A Volatile Year Wraps: Weak Oil Prices, Rising Stocks, and Policy Uncertainty

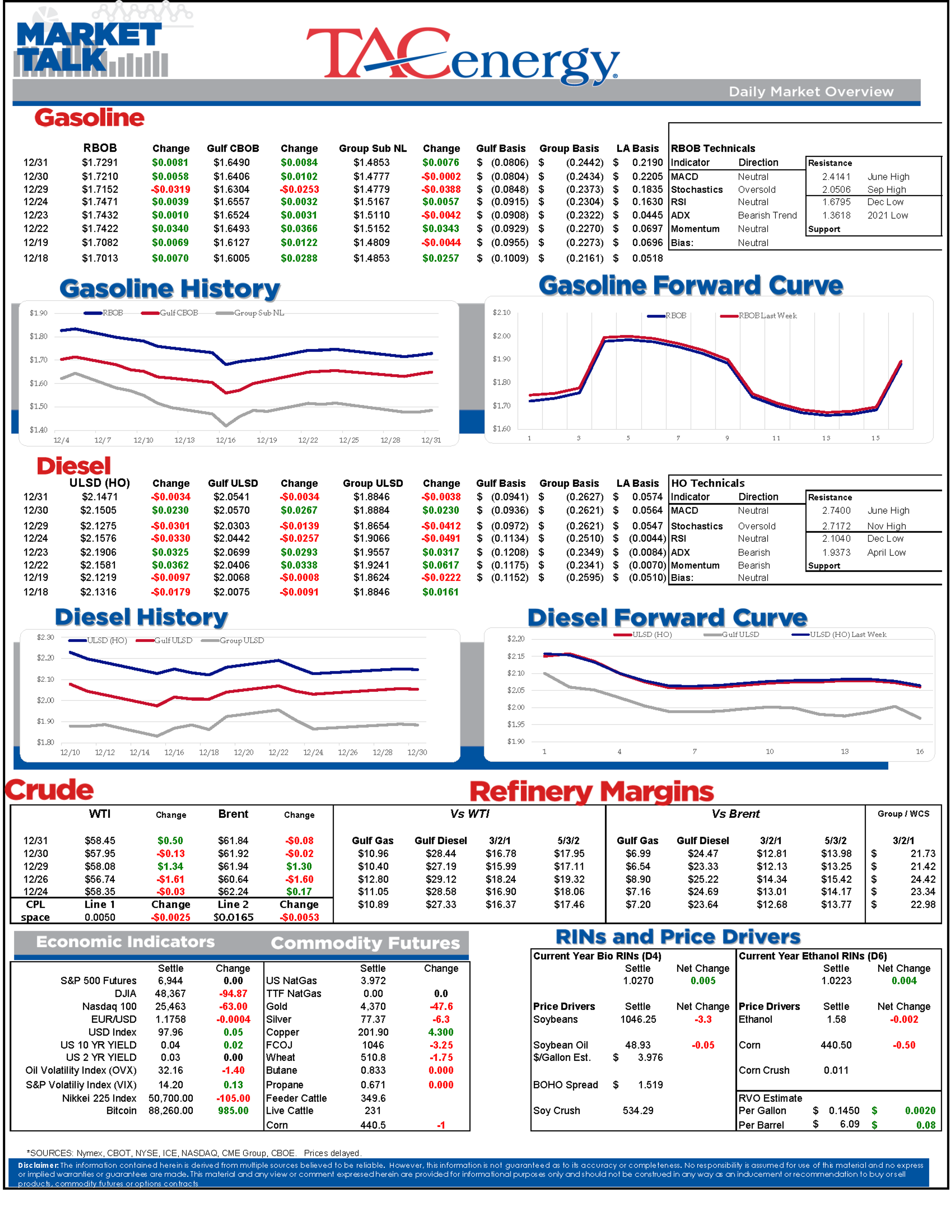

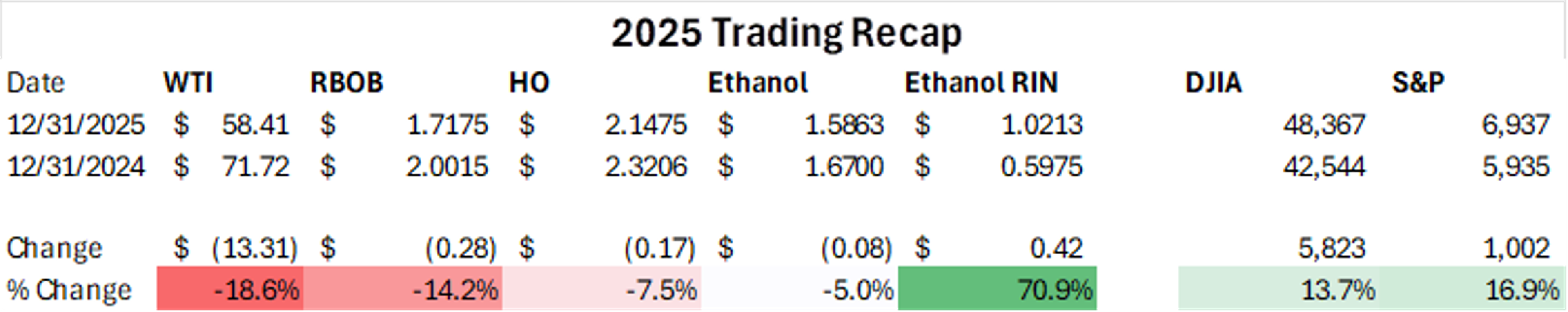

Energy futures are moving modestly higher as trading winds down for the year, wiping out some small overnight losses but doing little to erase what’s been the weakest year for oil prices since the COVID lockdowns of 2020.

Today is expiration day for the January RBOB and ULSD (HO) contracts, so be sure to watch the February contracts (RBG, HOG) for price direction today if your spot market hasn’t already rolled.

New Years trading schedule: The NYMEX will trade in a normal session today before the holiday tomorrow. Friday will be a normal trading session for futures, and spot markets will be assessed unlike last Friday, so prices posted tonight will not carry through the weekend.

New Year, new taxes: The Federal Oil Spill liability tax expires today, so that 9 cent/barrel charge should be removed from fuel invoices starting tomorrow. The Federal Hazardous Substance Superfund rate is increasing from $.17 to $.18 per barrel. The IRS guidance on both items can be found here.

While the IRS is being surprisingly clear on how to handle those two taxes, the industry is still in limbo on how to calculate their obligations for the renewable fuel standard this coming year. The EPA is not expected to release its final ruling until later in Q1, with a 50% RIN haircut for imported fuel and feedstocks and small refinery waiver reallocations two hotly contested topics.

The API estimates showed more inventory builds across the board last week with gasoline stocks swelling by 6.2 million barrels, while diesel stocks increased by 1 million barrels and crude stocks built by 1.7 million barrels. The DOE’s weekly status report is due out at its normal time this morning, and if they actually publish it on schedule, that will make 2 reports in less than 48 hours, which I don’t believe has ever happened before.

Ukraine’s drones hit the 240mb/day Rosneft refinery and a nearby port in Tuapse Russia overnight. That’s the 9th time that facility has been hit by drones in the past 2 years.

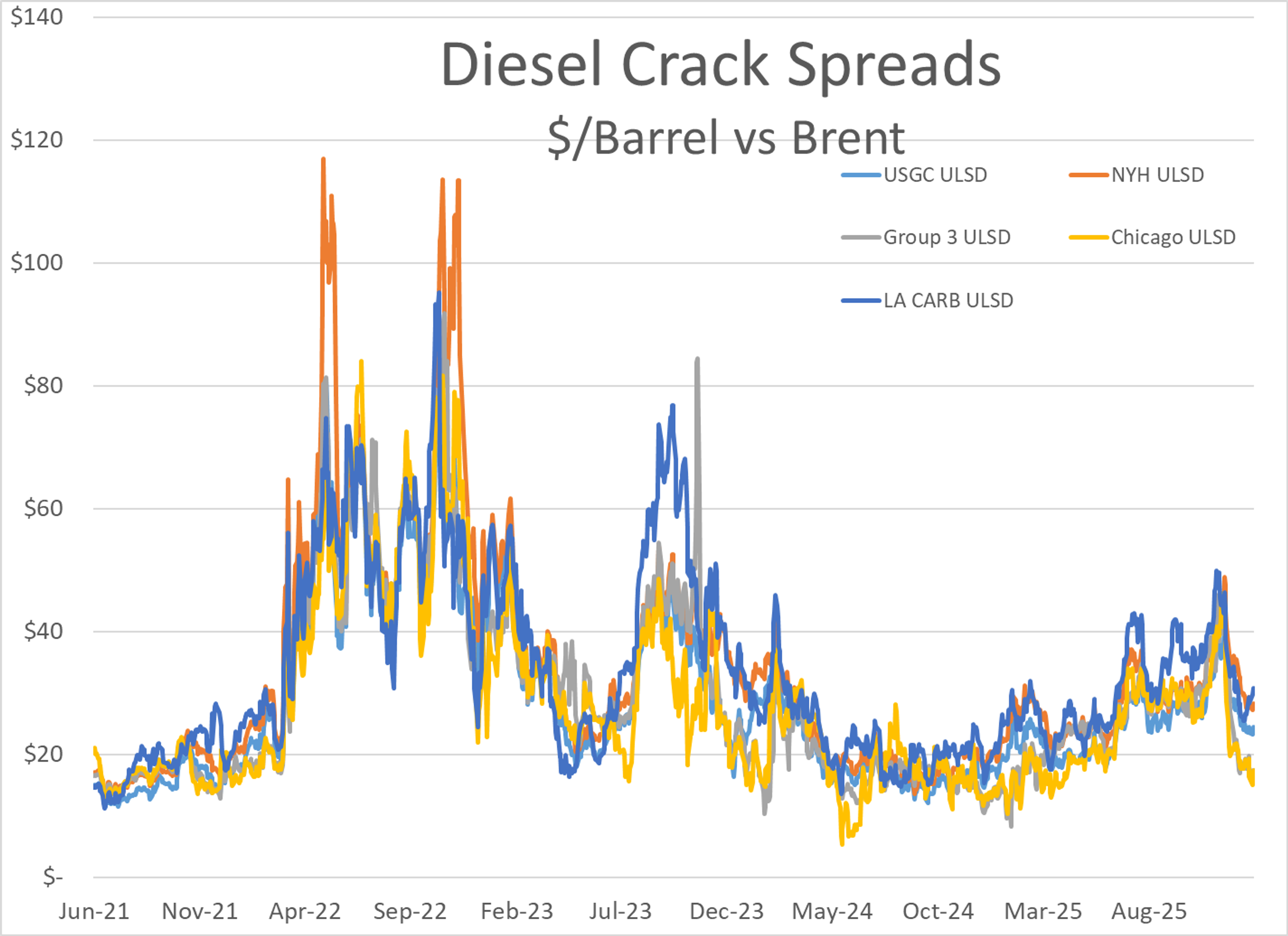

Sanctions on Russian related refiners in Europe, and Ukraine’s airmailed sanctions are a major reason that diesel prices fell by less than half of what WTI dropped over the past year as U.S. distillate exports were once again leaned on heavily to supplement supplies overseas. That has given a huge boost to refiners who continue to operate with Q4 earnings likely to be very strong even though prices have come back to more normal levels in the past few weeks.

Exxon reported flaring at its Baytown TX chemical plant Tuesday, but it appears that upset did not impact operations at the adjacent refinery.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets