Energy Markets Steady As OPEC Pauses Output Changes

It’s a quiet start to November trading in energy markets as prices are hovering near break-even after a modest round of selling overnight.

OPEC & Friends agreed to another output target increase for December, but will then pause their production changes through the first quarter of 2026 to assess market conditions. OPEC’s nemesis the IEA will no doubt say this is because of the supply glut it’s been suggesting is coming for months, while oil bulls may suggest that the cartel needs time to let the latest Russian sanctions settle out.

HF Sinclair had an explosion and fire at its 100mb/day Artesia NM refinery on Friday that injured 3 workers. That fire is adding to supply concerns in the area after October upsets at Valero McKee and P66 Borger caused allocations to be restricted. No word yet on the status of the 3 employees who were hospitalized, or the status of the refinery operations, although early reports suggest an alkylation unit that makes gasoline components was the source of the blaze.

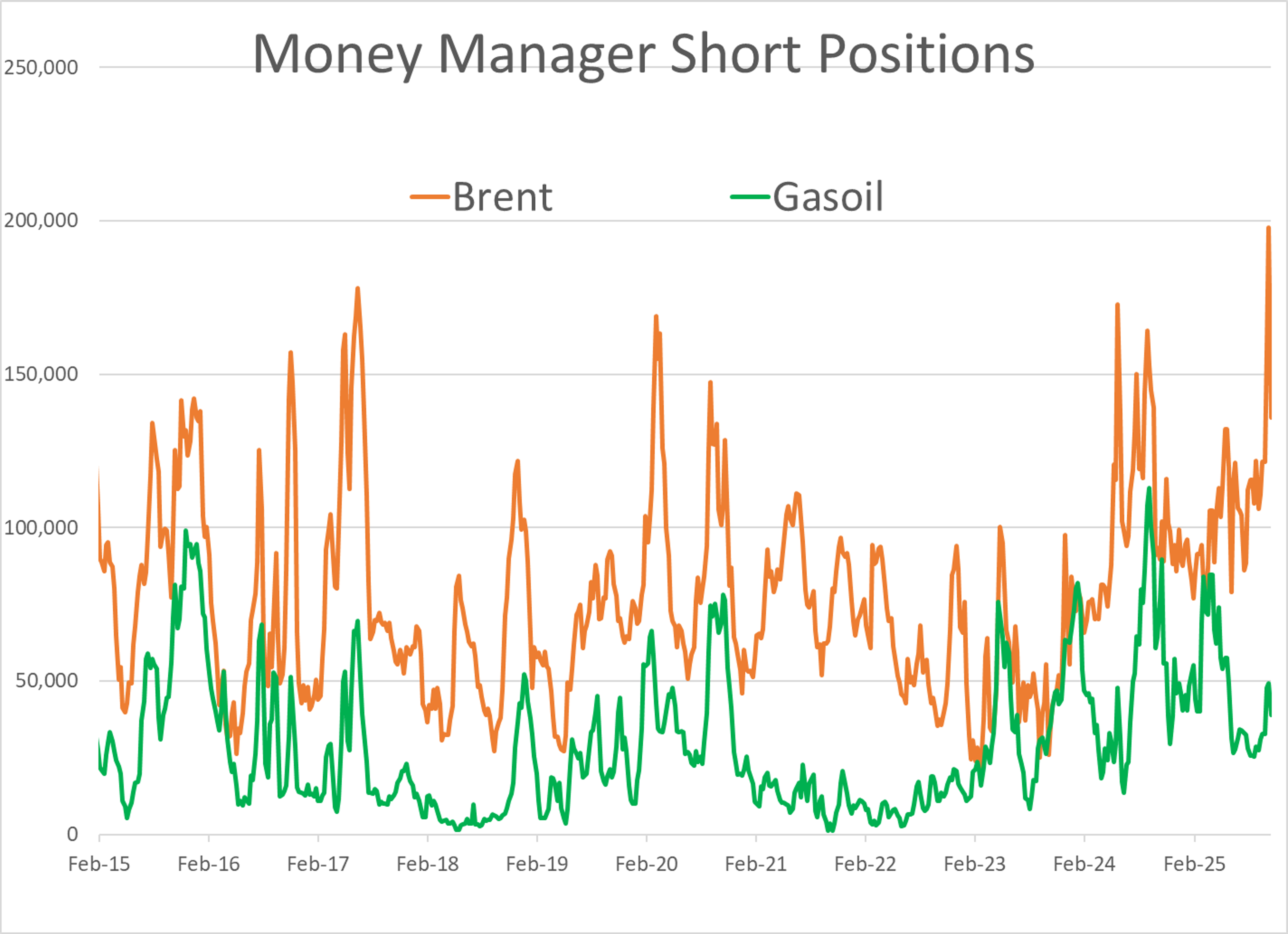

We finally got a partial look into how dramatic the change in speculative positioning was during the 10% rally in prices 2 weeks ago. While the US government shutdown has kept the CFTC weekly data offline for 5 straight weeks, ICE data shows money managers added almost 153,000 contracts of net length (6.4 billion notional gallons) in Brent and Gasoil alone last week. Short covering made up almost half of the move with nearly 1/3 of all outstanding bets on lower Brent prices covered after the speculative short bets hit a record high the week prior. In classic bandwagon jumping style, money managers were now also loading up on new bets on higher prices in both Brent and Gasoil following the latest round of sanctions targeting Russia’s two largest producers.

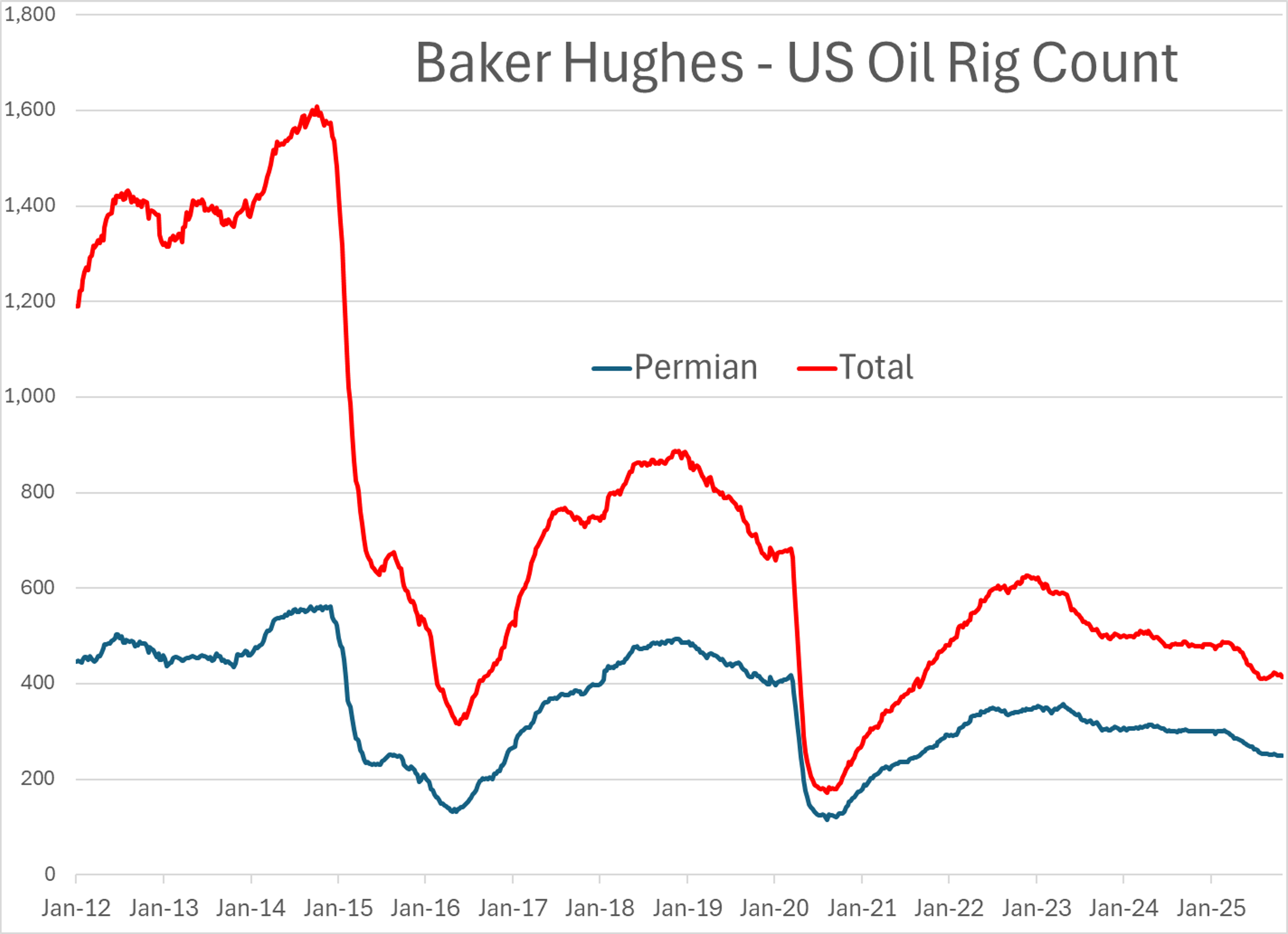

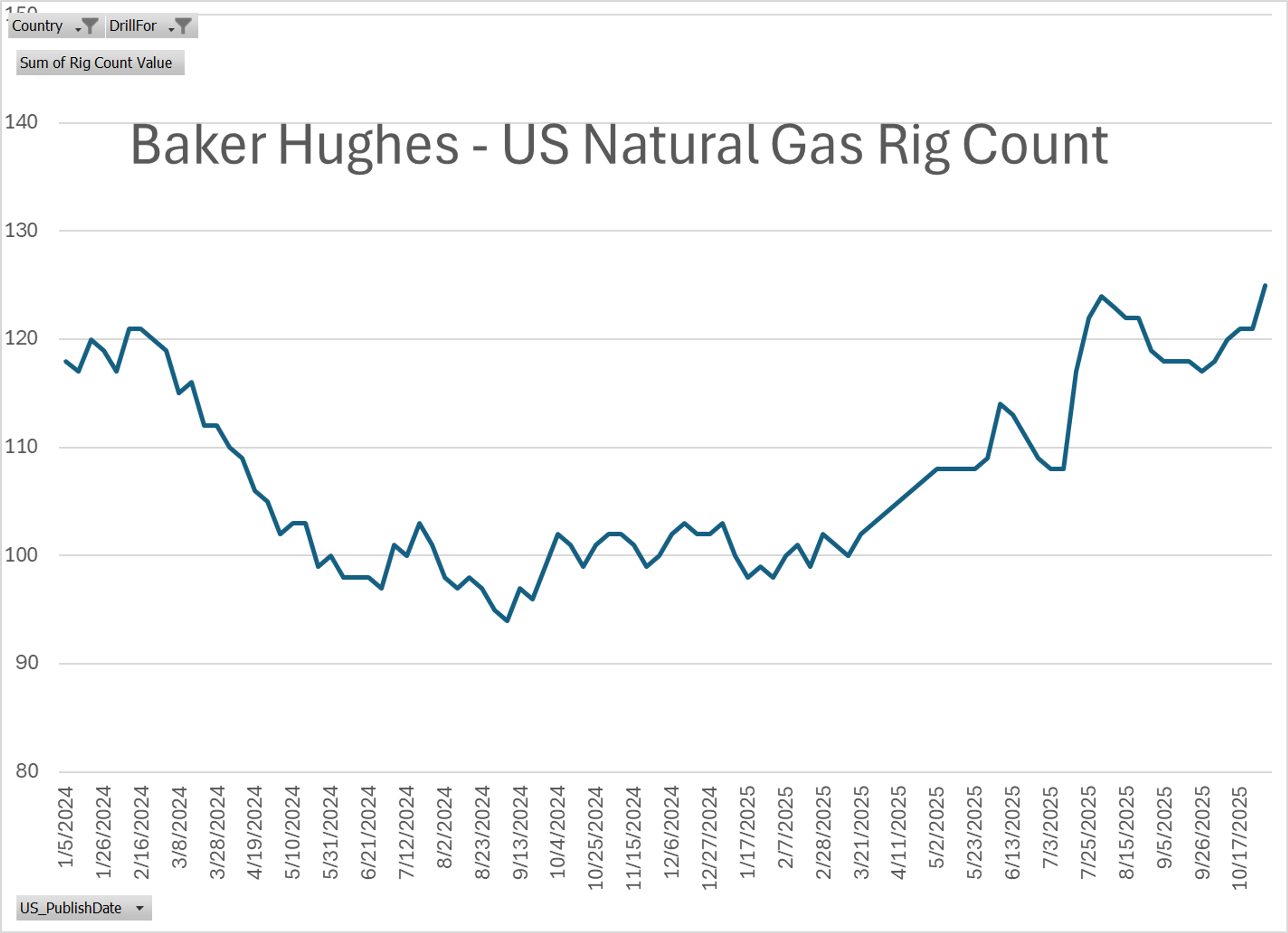

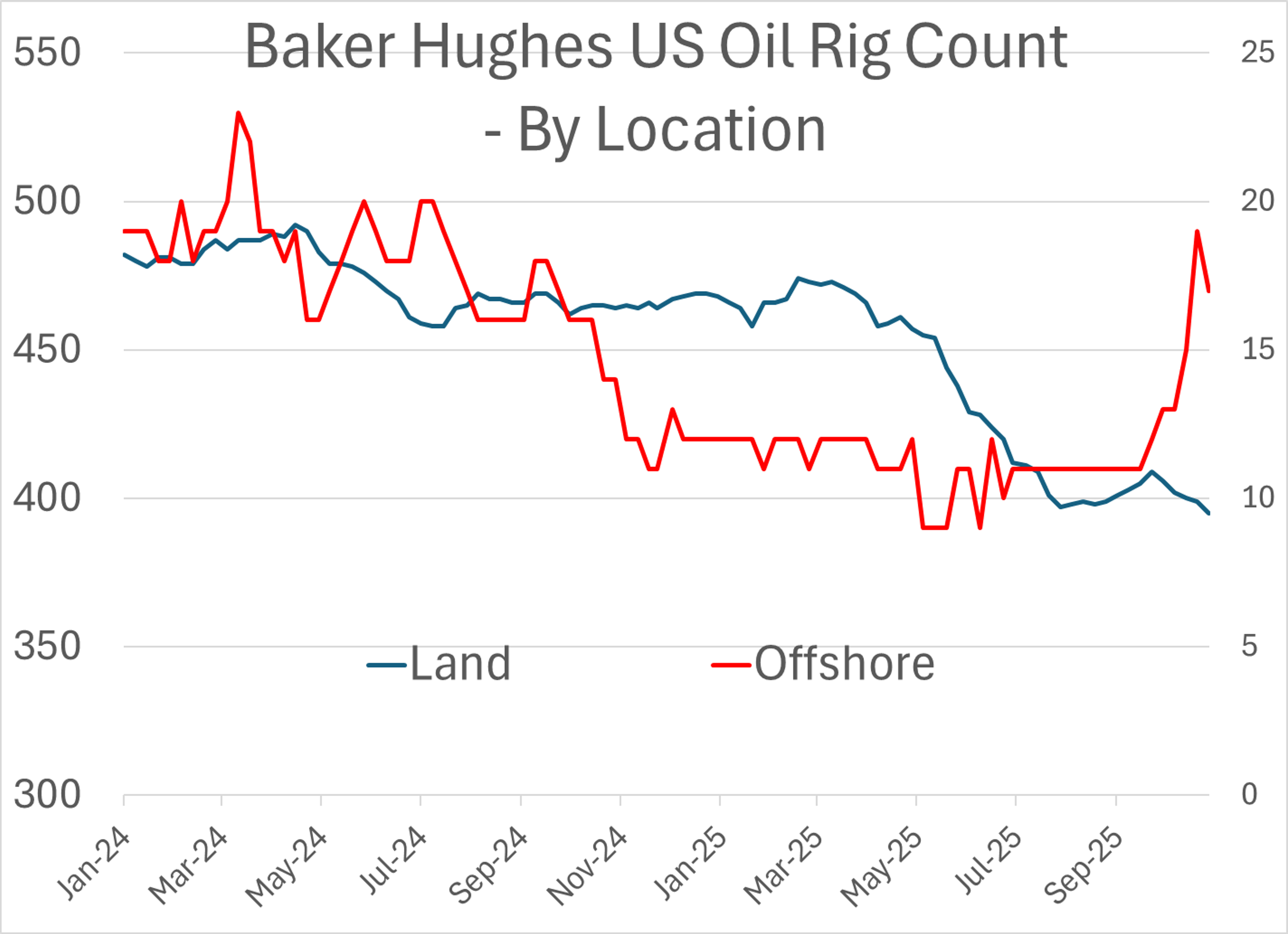

Baker Hughes reported a decrease of 6 oil rigs in the US last week with a widespread reduction on land and offshore. Of course, US oil production is sitting at record high levels (for any country, ever) which shows how “multi-fracking” continues to allow the industry to do more with less. The natural gas rig count meanwhile climbed by 4 on the week, reaching a 2 year high as new export and pipeline takeaway capacity continues to allow more production to come online.

Ukraine is continuing its drone campaign against Russian energy assets with the 100mb/day Saratov refinery hit for the 3rd time in as many months over the weekend, along with the Tuapse oil port on the Black Sea.

Exxon reported an upset in an FCC unit at its 630mb/day Beaumont TX refinery Friday, but that event only lasted an hour suggesting minimal impact on production.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets