Diesel At 4 Month High, Gas Futures Steady, Disruption In Supply Due To Unplanned Refinery Upsets

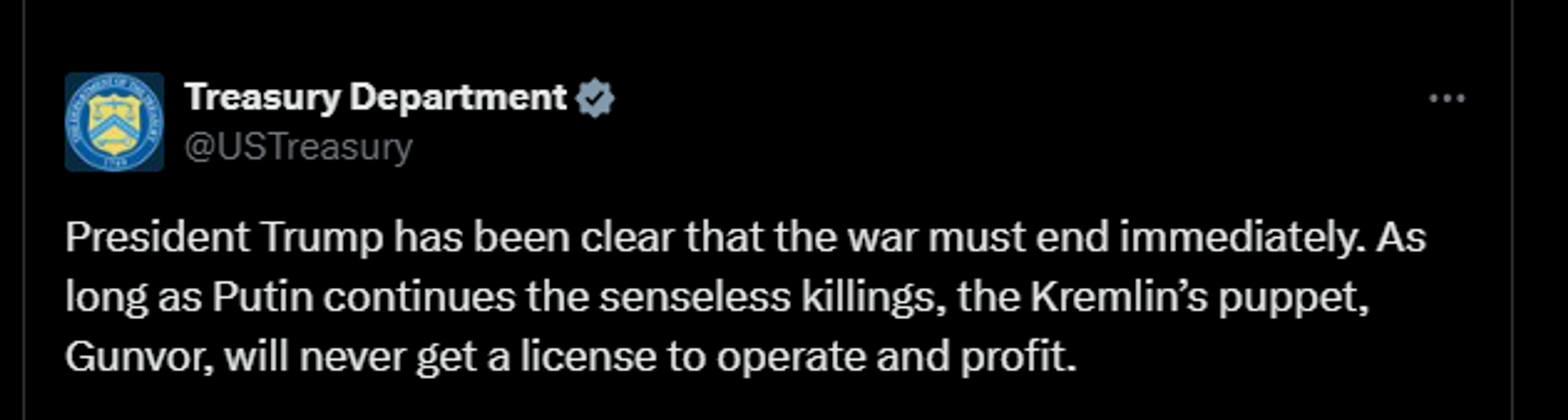

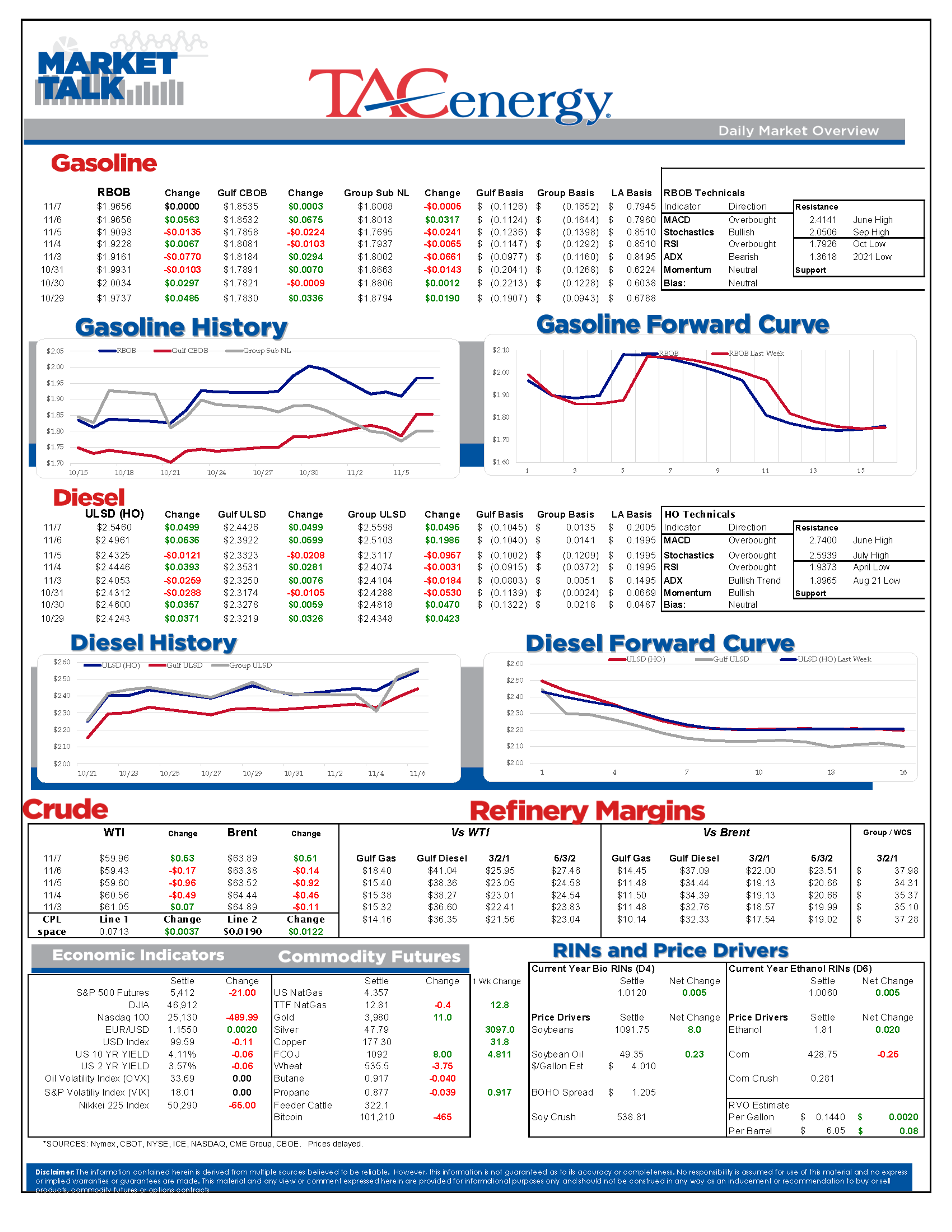

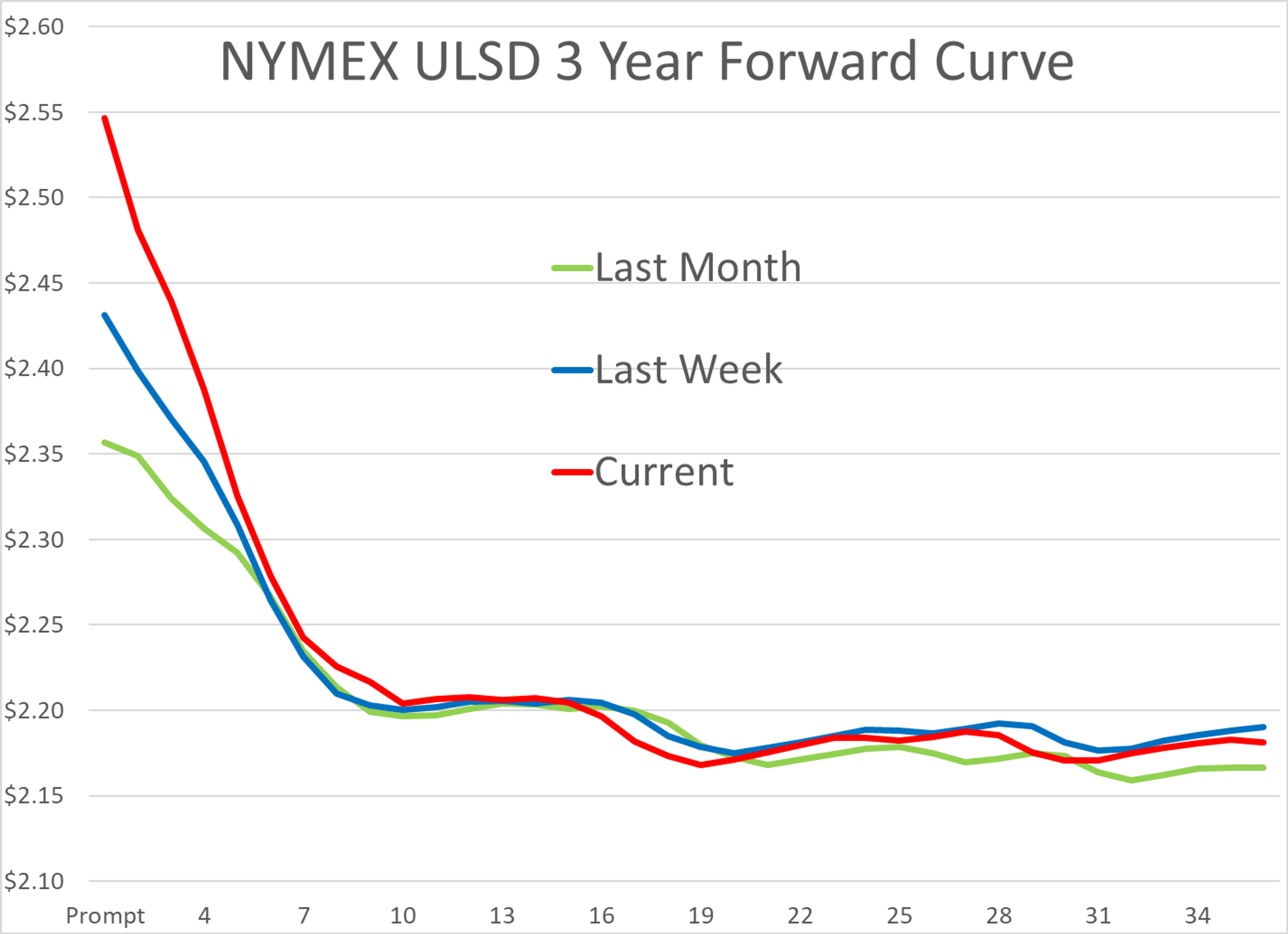

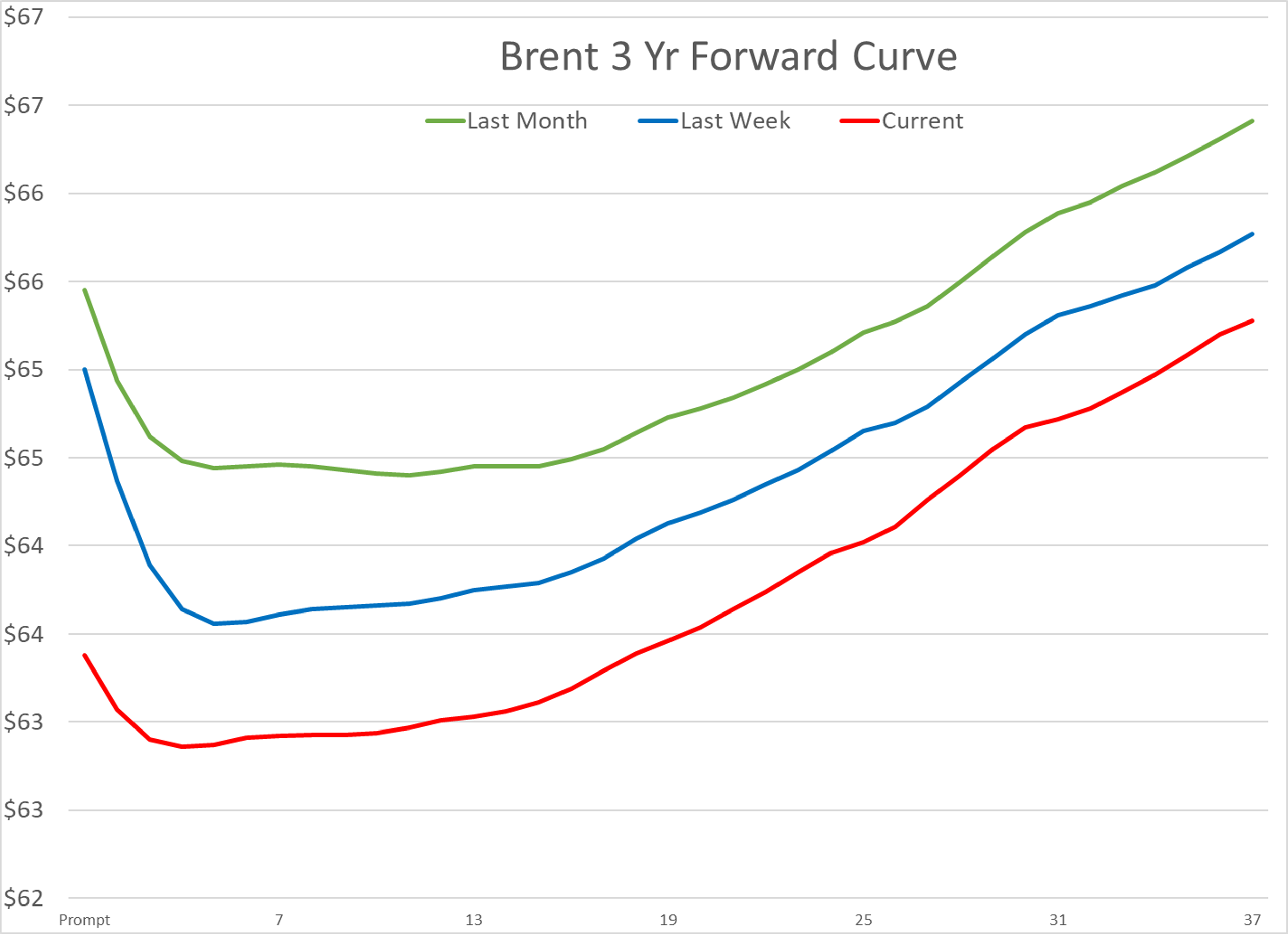

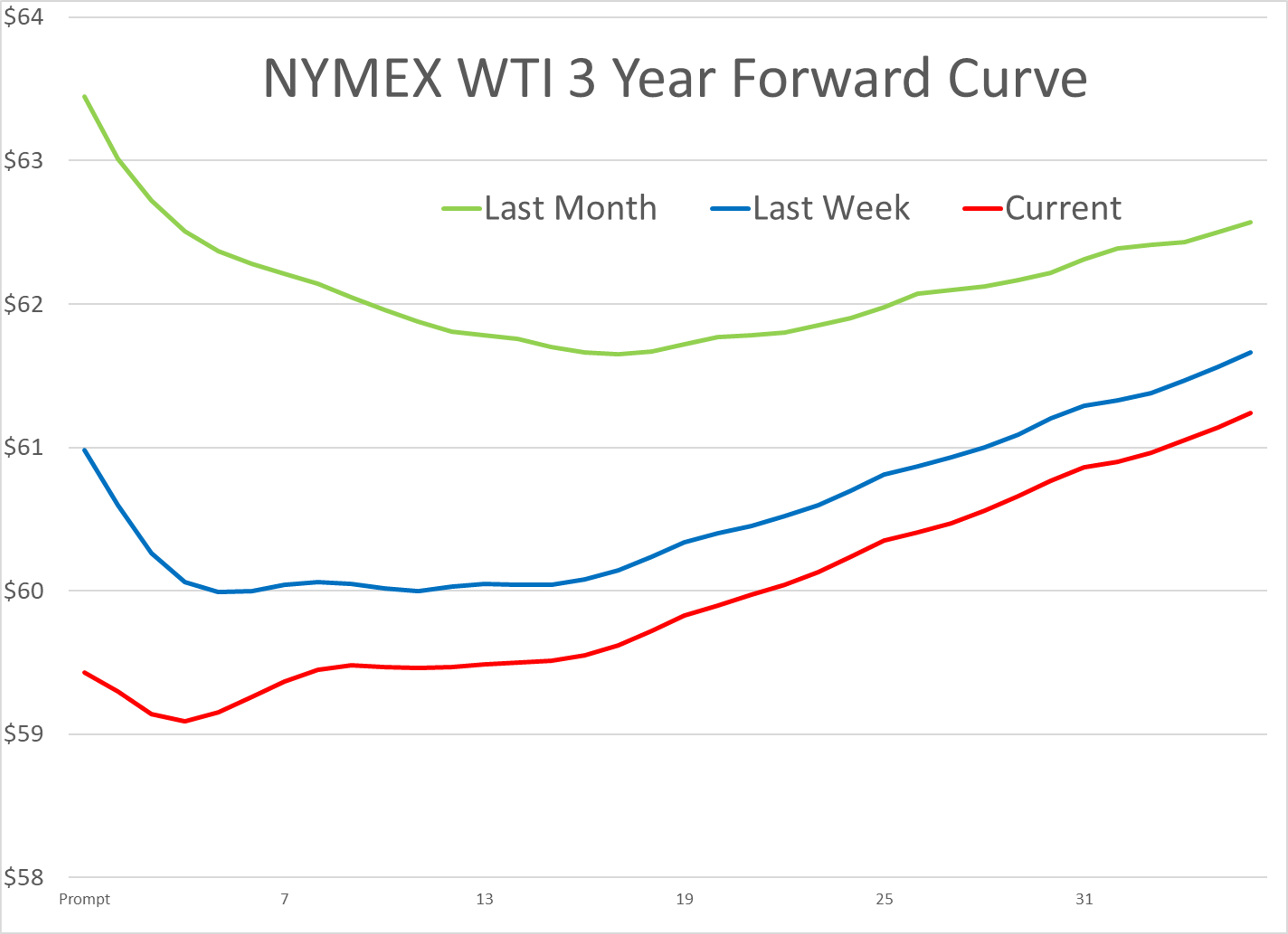

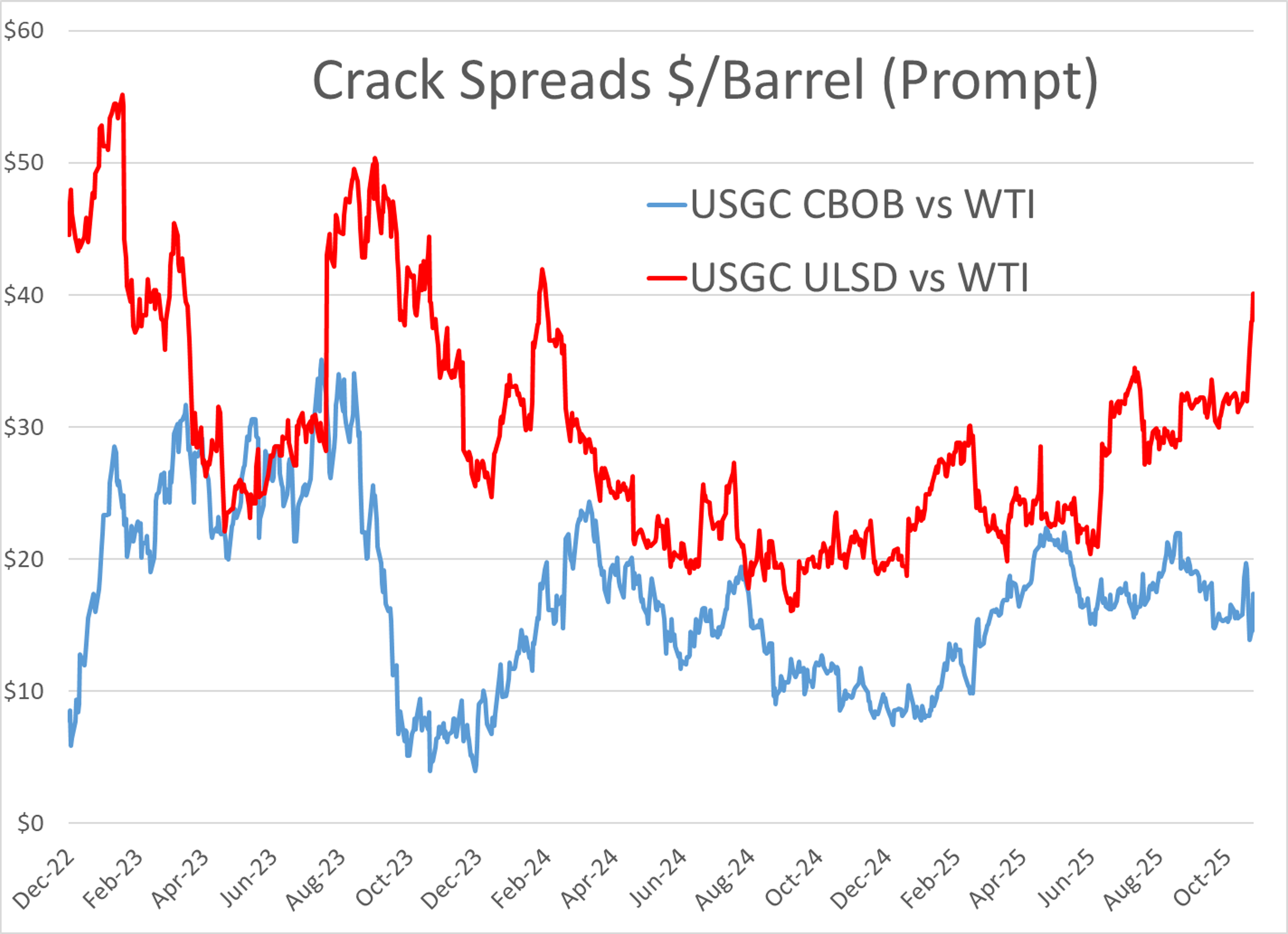

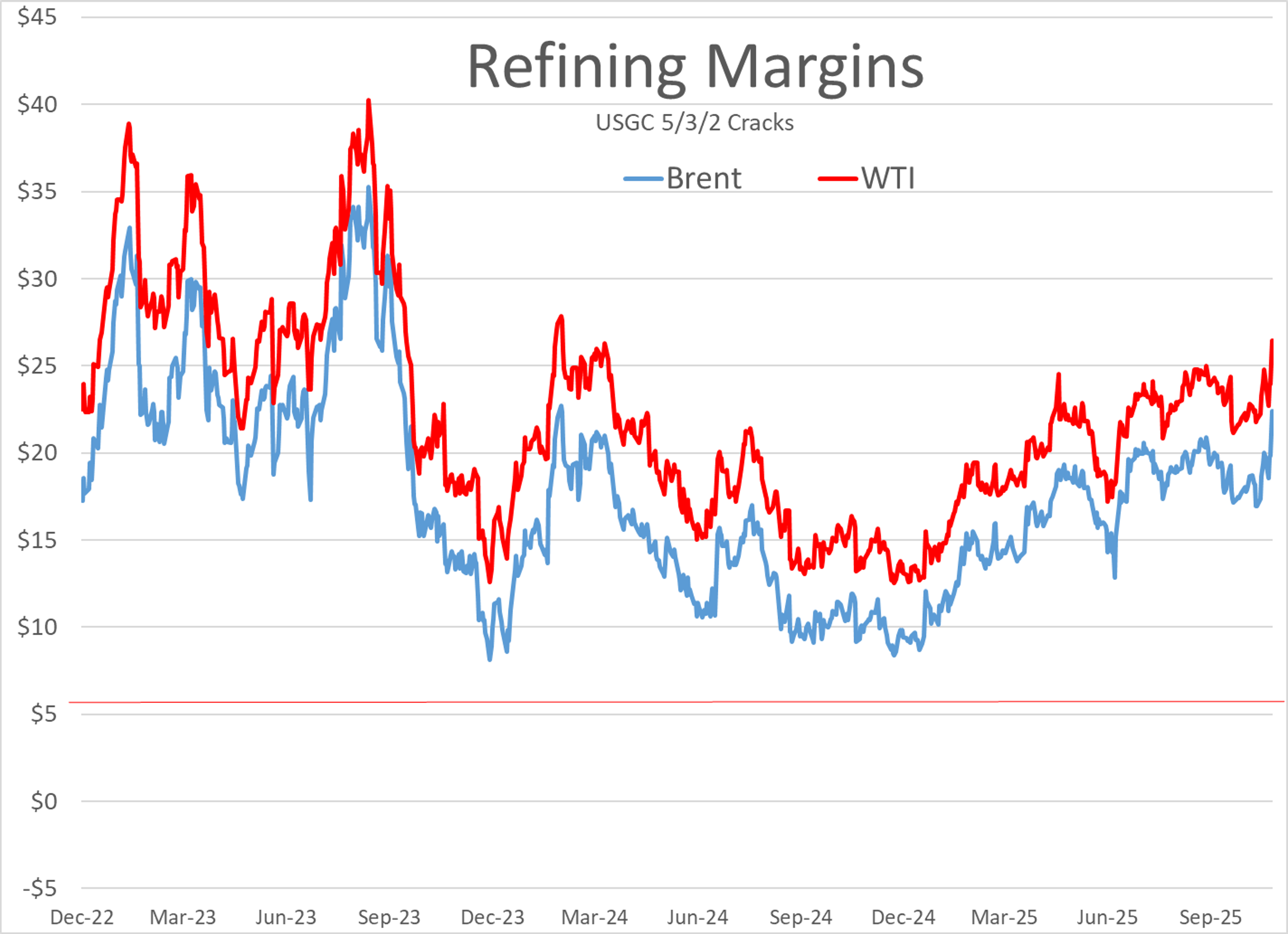

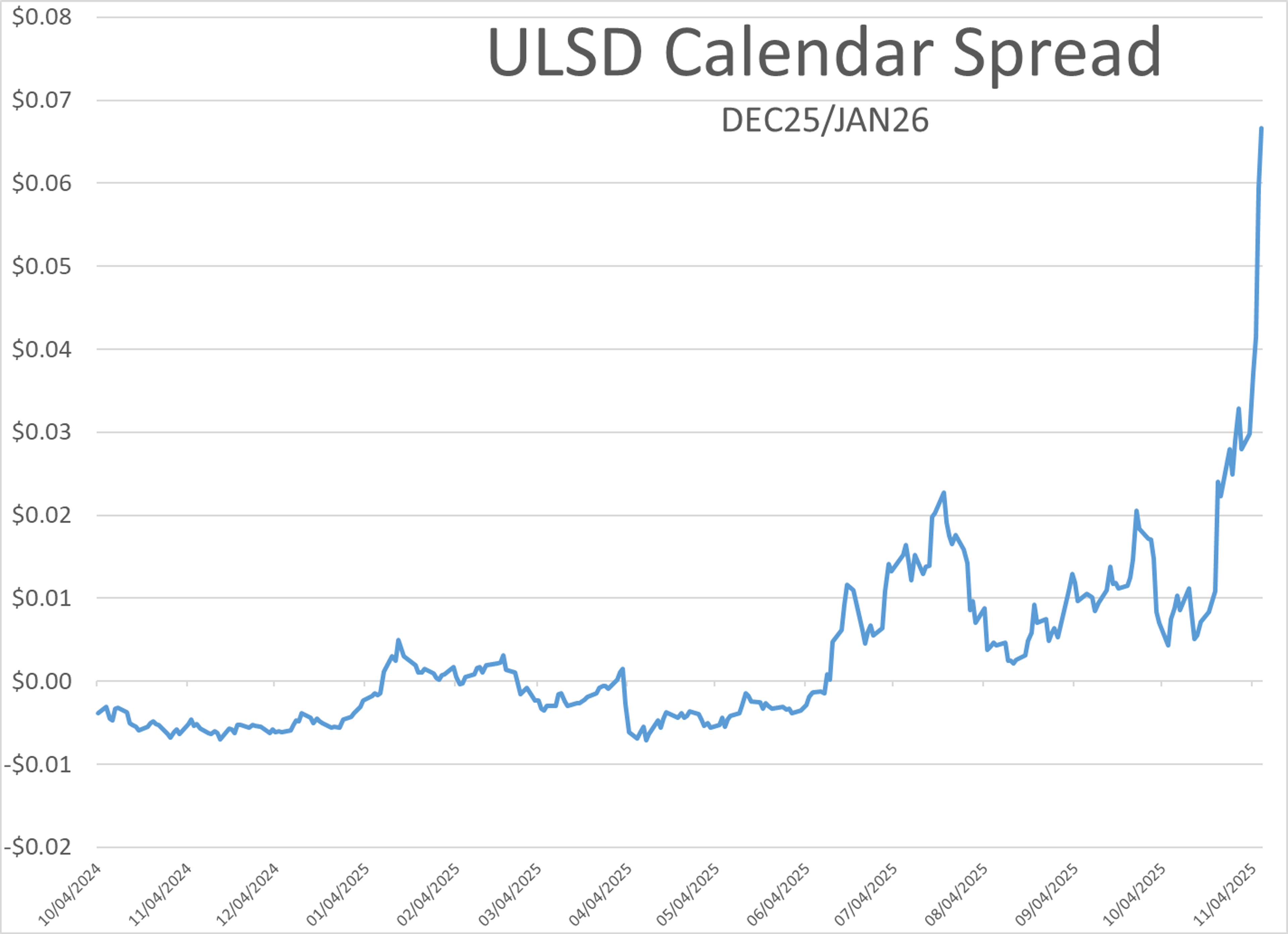

Diesel prices are off to the races once again Friday, with ULSD futures hitting a fresh 4 month high even though crude oil prices are trading lower for the week. European diesel prices continue to lead the moves with another 3% rally this morning, which is encouraging the 2% (5 cent) increase in December ULSD. As the charts below show the price spike is concentrated in the front months of the forward curve, which is a sign of a perceived shortage in supply short term, consistent with the disruption to supplies caused by sanctions, drones, and a few unplanned refinery upsets.

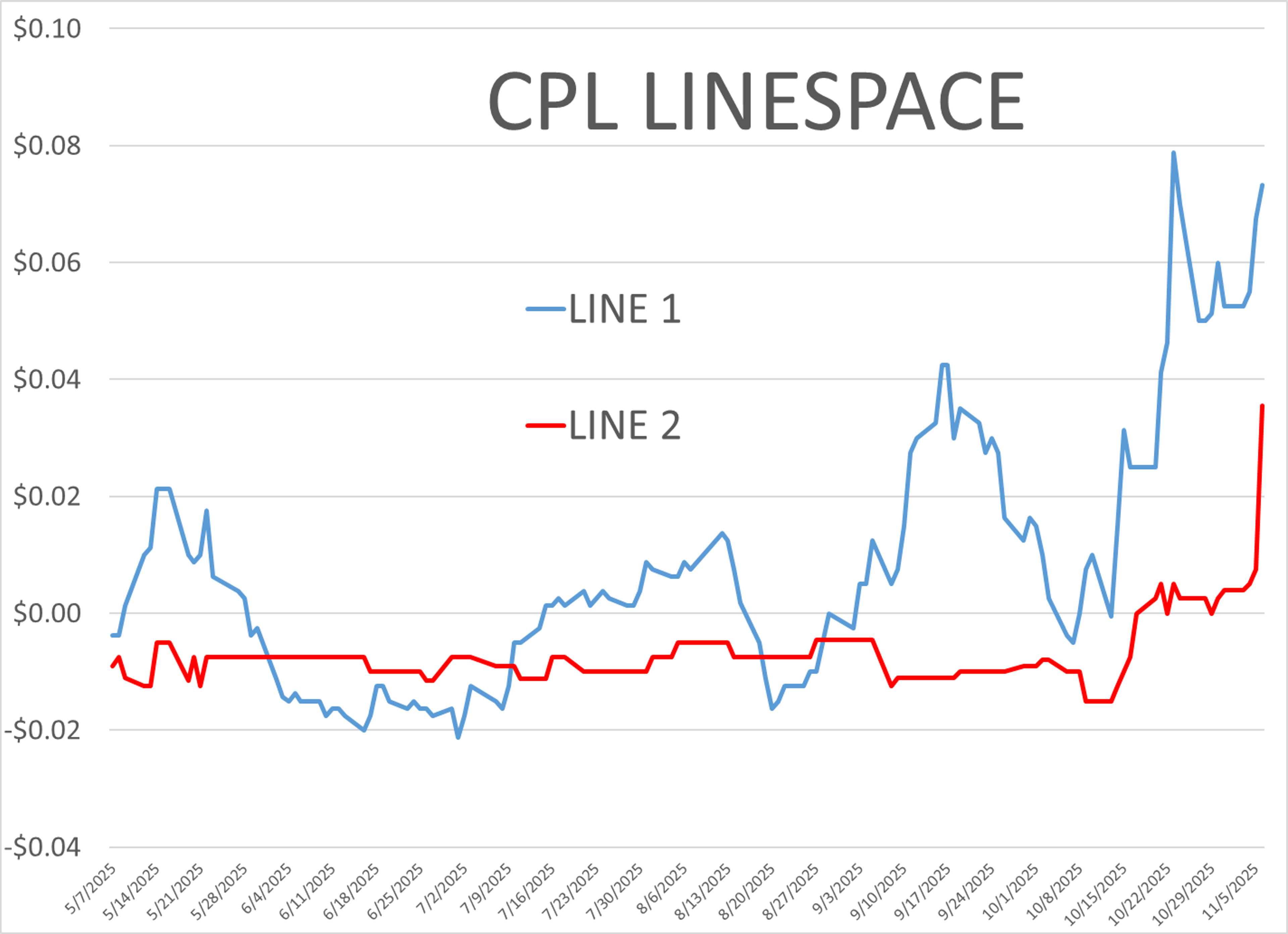

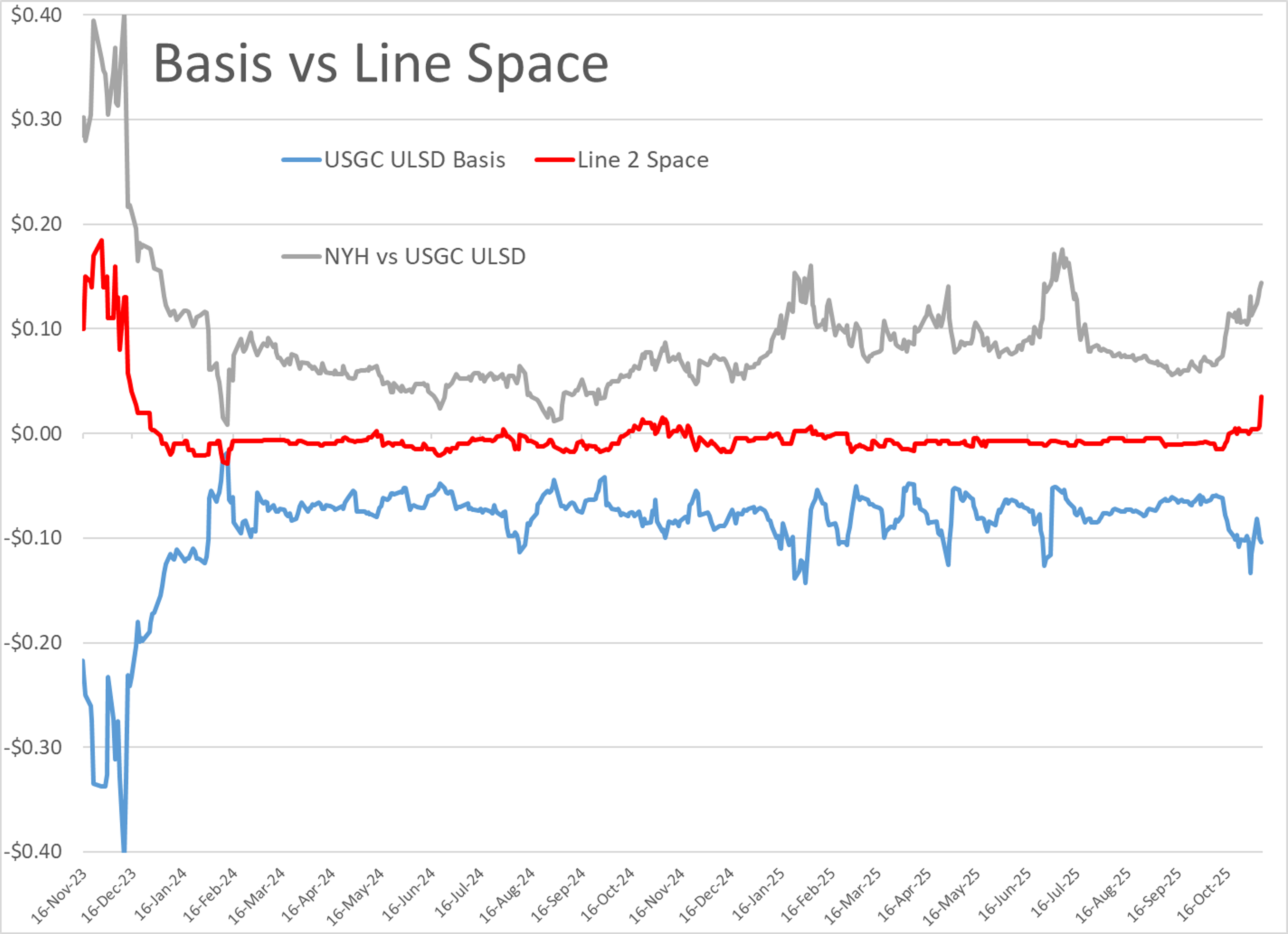

While several markets in the U.S. are seeing basis differentials partially offset the strength in spreads, the draw to ship barrels to Europe has also opened up the arb to ship diesel north on the Colonial pipeline, with premiums for Line 2 (the main diesel line) surging north of 3 cents/gallon Thursday for the first time in 2 years.

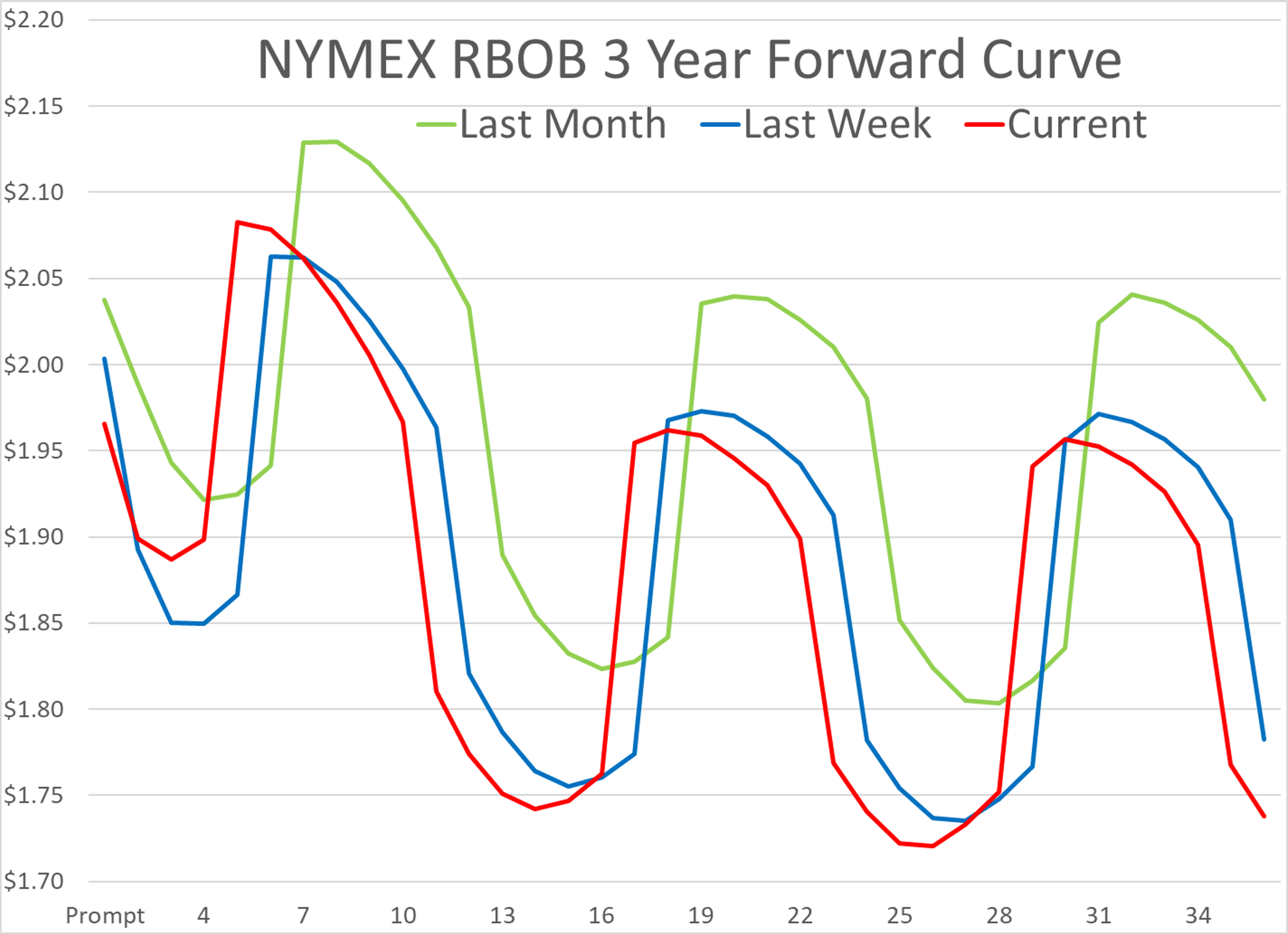

Gasoline futures are flat so far, but ended up stealing the show Thursday, after starting out the day lagging far behind the diesel rally. There’s also a bit of a short-term supply crunch on both the East and West coasts that’s creating steep backwardation ahead of the annual demand doldrums.

Los Angeles CARBOB differentials looked like they were turning the corner with a drop of a few cent Thursday but are still valued 50 cents higher than any other market in the country as LA makes its first fall transition. The drop in diffs may not be imminent however as late in the day Marathon announced Thursday that it was starting 19 days of “planned” flaring today at the Carson section of its LA-area refining complex, which is the largest facility remaining on the West Coast at 365mb/day. The filing with local regulators only states that an “essential operational need” is the reason for the event which did not seem to be on the calendar for planned maintenance previously.

While the values on the East Coast are just a fraction of what we’re seeing in LA, terminals throughout New England have been feeling the squeeze as a combination of weather delays a week ago, and traders unwilling to ship into the relatively steep backwardation both limiting supplies.

More ripple effects from the sanctions on Russia’s Lukoil: Bulgaria is making a move to nationalize its largest refinery that is currently owned by the Russian firm in order to avoid a shutdown as sanctions squeeze the company's ability to transact. Meanwhile, Gunvor (which was smart enough to rid itself of official Russian ownership more than a decade ago but still has Russian ties) has dropped its takeover bid of Lukoil’s other international assets following pressure from the US Treasury dept, who referred to the firm as the “Kremlin’s puppet”.

Hungary reported that its largest refinery, which may or may not have been sabotaged due to its purchases of Russian oil, will operate at just half of its 165mb/day capacity for several months due to “severe damage” done in those attacks.

Latest Posts

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets

Refinery Shifts, Winter Storms, And The New Anatomy Of US Fuel Supply

Energy Futures Break Out As Diesel Leads A Technical Rally

Week 7 - US DOE Inventory Recap

Diesel Futures Climb As Diplomatic Efforts Collapse

Social Media

News & Views

View All

Winter’s Grip Loosens, But Diesel Prices Keep Climbing

Crude Cracks 6-Month High As Storms Stall Terminals And Trade Tensions Roil Markets