Diesel Leads Gains As Sanctions And Refinery Issues Tighten Global Supply

Diesel futures are trying to lead the energy complex higher to start the week as new sanctions and ongoing drone attacks both bite into the supply capacity of European nations, which will lean on US exports to help fill the gap. ULSD prices are trading higher for a 7th straight session, after eking out a 1 point gain Friday, adding 28 cents during that strength and threatening a run into the $2.50 range if the can break resistance around $2.45.

Stock markets are pointing higher as a trade deal between the US and China looks more likely after weekend negotiations, but so far that optimism hasn’t helped gasoline futures move into the green for the day.

Soybean futures are surging following the trade deal reports as it appears China will once again buy from US farmers, but that may end up being bad news for domestic biofuel producers who needed feedstock prices to continue lower in order to break even.

BP reported a 2nd upset in a week Friday when an external power outage forced its 430mb/day Whiting IN (Chicago area) refinery to be evacuated. The facility was quickly restarted once power resumed and no damage seems to have occurred helping basis values in the region to continue to ease after spiking after the fire on October 17.

PBF reported 8 days of planned flaring at its Torrance CA (LA-area) refinery that will start tomorrow and is expected to end on November 5th. Basis values in the region have stabilized since the fire at Chevron’s El Segundo facility 3 weeks ago.

The Dangote refinery in Nigeria has announced plans to more-than double the facility’s capacity in 3 years, which would make it the largest plant in the world at 1.4 million barrels/day. The current facility is already contributing to an excess of capacity in the Atlantic basin, and IF this expansion actually comes online, it will certainly pound several more nails in the coffins of aging facilities in Europe and the US East Coast.

Trouble in Pt Arthur: Motiva reported an upset at its 650mb/day refinery in Pt Arthur over the weekend, shortly following a separate flaring event at its neighboring petrochemical plant. Valero also reported an upset on multiple units at its 430 mb/day Pt Arthur refinery after a loss of nitrogen from a 3rd party vendor. Those facilities are part of one of Colonial pipelines most active origin points, so they could create some swings in USGC basis values, but so far it appears the impacts to production are minimal.

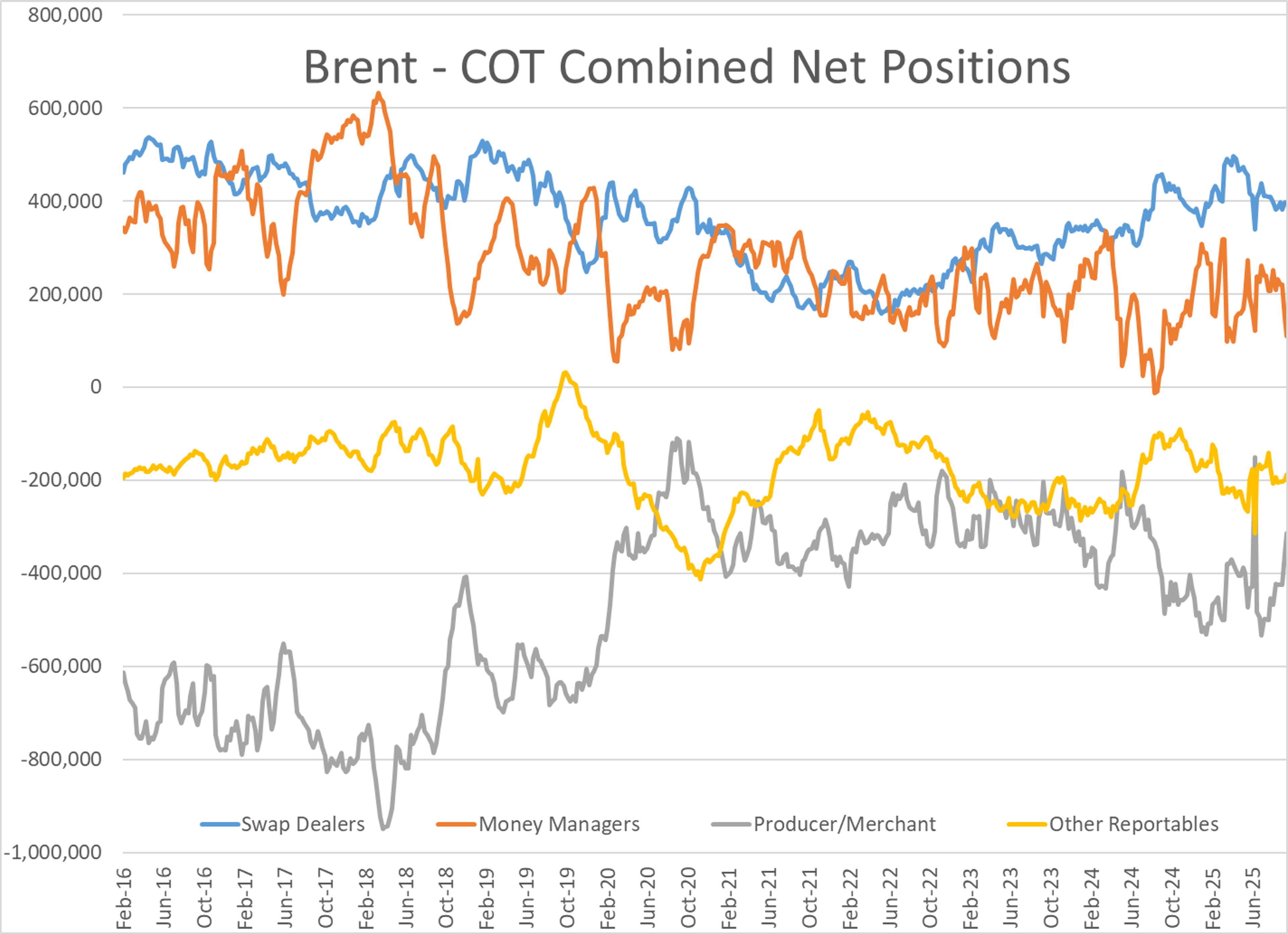

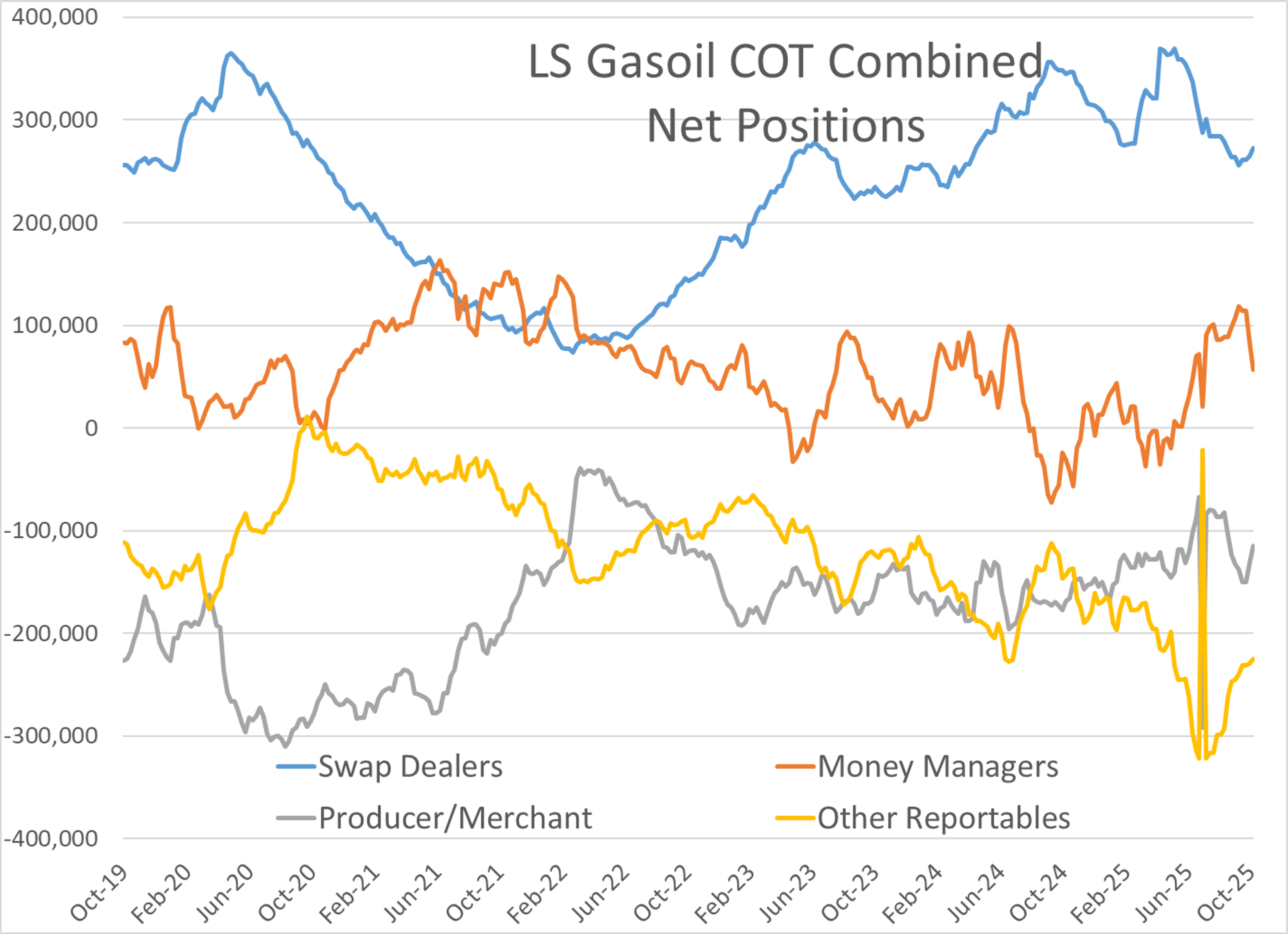

We are on week 4 of missing CFTC data on weekly trade positions, but the ICE exchange continues to publish their data giving us a window into the mindset of large speculators and other trade categories. Money managers continued to slash their net length in Brent and Gasoil (European ULSD equivalent) for a 3rd week last week with data compiled as of Tuesday 10/21. The biggest story was that the short position held by money managers reached a record high as of Tuesday, meaning a record amount of speculative money was run over by the price spike Wednesday and Thursday, which no doubt contributed to the move as those losing positions were forced to buy back their contracts to exit the trade.

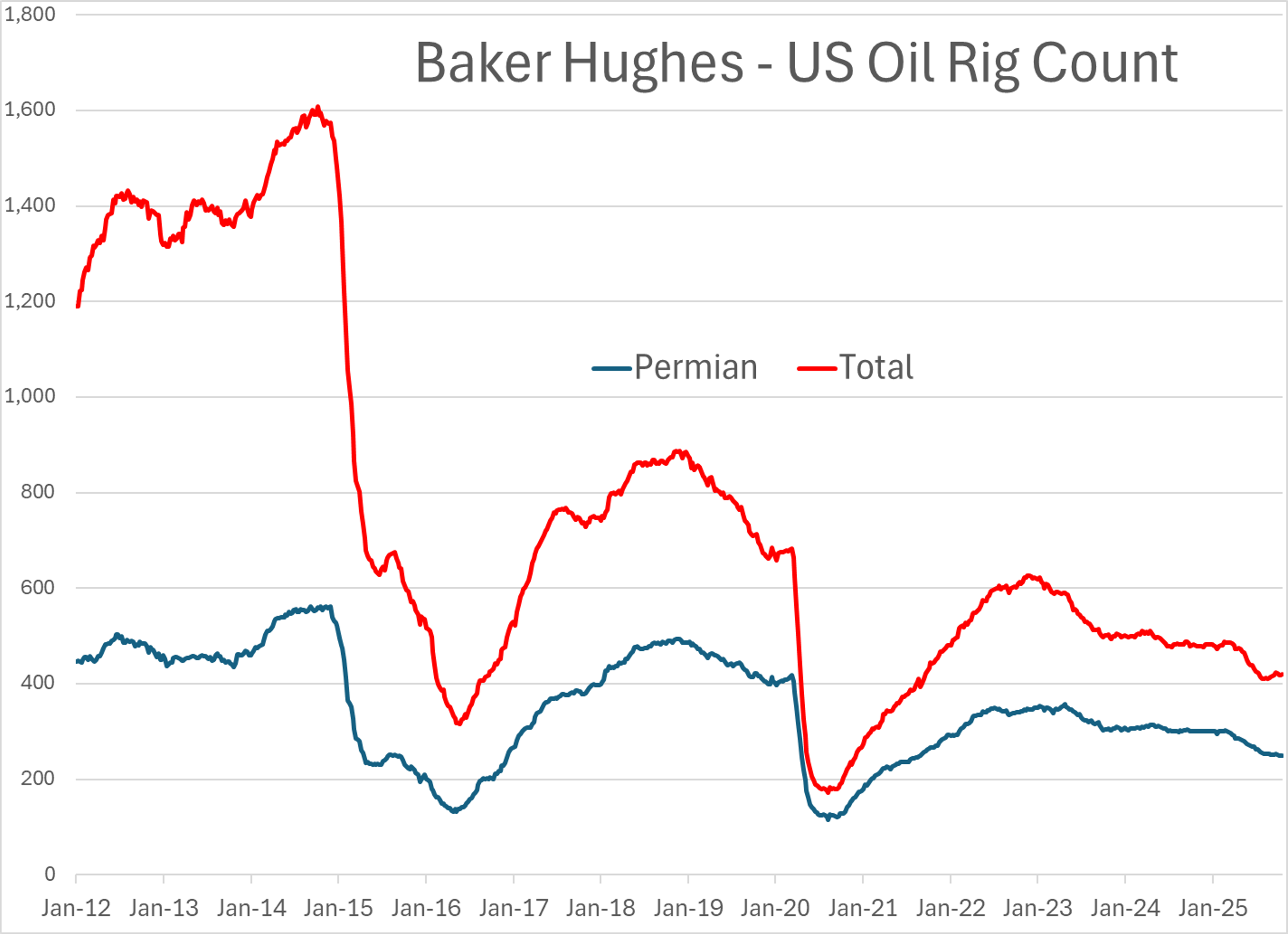

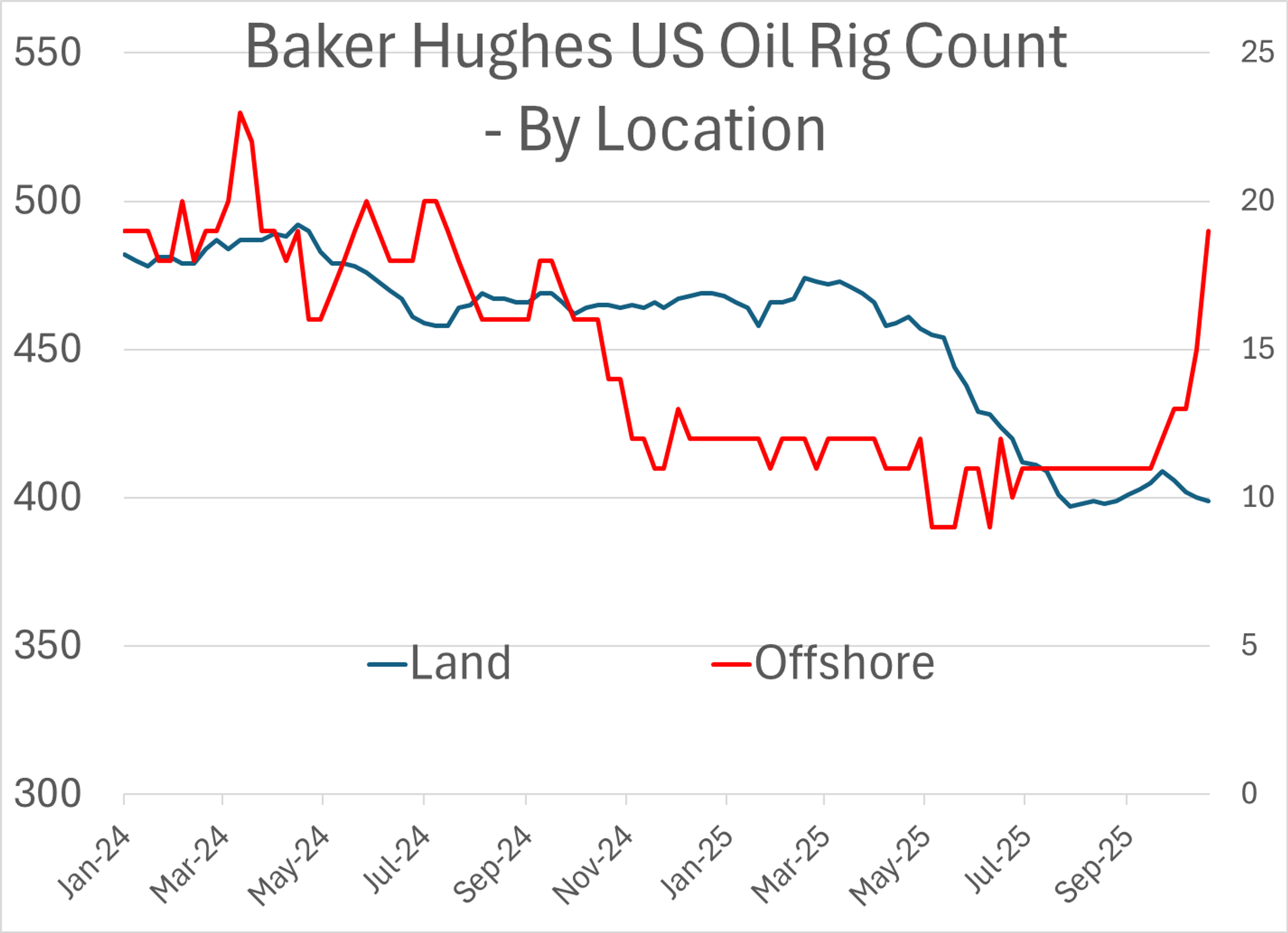

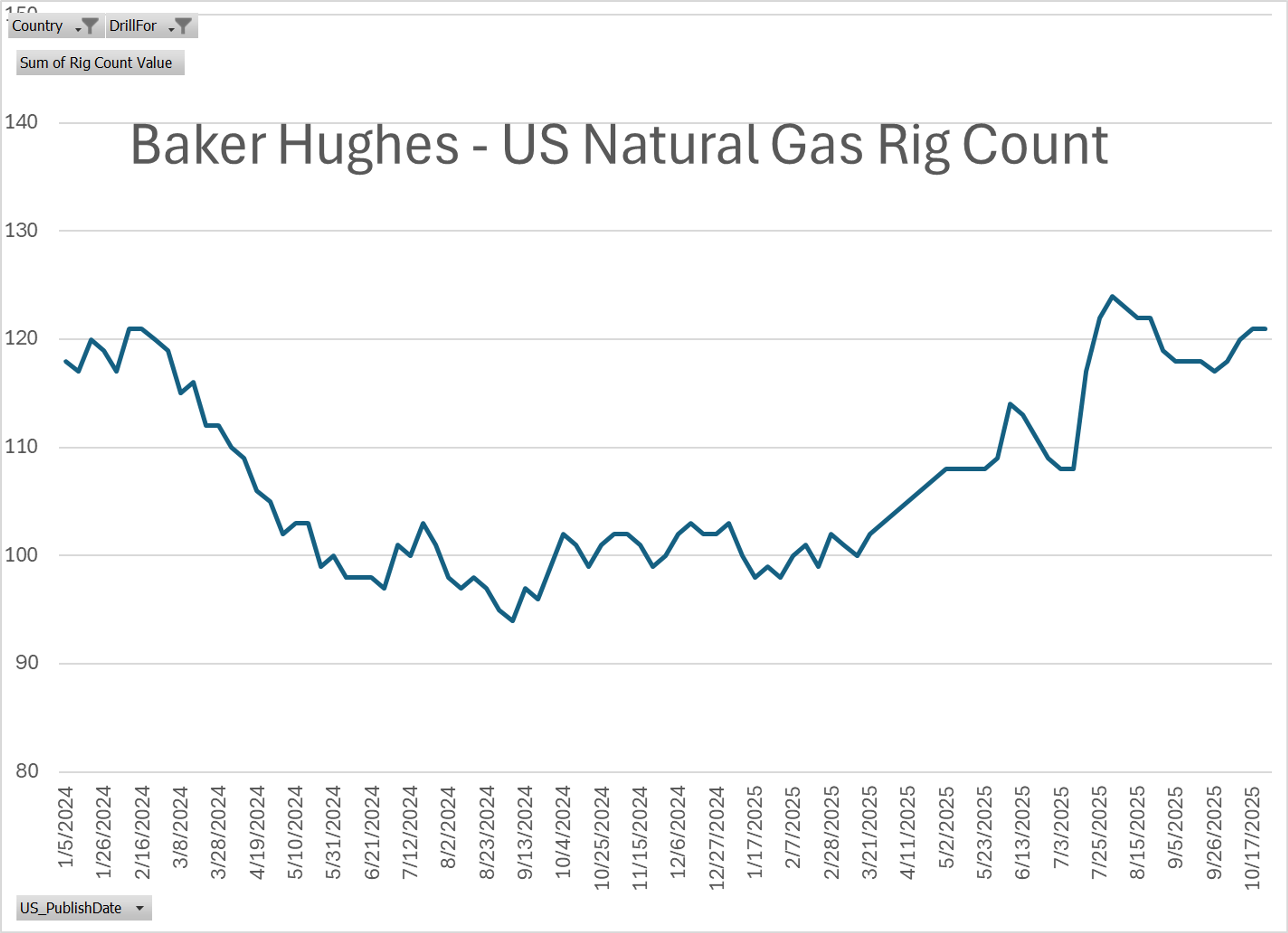

Baker Hughes reported a net increase of 2 oil rigs in the US last week, while the natural gas rig count held steady. While the headline values aren’t impressive, the big story here is that 4 more off-shore drilling rigs were added to the count last week, offsetting small declines on land and inland waters. In the past 2 weeks alone, the off-shore rig count has jumped by 6, which doesn’t sound like much, but is a 46% increase in the total and pushes that count to a 15 month high. It’s worth noting that off-shore rigs are generally much larger and more complex operations than the land-based rigs and suggest that the large producers are still willing to make long term investments on off-shore projects at current values, even while the returns for on-shore projects is marginal.

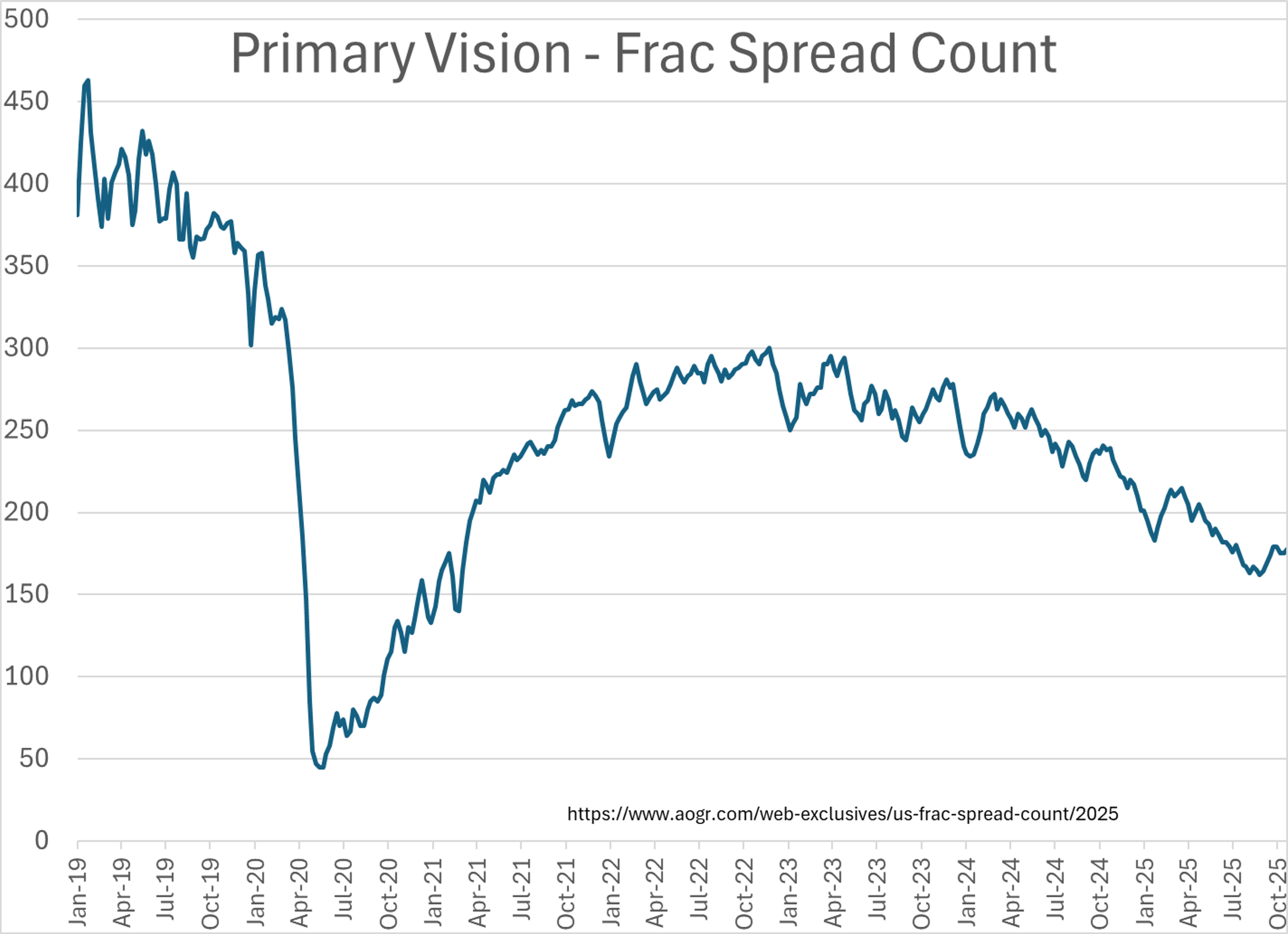

The Primary Vision weekly count of fracking crews active in the US increased by 3 last week to a total of 178. That count is up 16 in the past 2 months after reaching a multi-year low in August, but is still 50 crews less than were active this time last year.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets