Oil Starts 2026 in the Red Amid Weak Demand And Heavy Refining Output

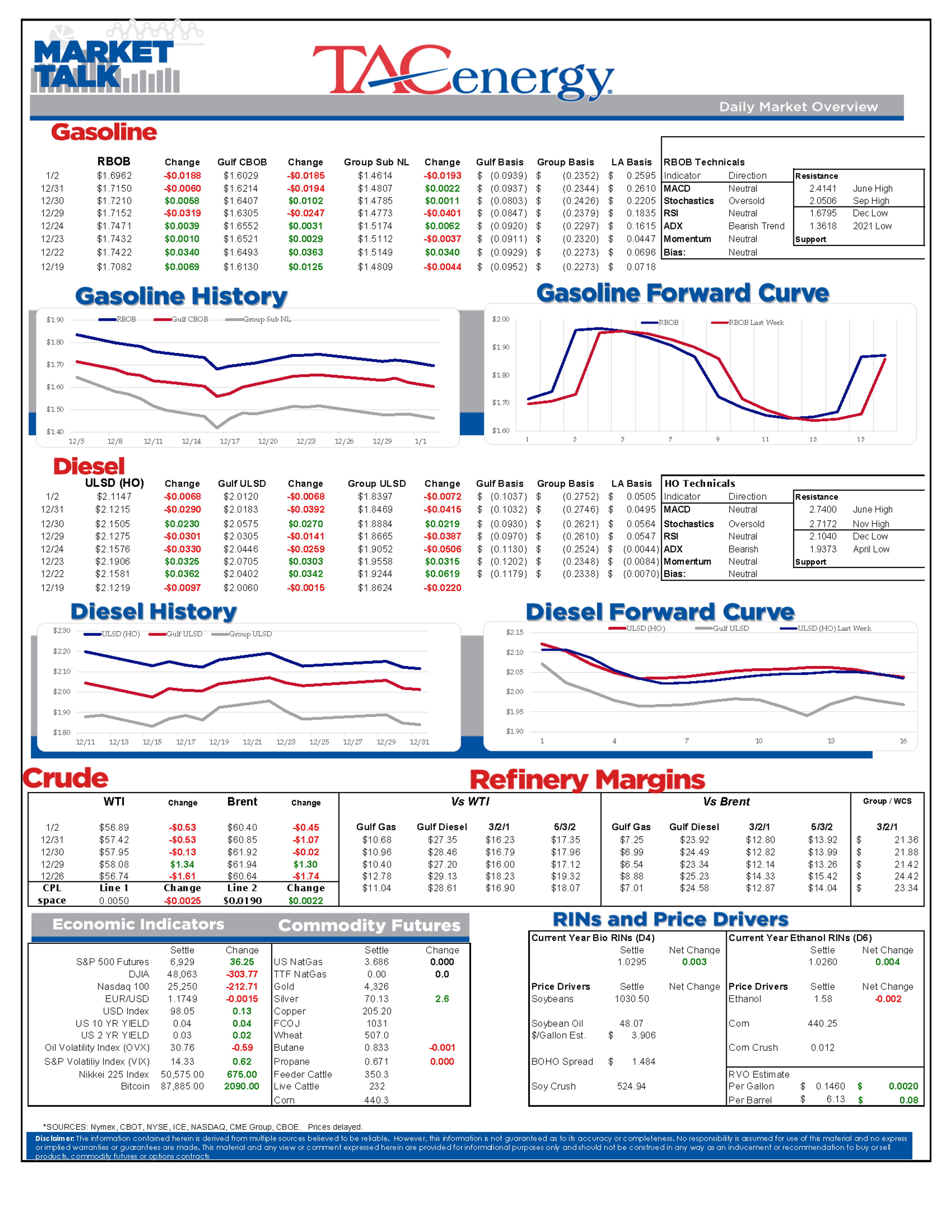

2026 is off to a soft start for petroleum prices with oil and product futures all slipping into the red this morning.

RBOB gasoline futures are starting out as the weak link, down by almost 2 cents in early trading as Wednesday’s DOE report reminded everyone that we’re in the weakest time of the year for fuel demand, and U.S. refiners continue to run at their highest levels of the past 5 years, cranking out much more gasoline than is needed this time of year.

OPEC & Friends have a meeting scheduled for Sunday, which will be particularly interesting since Saudi Arabia and the UAE are currently in a bit of a proxy war in Yemen. Expectations are low for any change in the cartel’s production plans, although considering the Saudis have had to lower their official prices for 3 straight months and futures are holding near 5 year lows, it wouldn’t be a shock if they signaled they may reduce production later in the year to try and prevent further selling. Meanwhile, OPEC’s Secretary General would really appreciate it if you stopped referring to oil as a “Fossil Fuel”.

Ukraine continued its refinery strikes over the holiday with the 130mb/day Ilsky refinery and a fuel depot north of Moscow both hit yesterday and the 170mb/day Novokuibyshevsk (try saying that one out loud) refinery hit this morning. A new article suggests the CIA has been assisting Ukraine in its targeting of the facilities, specifically a certain coupler that’s not available due to sanctions and would create extra complications for repairs. Hopefully the CIA is also sharing that intel with U.S. refiners so they can protect themselves.

India is reportedly asking its refiners to disclose how much Russian oil they’re buying as they try to hammer out a trade deal with the U.S.. Other reports suggest that India’s largest refiners may be trying to quickly buy up as much Russian oil as they can before new restrictions are put in place.

Notes from the DOE’s weekly status report. See charts attached.

Crude drew with imports slipping to a 2025 low as TX refiners held barrels offshore. Crude stocks finished out around 7 million barrels over last year but 2024 made up the bottom end of the range, so levels are still about 13 million barrels below the 5-year average. Overall refinery runs increased slightly to end the year in line with last at the high end of the chart.

Refinery utilization and run rates are well above average across the country, except for PADD 5 where another drop caused utilization to dip below 80% (although knowing that P66 Wilmington is permanently offline it’s really more like 86%) and leaves throughput 134 thousand barrels per day below average, which is almost exactly the size of that shuttered facility. Note the increase in PADD 5 gasoline imports in the past 2 months to see the numbers behind how the industry is adjusting.

Diesel stocks added about 5 million barrels to storage with the demand nosedive. All PADDs are below average except 3, which set 2025 highs across Q4 to finish out at a seasonal 5-year high. In total, diesel inventories landed about 4 million barrels below average but just ahead of year ago levels.

Year-end demand also dipped for gasoline where inventories built almost 6 million barrels despite declines to imports and production. Inventories by PADD are somewhat mixed with PADD 3 far exceeding typical year end levels. Gulf Coast storage increased by about 14 million barrels since the seasonal low set at the beginning of November to finish around 3 million barrels above the previous seasonal 5 year high, which suggests some Gulf Coast producers may struggle to find a home for their excess this winter. The total U.S. chart looks very similar; levels were at a 2025 low early November but increased substantially to finish the year with about 3 million barrels above average.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets