It’s Another Mixed Start For Energy Markets Wednesday With Crude Oil Prices Clinging To Modest Gains

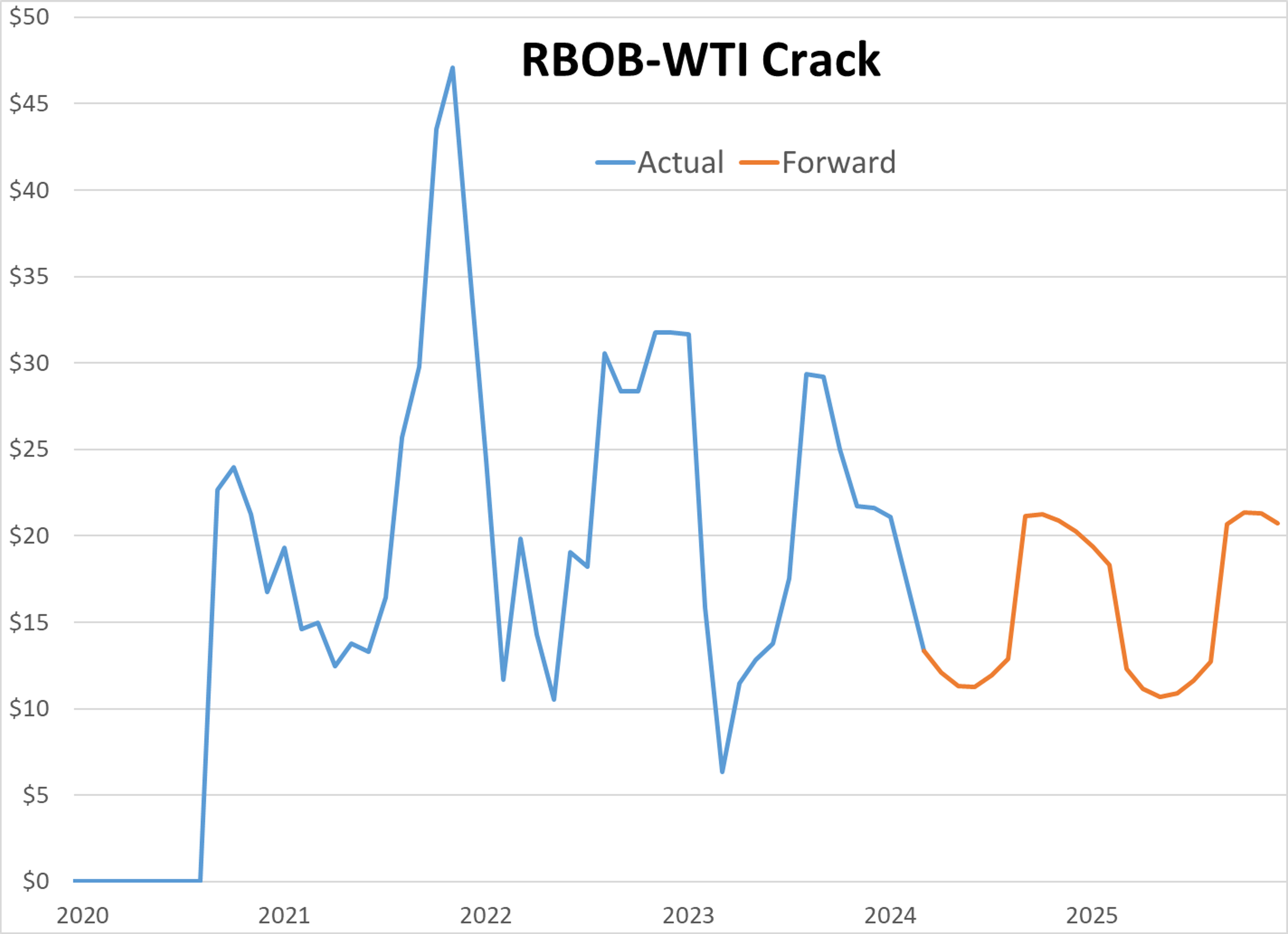

It’s another mixed start for energy markets Wednesday with crude oil prices clinging to modest gains, while refined products were seeing small losses in the early going. RBOB gasoline futures continue to lead the slide lower as the end of the driving season is now just a few weeks away, with traders shrugging off another inventory decline reported by the API.

Adding to the negative sentiment for gasoline futures were reports that Motiva had successfully restarted the FCC unit at its giant pt Arthur refinery after 2 weeks of unplanned repairs. Gulf Coast RBOB basis values dropped 6.5 cents on the day, essentially doubling the loss in futures, and pushing cash losses to more than 13 cents for reformulated supplies. While the Motiva restart made national news, Energy News Today reported late Tuesday that Valero’s Port Arthur refinery was forced to shut a 250mb/day crude unit for unplanned repairs that will take about a week, so it would not be surprising to see some recovery in the RBOB basis spreads today.

West Coast basis values saw the opposite moves Tuesday, with LA CARBOB differentials up more than 8 cents on the day, more than offsetting the slide in futures, while San Francisco and PNW diffs were both up a nickel. The next couple of months often bring some of the strongest basis values of the year for the West Coast as the rest of the country starts preparing for the fall RVP transition in September, while California markets need to wait an extra 6 weeks before shifting away from their summer 6lb RVP requirements.

California LCFS values jumped Tuesday following the opening of an open comment period on its long-awaited proposal to make the state’s clean fuel law more stringent over the next decade. While a 10% jump in a day is certainly noteworthy, LCFS credits are still going for just 1/3 of their value from 3 years ago as the state’s incentives worked a little too well and a rush of new renewable supply has outpaced the program’s requirement for credits.

The API reported a 5 million barrel decline in crude oil inventories last week, while gasoline stocks were down 3.7 million barrels, and distillates increased by 612,000 barrels. The DOE’s weekly report is due out at 9:30 central.

Don’t call it a cartel: A Bloomberg note last week highlighting anticipated run cuts from US refiners struggling with weak margins has some suggesting that US facilities are behaving just like OPEC.

Don’t call it extortion: Richmond CA officials are reportedly agreeing to remove a tax levy on Chevron’s refinery from the November ballot, in exchange for a $550 million payment to the city. Not a single broken knee cap was reported from the negotiations.

The July CPI report does not seem to be moving market prices much this morning as the .2% inflation reading for the month and 2.9% reading for the past year both were in line with many estimates. Lower gasoline and diesel prices continue to be a key limiter on the overall inflation number, helping to offset higher electricity prices that were up nearly 5% in the past 12 months.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets