Energy Prices Caught Up In Technical Breakout

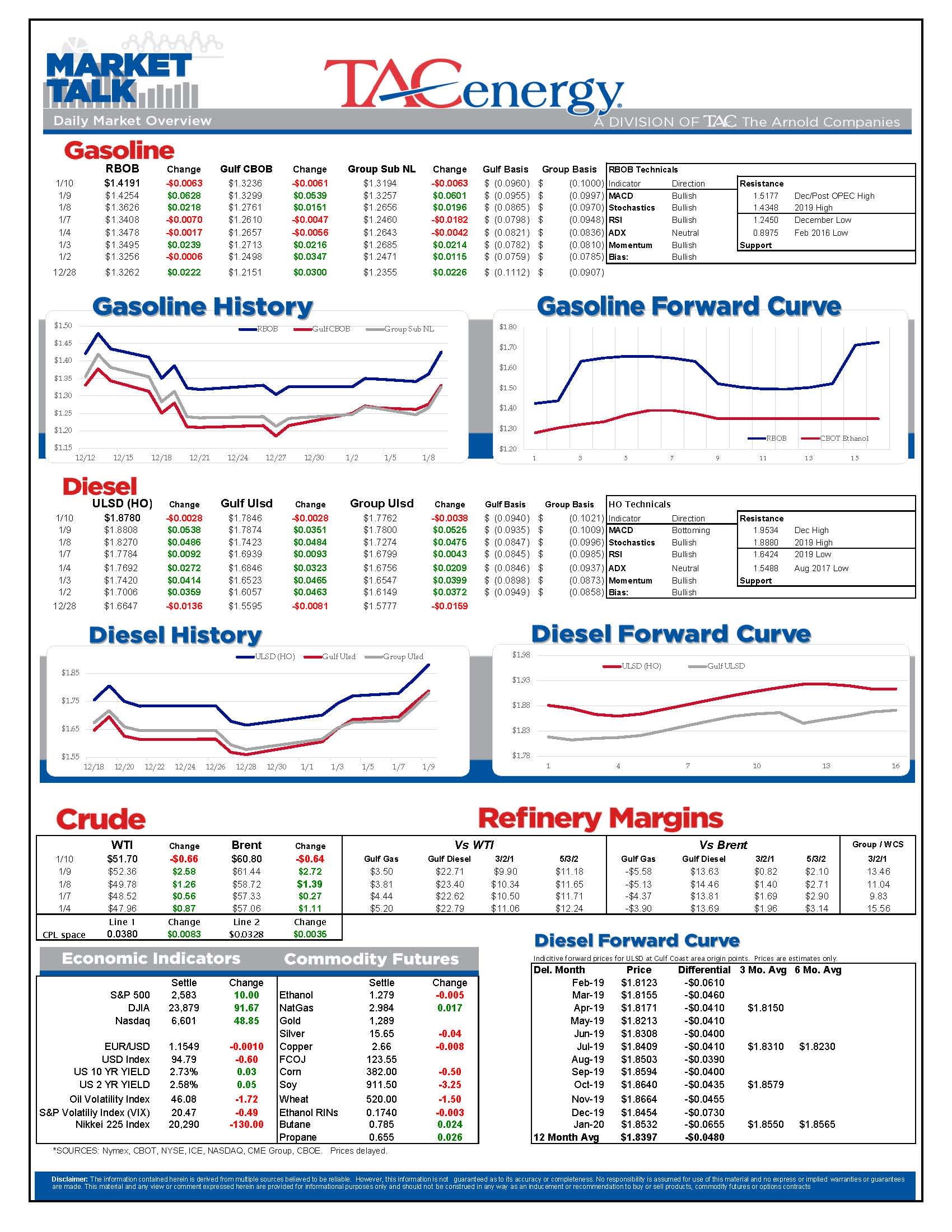

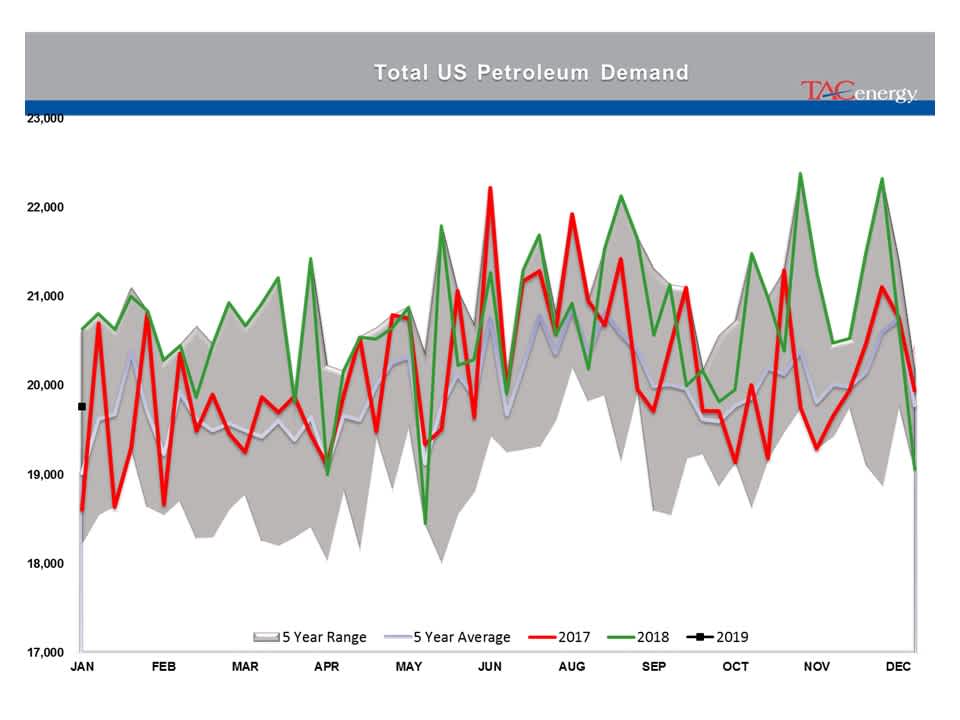

If all you saw were the 5-6 cent price increases in refined products Wednesday, you might have assumed that the weekly DOE report had some bullish figures. In reality, that report showed some of the worst demand figures and largest inventory builds in years, and yet those fundamental headwinds seemed to only matter for a few minutes as energy prices were caught up in a technical breakout.

Although there is some modest selling to start Thursday’s session, WTI prices are still up more than 20% from their Christmas even lows, and the entire petroleum complex looks poised to test its December highs, some 7-10 cents above current levels for refined products.

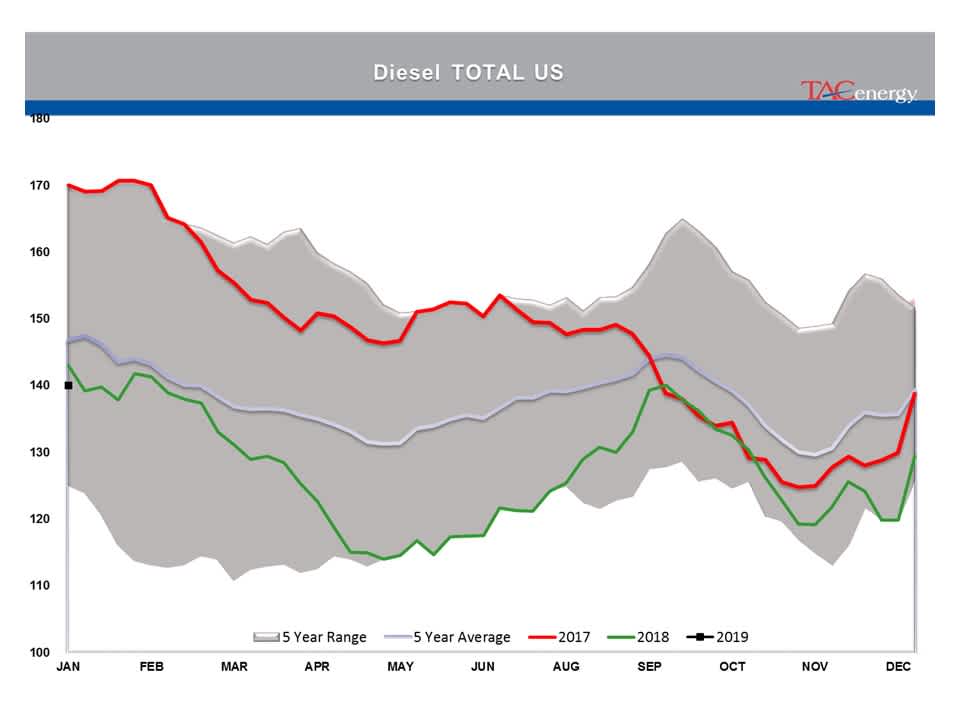

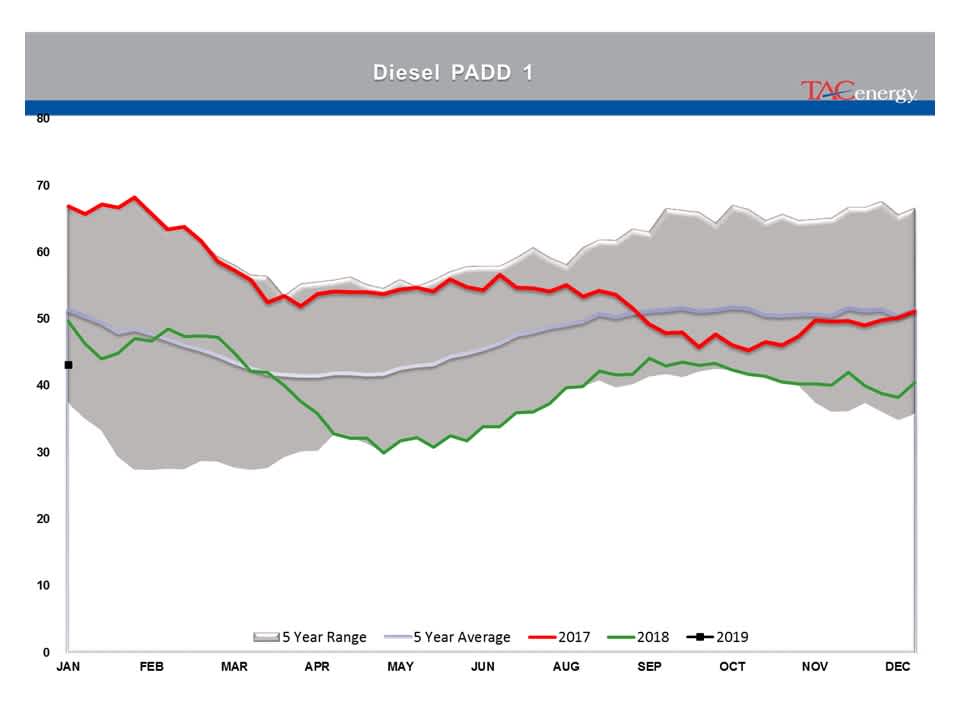

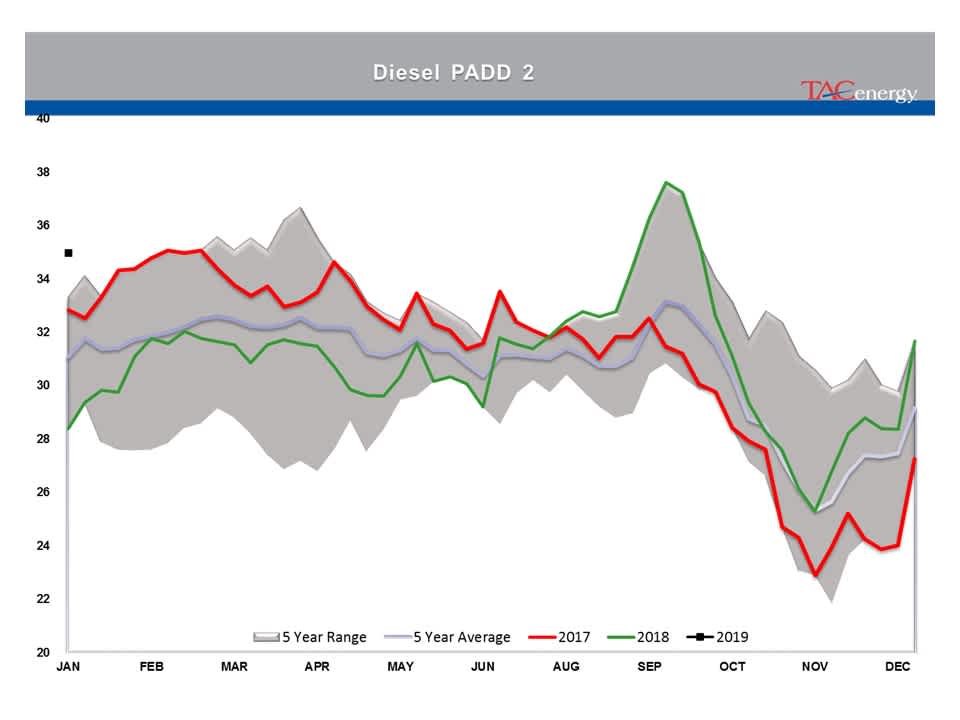

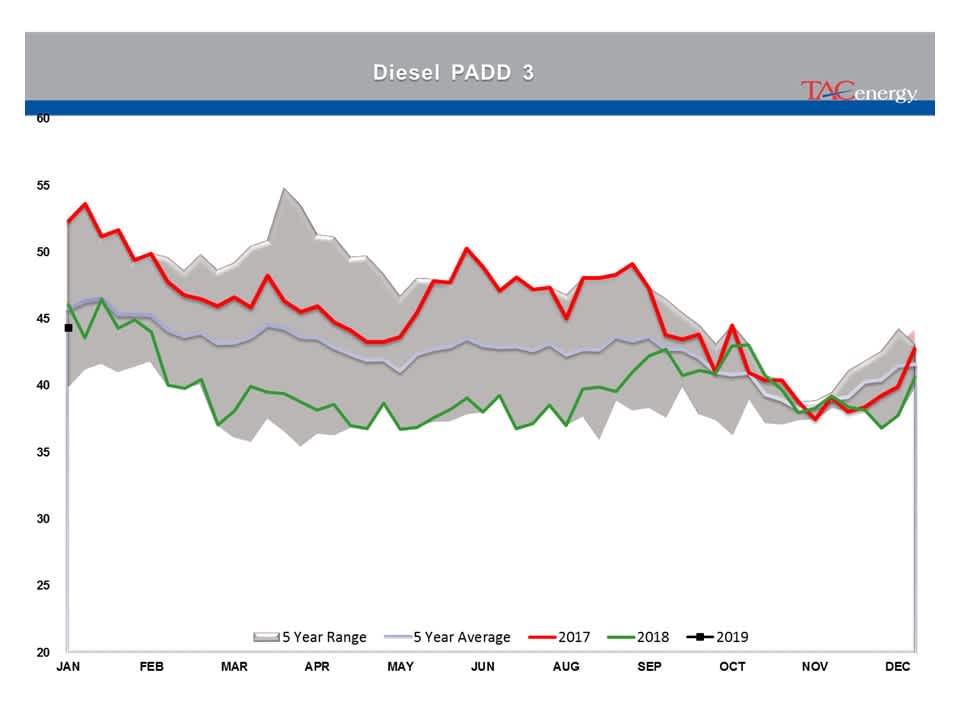

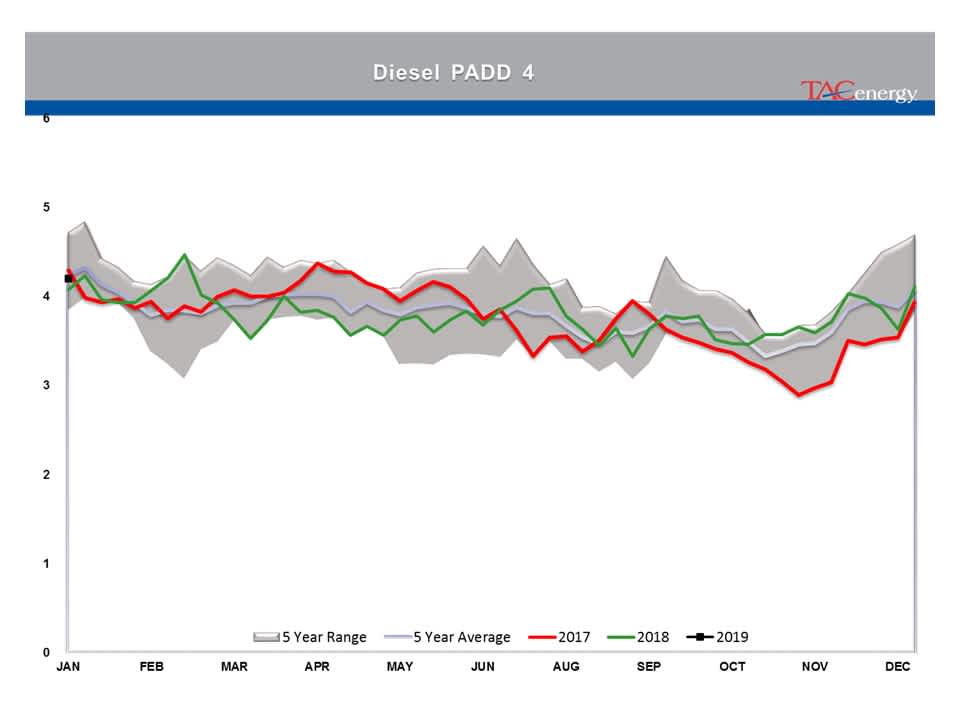

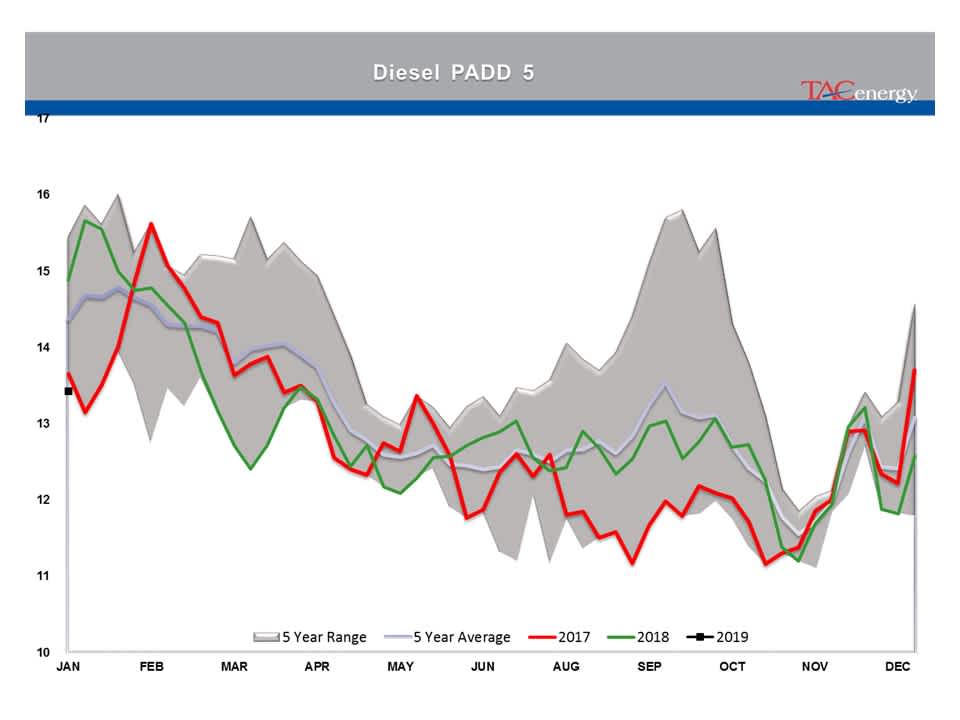

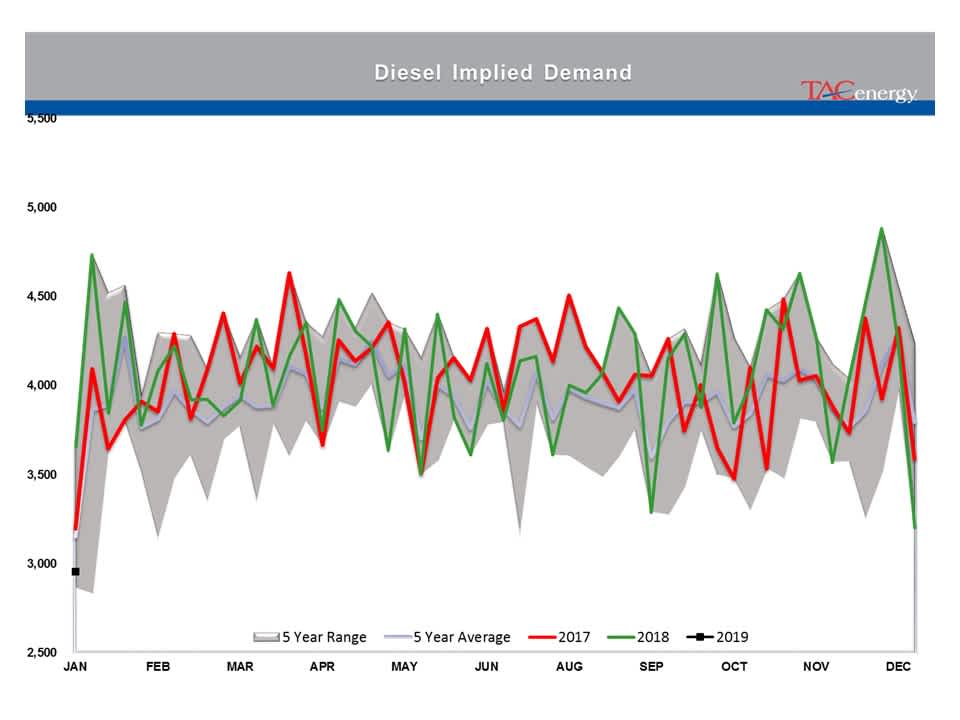

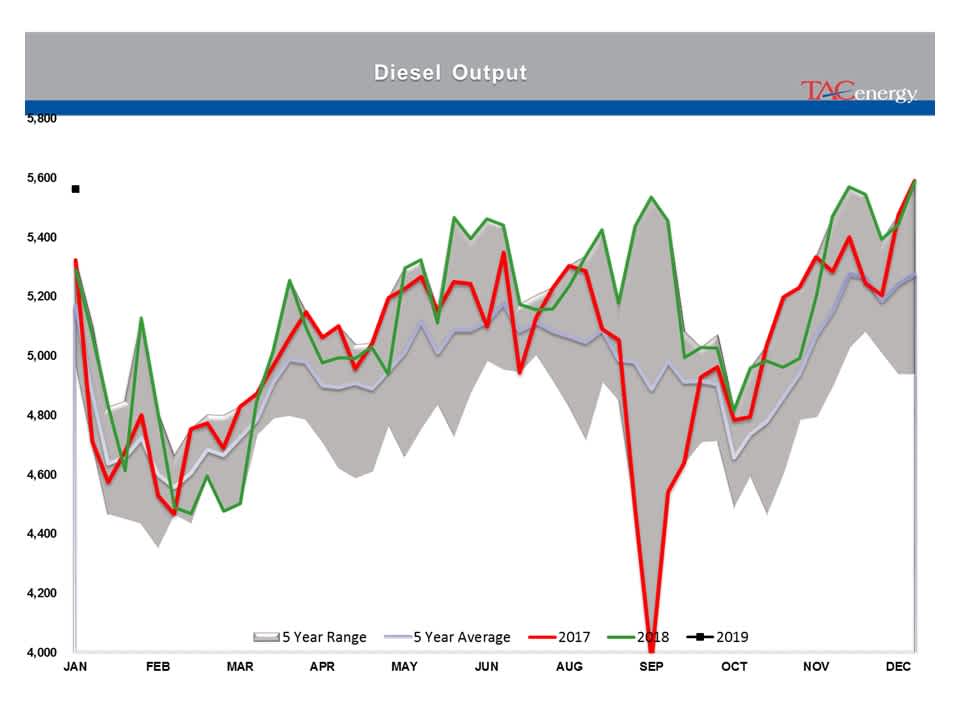

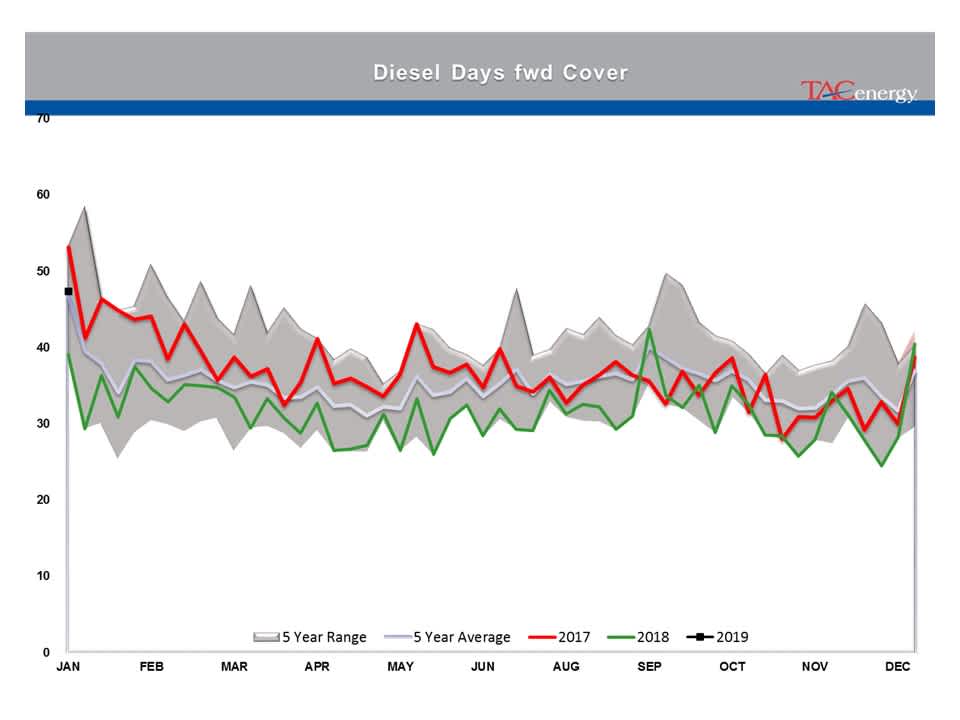

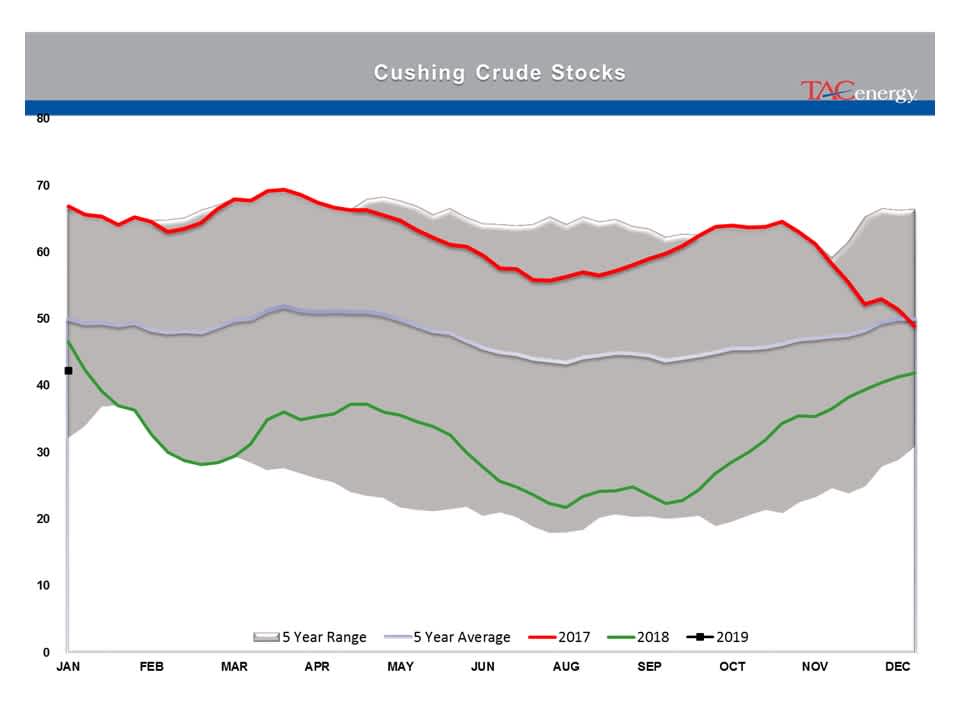

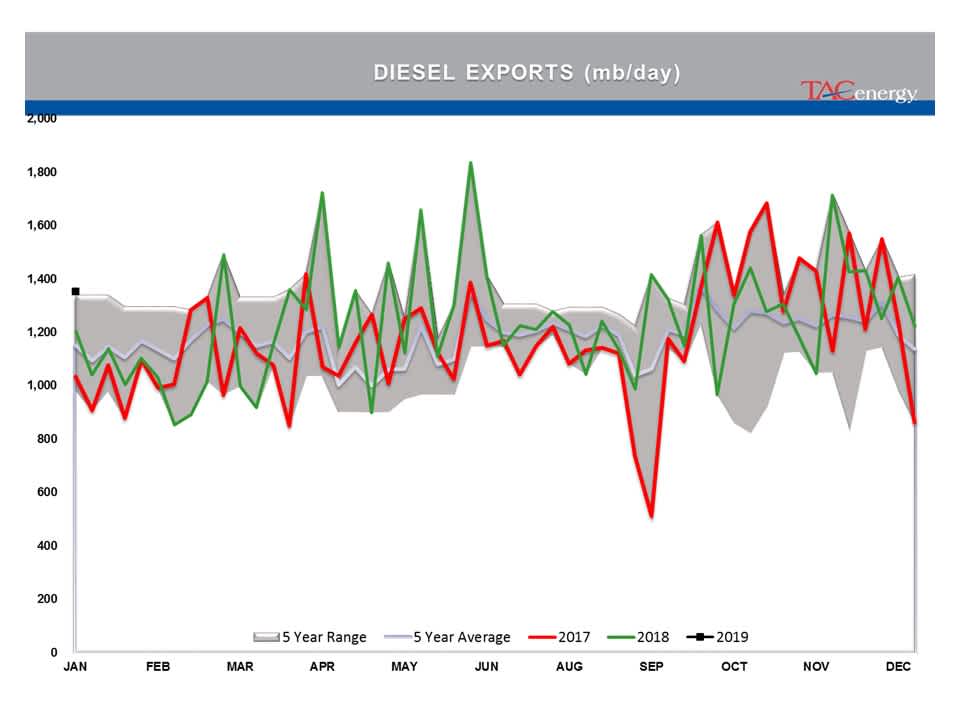

The weekly demand estimate for distillates fell to a 2.9 million barrels/day, marking a 3 year low, nearly 2 million barrels/day lower than the record high we saw just 3 weeks ago. The good news is that we typically see a dramatic demand drop this time of year, and in each of the past 5 years we’ve seen demand pop right back north of 4 million barrels/day by the 4th week of the year. The bad news, at least from a refining perspective, is that the demand drop is coinciding with US Diesel production setting new records, driving a 20 million barrel inventory increase in just 2 weeks.

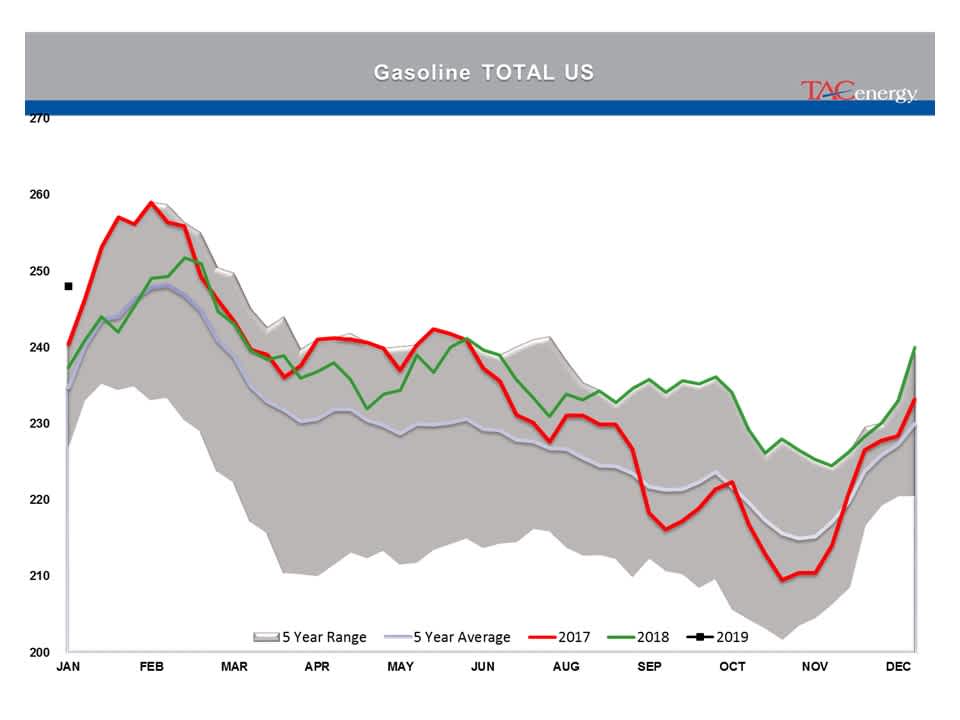

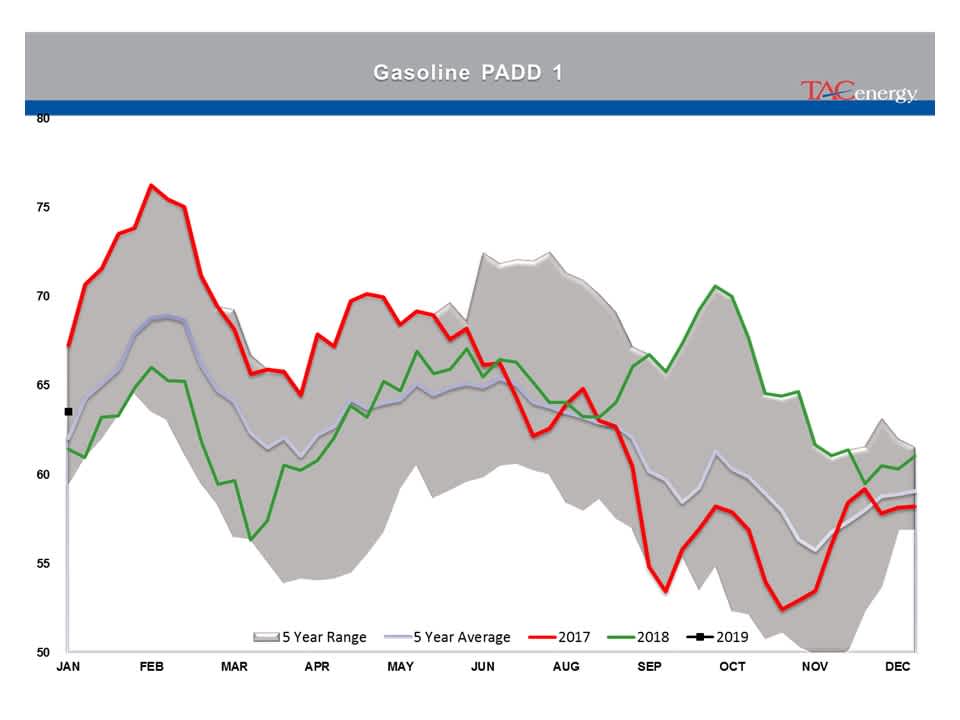

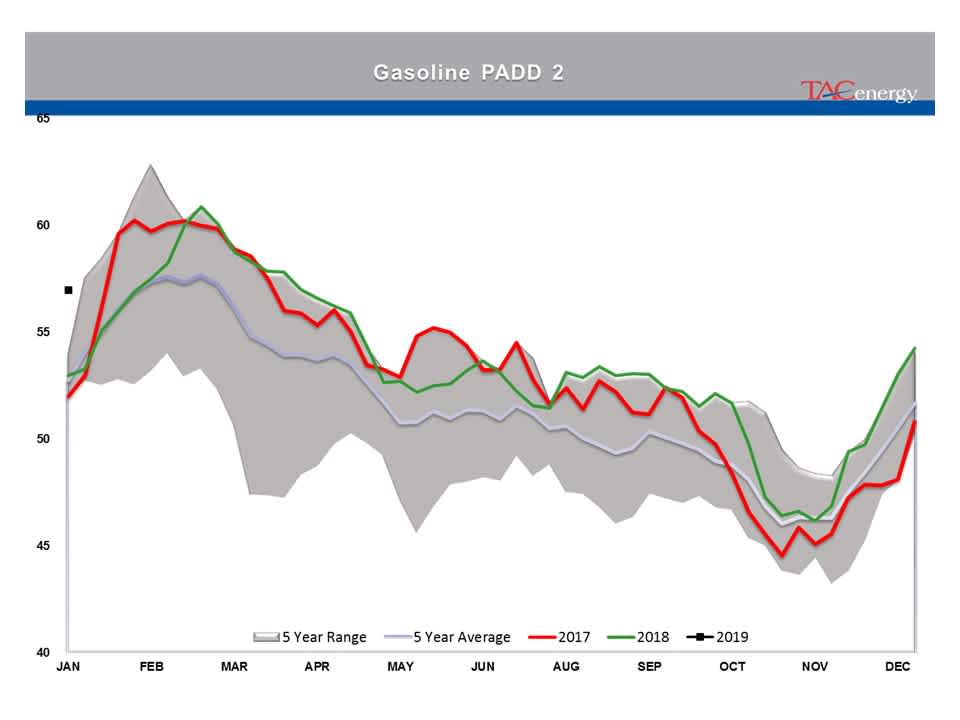

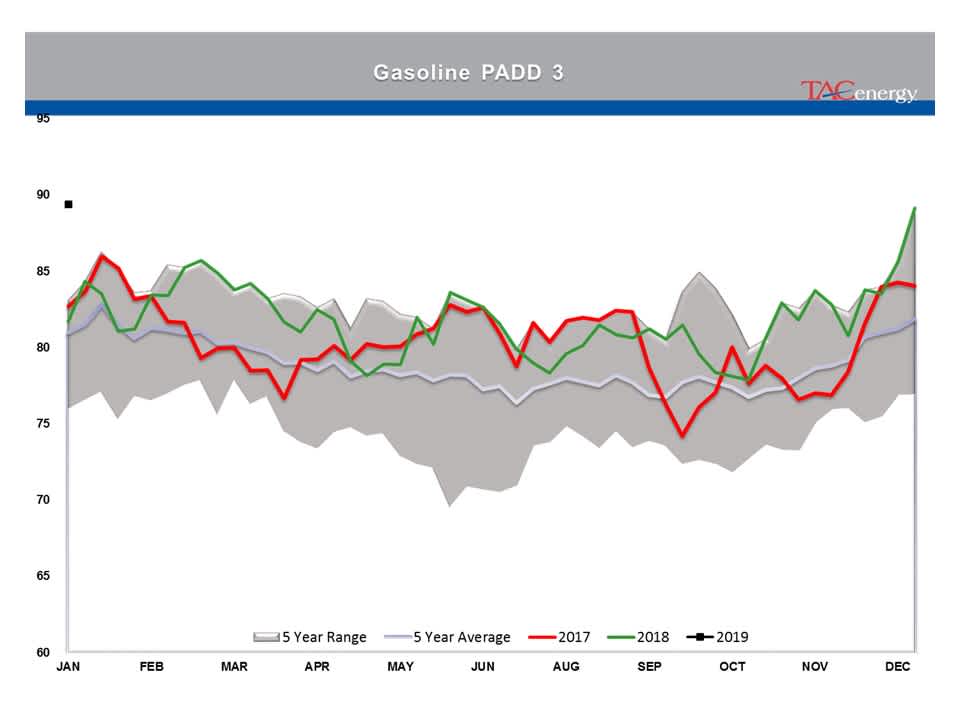

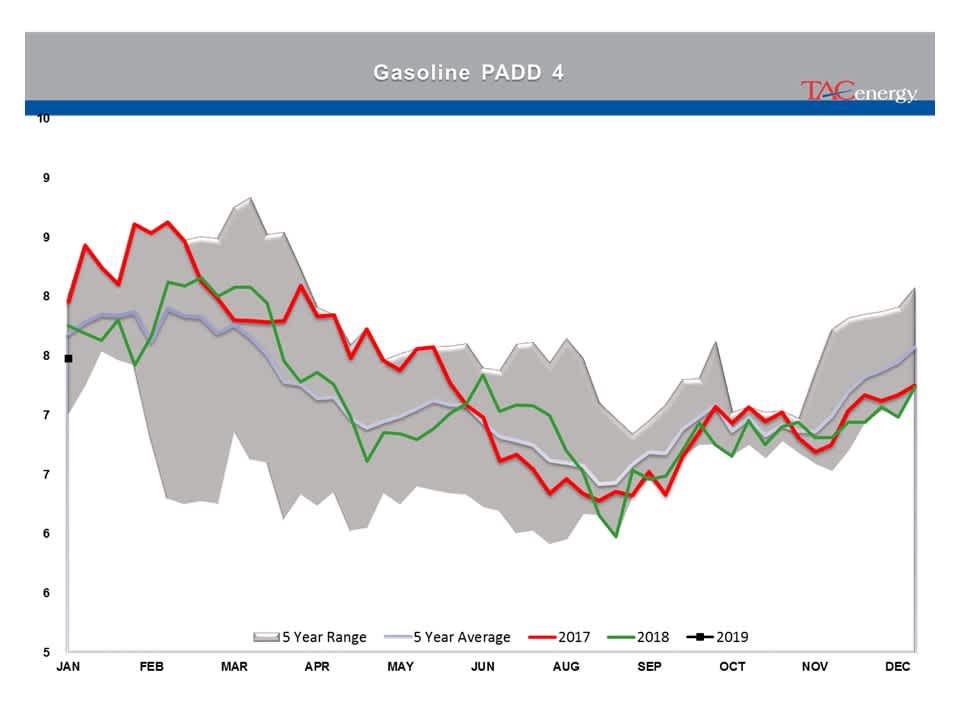

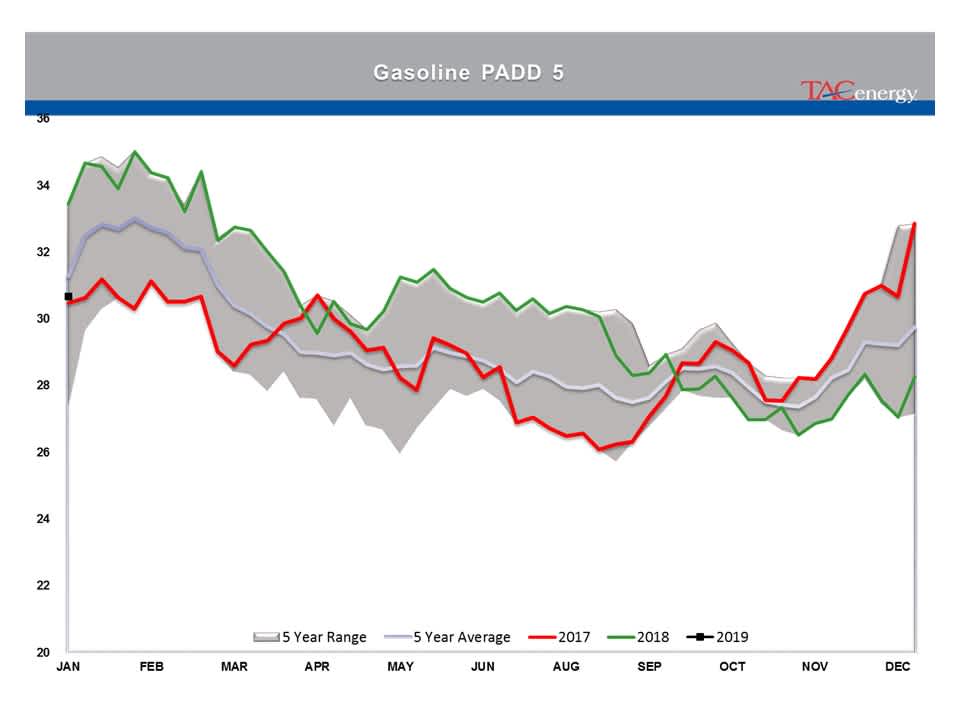

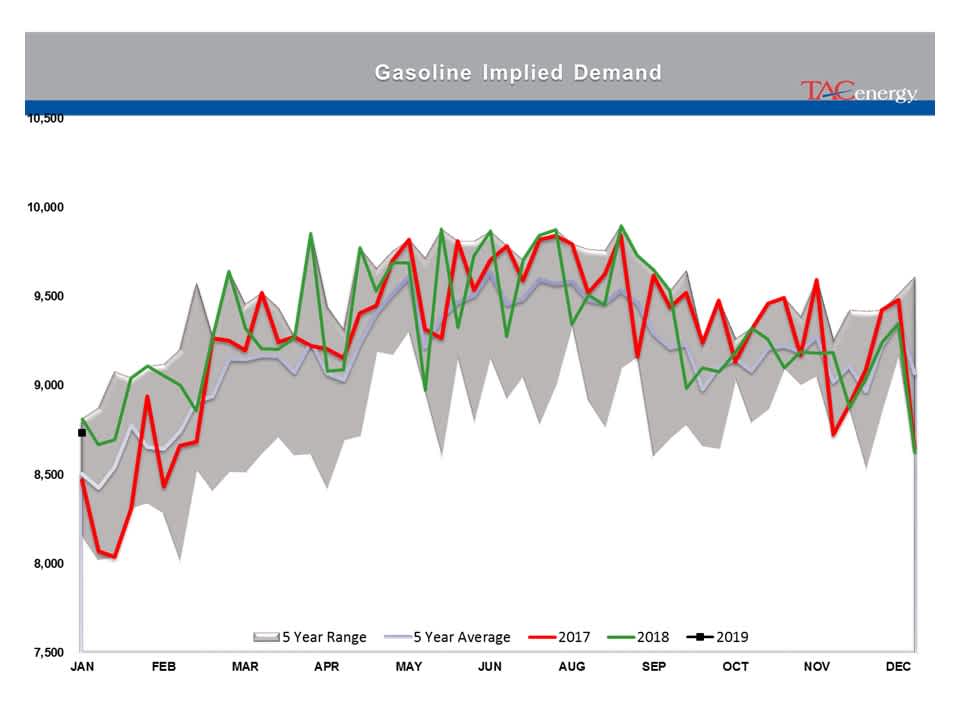

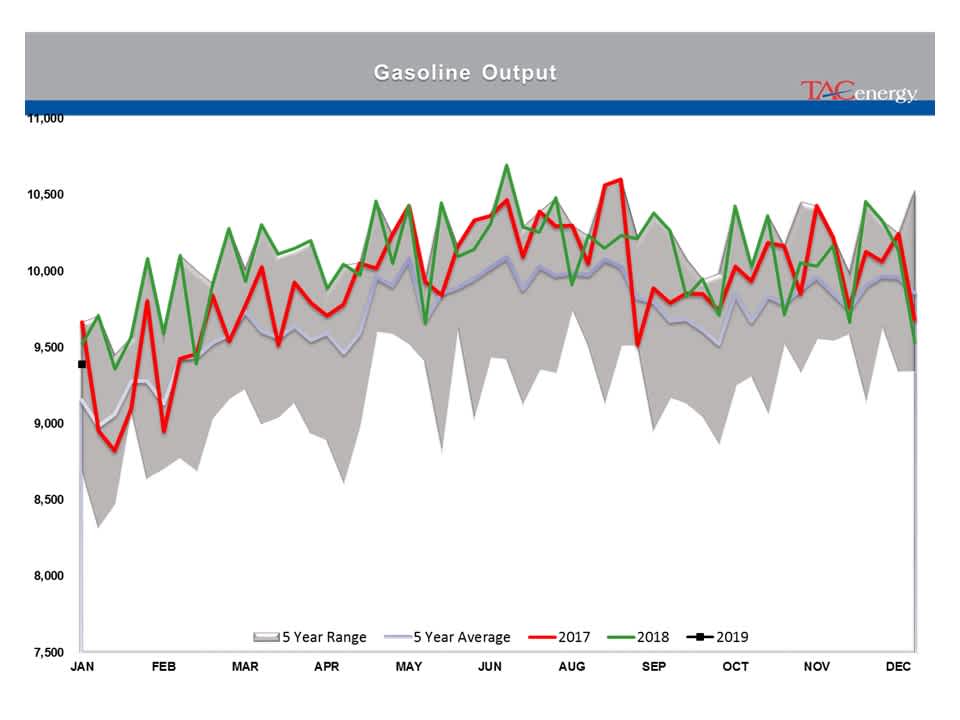

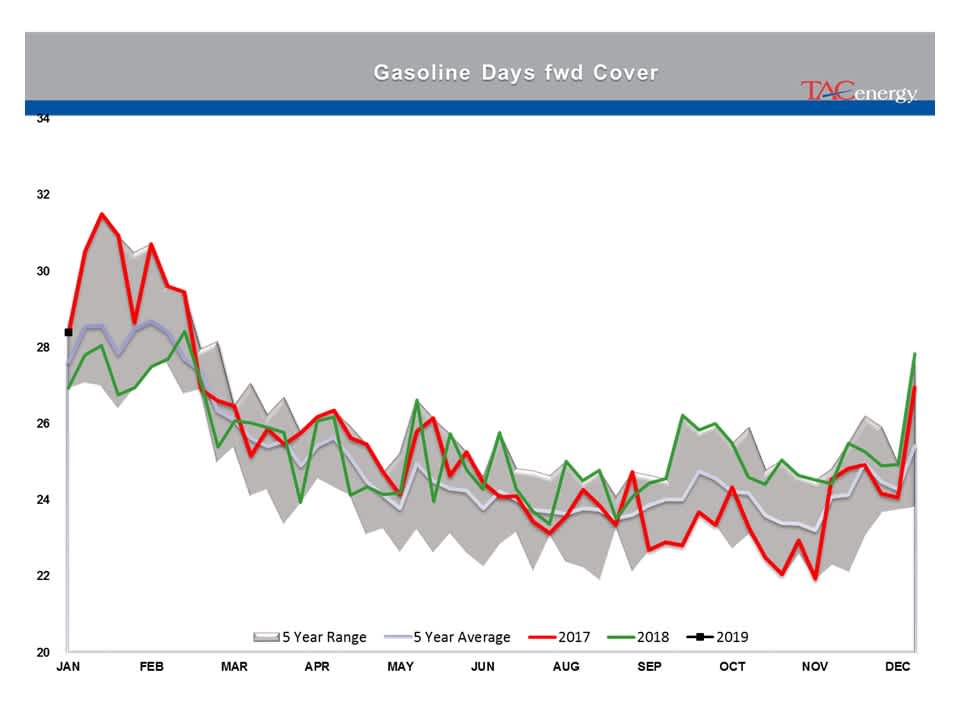

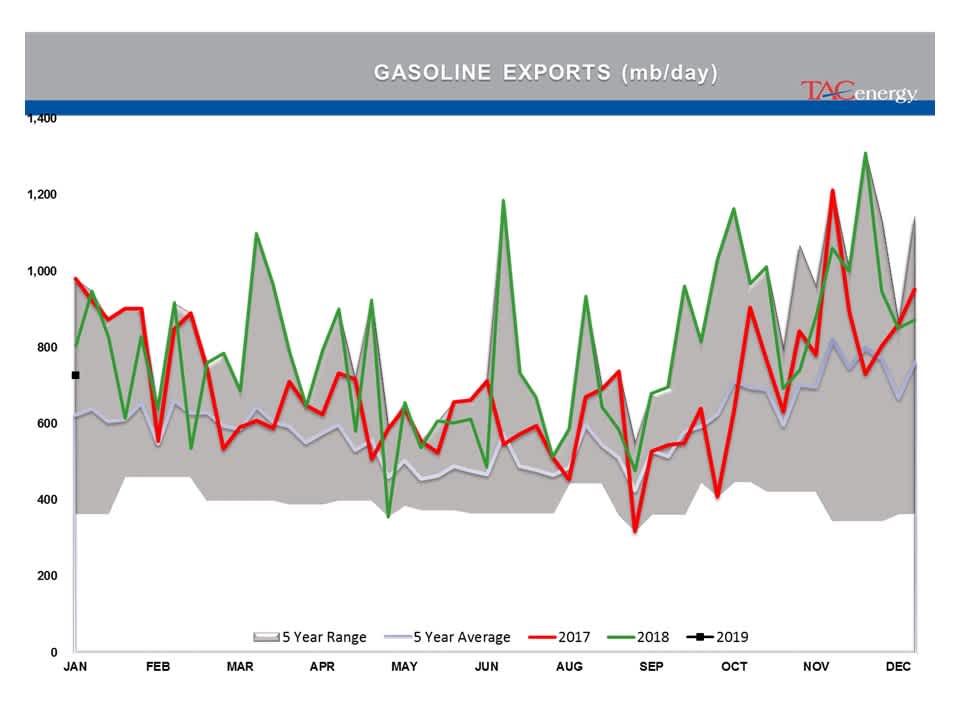

Gasoline inventories also had a large build last week, and have risen by 15 million barrels in the past 2 weeks, but have not seen nearly as dramatic of a demand drop as we often see in early January. Demand estimates are slightly lower than a year ago, but remain above the 5 year average for this time of year.

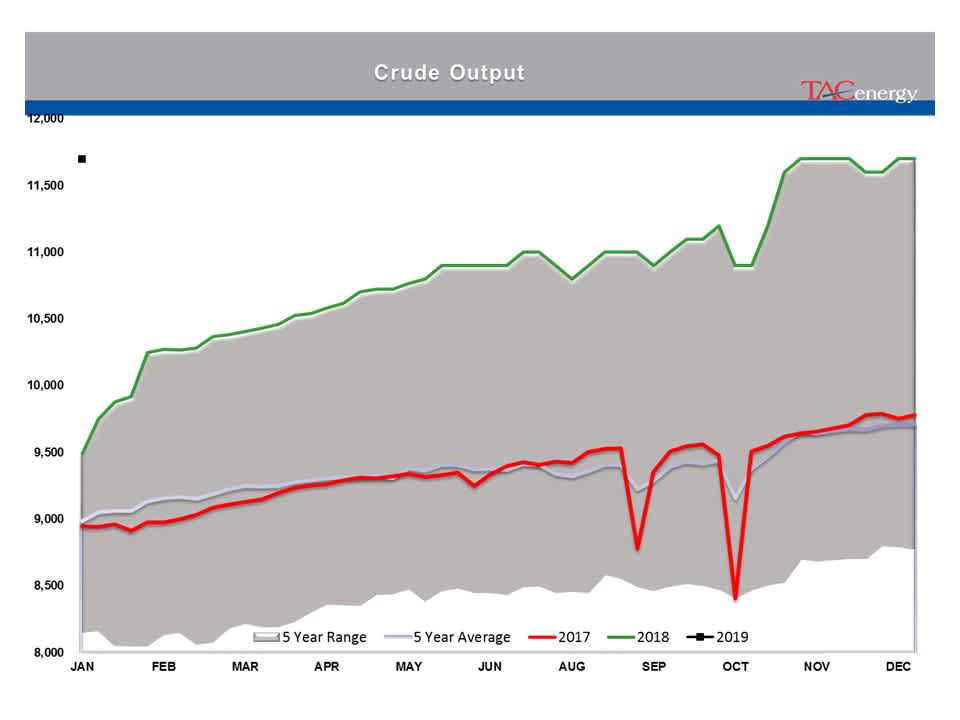

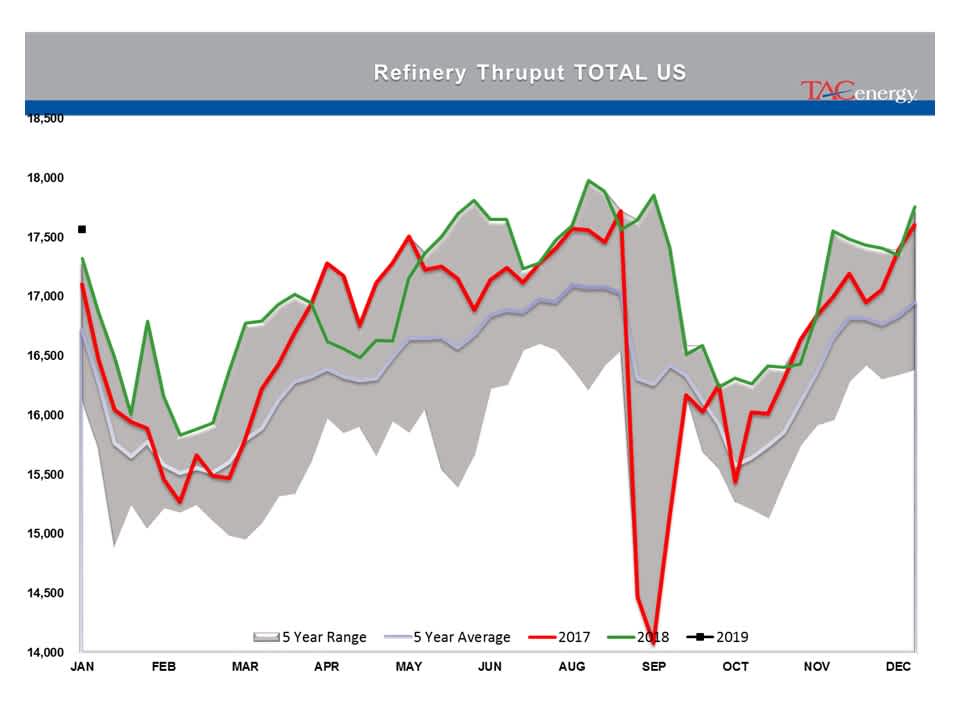

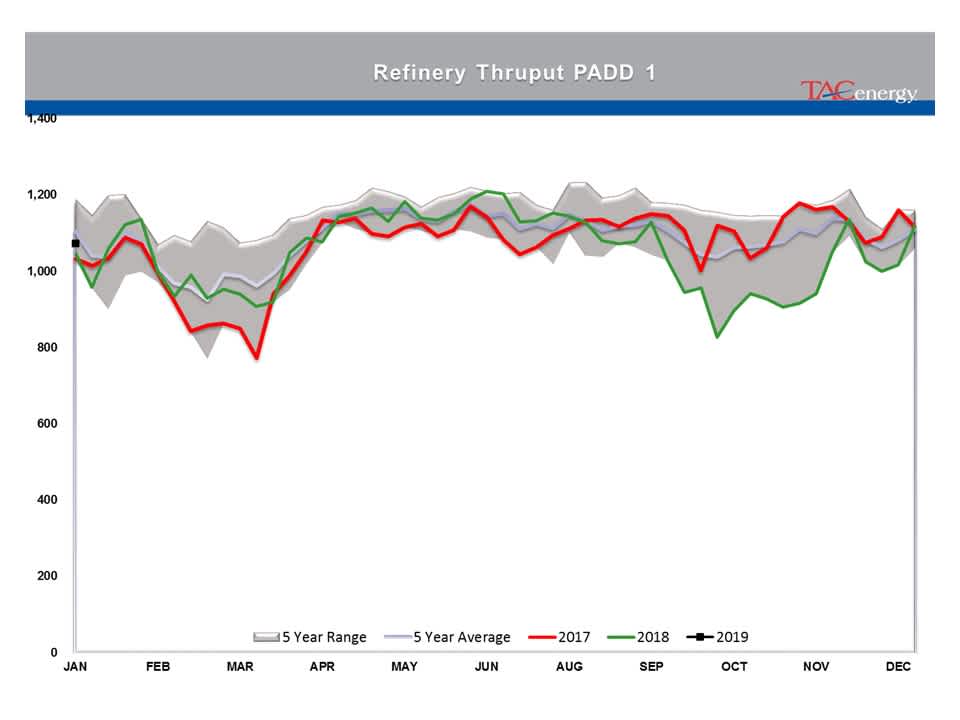

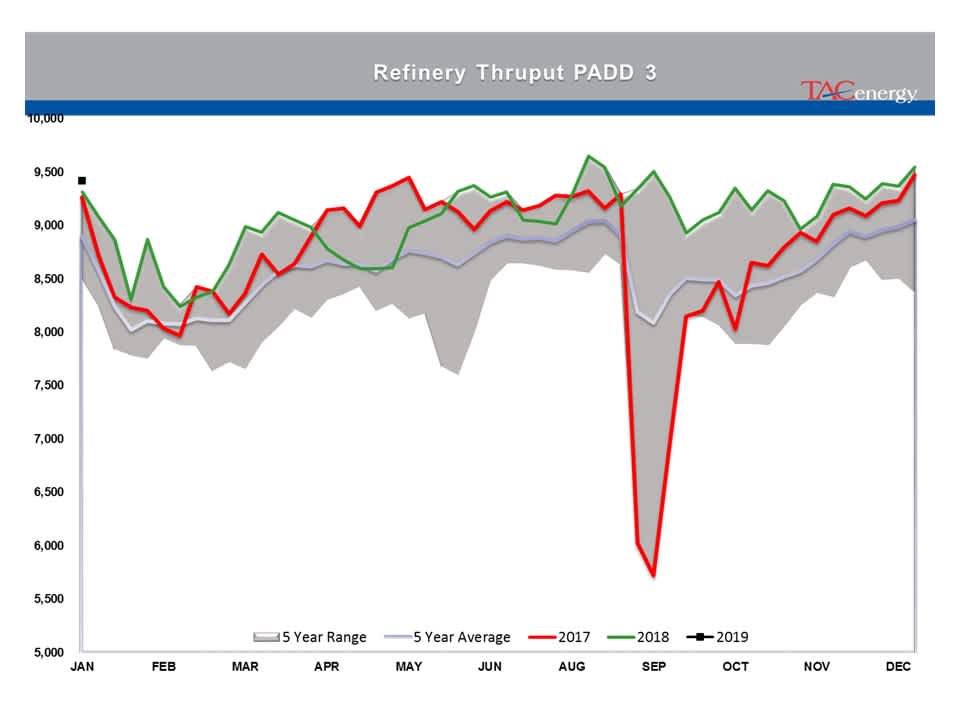

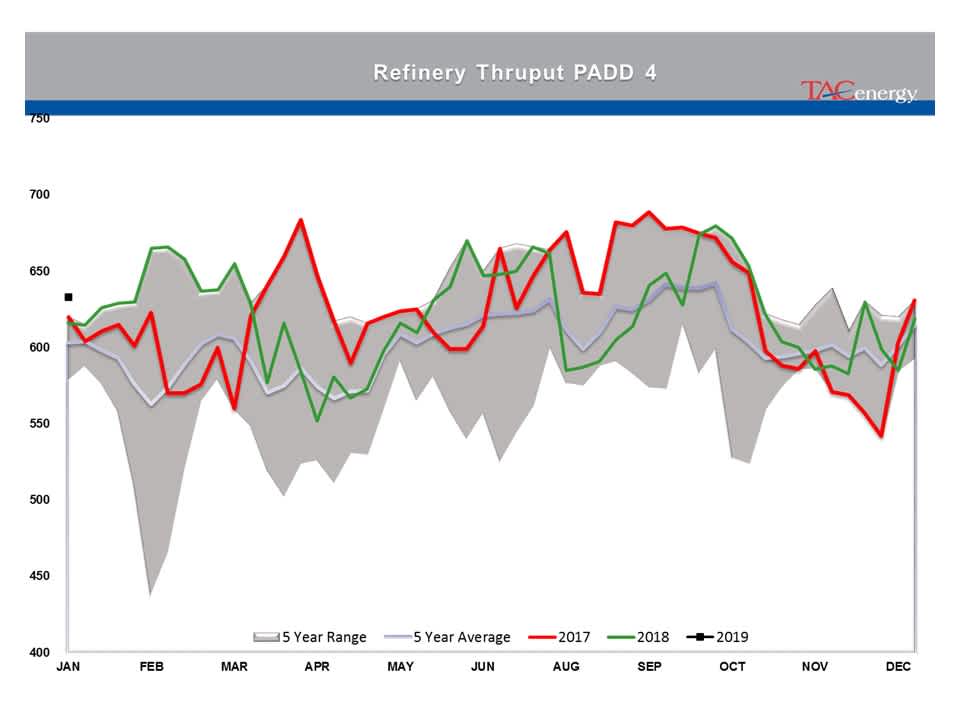

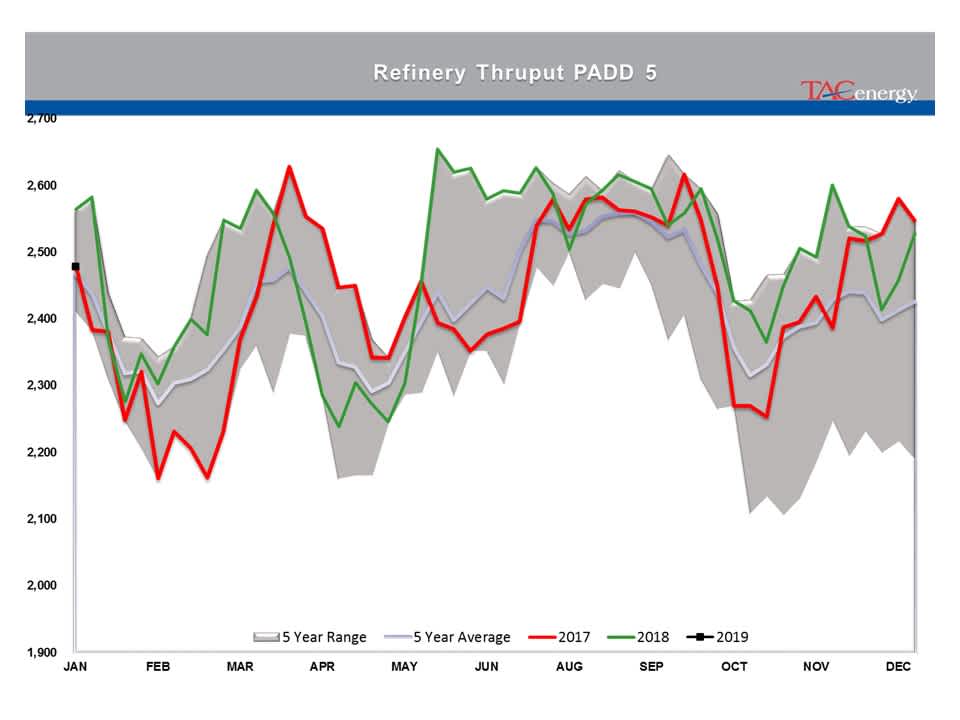

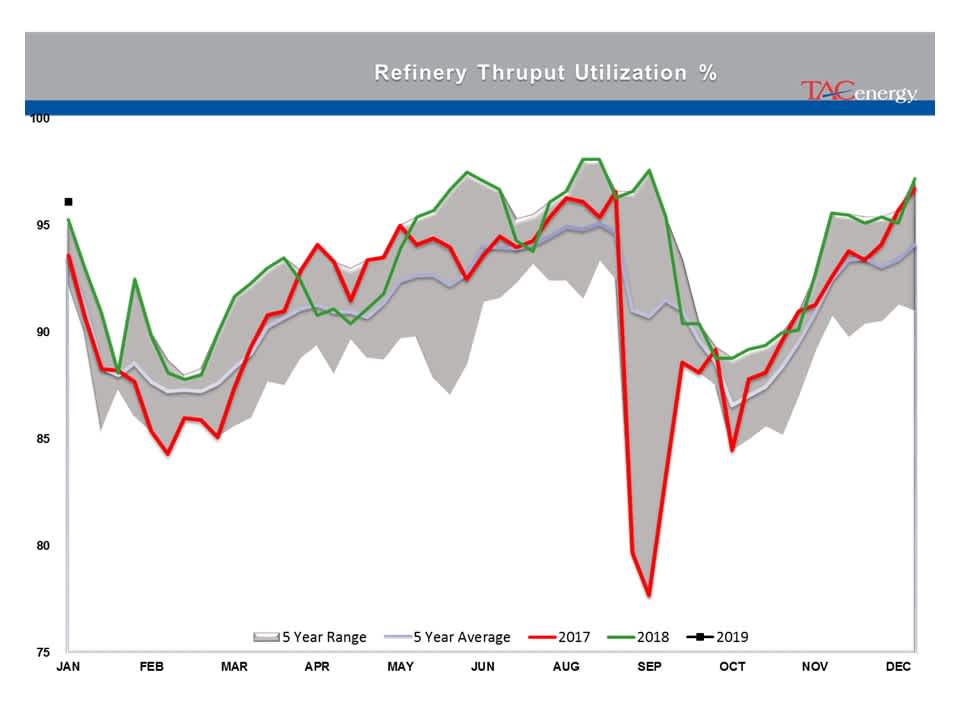

US Refineries just finished another record setting year for run rates, and are starting 2019 at an even faster pace. Expect that refinery run rate to drop over the next several weeks however as we typically see a decline of around 2 million barrels/day for the early maintenance period ahead of the spring transition.

News & Views

View All

Prices Continue To Move In A Relatively Tight Range Awaiting The Next Big Move

Energy markets are treading water heading towards the weekend after Thursday’s rally attempt fizzled and prices continue to move in a relatively tight range awaiting the next big move.

Ukraine struck another Russian refinery overnight, this one a small facility outside of Moscow that was previously hit in March. Yesterday a new type of Ukrainian drone set a record for distance traveled inside of Russia to strike another larger refinery far away from the border. These strikes don’t seem to be stirring market sentiment as they did a couple of months ago as the global market seems to be doing just fine without the incremental Russian barrels for now.

P66 reported unplanned flaring at its Wilmington CA refinery overnight. Since the AQMD doesn’t require the units to be named in the filings it's unclear what impact this may have on production or basis values in the LA-area, which have been the weakest on the West Coast lately as the region struggles with an oversupply of diesel and is less tight on gasoline than its peers.

Citgo continued to report quarterly earnings as it tries to convince bidders that they’re worth years of legal wrangling that’s sure to come along with the auction of its assets. The company had strong run rates of near 95% for the quarter at its 3 plants, and earnings were healthy at $709 million in EBITDA, which was half of year-ago levels.

The biggest story of Thursday’s earnings reports came from the smallest refinery as Vertex announced it was pausing renewable diesel output at its Mobile plant in an effort to survive its liquidity crisis. The company is currently struggling under a mountain of debt including a $196 million term loan that’s costing 17.25% interest as lenders are commanding a huge premium to take risk with the firm.

RBN Energy published an article on Renewable Diesel’s huge reliance on subsidies that helps explain why so many biodiesel and RD producers are cutting production as RIN values and LCFS credits tank. With the change in the blenders tax credit coming next year, those economics are expected to get even worse.

Click here to download a PDF of today's TACenergy Market Talk.

ULSD Futures Are Trading Higher For A 5th Straight Session

Energy prices are trying to rally Thursday as the liquidation cycle that pushed prices to multi-month lows earlier in May appears to have ended and new supply concerns trickle into the market. ULSD Futures are trading higher for a 5th straight session, and although the gains are minor at this point, they do suggest that buyers are willing to jump in near the pivotal technical support layers just below the $2.50 mark, and that the fund liquidation that pushed the HO contract to a net short position for money managers is probably over. RBOB futures are trading 8 cents above Wednesday’s low which also suggests that a buy the dip mentality may be taking hold, and now we’ll just see how long it lasts.

The latest in the drone wars: After a major Russian attack focused on Ukraine’s electricity infrastructure earlier in the week, Ukraine’s drones reportedly struck back hitting a Lukoil fuel terminal near Crimea, and a Gazprom oil refinery more than 1,000 miles from the border.

What feedstock problems? A surge of imports of used cooking oil (UCO) from China to the US, used to make RD with a lower CI score, has several domestic producers crying foul and adds to the long history of fraud surrounding renewables as bad actors try to take advantage of government subsidies.

The excess of Renewable Diesel on the west coast is only adding to the relative weakness of diesel margins for refiners who have watched their distillate cracks erode to the lowest levels since January 2022 over the past few months. A Reuters article this morning highlights the challenges that poses, and it will only get worse if the recent rebound in gasoline margins fails to hold. That excess of renewable production targeting the West Coast is also contributing to California’s LCFS values dropping to multi-year lows this week, which is putting pressure on earnings for companies that races to convert refineries to RD production in recent years.

Speaking of which, HF Sinclair reported another net loss in its renewable segment in Q1, while its traditional refineries followed the recent pattern of decent earnings that were far below year-ago levels.

Energy News Today reported a fire at the HF Sinclair refinery in Anacortes WA Wednesday which seemed to contribute to stronger basis values in the typically illiquid PNW spot market, and some tightening of allocations by suppliers in local terminals. In hopefully unrelated news, the company posted a job opening for an Emergency Response Specialist at that facility just last week.

P66 reported yet another upset at its Borger refinery Wednesday, marking the facility’s 14th TCEQ filing of the year so far. Two different sulfur recovery units were noted as being impacted by the event, but it appears the units were able to restore operations.

Click here to download a PDF of today's TACenergy Market Talk.