Energy Prices Surge Again Amid Global Flashpoints And US Weather Shifts

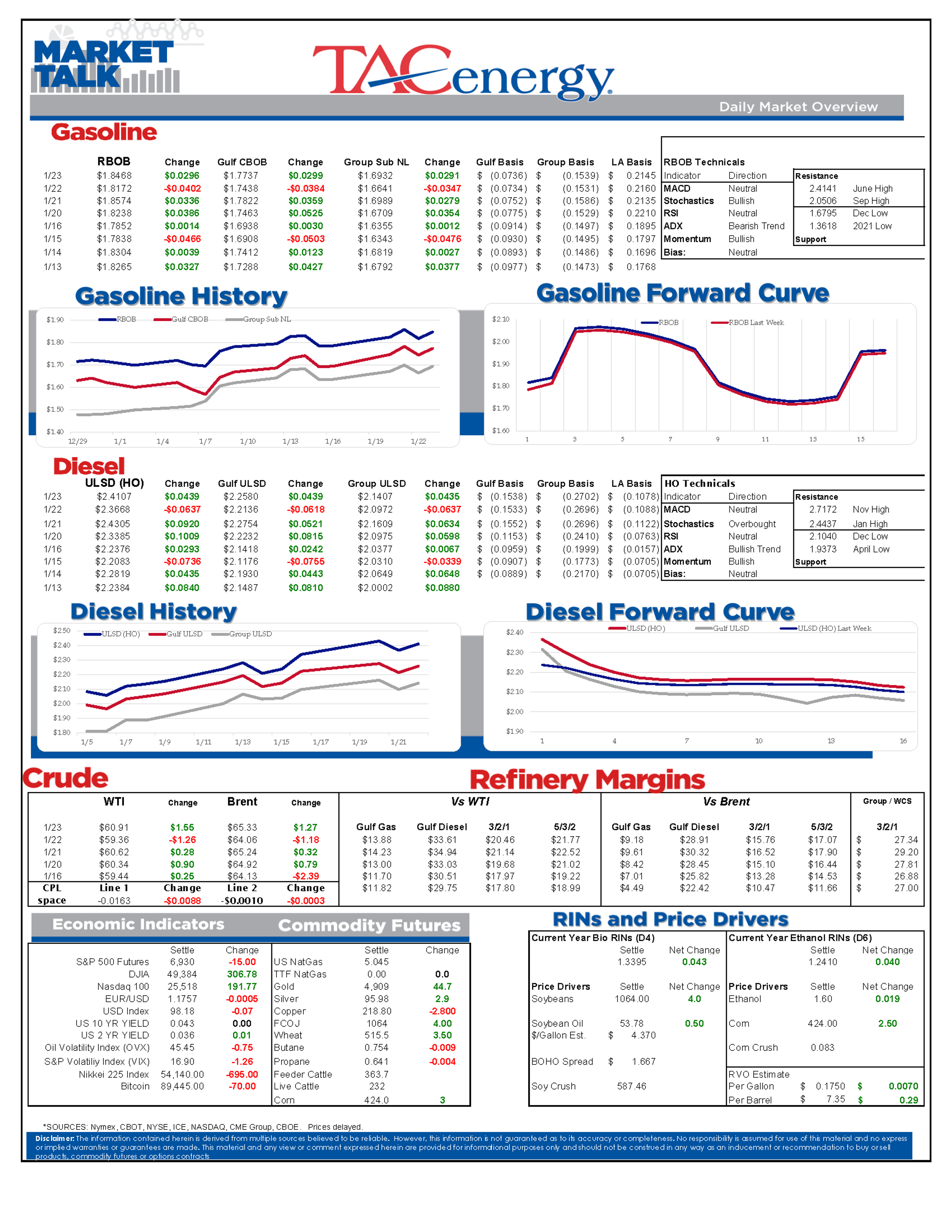

Energy markets are moving higher again Friday, after a big “Reversal Thursday” sell-off, following a very similar daily pattern to what we saw last week, albeit for very different reasons.

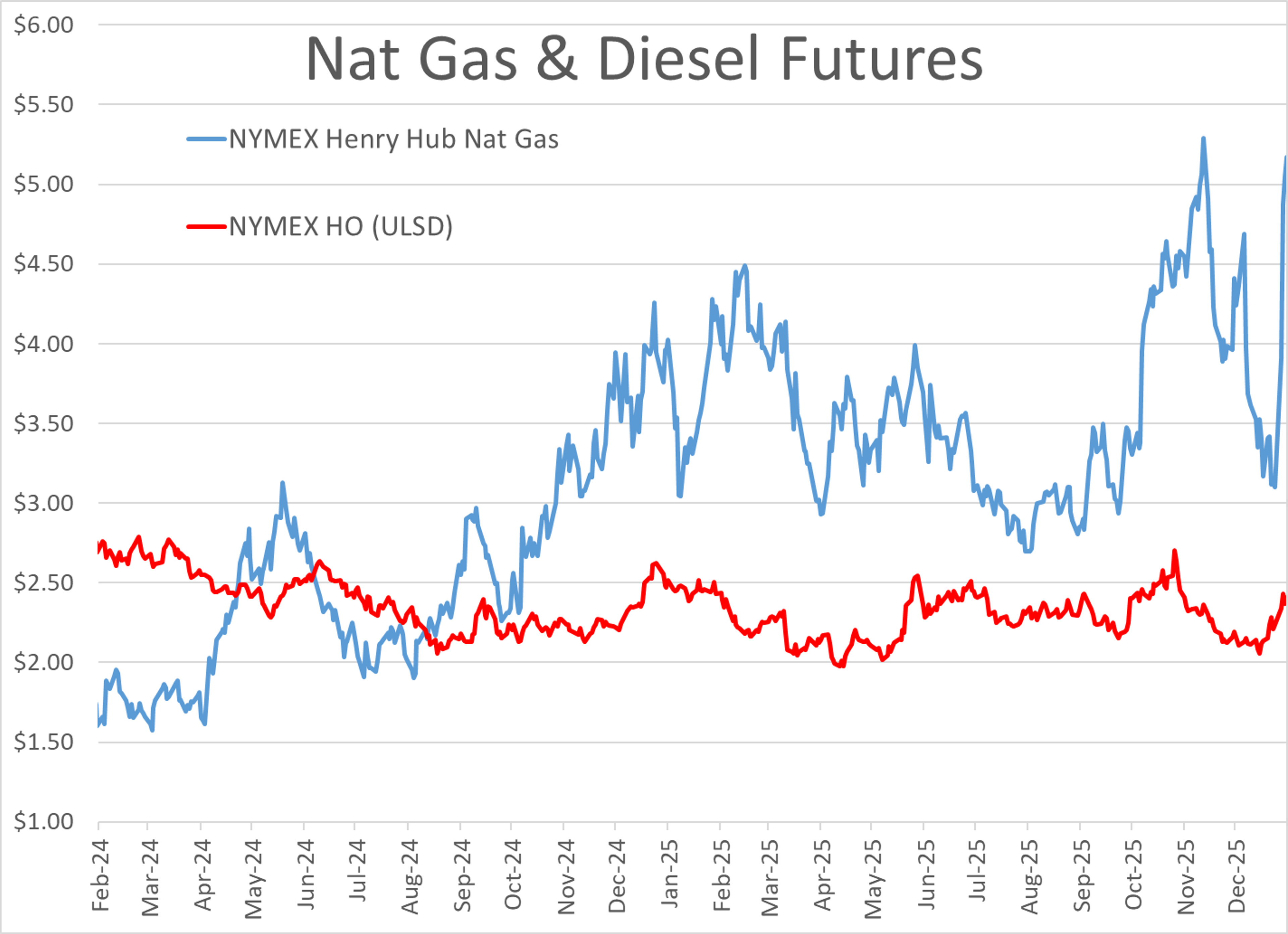

Unlike the strong rallies we saw in the front half of the week, this buying is not led by natural gas futures which have pulled back after a record-setting 82% rally from Friday’s settlement to Thursday’s high trade which marked the most expensive value since December of 2022.

The latest round of buying for petroleum contracts is getting blamed on geopolitical dustups after France and the UK combined forces to seize a Russian shadow fleet tanker in the Mediterranean Thursday, along with reports that the U.S. is sending an “Armada” of naval vessels towards Iran since they are apparently no longer needed to take over Greenland. In addition, Ukraine continues to do its part, striking multiple Russian refineries and fuel depots with drone strikes this week, while also calling out European leaders for not doing enough to stop the war.

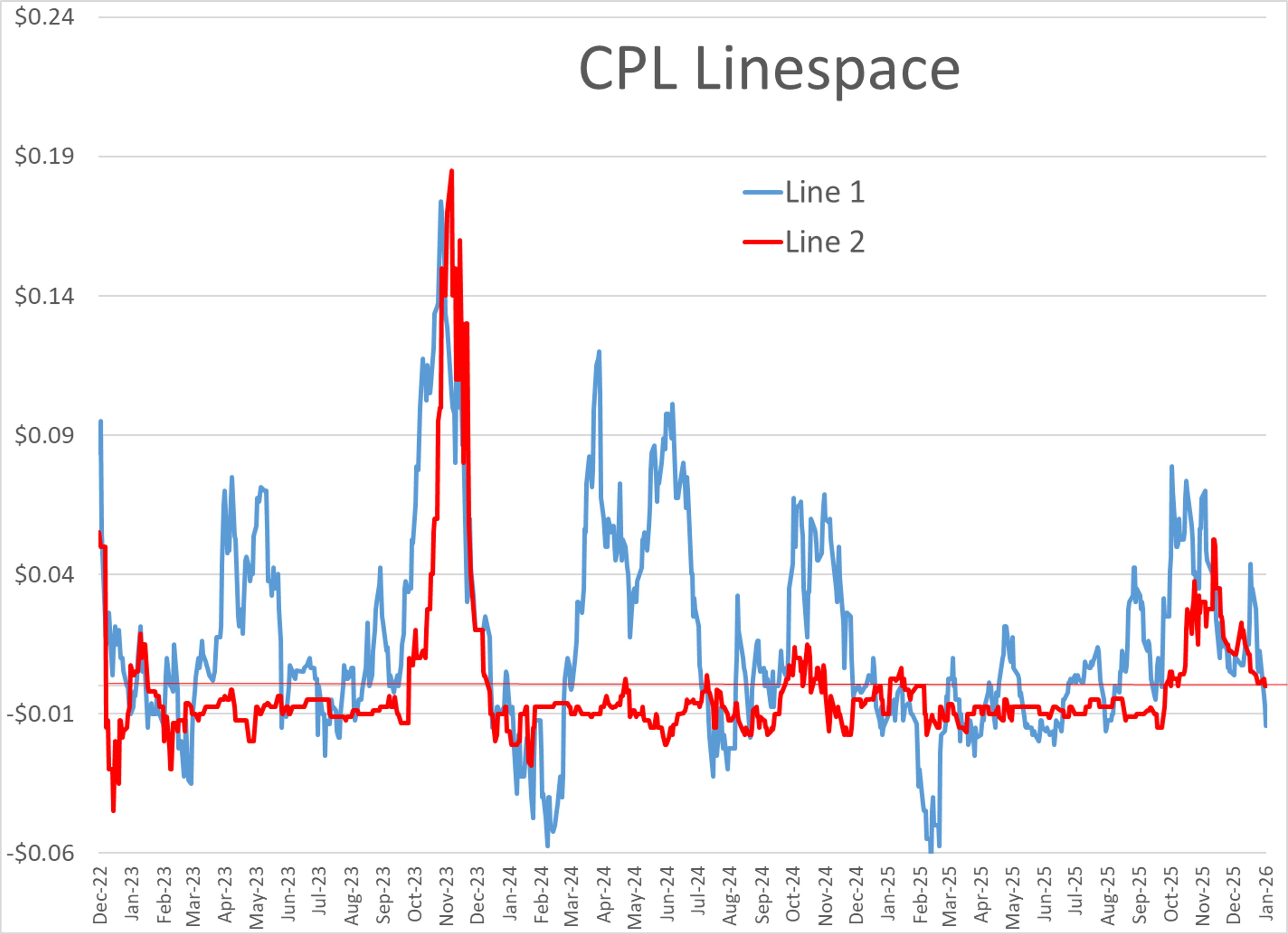

Values to ship gasoline along Colonial’s main gasoline line 1 have plummeted this week as it appears that the major refinery origin points along the Gulf Coast won’t get the ice and extended freezing temperatures expected elsewhere, meaning supply should be OK, while many of the pipeline’s delivery hubs are expected to be blanketed in ice and snow for days, which is going to kill demand.

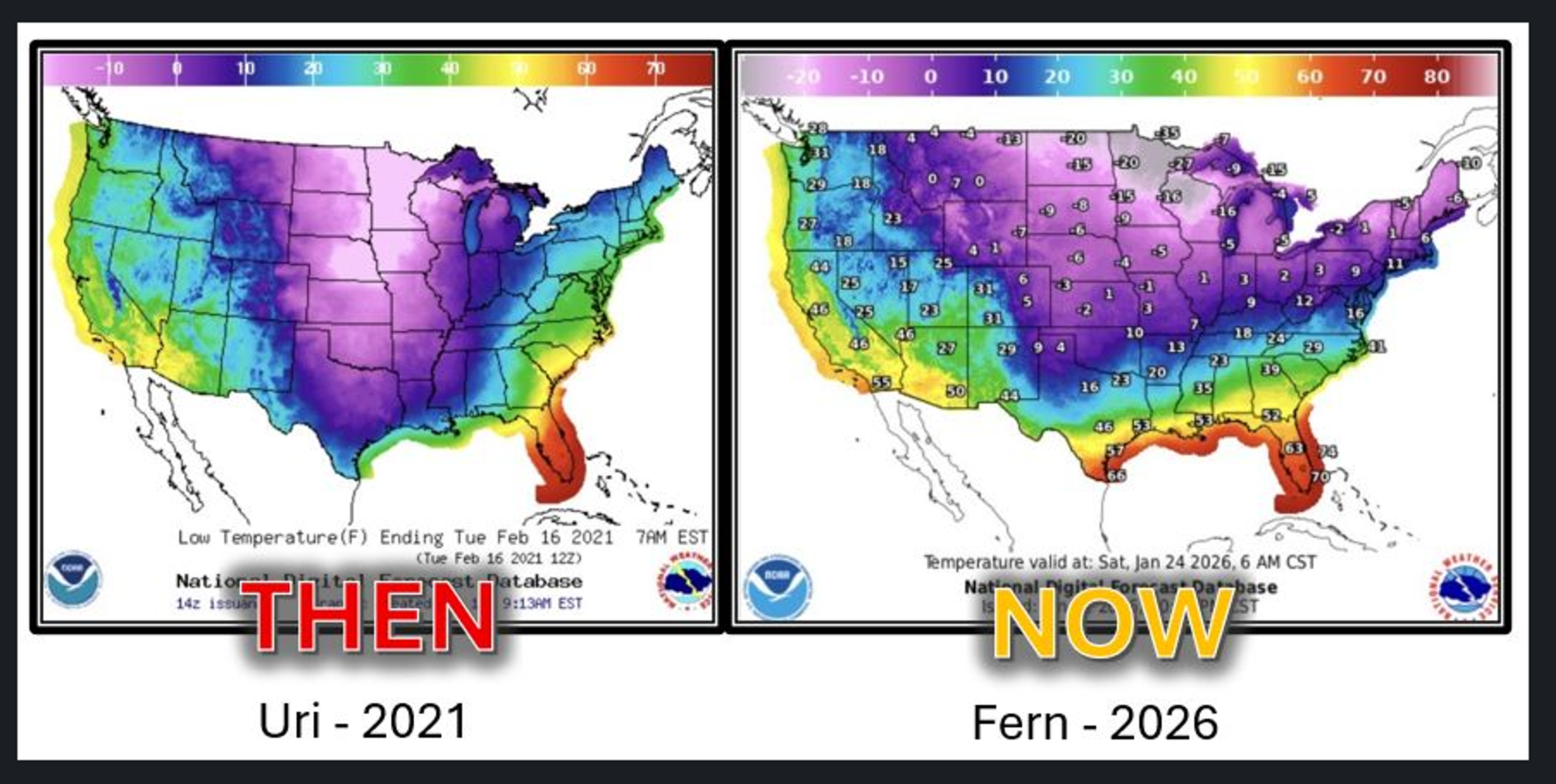

For those wanting a simple reason why this winter storm system won’t be a repeat of 2021’s disaster for the power grid and refining network, see the NOAA map comparisons below that show the difference in how far south the cold temperatures will stretch. The bad news is this system looks to be substantially worse for states in the north and east parts of the country.

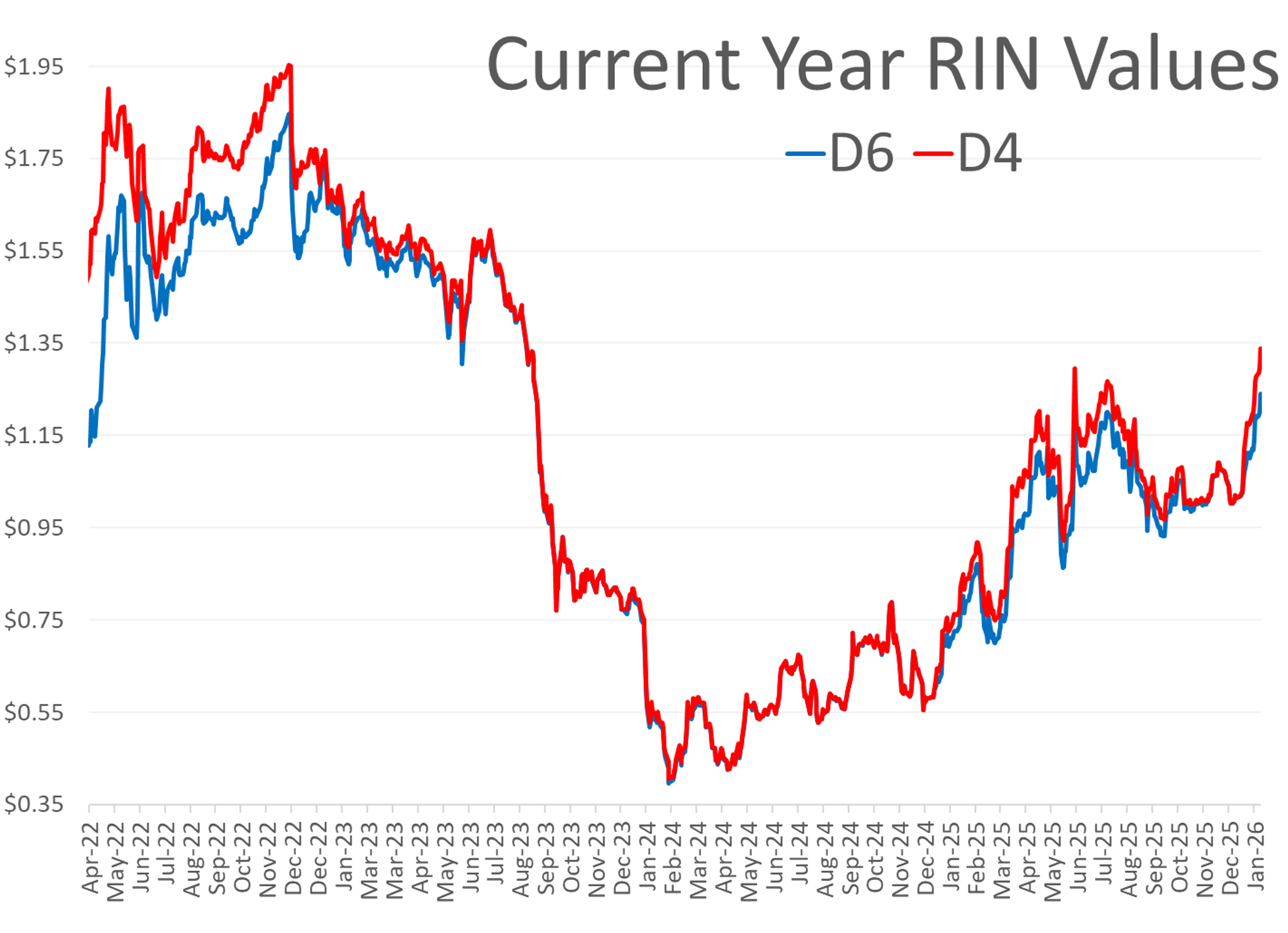

RIN values continue to reach multi-year highs this week after the compromise between the Oil and Ag lobbies to allow for year-round E15 in exchange for a standard small refinery exemption rule on the RFS failed to be included in the latest congressional spending packages approved this week.

Meanwhile, Marathon reported an upset at its 630mb/day Galveston Bay (Texas City) refinery Thursday with an FCC unit needing to be de-pressured to minimize flaring while the issue is addressed.

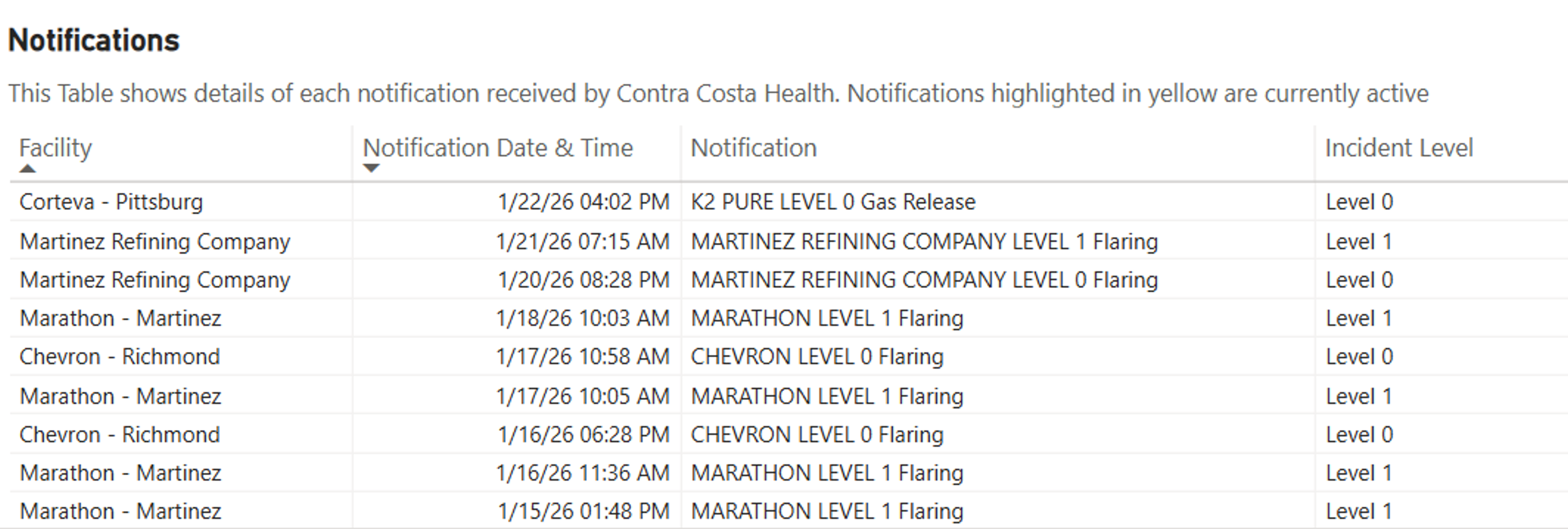

Marathon has also reported multiple flaring events at its 48mb/day Martinez CA RD refinery (which is a JV with Neste) as they undergo seasonal maintenance.

Notes from the DOE’s weekly status report.

Crude, gas, and diesel all posted builds last week as demand slid for each despite the accompanying slowdowns in production of refined products. Refinery runs pulled back heavily in PADD 3 along with declines in every other region except PADD 1, where rates have steadily ticked up to a seasonal 5-year high over the past three weeks. Even with PADD 3 having several plants working through planned maintenance and an end of January crude unit shutdown at Exxon’s Baytown refinery looming, that region and all others except the West Coast are charting seasonal 5-year highs.

Diesel inventories increased in PADDs 1-3 with the demand fall off and, as with crude, output remains above its 5-year range despite last week’s decline. PADD 3 is still propping up the total US count but healthy builds in PADDs 1 & 2 helped push overall diesel storage to within 1 million barrels of its 5-year average.

Gasoline stocks added ~6 million barrels, all of which was attributed to PADDs 1 & 2 with insignificant draws elsewhere. The 4-million-barrel increase in PADD 1 pulled inventories up to their 5-year average while the small drop in PADD 3 came off a 6-year high, pushing total U.S. gas storage to a 5-year high. While demand also retreated, gas production fell but not from elevated levels like crude and diesel. That, coupled with stock levels, helps explain why export activity remains strong. Speaking of exports, ethanol shot up 99 thousand barrels per day week over week, along with a drop in output and increased stock levels, suggesting strong demand internationally.

Latest Posts

Week 3 - US DOE Inventory Recap

Rally Stalls As Winter Weather Reshapes Fuel Demand And Refinery Operations

Fuel Markets Spike Ahead Of Major US Winter Storm

Diesel Futures Surge As Arctic Cold Fuels Sharp Rally

Holiday Session Starts Mixed As ULSD Leads, Markets Quiet

Diesel Futures Rebound As RIN Prices Surge Despite Rising Supply

Social Media

News & Views

View All

Week 3 - US DOE Inventory Recap

Rally Stalls As Winter Weather Reshapes Fuel Demand And Refinery Operations