Energy Futures Are Ticking Lower For A 2nd Day As The Search For Direction Continues Heading Into Year End

Energy futures are ticking lower for a 2nd day as the search for direction continues heading into year end. ULSD futures are now trading 15 cents below the highs reached last week but are still 14 cents above the lows set 2 weeks ago. That back and forth is indicative of the neutral technical outlook we’re in near term, while longer term charts still given slight favor to lower prices ahead.

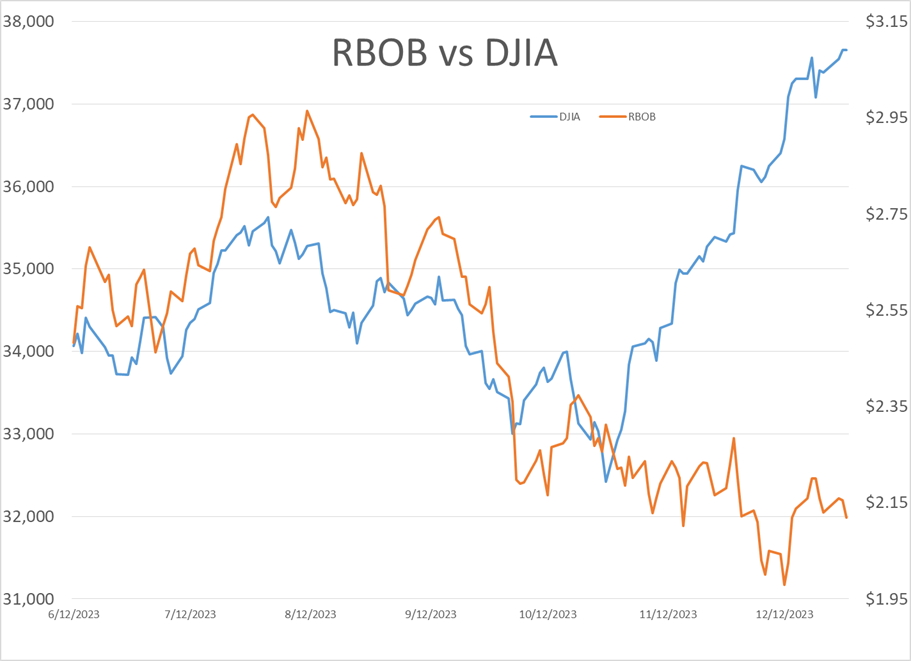

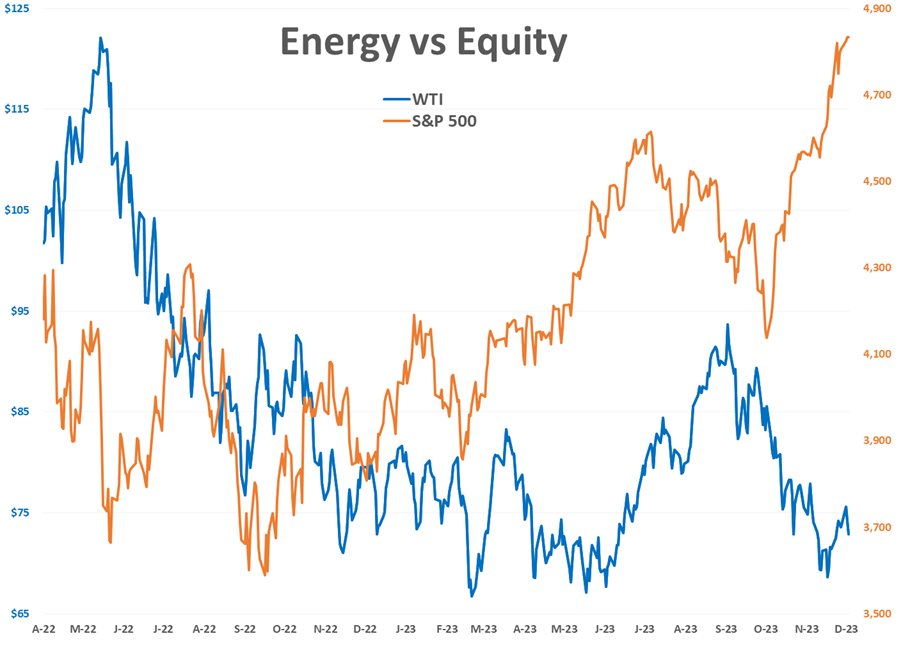

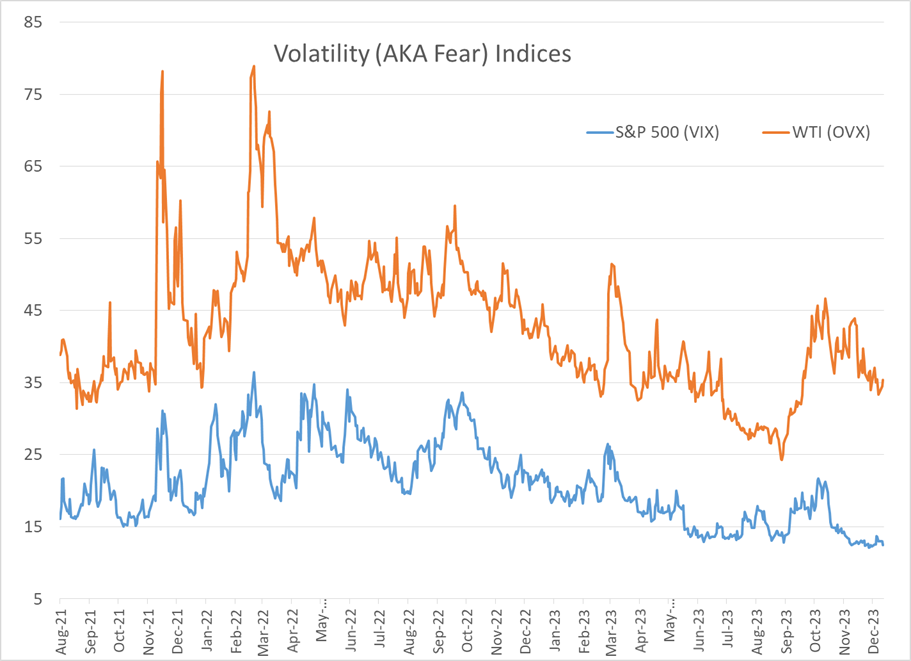

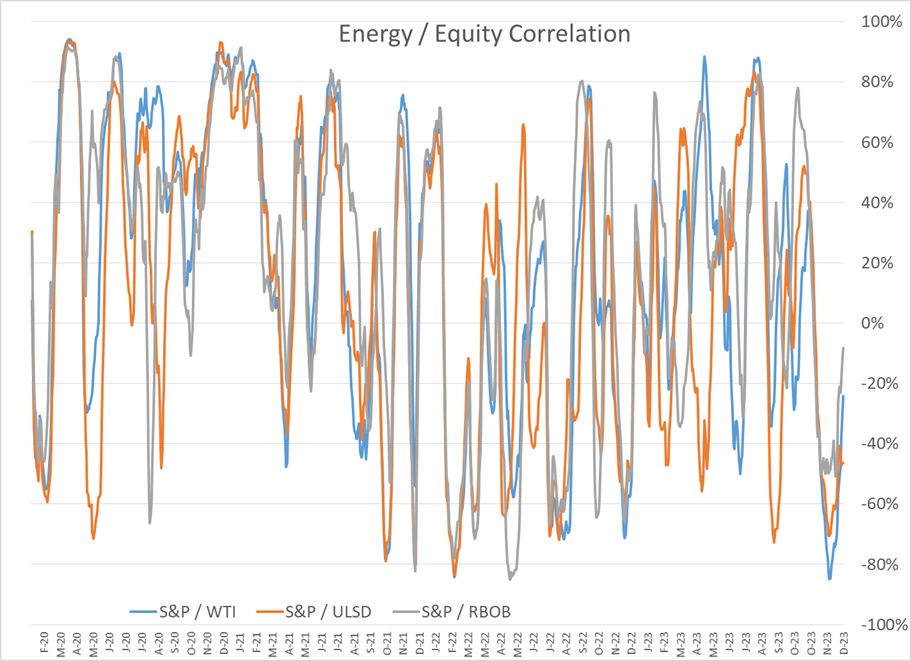

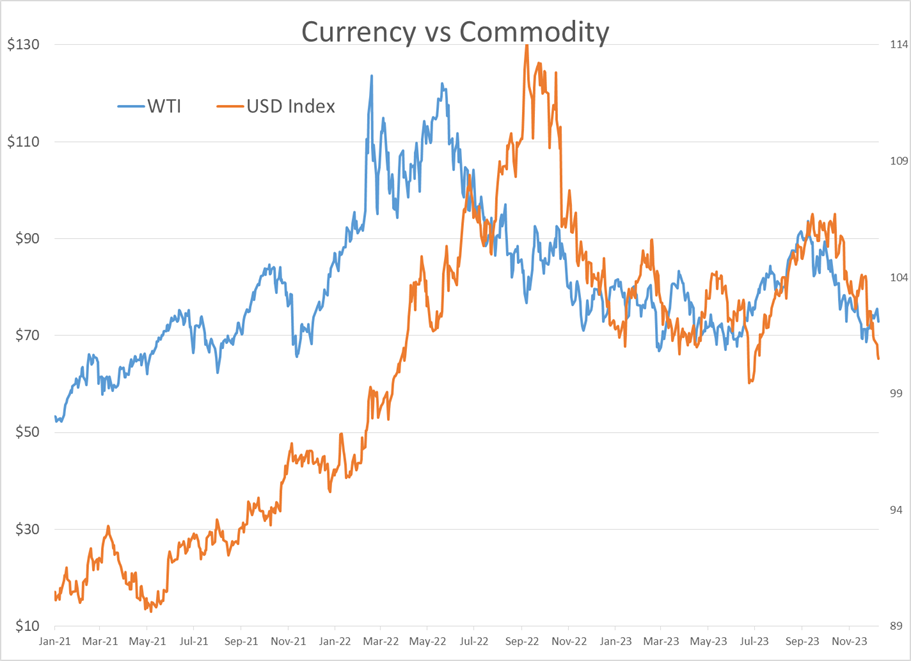

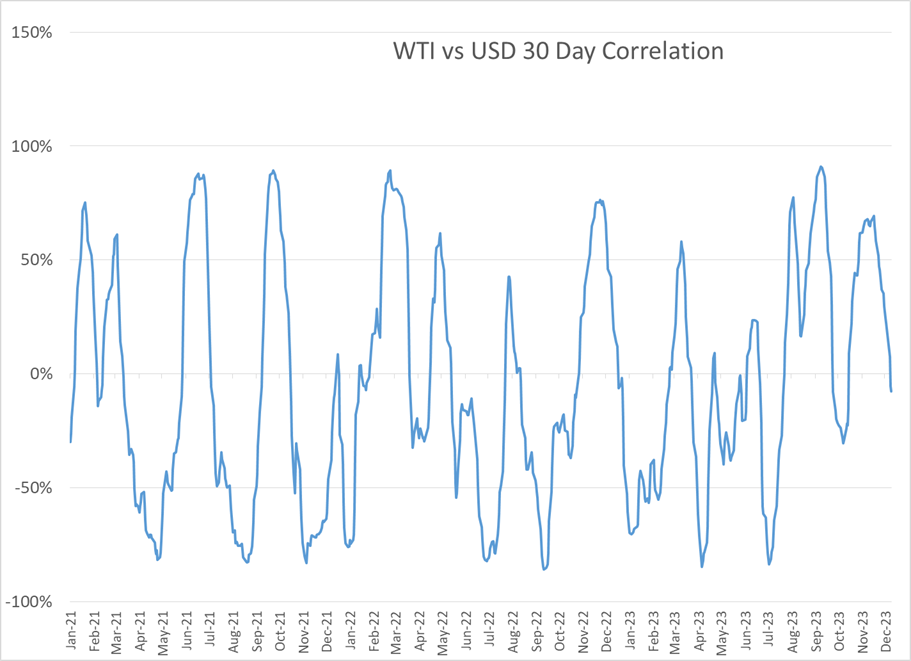

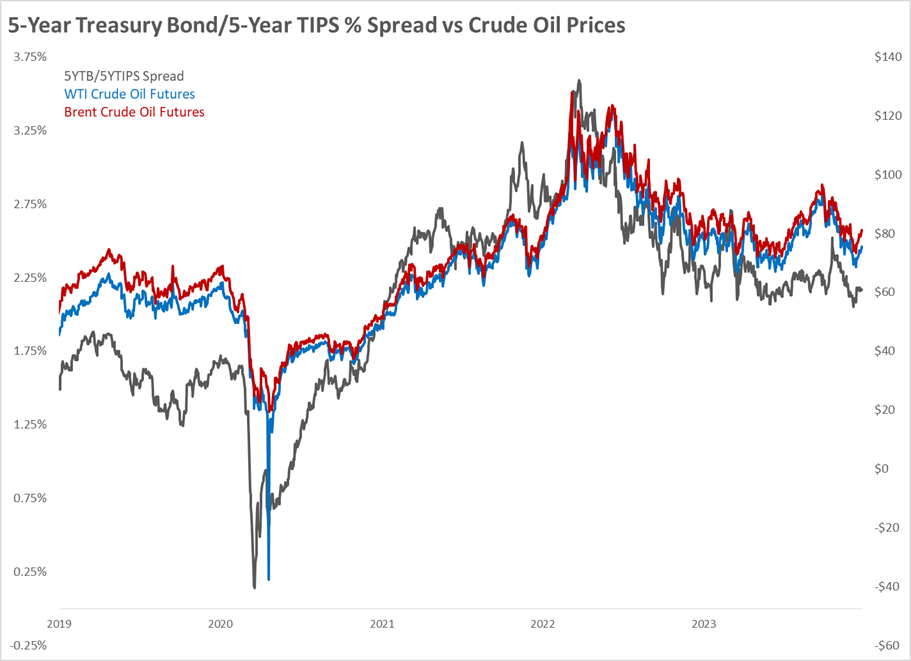

The DJIA reached a new record high Wednesday at 37,656, while the S&P 500 is just half of a percent from a new record of its own. Energy and equity prices had a strong positive correlation early in 2023 but have moved independently of each other the past few months, so the pull higher from stocks just isn’t there. Likewise, the US dollar influence on energy futures, which is often cited as a daily driver of price action, has been essentially non-existent of late, so the big drop in the US dollar coinciding with a huge rally in US treasuries, isn’t pushing up oil prices as it has in years past.

An attack on a container ship in the Red Sea Tuesday was repelled by the US Navy, which said it shot down 12 drones and 5 missiles heading for the ship and suggests that the coalition forces are up to the task of protecting ships in the region.

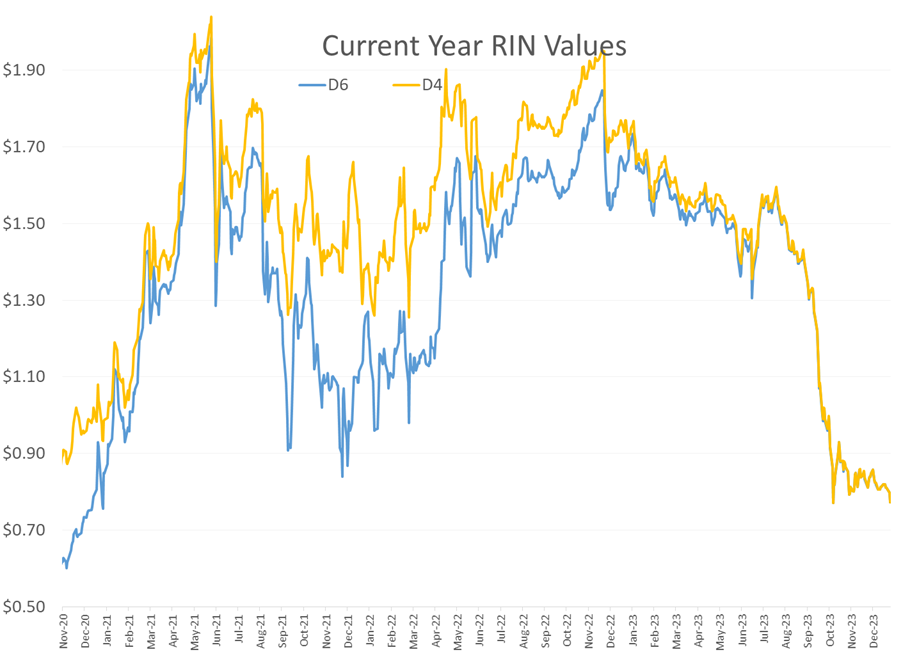

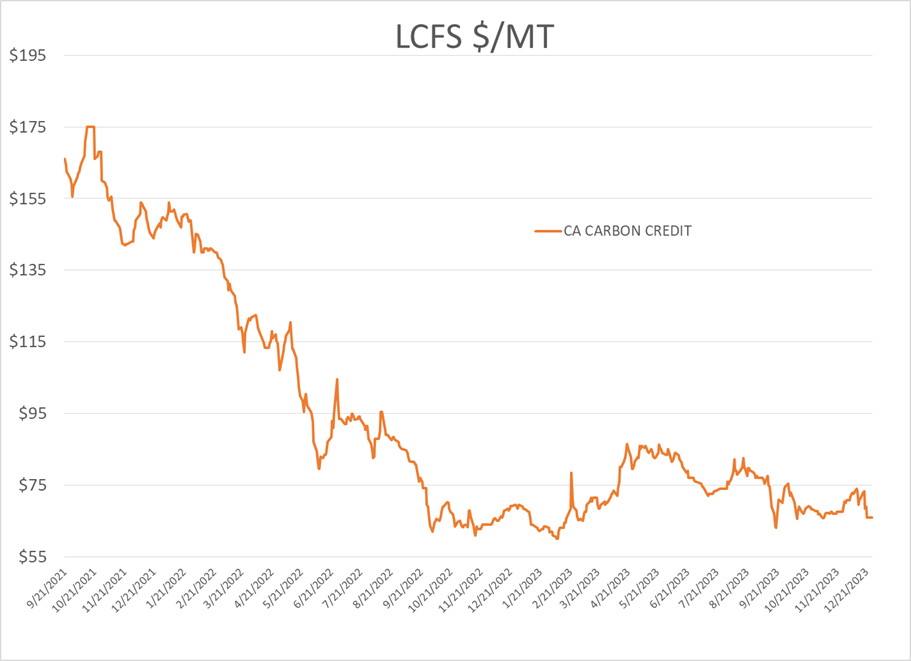

RIN prices have dropped near a 3-year low this week and are on the verge of a technical breakdown that could send prices sharply lower if they break and hold below $.75/RIN. RIN prices have dropped nearly $1/RIN this year as the rapid influx of renewable diesel (which creates 1.7 RINs/gallon vs 1.5 for biodiesel and 1.0 for ethanol) brought a huge increase to the RIN supply pool, while the EPA’s increase in bio-mass mandates wasn’t enough to offset that new supply. With the upcoming changes to the Blenders Tax Credit that will soon require bio-fuel producers to prove the environmental benefit of their product to receive a credit, vs today’s $1/gallon for everyone, and stagnate prices for LCFS credits, subsidy revenue for bio-producers looks like it will be a headwind in 2024.

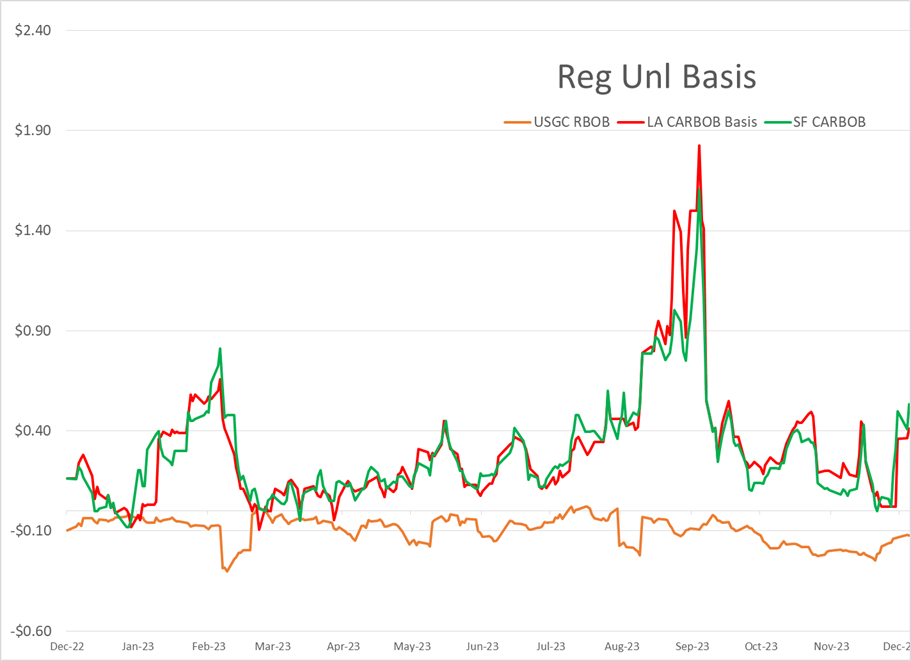

San Francisco basis values continued their recent rally, following a surprise inspection of PBF’s refinery in Martinez Wednesday, following multiple upsets the week prior. Prompt values for CARBOB gasoline traded up to a 60-cent premium to futures in San Francisco yesterday, compared to discounts of 15-30 cents/gallon in the Gulf Coast and Mid-West. Bay Area prices are expected to remain volatile this year as the 2nd of 5 local refineries is in the process of converting to renewable production, leaving the region more vulnerable to supply shocks.

The API reported a build in crude oil stocks of 1.8 million barrels last week, while diesel saw a small increase of 270,000 barrels, and gasoline stocks saw a small decline of 480,000 barrels. The DOE’s weekly report is due out at 10am central today and will be on the same delayed schedule next week for the New Year’s holiday and in 3 weeks for MLK day.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 18 - US DOE Inventory Recap

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.