A Tale Of Two Coasts: Diverging Gasoline Inventories Drive Early‑Year Energy Rally

Refined products are leading the energy complex in a healthy rally to start Thursday’s trading session. RBOB gasoline futures are leading the charge higher, rallying almost a nickel in early trading, in what seems to be a bit of a delayed reaction to relatively tight supplies along the East Coast, while most of the country struggles to deal with an excess of gasoline inventory.

Yesterday’s DOE report showed a huge glut of gasoline along the Gulf Coast that continues to build, with inventories nearly 4 million barrels (5%) above the top end of their seasonal range to start the year. PADD 1 gasoline inventories meanwhile are holding below the low end of their seasonal range, with 1B (home to the NYH) starting out 2 million barrels (5%) below the low end of its range, which can help explain why time spreads are rallying this week despite the overall sense of soft demand and ample supply nationally.

With the Gulf Coast seeing too much supply and the East Coast relatively tight, it’s not surprising to see values for leasing space along Colonial’s main gasoline line (Line 1) jump up to a 4 cent/gallon premium as they did yesterday. U.S. Gasoline exports are already holding at the top end of their range near 1 million barrels/day, so ramping up those overseas sales may be a challenge, although U.S. energy execs may be smart to offer an oil for gasoline swap in their upcoming White House negotiations on Venezuela. The excess supply of gasoline and diesel could almost certainly also be used by our neighbors in Cuba, and could become a bargaining chip, if the U.S. & Cuba ever get to the bargaining table together.

U.S. Oil company executives are set to meet at the White House Friday to discuss plans for Venezuela, which will likely add a dose of reality to the ongoing claims of rapid production increases that continue to float through the media.

Speaking of which, both Exxon and Shell are warning investors of weaker earnings for Q4 largely due to a drop in crude oil prices, which will offset stronger refining margins in the quarter. Exxon expects to see an earnings drop of around $1 billion for the quarter in its upstream segment, while its margins for refined products are expected to increase by $300-$700 million after crack spreads surged in October and November following the U.S. Sanctions on Rosneft and Lukoil.

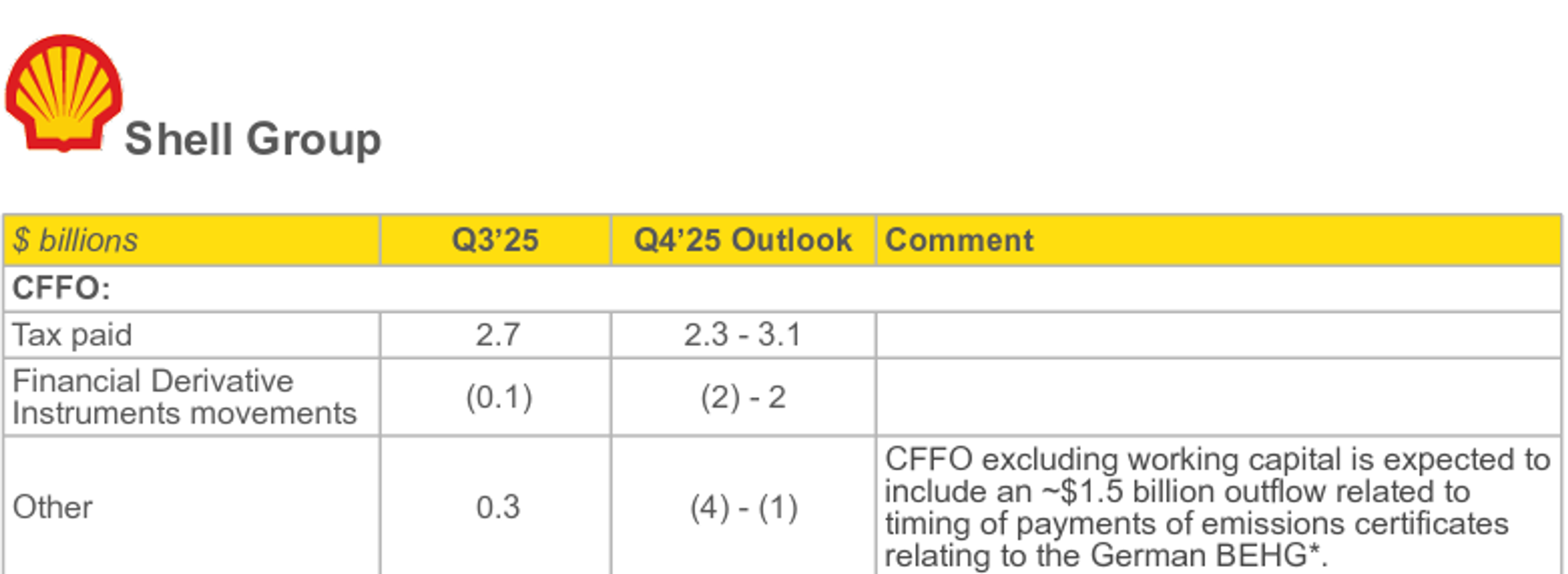

Shell meanwhile said its Chemicals & Products segment is expected to show a loss for Q4, with its trading and optimization category expected to show a significant drop. What may be indicative of a larger issue at Shell is the company listed “Financial Derivative Instrument Movements” for the quarterly outlook to be somewhere between negative $2 Billion and positive $2 Billion, which suggests they actually have no idea. In addition, the company expects a loss of $1-$4 billion in the quarter due to “other” items including payments of emissions certificates.

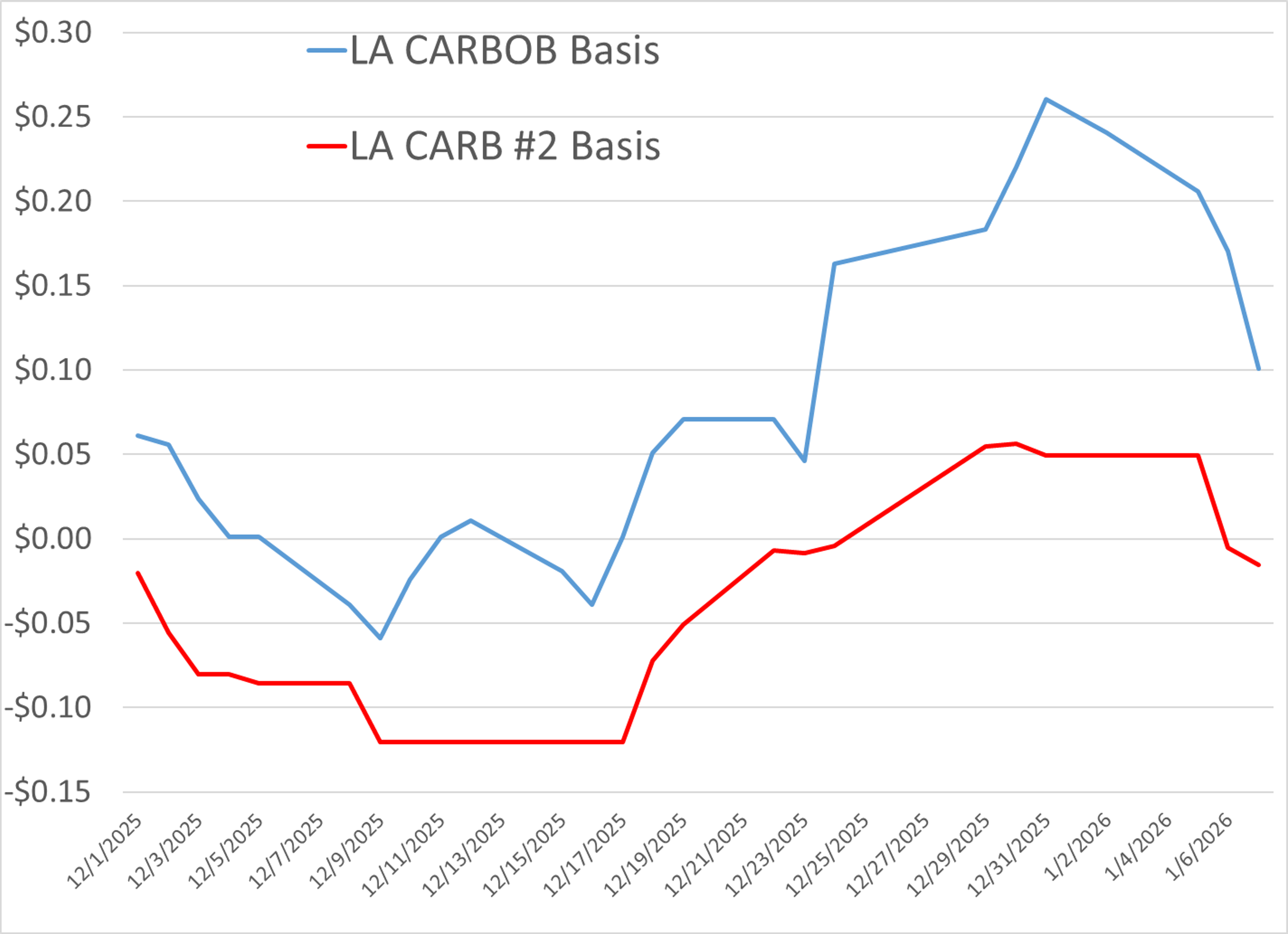

Unplanned flaring at Marathon’s LA-area refining complex reported Tuesday night didn’t stop the sellers from continuing to push LA-spot basis values lower Wednesday with both CARBOB and CARB diesel values continuing to slide.

Northern California is seeing a flurry of refinery flaring notices as facilities in the Bay Area undergo planned maintenance. The Contra Costa health website shows 8 different notices in the first 8 days of the year with P66 Rodeo and Marathon Martinez (both converted to renewables output in recent years) and Chevron Richmond all reporting minor flaring events. California’s governor released a statement Wednesday patting himself on the back after Valero stated they’d continue importing gasoline to the region after they shut down the 170mb/day Benicia refinery in April. State efforts to convince Valero to keep the facility operating, or to find a willing buyer have been unsuccessful thus far.

Meanwhile, a damaged gas line in Valero’s Houston refinery Tuesday afternoon appears to have had no impact on operations after emergency response crews were called to the site to secure the line.

Notes from the DOE’s weekly status report.

Crude drew almost 4 million barrels despite heavy imports as exports increased alongside, starting the year well ahead of the previous two. Refinery runs ticked up slightly everywhere except PADD 1 but that region, along with PADDs 2-4, is kicking off 2026 at seasonal 5-year highs. PADD 5 runs increased week over week but are a little over 100 kbd behind their 5-year average.

Despite exports increasing from already high values and starting the year ~170kbd ahead of 2025, diesel stocks built across the board as demand readings continued to dwindle through the holidays. U.S. totals are in line with where last year began, around 3 million barrels below 2024 and 4 million below average. October’s RD stats came through showing renewable stocks down everywhere except PADD 3, but they’re still tracking ahead of year ago levels in total.

Gasoline inventories increased across the country with the exception of PADD 1 where they’re down technically, but essentially flat week over week. Declining post-holiday demand lends to the build here as well with this year starting out above its 5-year average, but lower than the previous two years. With no real movement in PADD 1, stocks are sitting under their 5-year range to start 2026, around 6 million barrels below average. Other PADDs are hovering right at their 5-year averages while PADD 3 continues its run up to start the year around 3 million barrels over the high end of the 5-year range. The Gulf Coast glut is enough to outweigh the East Coast deficit, wedging total U.S. stocks between year and two-year ago levels but about 4 million barrels over the 5-year average.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets