Quiet Start For Energy Markets Despite New Refinery Disruptions And Regional Tensions

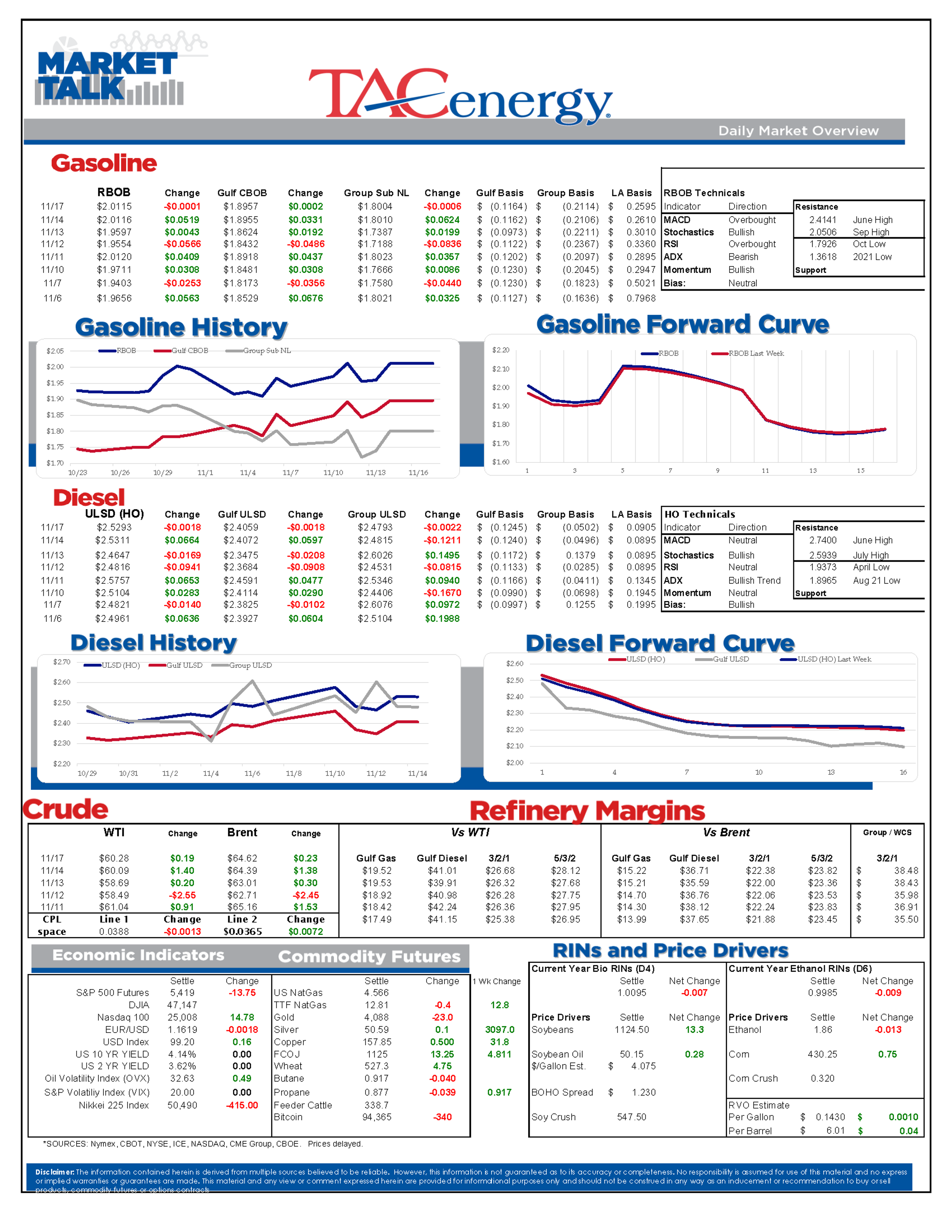

It’s a quiet start to the week for energy markets as refined products have erased a modest wave of selling overnight to trade near break-even as we approach the 8 o’clock mark.

Russia’s Novo export hub has returned to service after a 2 day shutdown caused by a Ukrainian attack last week, which is helping to calm fears of a supply squeeze that helped contribute to Friday’s big rally. Ukraine continues to pound away at Russian refineries with the 340mb/day Ryazan plant near Moscow and the 180mb/day Rosneft Novo refinery more than 600 miles from the border both hit over the weekend.

Iran confirmed over the weekend that it had seized an oil tanker as it transited the Strait of Hormuz Friday. While a tanker being seized in the world’s most important oil shipping chokepoint would historically be seen as a big deal, Iran has been playing this type of game for the past 6+ years with minimal impact on supplies. In addition, the country’s military was exposed during the 12 day war this summer, and its capital may have to be evacuated due to a water shortage crisis, so the market seems to be shrugging off any concern that this could lead to a more serious threat to oil shipments for now.

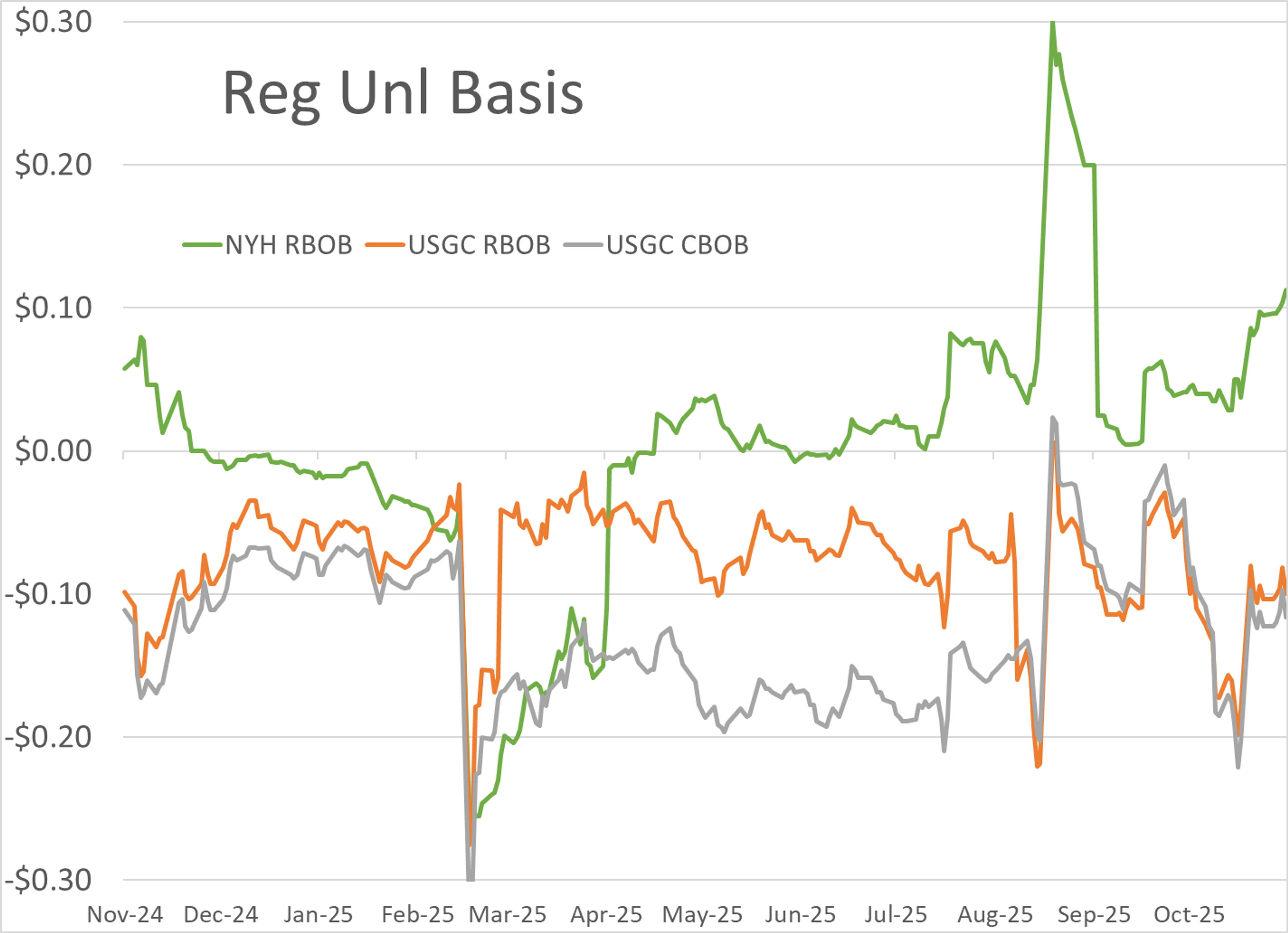

Valero’s 430mb/day Port Arthur refinery reported an upset in a delayed coking unit over the weekend. The flaring reported from that “temporary process unit upset” lasted just 18 minutes suggesting that output should not be materially affected.

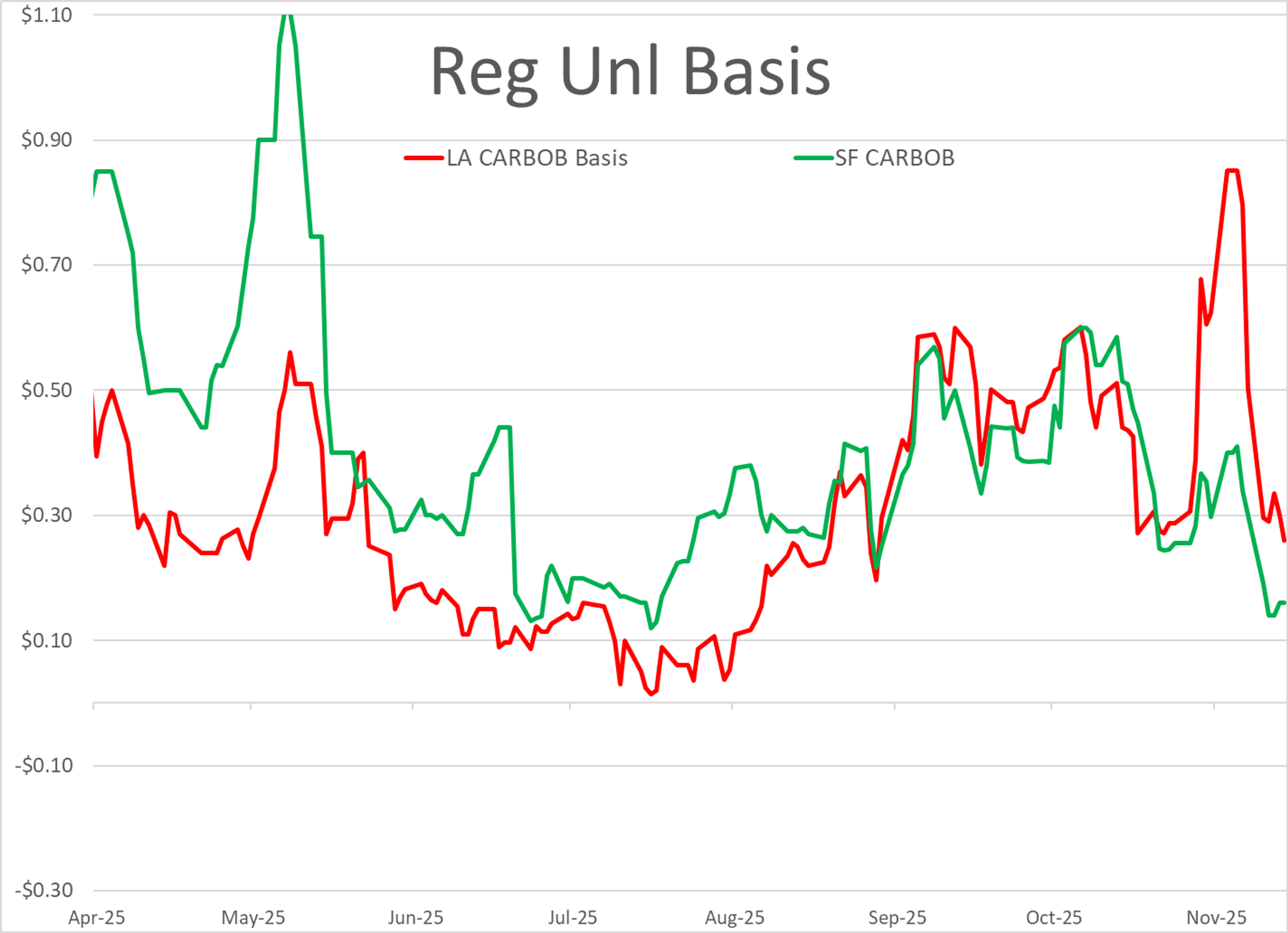

Marathon reported an unplanned upset at the Carson section of its 365mb/day Los Angeles area refining complex. That facility was undergoing 9 days of planned maintenance according to filings with the AQMD, and it’s not yet clear if the unplanned flaring was related to that maintenance or if it impacted other units. Gasoline basis values in the area have dropped nearly 60 cents/gallon in the past two weeks as winter gasoline supplies flood the market and heavy rains are certainly not going to be helping demand, so this latest hiccup may not have the impact it would have earlier in the fall.

Meanwhile, the fallout from the October fire in a Jet Fuel production unit at Chevron’s El Segundo refinery is becoming more evident as India’s first ever Jet fuel cargo is in transit to the U.S. West Coast according to a Reuters report.

Although the government restarted last week, the CFTC hasn’t yet started publishing its Commitments of Traders data, and no announcement has yet been made on how soon that data will be made available. The ICE data shows that money managers were making small increases to their net length in Brent and Gasoil contracts albeit in different ways. The increase in Brent was almost exclusively tied to short covering, with more than 12,000 short contracts liquidated during the week as speculators continue to unwind what proved to be losing bets when a record amount of money bet on even lower prices after values flirted with a 4 year low in October. The perceived diesel shortages that’s driving big increases in time and crack spreads is visible in speculative positioning in Gasoil which had nearly 19,000 new long positions added for the week, offsetting 7,000 new short contracts by those who literally aren’t buying the hype.

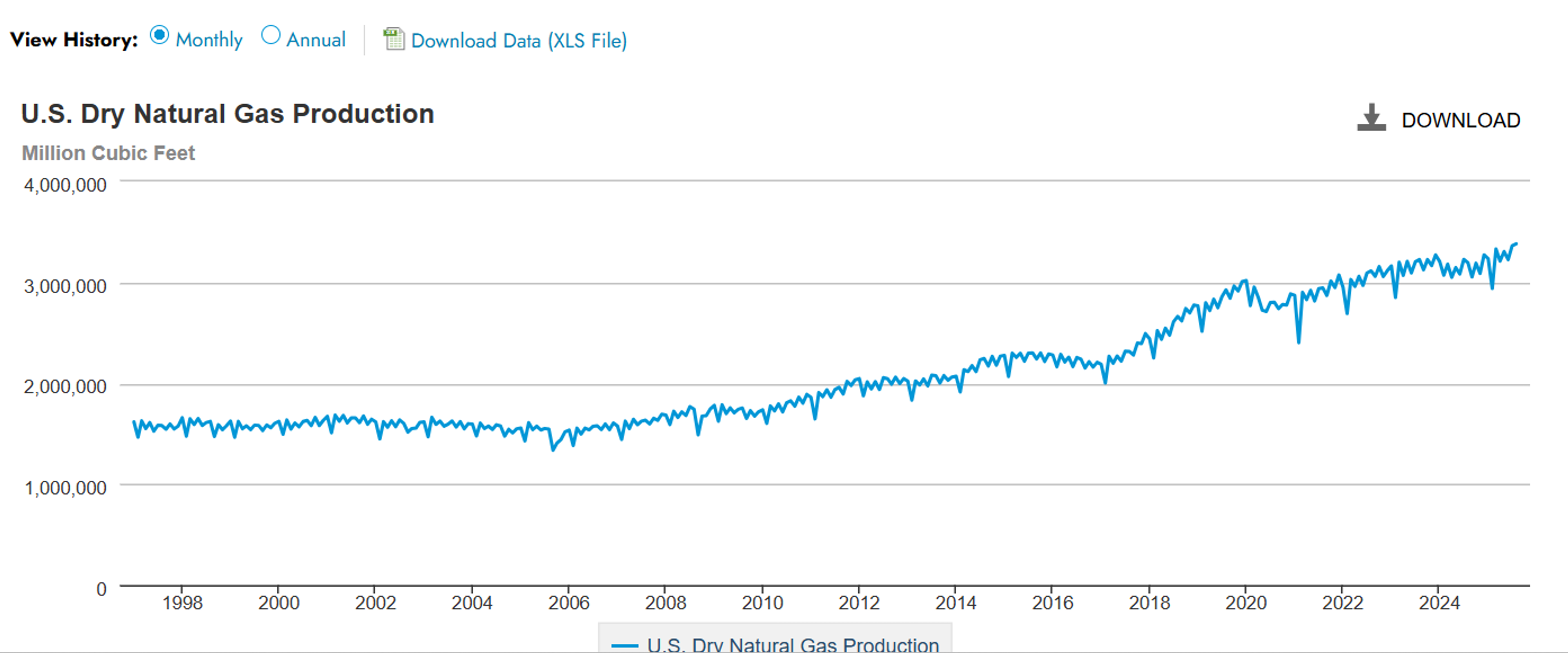

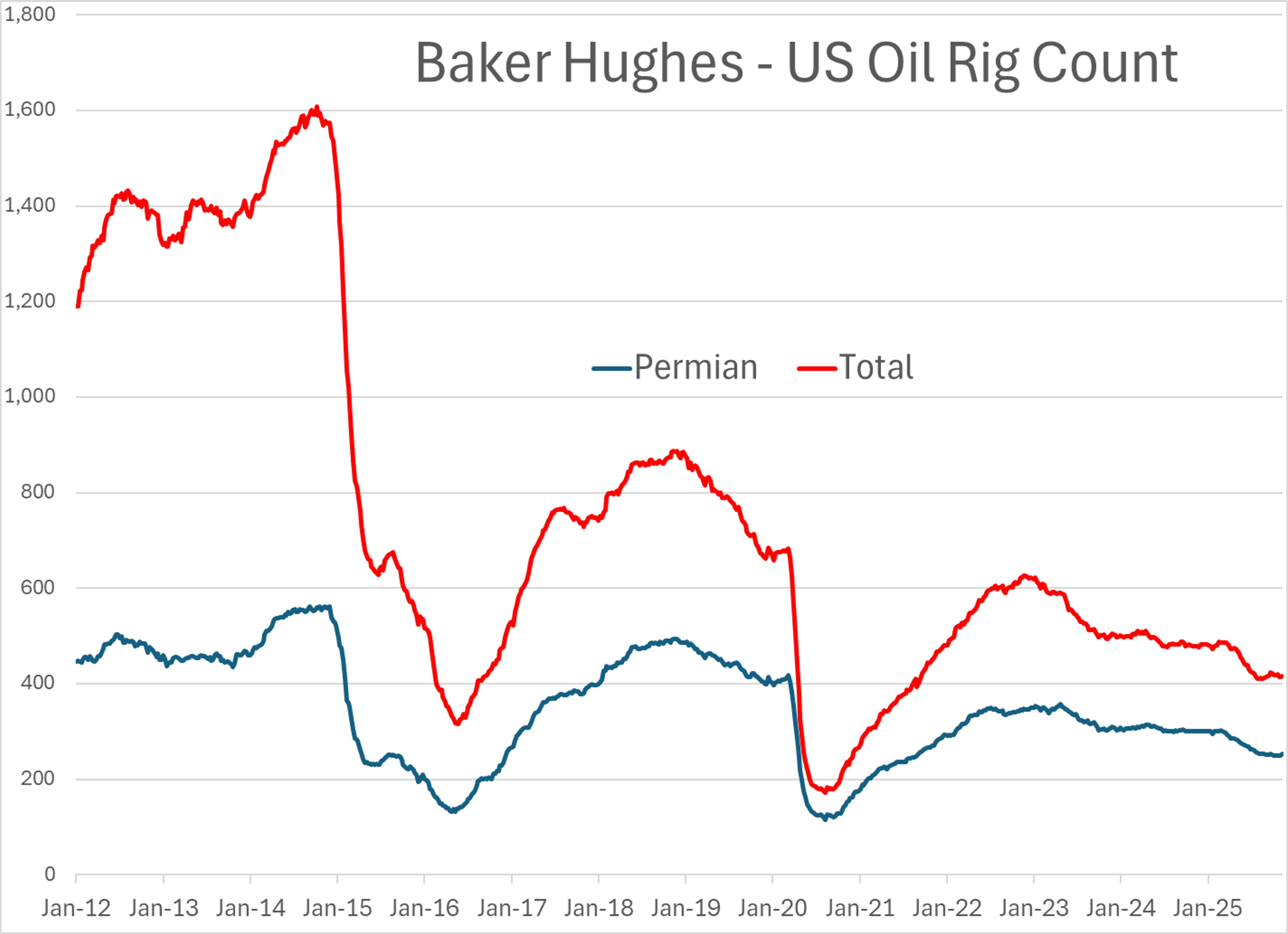

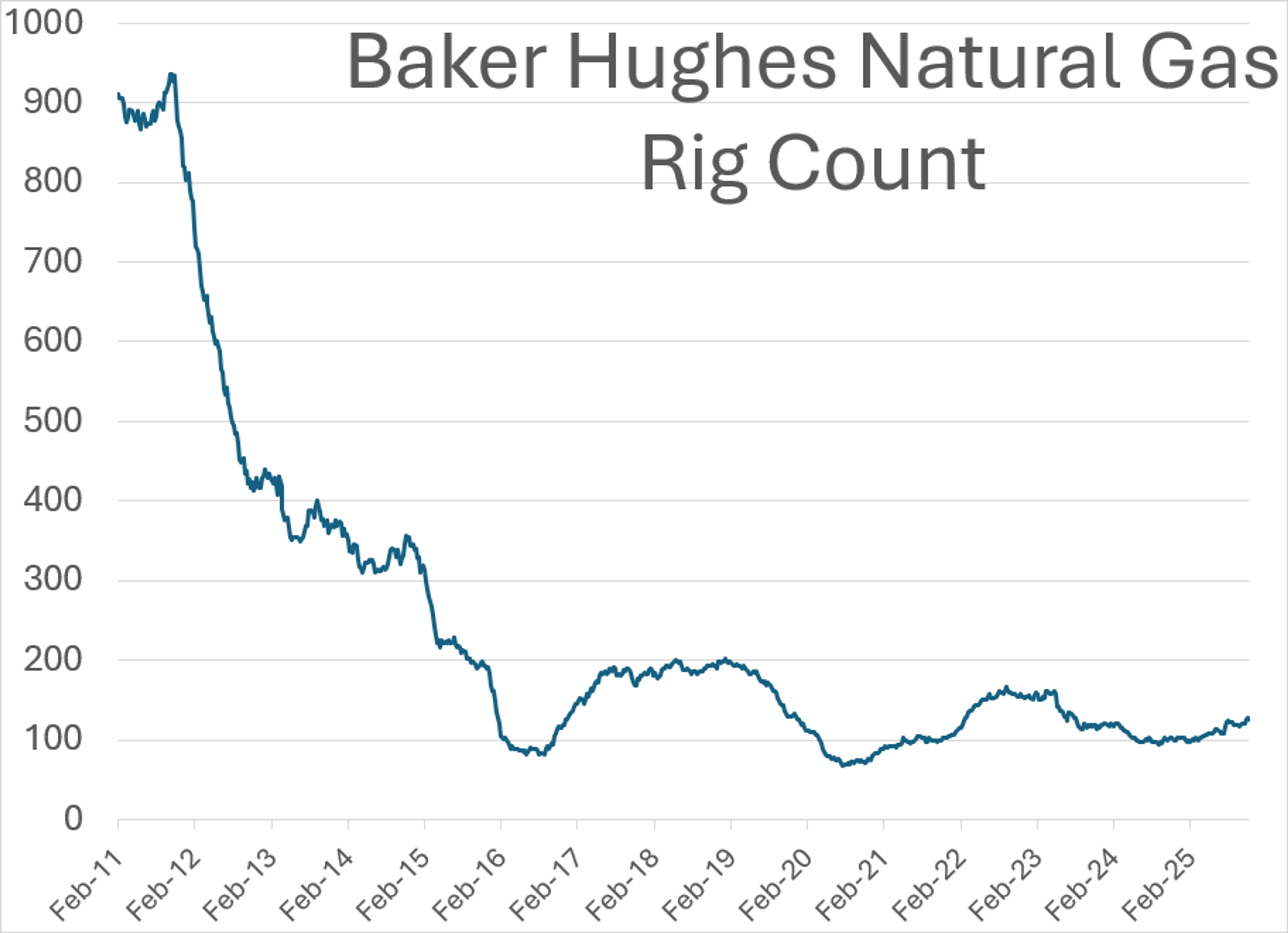

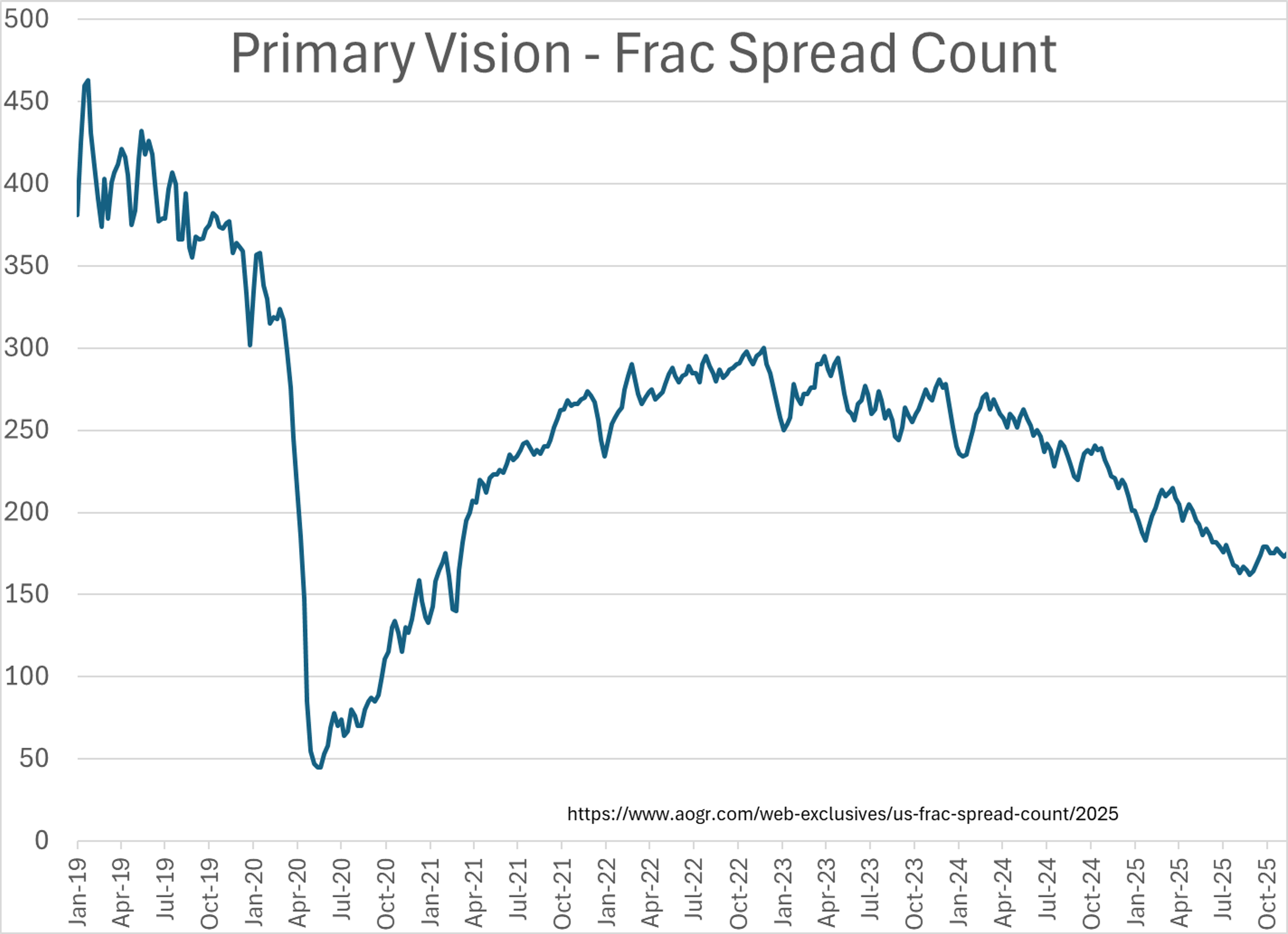

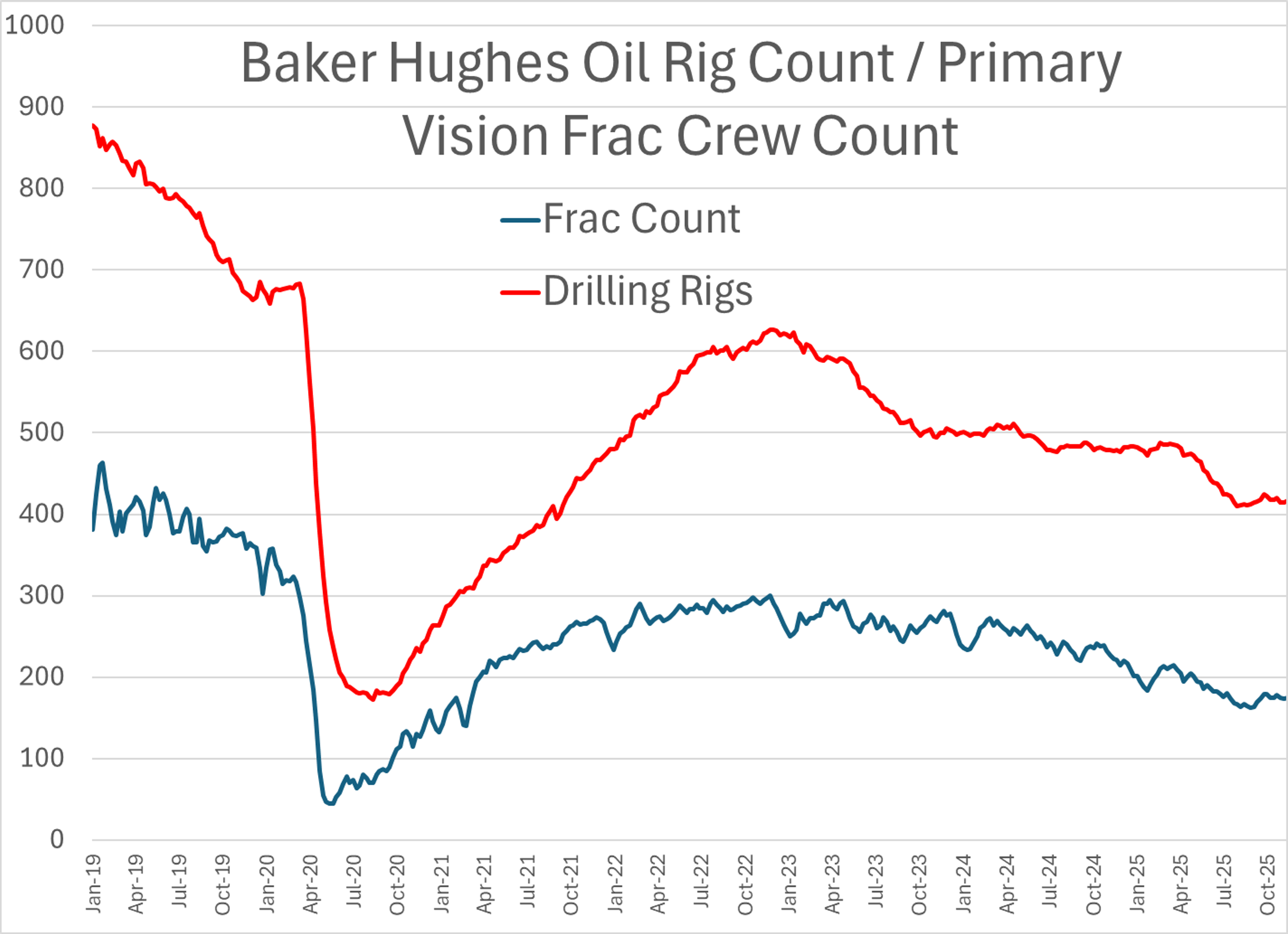

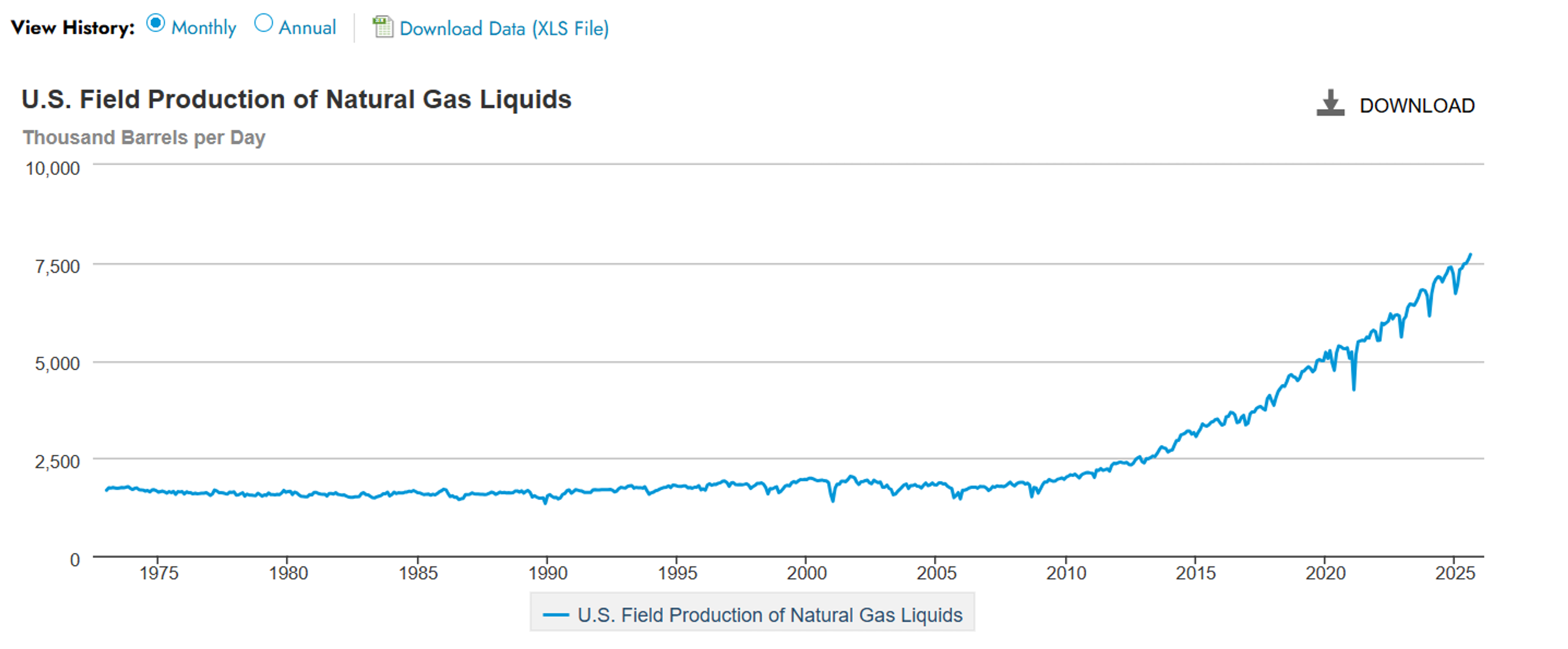

Baker Hughes reported an increase of 3 oil rigs drilling in the U.S. last week, while the natural gas rig count declined by 3. The Primary Vision count of fracking crews active in the U.S. ticked up by 2 to 175 last week, erasing the drop from the previous week. U.S. Oil production smashed the all-time record (for any country, ever) last week with output approaching 13.9 million barrels/day of oil, while natural gas liquid output continues at record levels north of 7.7 million barrels/day, despite the modest rig and fracking crew counts as producers flex their ability to drill multiple wells from the same site. In addition to total liquid output greater than Saudi Arabia and Russia combined, U.S. producers are also churning out a record amount of dry natural gas despite a rig count that’s less than half of what it was a decade ago.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets