Energy Prices Attempting Move Lower To Begin Penultimate Day of Trading For 2022

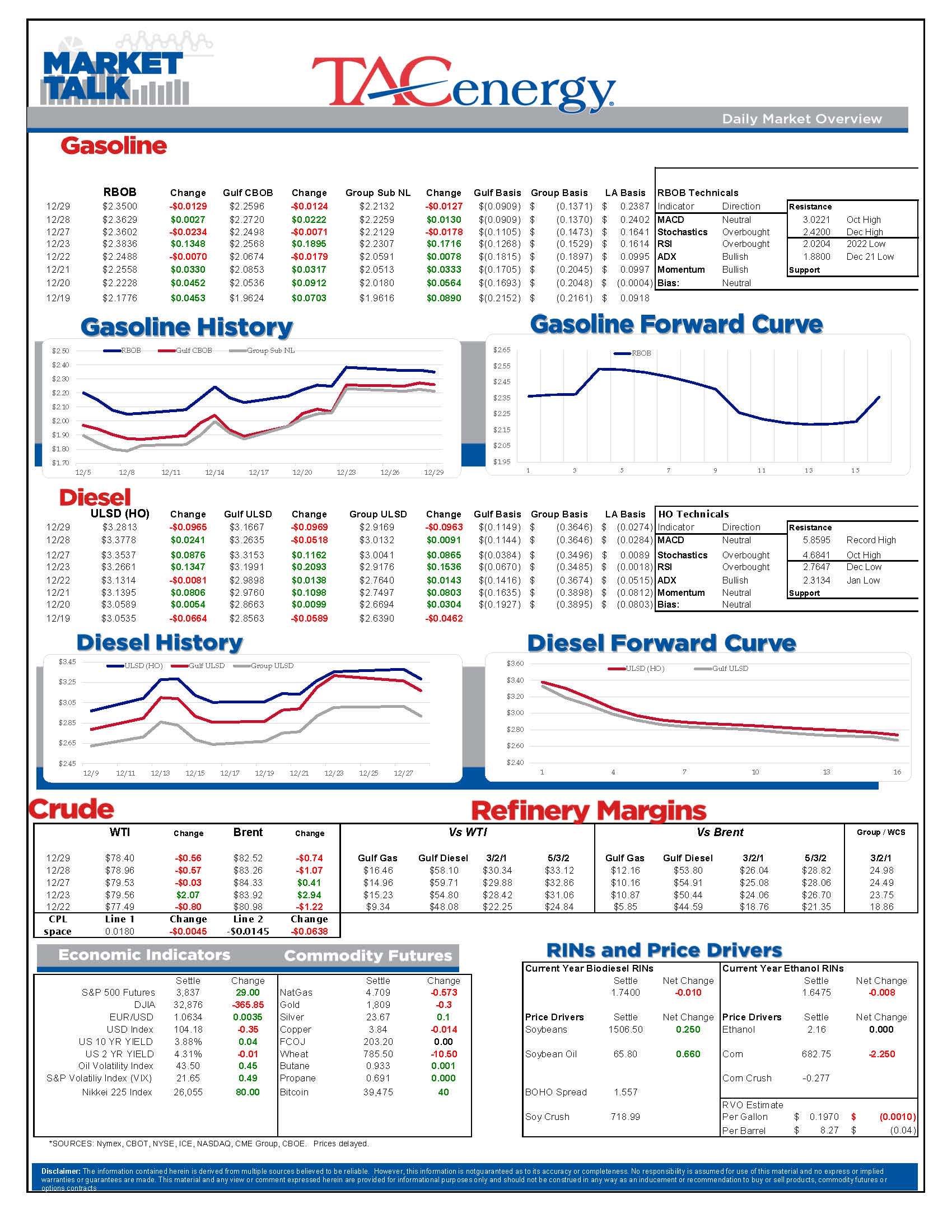

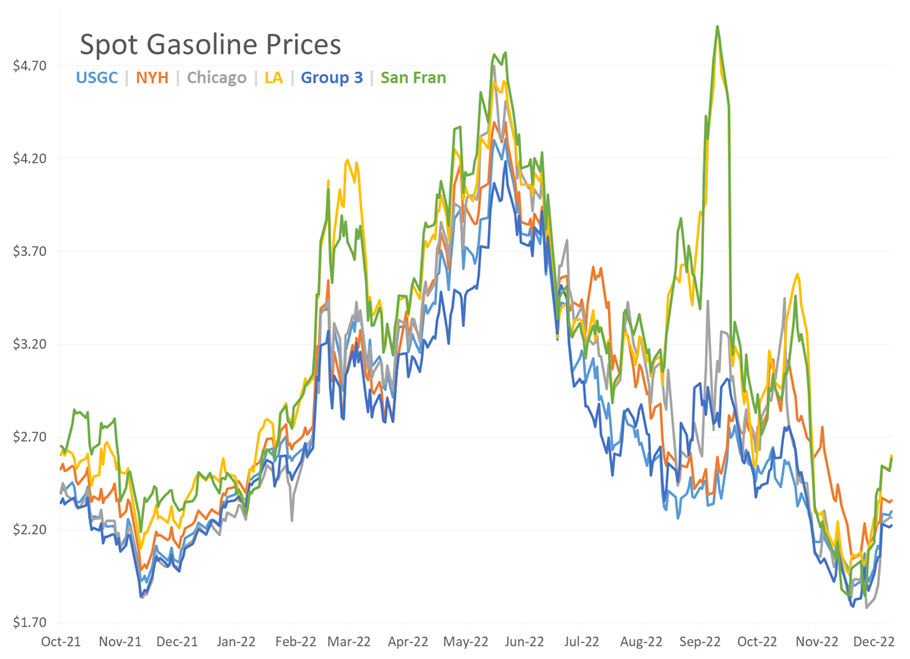

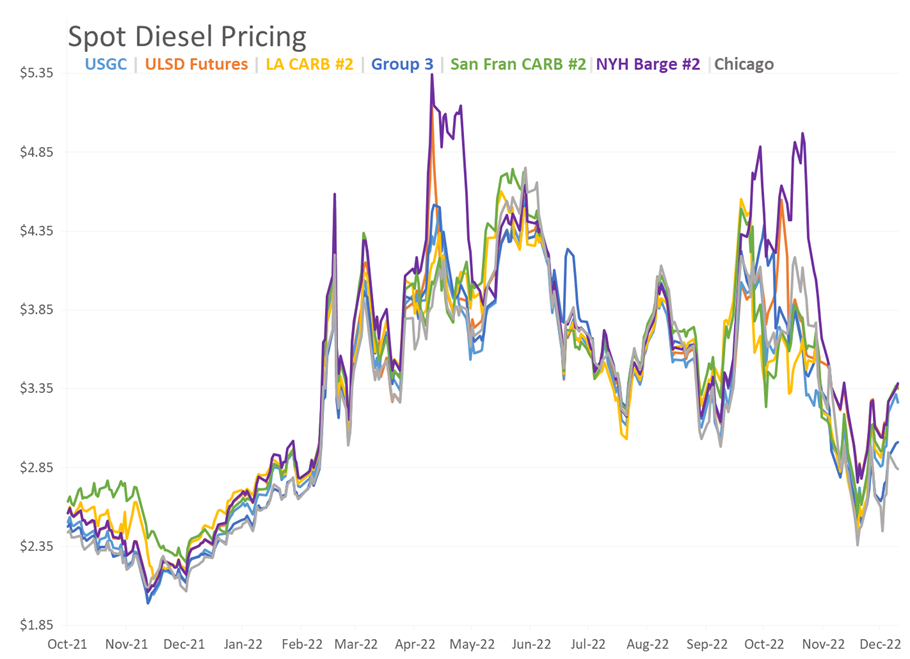

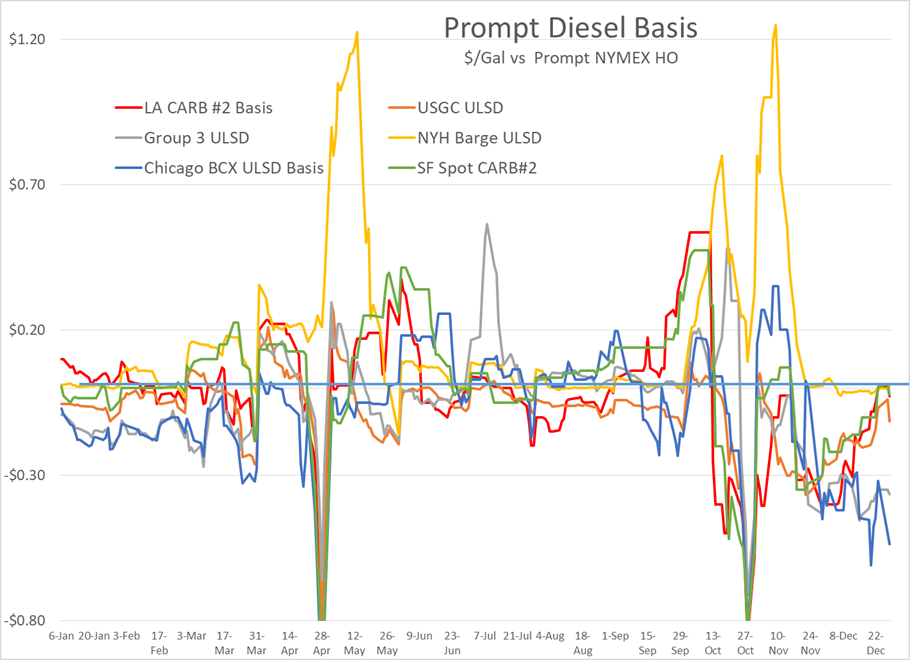

Energy prices are attempting another move lower to begin the penultimate day of trading for 2022. We saw a very similar sell-off happening this time yesterday, only to see a strong rally in the afternoon wipe out those losses. Refinery restarts, weak equity markets and increasing COVID counts in China are all getting credit for the selling over the past couple of days, although it’s unclear what may have prompted yesterday’s buying spree that added 14 cents to diesel prices in just under an hour.

The selling in both futures and cash markets seemed to follow news that the country’s largest refineries along the Gulf Coast were making fast work of restarting units shut by last week’s storm, reducing the chances of significant supply disruptions from that downtime.

While many facilities weathered the storm well, there’s at least one long-term casualty so far. Suncor issued a press release Wednesday saying its Commerce City refinery – the only one in the state of Colorado - would shut completely, most likely for several months, to allow for damage assessments and repairs following multiple fires since the plant was knocked offline last week. The release says full operations are expected by late Q1 2023. The loss of a refinery in the Denver area will max out pipeline resupply options from the Midwest, TX Panhandle and from Wyoming. It would also be a great time to have a refinery 100 miles to the north in Cheyenne, but that facility was converted to RD production 2 years ago when oil refiners were desperate to stay afloat. Given the region isn’t directly tied into any major spot markets, don’t expect this shutdown to have an influence on prices beyond the cities directly impacted.

Remarkably, that shutdown announcement may not have been the worst news of the day for the facility, as the EPA announced it was investigating the state of Colorado for discriminatory air permitting policies, which could make restarting the Suncor facility much more challenging. You may recall the EPA recently made it all but impossible for the St. Croix refinery FKA Hovensa to restart after multiple operational upsets, and it’s not too far-fetched to think the Suncor plant could wind up with a similar fate, particularly given its horrible operating track record over the past couple of years.

The API reported small inventory builds for refined products last week of 510,000 barrels of gasoline and 38,000 barrels of distillates, while oil inventories fell by 1.3 million barrels. Given that products still increased despite the pre-Christmas demand rush, and oil only declined slightly despite the Keystone shutdown and importers avoiding taking oil into Texas to avoid year-end taxes, those figures seem pretty bearish and are likely contributing to the latest sell-off attempt. The DOE/EIA’s weekly report is due out at 10 am central today. Don’t expect to see any impact of the refinery shutdowns in this report as the data was collected for the week ending last Friday, right when the storm’s impact was being felt.

Click here to download a PDF of today's TACenergy Market Talk

Latest Posts

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

Gasoline And Crude Oil Prices Reached Fresh Multi-Month Highs Friday Morning As News Of The Anticipated Attacks Spread

Social Media

News & Views

View All

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Energy markets are sliding lower again to start Wednesday’s trading as demand concerns and weaker stock markets around the world seem to be outweighing any supply concerns for the time being.

Rumors continue to swirl about an “imminent” response by Israel to Iran’s attacks, but so far, no news seems to be taken as good news in the hopes that further escalation can be avoided, even as tensions near the Red Sea and Strait of Hormuz continue to simmer.

Prices to lease space on Colonial’s main gasoline line continue to rally this week, trading north of 11 cents/gallon as Gulf Coast producers still struggle to find outlets for their production, despite a healthy export market. Gulf Coast CBOB is trading at discounts of around 34 cents to futures, while Gulf Coast RBOB is trading around a 16-cent discount, which gives shippers room to pay up for the linespace and still deliver into the East Coast markets at a profit.

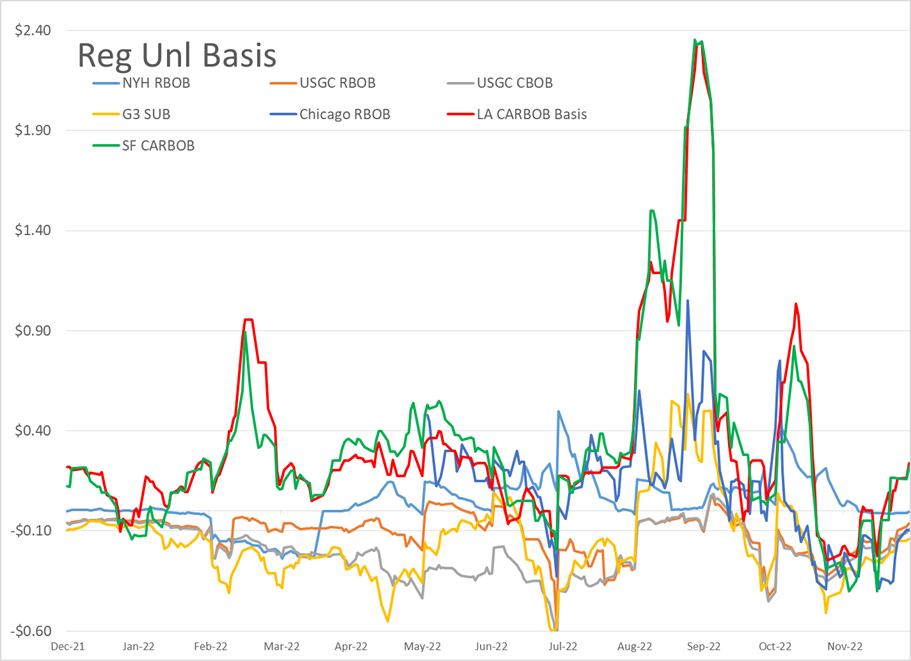

Back to reality, or just the start of more volatility? California CARBOB basis values have dropped back to “only” 40 cent premiums to RBOB futures this week, as multiple flaring events at California refineries don’t appear to have impacted supply. The state has been an island for fuel supplies for many years as its boutique grades prevent imports from neighboring states, and now add the conversion of the P66 Rodeo refinery to renewable diesel production and the pending changes to try and cap refinery profits, and it’s easier to understand why these markets are increasingly vulnerable to supply shocks and price spikes on gasoline.

RIN prices continue to fall this week, touching 44 cents/RIN for D4 and D6 values Tuesday, their lowest level in 6 weeks and just about a nickel above a 4-year low. While the sharp drop in RIN and LCFS values has caused several biodiesel and Renewable Diesel producers to either shut down or limit production, the growth in RIN generation continues thanks to projects like the Rodeo refinery conversion, making the supply in RINs still outpace the demand set by the Renewable Fuel Standard by a wide margin.

The API reported draws in refined products, 2.5 million barrels for gasoline and 427,000 barrels for distillates, while crude oil stocks had an estimated build of more than 4 million barrels. The DOE’s weekly report is due out at its normal time this morning.

Click here to download a PDF of today's TACenergy Market Talk.

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

It’s a mixed bag for energy markets to start Tuesday’s session with gasoline prices holding small gains, while oil and diesel prices show small losses as the world anxiously debates what comes next in the conflict, we’re still hoping we don’t have to call a war in the Middle East.

An early sell-off picked up steam Monday morning with refined products down more than a nickel for a few minutes, before reports that Israel was vowing to respond to Iran’s attack seemed to encourage buyers step back in an erase most of the losses for the day.

Equity markets have been pulling back sharply in recent days as inflation and trade concerns inject a sense of reality into stocks that had been flying high earlier in the year. The correlation between gasoline and crude oil prices had been fairly strong for the past couple of months but has since weakened as the weakness in stocks hasn’t yet trickled over into the energy arena. Both asset classes are seeing a tick higher in their volatility (aka Fear) indices this week however, and when fear starts driving the trade, we often see these prices move together.

Diesel has been underperforming the rest of the energy complex for most of the year so far, and those hoping for lower diesel prices got more good news when the Dangote refinery in Nigeria began loading diesel for domestic use Monday, in the latest milestone for the giant project that will have a major influence on Atlantic basin supply. Naturally, local lawmakers are already complaining that the refinery’s prices are too high.

The EIA this morning highlighted the record amount of crude oil China imported in 2023 after reopening the country post-COVID and after completing numerous new refinery builds in the past few years. Russia accounted for the largest increase in shipments to China last year, as China is one of the few countries that doesn’t mind ignoring sanctions. Speaking of which, the US House is expected to take up a new vote this week on sanctioning Chinese imports of Iranian crude, which the EIA notes are often hidden by relabeling the crude to make it appear as if it originated in Malaysia, Oman or the UAE.

We’re just 2 weeks away from the startup of Canada’s long-awaited Transmountain pipeline expansion that will bring roughly 600,000 barrels/day of capacity to the Pacific basin. That new outlet is great news for Canadian producers long restricted by takeaway capacity, and bad news for Midcontinent refiners who have grown accustomed to the discounted Canadian grades. A Bloomberg article Monday noted that Iraq’s Basrah Heavy crude is most likely to be displaced by West Coast US refiners who can now buy much closer to home.

Click here to download a PDF of today's TACenergy Market Talk.