Energy Markets Stumble As Diesel Plunges And Winter Storms Stress The Grid

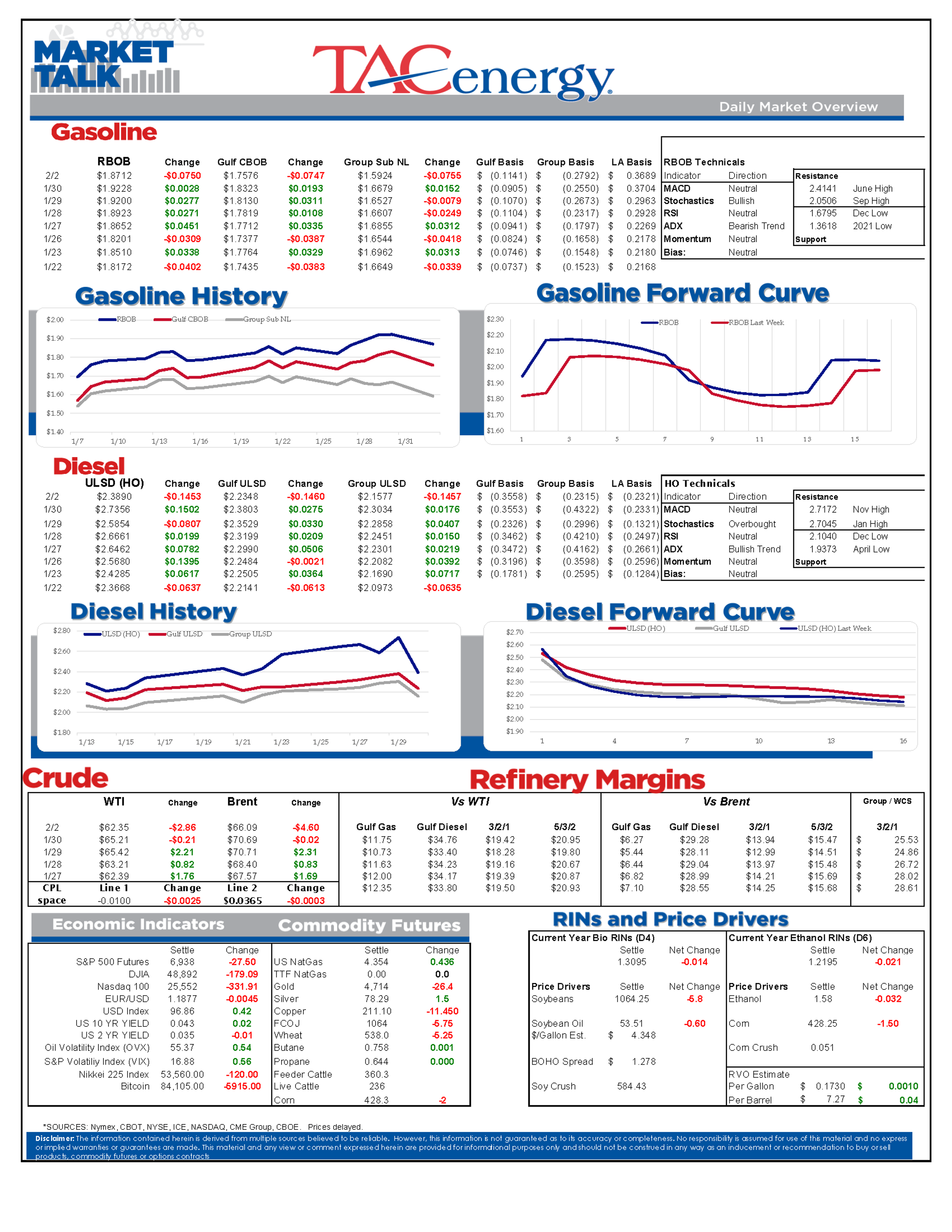

Energy markets are flopping to start February as reports of progress in negotiations between the U.S. and Iran emerge. Diesel prices continue to lead the swings and is trading down nearly 6% (just under 15 cents) so far this morning after the expiring Feb contract hit a 2 year high Friday.

The “bomb cyclone” that pummeled parts of the Carolinas and Virginia with over a foot of snow this weekend stayed just far enough offshore to spare other parts of the North East from the worst of its impacts. While the worst of the 2 major storm systems is behind us, the arctic air appears set to stick around with forecasts suggesting February will continue seeing polar instability pushing cold air into the northeastern third of the country.

Those freezing temps continue to challenge the power grid and fuel supply network with freezing rivers beginning to vessel flows to at least one PA refinery, forcing allocation restrictions at terminals in the region.

Colonial pipeline appears to have continued operations throughout both winter storms, but numerous terminals along the line are struggling with a lack of demand pushing storage to capacity. Numerous requests from terminal operators and suppliers from Tennessee to Maryland highlight the sharp divergence between gasoline inventories which are swelling as drivers stay off the road, and diesel which is seeing spikes in demand from power plants.

Speaking of which, the EIA highlighted Friday how a new hydro-electric transmission line that’s set to bring power from Canada to New England was reversed during last week’s winter storm as Canada struggled to meet domestic demand, while surging diesel burns in the NE allowed for excess power to be generated.

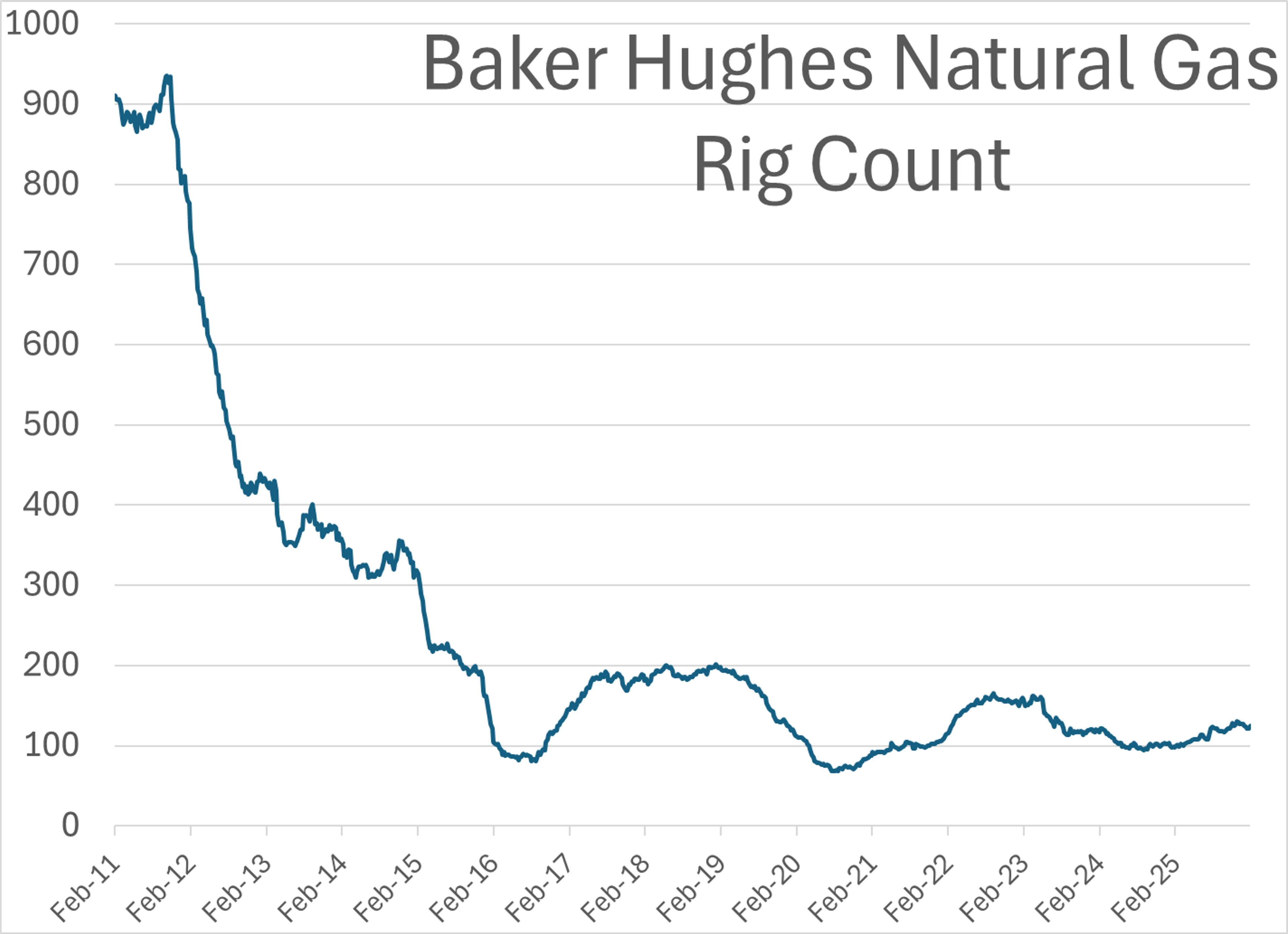

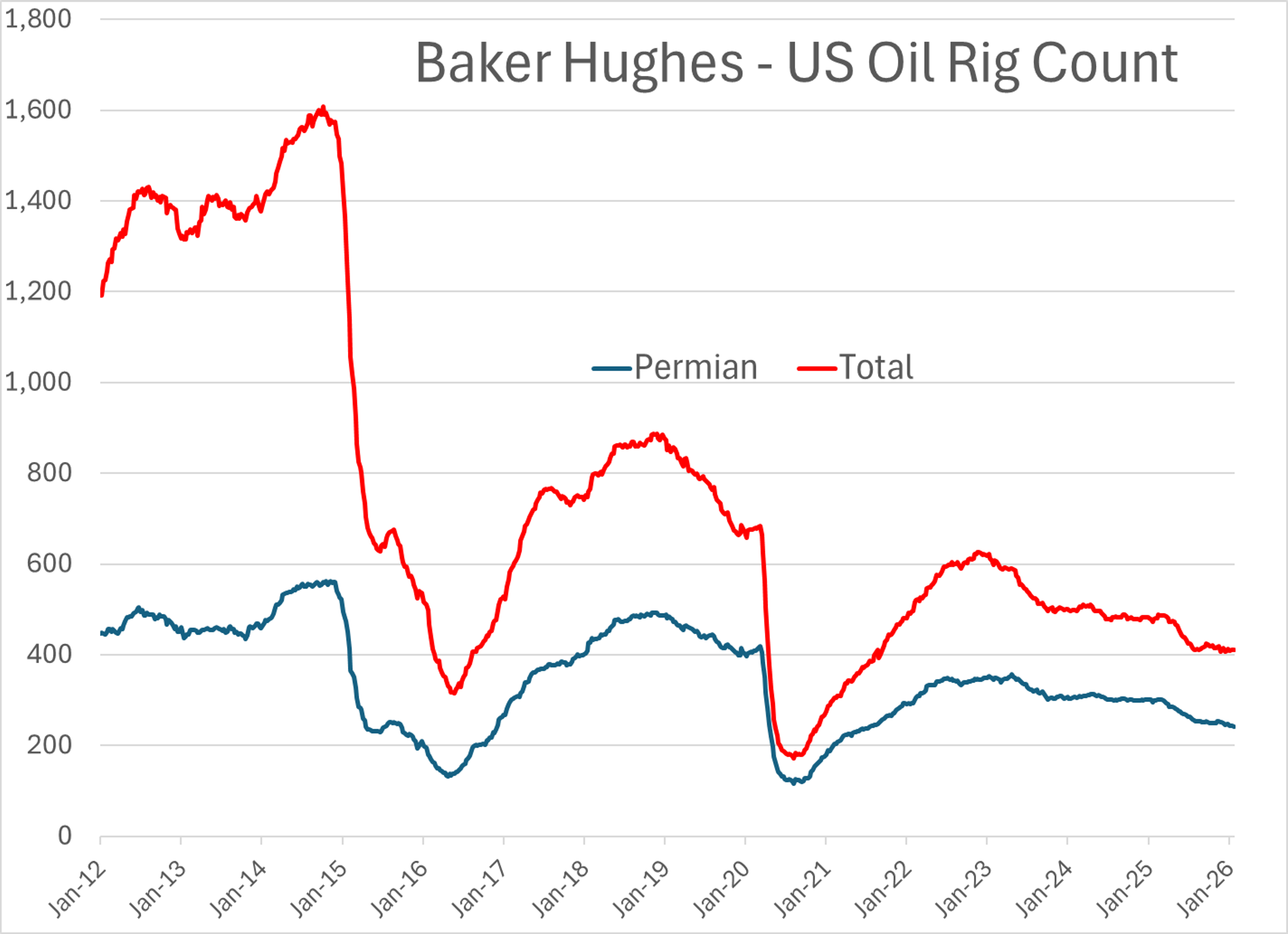

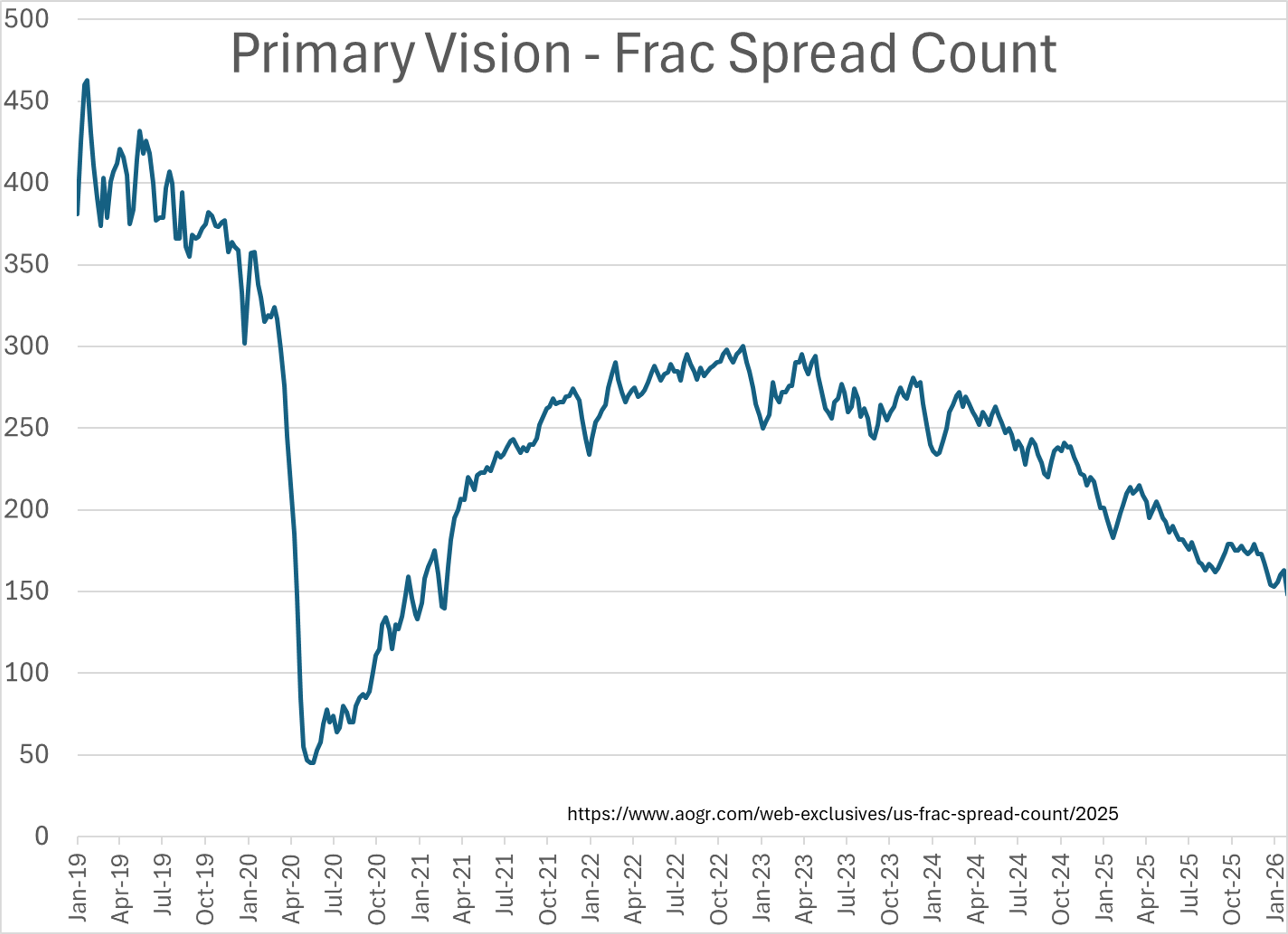

Baker Hughes reported that the U.S. oil rig count held steady at 411 active rigs last week, while the natural gas rig count increased by 3 to 125. The Primary Vision count of U.S. Frac crews dropped by nearly 10% last week as crews were no doubt pulled off the job during the winter storm leaving just 148 crews operating vs 163 the week prior.

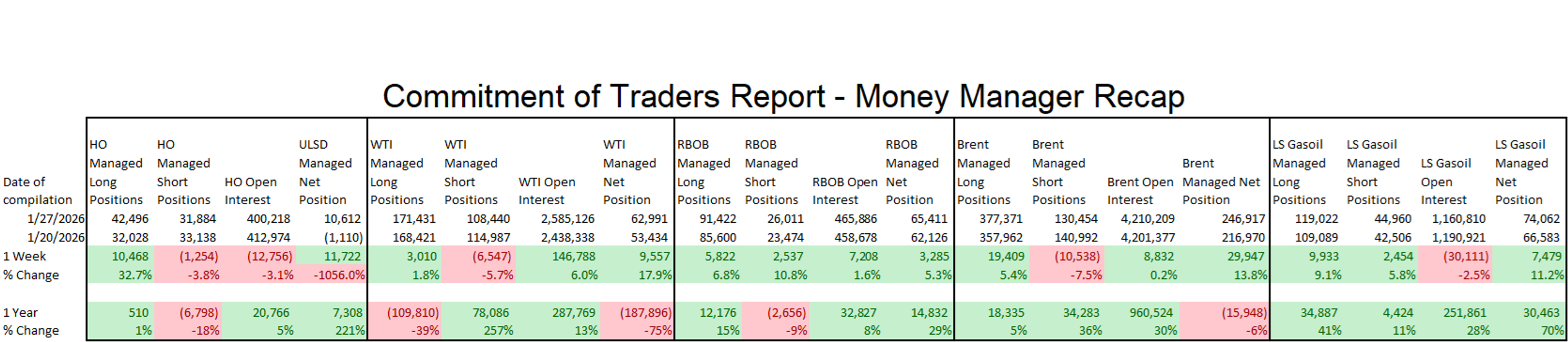

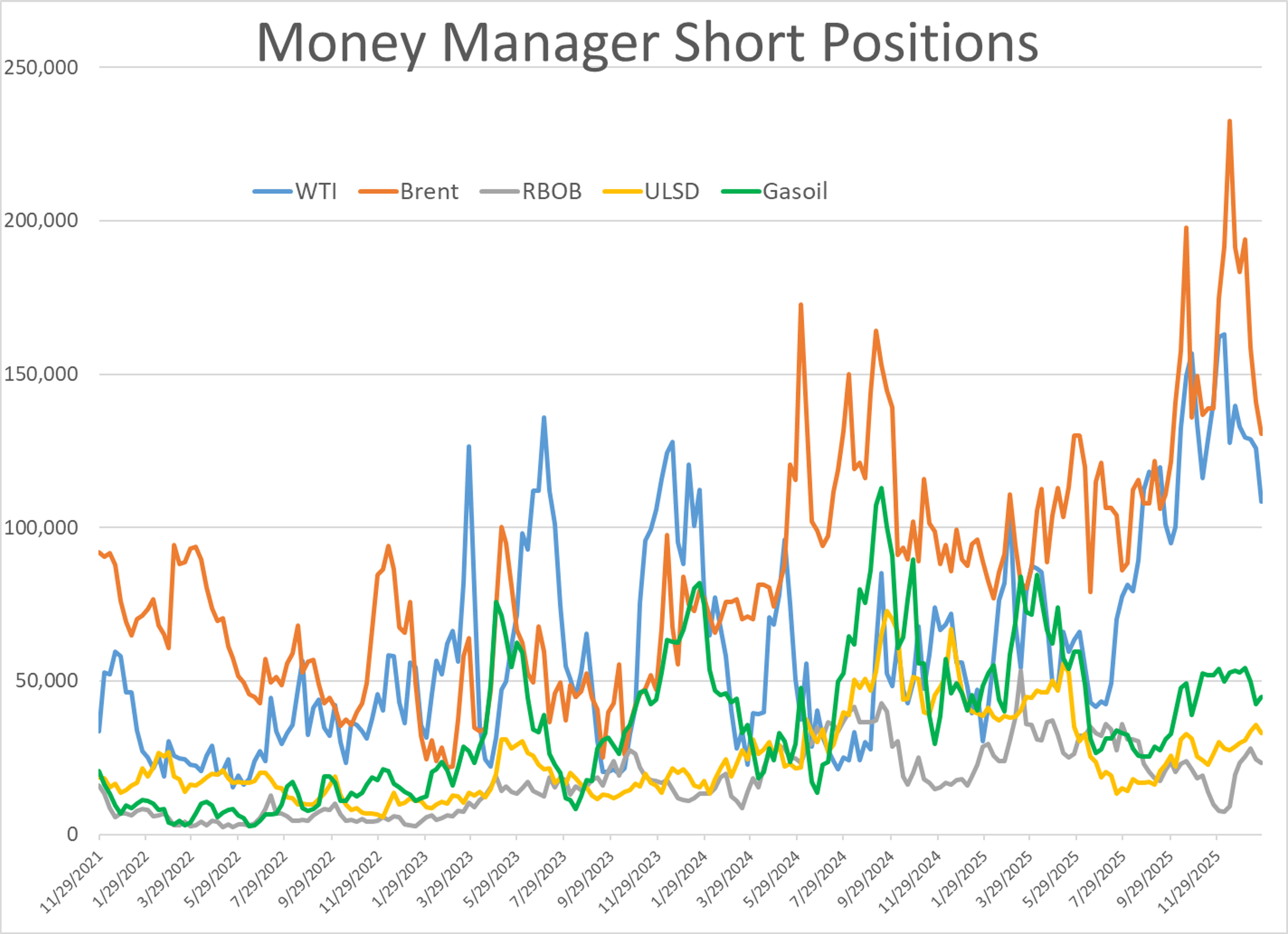

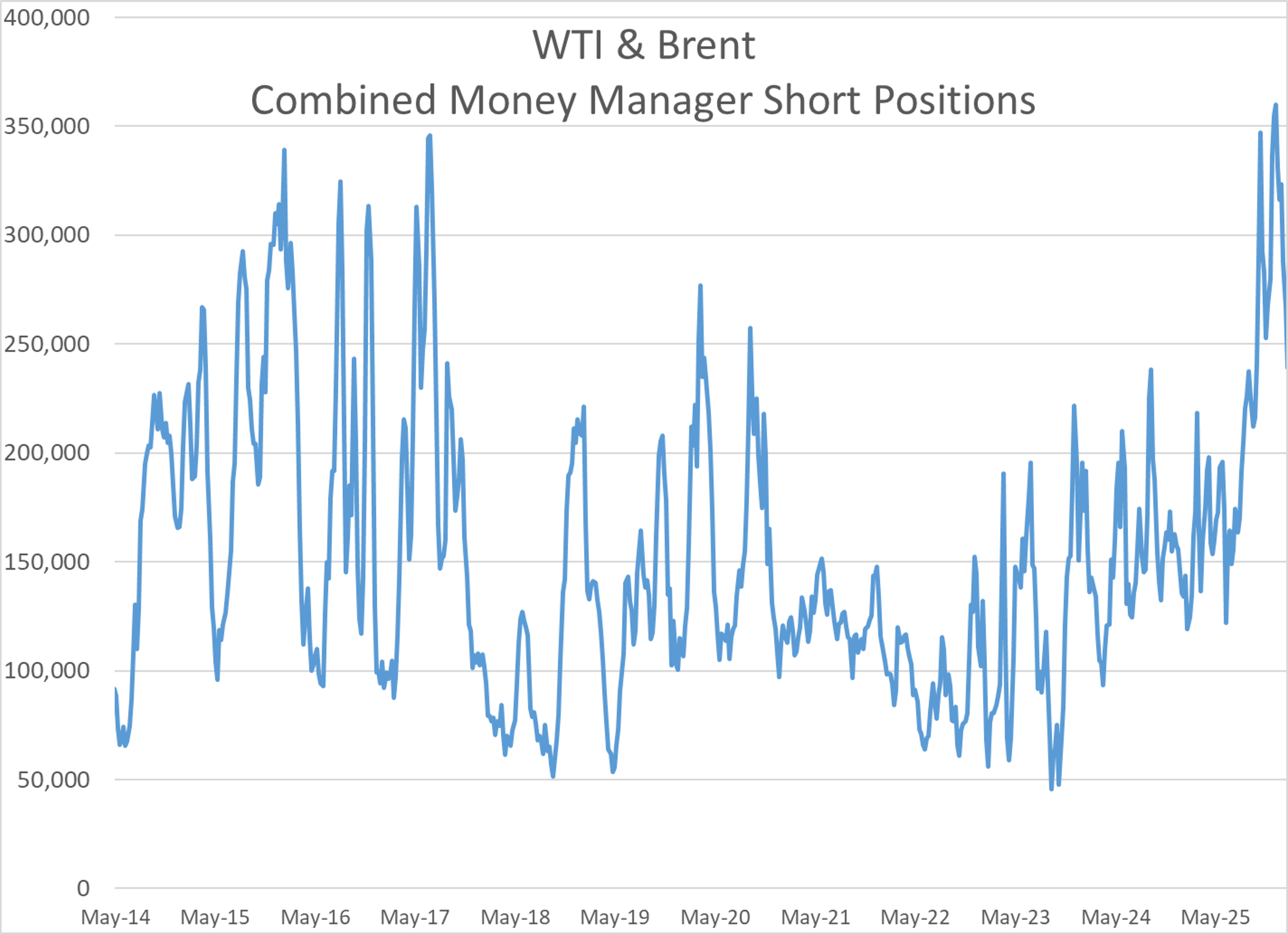

Money managers were adding to bets on higher energy prices last week as the big short position in crude oil contracts continued to be squeezed out, and new long positions were added across the complex.

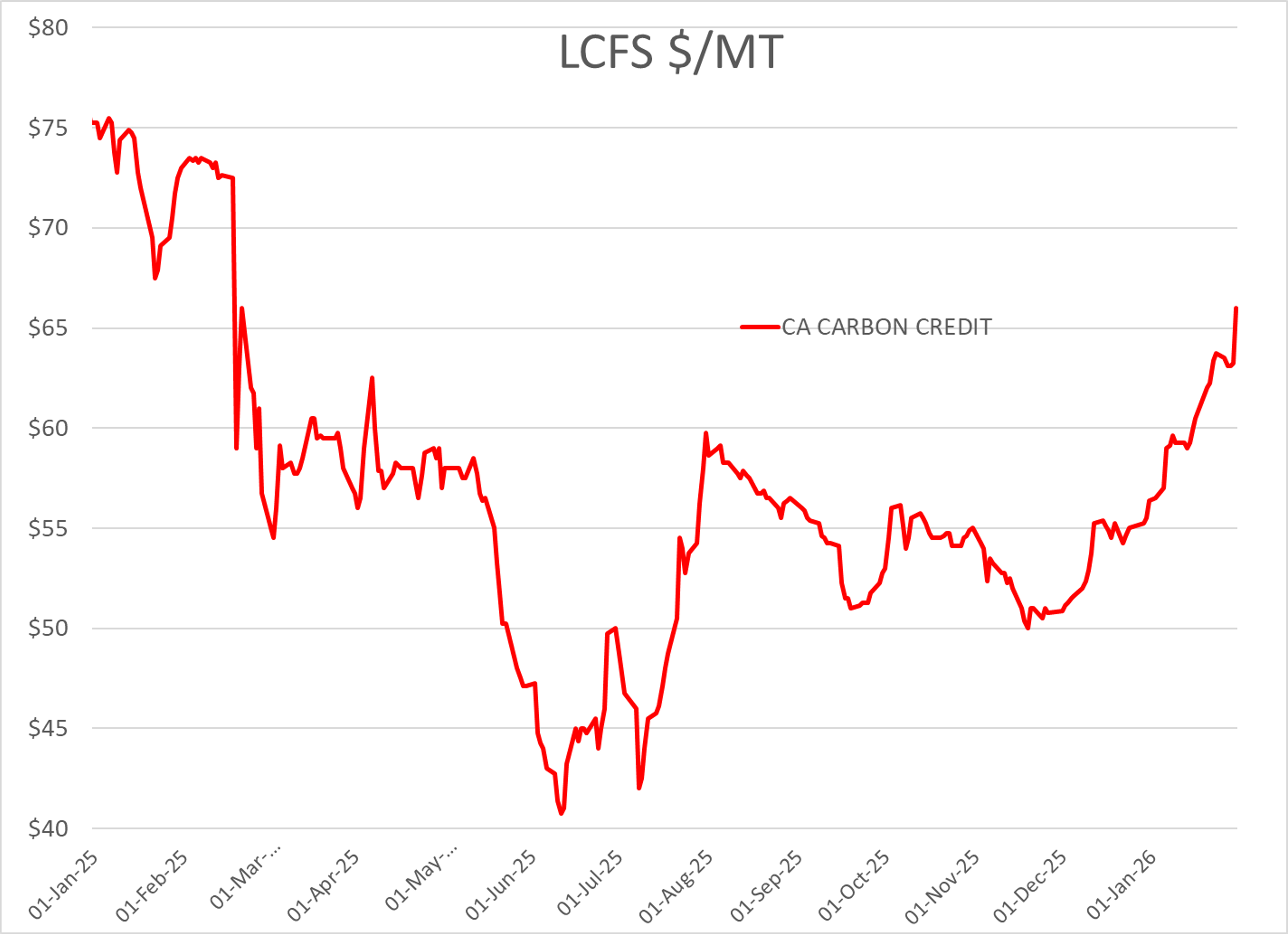

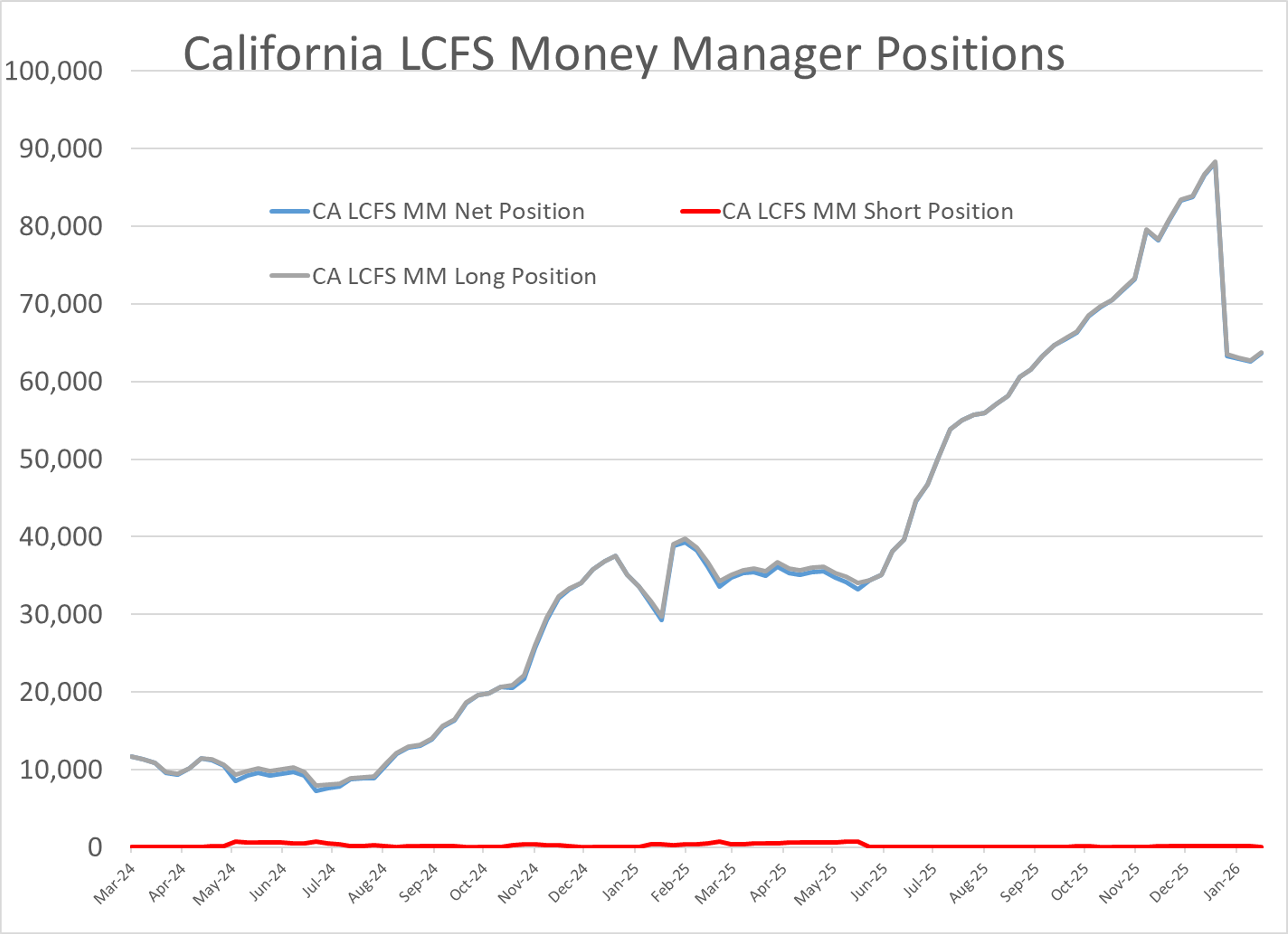

California’s LCFS values surged to a 1 year high on Friday after the Q3 program report showed the first decline in the credit bank since 2021. Big declines in Renewable Diesel output and EV charging were the largest drivers of the decline for the quarter.

PBF reported more unplanned flaring at its Torrance CA refinery Friday afternoon as that facility struggles to return to normal operating rates.

P66 reported another upset in an FCC unit at its Borger TX refinery that lasted most of Friday.

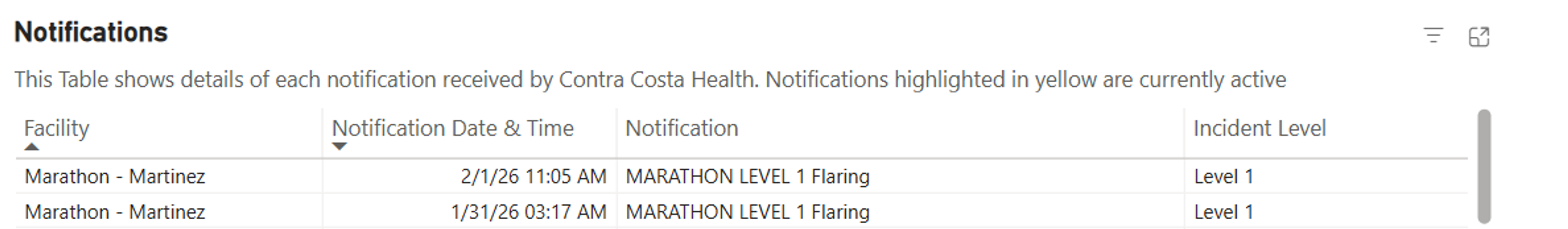

Marathon reported two different flaring episodes at its 48mb/day Renewable refinery in Martinez CA over the weekend as that facility works through a planned turnaround.

Latest Posts

War, Peace, And Mixed Signals: Energy Prices React To A Turbulent Week

Energy Prices Surge Amid Middle East Tensions And Domestic Supply Disruptions

Week 4 - US DOE Inventory Recap

Diesel Futures Spike Again Amid Middle East Strains And Weather Whiplash

Freeze Fallout Triggers Extreme Volatility Across US Energy Markets

Winter Storm Disrupts Energy Markets As Diesel Rallies And Refineries Struggle

Social Media

News & Views

View All

War, Peace, And Mixed Signals: Energy Prices React To A Turbulent Week

Energy Prices Surge Amid Middle East Tensions And Domestic Supply Disruptions