Lack Of Enthusiasm From Gasoline And Crude Oil Prices

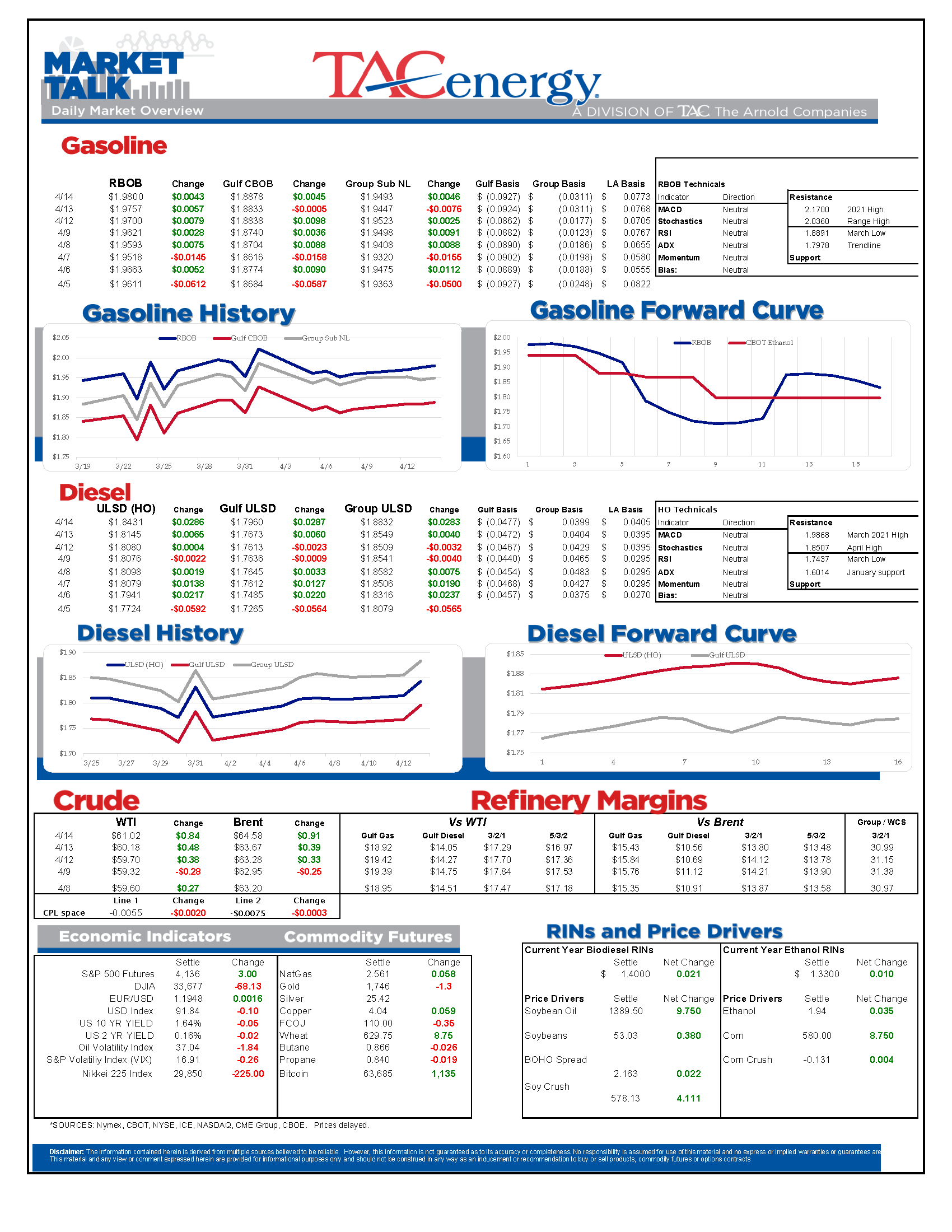

If at first you don’t succeed…Diesel prices are trying to lead the energy complex higher this morning, after rally attempts stalled out Monday and Tuesday. This time could be different, however, as ULSD futures have broken the top side of their month old sideways trading range in the early going, which could spark some buying from trading programs and bandwagon jumpers. If diesel futures can hold above the $1.84 mark today, there’s a good chance we will see them push into the mid $1.90s in the next week, but if they fail, it seems like we’ll be stuck back in the sideways range for a while longer.

A lack of enthusiasm from gasoline and crude oil prices seems to be a limiting factor in the diesel rally so far. RBOB futures have managed to move higher in the past five sessions, and yet the combined gains during that stretch are less than three cents, suggesting a lack of conviction from buyers after prices doubled from November to March.

The IEA’s monthly oil market report followed the lead of the EIA and OPEC monthly reports, increasing global fuel demand estimates as vaccine & stimulus package rollouts are getting people moving again. The IEA’s report did highlight concerns that rising case counts in Europe, Brazil and India could slow the demand recovery, and noted that excess supply capacity from OPEC and the U.S. should help keep prices from getting too high. The IEA also highlighted that Iran’s oil production has reached a two year high as the country is finding ways to get around U.S. sanctions, which could bring more downward pressure to prices if that trend continues.

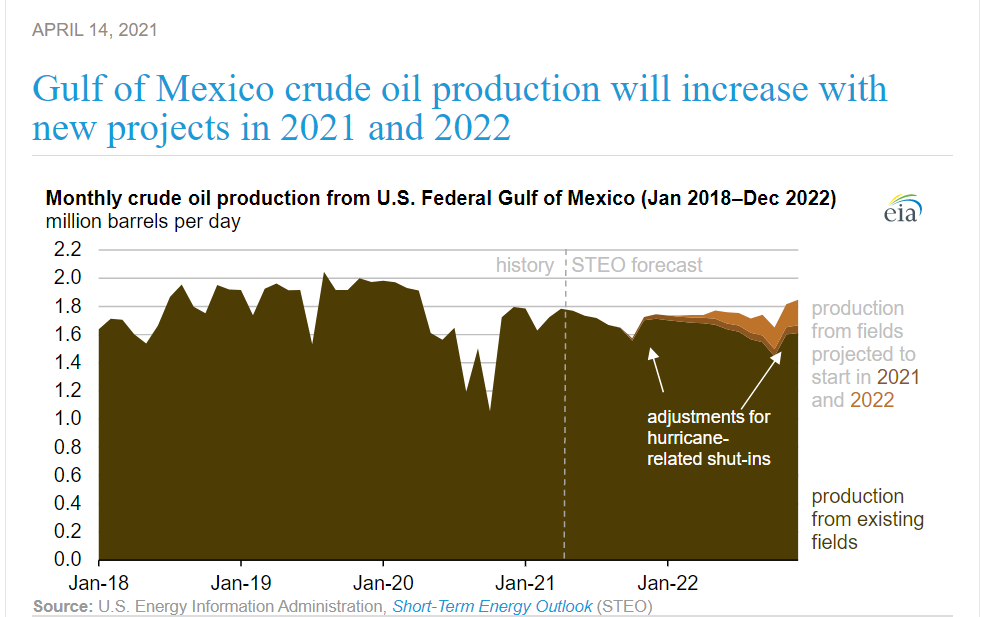

The EIA this morning highlighted several new oil projects in the Gulf of Mexico that could bring 200mb/day of production online by the end of next year, which is a completely different outlook than a year ago when many projects were shutting down. The report also highlights the threat hurricanes create to GOM production, as early forecasts call for another above-average season for storm activity, after we just lived through the most active season on record.

Chicago-area refineries are making news this week. The DOJ announced a settlement deal with ExxonMobil and the state of Illinois that requires Exxon to pay $1.5 million in fines, and spend $10 million in upgrades to its Joliet facility. The headline writers are touting this as the new administration’s tough stance on the energy industry, but in reality this settlement stems from an agreement made 12 years ago. Meanwhile, BP is reportedly selling off a major stake in its U.S. pipeline assets, as it continues to shed assets to pay down debt, cover severance payments from their annual reorganizations and continue paying their $1.2 annual settlement the 2010 Gulf of Mexico oil spill.

Meanwhile, two midcontinent refining companies still aren’t getting along taking with the war of words and shareholder votes between Carl Icahn backed CVR and Delek being taken to the court of public opinion, proving that there’s apparently more money to be made through financial engineering of refining-related companies than there is in engineering those refineries to make more product.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

Social Media

News & Views

View All

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

The sigh of relief selloff continues in energy markets Tuesday morning, with gasoline prices now down more than 20 cents in 7 sessions, while diesel prices have dropped 26 cents in the past 12. Crude oil prices are within a few pennies of reaching a 1 month low as a lack of headlines from the world’s hot spots allows some reflection into the state of the world’s spare capacity for both oil and refined products.

Gasoline prices are trading near a 6-week low this morning, but still need to fall about another nickel in order to break the weekly trendline that pushed prices steadily higher since December. If that trend breaks, it will be safer to say that we saw the end of the spring gasoline rally on April 12th for the 2nd year in a row. Last year RBOB futures peaked on April 12 at $2.8943 and bottomed out on May 4th at $2.2500. The high (at this point) for this year was set on April 12th at $2.8516, and the low overnight was $2.6454.

It’s not just energy commodities that are seeing an unwind of the “flight to safety” trade: Gold prices had their biggest selloff in 2 years Monday and continue to point lower today. Just how much money poured into commodities in the weeks leading up to the direct confrontation between Israel and Iran is unclear, but we have seen in year’s past that these unwind-events can create a snowball effect as traders can be forced to sell to cover their margin calls.

Supply > Demand: The EIA this morning highlighted the record setting demand for natural gas in the US last year, which was not nearly enough to offset the glut of supply that forced prices to a record low in February. A shortage of natural gas in Europe was a key driver of the chaotic markets that smashed just about every record in 2022, and an excess of natural gas supply in Europe and the US this year is acting as a buffer, particularly on diesel prices.

The struggle for renewable producers continues as a rapid influx of supply and crashing credit prices make Biodiesel, RD and SAF unprofitable for many. In addition to the plant closures announced in the past 6 months, Vertex Energy reported Monday it’s operating its Renewable Diesel facility in Mobile AL at just 50% of capacity in Q1. The truly scary part for many is that the $1/gallon Blender's tax credit ends this year and is being replaced by the “Clean” Fuel production credit that forces producers to prove their emissions reductions in order to qualify for an increased subsidy. It’s impossible to say at this point how much the net reduction will be for domestic producers, but importers will get nothing, and at current CI values, many biodiesel producers may see their “blend credit” cut by more than half.

Click here to download a PDF of today's TACenergy Market Talk.