Hurricane Shifts From The Heart Of Refining Country

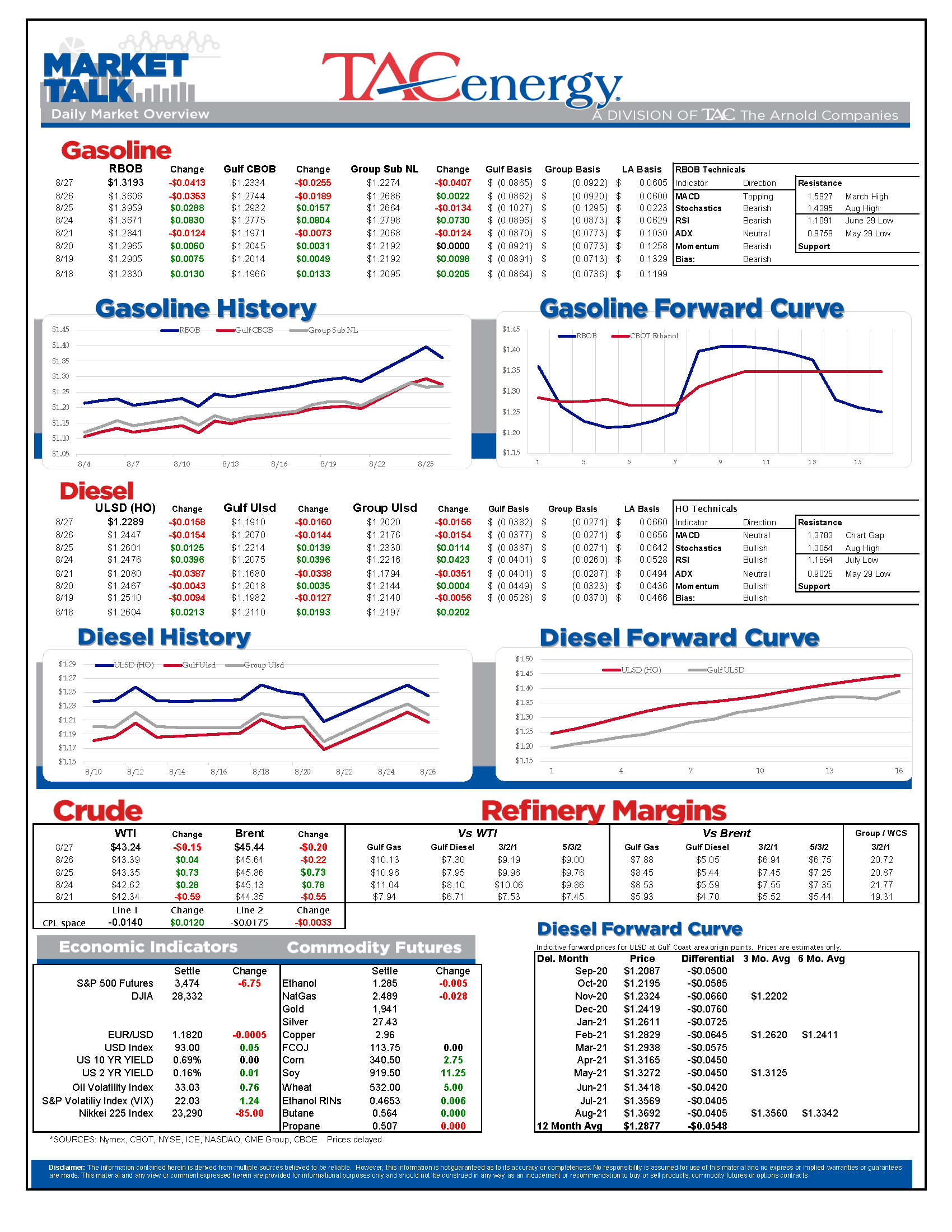

Energy futures continue to retreat this morning as the strongest hurricane to hit the Gulf Coast in decades appears to have shifted just enough to the east to avoid damaging the heart of refining country. Equity futures are also pointed lower this morning as another weekly jobless claim report north of one million gives a dose of reality to indices that have reached record highs, despite the damage done to the economy by the COVID fallout.

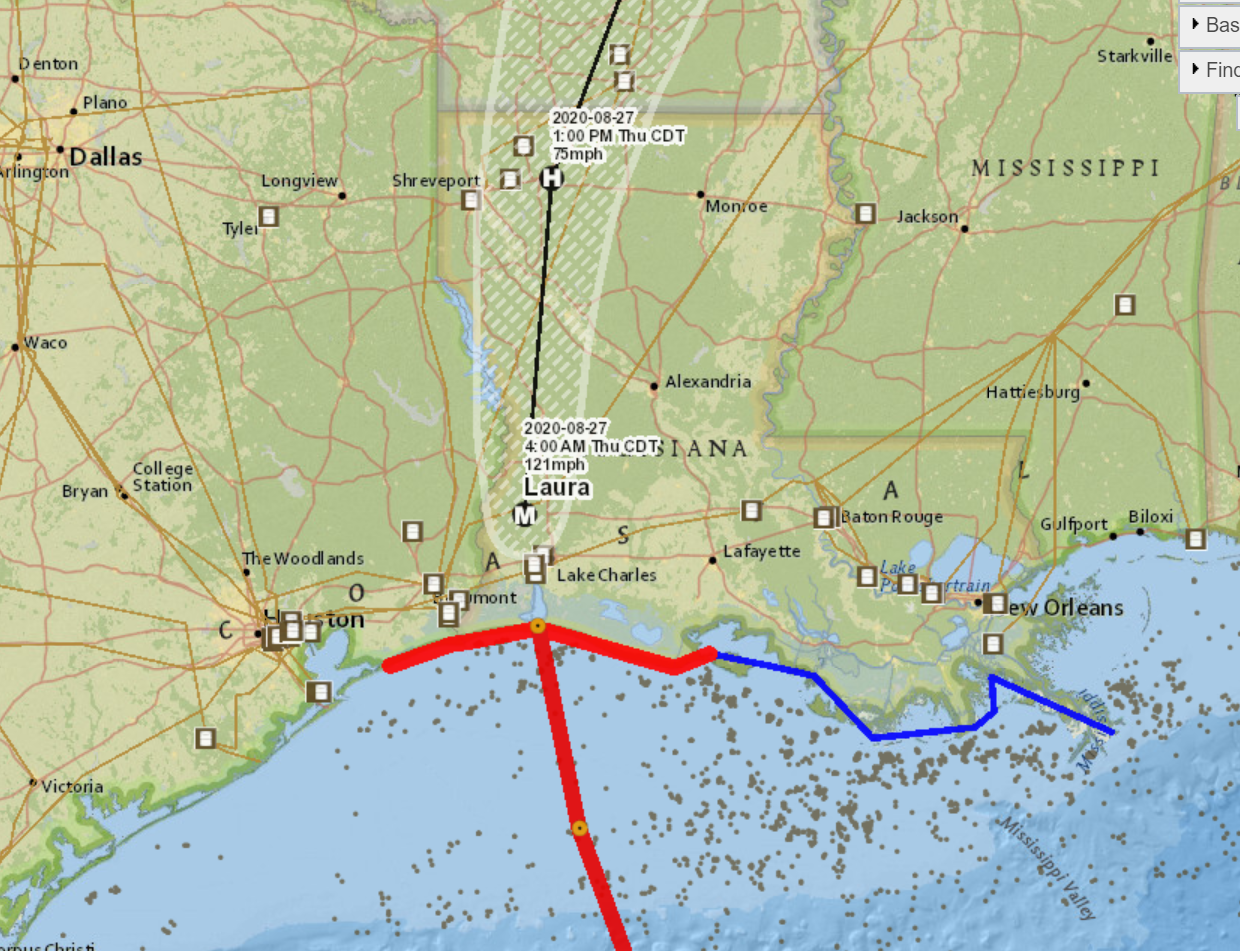

Hurricane Laura made landfall overnight as a Category 4 storm, the strongest to hit the Louisiana coast in 168 years. Another shift to the east prior to landfall meant many gulf coast facilities look like they dodged most of the storms wrath, and some Houston-area terminals are already loading trucks this morning.

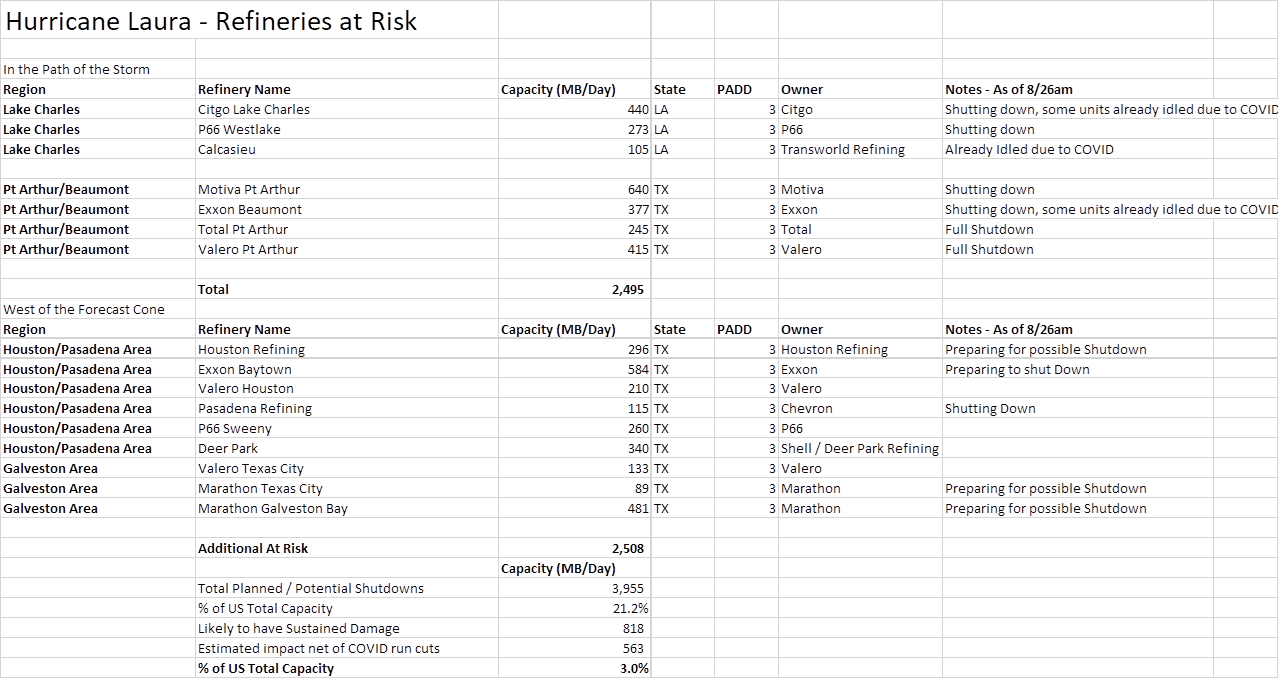

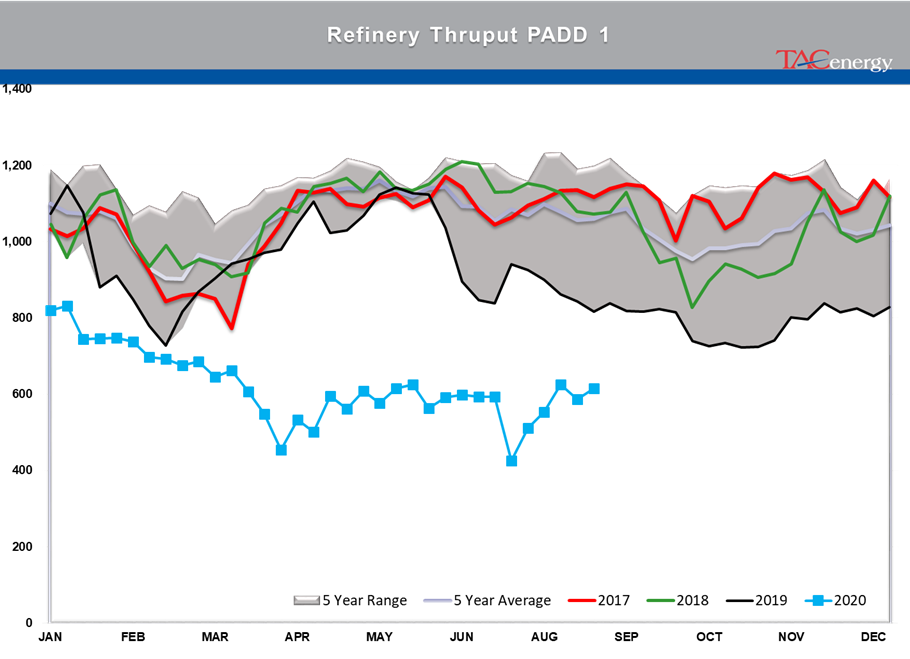

Unfortunately for the residents and refineries around Lake Charles, the storm did not appear to move far enough east for them to avoid a direct hit, although it’s too soon to say what damage may have been done to those facilities, but early reports from the city suggest substantial flooding and wind damage. One of three refineries around Lake Charles was already idled due to COVID-related demand destruction, and another was running well below normal rates, so it seems that in total we may only see roughly three percent of total U.S. refining capacity damaged by the storm, compared to estimates closer to 20 percent had the storm hit further west.

Although Lake Charles is an origin point along the Colonial pipeline, as long as the Houston/Pasadena and Port Arthur/Beaumont hubs weren’t damaged, we likely won’t see any major impact on pipeline deliveries. Explorer pipeline did shut down temporarily to allow the storm to pass, but it too may see limited impact thanks to the eastward shift of the storm since it originates from the Houston and Port Arthur hubs.

Now that the storm has passed by the majority of petroleum supply infrastructure, it may become a demand killer as it spreads flooding rains among large parts of the U.S. until re-emerging off the East Coast this weekend.

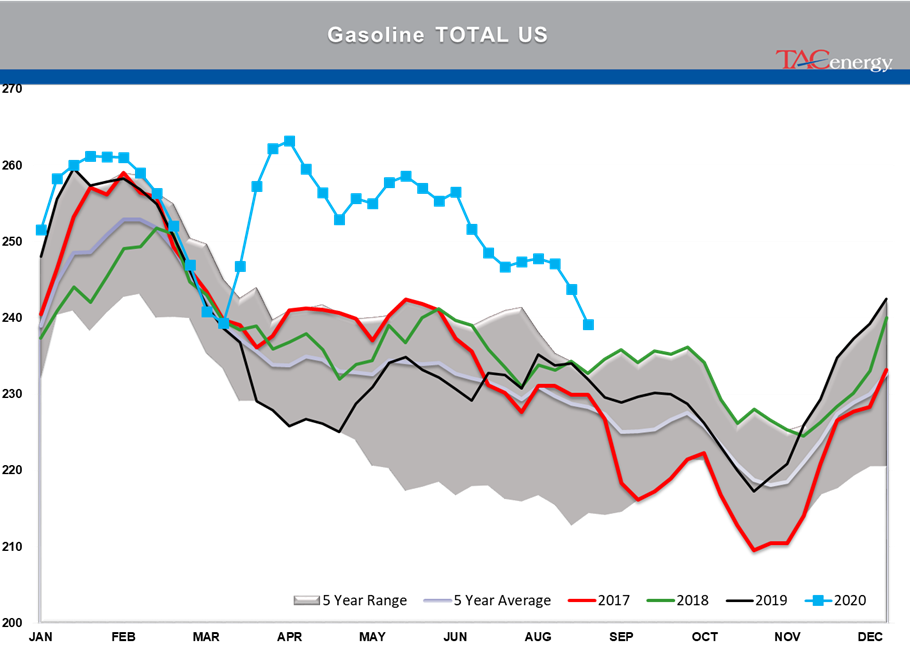

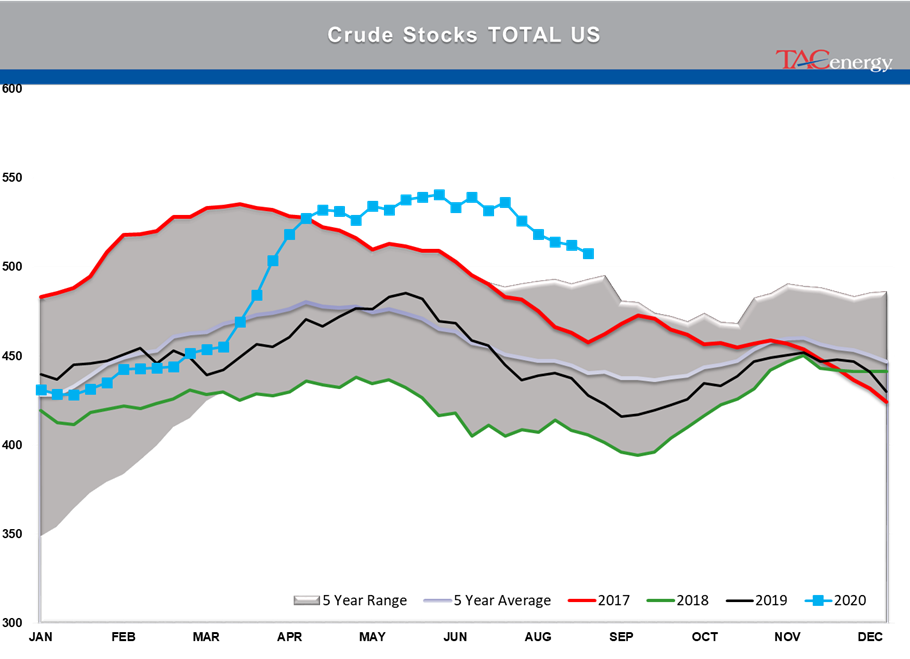

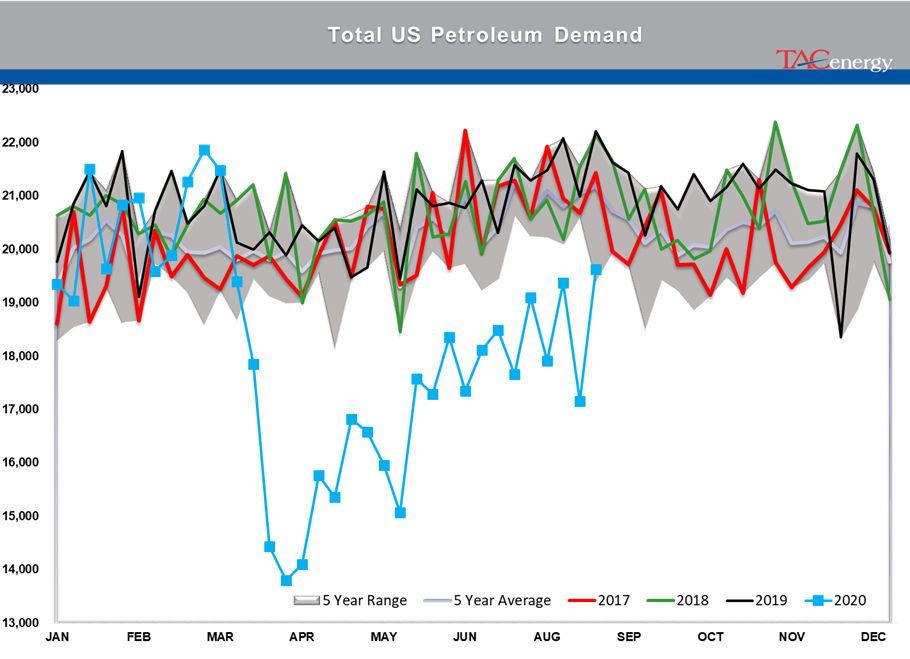

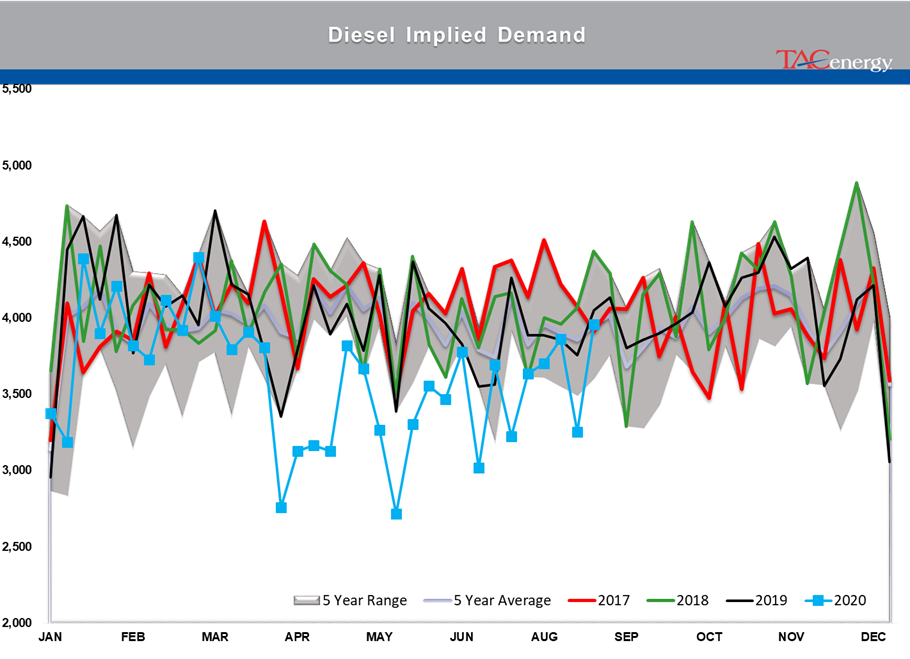

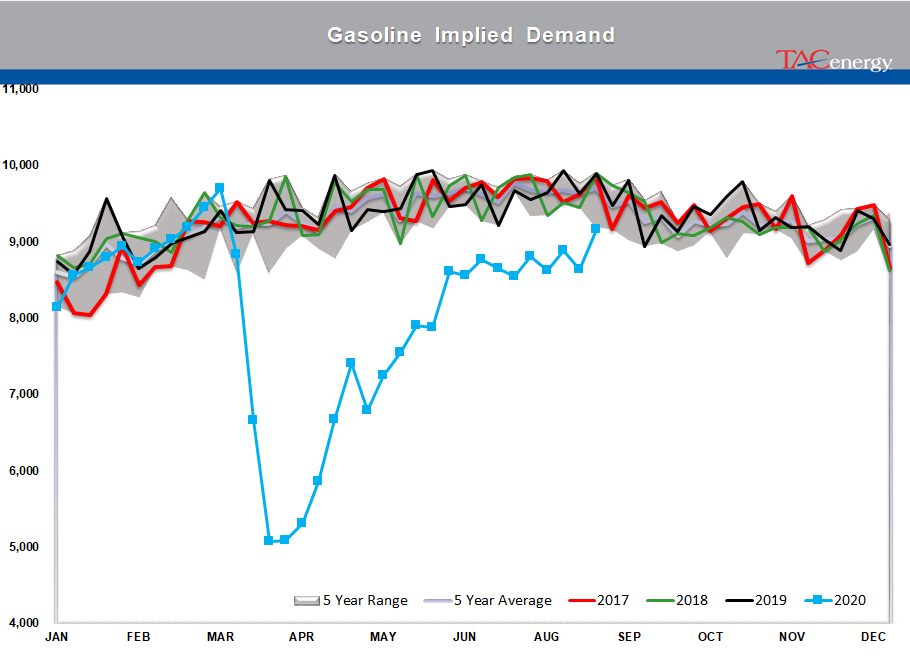

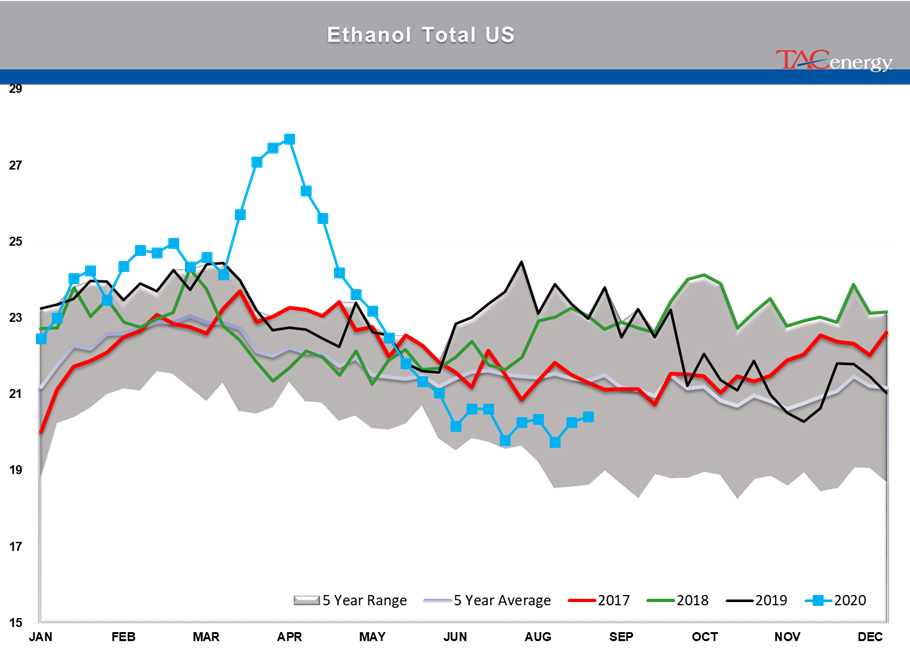

Yesterday’s DOE report was largely ignored due to the focus on the storm, but it did have some good news as demand estimates reached their highest levels since the start of COVID shutdowns, and in some cases demand has returned to the low end of the five year seasonal range.

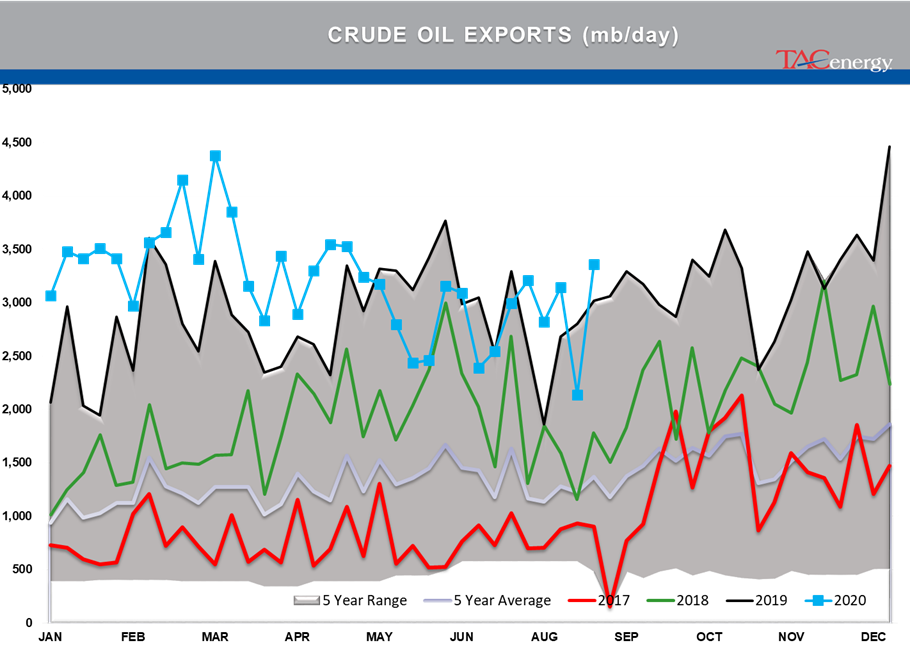

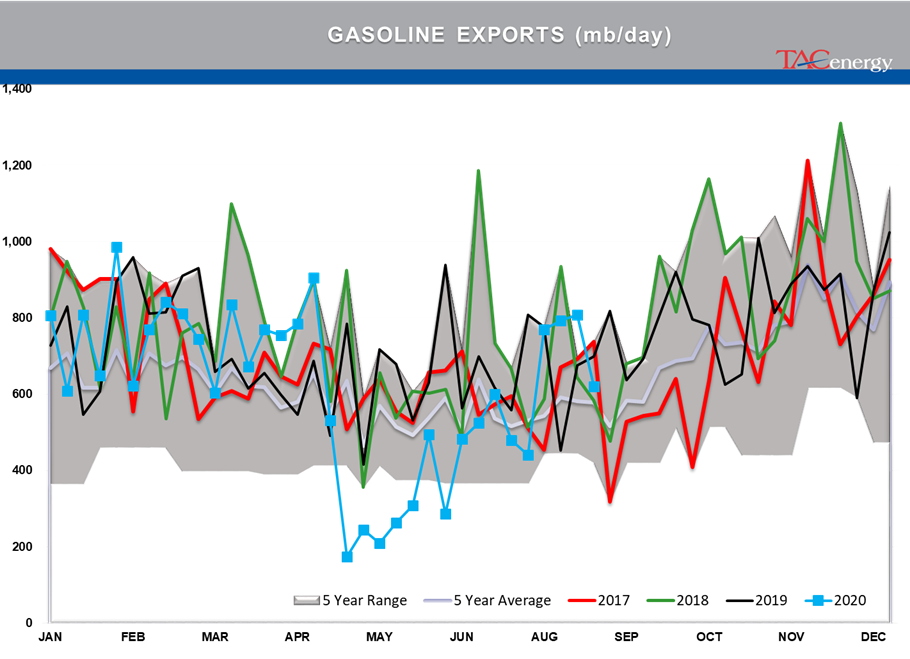

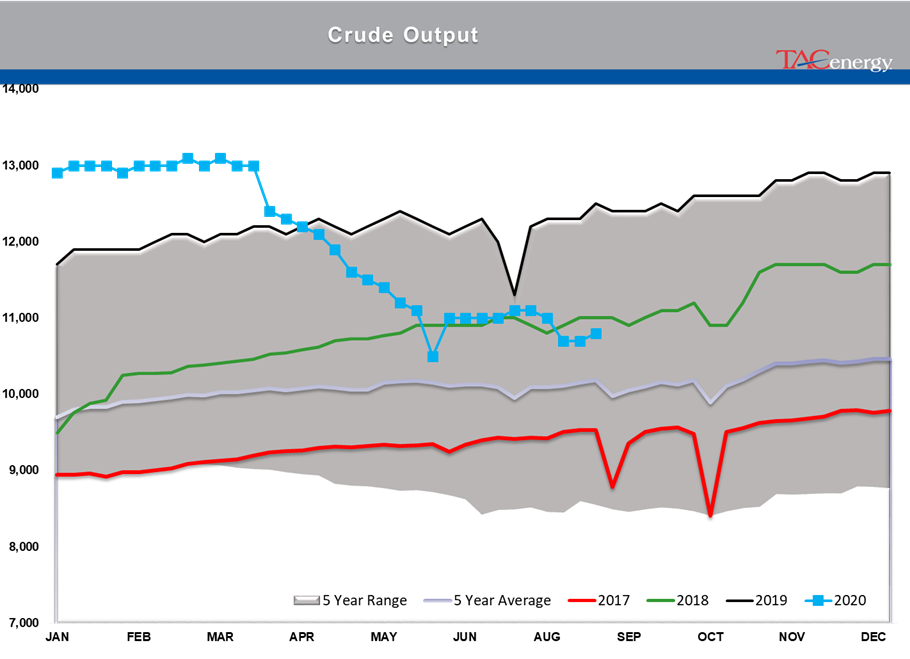

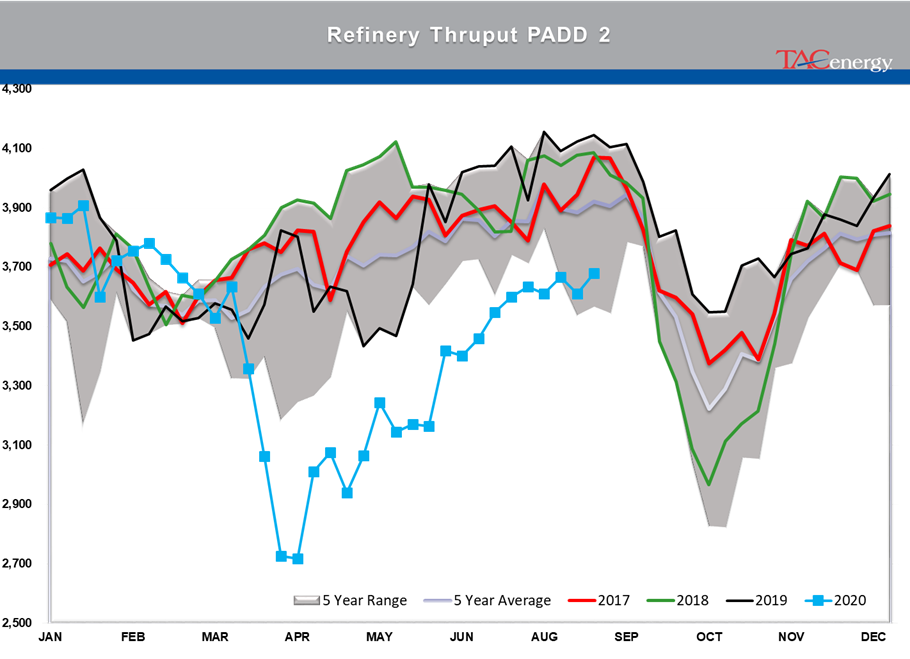

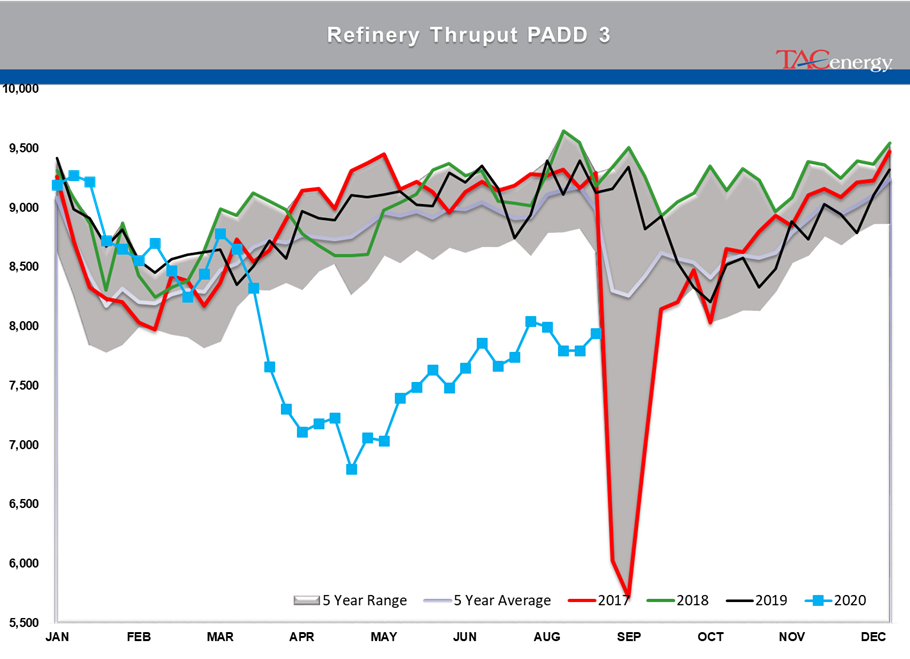

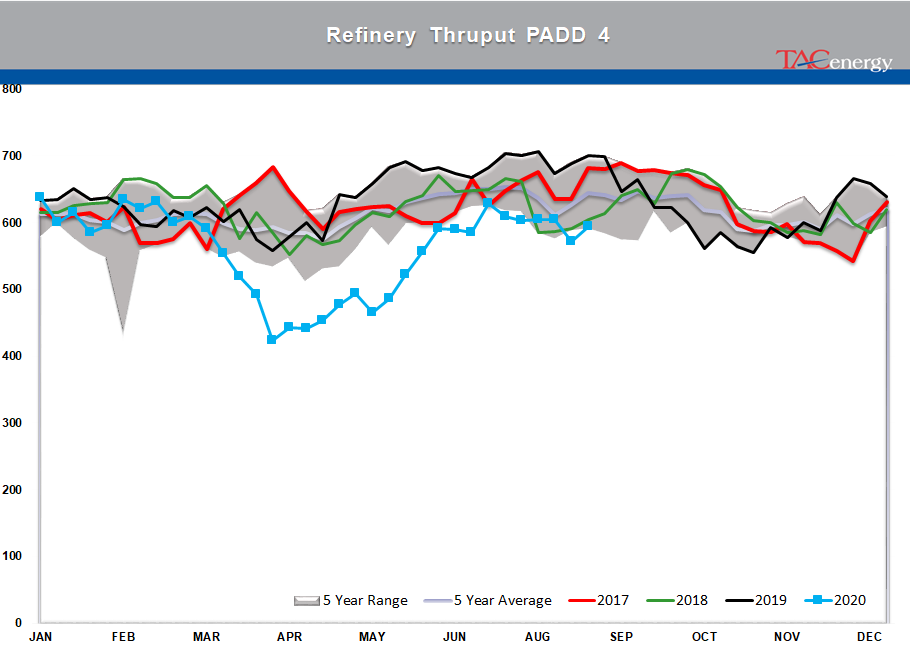

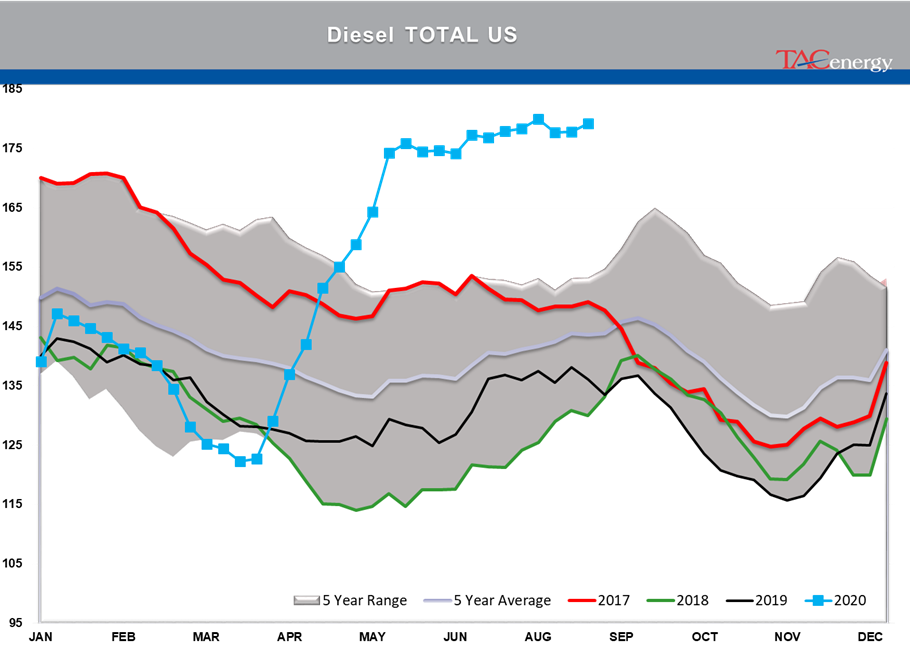

Note the large declines in export volumes and refinery runs in September 2017 in the aftermath of Harvey (red line in the seasonal charts below) and you’ll get a good idea of what next week’s DOE report might look like due to the widespread shutdowns ahead of Laura’s landfall. The difference in the two storms so far is that more plants and ports shut ahead of the storm, which should mean a faster recovery when it moves past barring catastrophic damage.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Gasoline Futures Are Leading The Way Lower This Morning

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Social Media

News & Views

View All

Gasoline Futures Are Leading The Way Lower This Morning

It was a volatile night for markets around the world as Israel reportedly launched a direct strike against Iran. Many global markets, from equities to currencies to commodities saw big swings as traders initially braced for the worst, then reversed course rapidly once Iran indicated that it was not planning to retaliate. Refined products spiked following the initial reports, with ULSD futures up 11 cents and RBOB up 7 at their highest, only to reverse to losses this morning. Equities saw similar moves in reverse overnight as a flight to safety trade soon gave way to a sigh of relief recovery.

Gasoline futures are leading the way lower this morning, adding to the argument that we may have seen the spring peak in prices a week ago, unless some actual disruption pops up in the coming weeks. The longer term up-trend is still intact and sets a near-term target to the downside roughly 9 cents below current values. ULSD meanwhile is just a nickel away from setting new lows for the year, which would open up a technical trap door for prices to slide another 30 cents as we move towards summer.

A Reuters report this morning suggests that the EPA is ready to announce another temporary waiver of smog-prevention rules that will allow E15 sales this summer as political winds continue to prove stronger than any legitimate environmental agenda. RIN prices had stabilized around 45 cents/RIN for D4 and D6 credits this week and are already trading a penny lower following this report.

Delek’s Big Spring refinery reported maintenance on an FCC unit that would require 3 days of work. That facility, along with several others across TX, have had numerous issues ever since the deep freeze events in 2021 and 2024 did widespread damage. Meanwhile, overnight storms across the Midwest caused at least one terminal to be knocked offline in the St. Louis area, but so far no refinery upsets have been reported.

Meanwhile, in Russia: Refiners are apparently installing anti-drone nets to protect their facilities since apparently their sling shots stopped working.

Click here to download a PDF of today's TACenergy Market Talk.

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

The sell-off continues in energy markets. RBOB gasoline futures are now down nearly 13 cents in the past two days, and have fallen 16 cents from a week ago, leading to questions about whether or not we’ve seen the seasonal peak in gasoline prices. ULSD futures are also coming under heavy selling pressure, dropping 15 cents so far this week and are trading at their lowest level since January 3rd.

The drop on the weekly chart certainly takes away the upside momentum for gasoline that still favored a run at the $3 mark just a few days ago, but the longer term up-trend that helped propel a 90-cent increase since mid-December is still intact as long as prices stay above the $2.60 mark for the next week. If diesel prices break below $2.50 there’s a strong possibility that we see another 30 cent price drop in the next couple of weeks.

An unwind of long positions after Iran’s attack on Israel was swatted out of the sky without further escalation (so far anyway) and reports that Russia is resuming refinery runs, both seeming to be contributing factors to the sharp pullback in prices.

Along with the uncertainty about where the next attacks may or may not occur, and if they will have any meaningful impact on supply, come no shortage of rumors about potential SPR releases or how OPEC might respond to the crisis. The only thing that’s certain at this point, is that there’s much more spare capacity for both oil production and refining now than there was 2 years ago, which seems to be helping keep a lid on prices despite so much tension.

In addition, for those that remember the chaos in oil markets 50 years ago sparked by similar events in and around Israel, read this note from the NY Times on why things are different this time around.

The DOE’s weekly status report was largely ignored in the midst of the big sell-off Wednesday, with few noteworthy items in the report.

Diesel demand did see a strong recovery from last week’s throwaway figure that proves the vulnerability of the weekly estimates, particularly the week after a holiday, but that did nothing to slow the sell-off in ULSD futures.

Perhaps the biggest next of the week was that the agency made its seasonal changes to nameplate refining capacity as facilities emerged from their spring maintenance.

PADD 2 saw an increase of 36mb/day, and PADD 3 increased by 72mb/day, both of which set new records for regional capacity. PADD 5 meanwhile continued its slow-motion decline, losing another 30mb/day of capacity as California’s war of attrition against the industry continues. It’s worth noting that given the glacial pace of EIA reporting on the topic, we’re unlikely to see the impact of Rodeo’s conversion in the official numbers until next year.

Speaking of which, if you believe the PADD 5 diesel chart below that suggests the region is running out of the fuel, when in fact there’s an excess in most local markets, you haven’t been paying attention. Gasoline inventories on the West Coast however do appear consistent with reality as less refining output and a lack of resupply options both continue to create headaches for suppliers.