Energy Markets Rally As Global Flashpoints Multiply

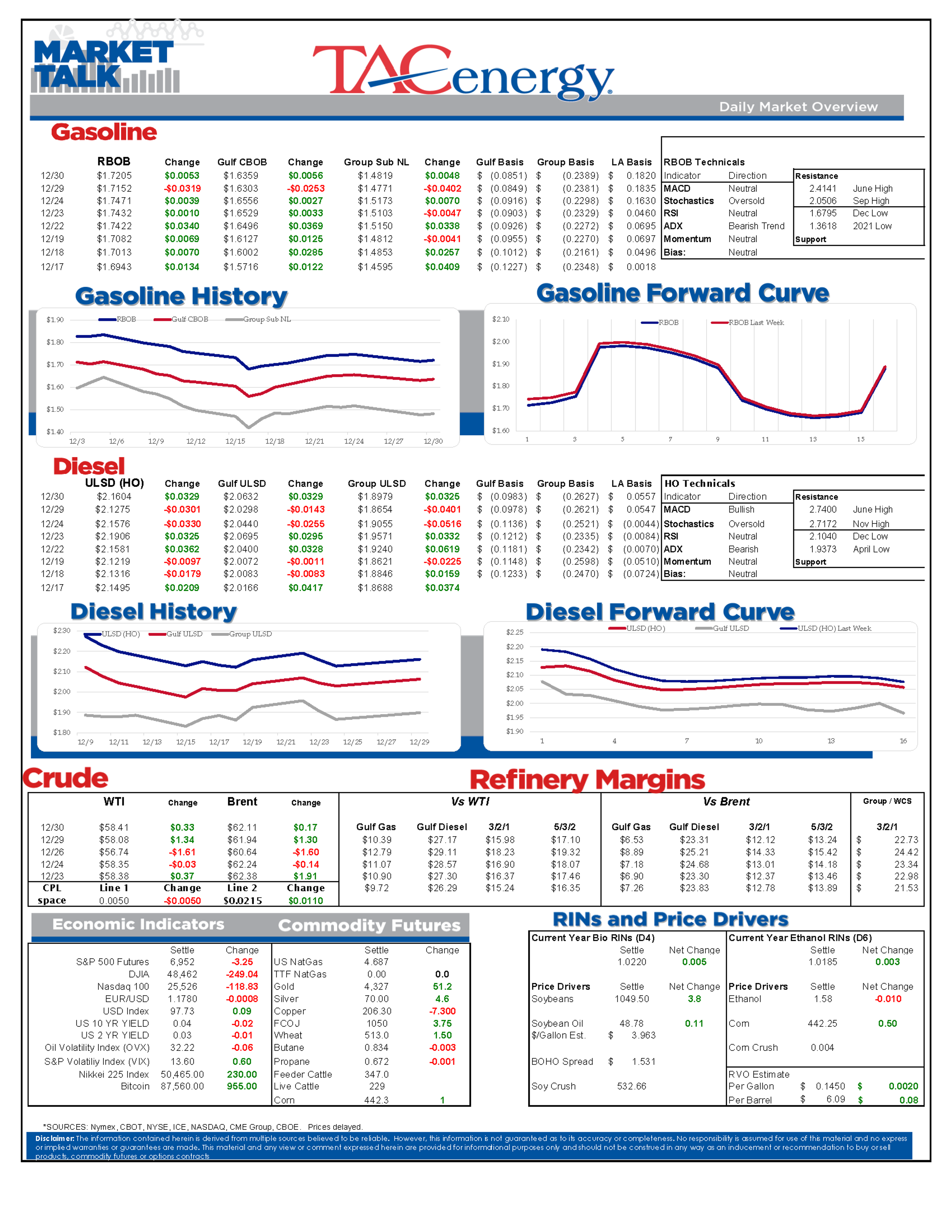

Energy markets are trying to stage a modest rally on the penultimate trading day for 2025, with ULSD futures once again leading the pull higher, as geopolitical concerns keep traders on edge while the great oil supply overhang seems to be keeping them from getting too worked up.

The number of almost-war events is stacking up around the world this week to the point that they need to be listed out to keep track. While each situation needs to be watched, so far none of them seems to be causing major upsets to the supply network beyond the fallout from the Russia/Ukraine war.

Venezuela: The CIA reportedly attacked a port facility, which marks the first strike on land in the growing conflict. Separately, oil production in the Orinoco belt is being cut by 50% as U.S. restrictions on exports via sanctioned vessels is causing inventories to swell.

Taiwan: A Reuters report suggests that China has been doing dry runs of an invasion long before this week’s naval exercises that are encircling the island. Meanwhile, Taiwan is under pressure to cut its exports of Russian Naphtha, which is a critical building block for its chip industry. Taiwan’s dependence on fuel imports is seen as a weak link in a potential conflict with China, while China has been stockpiling oil in its expanding strategic reserve network all year which would allow it to hold out for weeks if the US or others attempted to block their supply routes.

Yemen: Saudi Arabia attacked a port facility, apparently targeting an arms shipment from UAE to forces who are fighting against the Houthi rebels, which potentially opens up a 3-way battle for control in the decades-long conflict and increases the tensions between the Gulf neighbors, who are largely believed to be the key swing producers for OPEC as they’re the only 2 nations with spare capacity that can be quickly brought to market.

Ukraine: While Ukraine’s drone attacks on Russia’s infrastructure have been a major story this year, yesterday Russian drones destroyed a small refinery near Kharkiv. The Caspian Pipeline Consortium was forced to suspend oil shipments due to weather delays as they attempt to repair damage done by Ukraine’s attacks in November. Kazakhstan’s oil output was already said to have dropped 6% due to those strikes and this shutdown is likely to push that supply even lower.

Iran: The U.S. and Israel threatened another round of war with Iran Monday, as the 12 day war this summer apparently didn’t do enough to prevent the country’s nuclear capabilities. The Iranian President meanwhile is suggesting that they’re already in an all-out war with the U.S., Israel and Europe.

Marathon reported brief flaring at its 133mb/day El Paso TX refinery Monday, but that event does not appear to have taken any units offline.

Delek is beginning maintenance on an FCC unit at its 73mb/day Big Spring TX refinery today that is expected to last until early February.

The DOE’s weekly status report was unexpectedly delayed until 5pm eastern time Monday, after being expectedly delayed by several days due to last week’s unexpected federal holidays. The agency also changed its data transmission format which is creating challenges with downloads. The builds in refined products continued last week, even though refinery runs dipped slightly. Gasoline and Diesel inventories remain tight along the East Coast but are in good shape across PADDs 2 and 3 which continues to encourage wide spreads between certain markets.

U.S. crude production dipped on the week but is holding above 13.8 million barrels/day, which is a level never seen before a couple months ago. U.S. ethanol exports reached a record high last week as the corn lobby appears to have become a winner in the U.S. trade wars as several nations have given in to buying more U.S. alcohol for transportation fuel, even as U.S. exports of alcohol for other purposes has plummeted.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets