Energy Markets Mixed With Gasoline And Crude Oil Clinging To Small Gains While Diesel Tracks Lower

It’s a mixed bag for energy markets to start the week with diesel prices moving lower after Friday’s 10 cent reversal lower after hitting a 4 month high, while gasoline and crude oil prices are trying to cling to small gains. Equity markets are pointing higher as optimism for an end to the government shutdown is starting to appear, although it may already be too late to prevent a Thanksgiving travel nightmare.

Besides the big reversal lower in ULSD futures on Friday, the big market moving news came from the LA spot market that saw CARBOB gasoline differentials start their return to earth with a 30 cent drop. LA Spot values are still the most expensive in the country by a wide margin, but now that the corner has been turned, we typically see those values continue to descend rapidly. A surge in imports over the coming weeks is expected as the region shifts to winter gasoline grades, and vessels booked to take advantage of the open arbitrage window when prices spiked should start to arrive.

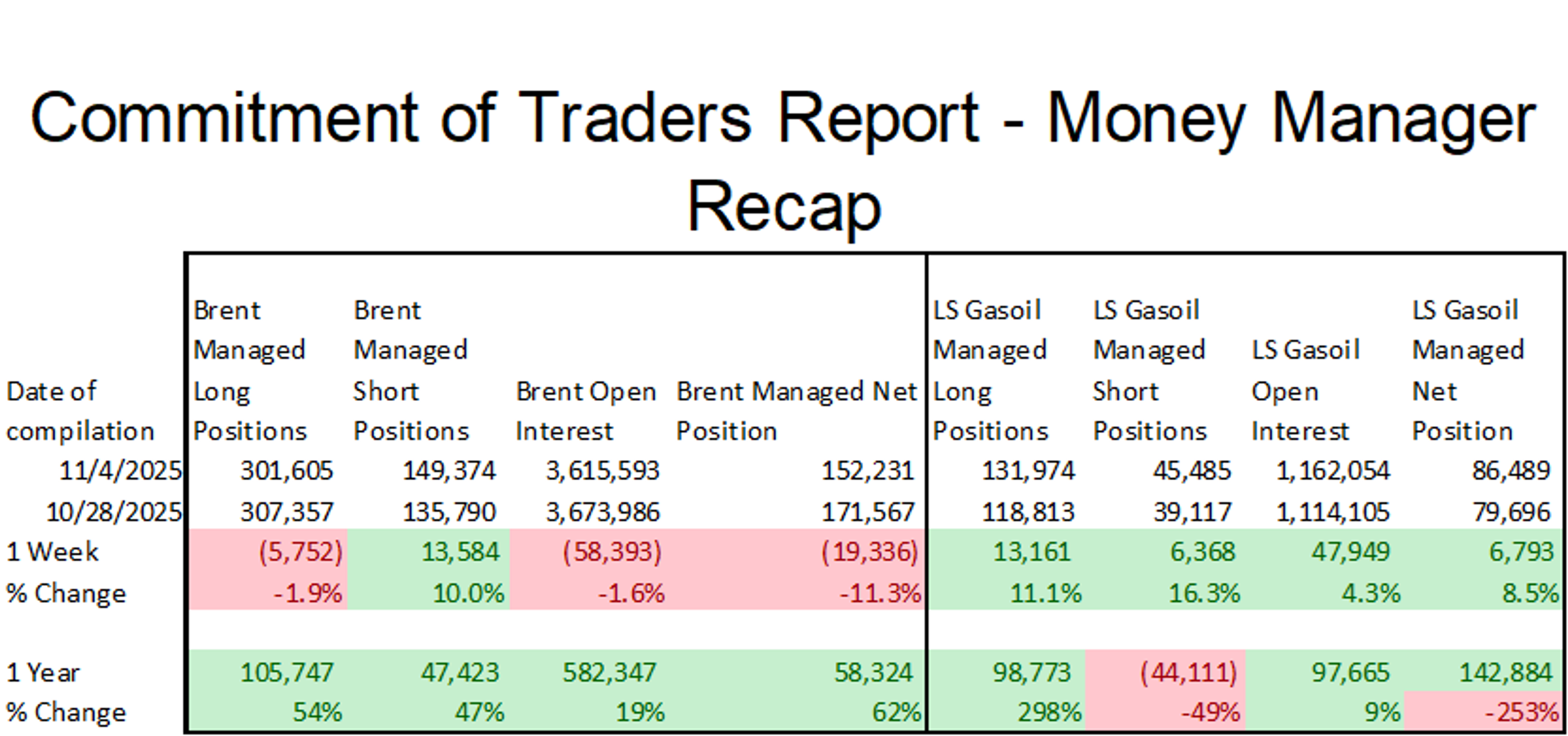

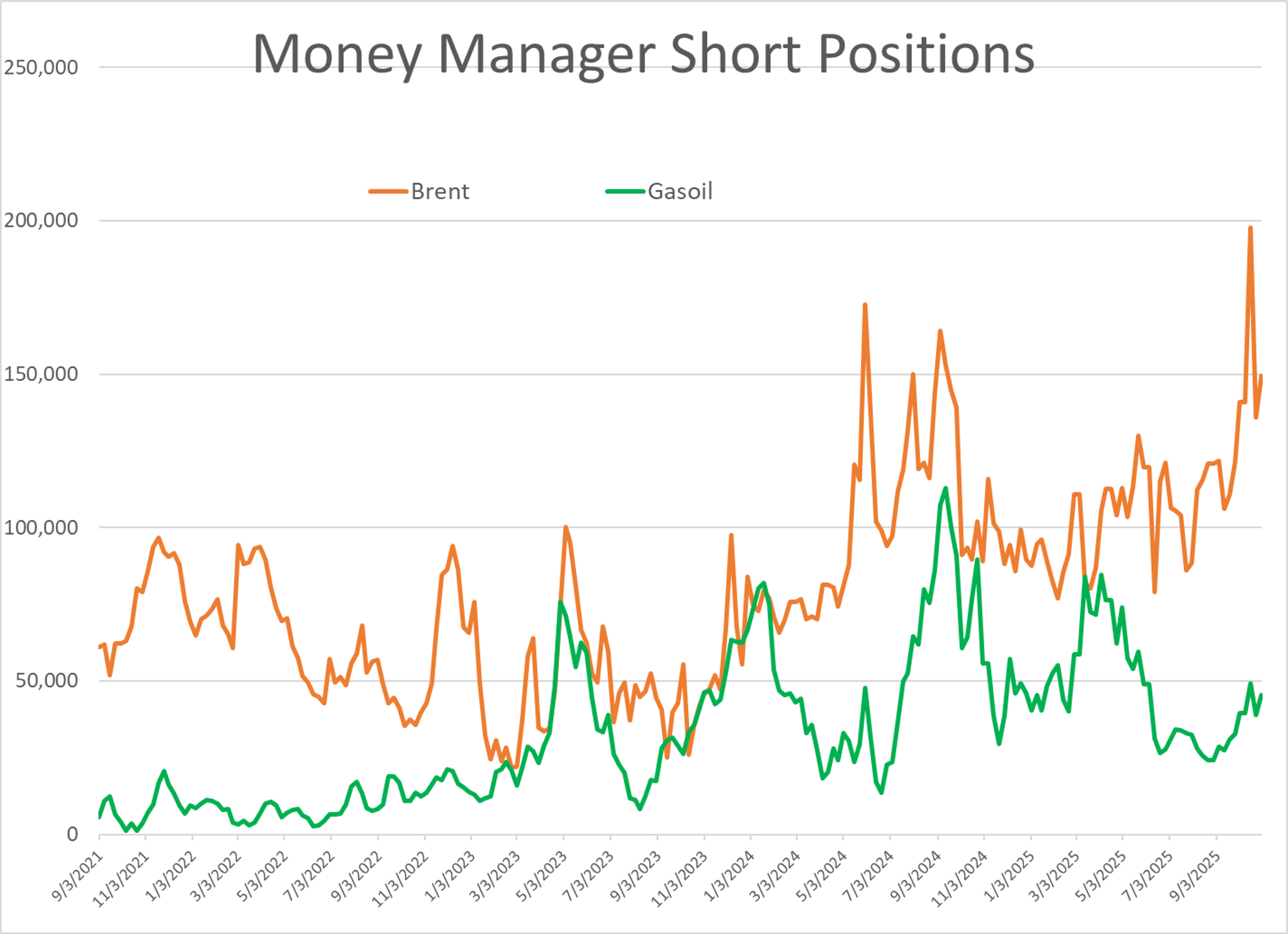

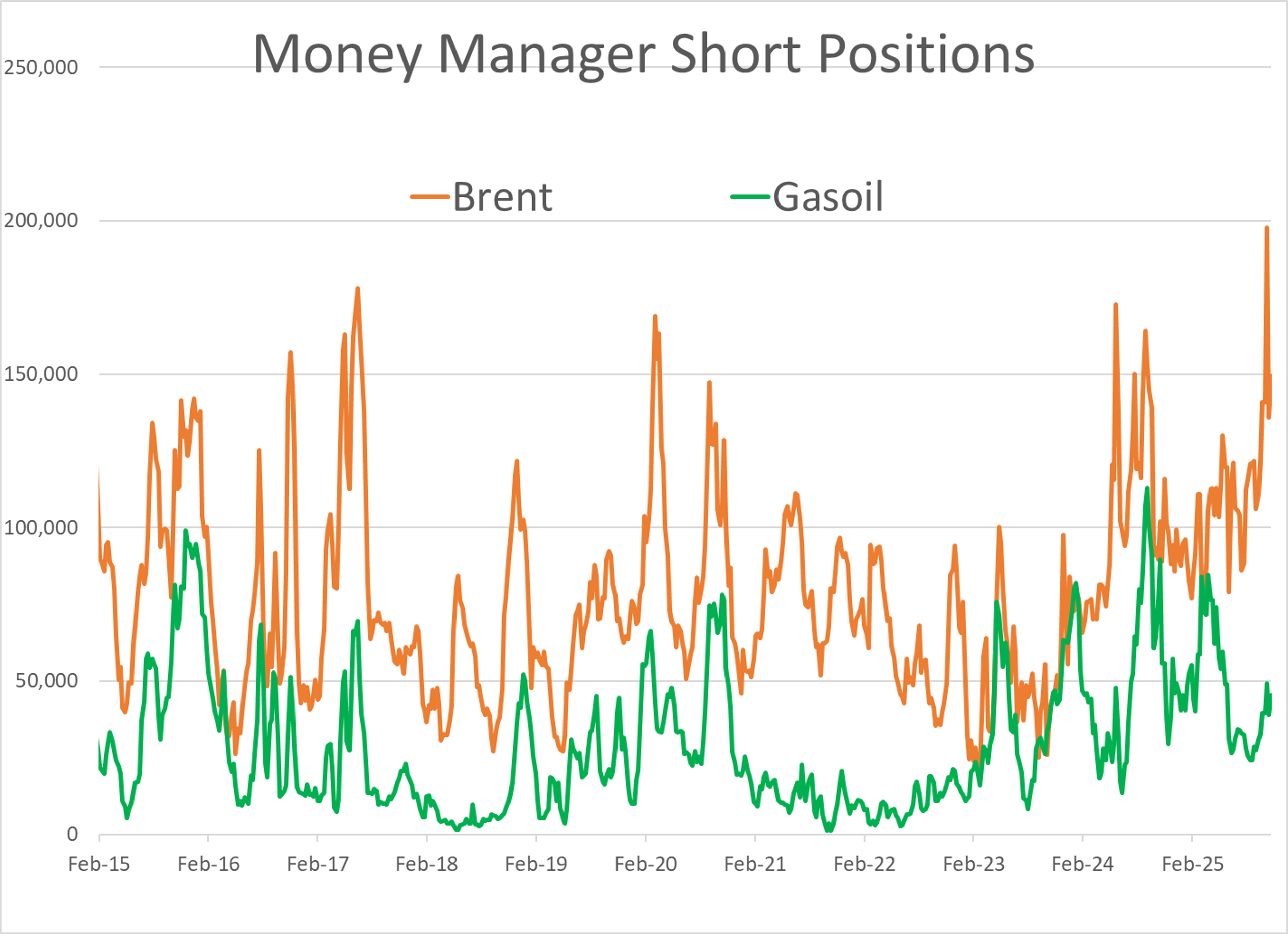

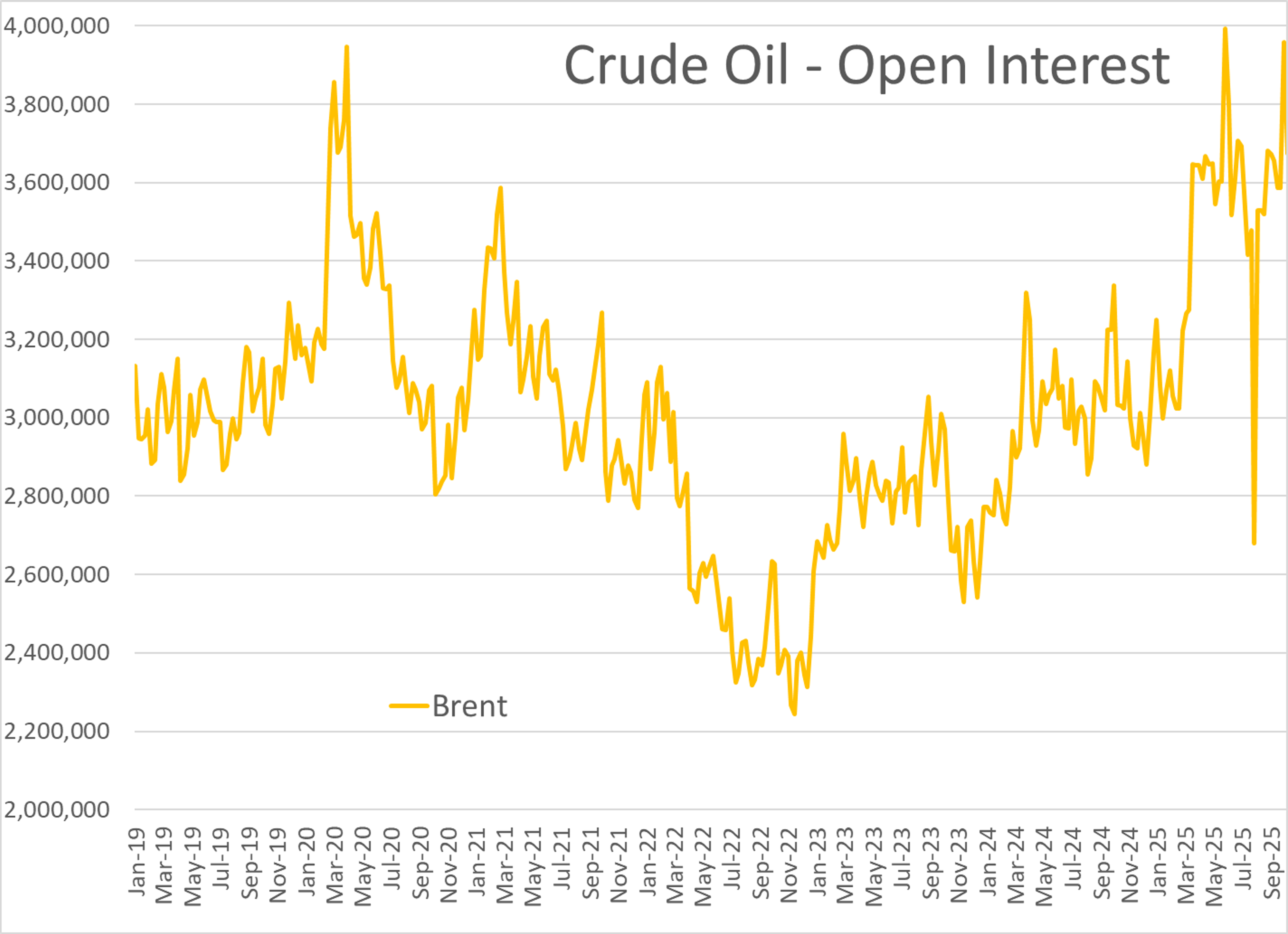

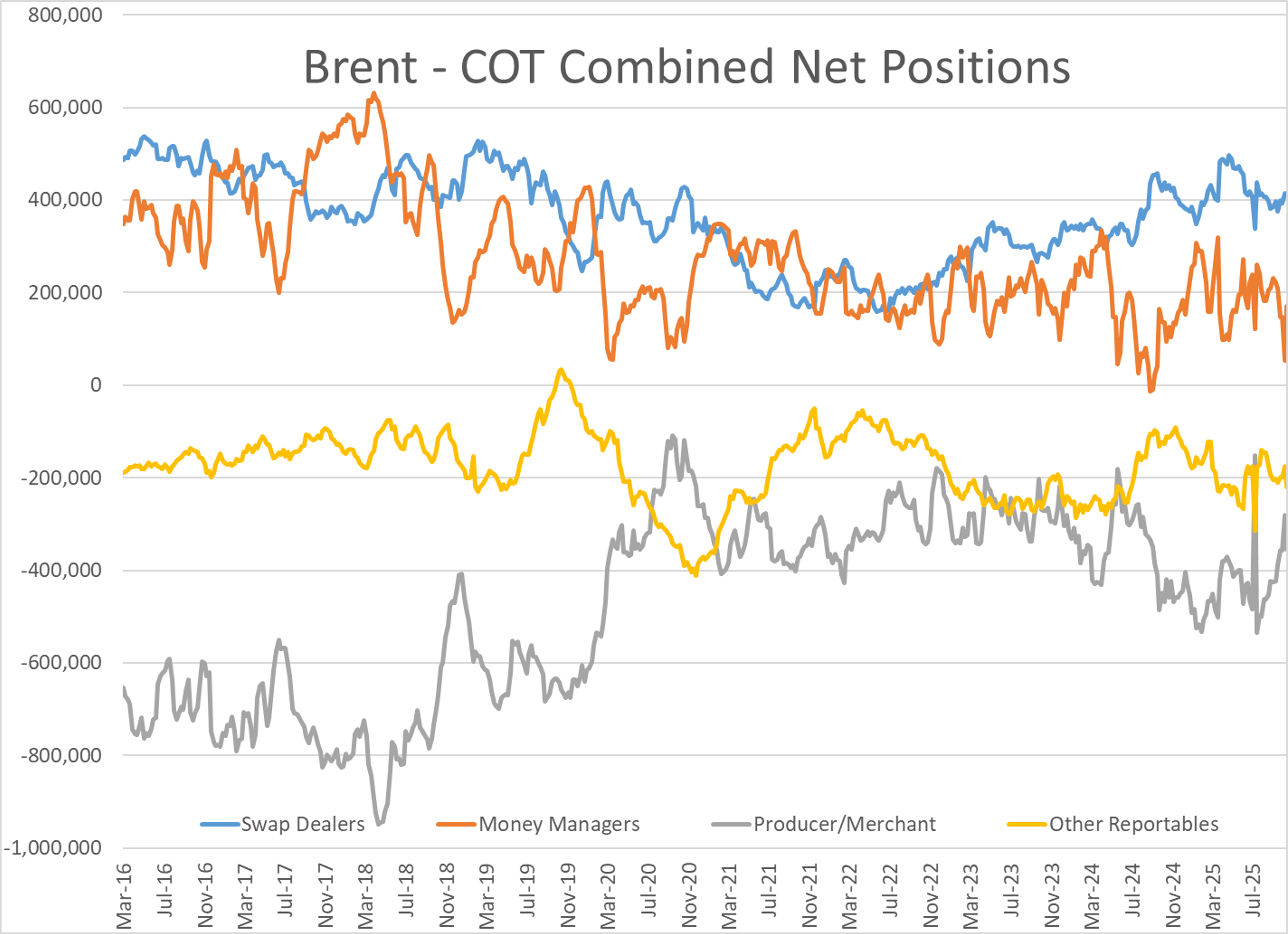

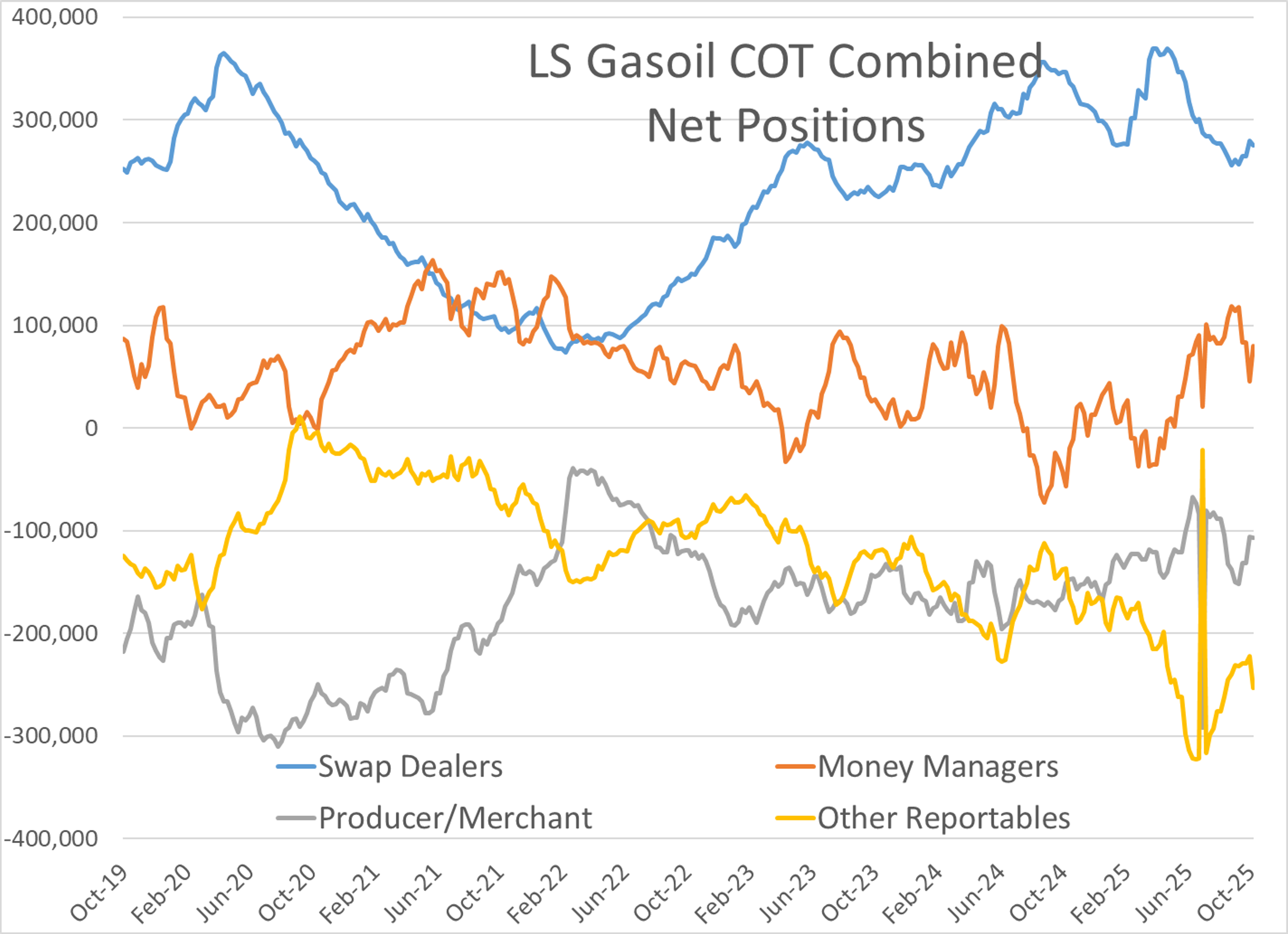

We missed a 6th consecutive CFTC commitments of traders report Friday as the government shutdown grinds on. The ICE data released Friday showed a mixed bag for speculators who were run over in the prior 2 weeks leading to a record amount of short covering in Brent crude oil to end October. November’s early positioning showed a small decrease in speculative length in Brent contracts, with a combination of long liquidation and new shorts. European diesel saw another build in speculative length betting on higher prices as we enter the winter months with numerous questions about diesel supplies with the refining loophole on Russian sanctions coming under pressure this year.

In addition to the pressure on Russian-related refiners, Lukoil announced it was declaring Force Majeure on its Iraqi oil exports as the latest round of sanctions actually seems to be having its intended impact, unlike the dozens of other half-hearted attempts over the past 3.5 years. It appears that the Iraqi Oil companies may still be able to find other buyers for the oil coming from the Lukoil field which is currently producing close to ½ million barrels/day so it may not have widespread impact on supply as much as the parties to the transactions.

The U.S. still is not tightening the screws as much as it could, as the White House announced it was granting Hungary an exemption to the Russian sanctions on Friday. Hungary is particularly exposed given its logistical restrictions and the fact that its largest refinery was apparently sabotaged last month and will be operating at half rates for months as a result.

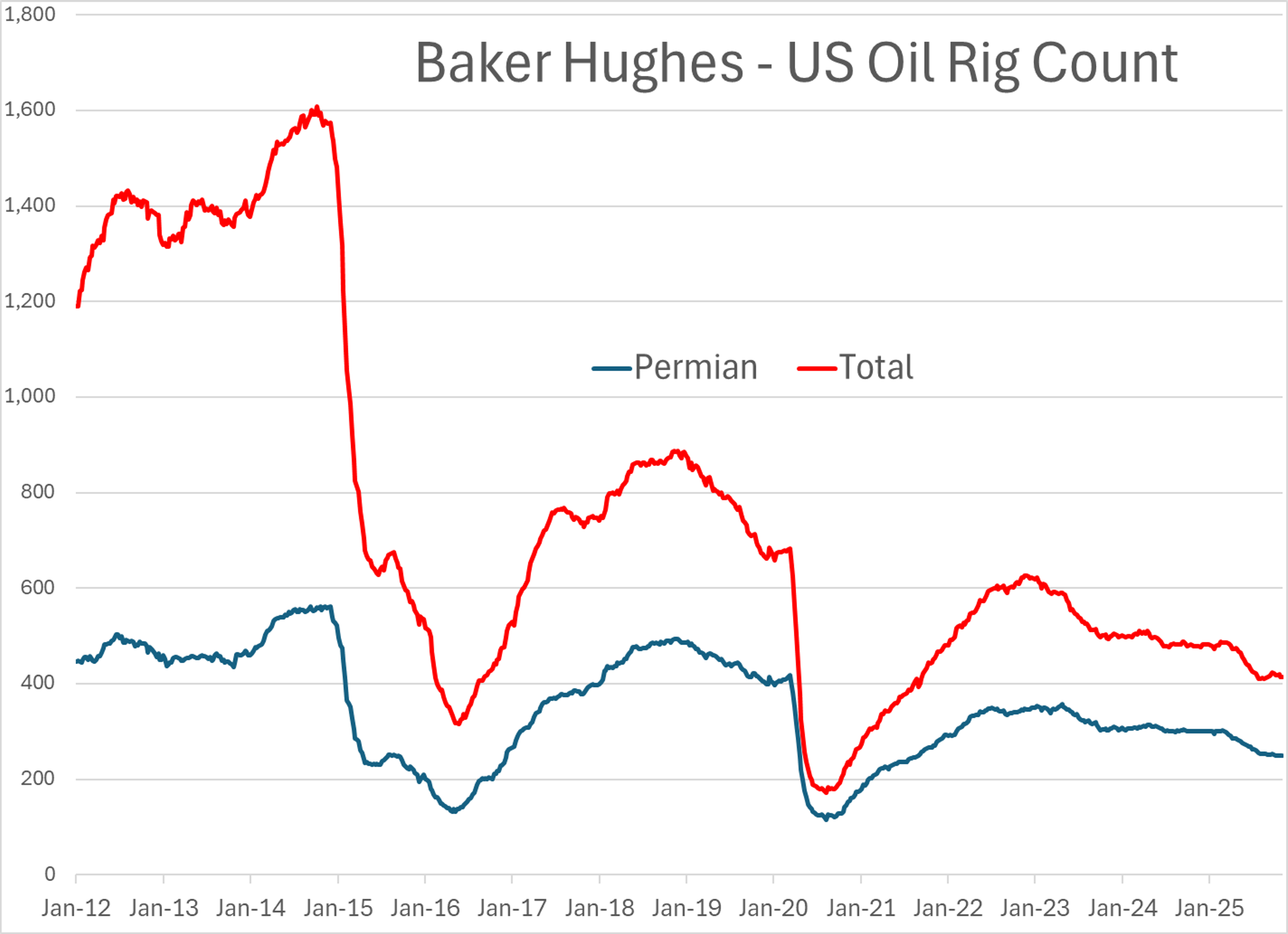

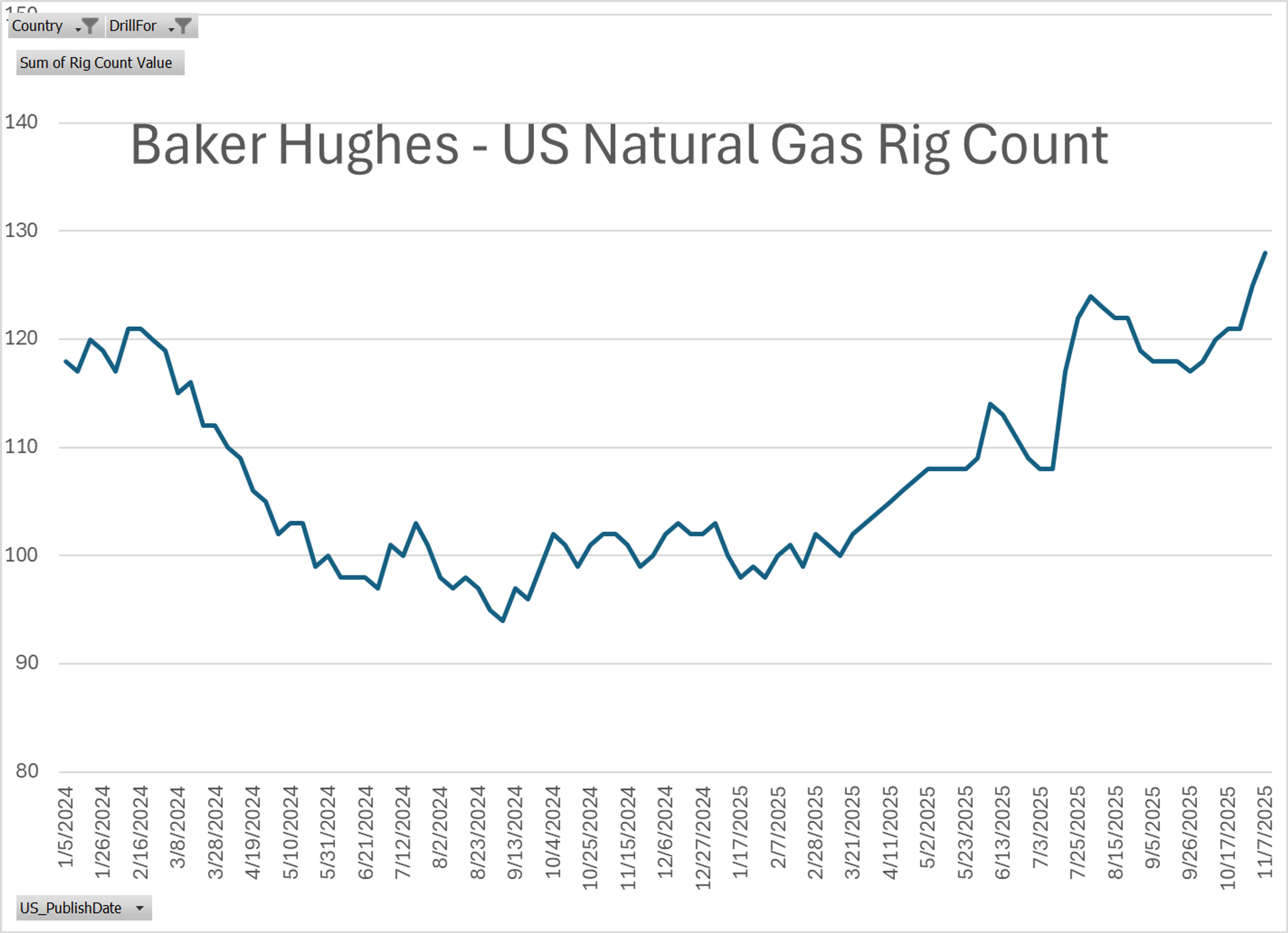

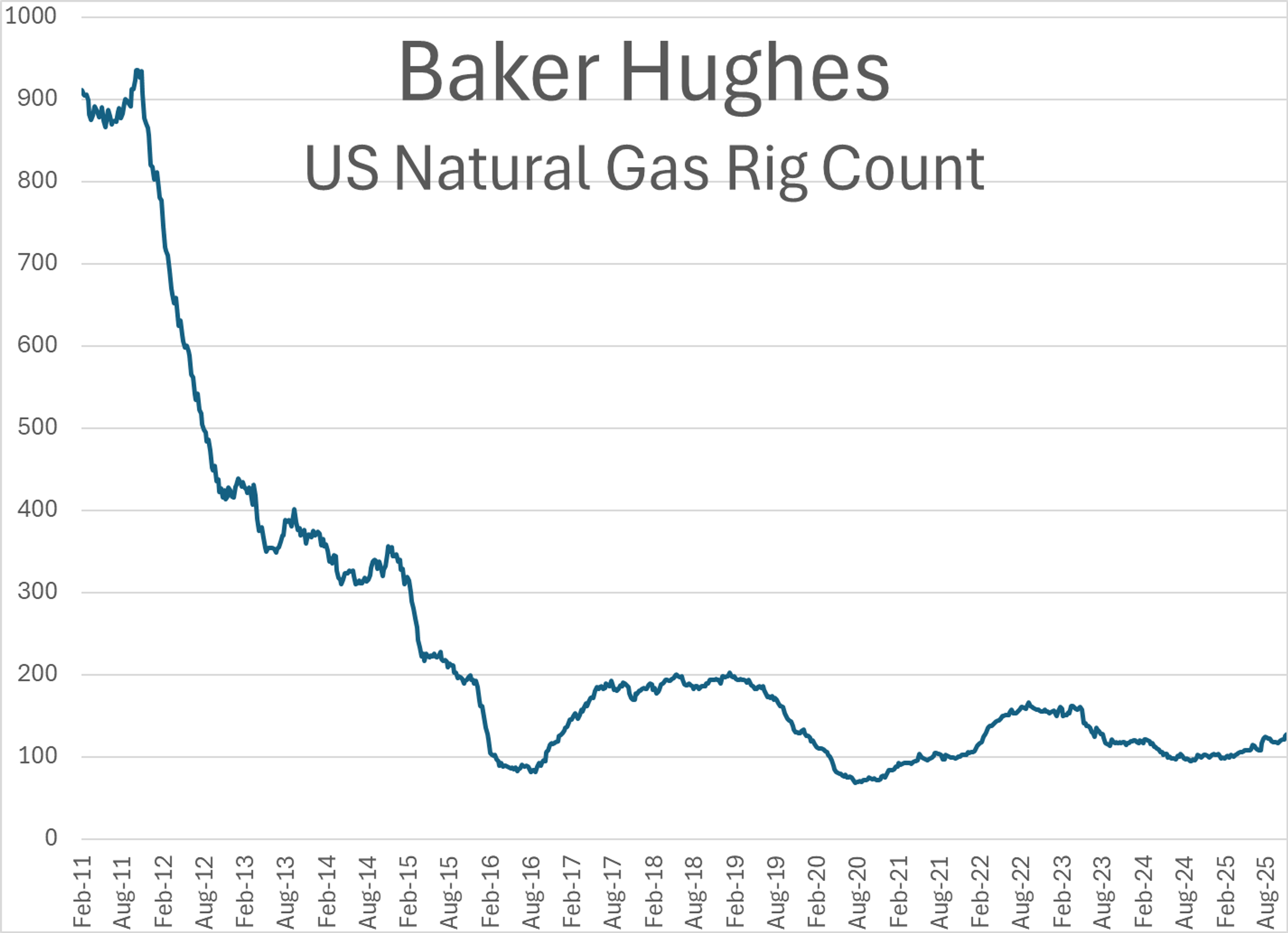

Baker Hughes reported the U.S. Oil Rig count held steady last week at 414 active drilling rigs, while natural gas rigs increased by 3 to 128, which is the highest level since August 2023.

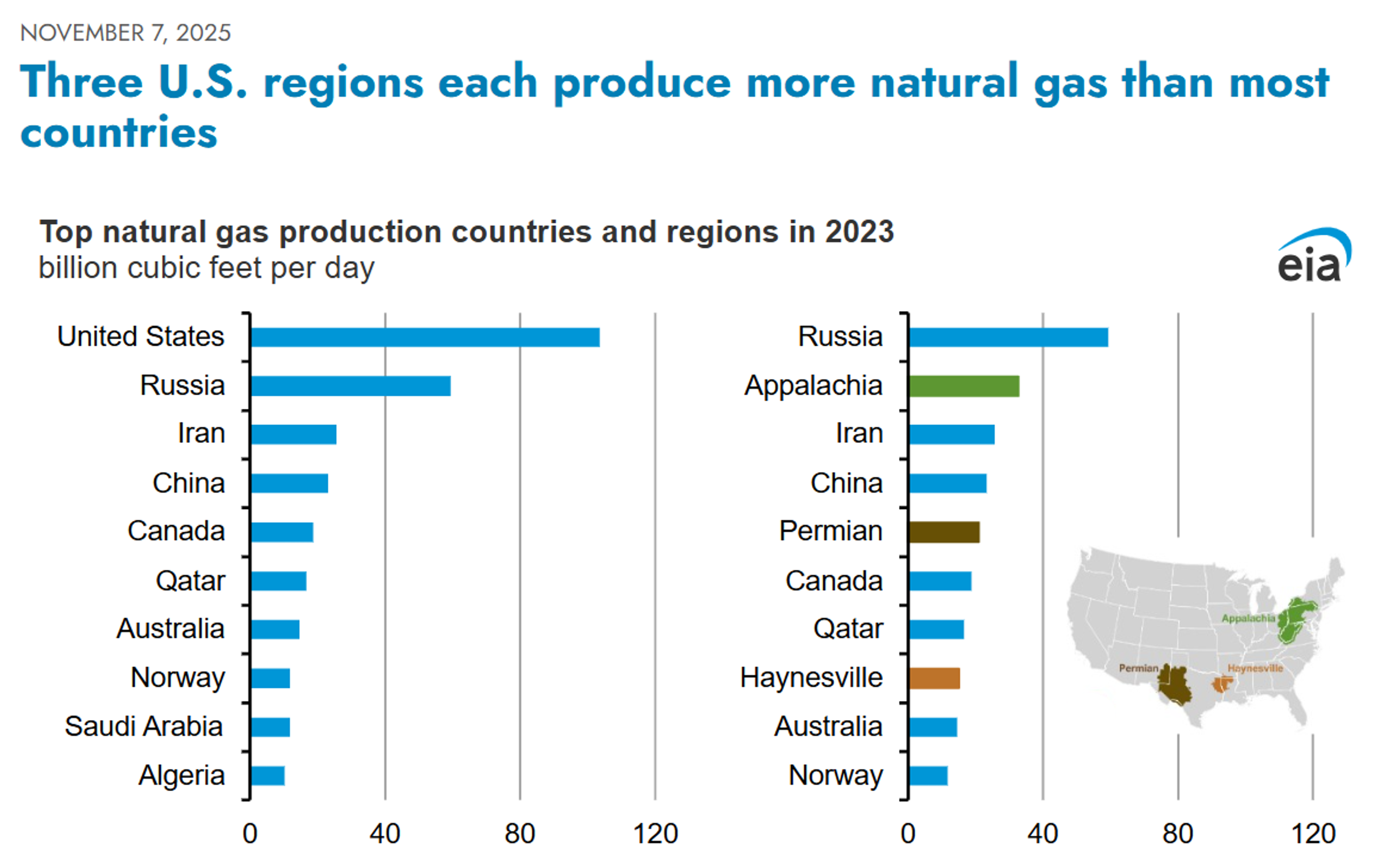

While the natural gas rig count is still just a fraction of what it was a decade ago, there is becoming a louder argument that more production is needed to meet the increased demand coming from the rapid growth in LNG export capacity and electricity demand from data centers, so continued increases in that rig count may be coming. One interesting note from RBN last week highlights how U.S. producers are having to juggle an excess of propane supply that’s a byproduct of oil and gas production, even while natural gas is becoming more scarce. The EIA on Friday published a look at the 3 regions that dominate gas production in the U.S..

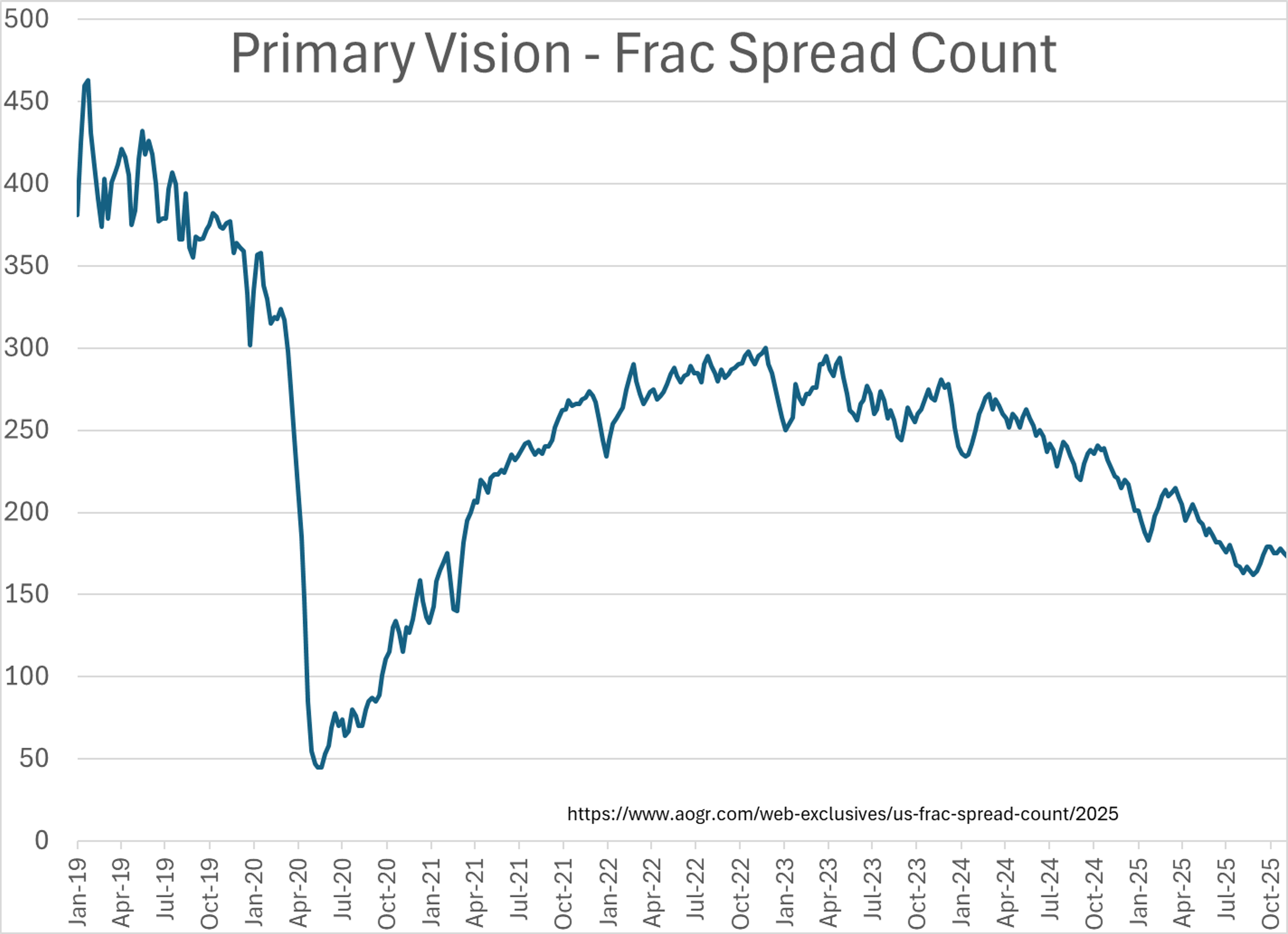

The Primary Vision count of fracking crews active in the U.S. dropped by 2 on the week to 173.

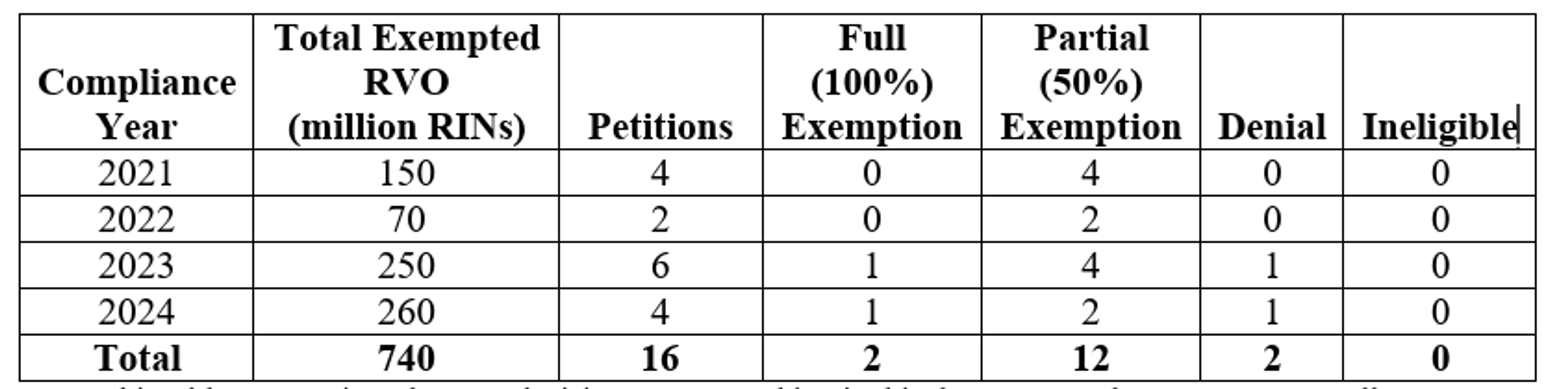

The EPA announced its latest Small Refinery Exemption decisions Friday for 16 positions ranging from 2021-2024. The Agency approved 2, denied 2 and gave 50% approval to 12 of the petitions, which covers 8 different facilities. In total, 740 million RINs were exempted in this round over the 4 year time frame. RINs were little moved by the update, which is just a fraction of the waivers granted in September that resulted in several refiners booking hundreds of millions of dollars in gains in their Q3 earnings.

The FED released its annual financial stability report Friday. The report highlighted that demand for higher-risk assets has bounced back since the tariff-chaos in April, which helped liquidity to improve in treasury and equity markets. The report also noted that household and business debt vs GDP was stable near 20 year lows, but hedge fund leverage remained high, which is supporting significant positions in key markets.

Total reported an upset in a coker unit at its 238mb/day Port Arthur refinery over the weekend after a transformer failed, causing 3 hours of flaring.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets