Refined Products Lead A Fierce Rally As Traders Unwind Record Shorts

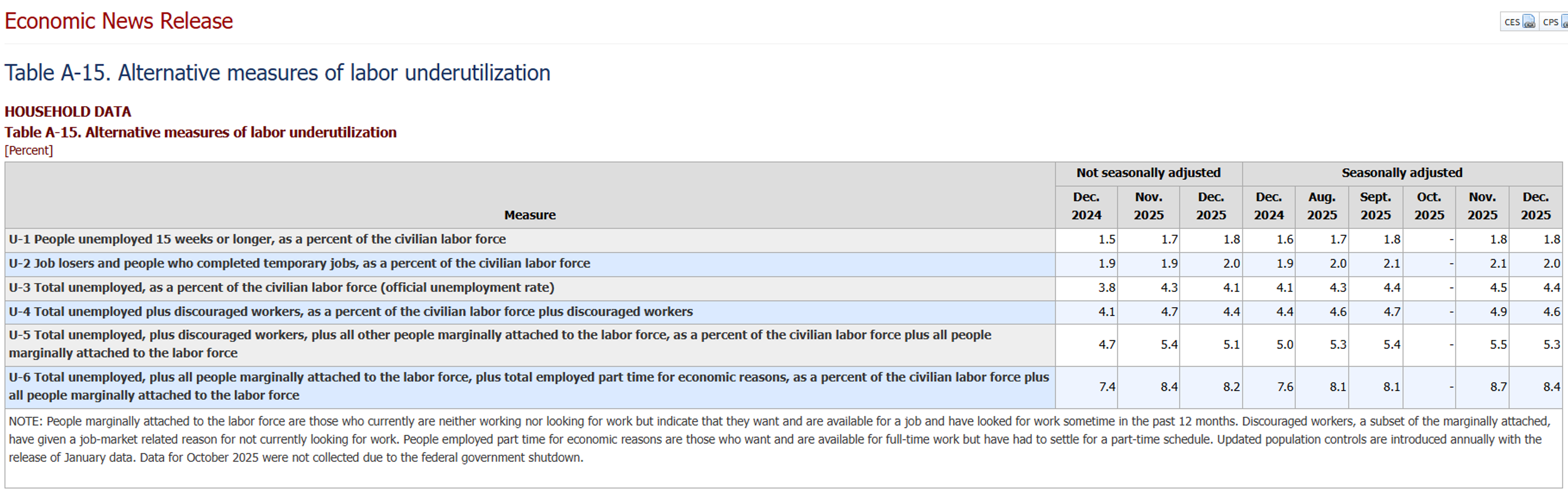

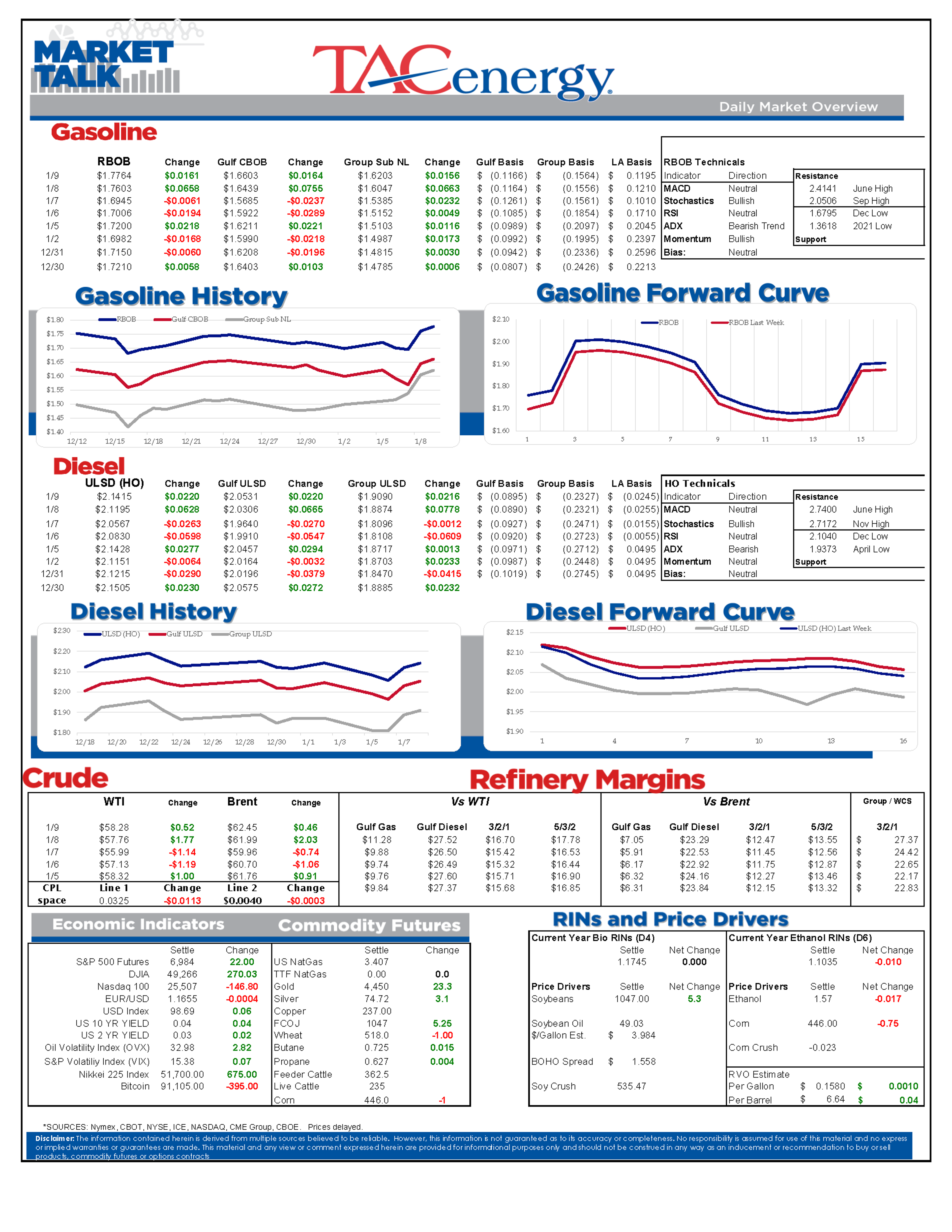

Refined product futures continue to lead the energy complex higher Friday after a furious Thursday rally. Both ULSD and RBOB contracts are up more than 8 cents from Wednesday’s settlement, pulling prices away from the technical cliff they’d been flirting with to start the year.

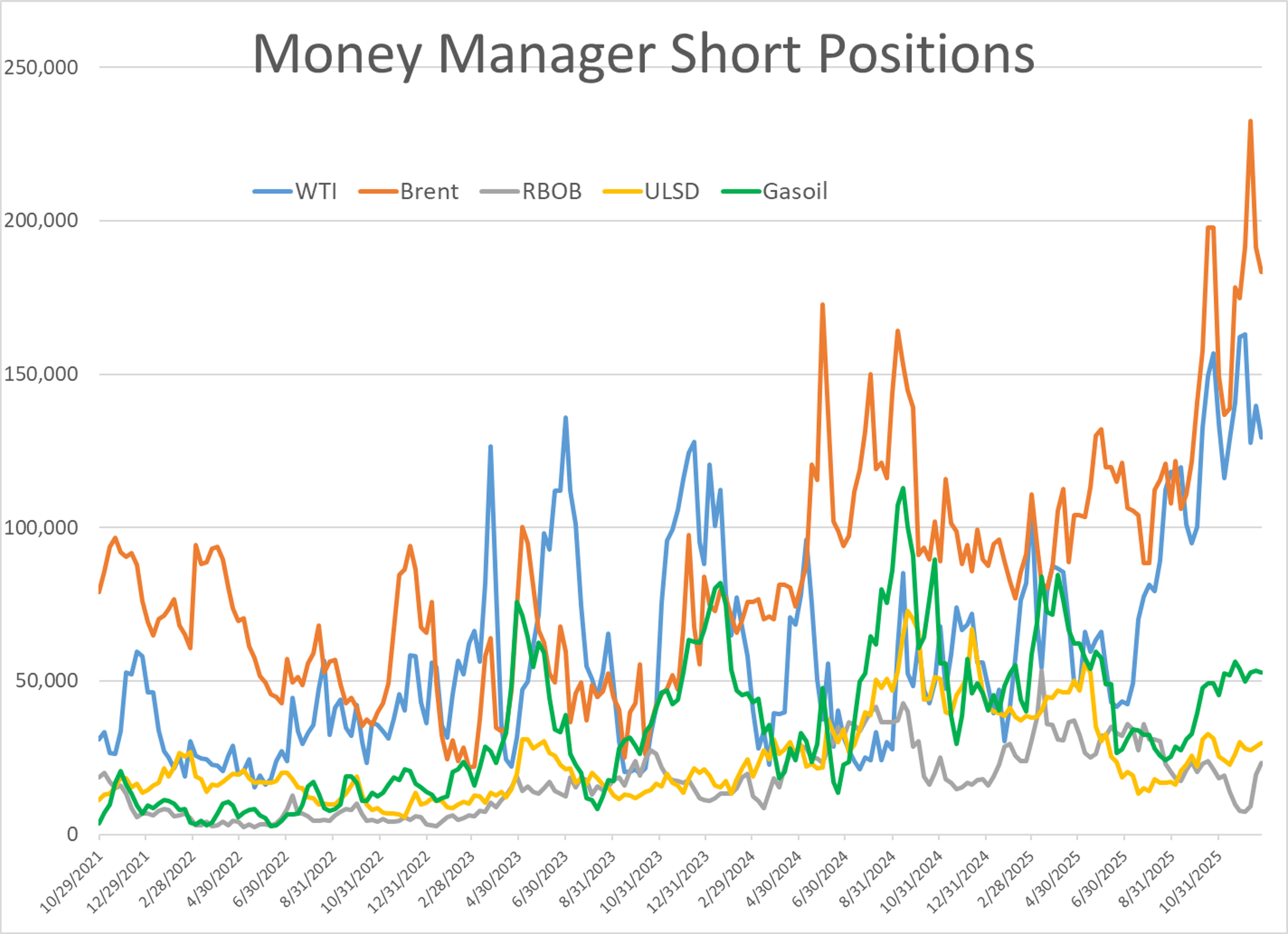

While the fast and furious geopolitical headlines have certainly captured the world’s attention this week, yesterday’s big price move was likely as much technical as it was fundamental. Chart support for crude and products held after prices tested levels we haven’t seen in almost 5 years, and Money Managers were exposed with short positions in WTI and Brent holding near record levels. The snowball effect we witnessed during Thursday’s session was undoubtedly partially caused by some of those speculative shorts being forced to buy to cover their (now losing) positions.

Here’s a list of the latest potential flash points for the fuel markets:

Russia: After U.S. and British forces cooperated to seize the long-pursued tanker that Russia tried to aid in escaping the U.S., there is speculation that two more sanctioned Russian tankers currently transiting the English Channel could be seized as well.

Ukraine’s attacks on Russian energy assets continue with a fuel depot and the 120mb/day Novoshakhtinsk refinery struck Thursday. In addition, a drone struck another Russian Shadow Fleet tanker in the Black Sea Thursday, near the Turkish coastline, proving again that Ukraine’s assets are capable of targeting ships far from the front lines.

Iran: So far, the growing protests in Iran don’t appear to have impacted the country’s oil output or exports. There is the potential for a short term disruption to those supplies should the violence escalate, and the targeting of sanctioned tankers may complicate shipments. Longer term, similar to Venezuela, if there is a regime change, Iran has capacity to increase output and exports as U.S. sanctions are the main limitation on their production.

Iraq: Iraq announced it would nationalize Lukoil’s ownership in the West Qurna 2 oilfield this week. That move was cited as a bullish factor by some during yesterday’s strong rally. In reality, the move should ensure more production after Lukoil had declared force majeure due to the sanctions it was hit with in November. Meanwhile, numerous oil companies and investment firms continue to try and buy Lukoil’s non-Russian assets, and that strong interest suggests its unlikely we see a major decline in either their oil or refining output this year.

Venezuela: U.S. energy executives are meeting at the White House this afternoon to discuss plans for oil production and distribution. A few U.S. Gulf Coast refiners who were originally configured to run Venezuela’s heavy oil grades stand to be the immediate beneficiaries if more shipments are diverted to the U.S. rather than to China, while any actual increase to production is likely to take years. Those executives will also be sure to point out that any new Venezuelan oil brought online (vs existing production that just finds a new home) will put pressure on U.S. domestic production. Meanwhile, the U.S. President is saying a 2nd wave of attacks on Venezuela have been canceled. That’s nice.

Canada: Canadian heavy oil producers were seen as a potential loser if Venezuelan oil starts heading to the U.S. instead of China. Near term, it looks like this may not be a major factor as the recently expanded Transmountain pipeline that can bring Canadian oil to Pacific ports still has available capacity suggesting Chinese heavy buyers can go to Vancouver to replace a large portion of anything they may lose from Caracas.

U.S.: The December payroll report estimated 50,000 jobs were added during the month, but those modest gains were wiped out by reductions to the October and November estimates of 76,000 jobs. If you add the current government estimates for October-December, the US lost 67,000 total jobs during the quarter. Despite the weakness in jobs added, both the headline and U6 unemployment rates ticked lower in December.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets