Diesel Prices Continue To Rise With Trading On ULSD At A 5-Month High

The runaway diesel train continues this morning with December ULSD futures trading at a 5-month high, up around 7 cents (3%) on the day, chasing a 4% rally in European gasoil prices. The last time ULSD futures were trading north of $2.60/gallon came during the 12-day war in June, just before prices crashed by 50 cents in 2 days.

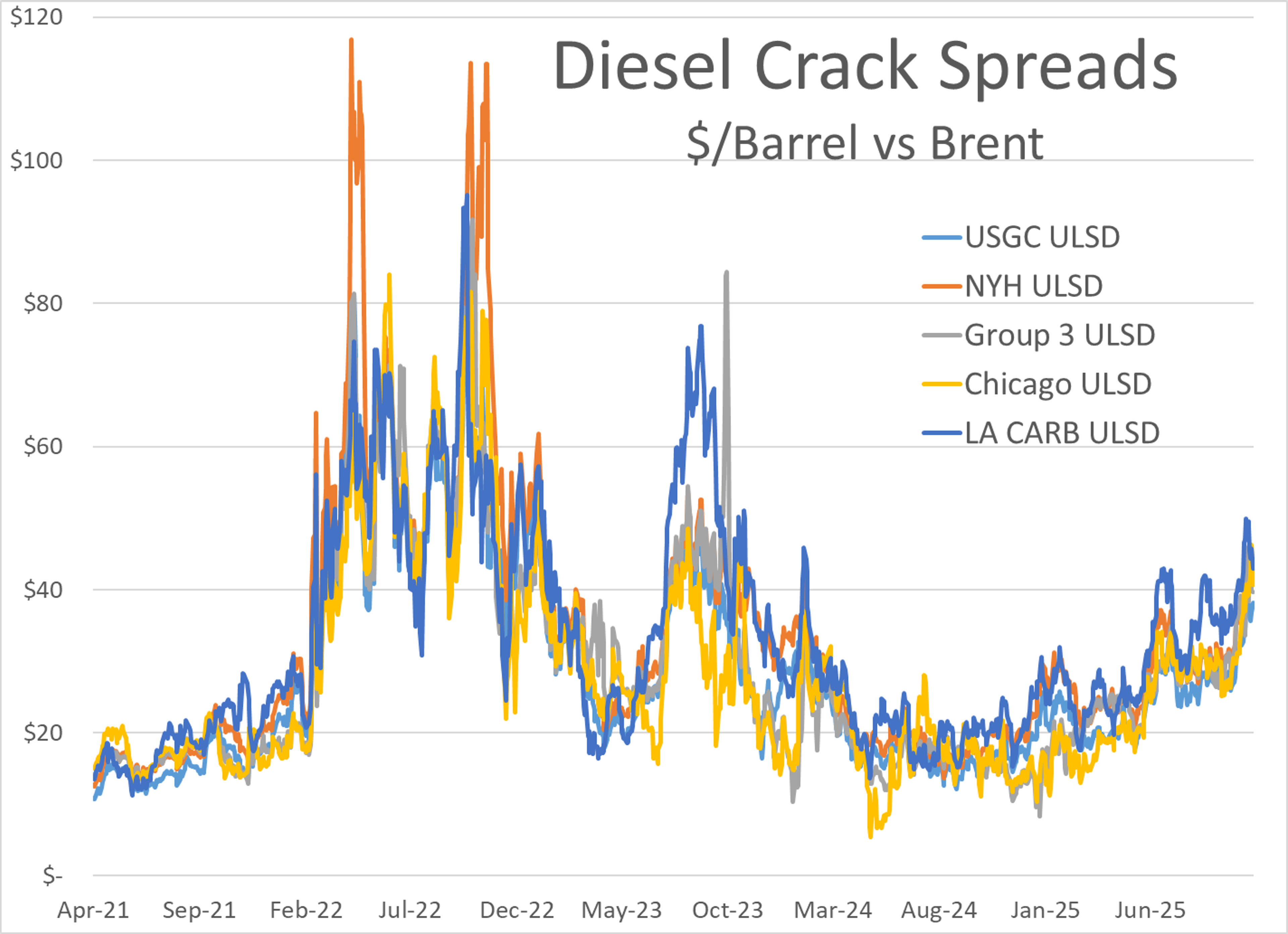

So far today this is purely a diesel story with RBOB futures ticking modestly lower as we creep closer to the winter demand doldrums and oil futures hovering around break even. The strength in diesel is concentrated at the front end of the curve, signaling a market dealing with a short-term supply crunch as several refineries in Europe race to find a way around the sanctions on their owners set to take effect in 3 days. In addition, diesel inventories across the U.S. East Coast had been running at the low end of their range for most of the year, so the pull across the pond for incremental barrels is felt more quickly than if the system was sitting on excess supply. The move is great news for U.S. refiners who are seeing margins surge to their best levels in 2 years

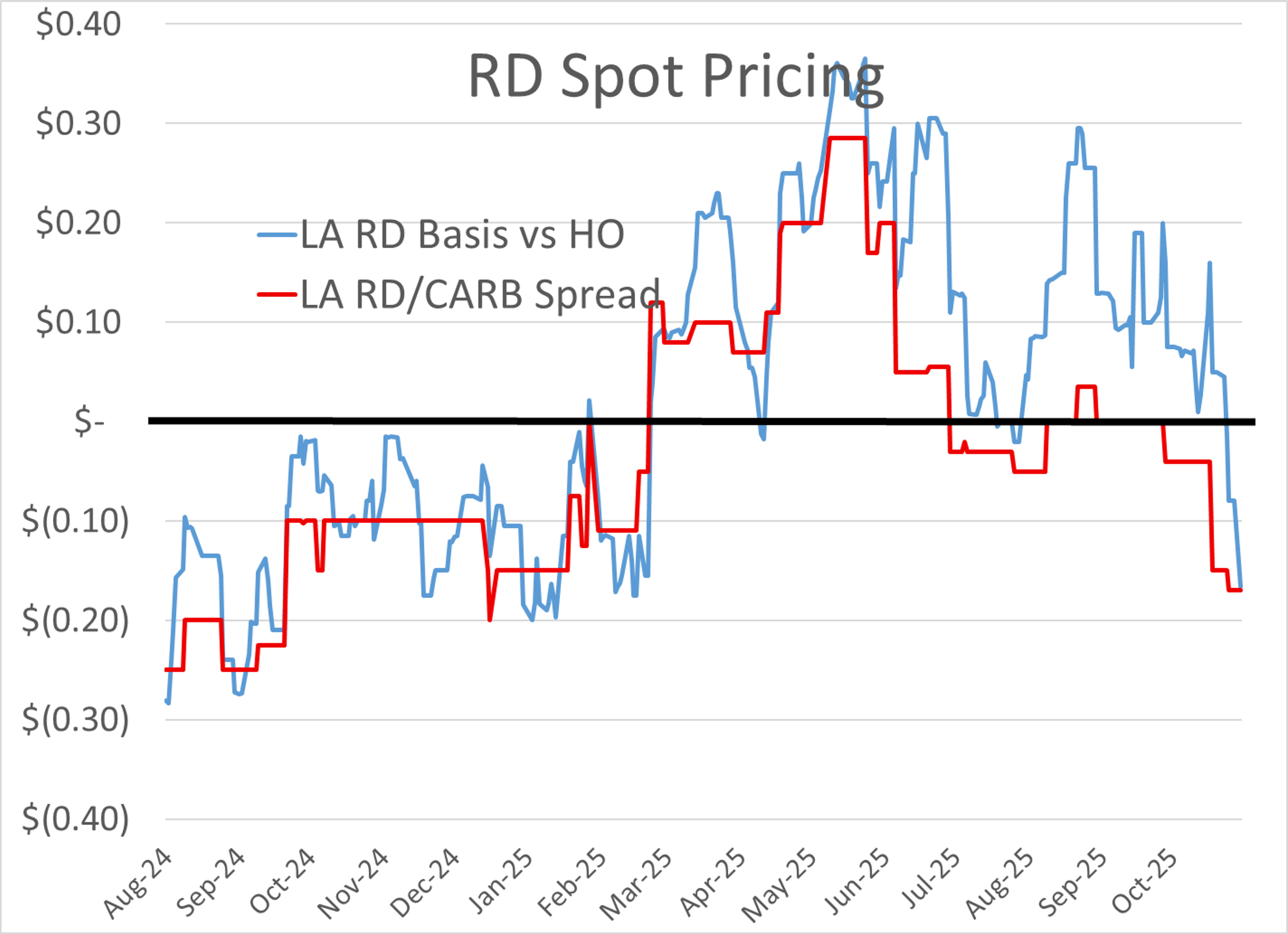

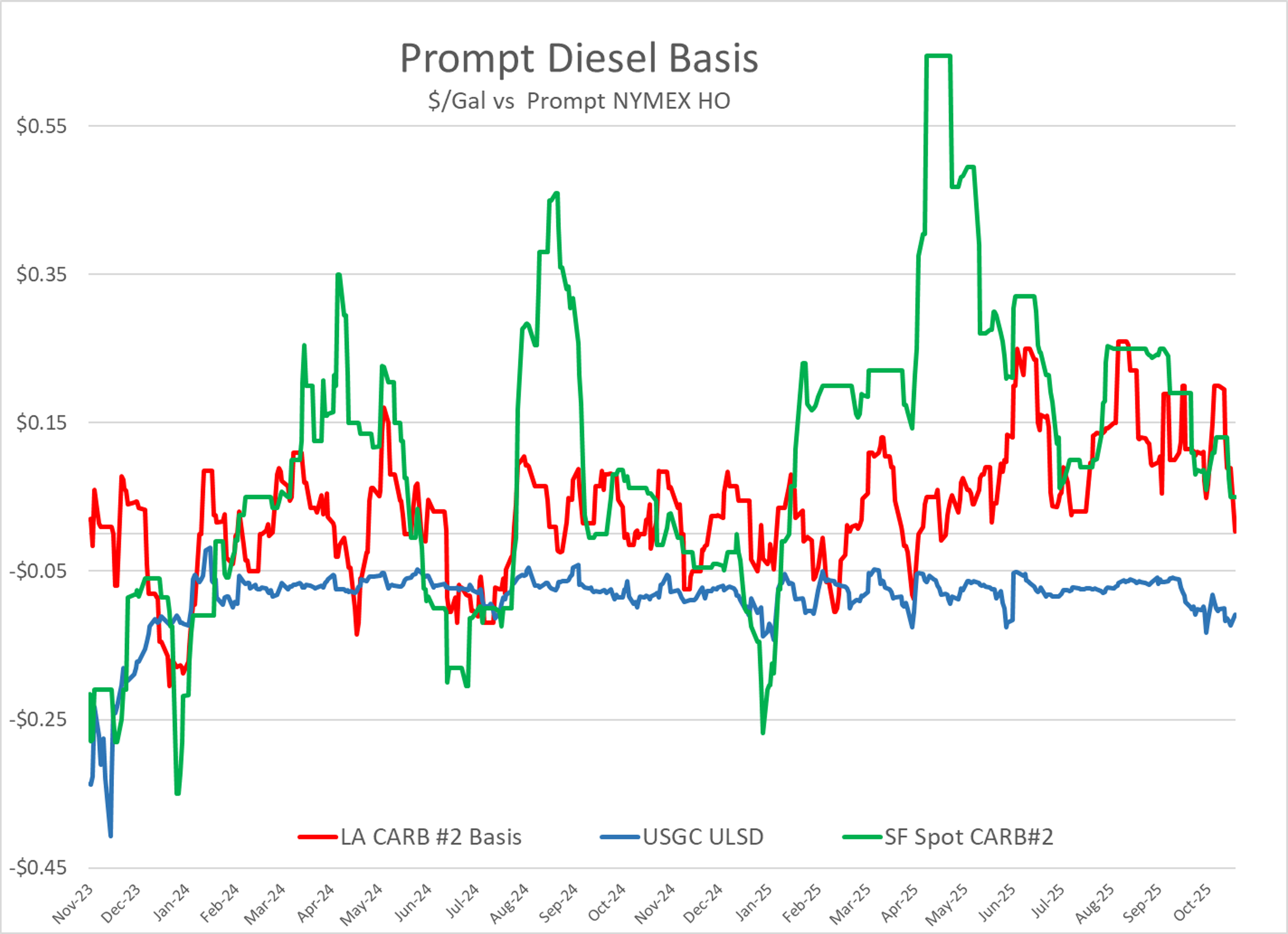

Not buying it: As is often the case with strong moves in spreads tied to an East Coast delivery point, basis values in other parts of the country that aren’t so tight on supply will move in the opposite direction and offset some or all of the gains in the NYMEX contracts. Yesterday we saw Los Angeles diesel basis values crumble by nearly a dime as the influx of Renewable Diesel trying to beat the year-end change in RIN rules coupled with a harsh drop in demand due to heavy rains in the region.

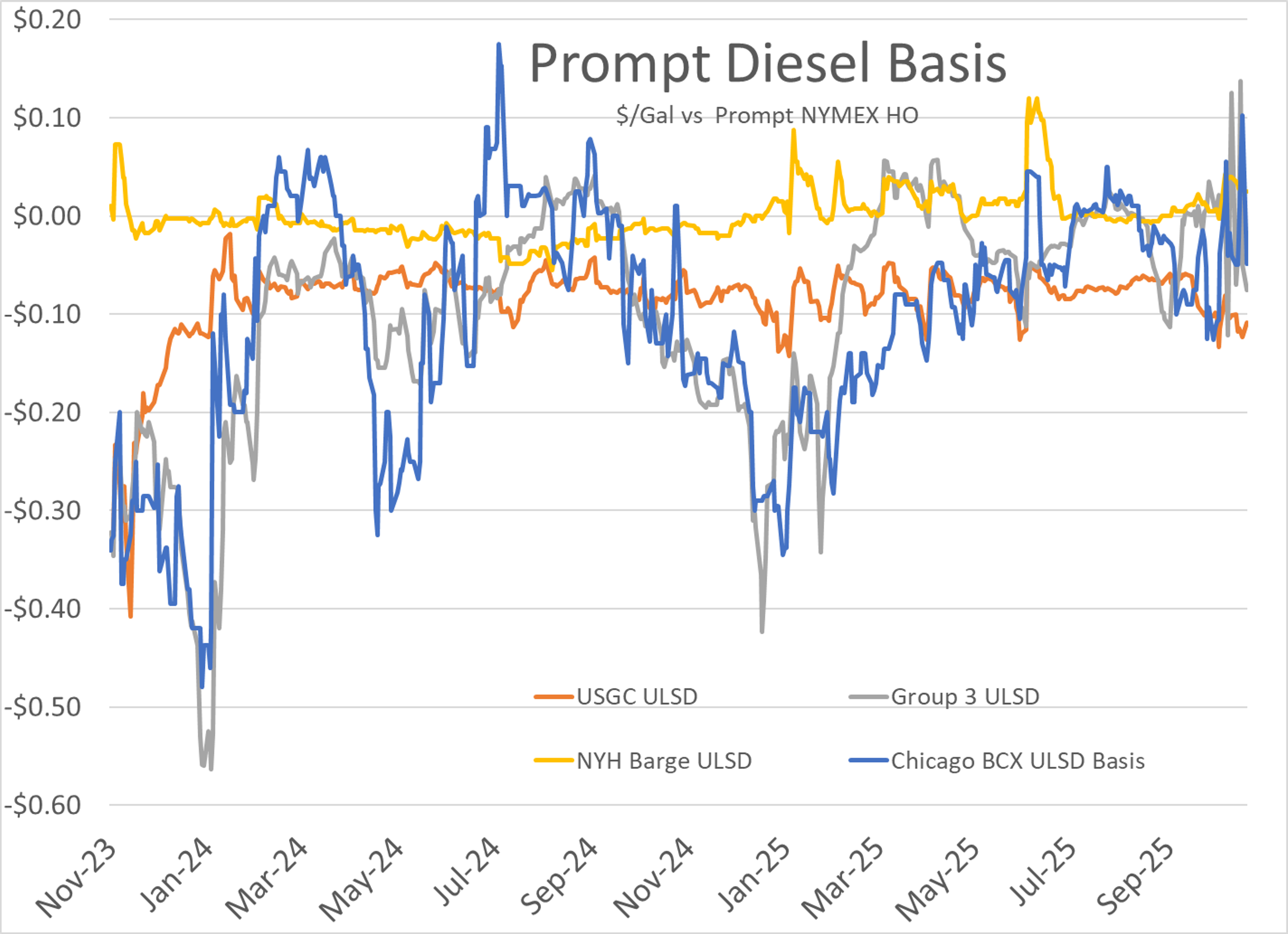

Mid-Continent diesel differentials have also been whipsawed by the big moves in futures and the end of harvest season with Group 3 and Chicago differentials now threatening double digit discounts to futures after brief spikes higher earlier in the month.

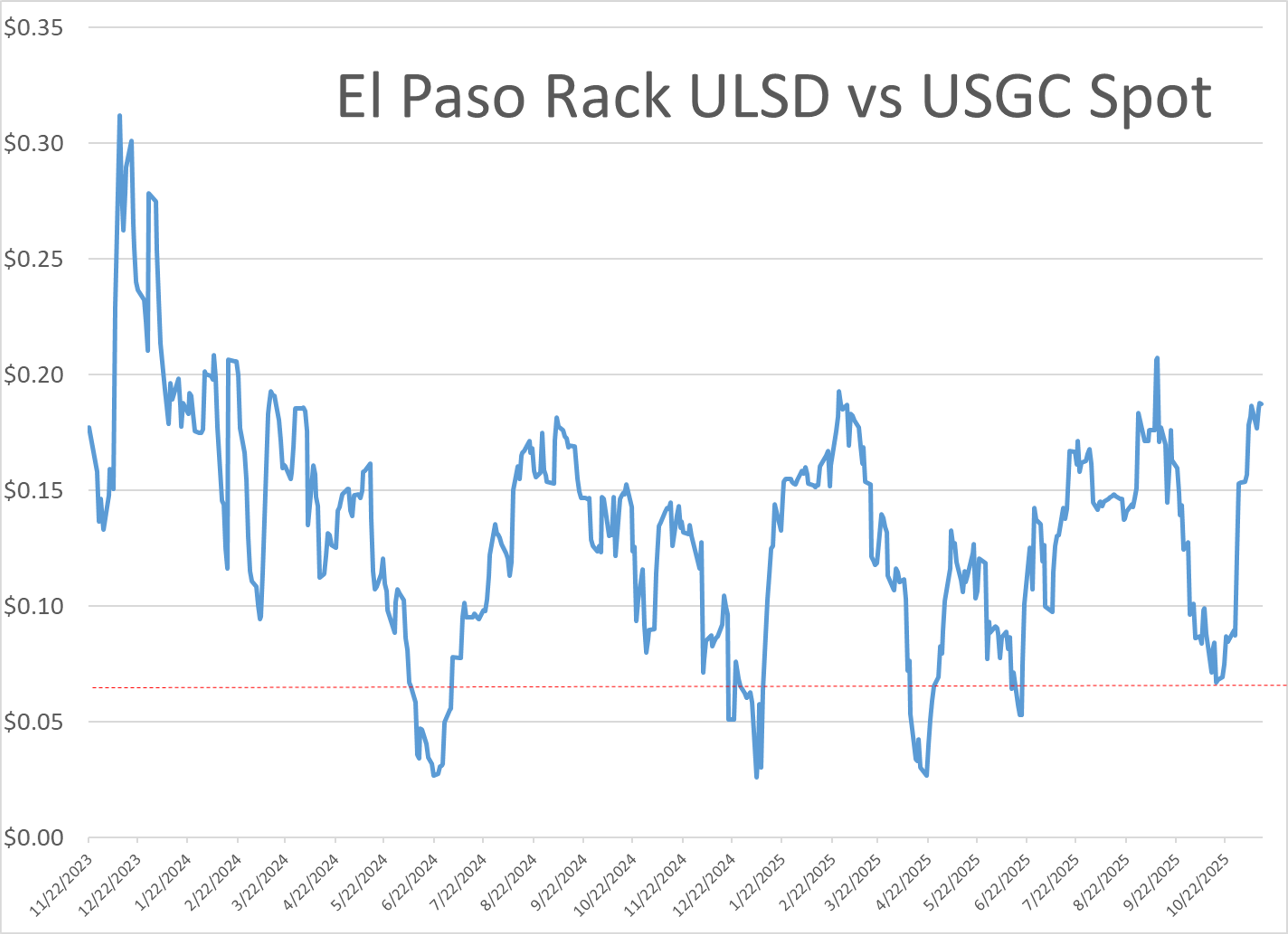

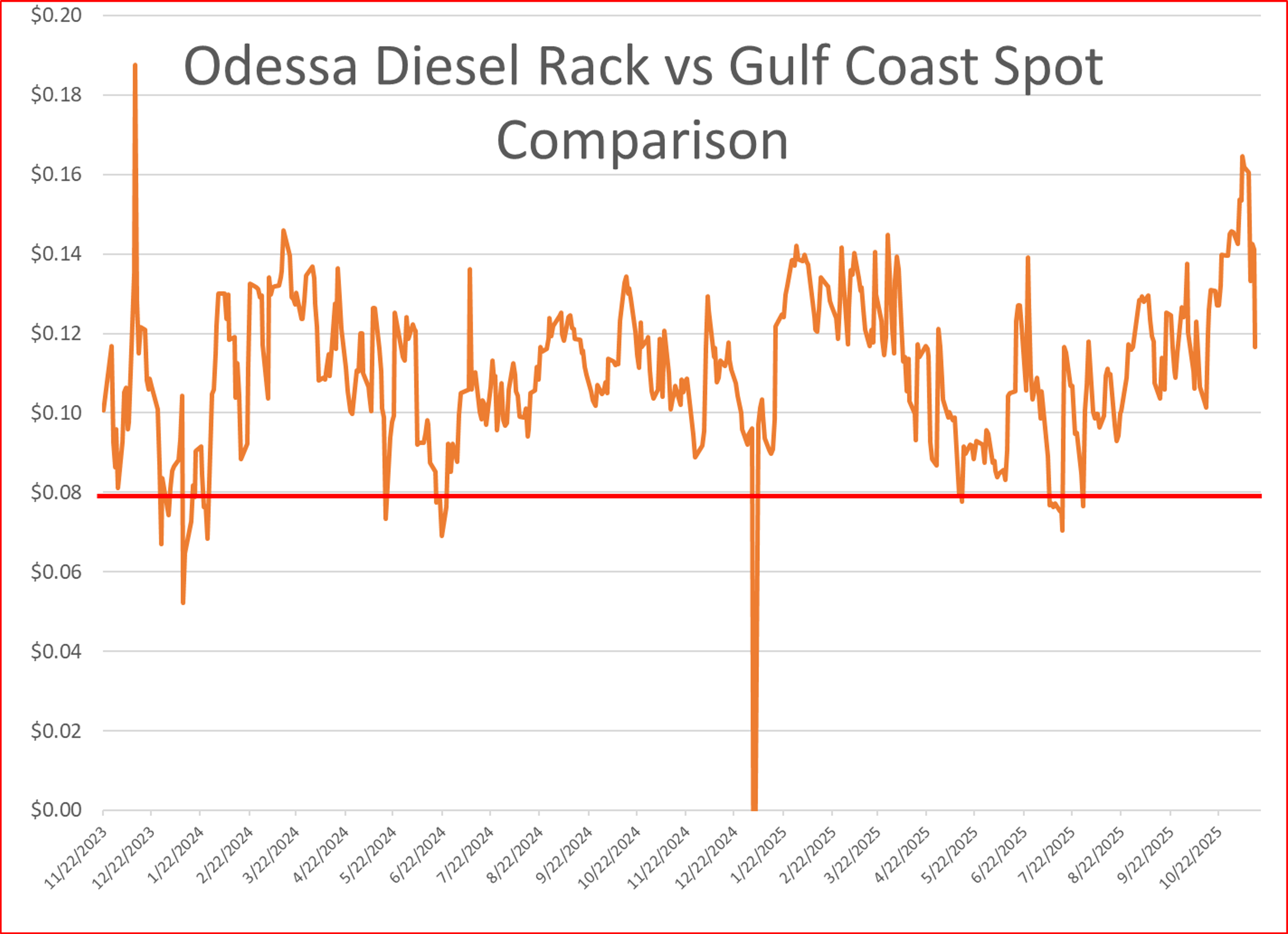

Marathon reported an upset at its 133mb/day El Paso refinery Monday. The event took place over the weekend and lasted more than 31 hours. The filing with the TCEQ says that the reason for the shutdown of the Main Fractionator Reflux pump was under investigation, and that the facility was shutting down process units suggesting its production will be reduced from the event. Rack Spreads in the W. Texas and New Mexico markets had just begun to ease in the past few days after upsets at 3 other regional refineries in October tightened up supplies, but overnight pricing suggests that those spreads may widen once again until more is known about the impact on the operations in El Paso.

Marathon also reported an upset at its 631mb/day Texas City refinery this morning. That flaring event appears to have been limited to an Aromatics unit and lasted 3.5 hours but does not appear to have affected other units according to the filing.

That’s a wrap? With just 12 days left in the official season for Atlantic Hurricanes, the NHC suggests no activity is expected for the next week making it increasingly likely that the U.S. will dodge a hurricane landfall for the first time in 9 years.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets