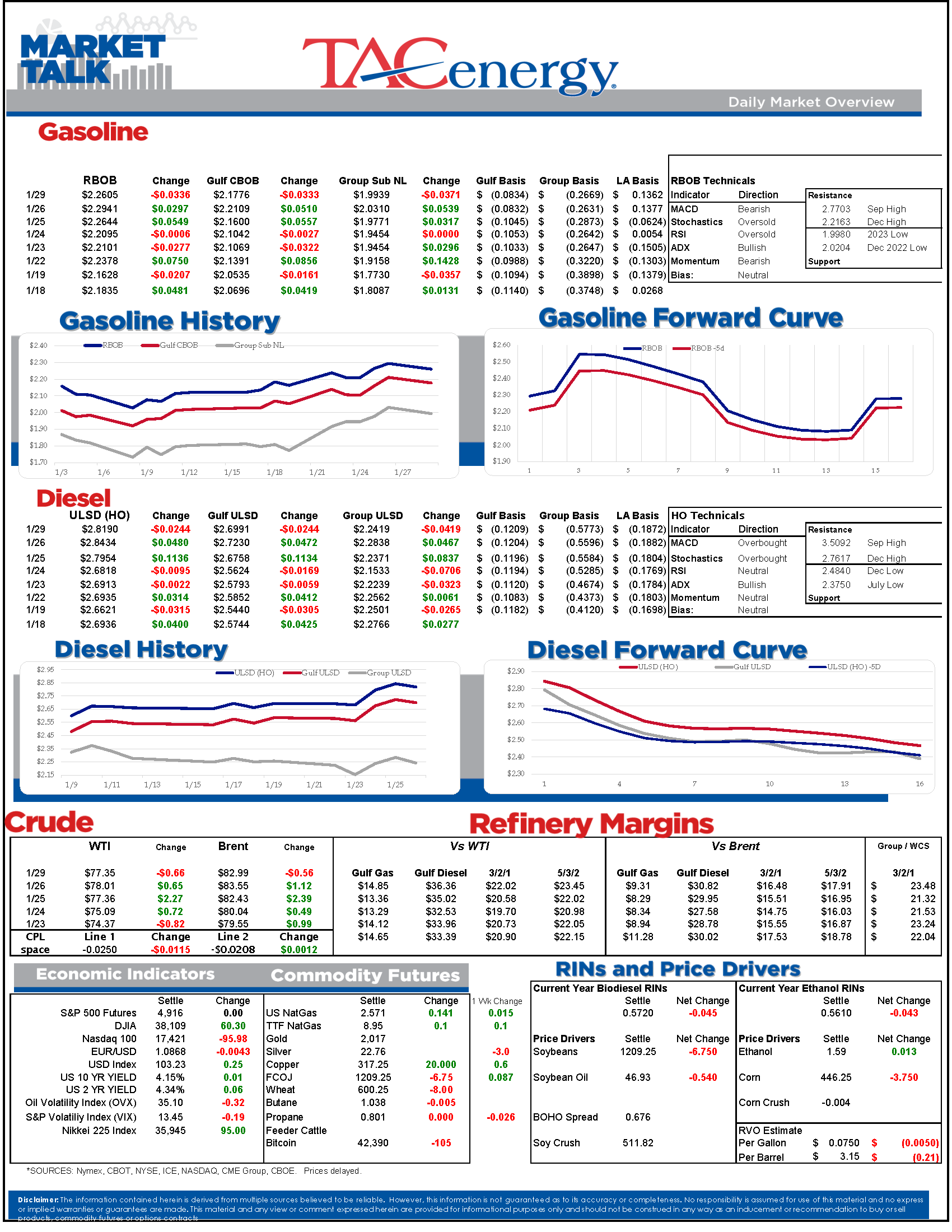

Energy Markets Are Ticking Lower This Morning After Reaching 2-Month Highs To End Last Week

Energy markets are ticking lower this morning after reaching 2-month highs to end last week. The breakthrough to the upside last week leaves the door open for higher prices in the week’s ahead, even though moves lower like we’re seeing this morning are necessary to correct the short-term overbought condition on some charts.

Friday’s session was highlighted by early weakness turning into more afternoon gains following reports that a tanker operated by Trafigura carrying Russian naphtha was hit by a Houthi missile, and a US destroyer shot down another missile shortly thereafter. That targeting of tanker with Russian fuel aboard marked a potential paradigm shift for the tanker industry that had largely shrugged off the attacks, particularly with Russian fuel making up the majority of southbound tanker traffic through the Suez Canal.

While that new attack risks higher prices near term, it could also help to bring about a long term resolution as Iran’s proxies are turning the country into an international pariah, with China, Russia and the US all now having a vested interest in stopping the attacks on shipping even if their other interests are not aligned.

Buyers jumped back in when trading resumed Sunday night following the attacks on a US military outpost in Jordan that killed 3 and injured dozens more, but those gains didn’t last long as the market continues to discount the threat to physical supplies despite the continuous ramping up of violence in the region.

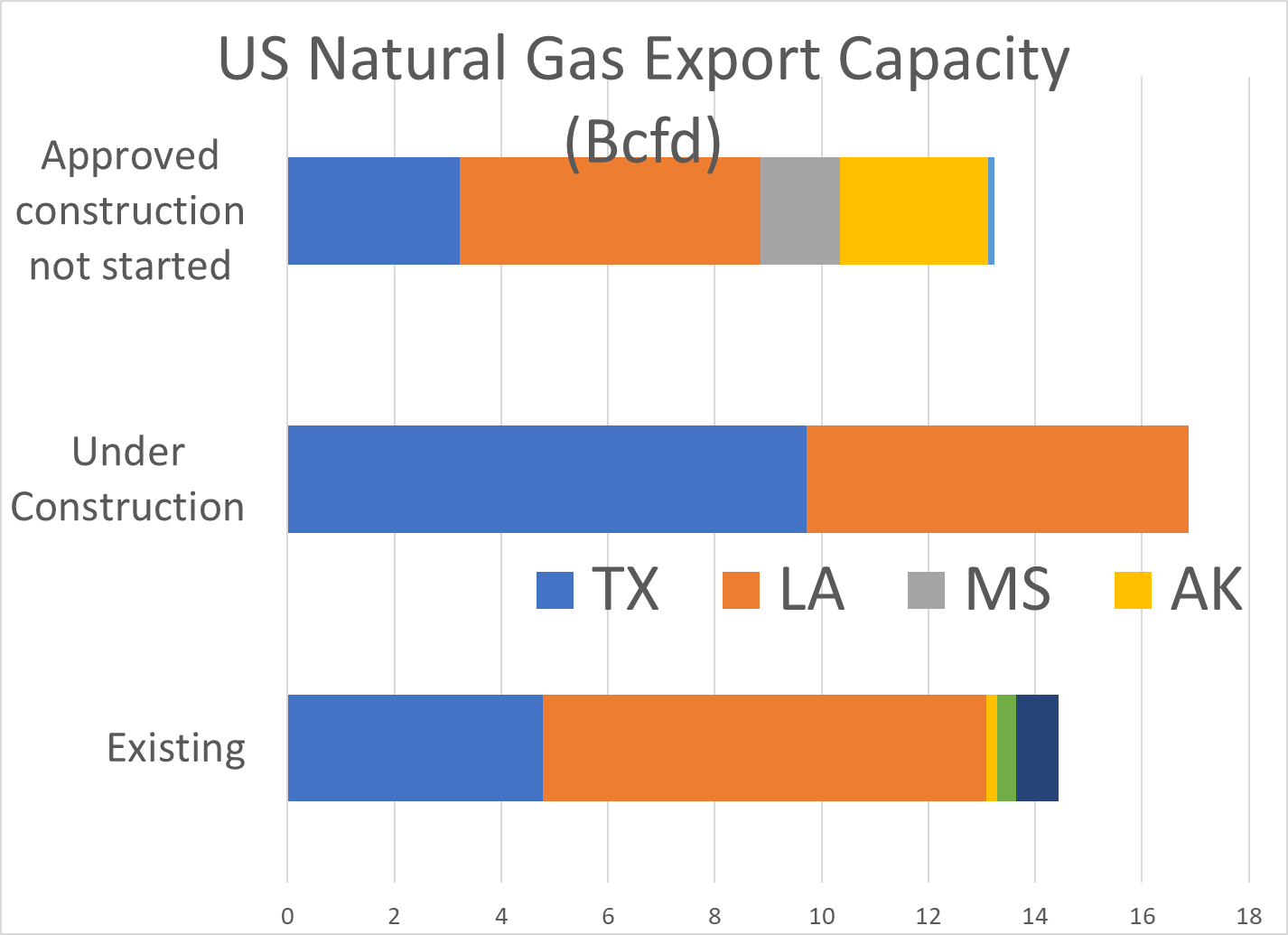

The White House on Friday announced a pause in the permitting process for new LNG export facilities.

A WSJ article over the weekend argues why this policy is actually worse for the environment, and the chart below from FERC data of existing projects shows why it’s probably nothing more than a political stunt in an election year with capacity set to more than double in the next few years via projects already approved and under construction, while even more projects are already approved.

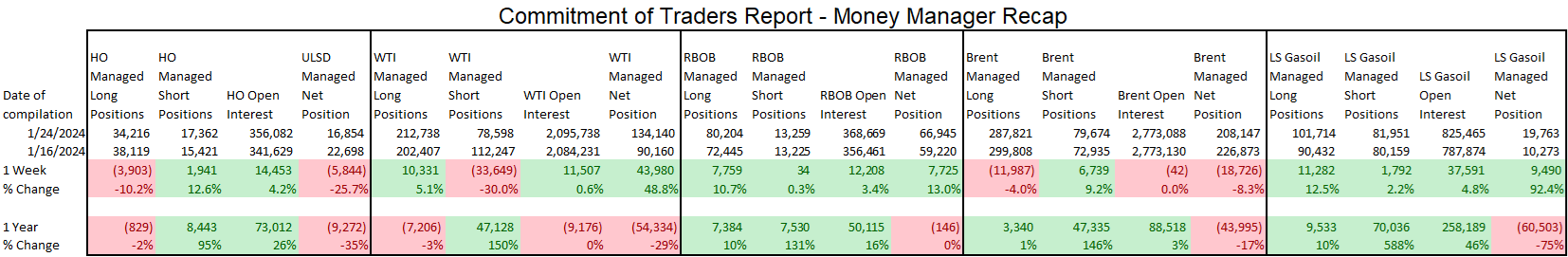

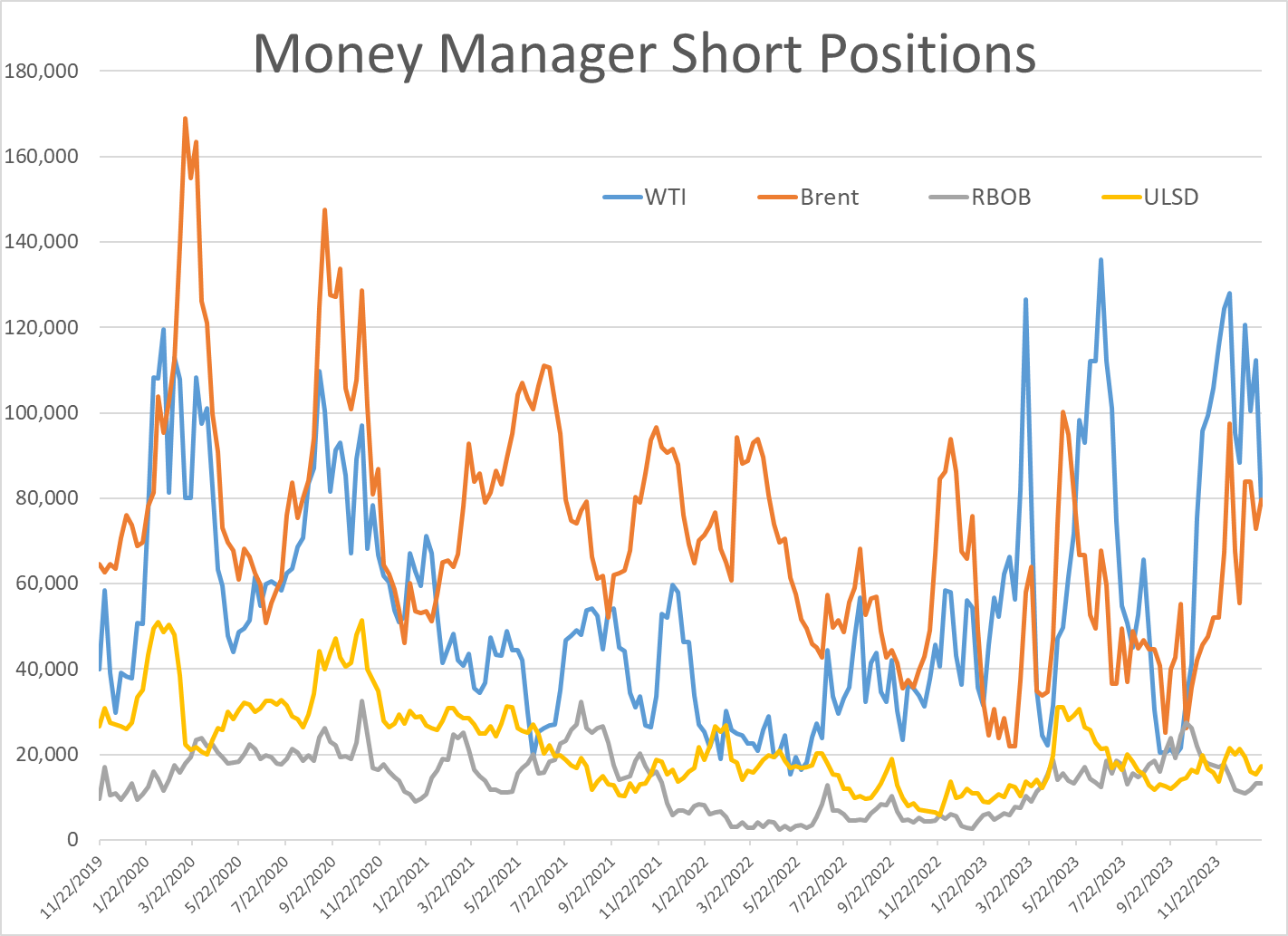

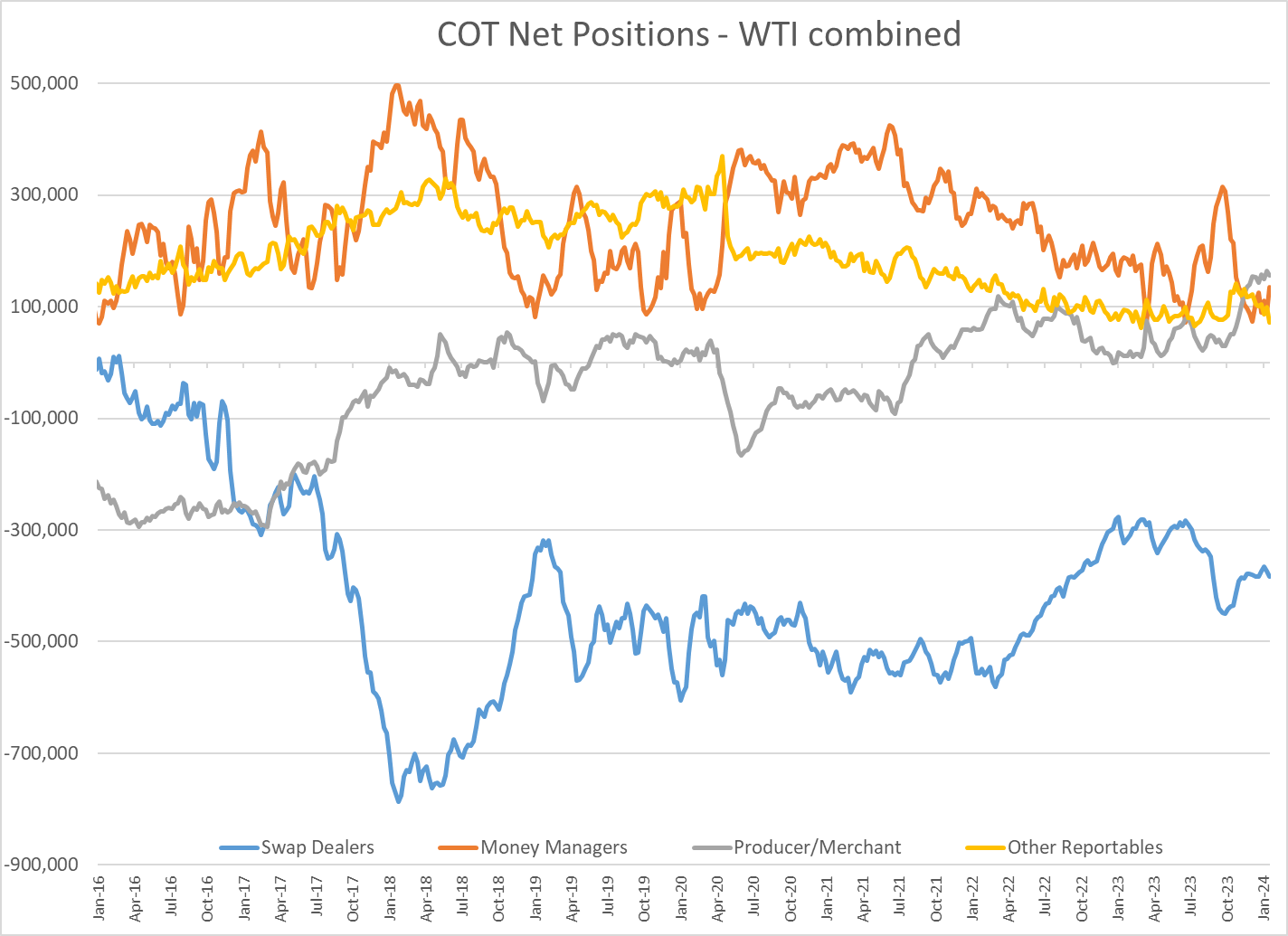

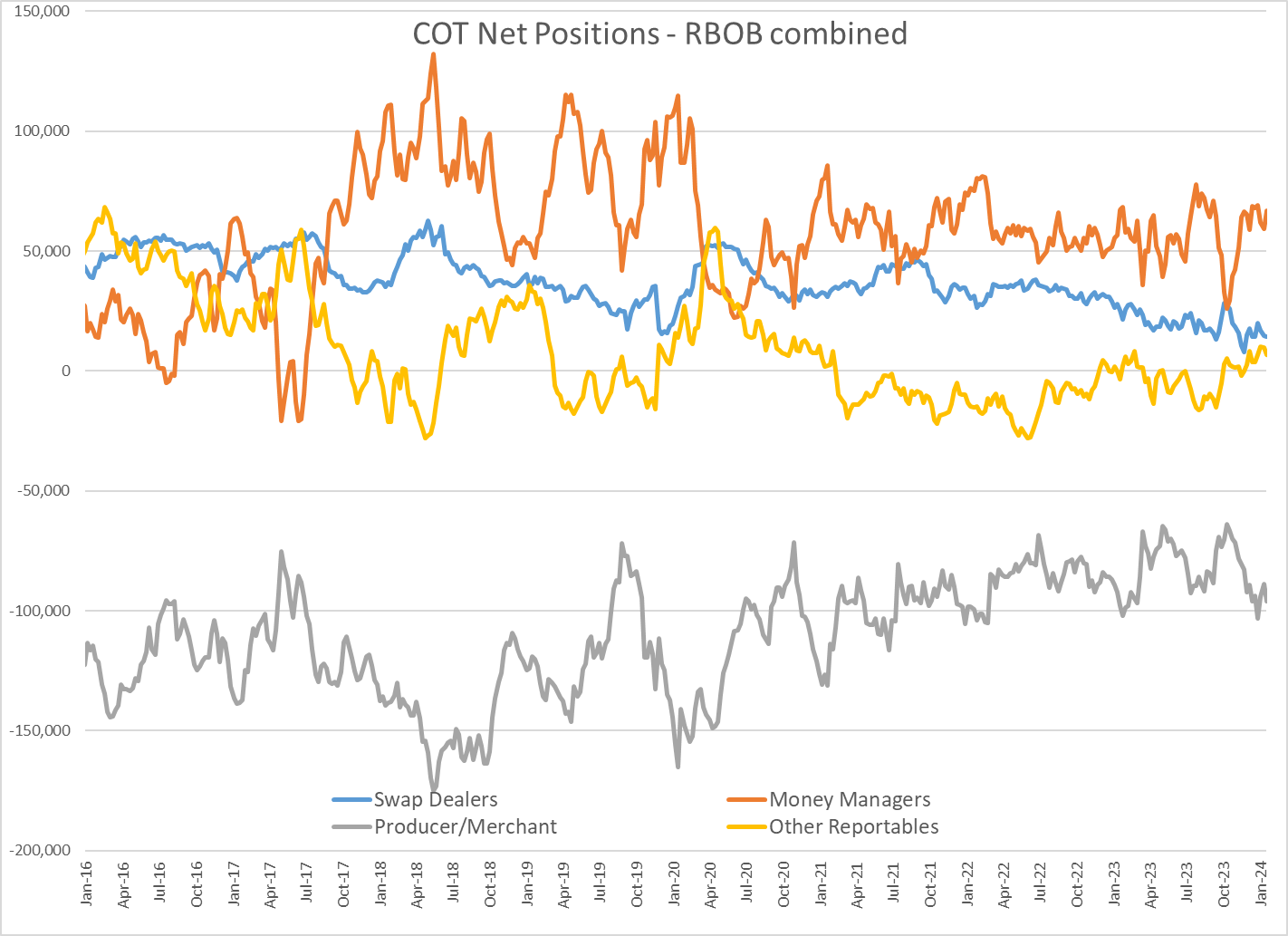

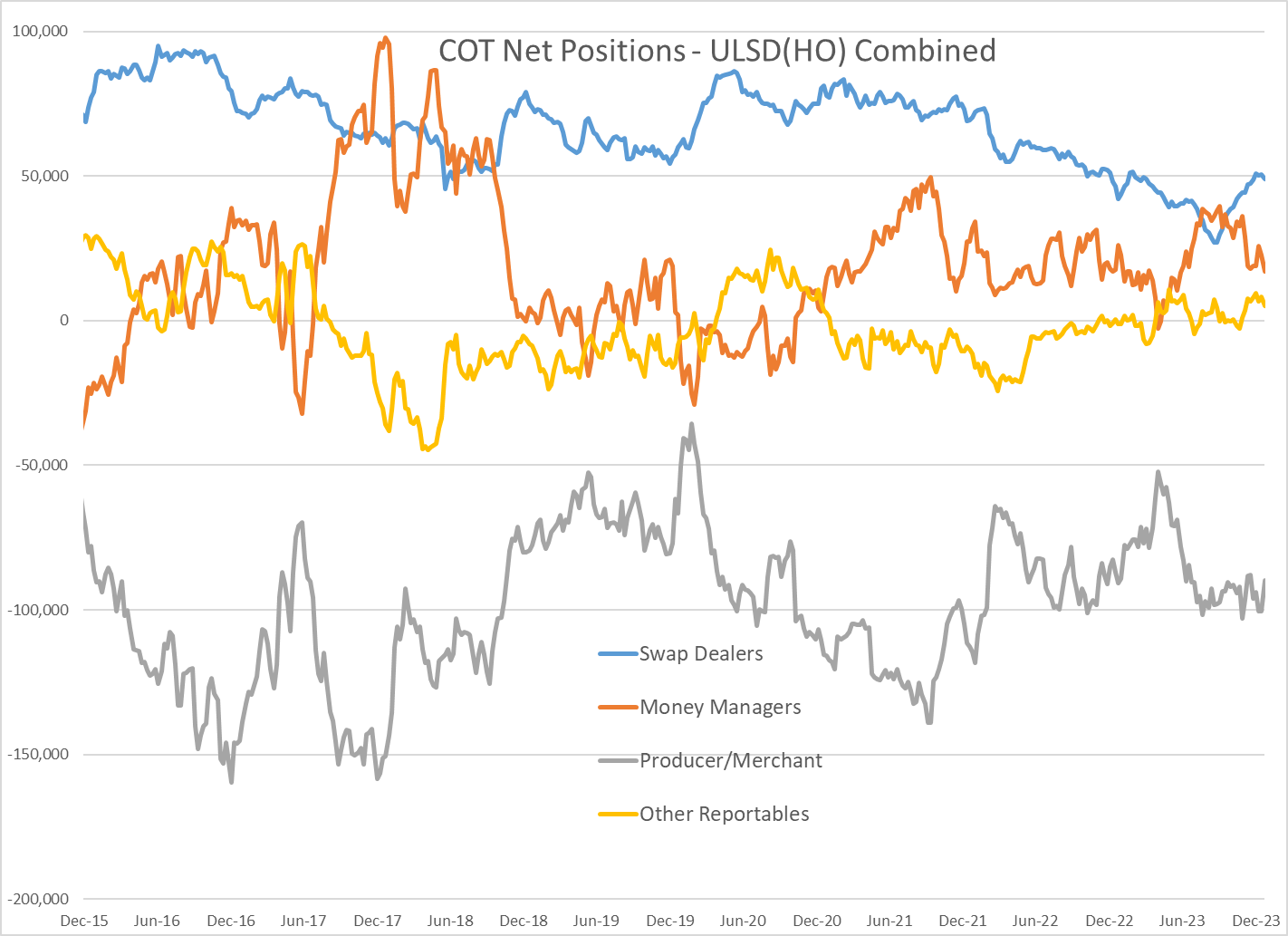

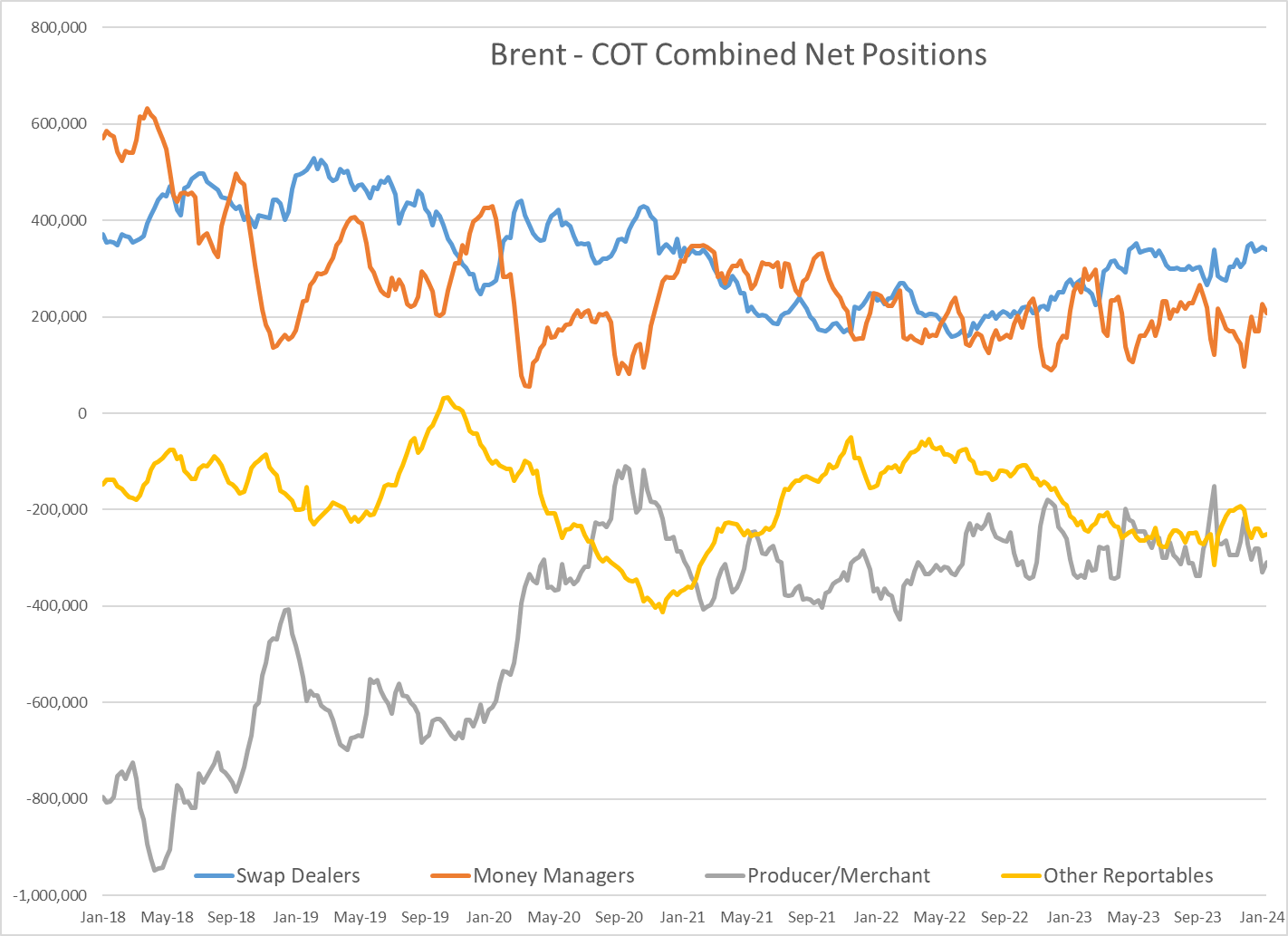

Money managers continue to be conflicted in their energy contract positioning, with large speculators reducing their net length in ULSD and Brent contracts last week, while increasing their bets on higher WTI, RBOB and Gasoil prices. A large wave of short covering in WTI was perhaps the most notable change on the week as the big bettors seemed to throw in the towel on getting lower US crude values after WTI touched a 2-month high.

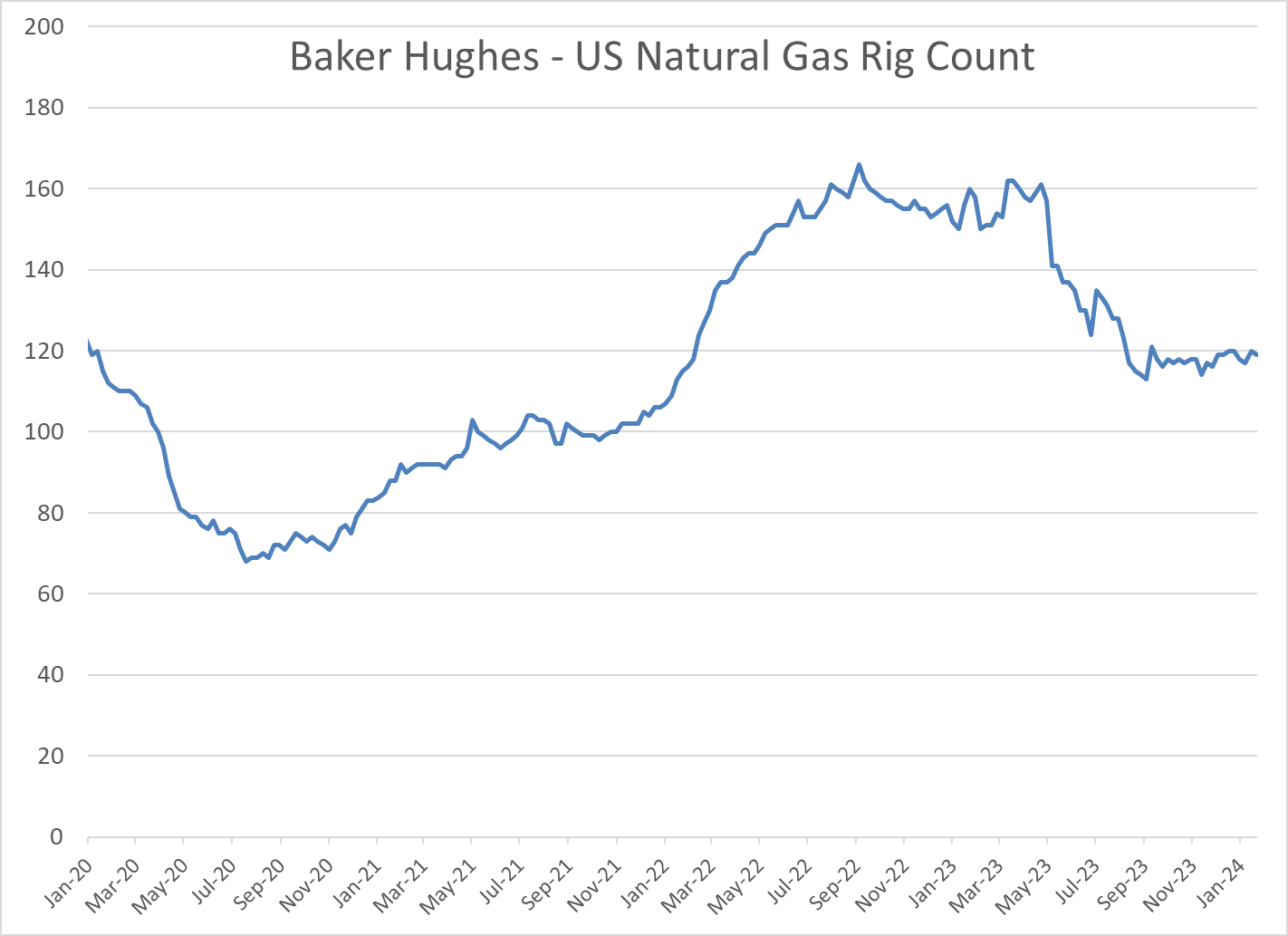

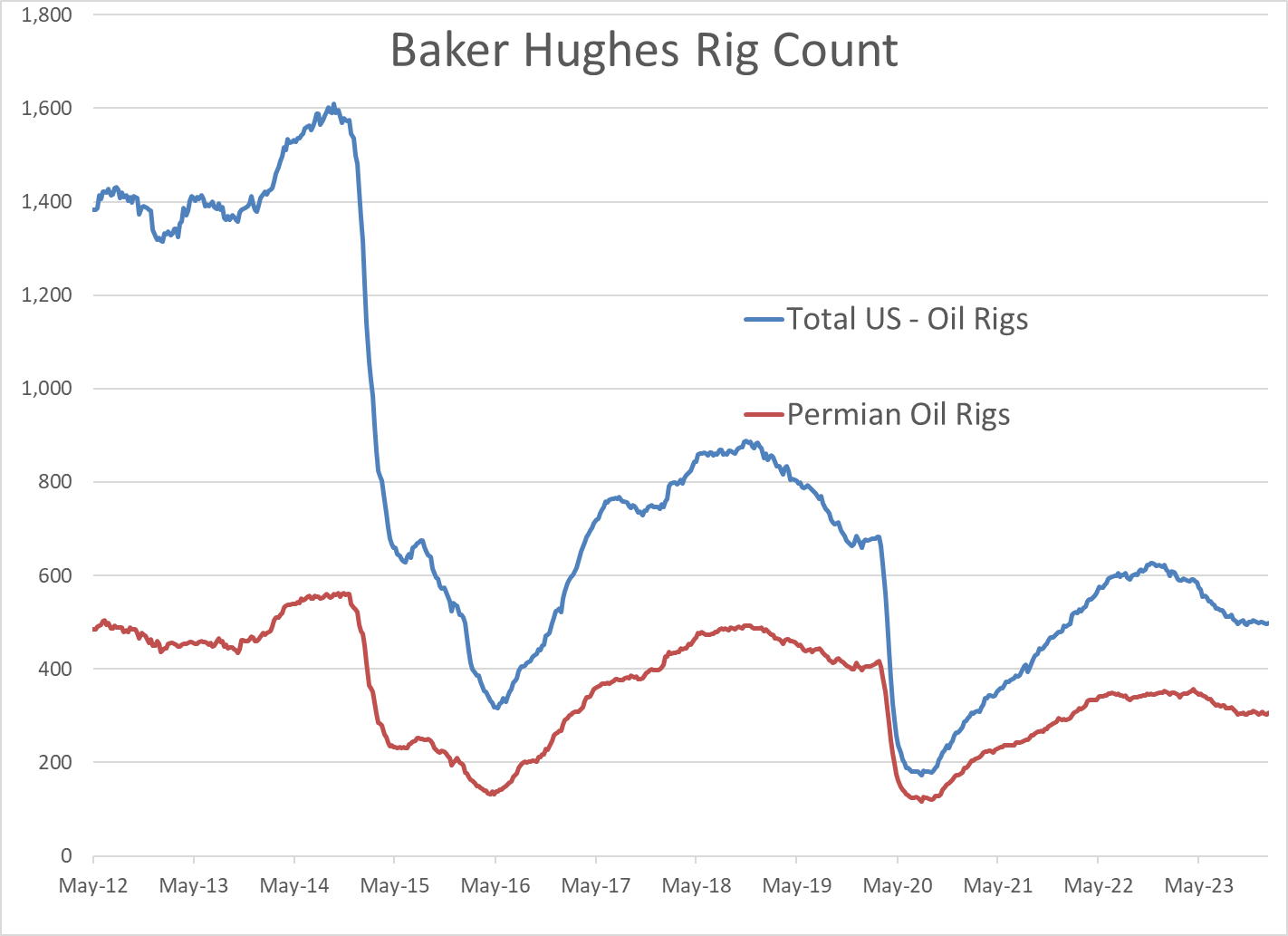

Baker Hughes reported a net increase of 2 oil rigs working in the US last week, while natural gas rigs decreased by 1.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

ULSD Futures Are Trading Higher For A 5th Straight Session

Energy prices are trying to rally Thursday as the liquidation cycle that pushed prices to multi-month lows earlier in May appears to have ended and new supply concerns trickle into the market. ULSD Futures are trading higher for a 5th straight session, and although the gains are minor at this point, they do suggest that buyers are willing to jump in near the pivotal technical support layers just below the $2.50 mark, and that the fund liquidation that pushed the HO contract to a net short position for money managers is probably over. RBOB futures are trading 8 cents above Wednesday’s low which also suggests that a buy the dip mentality may be taking hold, and now we’ll just see how long it lasts.

The latest in the drone wars: After a major Russian attack focused on Ukraine’s electricity infrastructure earlier in the week, Ukraine’s drones reportedly struck back hitting a Lukoil fuel terminal near Crimea, and a Gazprom oil refinery more than 1,000 miles from the border.

What feedstock problems? A surge of imports of used cooking oil (UCO) from China to the US, used to make RD with a lower CI score, has several domestic producers crying foul and adds to the long history of fraud surrounding renewables as bad actors try to take advantage of government subsidies.

The excess of Renewable Diesel on the west coast is only adding to the relative weakness of diesel margins for refiners who have watched their distillate cracks erode to the lowest levels since January 2022 over the past few months. A Reuters article this morning highlights the challenges that poses, and it will only get worse if the recent rebound in gasoline margins fails to hold. That excess of renewable production targeting the West Coast is also contributing to California’s LCFS values dropping to multi-year lows this week, which is putting pressure on earnings for companies that races to convert refineries to RD production in recent years.

Speaking of which, HF Sinclair reported another net loss in its renewable segment in Q1, while its traditional refineries followed the recent pattern of decent earnings that were far below year-ago levels.

Energy News Today reported a fire at the HF Sinclair refinery in Anacortes WA Wednesday which seemed to contribute to stronger basis values in the typically illiquid PNW spot market, and some tightening of allocations by suppliers in local terminals. In hopefully unrelated news, the company posted a job opening for an Emergency Response Specialist at that facility just last week.

P66 reported yet another upset at its Borger refinery Wednesday, marking the facility’s 14th TCEQ filing of the year so far. Two different sulfur recovery units were noted as being impacted by the event, but it appears the units were able to restore operations.

Click here to download a PDF of today's TACenergy Market Talk.

Week 18 - US DOE Inventory Recap

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.