Refinery Woes And Weak Demand Push Fuel Prices Down

The steady selling continues in energy markets with WTI reaching a 7 month low this morning while spot prices for gasoline and diesel approach multi-year lows in several U.S. markets.

RBOB gasoline futures are now testing the year’s lows for the January contract around $1.70, and if chart support breaks here, there’s little from a technical perspective to prevent a slide into the $1.50s. That said, the contract has moved into severely “over sold” territory after 7 straight days of selling and is due for a corrective bounce, so it wouldn’t be surprising to see some bottom fishing this week.

Cash prices in several U.S. spot markets are approaching 5 year lows with big discounts adding to the softness in futures prices. Those weak cash markets have already pushed the national retail average below $3/gallon earlier in the month, and now several states across the middle of the country are posting retail prices below $2/gallon. Those low gasoline prices will be a welcome Christmas present for consumers struggling to deal with stubborn inflation in most other parts of the economy and a soft job market.

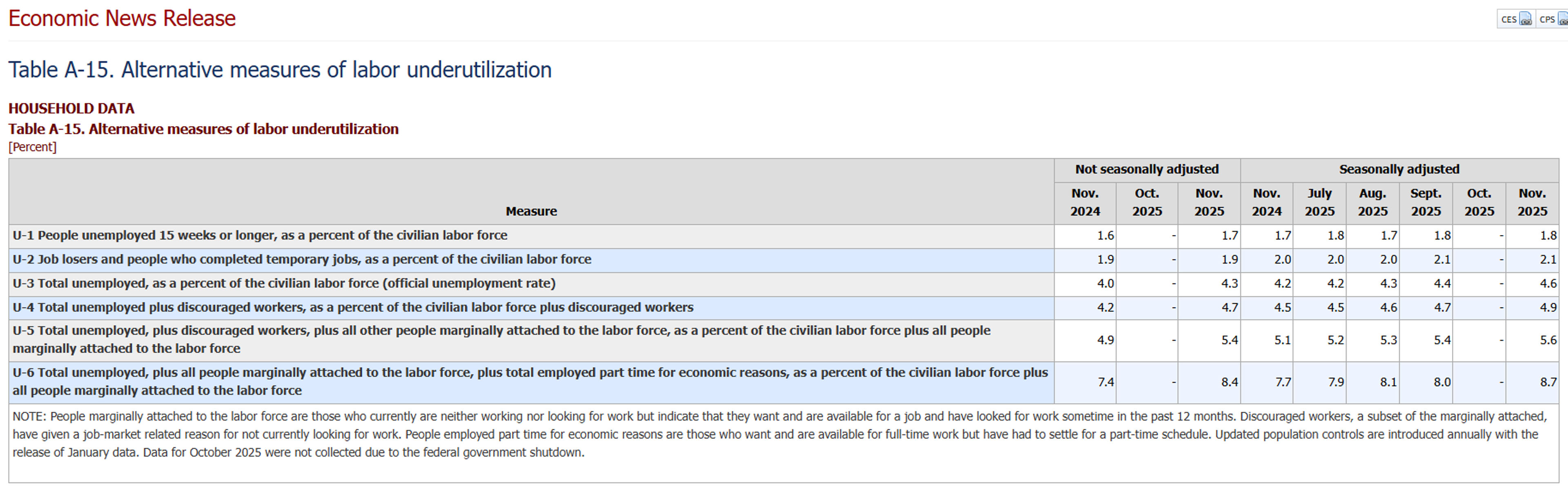

The BLS issued its October and November payrolls report this morning, catching up after the government shutdown. The report showed a stagnate job market with payrolls essentially unchanged since April. While November’s payrolls were estimated to increase by 64,000 the October estimate was negative 105,000 and the August/September estimates were revised lower by 33,000. The headline unemployment rate ticked up from 4.4% to 4.6% from the September reading until November, while the less manipulated U-6 unemployment rate jumped up to 8.7% from 8% in September.

Delaware officials issued an order to PBF demanding they install fence line air sensors at their Delaware City refinery after multiple upsets earlier this year polluted far more than initial estimates. Energy News Today is reporting that the facility is currently dealing with another upset at the 190mb/day facility with its sole FCC unit forced offline due to a mechanical upset. Given PBF’s stated challenges with cash flow, which was part of the reason the company sold 2 of its terminals this fall, and the challenging environment for East Coast refiners in general, the possibility that this facility or its counterpart in New Jersey, may be forced to close permanently seems to be looming.

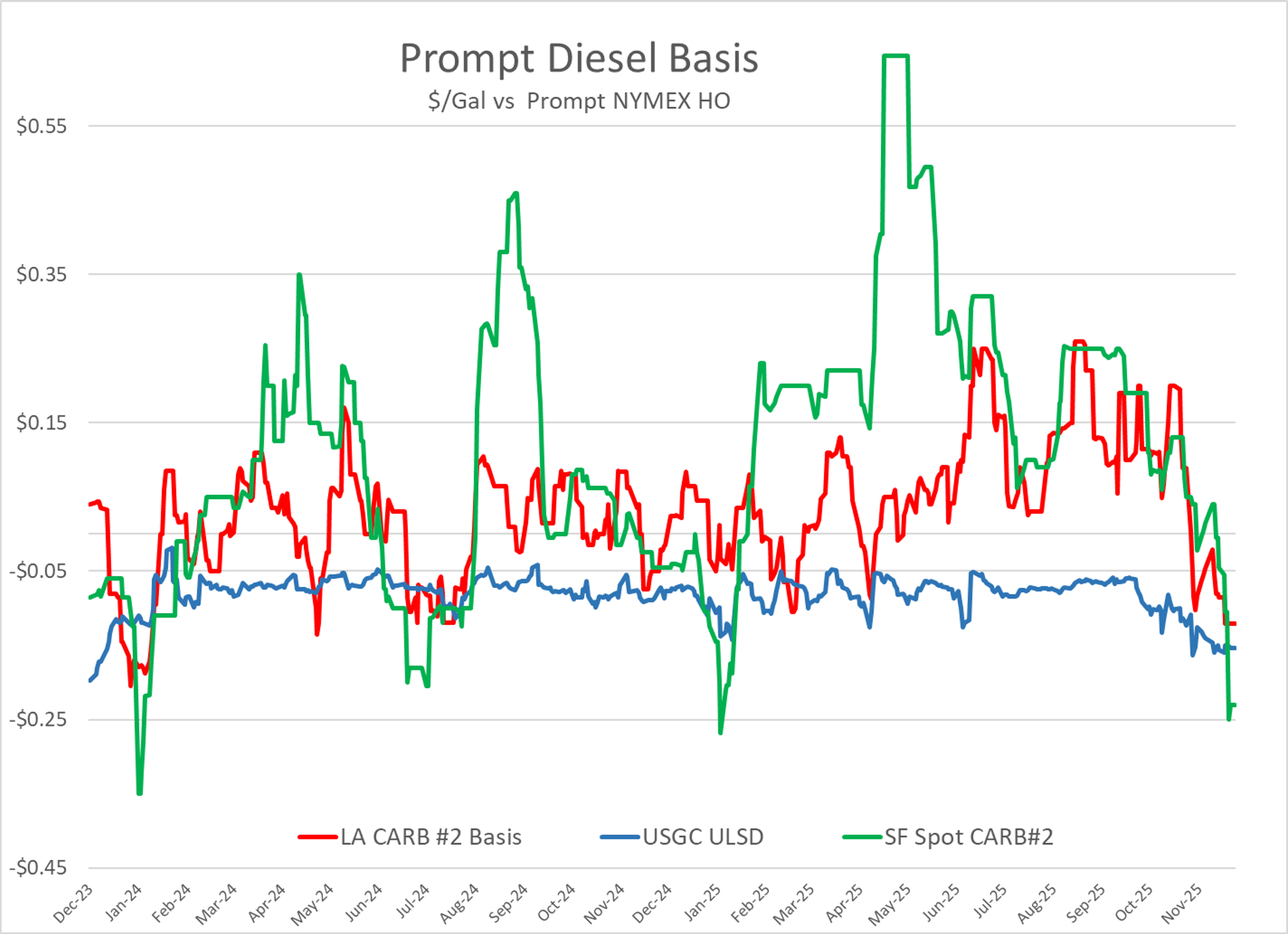

On the other coast meanwhile, PBF is working urgently to meet its year-end target to restore operations at several units within its 160mb/day Martinez CA refinery that have been offline since a fire on February 1. The company has issued more than a dozen low level flaring notices to Contra Costa Health officials so far in December, consistent with efforts to restart units that have been shuttered for an extended period. The timing of this new supply couldn’t be worse however as differentials for both gasoline and diesel in the San Francisco spot market have dropped to their lowest levels of the year as weak seasonal demand set in and some RD suppliers raced to beat the potential changes in RIN quantities for imported feedstocks and fuels.

Marathon is also dealing with upsets on multiple coasts this week. The company reported an upset at its 630mb/day Texas City (AKA Galveston Bay) refinery Monday as a control valve malfunctioned causing flaring in an FCC and Gas Con unit. That event lasted only an hour and the valve was bypassed to allow operations to continue according to the TCEQ filing. The company also reported unplanned flaring at the Carson section of its 365mb/day Los Angeles area refining complex Monday afternoon, with the reason for the event still unknown according to its filing with the AQMD. That facility is still undergoing 5 weeks of planned maintenance, so this flaring could be related to that and if that’s the case it shouldn’t have any impact on production.

The EIA on Monday highlighted the recent bout of cold weather and noted how that will increase heating costs this winter. Those estimates were clearly written prior to Heating Oil values dropping 55 cents/gallon in the past 4 weeks which will help mitigate any increase in demand for consumers and longer-range forecasts that predict Q1 will be warmer than average is helping alleviate concerns of shortages for both natural gas and heating oil.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets