Trio Of Supply Concerns Dissipate

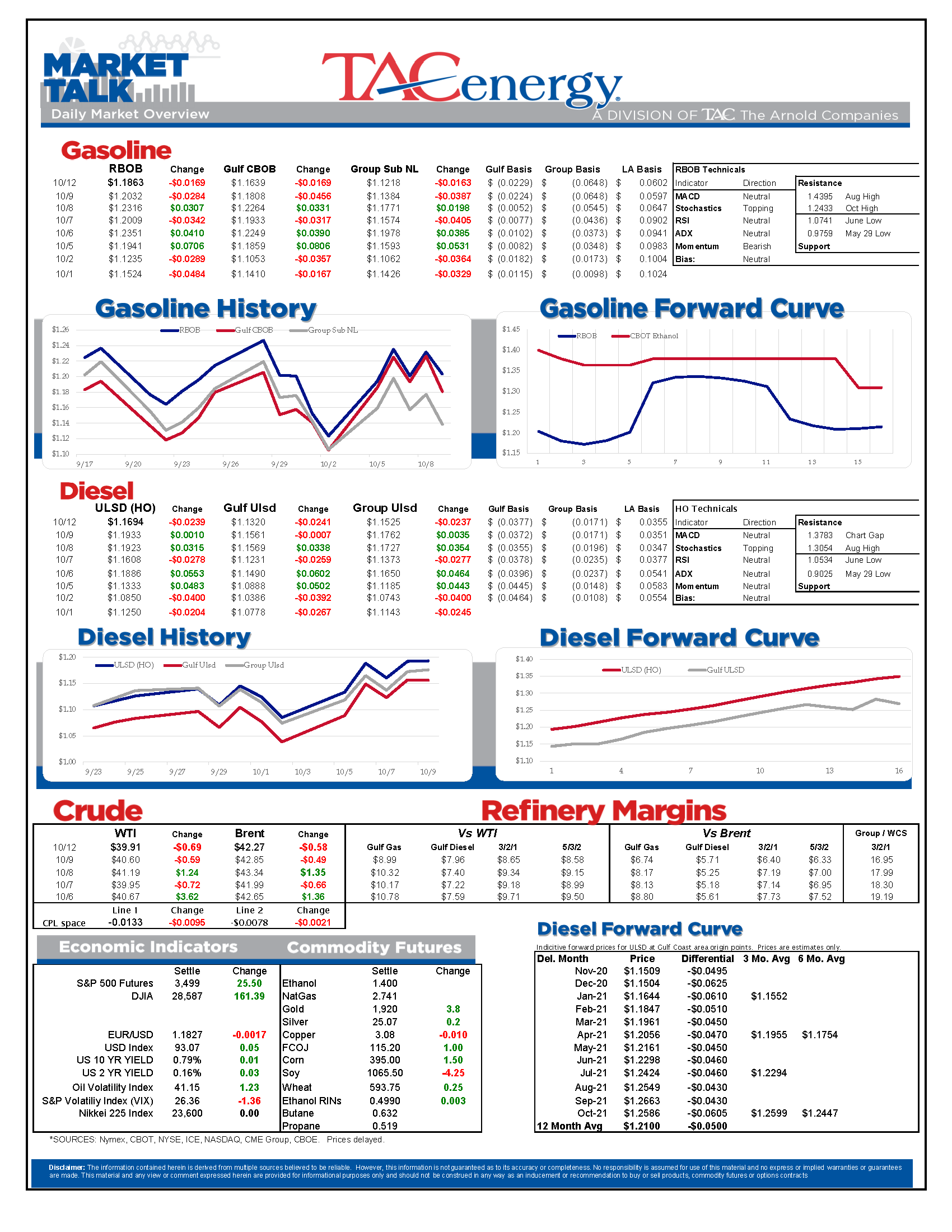

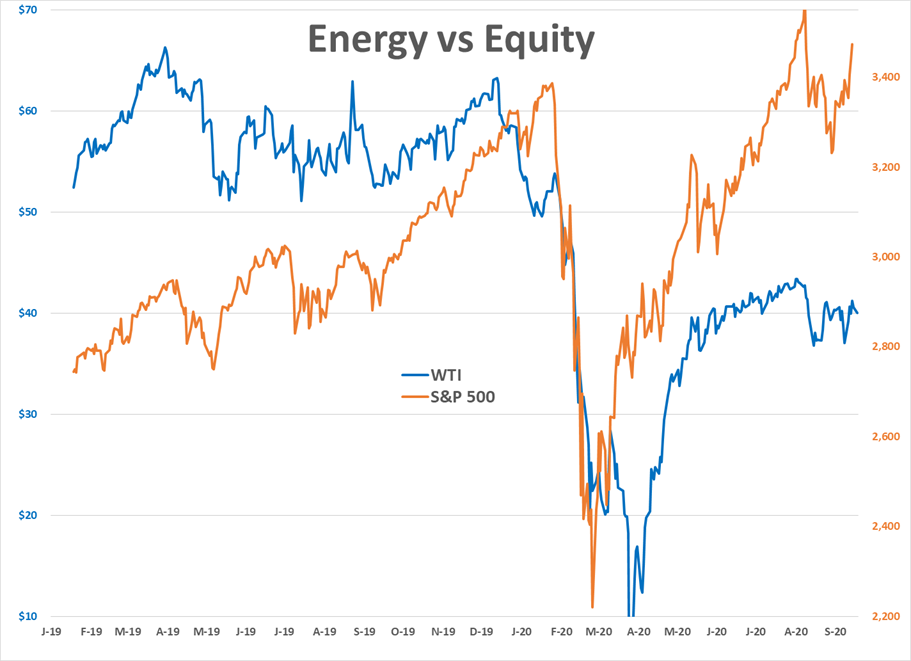

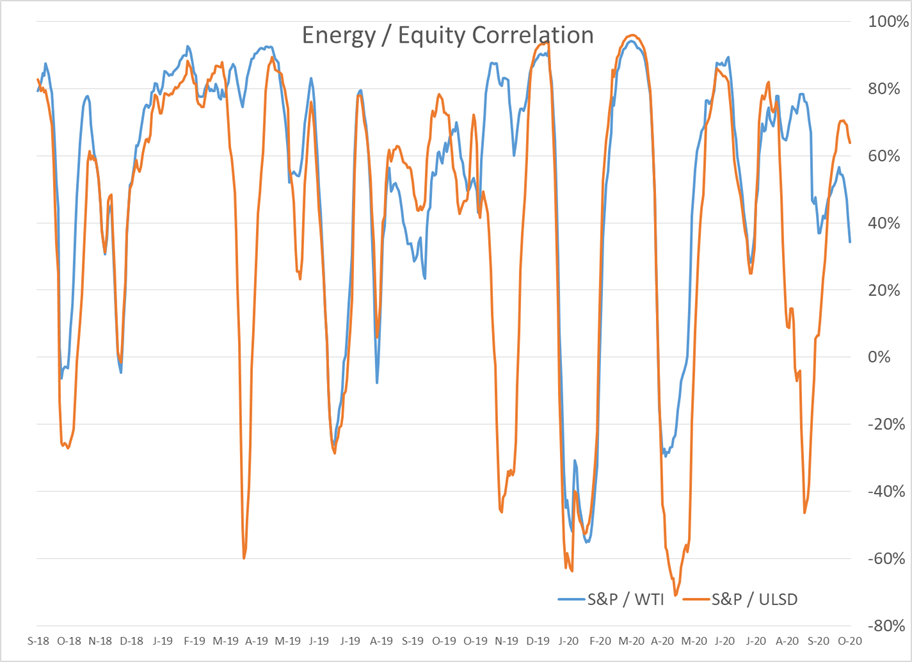

Energy prices are under pressure for a second straight session following strong weekly gains as a trio of supply concerns are dissipating, which seems to be outweighing the stimulus optimism fueling another rally in equity markets.

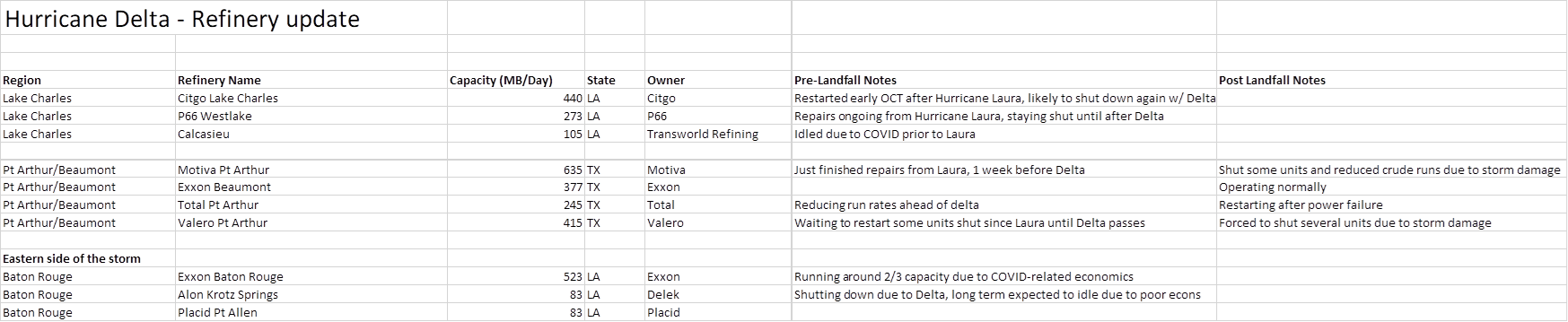

Hurricane Delta made landfall as a Category 2 storm Friday evening, just 13 miles from where Hurricane Laura hit six weeks ago. While Delta didn’t pack the punch that Laura did, and didn’t stick around long enough to dump the huge amounts of rain parts of the gulf coast saw from Hurricane Sally, it did produce wide spread power outages that are hampering the supply network. Most of the refiners in the Pt Arthur area had to shut units down due to storm-related issues, and Colonial pipeline’s main diesel line is still shut down as they await power to be restored near the Lake Charles area.

No word yet on the status of the Lake Charles refineries, but based on the storm’s path, and the damage we’ve already seen further away in Pt. Arthur, it appears likely both facilities will have to go through another round of repairs to resume operations. Just like with Laura, it will likely be a few days until the damage can be assessed at the facilities that were just resuming operations after Laura and will now start over again. It appears that the plants around Baton Rouge and New Orleans, which were originally in Delta’s crosshairs, have dodged yet another bullet in the busiest hurricane season on record.

There are roughly seven weeks left in the 2020 Atlantic hurricane season, and the NHC is giving 30% probability that a system churning east of the Windward islands will develop in the next five days. Those are relatively low odds, and wind conditions don’t appear favorable at the moment, but in this record setting year, it seems like a mistake to ignore any potential storm.

Good news for Libya, bad news for OPEC? The beleaguered country’s oil output is coming back online, complicating OPEC’s output plans as Libya has been exempted from previous production cuts.

The Norwegian oil strike came to an end after successful mediation last week, which will keep more than 300mb/day of oil production online, adding to the downward pressure on prices.

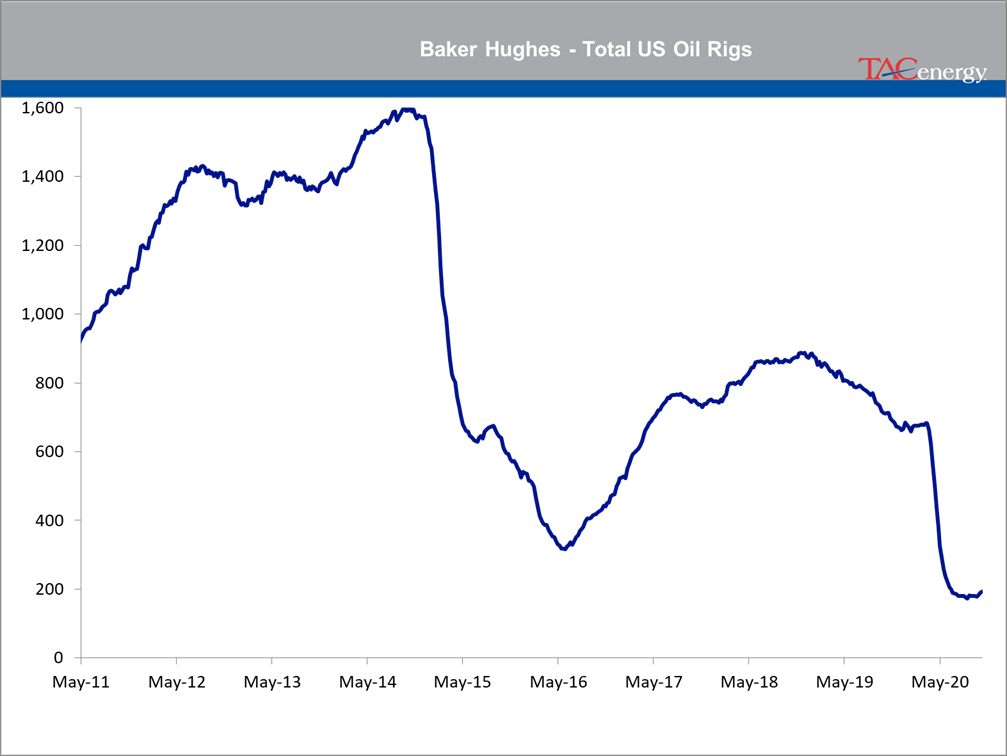

Baker Hughes reported four more oil rigs were put to work last week, the third weekly increase in a row. Texas and New Mexico accounted for the build with Permian and Eagle Ford basins each adding one rig on the week, and two more were added in smaller unclassified areas.

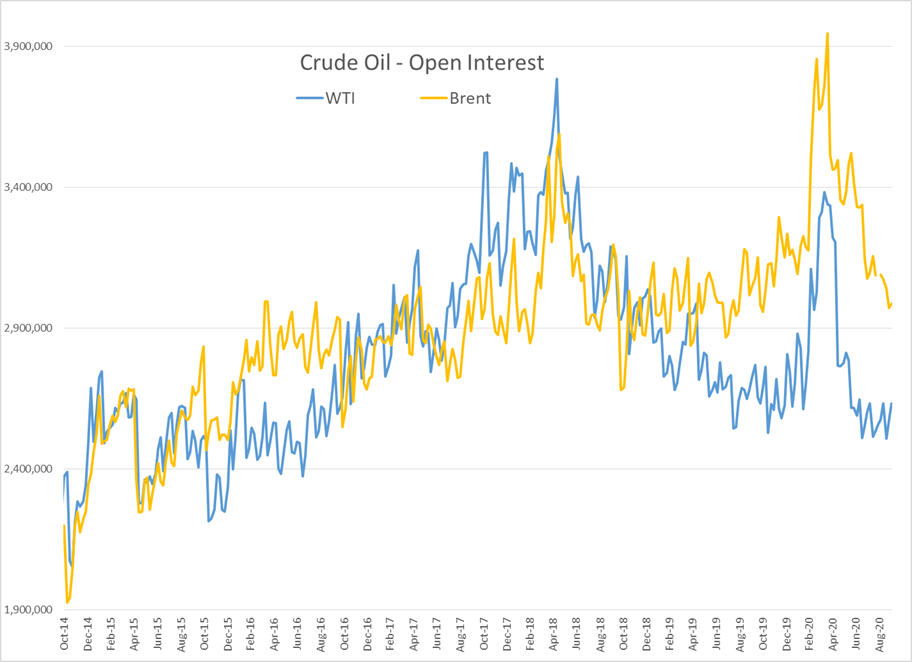

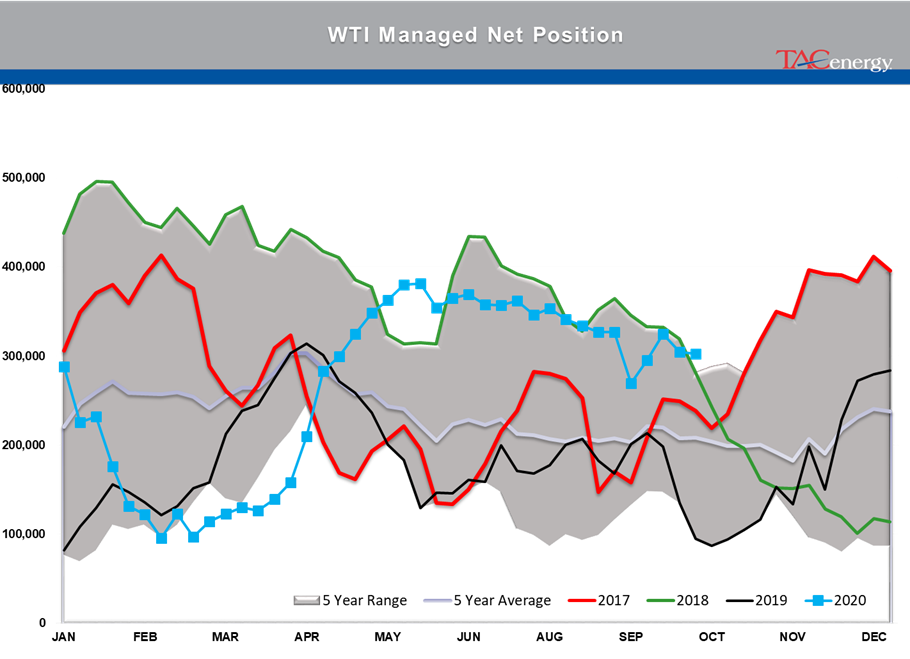

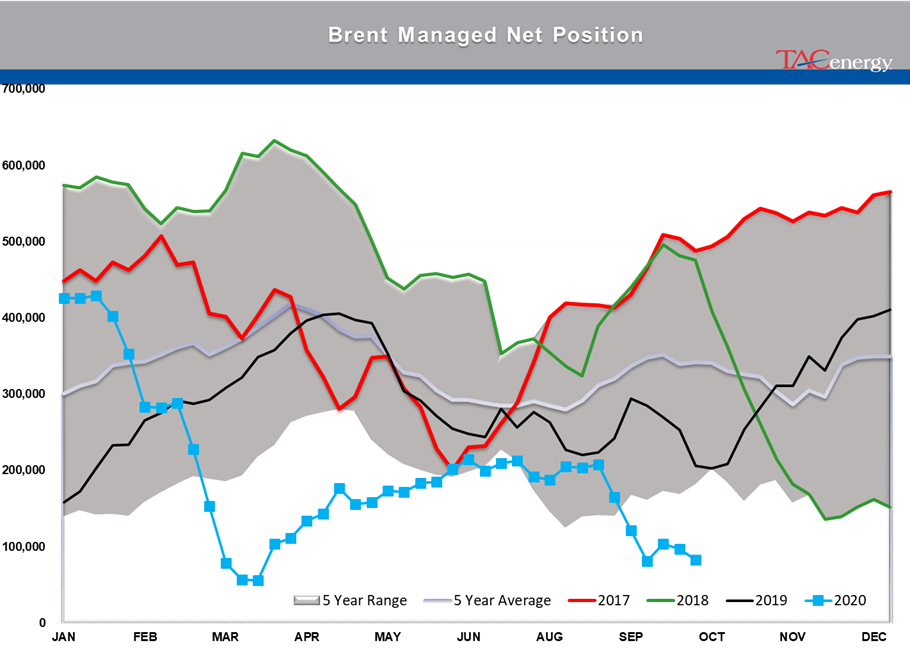

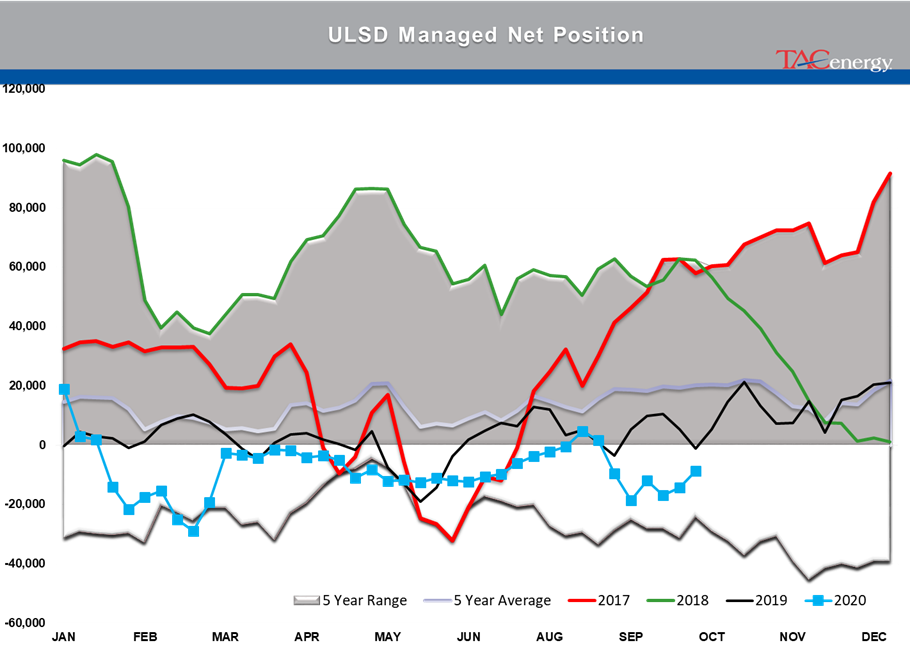

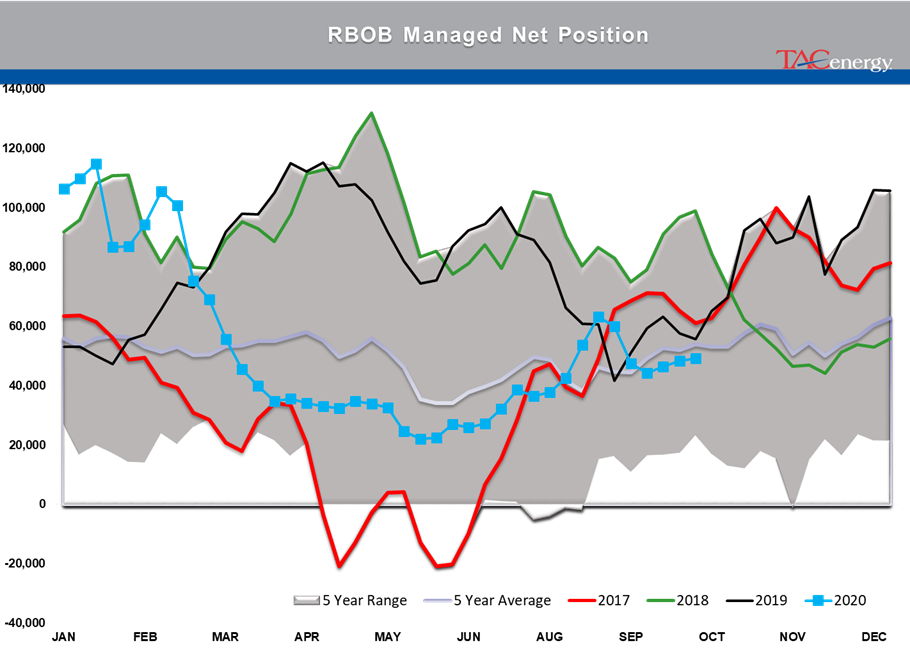

Money managers continue to be unimpressed with oil contracts, making small reductions in net length in WTI and Brent for a second week, while making small increases to bullish wagers on refined products. RBOB gasoline continues to see a counter-seasonal bet on higher prices from the large speculators, while ULSD contracts remain in a net short position as the big funds bet diesel prices will lag.

New cleaner energy options continue to be a major story that’s getting even more attention given the polarity of the Presidential candidates on the issue. An unintended consequence in the surge of “green” stimulus packages is that they’re driving up costs for these projects, similar to what we saw with the spike in home remodeling & pool installation projects this summer. A Rystad energy report last week highlighted how those rising costs may hamper the development of one of the more promising alternatives, Green Hydrogen.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

Energy Futures Are Drifting Quietly Higher This Morning

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Social Media

News & Views

View All

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

The energy complex is trading modestly lower so far this morning with WTI crude oil futures leading the way, exchanging hands $1.50 per barrel lower (-1.9%) than Tuesday’s settlement price. Gasoline and diesel futures are following suit, dropping .0390 and .0280 per gallon, respectively.

A surprise crude oil build (one that doesn’t include any changes to the SPR) as reported by the American Petroleum Institute late Tuesday is taking credit for the bearish trading seen this morning. The Institute estimated an increase in crude inventories of ~5 million barrels and drop in both refined product stocks of 1.5-2.2 million barrels for the week ending April 26. The Department of Energy’s official report is due out at it’s regular time (9:30 CDT) this morning.

The Senate Budget Committee is scheduled to hold a hearing at 9:00 AM EST this morning regarding a years-long probe into climate change messaging from big oil companies. Following a 3-year investigation, Senate and House Democrats released their final report yesterday alleging major oil companies have internally recognized the impacts of fossil fuels on the climate since as far back as the 1960s, while privately lobbying against climate legislation and publicly presenting a narrative that undermines a connection between the two. Whether this will have a tangible effect on policy or is just the latest announcement in an election-yeardeluge is yet to be seen.

Speaking of deluge, another drone attack was launched against Russian infrastructure earlier this morning, causing an explosion and subsequent fire at Rosneft’s Ryazan refinery. While likely a response to the five killed from Russian missile strikes in Odesa and Kharkiv, Kyiv has yet to officially claim responsibility for the attack that successfully struck state infrastructure just 130 miles from Moscow.

The crude oil bears are on a tear this past week, blowing past WTI’s 5 and 10 day moving averages on Monday and opening below it’s 50-day MA this morning. The $80 level is likely a key resistance level, below which the path is open for the American oil benchmark to drop to the $75 level in short order.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Futures Are Drifting Quietly Higher This Morning

Energy futures are drifting quietly higher this morning as a new round of hostage negotiations between Israel and Hamas seem to show relative promise. It seems the market is focusing on the prospect of cooler heads prevailing, rather than the pervasive rocket/drone exchanges, the latest of which took place over Israel’s northern border.

A warmer-than-expected winter depressed diesel demand and, likewise, distillate refinery margins, which has dropped to its lowest level since the beginning of 2022. The ULSD forward curve has shifted into contango (carry) over the past month as traders seek to store their diesel inventories and hope for a pickup in demand, domestic or otherwise.

The DOE announced it had continued rebuilding it’s Strategic Petroleum Reserve this month, noting the addition of 2.3 million barrels of crude so far in April. Depending on what the private sector reported for last week, Wednesday’s DOE report may put current national crude oil inventories (include those of the SPR) above the year’s previous levels, something we haven’t seen since April of 2022, two months after Ukraine war began.

The latest in the Dangote Refinery Saga: Credit stall-out, rising oil prices, and currency exchange.

Click here to download a PDF of today's TACenergy Market Talk.