Diesel Futures Spike Again Amid Middle East Strains And Weather Whiplash

Energy markets are ticking higher again Wednesday as tensions in the middle east ratchet up once again just as the winter weather supply squeeze appears to be easing.

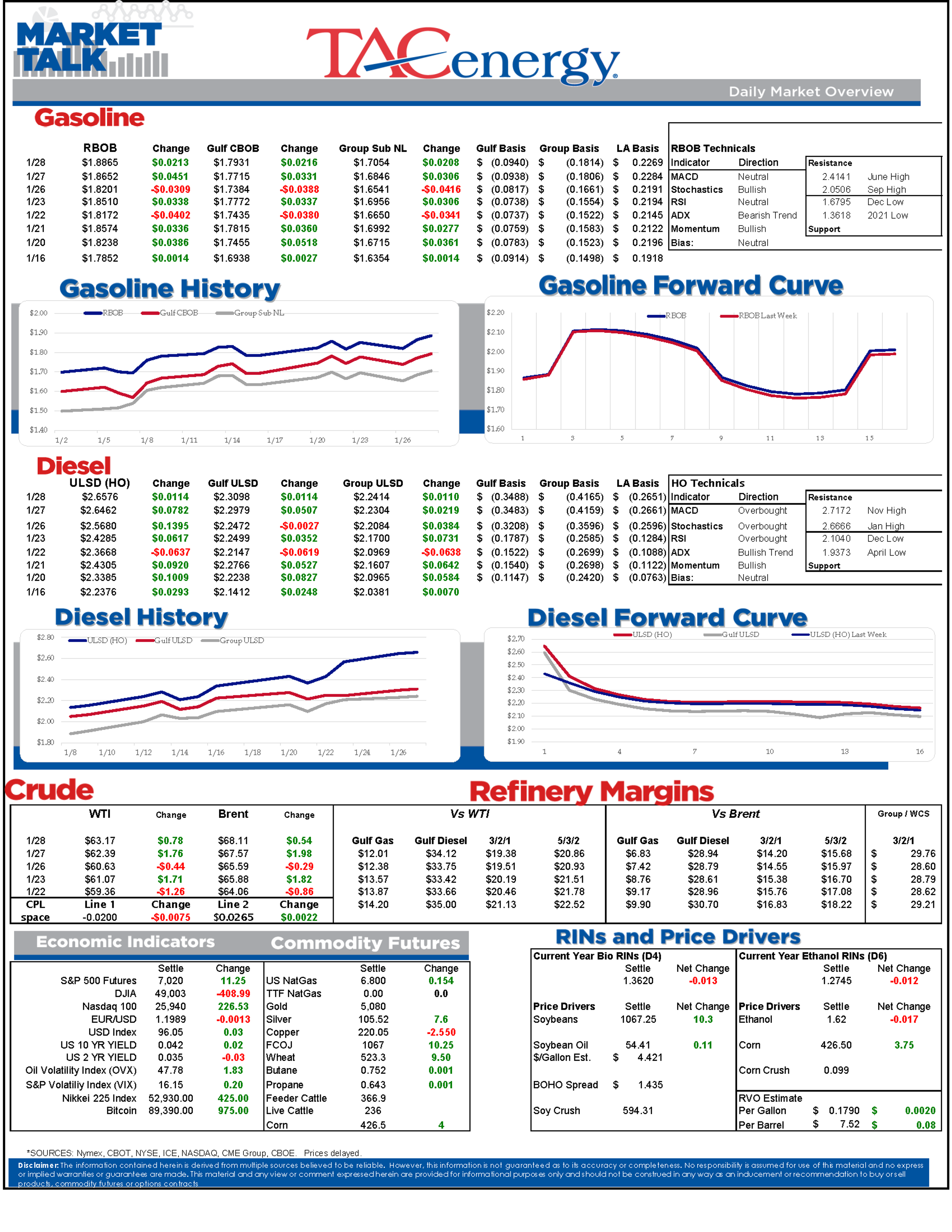

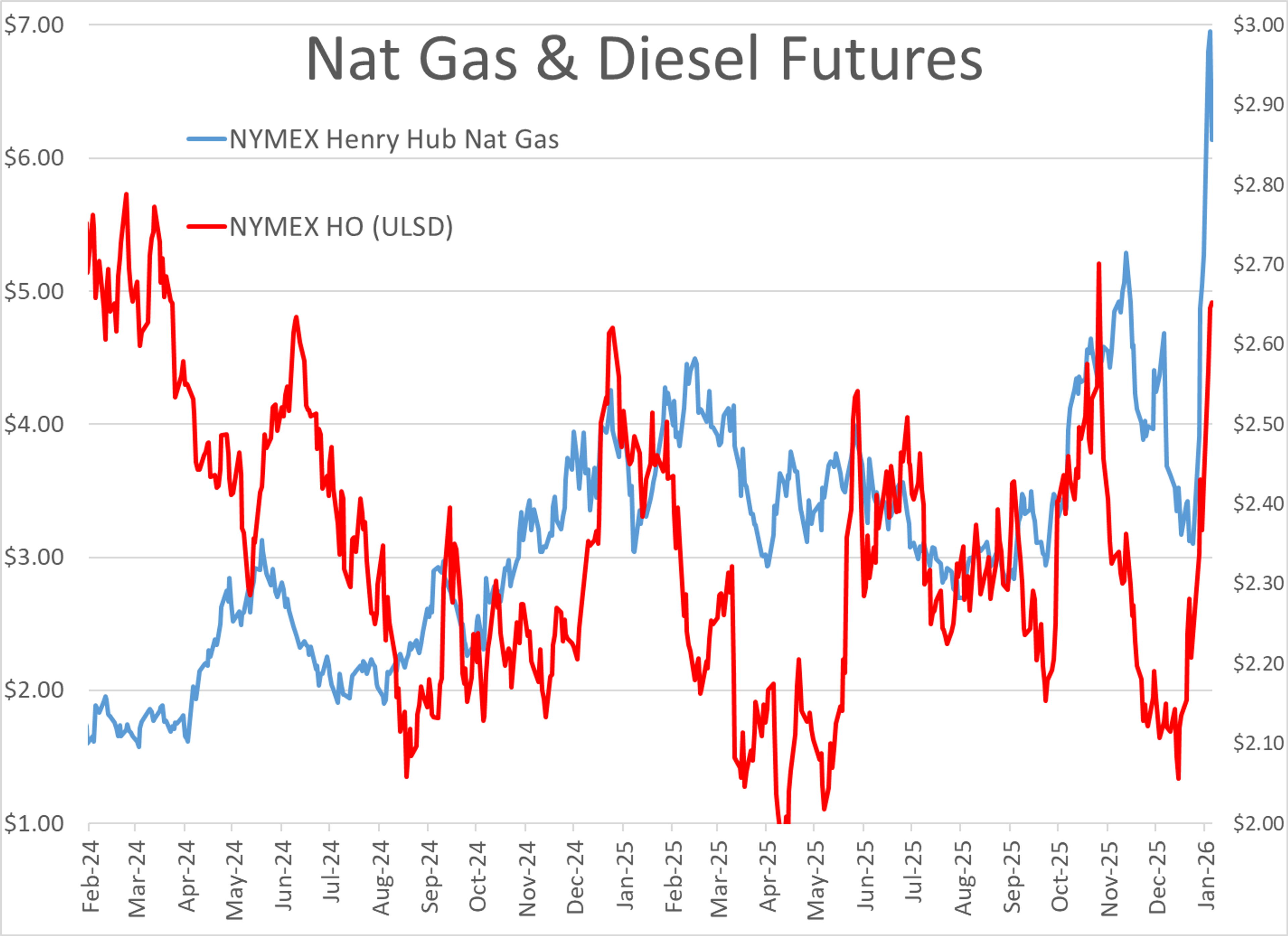

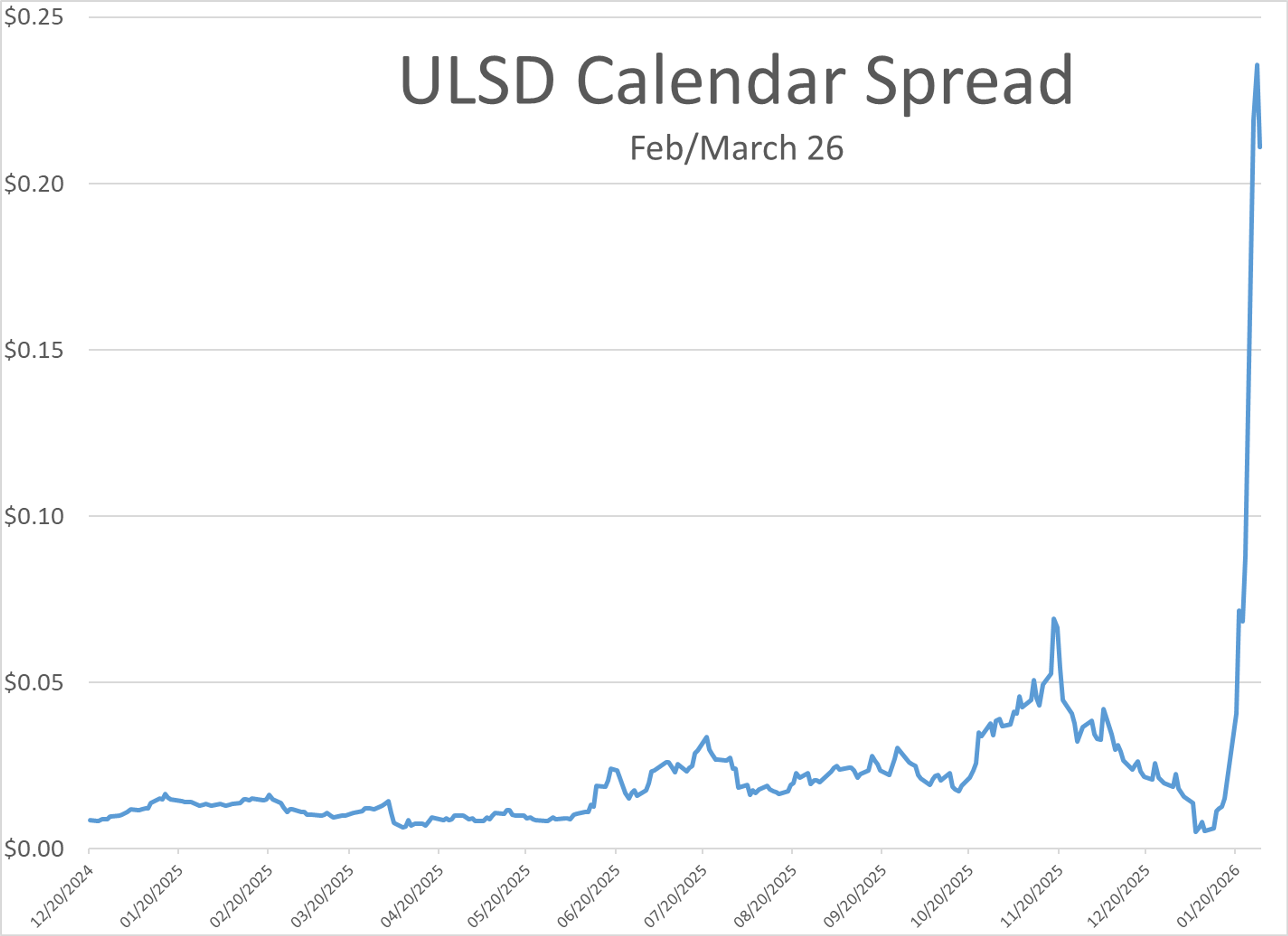

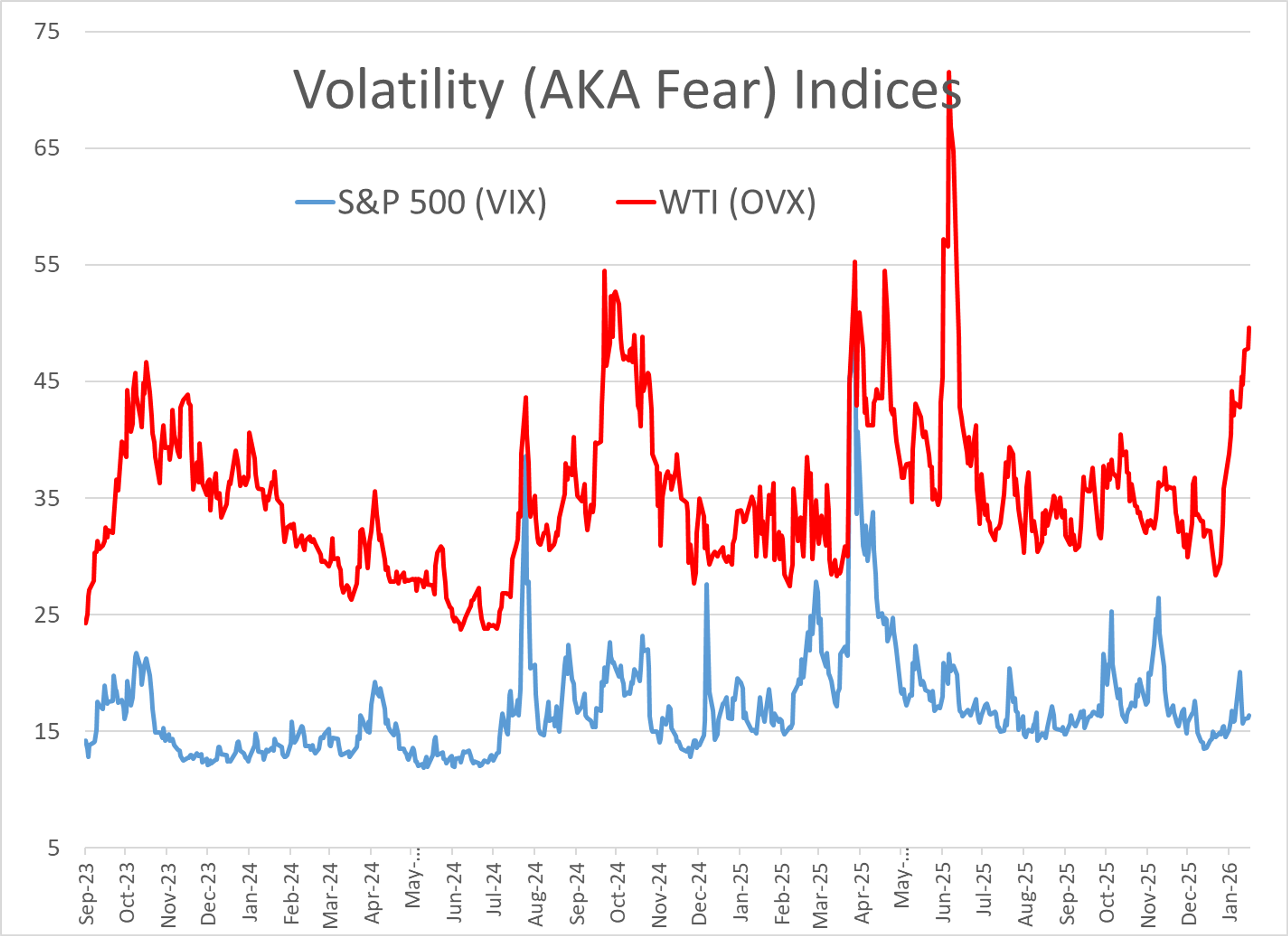

The February ULSD contract saw a casual 16 cent swing from a morning low of $2.49 to an afternoon high north of $2.66 as the volatile trading spurred by the spike in heating demand continues.

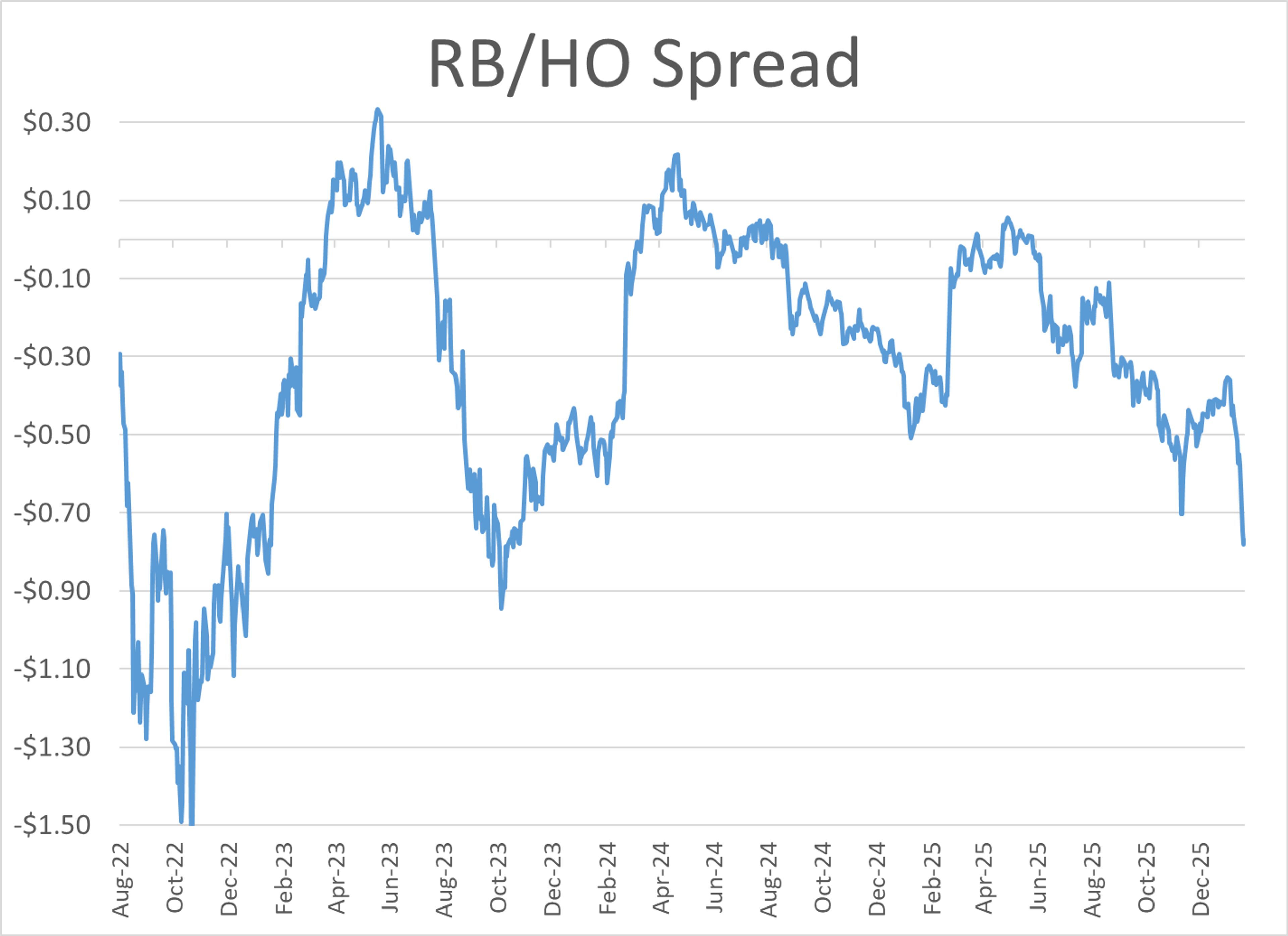

Caveat Emptor: This is the 5th time in the past 18 months we’ve seen prompt diesel futures hit the $2.65 range, and in each previous instance values have dropped 40 cents or more in the following 2 months. You can expect a similar phenomenon this time around simply because the March contract that will take the pole position on Monday is trading 22 cents below Feb.

One of those previous boom/bust cycles for diesel came last summer during the 12 day war in Iran. The U.S. is once again pressuring Iran to “come to the table” to negotiate a nuclear deal this morning after shifting naval assets to the region last week. Saudi Arabia and the UAE have said they will not let the U.S. use their airspace to attack Iran, in a show of something resembling solidarity after the dust up between the two countries’ forces in Yemen.

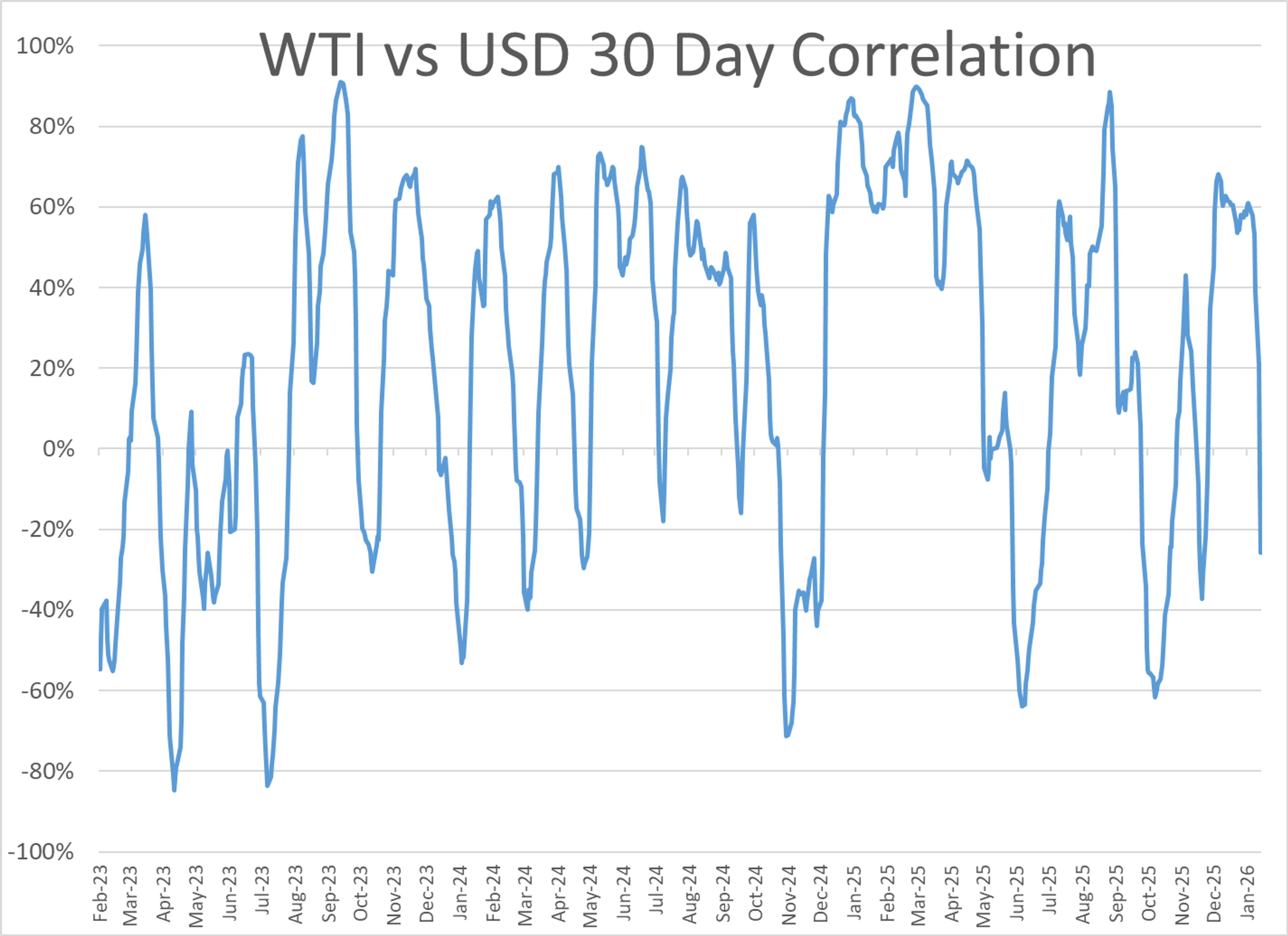

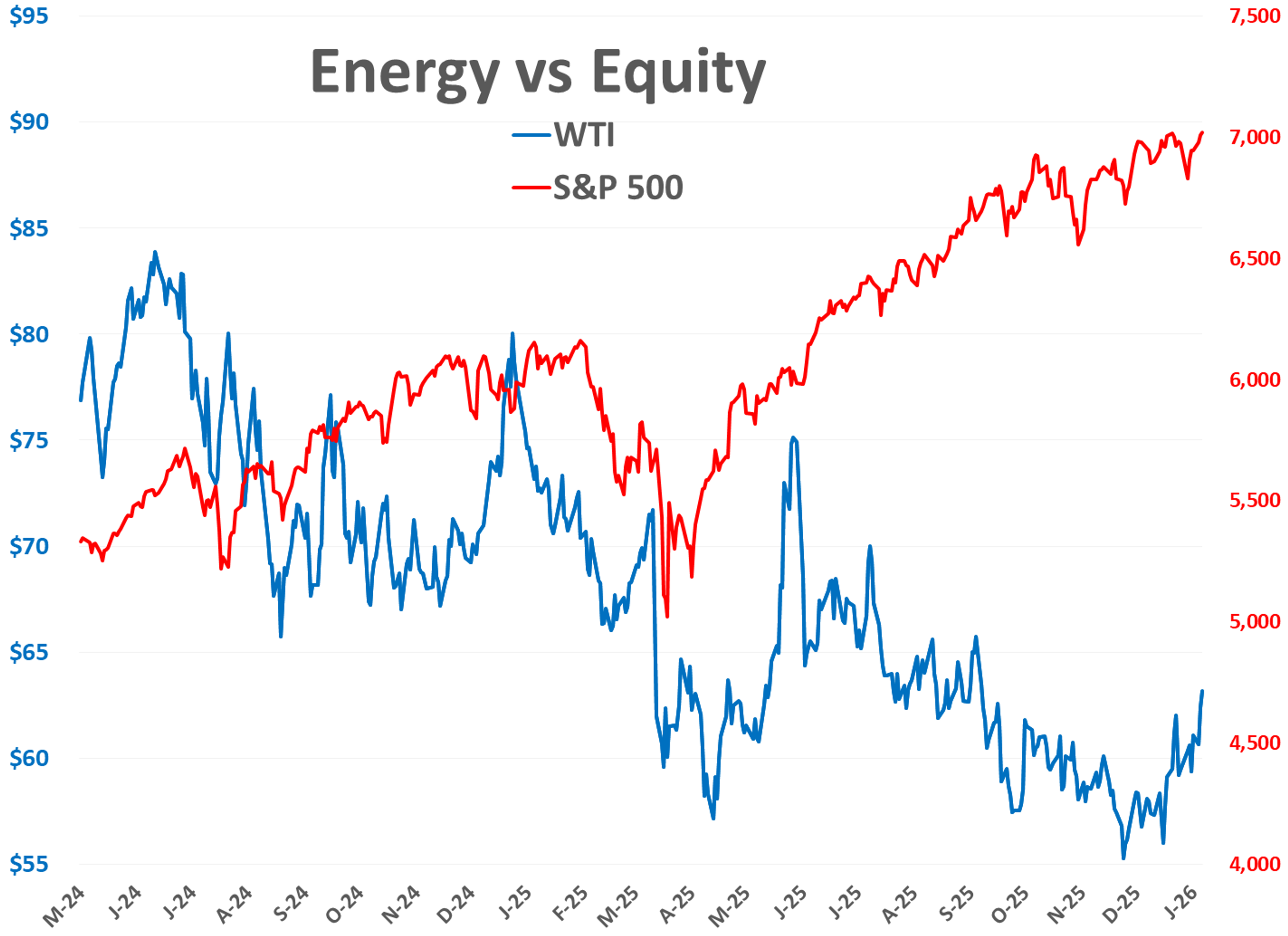

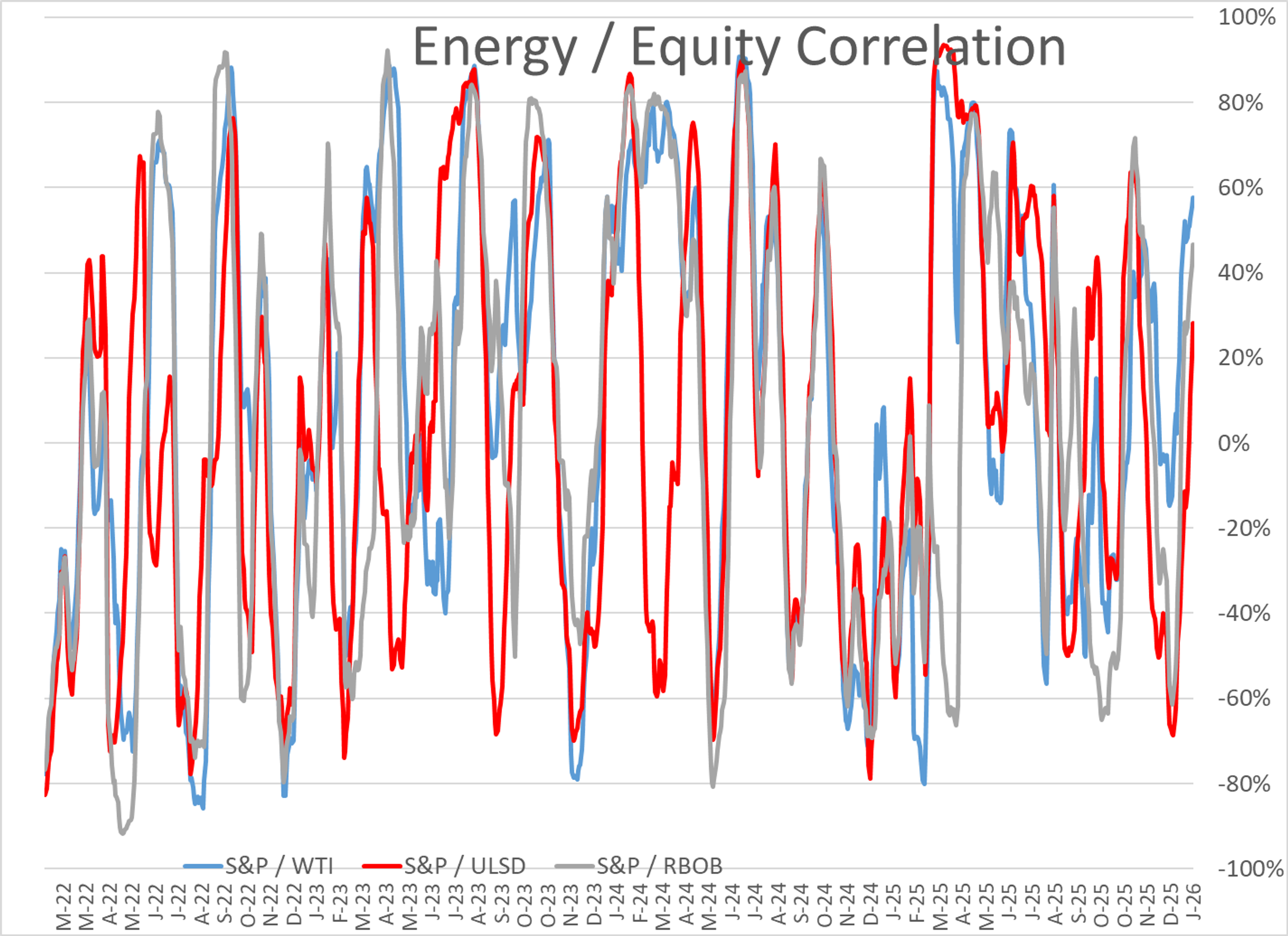

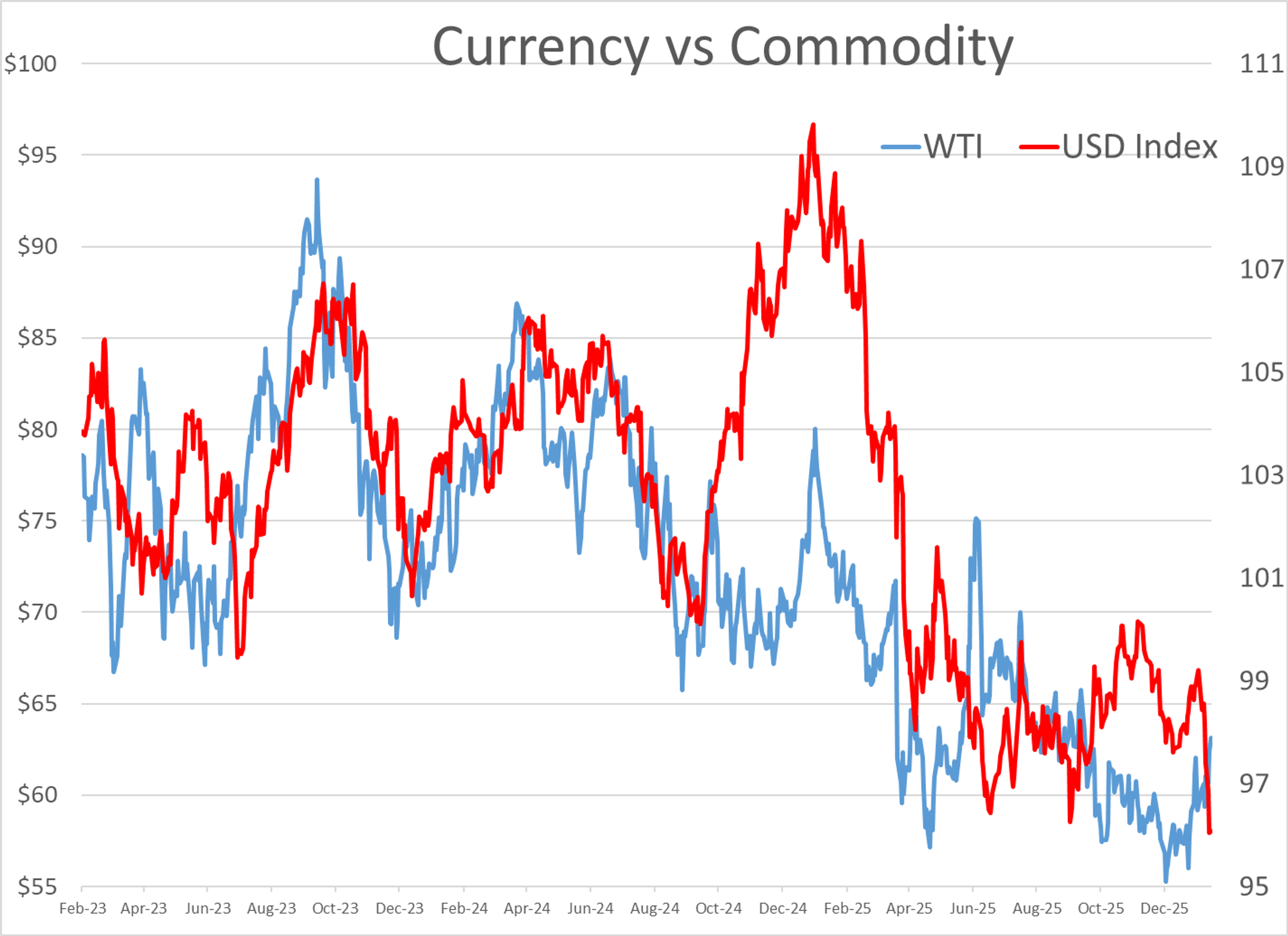

The U.S. Dollar reached a 4-year low this week, and the S&P 500 is trading at a record high, both of which historically would suggest stronger energy prices so they’re getting some of the credit for the multi-month highs being set by WTI and ULSD this week. The problem with those theories is the correlation between asset classes has been pretty much non-existent, or even opposite of their “normal” patterns for most of the past year.

There’s another winter storm that could hit the East Coast this weekend. Forecast models are still split on whether or not the system will hug the coast or head out to sea, but they agree that another wave of below-average temperatures will follow the system, keeping pressure supplies of heating fuels next week. That storm is also likely to disrupt vessel traffic at waterborne terminals along the Eastern Seaboard, many of which are depending on diesel imports to meet the spike in demand we’ve seen over the past week.

The API estimated small decreases in oil and gasoline stocks of less than? million barrels each last week while diesel inventories increased by 2 million barrels. The EIA’s weekly report is due out at its normal time despite Washington being snowed in. It’s important to remember that the weekly status report is based on data collected last Friday, so the impacts of the winter storm will not start showing up in the data until next week.

Although natural gas and crude oil production were both heavily impacted by the storm, and there were close to a dozen refinery upsets reported, so far none of these operational glitches appear to have done long term damage so the supply network is rapidly returning to normal.

Motiva reported an upset at its 650mb/day Pt Arthur TX refinery Monday night after a wet gas compressor tripped. Weather was not listed as a factor in the upset which impacted a delayed coker unit, which appears to have been restarted based on the TCEQ filing.

Breaking Bad: New Mexico approved the rules for its new Clean Transportation Fuel Program, which some had doubted would be approved due to the executive order made last April trying to prevent this type of thing. This newly approved program marks New Mexico as the first state not touching the Pacific Ocean to adopt a “low carbon” fuel policy. If you want to see details of the approved rule set to take effect this spring, you’ll need to reach out to state officials as they haven’t yet published the final regulation.

Latest Posts

Energy Prices Surge Amid Middle East Tensions And Domestic Supply Disruptions

Week 4 - US DOE Inventory Recap

Freeze Fallout Triggers Extreme Volatility Across US Energy Markets

Winter Storm Disrupts Energy Markets As Diesel Rallies And Refineries Struggle

Energy Prices Surge Again Amid Global Flashpoints And US Weather Shifts

Week 3 - US DOE Inventory Recap

Social Media

News & Views

View All

Energy Prices Surge Amid Middle East Tensions And Domestic Supply Disruptions

Week 4 - US DOE Inventory Recap