA refinery over the weekend was actually caused by a fire in a coking unit, which was certainly downplayed in its filing to the AQMD. That news did little to stir the weak LA spot market however, with CARBOB values continuing to trade lower around a 4 cent discount to futures, and CARB diesel values seeing only a hint of a bid following that news still hovering near an 11-12 cent discount to futures.

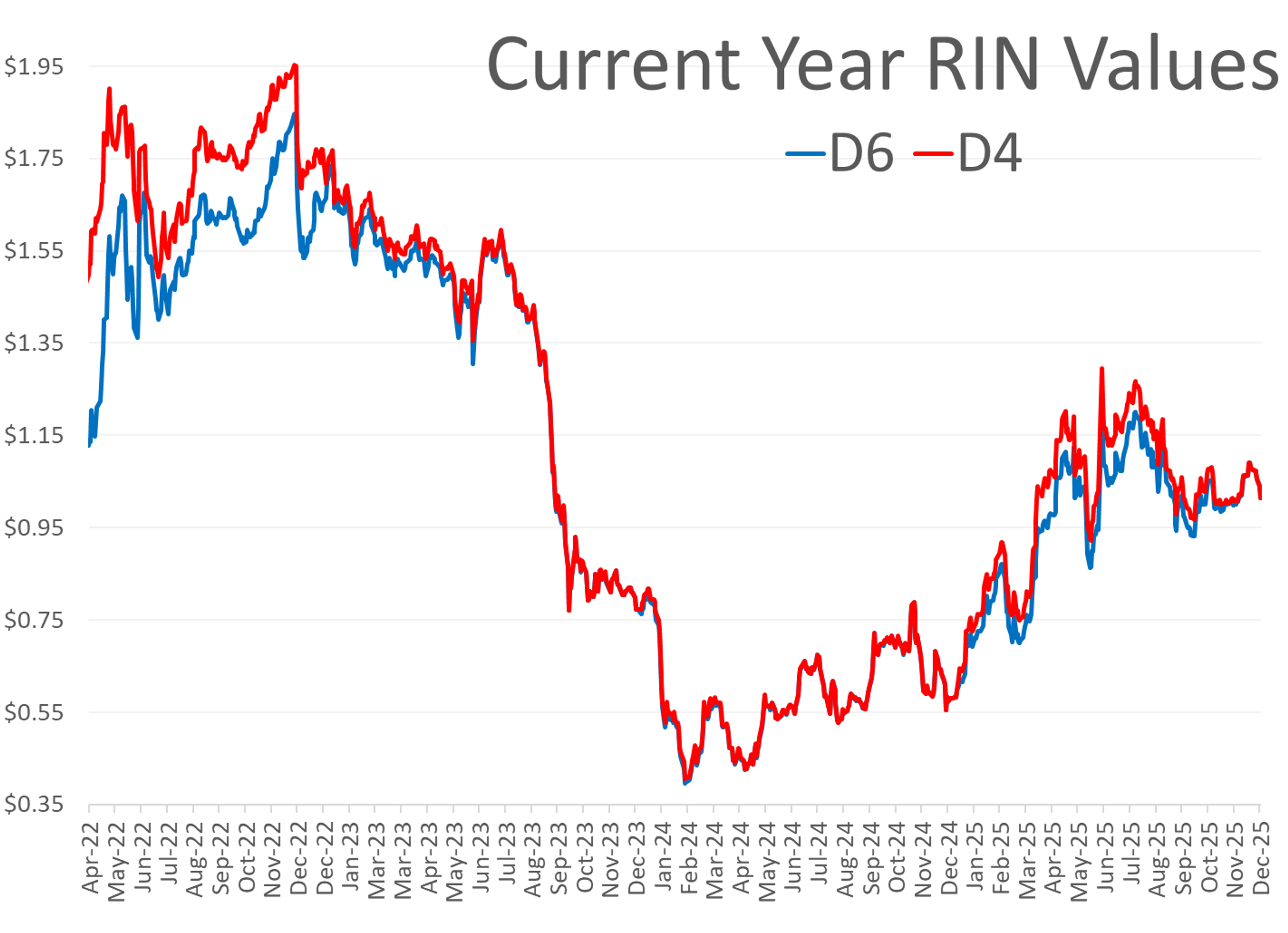

RIN prices have also been under steady selling pressure this week pushing values for 2025 vintages close to $1/RIN for both D4 and D6 contracts for the first time in a month as the industry impatiently waits on the EPA’s decisions on what the law will actually say for 2026.

The EPA responded to a court order Tuesday, saying it intends to finalize its 2026/2027 Renewable Fuel Standard proposal in the first quarter of next year. That means the industry will be left to guess whether proposals to cut RIN generation for imported fuels and feedstocks will actually happen, along with other changes like reducing the RIN value for RD from 1.7 to 1.6 RINs/gallon and redistributing some or all of the volume waived for small refiners. While having to guess the details of a law that takes effect January 1 for several months seems more than a bit unfair, it certainly isn’t new as the EPA has often been months or even years behind on issuing its rulings in the first 2 decades of the RFS. In reality, since imported fuels and feedstocks already don’t qualify for the Clean Fuel Production Credit that replaced the $1/gallon Blenders tax credit in 2025, imports of renewable fuels have already dropped to a small fraction of what they used to be even at full RIN values, so the EPA’s decision on the 50% rule may not move the needle much.

It's not just Renewable Diesel and Biodiesel producers stuck in limbo Waste Companies are also facing uncertainty and headwinds on their Renewable Natural Gas projects that leverage their landfills to generate fuel and D3 RINs. D3 RIN values have already plummeted in value this year due to rapidly growing supply taking advantage of the combination of RIN and LCFS credits and a neutral stance from the EPA on demand targets.

The API reported more builds in refined products with its weekly estimate showing an increase of 4.8 million barrels for gasoline and 2.5 million barrels for diesel. The industry group’s estimate for crude oil inventories showed a large decrease of 9.3 million barrels last week, but it's worth noting that refiners will often hold barrels offshore as we approach year-end to avoid the Texas property tax assessed on inventory sitting in tank on 12/31. For those of you buying off the racks in TX, this also mean some heavy discounts can be expected as inventory holders try to minimize their tax hit, although perhaps not as steep as the past few years given that flat prices are approaching 5 year lows, and the tax is a percentage of the outright fuel value. The DOE’s weekly report is due out at its normal time.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets