Rally Stalls As Winter Weather Reshapes Fuel Demand And Refinery Operations

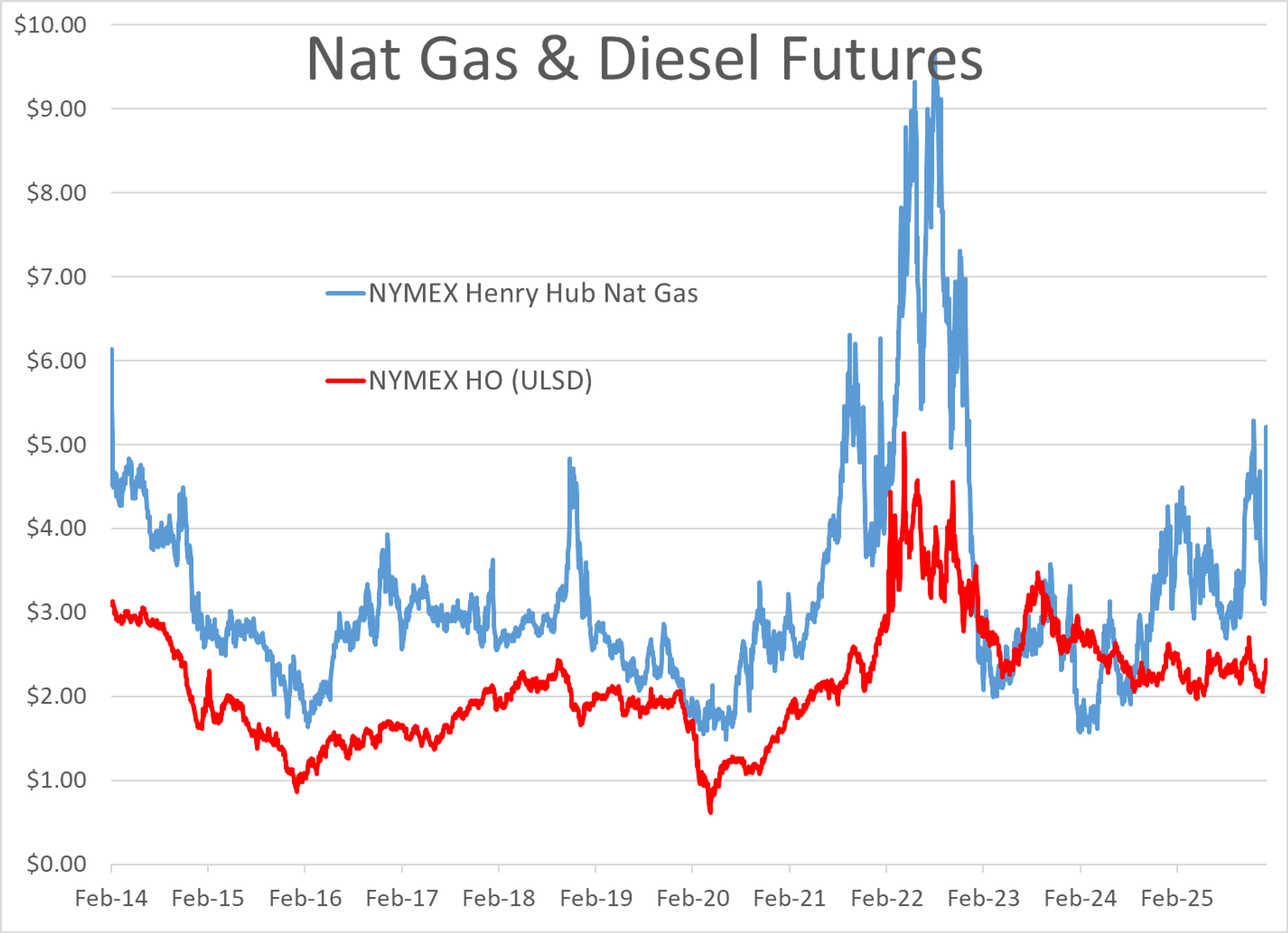

The petroleum complex is pulling back this morning after a furious rally to start the week. February ULSD futures are down a little over 3 cents this morning after gaining nearly 20 cents since Friday’s settlement, while gasoline futures have given back nearly half of the 7 cents they’d added through Wednesday.

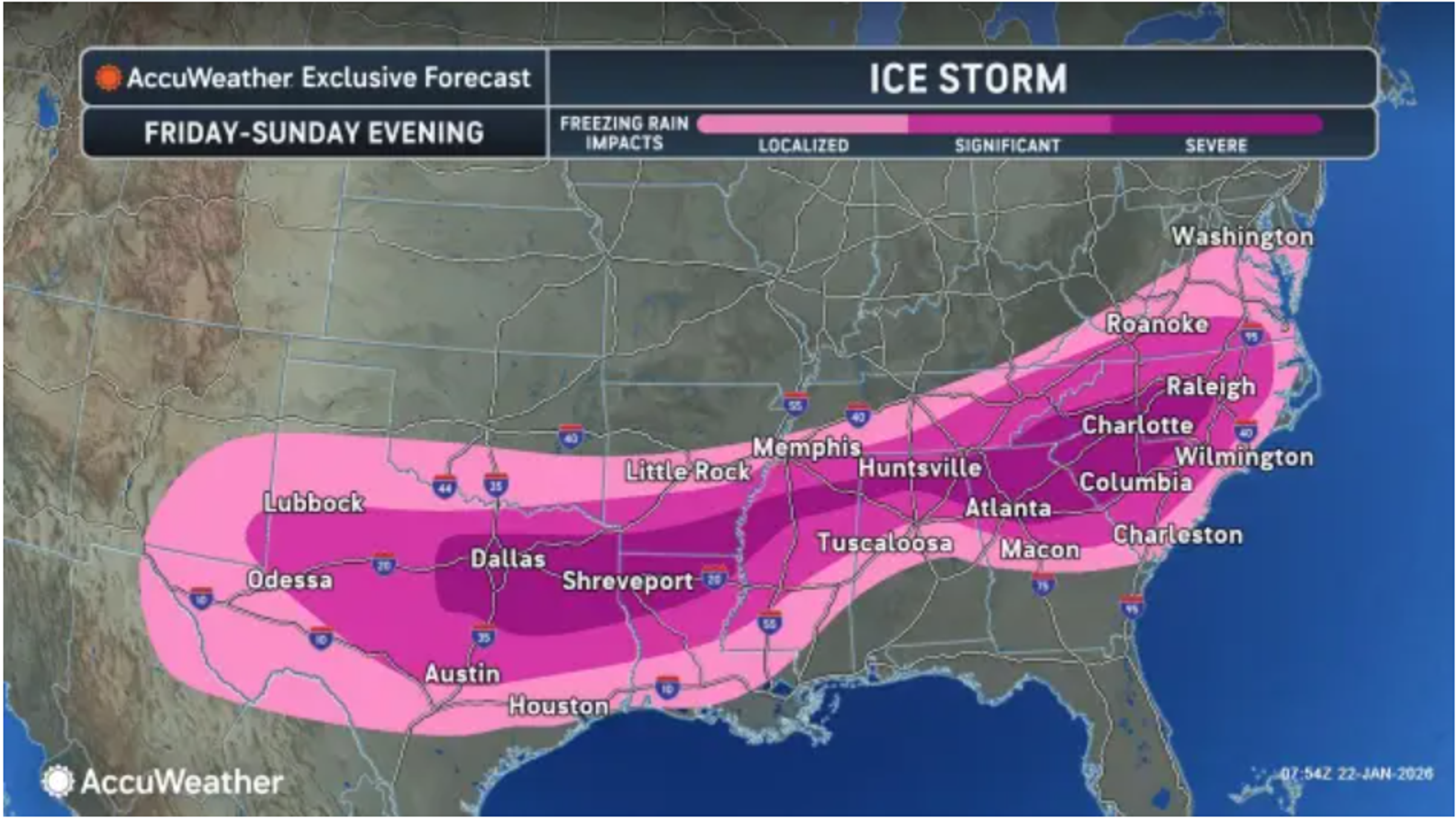

While the market has been largely caught up in concerns over the spike in demand for heating fuels this week, and doubts about whether or not the supply network can keep pace, the flip side of that coin comes from transportation fuels which are set to see a significant drop in demand as drivers stay off the roads in parts of the country for days, while the threat to gasoline and diesel production is much lower, which may be contributing to some of the reality-check in today’s price action.

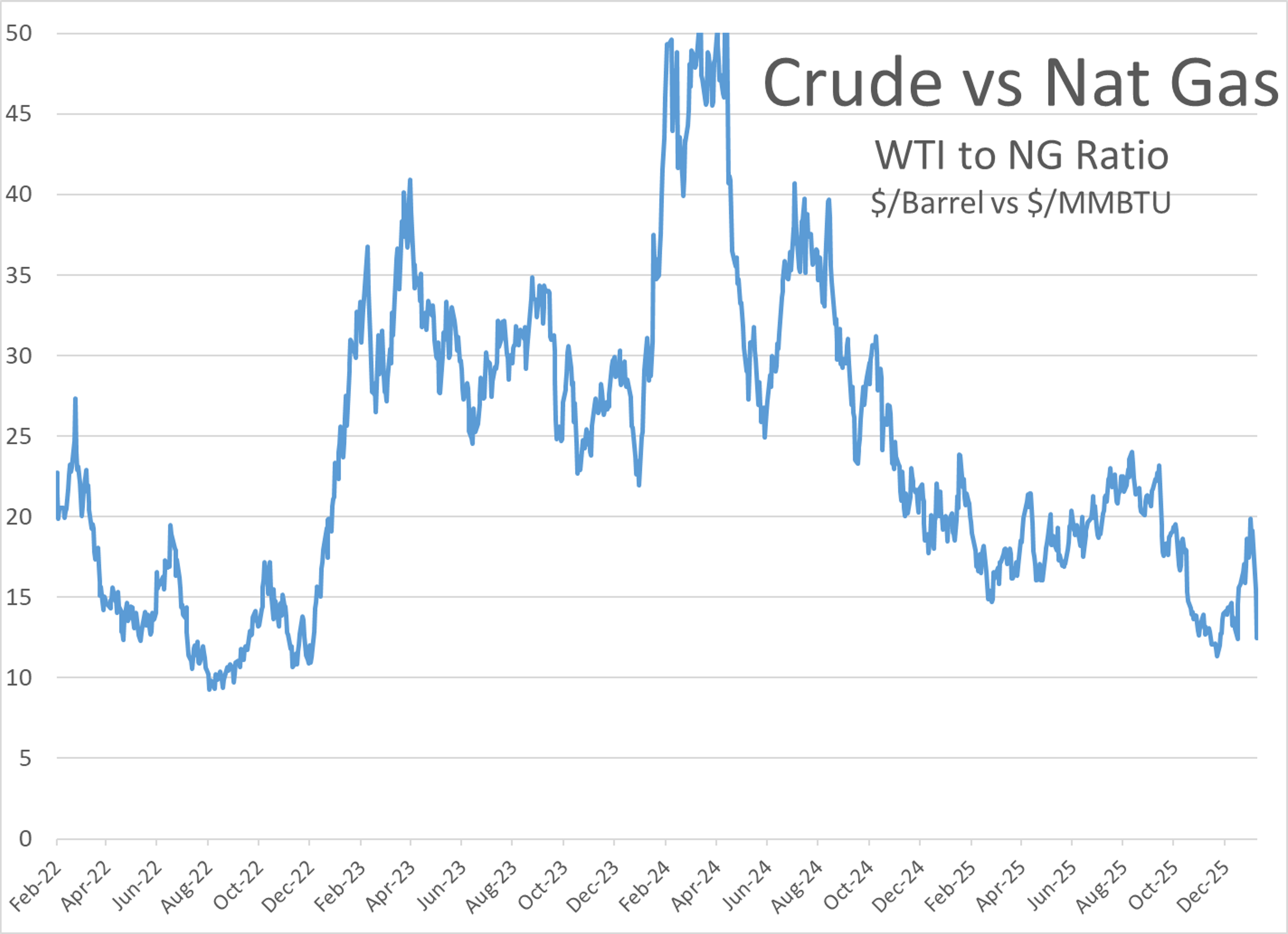

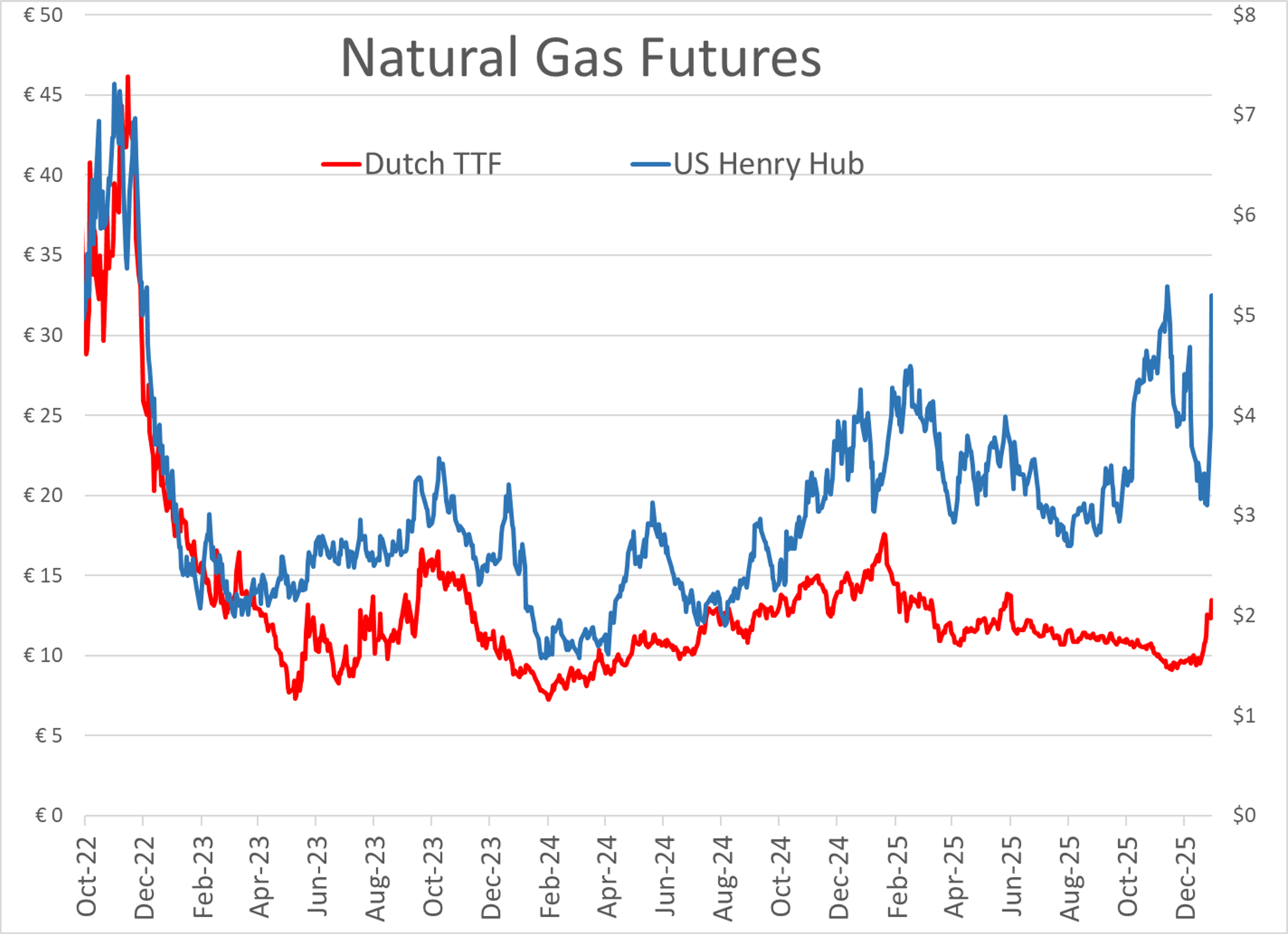

The NYMEX February Natural gas contract is trading up another 7 percent this morning at $5.20 per million BTU, up 67% from Friday’s settlement of $3.10. While that contract continues to trade higher, they are down sharply from the 3 year high at $5.578 they reached overnight, which seems to be contributing to the ULSD contract losing its momentum as well.

The API estimated large builds in crude oil and gasoline inventories last week of 3 million barrels and 6.2 million barrels respectively, while diesel stocks saw a small decrease which amounts to a rounding error. Today’s DOE report is scheduled to be released at noon eastern today.

Valero reported an upset at its 200mb/day Mckee TX refinery, even before the winter weather starts to hit the region. The company’s report to the TCEQ said that an FCC unit at the refinery was flaring due to maintenance activities that would run through this morning. If they can get the unit back online before the storm, they may be ok. If not, those restart efforts may be delayed a few days.

Meanwhile, Delek’s 77mb/day Tyler TX refinery is undergoing maintenance that will be delayed by the ice storm this weekend, which is causing outages at nearby terminals, and complicating efforts by consumers in the NE Texas area to fill up before the ice hits.

A Reuters report this morning said that HF Sinclair has already reduced run rates at their 135mb/day El Dorado KS refinery as a precaution ahead of the storm, with other mid-con facilities likely to make similar adjustments to minimize potential damage.

Yesterday’s IEA Monthly Oil Market report increased the demand growth forecast for oil products this year by 80mb/day, largely due to a “normalization” of economic conditions after last year’s tariff turmoil. While the agency seems to be conceding something here in its ongoing feud with OPEC, they did still call for a supply overhang this year. The report also highlighted a rebound in Russian crude production and refinery operations in December, while output from Kazakhstan has been forced lower by Ukraine’s attacks on their Russian outlet.

This is what they’re doing now? The EIA this morning published a theoretical look at using retired military aircraft engines to generate electricity to support data centers. The “study” provides no mention of the supply or cost of jet fuel needed to convert these engines, but it does note that attaching them to generators would be complicated. No word yet if the author will get a blue ribbon at his middle school science fair for the article.

Latest Posts

Week 3 - US DOE Inventory Recap

Fuel Markets Spike Ahead Of Major US Winter Storm

Diesel Futures Surge As Arctic Cold Fuels Sharp Rally

Holiday Session Starts Mixed As ULSD Leads, Markets Quiet

Diesel Futures Rebound As RIN Prices Surge Despite Rising Supply

Oil Prices Retreat As US–Iran Tensions Cool And Sanctions Timelines Slip

Social Media

News & Views

View All

Week 3 - US DOE Inventory Recap

Fuel Markets Spike Ahead Of Major US Winter Storm