Volatility Returns To The Energy Arena

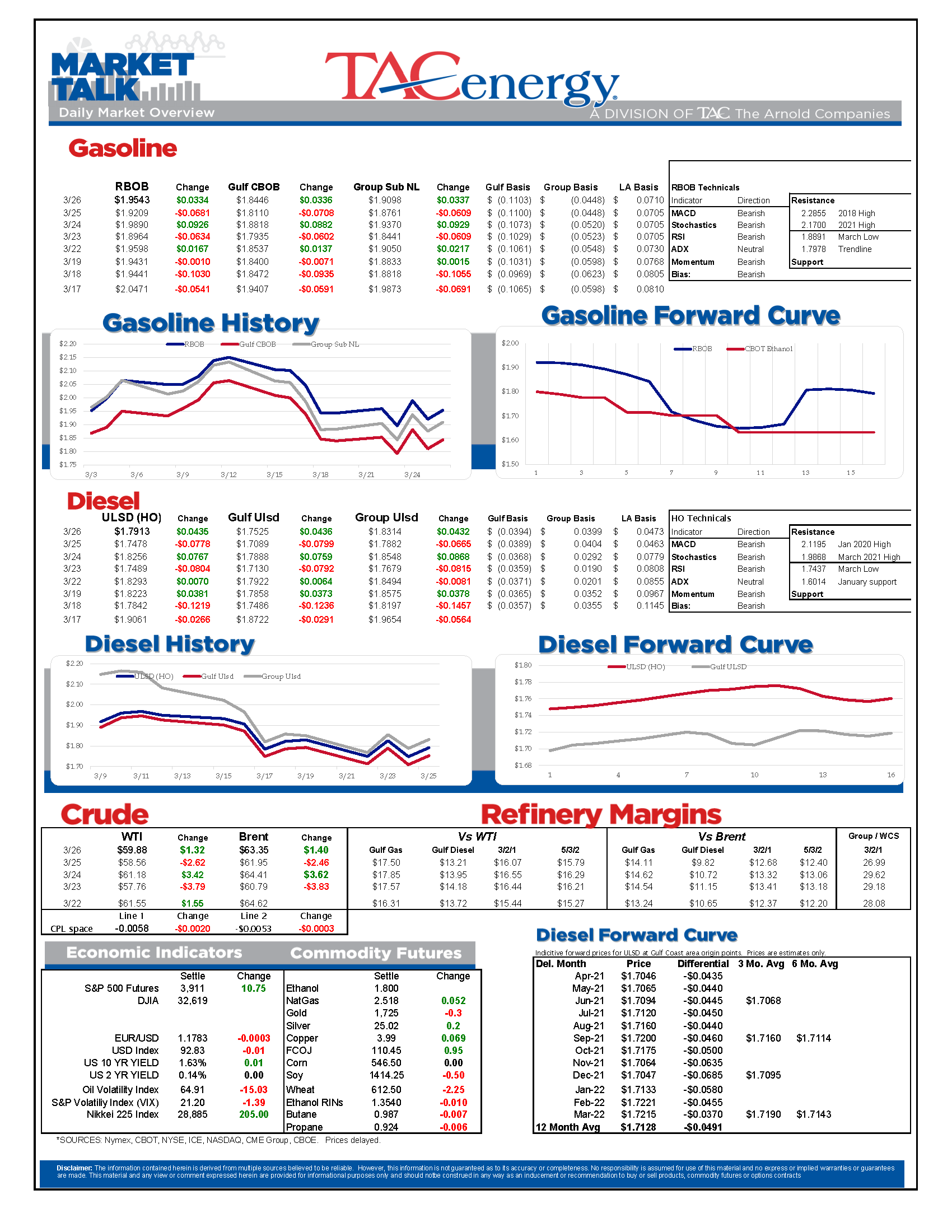

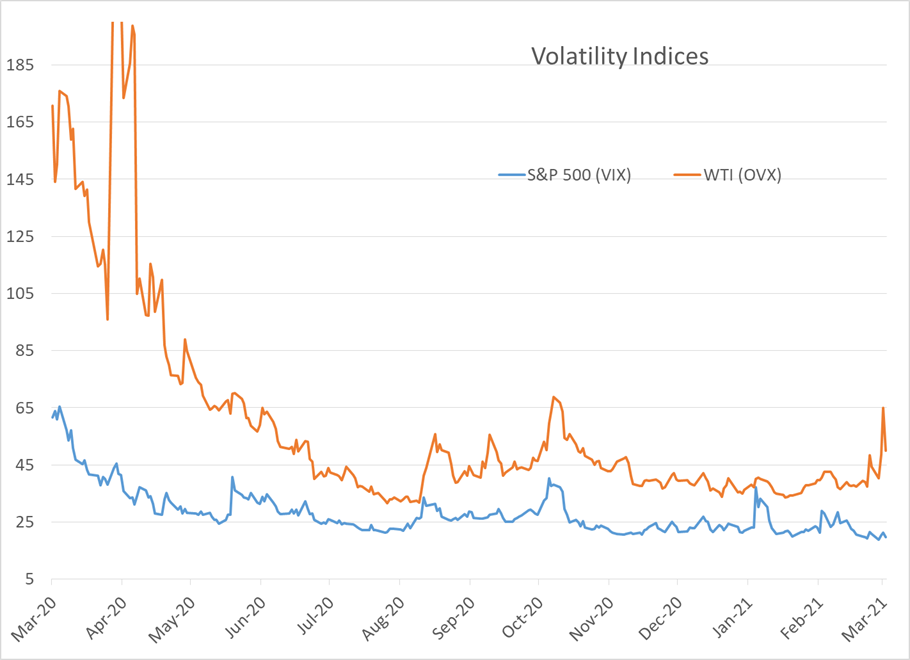

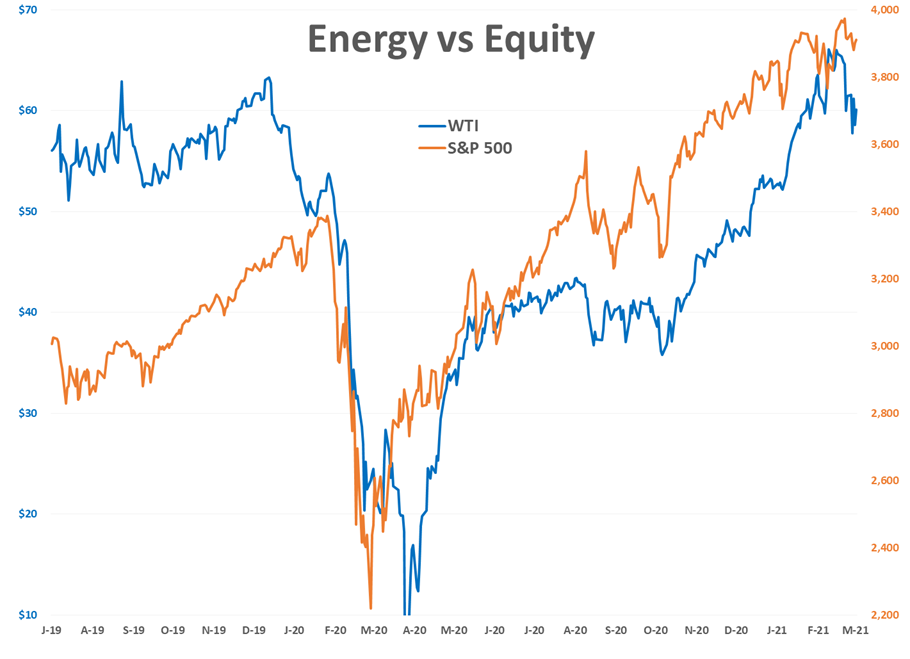

March madness is not disappointing this year as volatility returns to the energy arena, making 5% price swings a common occurrence. This week’s action has been a rollercoaster with huge selloffs Tuesday and Thursday surrounded by strong rallies Monday, Wednesday and Friday that have kept the selling that started last week from snowballing into an outright price collapse.

When this type of wild back and forth action happens, it helps to look at the weekly charts to get a sense for the bigger picture, and to see that despite multiple days of 8 cent or greater moves, ULSD futures are only down 2 cents on the week, while RBOB prices are up 1.5, and those small net moves have done little to change the technical outlook going forward. That said, this type of manic price movement is often seen at the end of a trend, so there’s still a strong case to be made that after a huge rally from November-March, lower prices are coming, and could be here soon if chart support breaks next week.

The Suez canal blockage continues to be a major story this week, with new estimates suggesting it may take weeks not days to clear the stranded ship. While that continues to be an easy headline to pin the blame on a rally, it doesn’t explain why oil and product prices 6 months forward are rallying about the same amount this morning.

On the flip side, European COVID lockdowns are the easy smoking gun for the days when prices collapse, even though it would be hard to justify prices 1 year forward dropping due to those temporary measures. The drop in European demand should also help limit the fallout from the Suez canal blockage that’s keeping some 3 million barrels/day of oil and refined products stranded at sea.

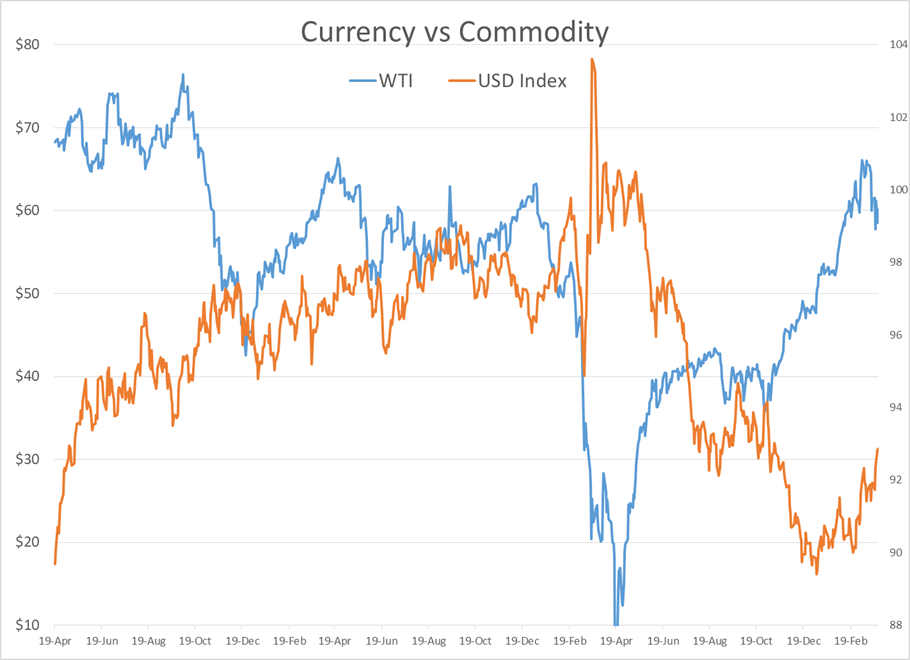

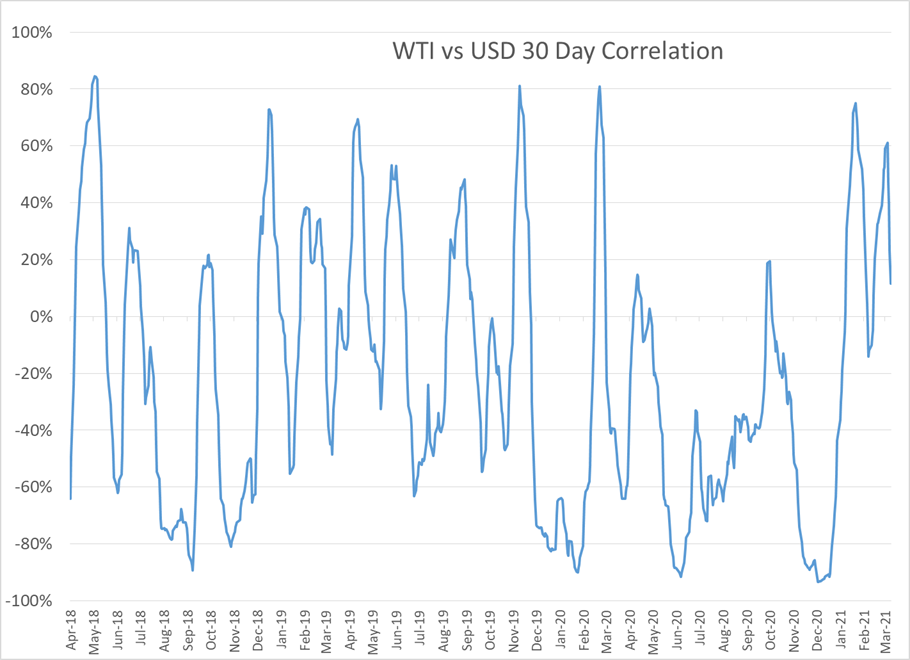

There does seem to be a “risk on” vs. “risk off” feel to the wild back and forth this week, even though the correlation between daily price moves between equity, currency and energy markets is almost non-existent.

Today’s refining lesson: Don’t rain oil on your neighbors. The EPA announced it was pulling an expansion permit for the Limetree Bay (FKS Hovensa) refinery in St. Croix after multiple lawsuits filed to challenge its restart. It’s important to note that decision will not halt operations at the refinery, but will make expansion a challenge, and given the events of the past two months feels like just the start of the regulatory changes coming. For those that were around when Hovensa was operating, its location and ability to import barrels all along the U.S. East Coast often gave its operations an outsized influence on (NY Harbor based) RBOB and ULSD prices.

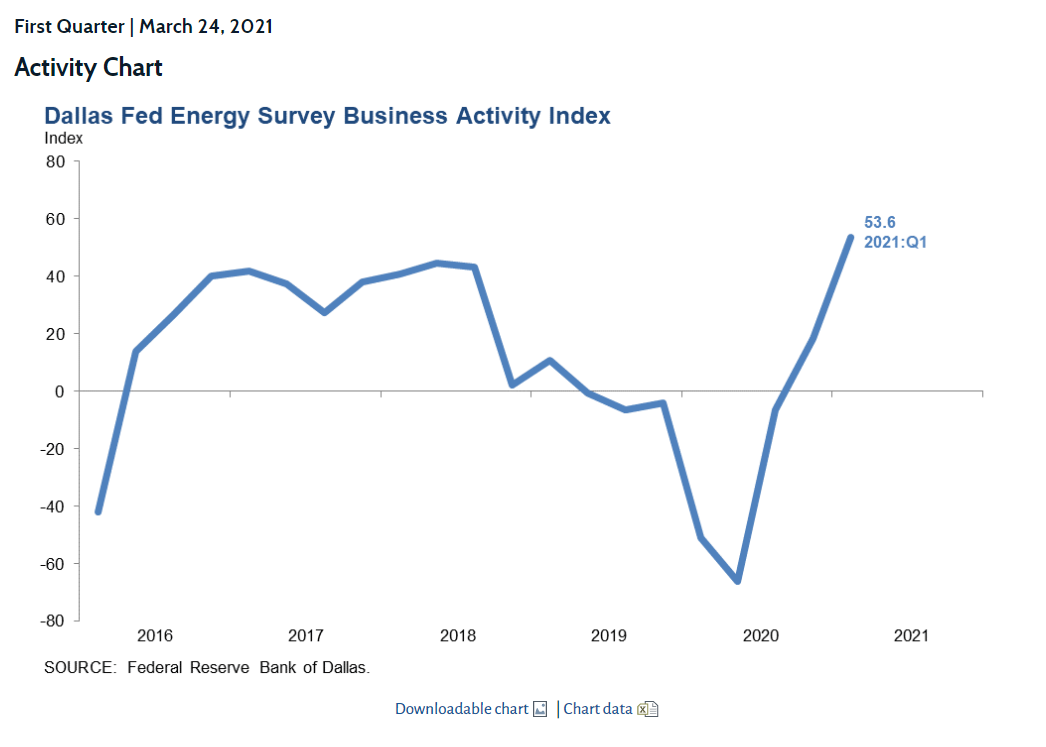

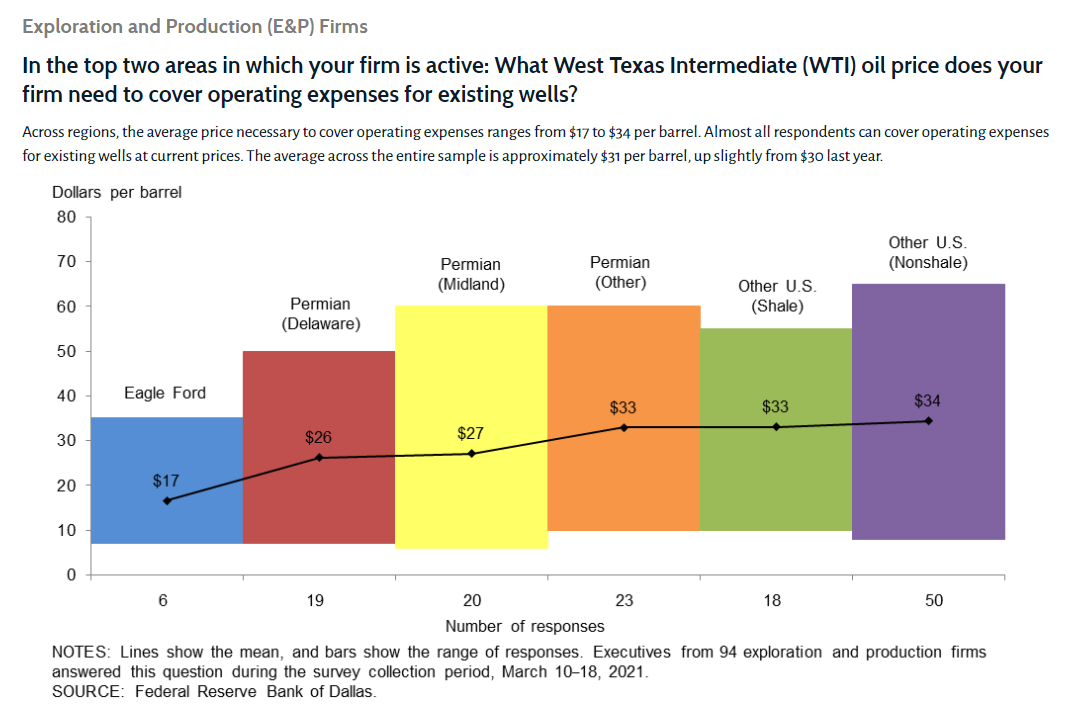

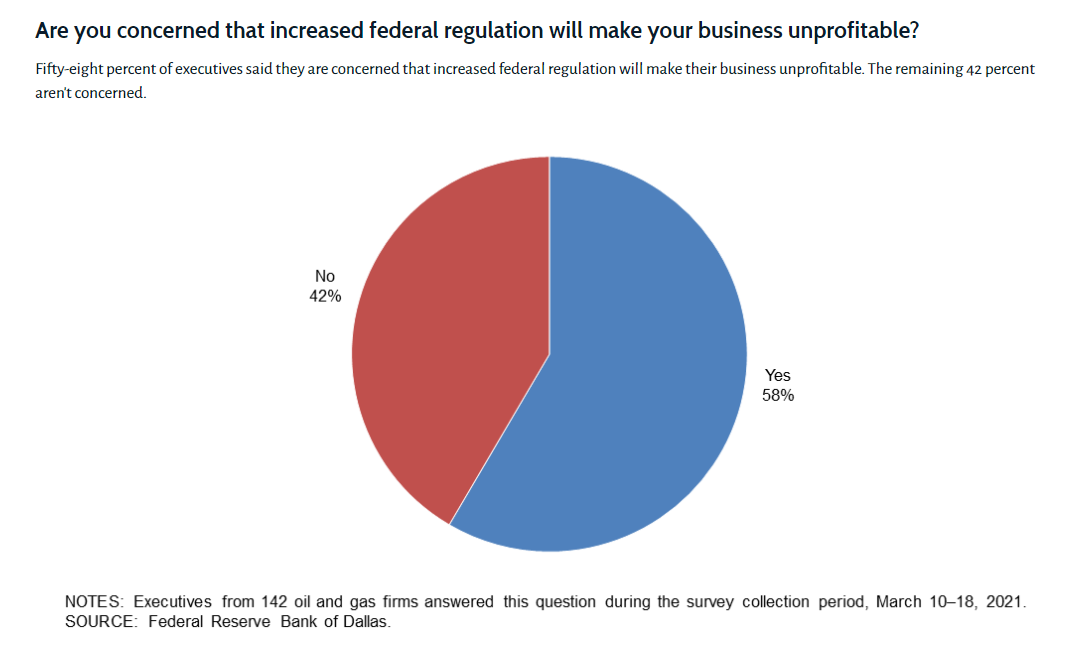

The Dallas Fed’s energy survey for March showed a strong recovery in oil and gas operations as producers that had been on the brink for much of the past year took advantage of the rally in prices. Continued expansion is predicted in the survey results, and the chart of break evens shows that we should see operations continue to increase with just about all basins securely in the black at current price levels.

Los Angeles has revealed a study that would allow it to use 100% renewable energy sources to power its electric grid by 2035, even as it remains one of the only coal burning municipalities left in the state. The plan is simple: “Build solar farms, wind turbines and batteries as fast as possible.” The plan to pay for it is: not part of the study.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

Social Media

News & Views

View All

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

The sell-off continues in energy markets. RBOB gasoline futures are now down nearly 13 cents in the past two days, and have fallen 16 cents from a week ago, leading to questions about whether or not we’ve seen the seasonal peak in gasoline prices. ULSD futures are also coming under heavy selling pressure, dropping 15 cents so far this week and are trading at their lowest level since January 3rd.

The drop on the weekly chart certainly takes away the upside momentum for gasoline that still favored a run at the $3 mark just a few days ago, but the longer term up-trend that helped propel a 90-cent increase since mid-December is still intact as long as prices stay above the $2.60 mark for the next week. If diesel prices break below $2.50 there’s a strong possibility that we see another 30 cent price drop in the next couple of weeks.

An unwind of long positions after Iran’s attack on Israel was swatted out of the sky without further escalation (so far anyway) and reports that Russia is resuming refinery runs, both seeming to be contributing factors to the sharp pullback in prices.

Along with the uncertainty about where the next attacks may or may not occur, and if they will have any meaningful impact on supply, come no shortage of rumors about potential SPR releases or how OPEC might respond to the crisis. The only thing that’s certain at this point, is that there’s much more spare capacity for both oil production and refining now than there was 2 years ago, which seems to be helping keep a lid on prices despite so much tension.

In addition, for those that remember the chaos in oil markets 50 years ago sparked by similar events in and around Israel, read this note from the NY Times on why things are different this time around.

The DOE’s weekly status report was largely ignored in the midst of the big sell-off Wednesday, with few noteworthy items in the report.

Diesel demand did see a strong recovery from last week’s throwaway figure that proves the vulnerability of the weekly estimates, particularly the week after a holiday, but that did nothing to slow the sell-off in ULSD futures.

Perhaps the biggest next of the week was that the agency made its seasonal changes to nameplate refining capacity as facilities emerged from their spring maintenance.

PADD 2 saw an increase of 36mb/day, and PADD 3 increased by 72mb/day, both of which set new records for regional capacity. PADD 5 meanwhile continued its slow-motion decline, losing another 30mb/day of capacity as California’s war of attrition against the industry continues. It’s worth noting that given the glacial pace of EIA reporting on the topic, we’re unlikely to see the impact of Rodeo’s conversion in the official numbers until next year.

Speaking of which, if you believe the PADD 5 diesel chart below that suggests the region is running out of the fuel, when in fact there’s an excess in most local markets, you haven’t been paying attention. Gasoline inventories on the West Coast however do appear consistent with reality as less refining output and a lack of resupply options both continue to create headaches for suppliers.

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Energy markets are sliding lower again to start Wednesday’s trading as demand concerns and weaker stock markets around the world seem to be outweighing any supply concerns for the time being.

Rumors continue to swirl about an “imminent” response by Israel to Iran’s attacks, but so far, no news seems to be taken as good news in the hopes that further escalation can be avoided, even as tensions near the Red Sea and Strait of Hormuz continue to simmer.

Prices to lease space on Colonial’s main gasoline line continue to rally this week, trading north of 11 cents/gallon as Gulf Coast producers still struggle to find outlets for their production, despite a healthy export market. Gulf Coast CBOB is trading at discounts of around 34 cents to futures, while Gulf Coast RBOB is trading around a 16-cent discount, which gives shippers room to pay up for the linespace and still deliver into the East Coast markets at a profit.

Back to reality, or just the start of more volatility? California CARBOB basis values have dropped back to “only” 40 cent premiums to RBOB futures this week, as multiple flaring events at California refineries don’t appear to have impacted supply. The state has been an island for fuel supplies for many years as its boutique grades prevent imports from neighboring states, and now add the conversion of the P66 Rodeo refinery to renewable diesel production and the pending changes to try and cap refinery profits, and it’s easier to understand why these markets are increasingly vulnerable to supply shocks and price spikes on gasoline.

RIN prices continue to fall this week, touching 44 cents/RIN for D4 and D6 values Tuesday, their lowest level in 6 weeks and just about a nickel above a 4-year low. While the sharp drop in RIN and LCFS values has caused several biodiesel and Renewable Diesel producers to either shut down or limit production, the growth in RIN generation continues thanks to projects like the Rodeo refinery conversion, making the supply in RINs still outpace the demand set by the Renewable Fuel Standard by a wide margin.

The API reported draws in refined products, 2.5 million barrels for gasoline and 427,000 barrels for distillates, while crude oil stocks had an estimated build of more than 4 million barrels. The DOE’s weekly report is due out at its normal time this morning.

Click here to download a PDF of today's TACenergy Market Talk.