Tug Of War Between Reopening Optimism And Delta Variant Fears

Energy prices continue to hover close to multi-year highs, as markets endure a tug of war between reopening optimism and Delta variant fears.

The IEA’s monthly oil market report forecast that the world could see the largest draw in crude oil inventories in more than a decade this quarter as refiners ramp up run rates to try and keep pace with reopening around the globe. The report noted that this phenomenon should continue pushing prices into a steeper backwardation as suppliers will be challenged to keep pace with the uptick in demand, and noted how that phenomenon is pushing prices to multi-year highs and threatening the economic recovery. The report ended with a call for OPEC to figure out its output plan as the volatility caused by its lack of decision making is not, “…in the interest of either producers or consumers.”

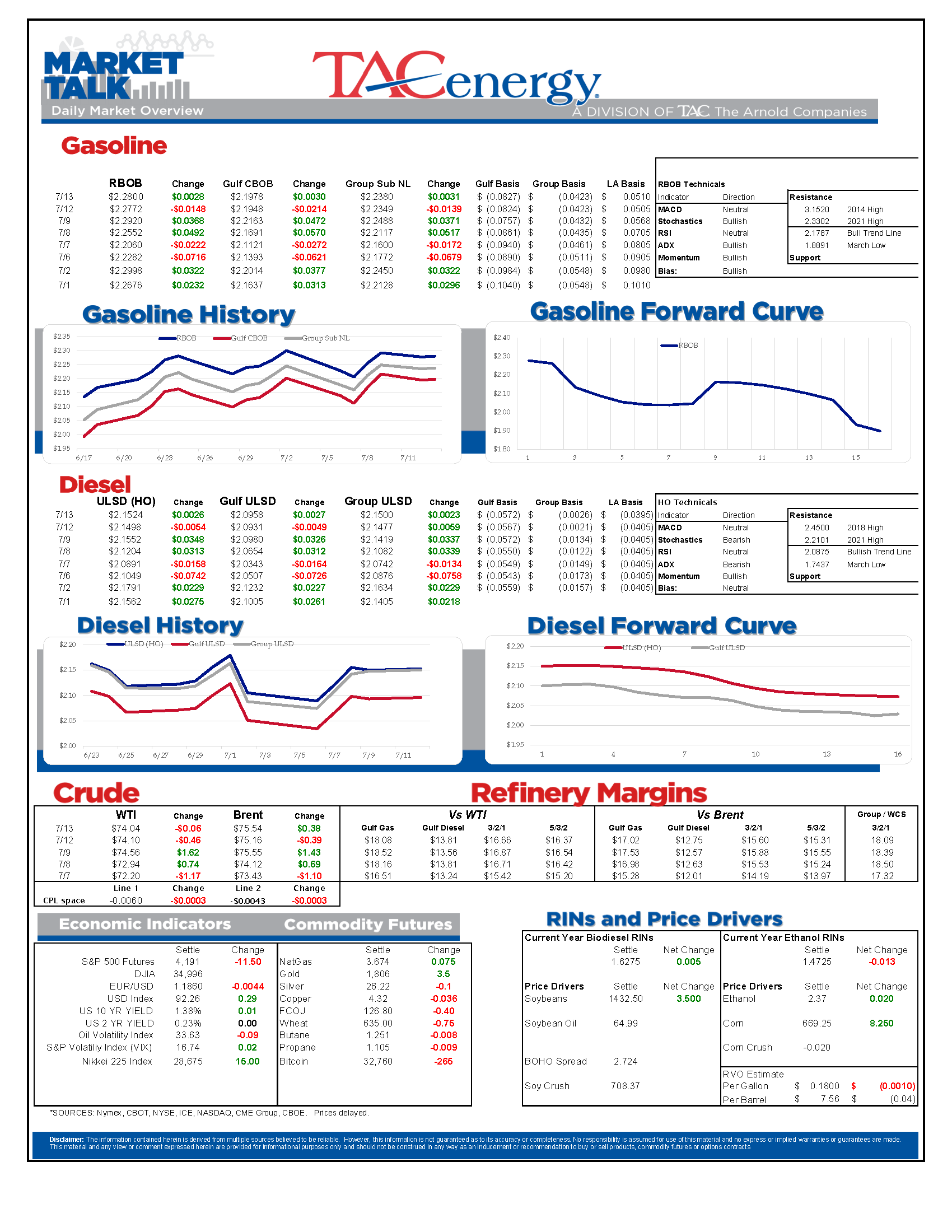

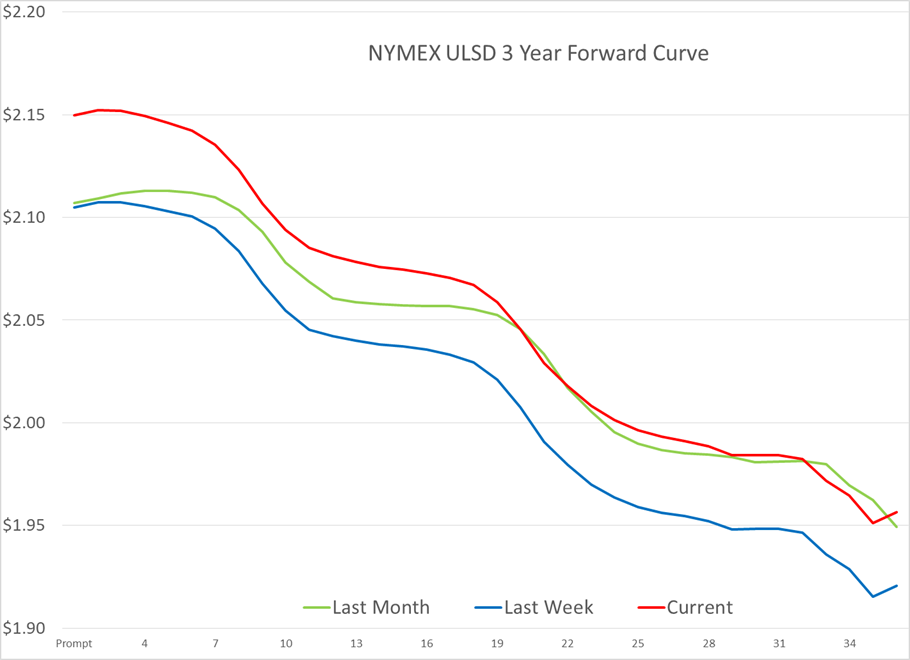

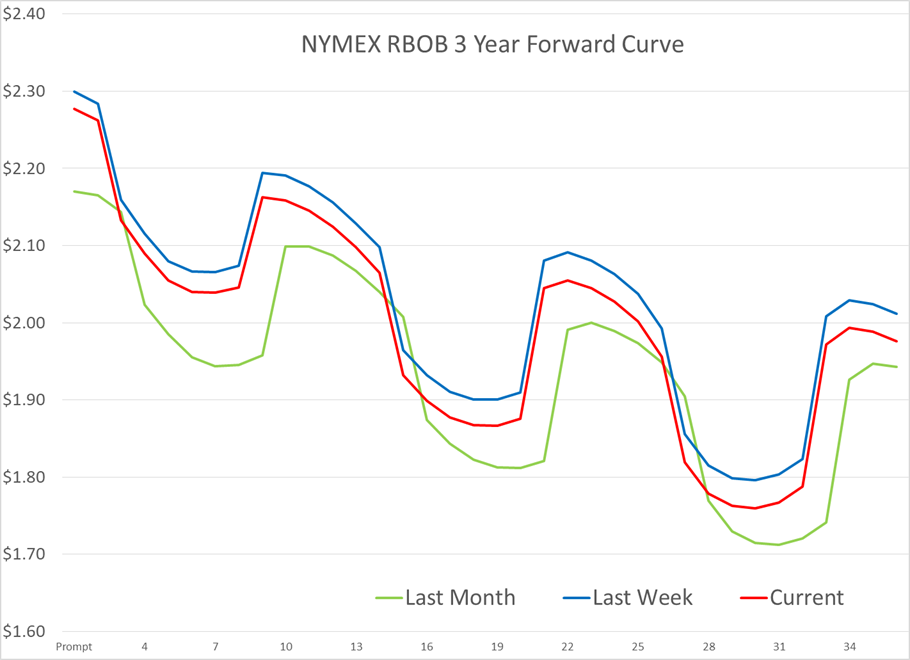

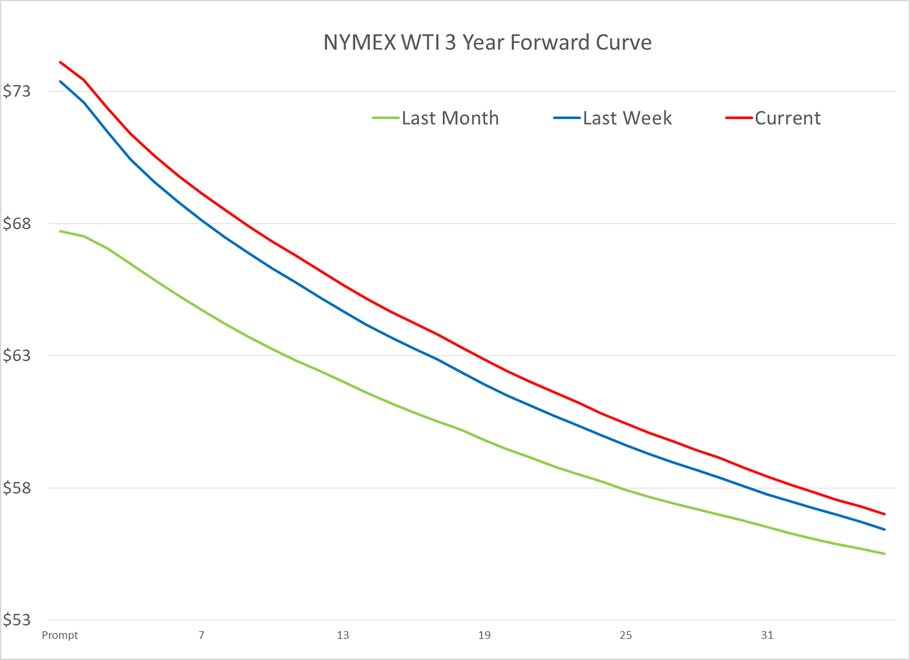

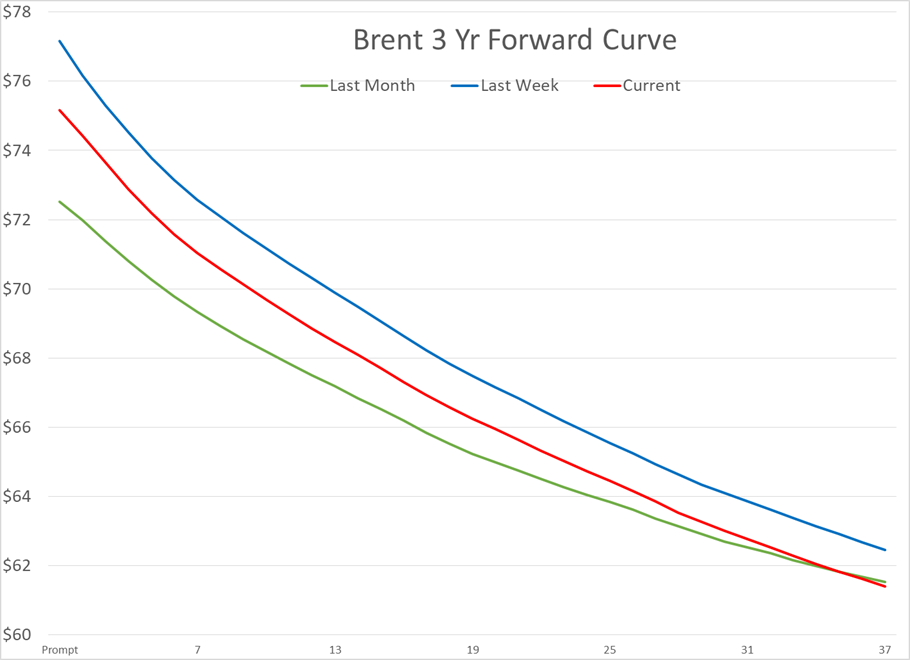

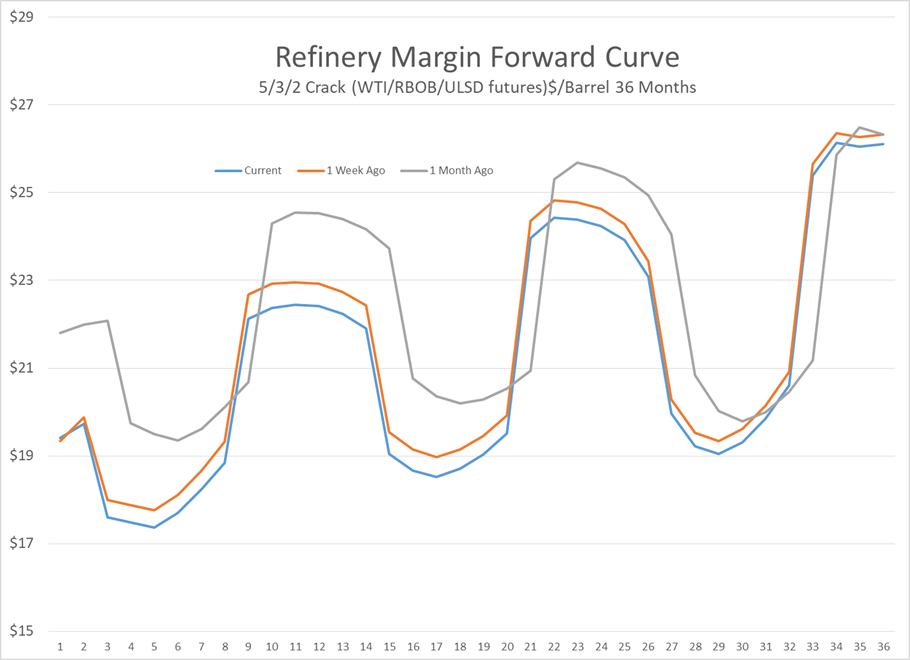

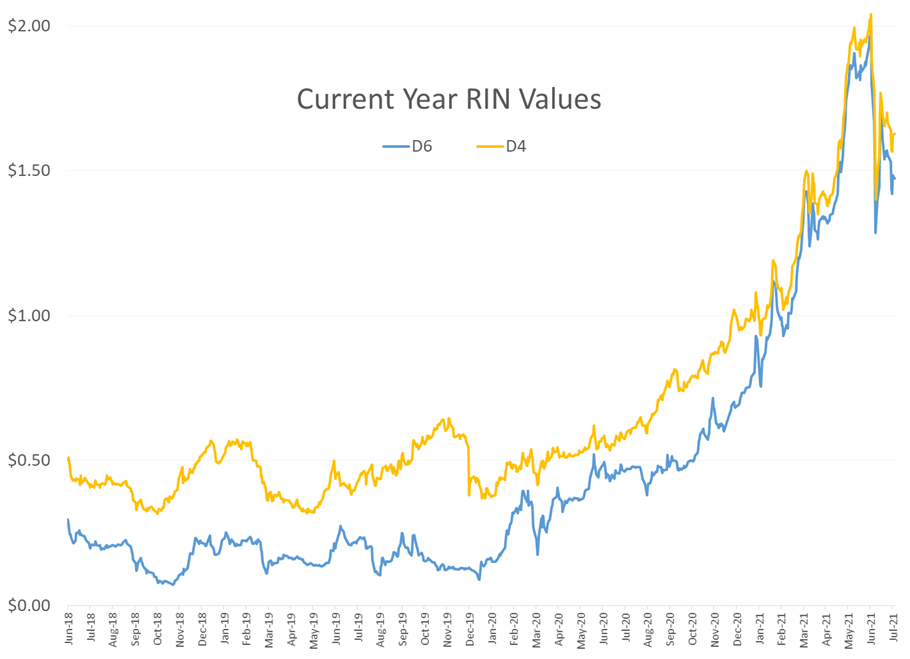

The forward curve charts below show how the recent increase in demand has pushed most petroleum contracts into a steeper backwardation, and put downward pressure on refinery margins as products have struggled to keep pace with the rise in crude prices. On the other hand, the crack spread chart does not account for the drop in RIN values that has taken roughly $2/barrel off the cost of doing business for US refiners over the past 5 weeks, which increases their net margin and largely offsets the drop in gross seen on the charts.

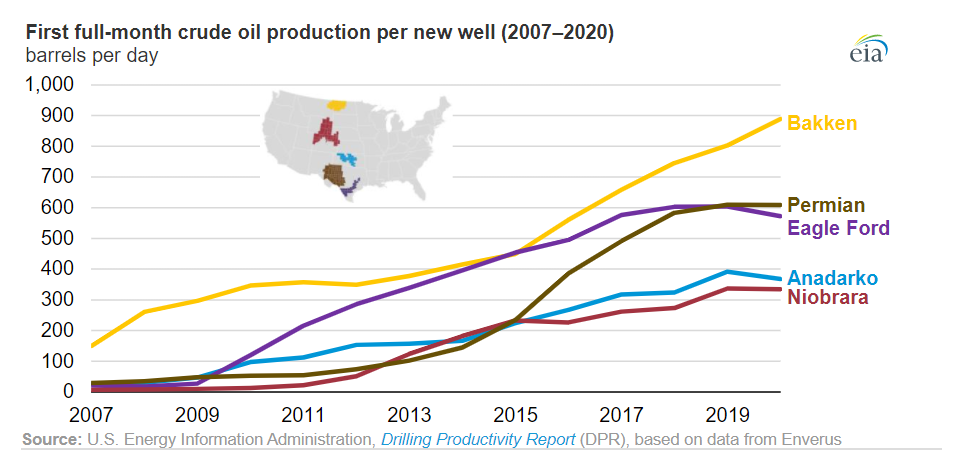

Technology topping out? An EIA report this morning highlights that most US drilling regions saw production/well drop in the past year, after more than a decade of steady increases that saw numbers increase 5 to 10 fold thanks to rapidly improving technology. Only the Bakken saw its total output per well increase to nearly 900 barrels/day (up from roughly 150 in 2007). This likely doesn’t mean that drillers are losing their edge however. The report also notes that the dip is likely due to unplanned shutdowns due to COVID, and that the rates are likely to increase again once more normal drilling patterns continue.

Hovensa no more: The refinery that threatened to bring more refined products to oversupplied Atlantic basin looks like it’s officially out of the game as the owners filed for bankruptcy after being forced to shut operations, and amidst multiple investigations from the US Attorney and EPA. Since that plant never really got back to full run rates, it’s unlikely to create any supply disruptions, but it may save another facility in the US or Europe from closing their doors as the race to rationalize refineries continues.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

Gasoline Futures Are Leading The Way Lower This Morning

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

Social Media

News & Views

View All

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

The sigh of relief selloff continues in energy markets Tuesday morning, with gasoline prices now down more than 20 cents in 7 sessions, while diesel prices have dropped 26 cents in the past 12. Crude oil prices are within a few pennies of reaching a 1 month low as a lack of headlines from the world’s hot spots allows some reflection into the state of the world’s spare capacity for both oil and refined products.

Gasoline prices are trading near a 6-week low this morning, but still need to fall about another nickel in order to break the weekly trendline that pushed prices steadily higher since December. If that trend breaks, it will be safer to say that we saw the end of the spring gasoline rally on April 12th for the 2nd year in a row. Last year RBOB futures peaked on April 12 at $2.8943 and bottomed out on May 4th at $2.2500. The high (at this point) for this year was set on April 12th at $2.8516, and the low overnight was $2.6454.

It’s not just energy commodities that are seeing an unwind of the “flight to safety” trade: Gold prices had their biggest selloff in 2 years Monday and continue to point lower today. Just how much money poured into commodities in the weeks leading up to the direct confrontation between Israel and Iran is unclear, but we have seen in year’s past that these unwind-events can create a snowball effect as traders can be forced to sell to cover their margin calls.

Supply > Demand: The EIA this morning highlighted the record setting demand for natural gas in the US last year, which was not nearly enough to offset the glut of supply that forced prices to a record low in February. A shortage of natural gas in Europe was a key driver of the chaotic markets that smashed just about every record in 2022, and an excess of natural gas supply in Europe and the US this year is acting as a buffer, particularly on diesel prices.

The struggle for renewable producers continues as a rapid influx of supply and crashing credit prices make Biodiesel, RD and SAF unprofitable for many. In addition to the plant closures announced in the past 6 months, Vertex Energy reported Monday it’s operating its Renewable Diesel facility in Mobile AL at just 50% of capacity in Q1. The truly scary part for many is that the $1/gallon Blender's tax credit ends this year and is being replaced by the “Clean” Fuel production credit that forces producers to prove their emissions reductions in order to qualify for an increased subsidy. It’s impossible to say at this point how much the net reduction will be for domestic producers, but importers will get nothing, and at current CI values, many biodiesel producers may see their “blend credit” cut by more than half.

Click here to download a PDF of today's TACenergy Market Talk.

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

The pullback continues for energy prices as violence in the Middle East looks like it won’t rapidly expand, and financial markets continue to struggle with a higher-for-longer interest rate reality.

After years of backwardation, diesel prices have slipped into contango over the past week, despite multiple canal disruption concerns of reduced exports coming out of Russia. A Reuters article highlights how sluggish demand in Europe, and a glut of Asian supply [thanks to the rapid influx of new refining capacity over the past 2 years] is contributing to the changing market structure. This sudden weakness in diesel is also leading many refiners to reconsider their max-diesel output stance that had been key to their record setting margins in 2022 and 2023.

Money managers were reducing their bets on higher energy prices last week, in what appears to be an unwind of the positions added the prior week when it seemed like we might have an all-out war between Israel and Iran. The exception to the reduction in speculative length was the Brent crude oil contract which saw its money manager positions increase for a 4th week to reach a 3-year high. Open interest in crude oil contracts is also increasing to multi-year highs as new money flows into the energy space as a hedge of both inflation and geopolitical concerns, which could contribute to a tick higher in volatility if the sell-off continues this week as the bandwagon jumpers may soon be looking for a new ride.

Baker Hughes reported a net increase of 5 oil rigs drilling in the US last week, while natural gas rigs dropped by 2 on the week to a fresh 2 year low. The Permian basin has quietly added 8 more rigs in the past 4 weeks as producers in that region try to find a way around the shipping bottlenecks to get their otherwise profitable production to market. An RBN note last week highlighted how the lack of natural gas pipeline capacity will limit crude oil production capacity in the basin, and Kinder Morgan highlighted the need for another pipe in its latest earnings call.

Valero reported an upset at its Corpus Christi West refinery Saturday, although it appears that the brief flaring didn’t reduce operational levels.

Click here to download a PDF of today's TACenergy Market Talk.

Gasoline Futures Are Leading The Way Lower This Morning

It was a volatile night for markets around the world as Israel reportedly launched a direct strike against Iran. Many global markets, from equities to currencies to commodities saw big swings as traders initially braced for the worst, then reversed course rapidly once Iran indicated that it was not planning to retaliate. Refined products spiked following the initial reports, with ULSD futures up 11 cents and RBOB up 7 at their highest, only to reverse to losses this morning. Equities saw similar moves in reverse overnight as a flight to safety trade soon gave way to a sigh of relief recovery.

Gasoline futures are leading the way lower this morning, adding to the argument that we may have seen the spring peak in prices a week ago, unless some actual disruption pops up in the coming weeks. The longer term up-trend is still intact and sets a near-term target to the downside roughly 9 cents below current values. ULSD meanwhile is just a nickel away from setting new lows for the year, which would open up a technical trap door for prices to slide another 30 cents as we move towards summer.

A Reuters report this morning suggests that the EPA is ready to announce another temporary waiver of smog-prevention rules that will allow E15 sales this summer as political winds continue to prove stronger than any legitimate environmental agenda. RIN prices had stabilized around 45 cents/RIN for D4 and D6 credits this week and are already trading a penny lower following this report.

Delek’s Big Spring refinery reported maintenance on an FCC unit that would require 3 days of work. That facility, along with several others across TX, have had numerous issues ever since the deep freeze events in 2021 and 2024 did widespread damage. Meanwhile, overnight storms across the Midwest caused at least one terminal to be knocked offline in the St. Louis area, but so far no refinery upsets have been reported.

Meanwhile, in Russia: Refiners are apparently installing anti-drone nets to protect their facilities since apparently their sling shots stopped working.

Click here to download a PDF of today's TACenergy Market Talk.