Freeze Fallout Triggers Extreme Volatility Across US Energy Markets

It’s another volatile and varying start for U.S. energy markets Tuesday as the country digs out from one winter storm and looks wearily at the potential for another one this weekend.

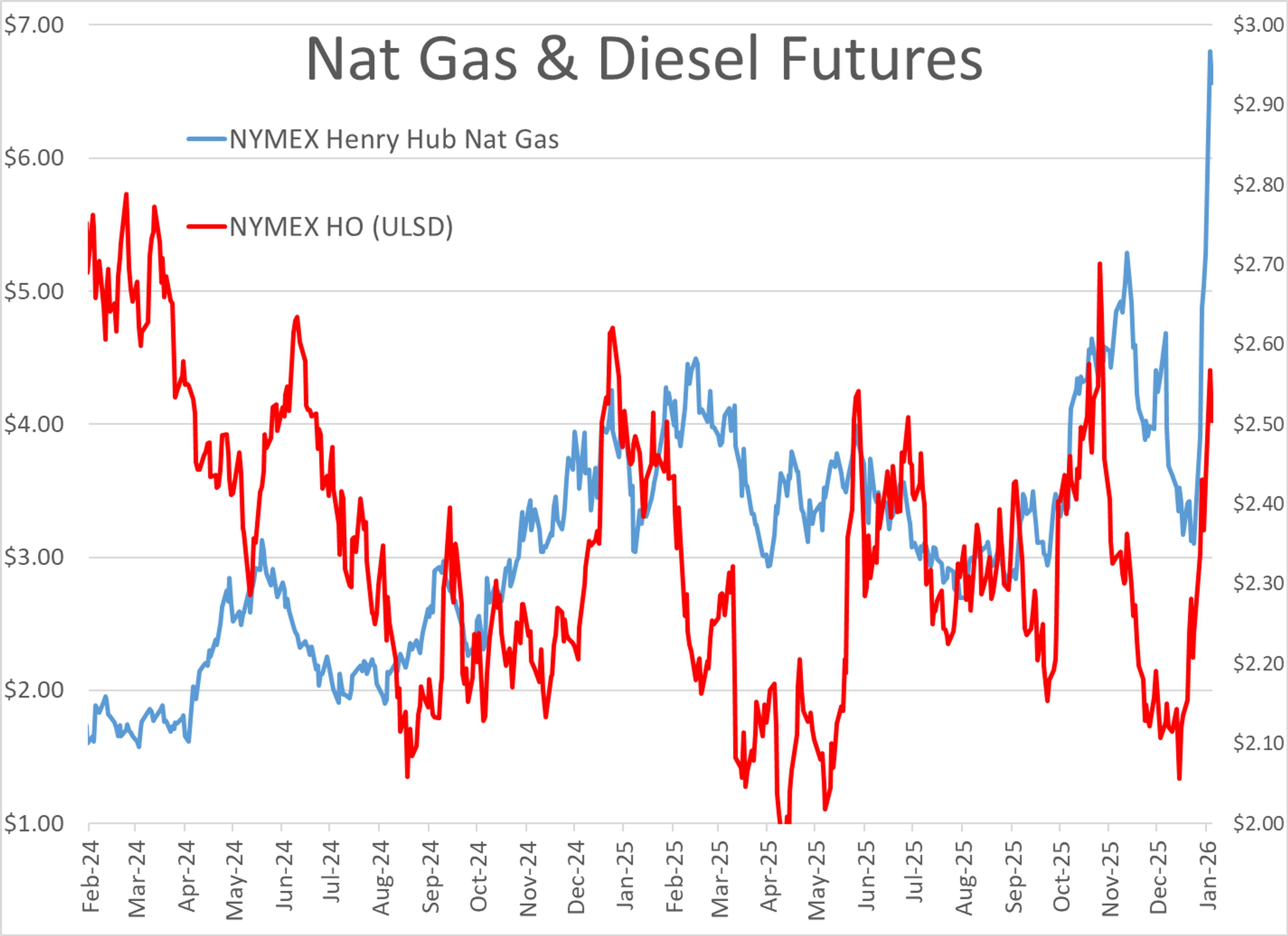

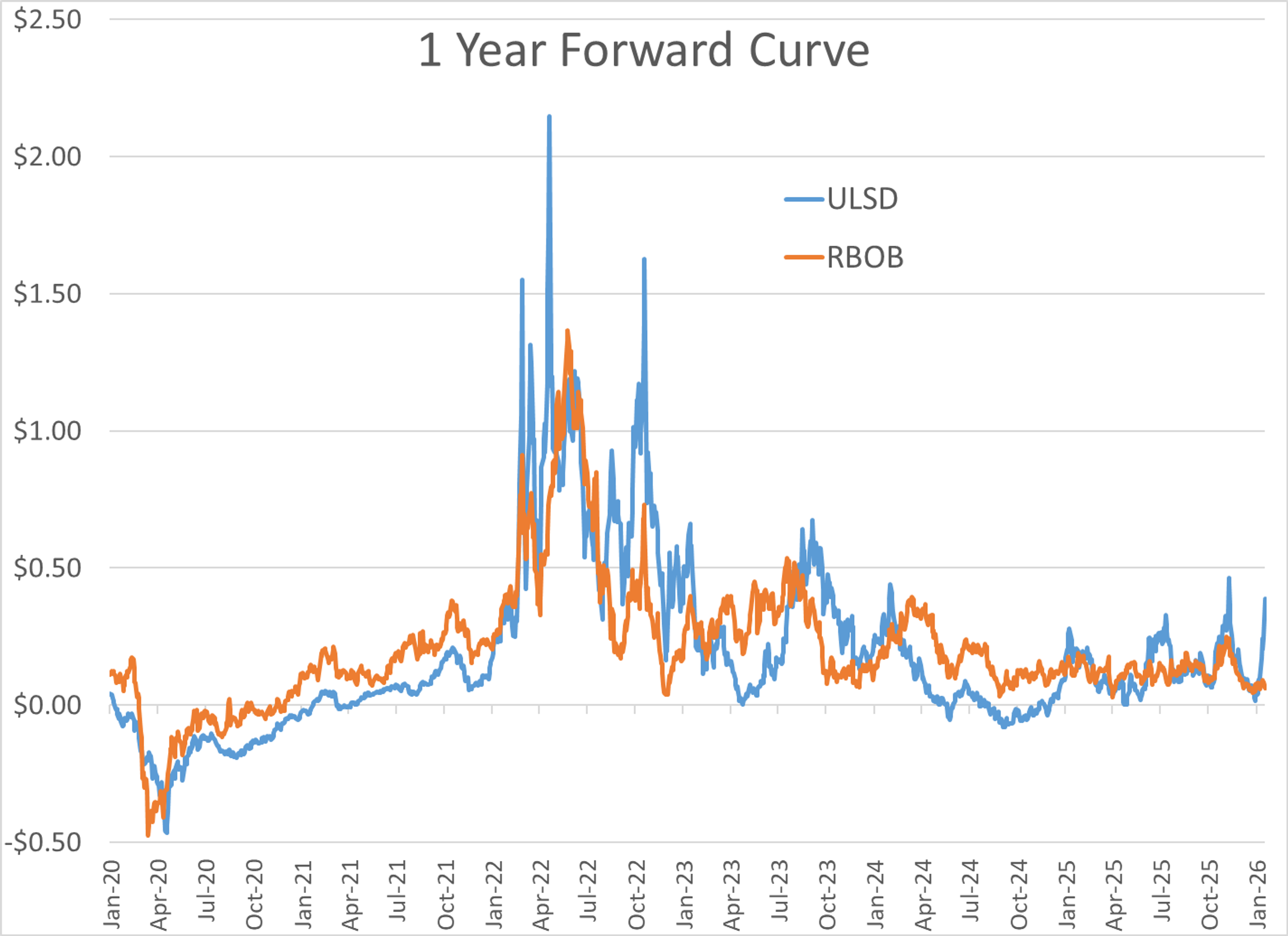

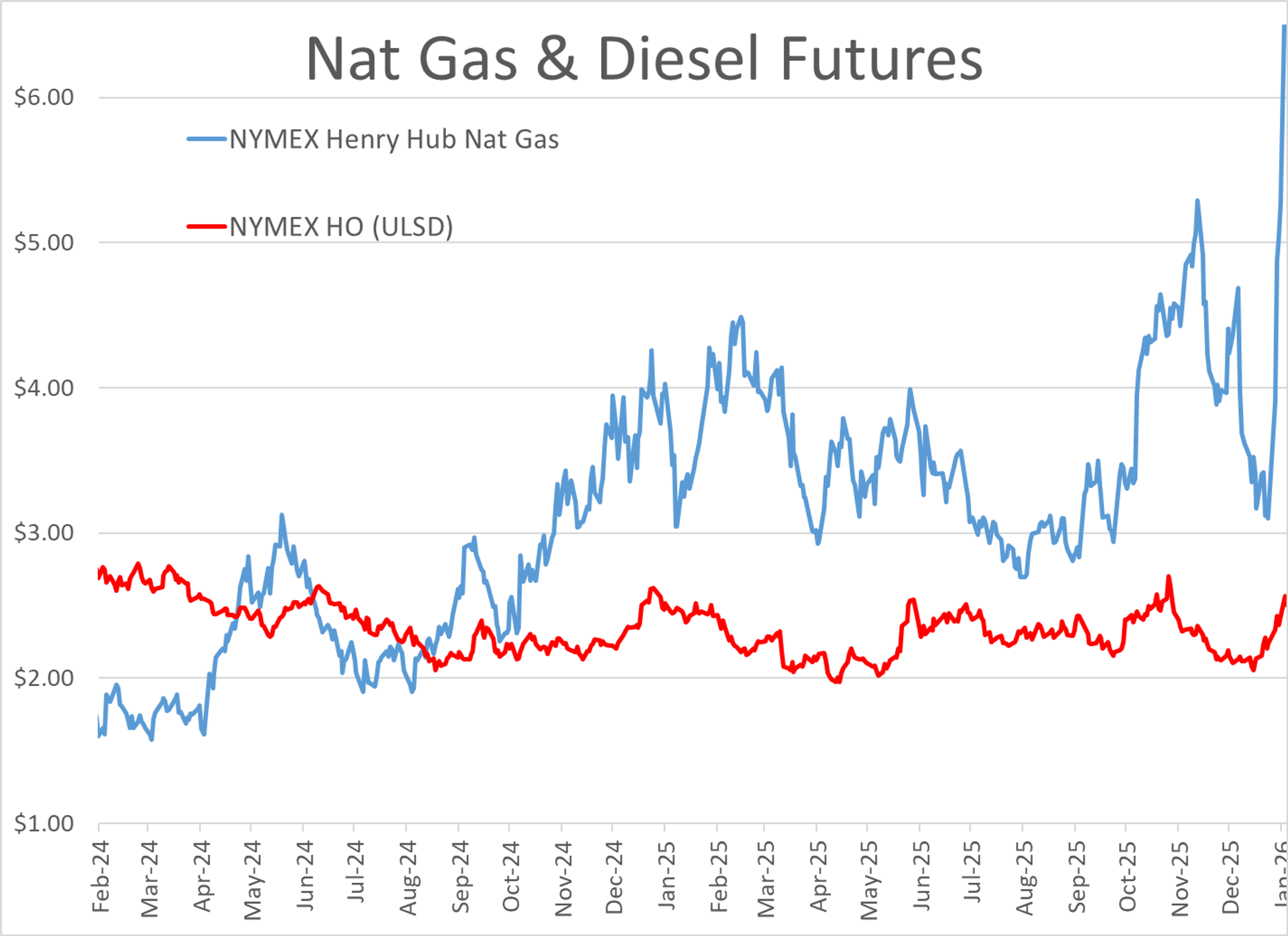

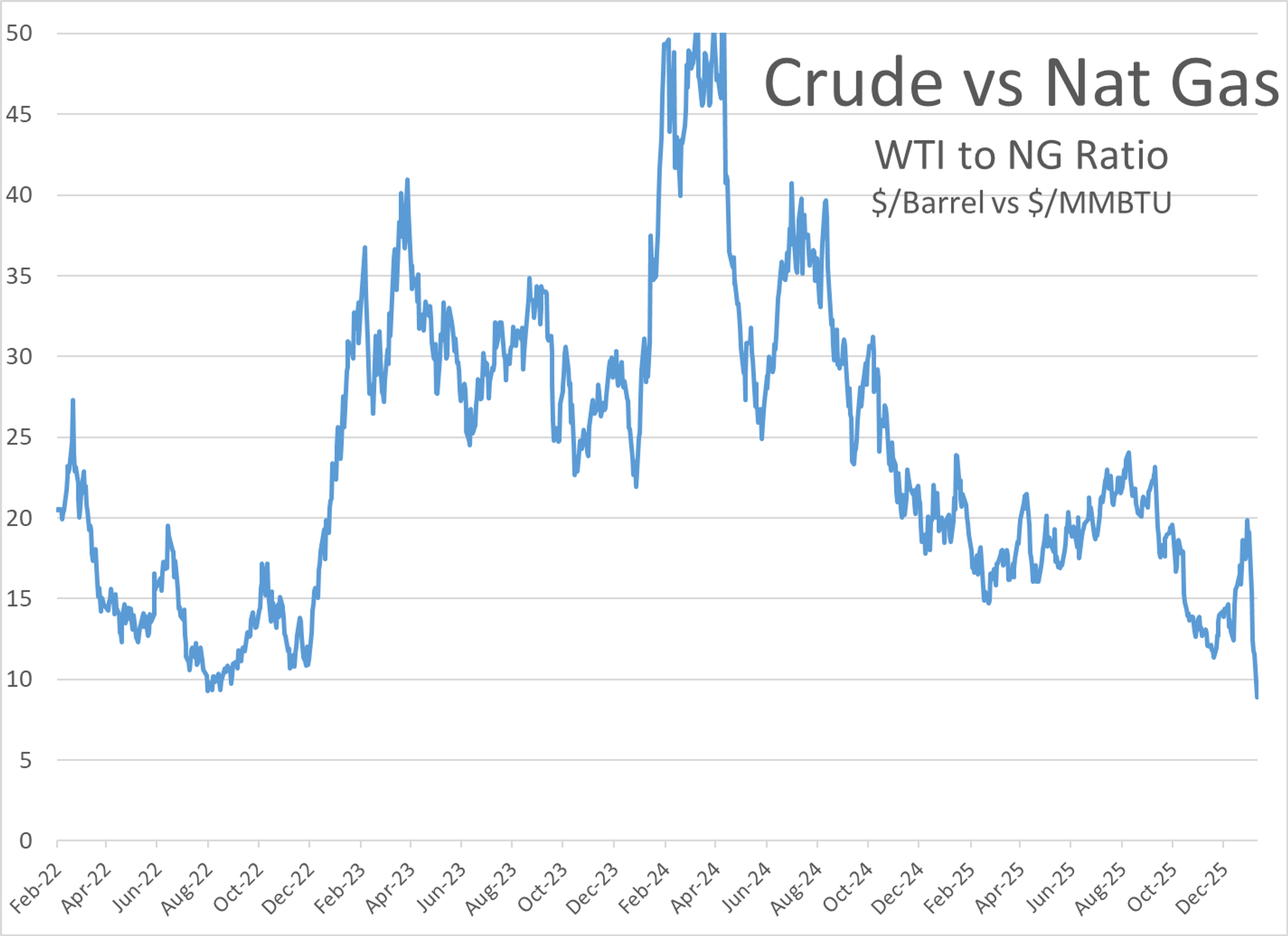

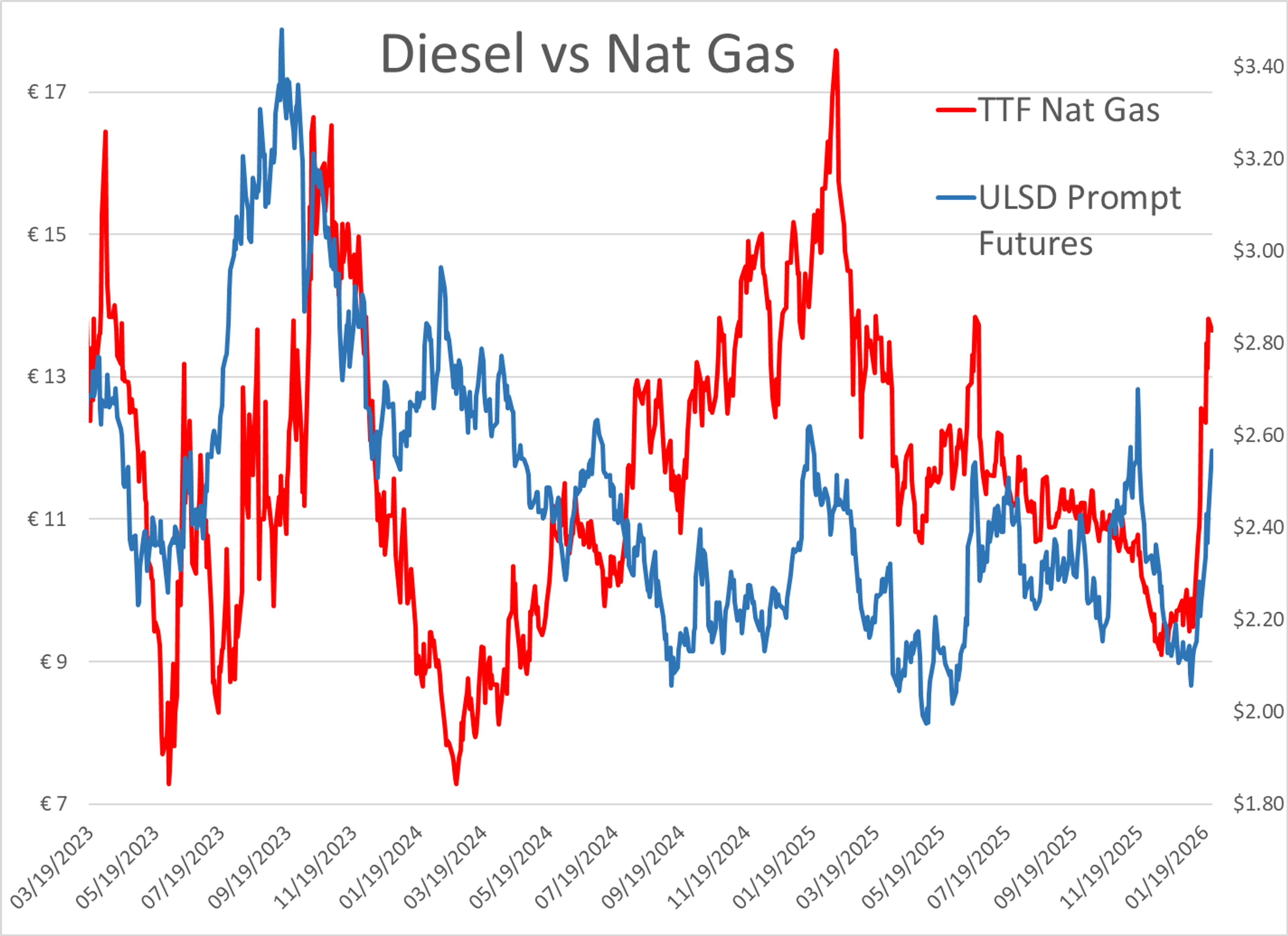

Natural gas prices have dwarfed the moves in other markets over the past 10 days, with a record setting rally that pushed futures from $3 per million BTU on January 16 to over $7 for the first time since the chaos of 2022. While the moves in futures are certainly noteworthy, they pale in comparison to cash prices in several U.S. spot markets that have spiked north of $100 per million BTU as prompt buyers scramble to find supply.

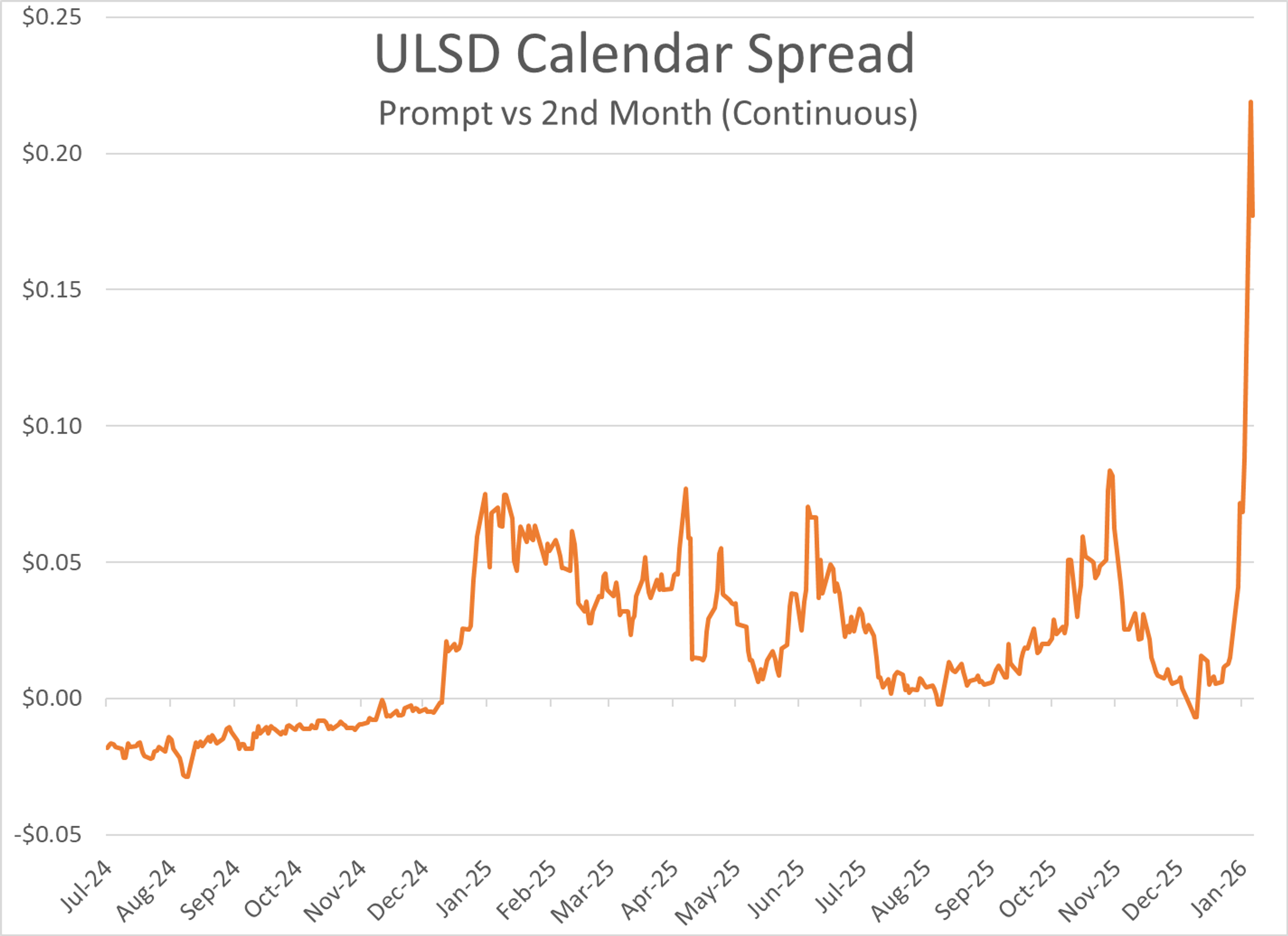

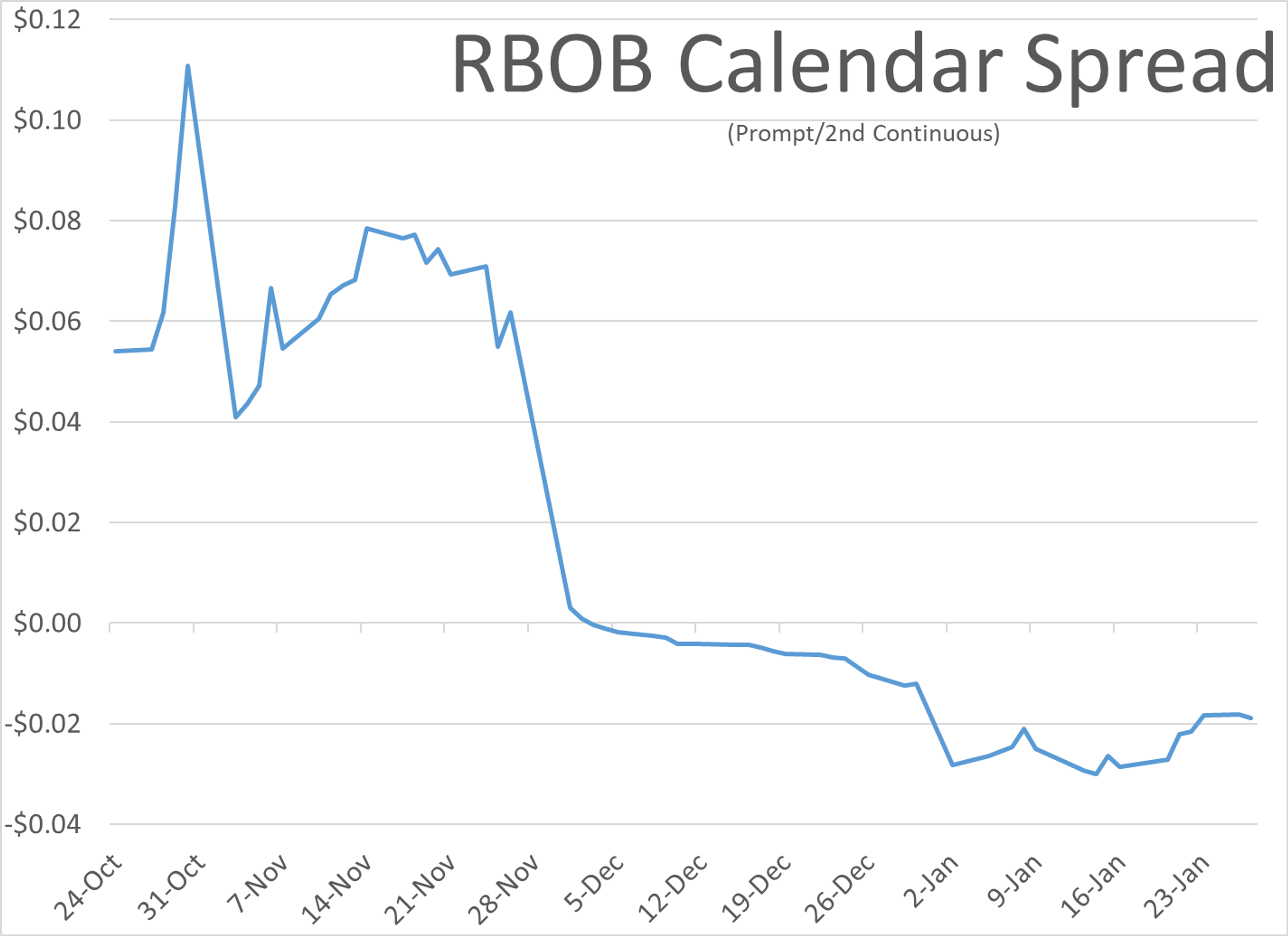

In the refined fuel arena, the February ULSD futures contract continues to steal the show, with huge swings as liquidity dries up ahead of Friday’s expiration, and most cash markets have started trading against the March contract. So far today the contract is all over the map, dropping 9 cents after hitting a 3 month high overnight, only to erase most of those losses just before 8am central.

Monday’s action saw the Feb ULSD contract rally 14 cents/gallon, while March was up less than a penny, and contracts further down the curve actually moved lower for the day, highlighting the short-term squeeze for supplies on the east coast as utilities curtail natural gas supplies forcing diesel to supplement the grid.

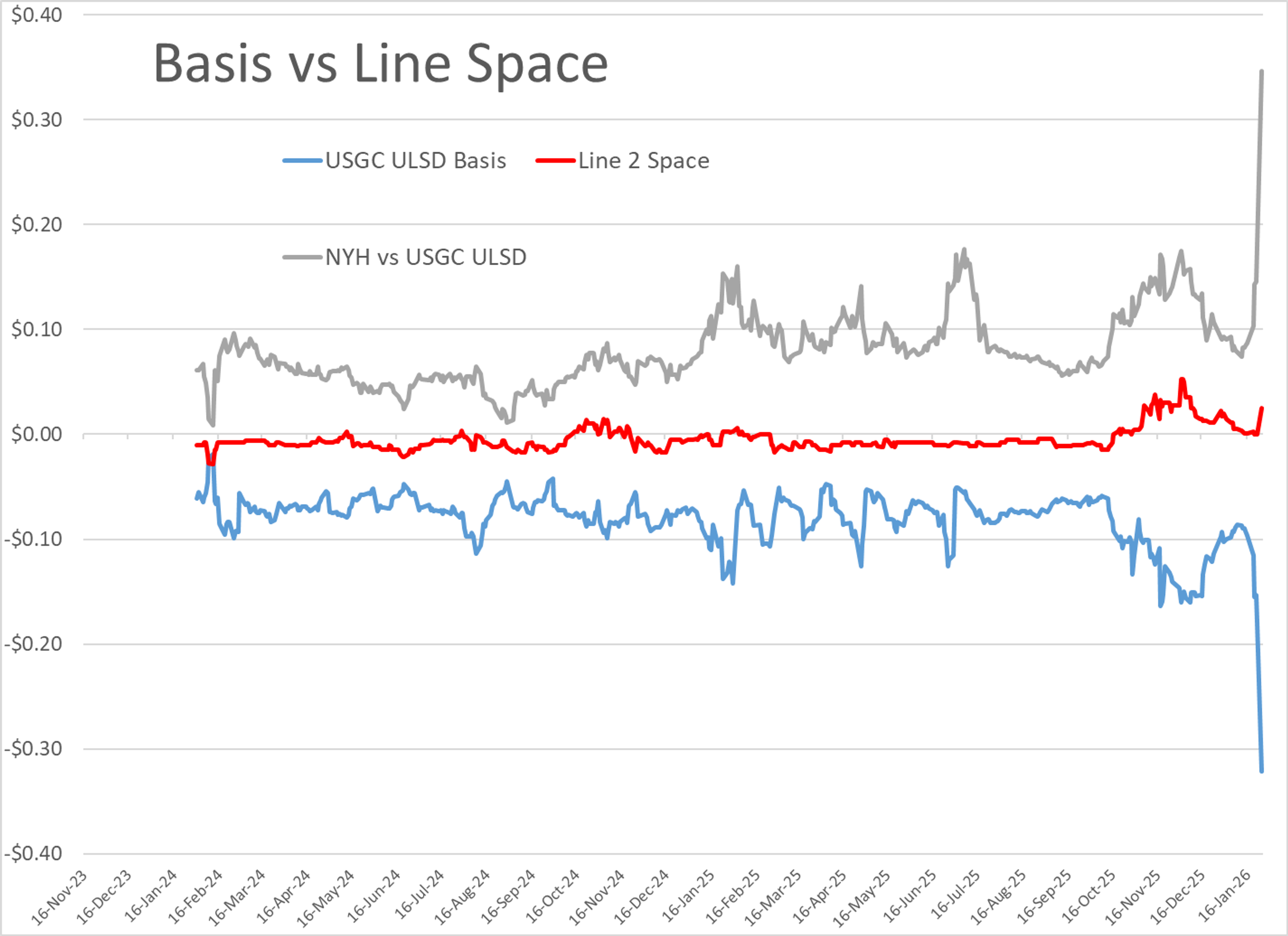

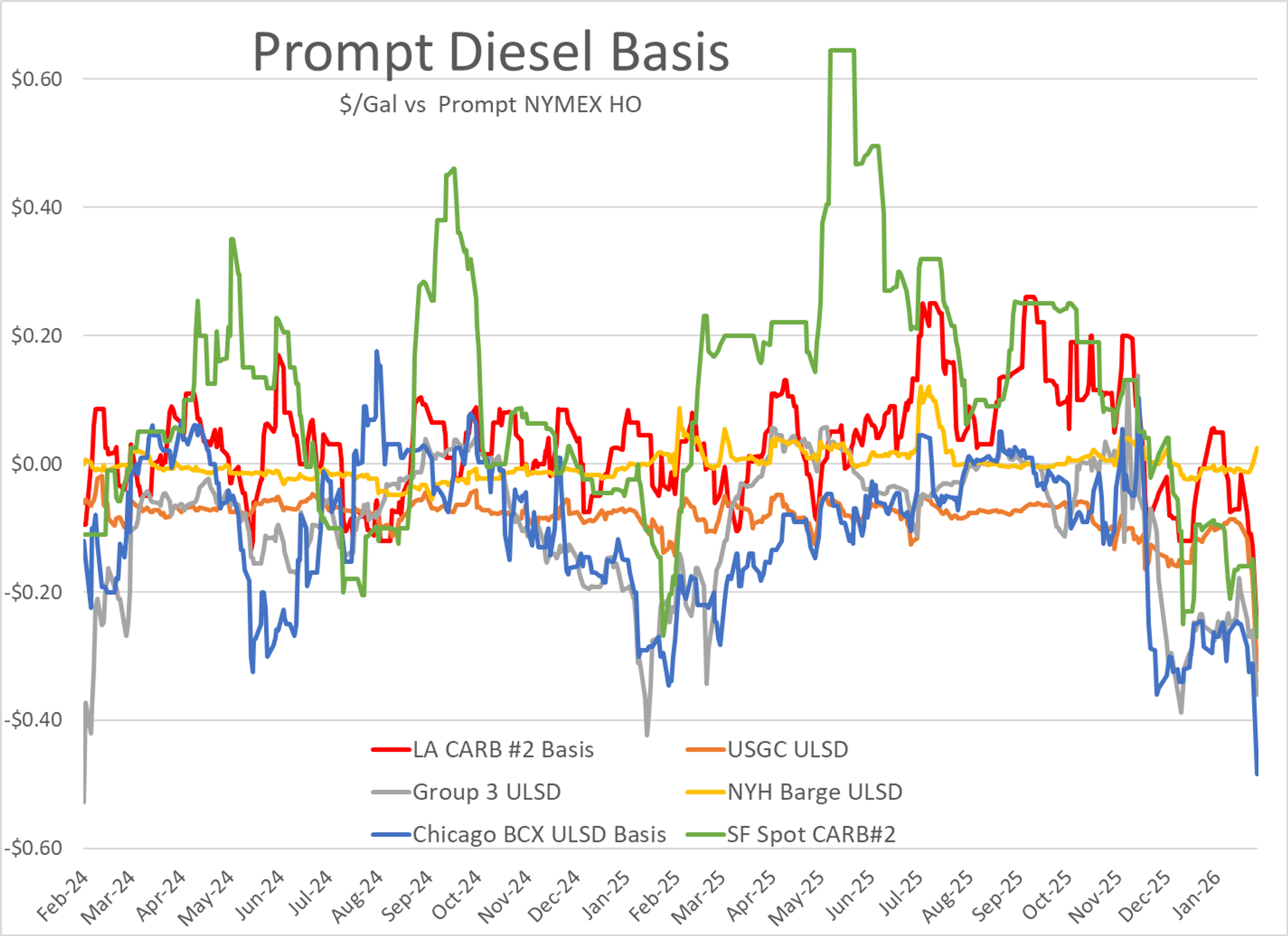

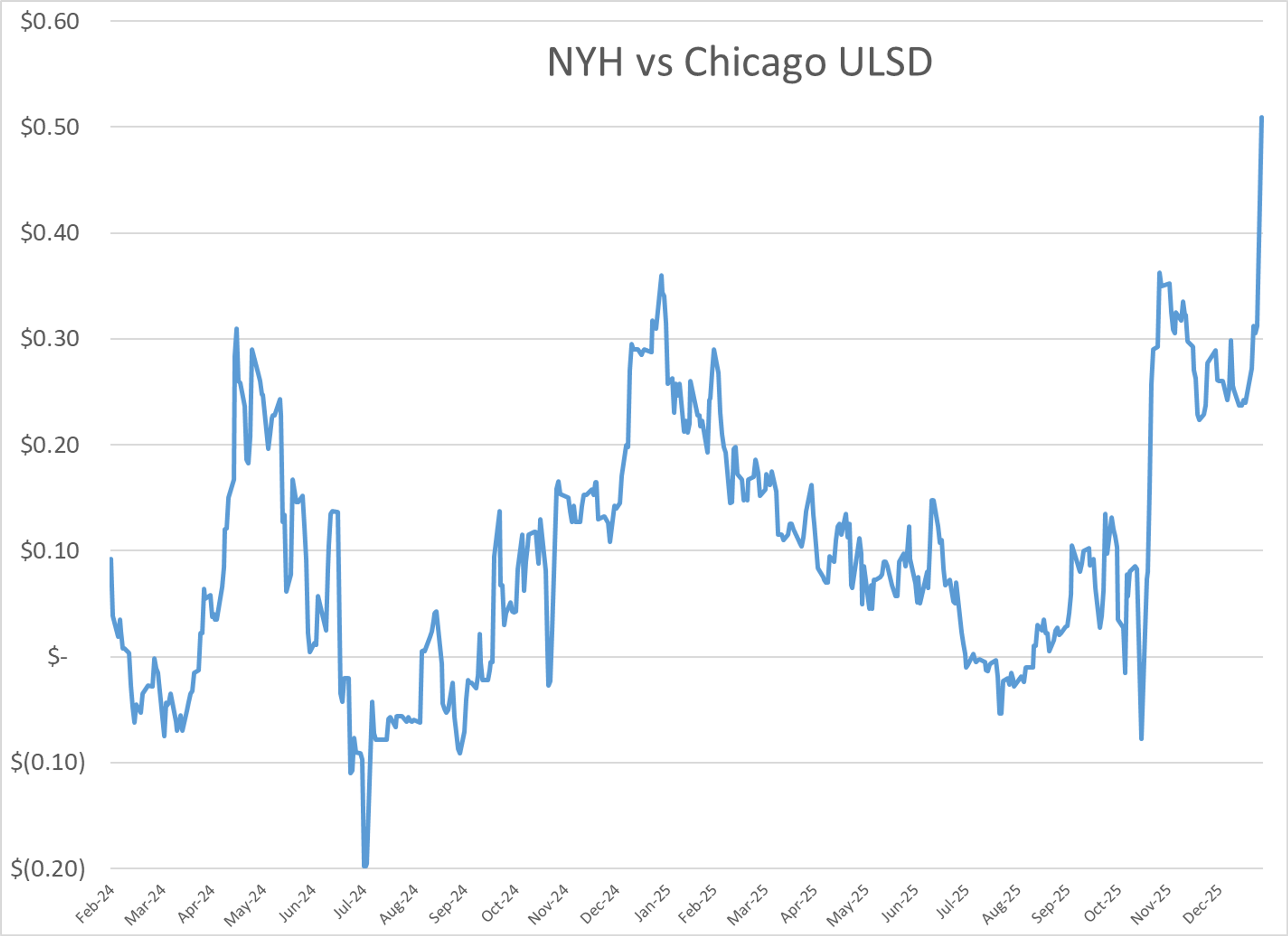

NYH basis values have outpaced the spike in futures, moving into positive territory as buyers are forced to pay up if they need barrels this week. That move comes in stark contrast to physical prices elsewhere in the country that are seeing wide discounts and distortion caused by the spike in time spreads.

A prime example of this spread phenomenon comes from the Midwest diesel markets this week with Group 3 ULSD (X Grade) Trading at a 40 cent discount to Feb futures, for a cash price around $2.10/gallon, while Chicago ULSD is trading at “only” a 25 cent discount to March futures, which comes out to around $2.07/gallon.

The damage reports from the storm continue to trickle in and can be summarized as widespread, but relatively minor so far. Oil and natural gas production in the Permian and Bakken basins has dropped sharply (as they typically do with this type of freeze) but there’s nothing to suggest that they won’t quickly rebound as temperatures normalize.

Likewise, given that power outages were largely contained, the fuel terminal network is coming back online quickly with icy roads a bigger hurdle than anything else.

Pemex reported multiple upsets at the 340mb/day Deer Park TX refinery it bought from Shell during their “we’re pretending to go green” phase a few years ago. The facility highlighted freeze-related issues at multiple units in a TCEQ filing as the freeze-prevention methods they implemented ahead of the storm appear to have failed.

Delek also reported equipment failures due to freezing at its 73mb/day Big Spring TX refinery.

In proof that you don’t need a deep freeze to have trouble running a refinery, PBF reported unplanned flaring at its 157mb/day Martinez CA refinery Monday as the facility continues to try and return units to service nearly 1 year after a major fire took the plant offline.

CVR is being sued by residents that live near its 132mb/day Coffeyville KS refinery for violating terms of an agreement the company made with the EPA over previous air quality violations. That facility has already halted its plans to convert units to RD production due to weak margins and is one of several smaller facilities that appear vulnerable in the years ahead, particularly if a suit like this has merit.

Latest Posts

Winter Storm Disrupts Energy Markets As Diesel Rallies And Refineries Struggle

Energy Prices Surge Again Amid Global Flashpoints And US Weather Shifts

Week 3 - US DOE Inventory Recap

Rally Stalls As Winter Weather Reshapes Fuel Demand And Refinery Operations

Fuel Markets Spike Ahead Of Major US Winter Storm

Diesel Futures Surge As Arctic Cold Fuels Sharp Rally

Social Media

News & Views

View All

Winter Storm Disrupts Energy Markets As Diesel Rallies And Refineries Struggle

Energy Prices Surge Again Amid Global Flashpoints And US Weather Shifts