Oil and Gas Futures Hold Firm Amid Venezuela Turmoil and Global Supply Shifts

Energy futures are ticking modestly higher Monday as markets around the world digest the news of the U.S. capture of Venezuela’s president over the weekend. So far, the reaction to the Venezuela news has been minimal with prices starting overnight trade with small losses before ticking back slightly into the green during the morning hours. The short story is that there are many potential impacts long term, but its unlikely we’ll see anything material change in the short term.

While there is plenty of talk about the potential for more oil output in Venezuela which has the world’s largest proven reserves and 20 years ago pumped 3% of the world’s total, the reality is any new output will likely take years not months to come online, and there won’t be substantial new investment until there’s more certainty on who’s in charge long term. Meanwhile, Exxon – who left Venezuela 18 years ago after the previous regime’s nationalization of assets – continues to bring more supply online next door in Guyana, with output there set to surpass Venezuela’s total in the next few years. That reality suggests that the Presidents assertions that U.S. companies will jump right back into Venezuela will not be as simple as some might hope.

So far, Citgo hasn’t come up much in the headlines, but it could become a bargaining chip as the U.S. tries to influence regime change. The U.S. Treasury has been preventing the sale of Citgo’s assets through a series of license extensions over the past 7.5 years, with the most recent restriction good through 2026. At this point, U.S. courts have proposed a sale of the Citgo assets to activist investor Elliott Management’s subsidiary known as Amber Energy, but that transaction is on hold pending the outcome of several legal challenges and now the potential for a new deal with the Treasury.

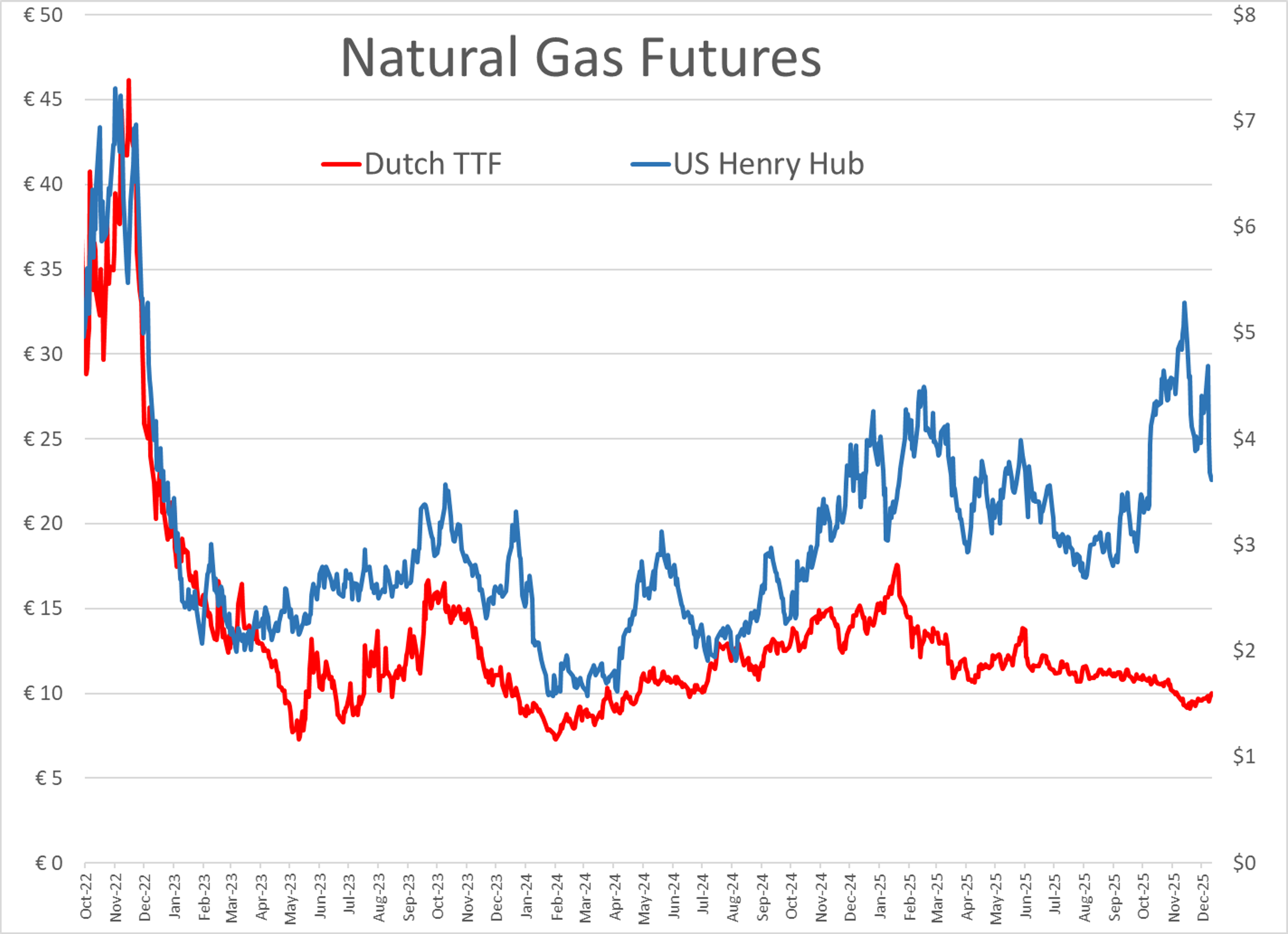

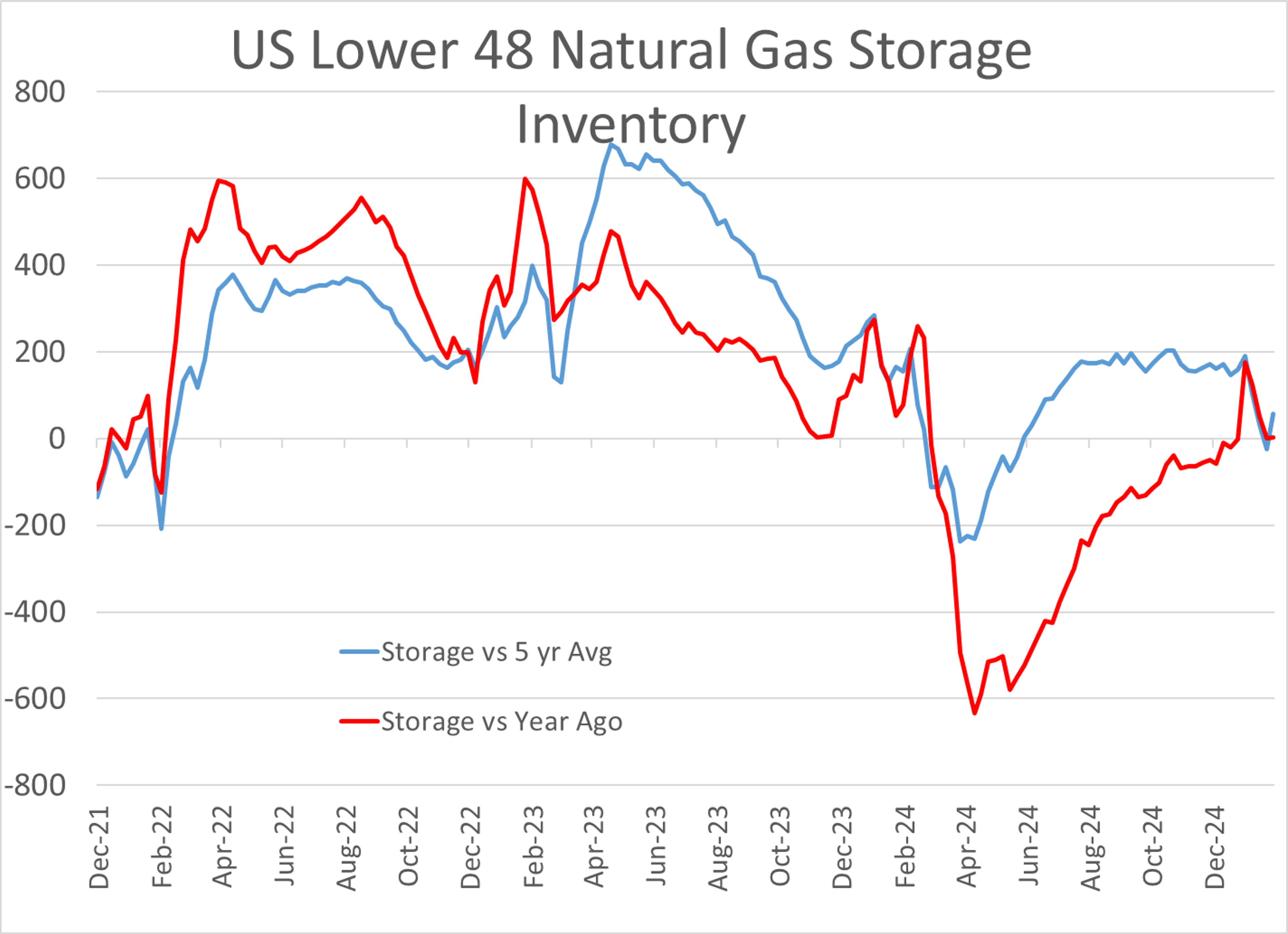

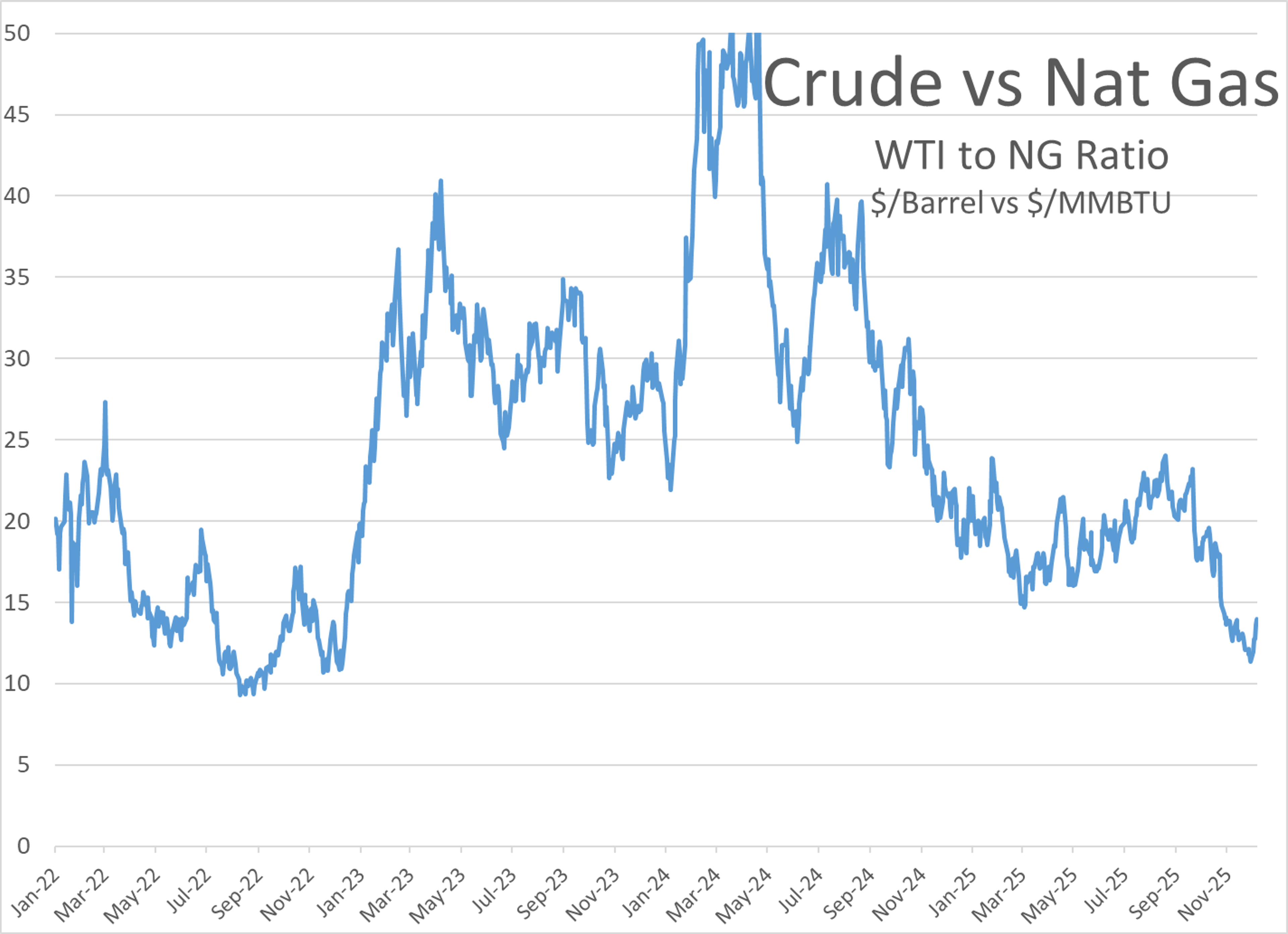

U.S. Natural gas futures are trading down more than 4% this morning, and have dropped 12% in the past week as warming January forecasts in the U.S. and record on-shore production both weigh on prices. European natural gas prices have held relatively steady despite winter storms sweeping the continent, suggesting comfortable supplies. As the charts below show, European natural gas futures have decoupled from U.S. values recently as the global market has found new options to replace Russian supplies to Europe.

PBF is delaying the restart of its Martinez CA refinery by 3 months, after missing its target to have the facility fully up and running in December. That plant has been partially offline since a fire on February 1, 2025. What will really make things interesting is if PBF isn’t able to get the facility fully back online before Valero shutters its Benecia plant nearby, which is scheduled for April.

P66 has agreed to take over the recently-shuttered 113mb/day Lindsey refinery in the UK, which was shuttered last year as the company’s finances collapsed. The Lindsey facility is nearby to P66’s existing 225mb/day Humber refinery, which is one of the most complex refineries in Europe. Early reports suggest P66 will integrate operations at the two plants but will not immediately restart the Lindsey facility on its own as it’s not “Viable in current form.”

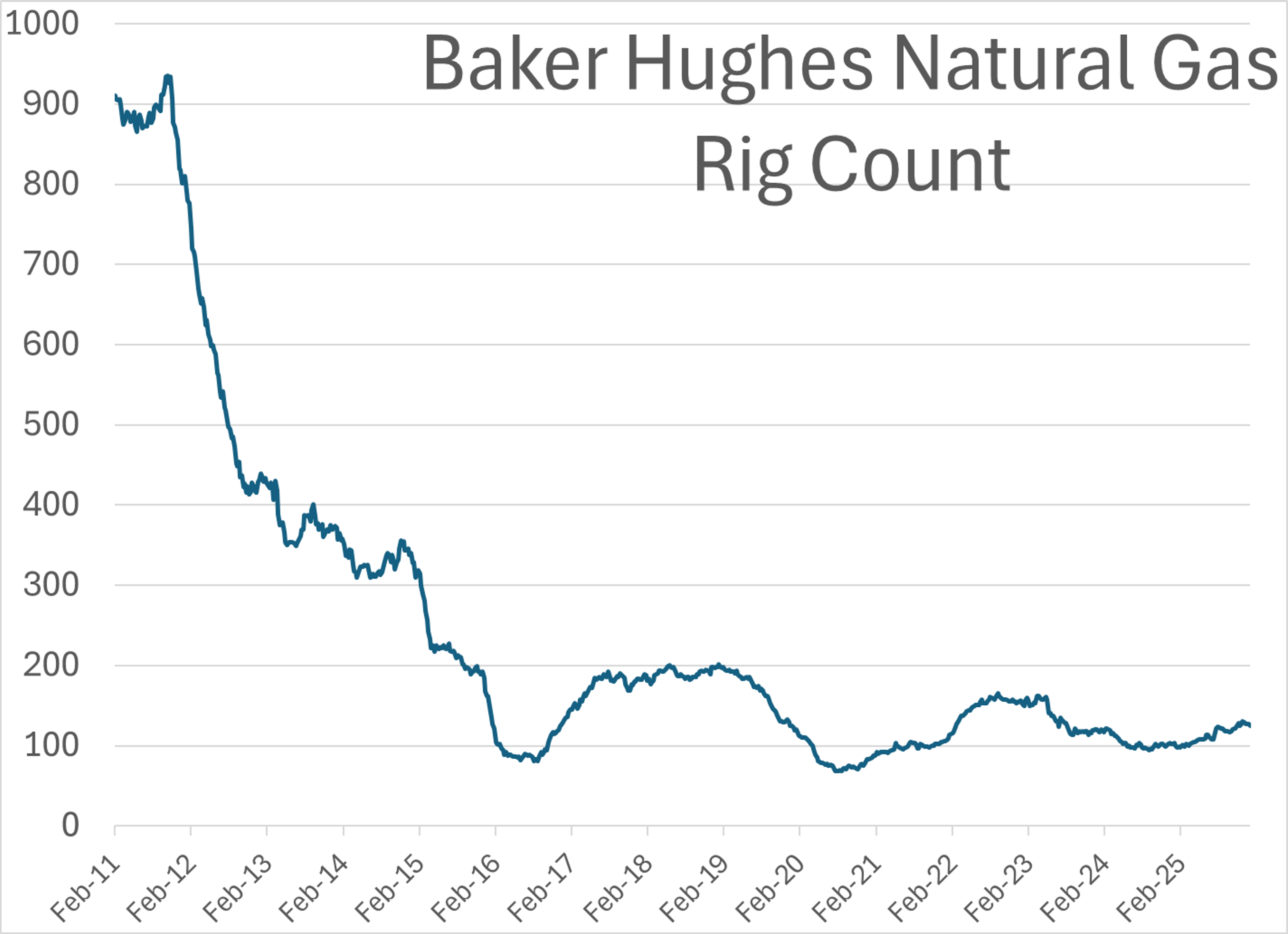

Baker Hughes reported an increase of 3 oil rigs drilling in the U.S. last week, while the natural gas rig count dropped by 2. The Primary Vision count of fracking crews active in the U.S. dropped by 1 on the week to 153.

Efficiency through technology: Take a look at the Natural Gas Rig Count chart below and keep in mind that the U.S. just hit record output onshore, despite only having around 125 active drilling rigs, compared to more than 900 in 2011.

The CFTC’s weekly Commitments of Traders report was delayed by the New Year holiday last week and is set to be released later today. The report data should now be all caught up after the government shutdown.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets