Volatility Returns: Fuel Prices Climb As Natural Gas Retreats And Global Tensions Rise

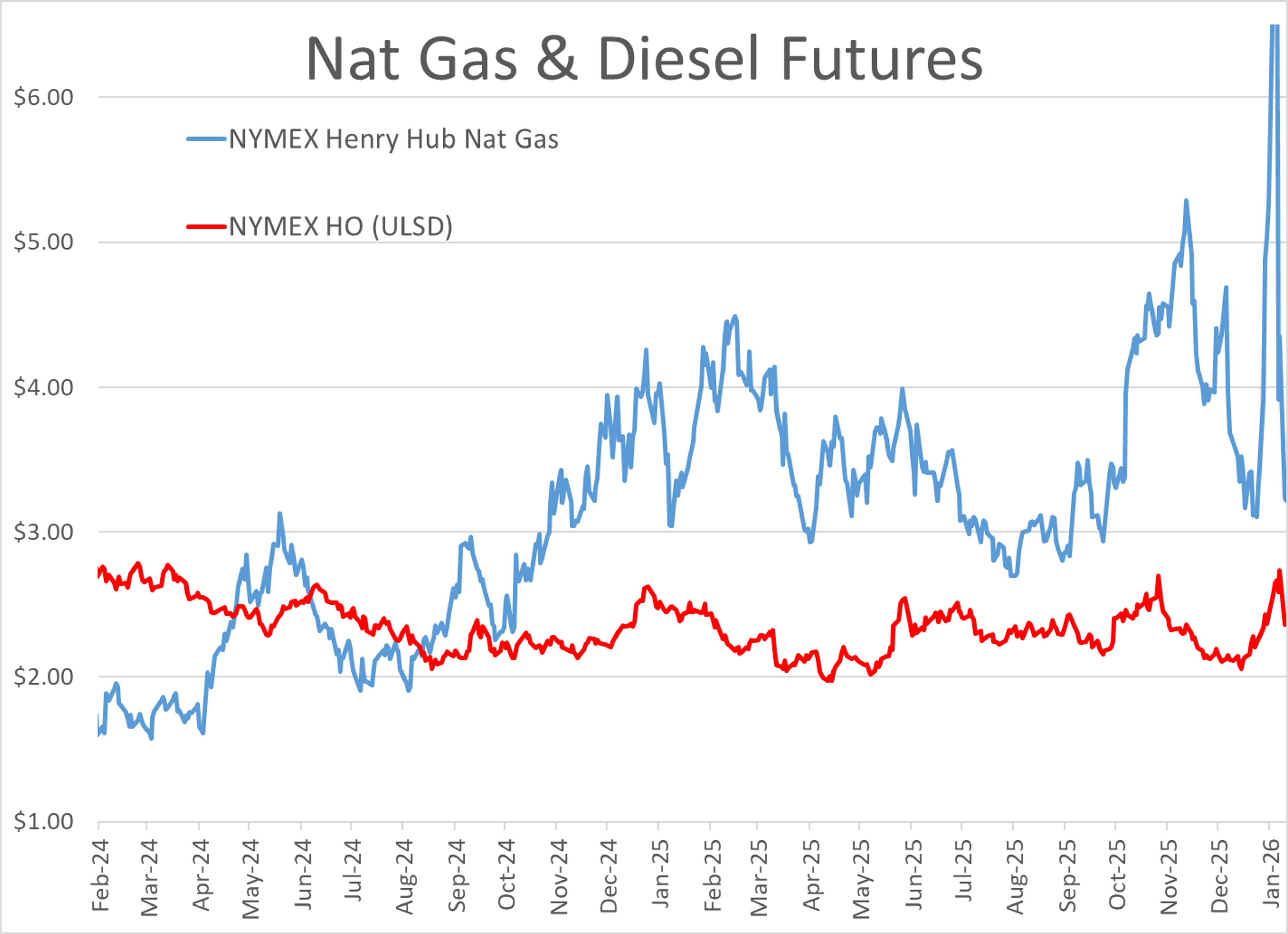

Energy markets are bouncing after a major sell-off to begin February trading. ULSD is once again leading the push higher, trading up around 3.5 cents this morning in the March contract, while RBOB futures are up around 2 cents, and crude contracts are up around 40 cents/barrel.

Natural gas futures meanwhile have dropped back to about where they were before the deep freeze caught the market off-guard two weeks ago, but diesel prices remain elevated as utilities purchase large quantities to replace their safety stock used to supplement the grid. NYH ULSD basis is holding 20 cents above March futures, which themselves are trading 9 cents above April, proving that prompt supplies remain tight despite yesterday’s big pullback in futures.

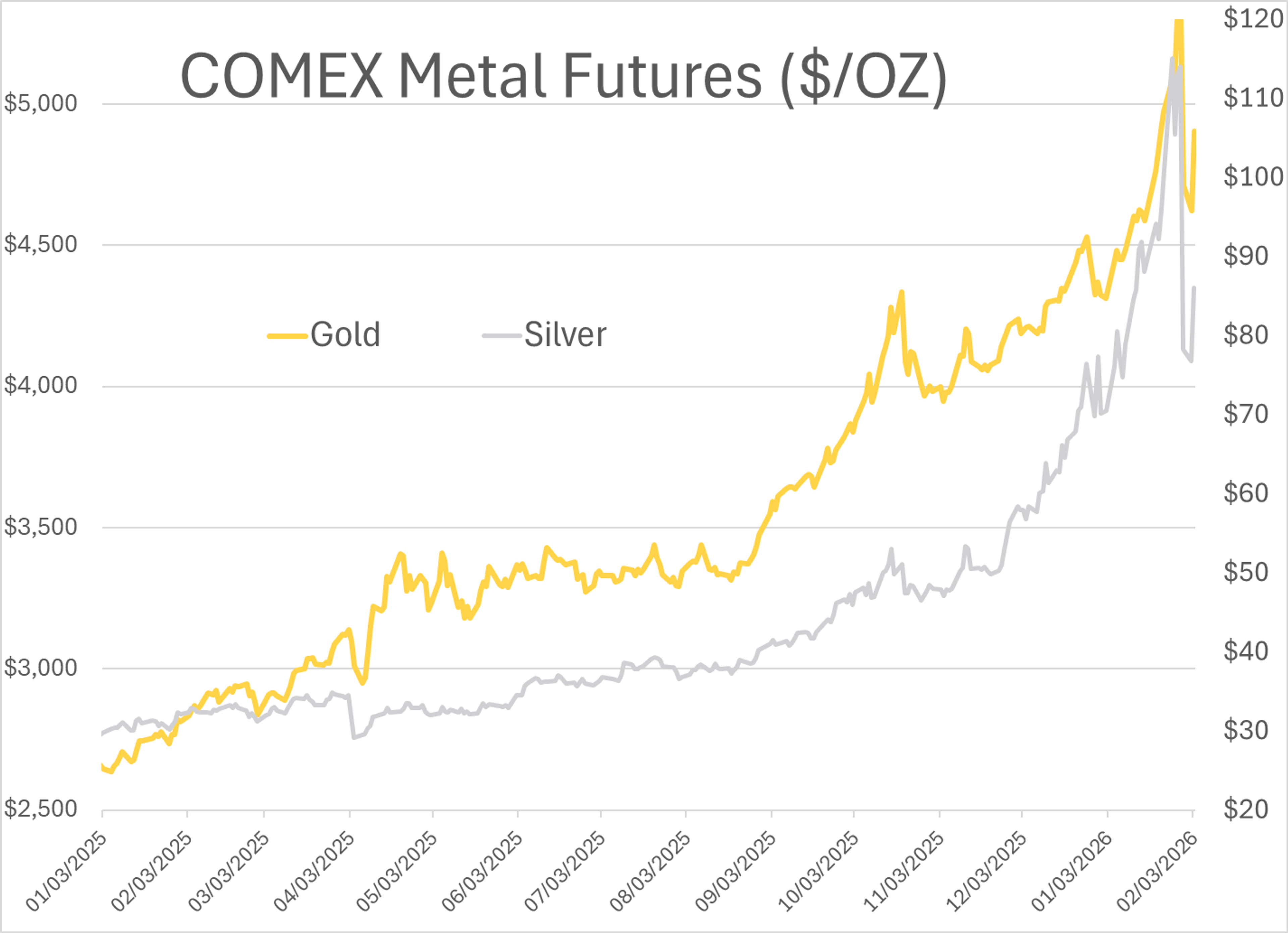

Broader commodity markets, particularly Gold and Silver, are also seeing a bounce after a heavy sell-off in the wake of the new Fed Chair announcement that helped the U.S. dollar recover from a 4 year low.

The U.S. President said he was reducing tariffs on Indian goods as part of a deal he says includes a promise from Indian refiners to stop buying Russian oil. We’ll have to wait and hear India’s version of this agreement after a similar claim largely rebuffed back in October. The squeeze on India seems to be taking a page out of “Red Notice” author Bill Browder’s playbook on how to end the Ukraine war by targeting refiners instead of the shadow fleet.

Meanwhile, China isn’t wasting any time taking further advantage of the situation and has announced plans to reopen a refinery it shuttered last year to run on Russian oil imports.

Trouble brewing? The U.S. Steelworkers union that counts more than 30,000 refinery workers as members saw its contract expire over the weekend with negotiators still far apart on a deal. The union has put in a temporary 24-hour rolling extension to the current agreement to avoid a strike and allow negotiators a chance to hash out a deal. The industry is offering a 15 percent pay raise over the next 4 years while workers are looking for 25 percent increase and guarantees that their jobs won’t be automated.

The U.S. Treasury updated its Venezuela sanctions Monday, extending the ban on Citgo’s asset sales to March 20, kicking the can down the road on that process as they’ve done since 2018. There are still many more questions than answers surrounding numerous topics in Venezuela, and the future of Citgo’s U.S. operations is likely to be a major bargaining chip in those negotiations.

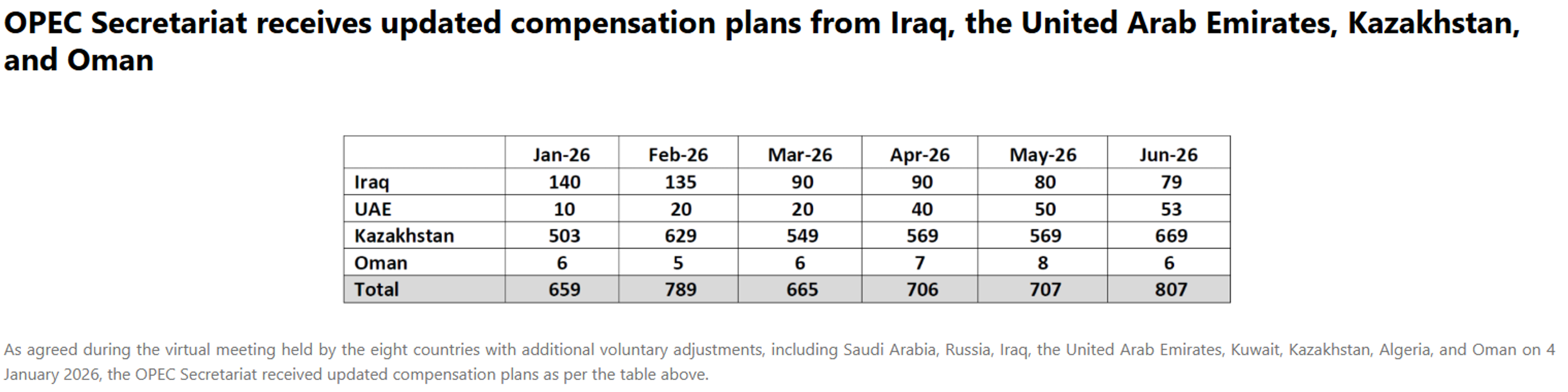

OPEC & Friends announced they would be holding their output targets steady over the weekend and will reassess the supply/demand balance at their next meeting March 1. On Monday, OPEC updated its compensation plans from countries that had overproduced their quotas in prior years. The notable changes came from Iraq and Kazakhstan who both accelerated their “voluntary” reductions in January and February which is likely a reflection of forced output reductions due to the CPC damage forcing a reduction in Kazakh exports and the Lukoil Force Majeure in Iraq.

A deeper dive into California’s LCFS data released Friday shows the impact the more stringent rules that took effect are having on the market.

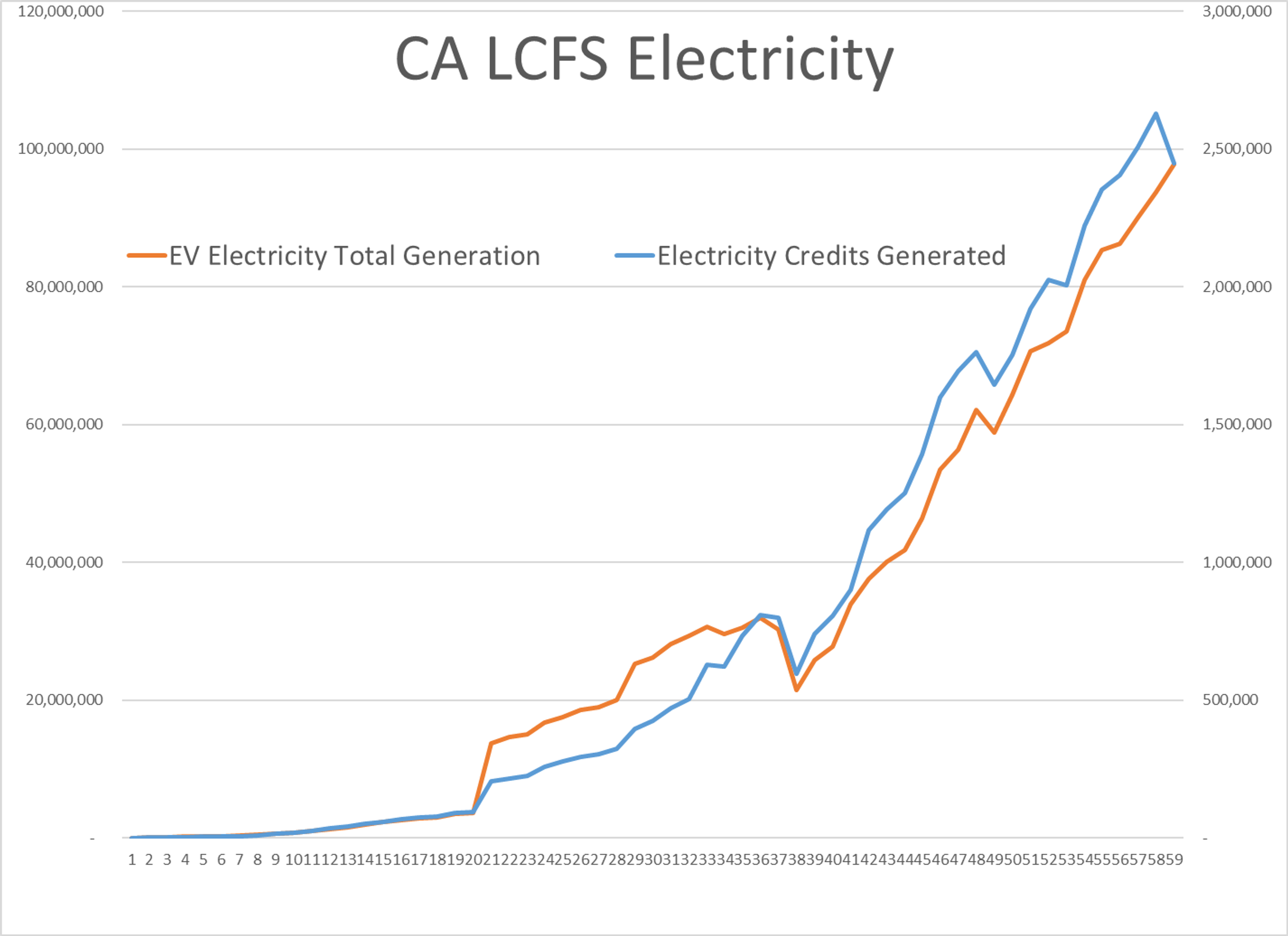

Electricity: EV charging volumes were actually higher in Q3 (although growth is slowing) but credit generation was down because the target CI was lowered with the program revision. This phenomenon is true for all credit generators (BIO/RD etc) that create fewer credits for the same volume today under the new rules.

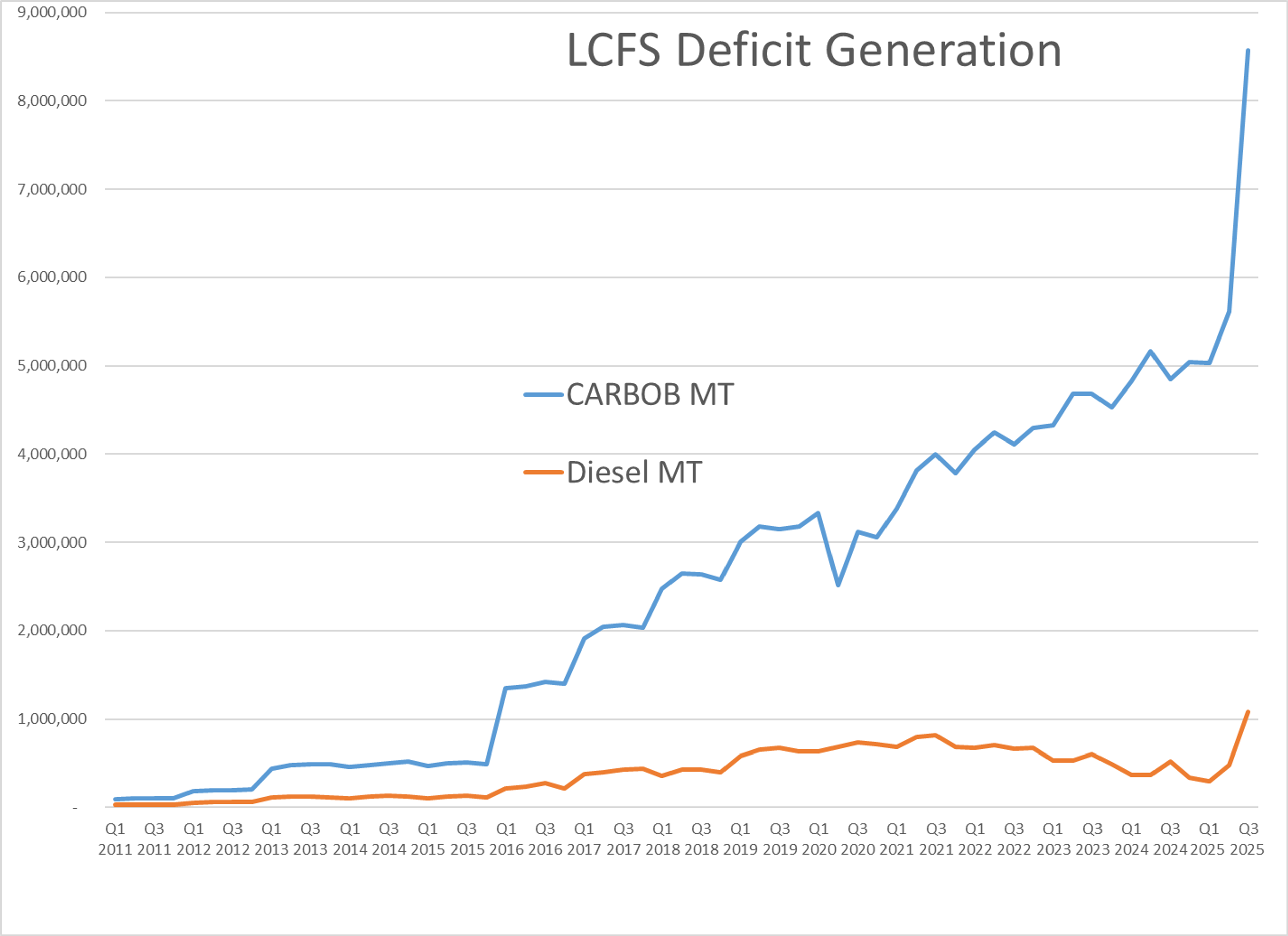

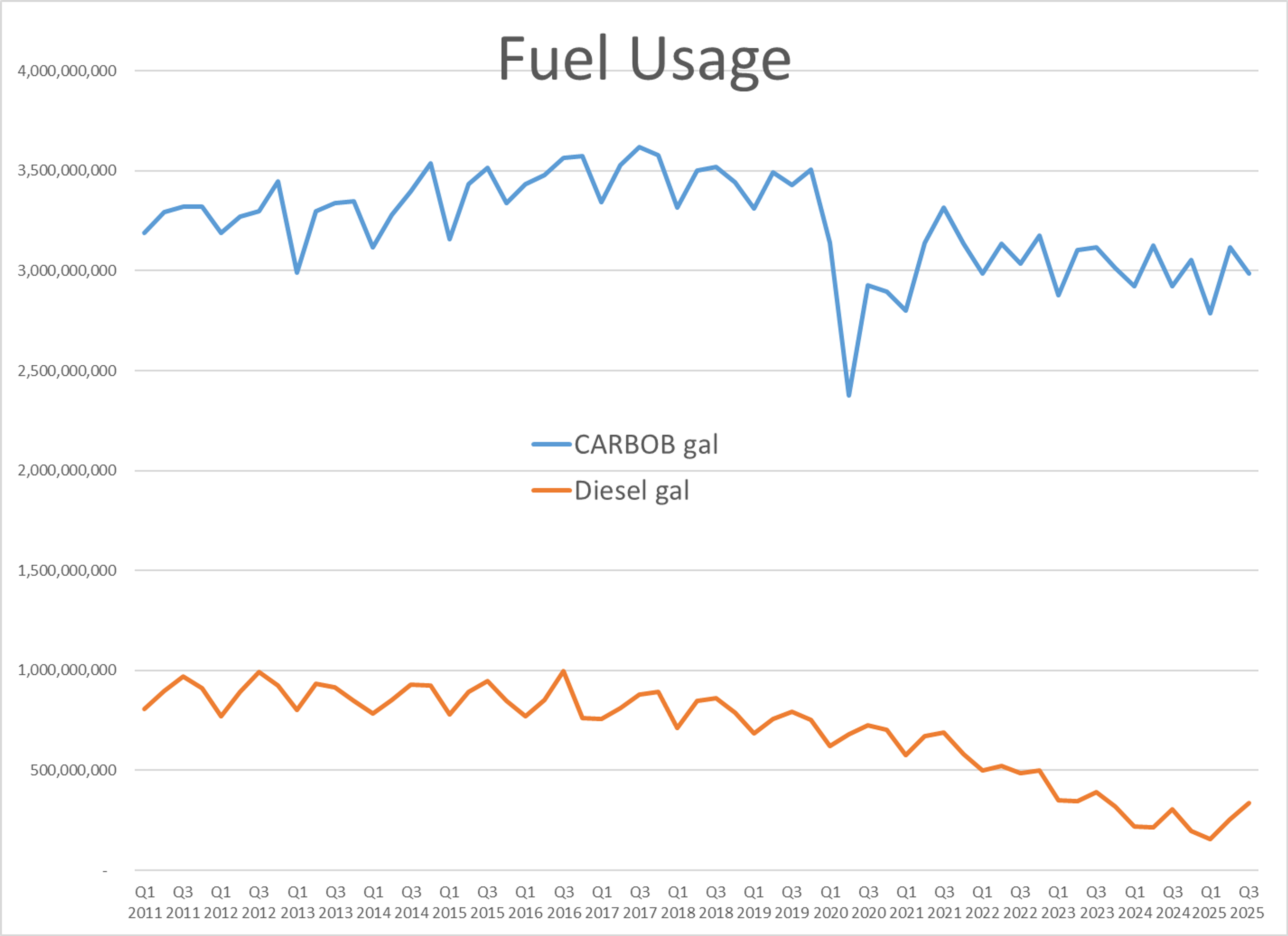

The flip side of that coin is the deficits created from CARBOB usage saw a huge spike, even though CARBOB gallons were down from Q2. This one stands out so much on the chart below that I wouldn’t be surprised if there’s an error in the data somewhere but certainly helps explain the LCFS credit rally since the report’s release.

That phenomenon of lower volume, higher deficit for CARBOB and Diesel, vs higher volume fewer credits for electricity and other “clean” fuels helps explain why LCFS credits are spiking while CCA values continue to sell off since the ratios/gallon for those credits haven’t changed.

Latest Posts

Energy Markets Stumble As Diesel Plunges And Winter Storms Stress The Grid

War, Peace, And Mixed Signals: Energy Prices React To A Turbulent Week

Energy Prices Surge Amid Middle East Tensions And Domestic Supply Disruptions

Week 4 - US DOE Inventory Recap

Diesel Futures Spike Again Amid Middle East Strains And Weather Whiplash

Freeze Fallout Triggers Extreme Volatility Across US Energy Markets

Social Media

News & Views

View All

Energy Markets Stumble As Diesel Plunges And Winter Storms Stress The Grid

War, Peace, And Mixed Signals: Energy Prices React To A Turbulent Week