Energy Markets Retreat As Supply Fears Ease, Eyes On Moscow Talks

Energy markets are giving back most of Monday’s gains early in Tuesday’s trading session as the supply concerns from weekend drone attacks seem to be easing, and traders await news from U.S./Russian negotiations in Moscow.

The CPC oil export facility has resumed operations at one of its 3 offshore mooring points following Ukraine’s naval drone attacks on the facility over the weekend. That facility typically processes more than 1.4 million barrels of oil/day.

Ukraine’s drones continued their record-setting pace of attacks on Russian refineries, striking a small refinery and oil depot in the Oryol region overnight. Details on the facility are scarce, but some reports that the facility had already been reduced following previous attacks earlier in the year.

OPEC & Friends agreed to hold their output targets steady for the first quarter of 2026 in their Sunday meeting as the cartel moves into wait and see mode with record amounts of oil stored on the water as shippers try to navigate the latest sanctions on Russian and Iranian supplies. Perhaps most notable within the press release was that the group has come up with a new way to measure countries’ maximum sustainable production capacity (MSC) that will be used for its production targets starting in 2027. A Reuters article this morning suggests this new accounting method will spark a wave of investment in several producing countries who will want to maximize their MSC since each country in the cartel will have the same percentage set as their production target.

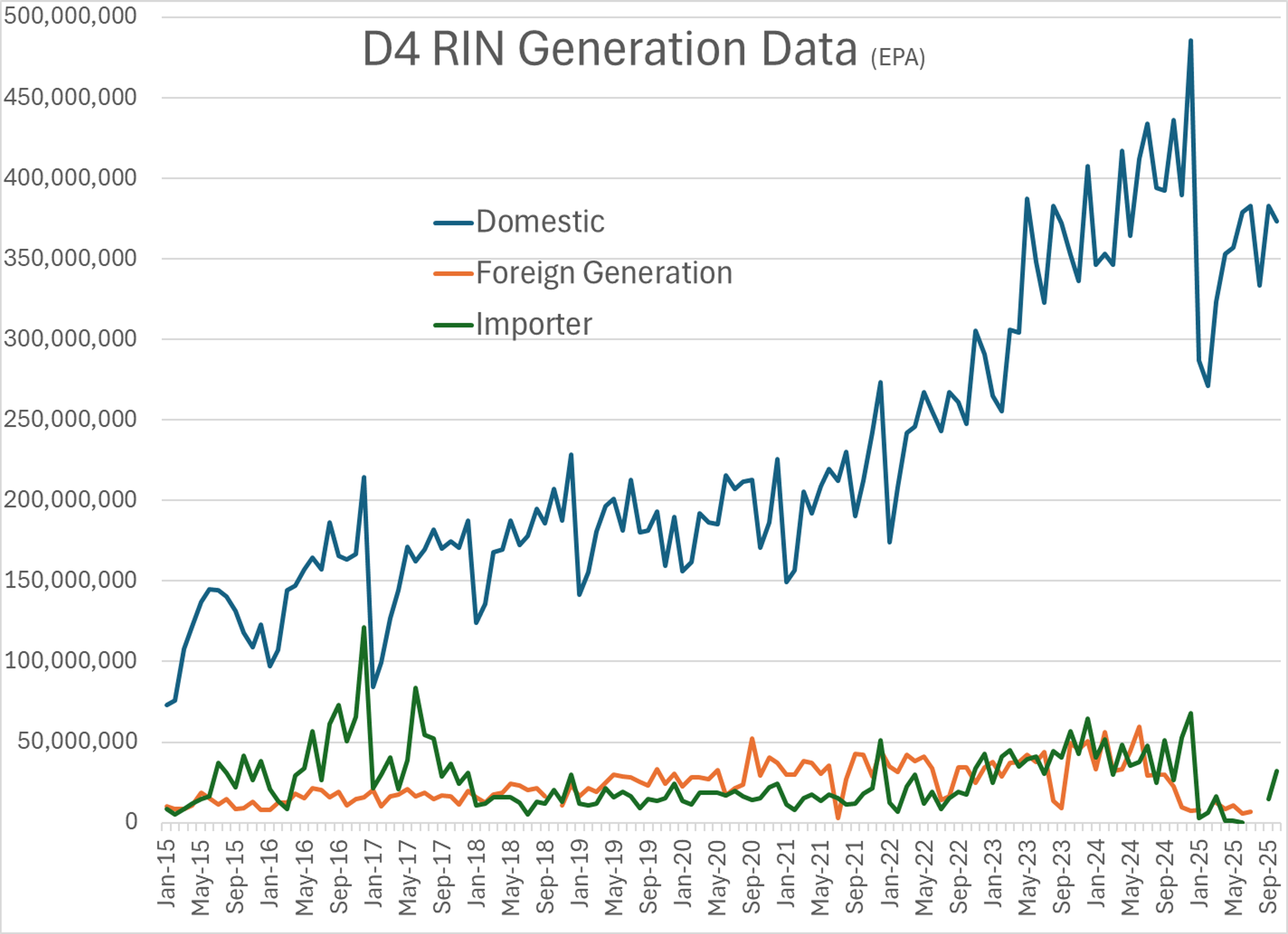

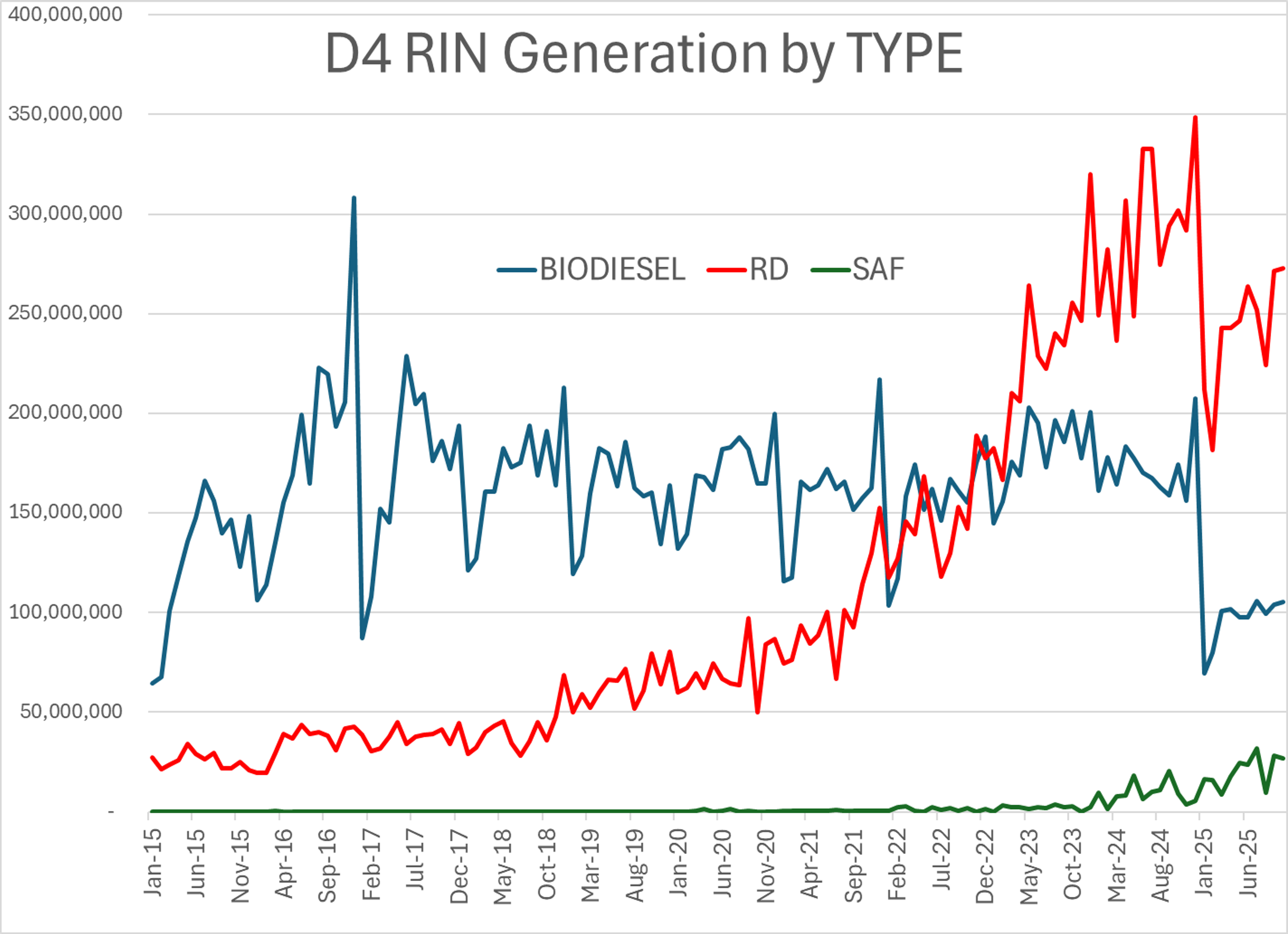

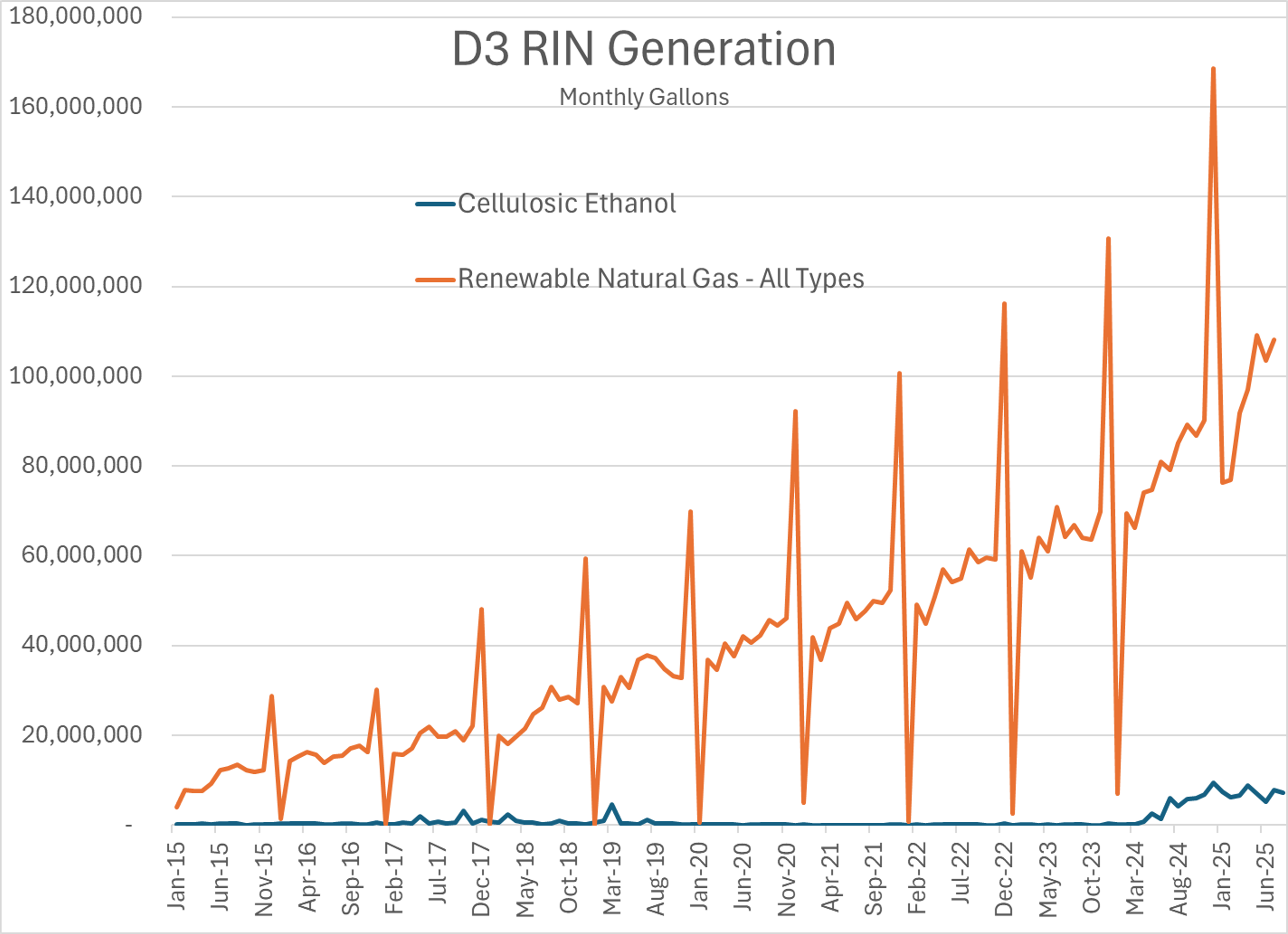

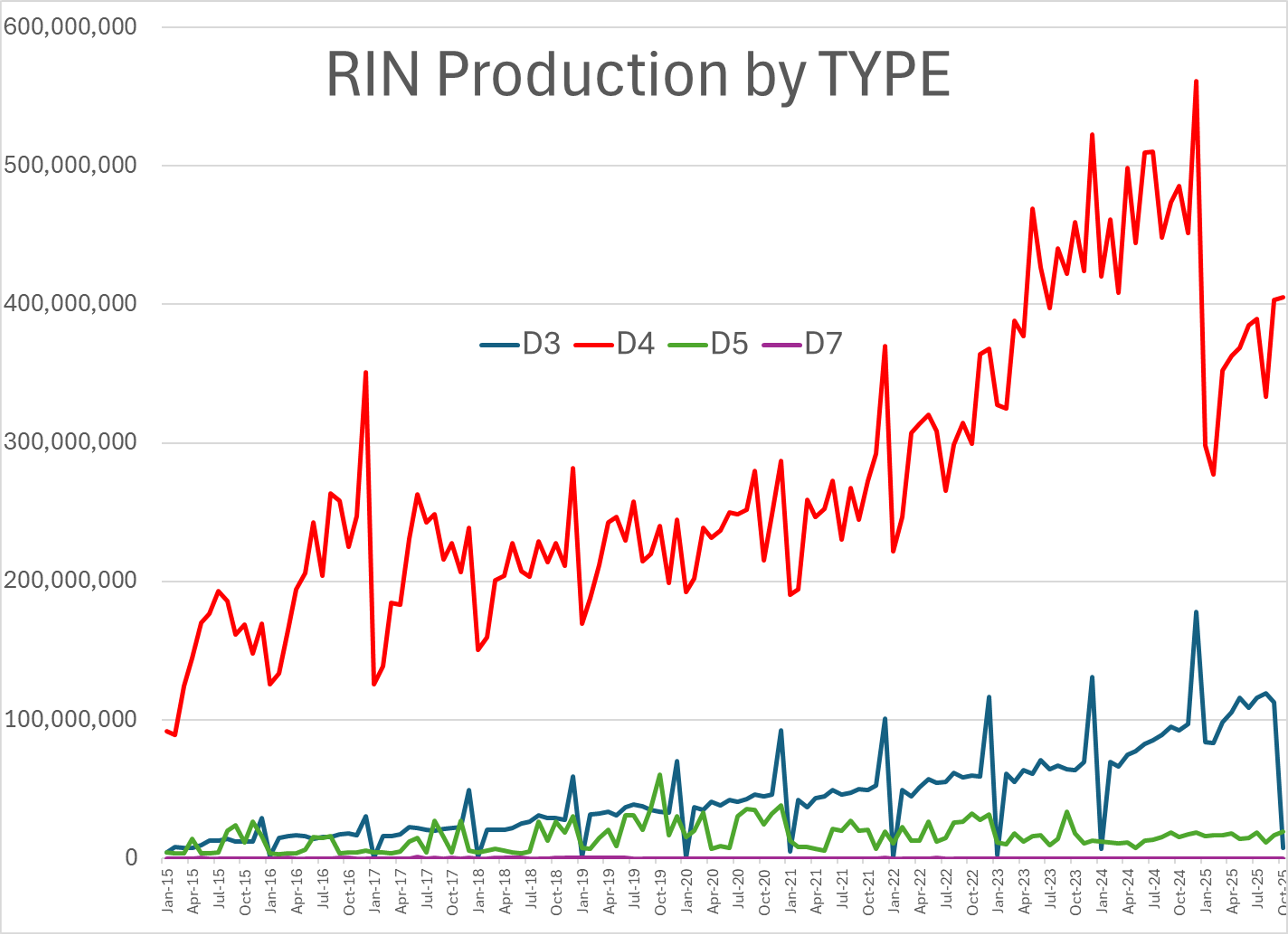

The RIN generation data through October was published by the EPA last week and showed a healthy increase of 4% for D6 (traditional ethanol) and 15% for D5 (advanced biofuel) RINs. Renewable Diesel imports helped offset lower domestic production to push the D4 (bio/RD) RIN generation to a modest gain. The increased supply of RINs hasn’t stopped the latest rally in RIN prices with D6 values reaching a 3 month high north of $1.06/RIN on Monday.

Latest Posts

Energy Markets At A Crossroads: Volatility Surges As Hormuz Shutdown Unfolds

Energy Markets On Edge As US–Iran Dynamics Shift Again

Energy Markets At An Inflection Point: Prices Fall As Policy Pressure Builds

Week 8 - US DOE Inventory Recap

Crude Holds Firm Despite Bearish Inventory Data As Product Markets Tighten

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Social Media

News & Views

View All

Energy Markets At A Crossroads: Volatility Surges As Hormuz Shutdown Unfolds

Energy Markets On Edge As US–Iran Dynamics Shift Again