Downside Pressure On The Petroleum Complex

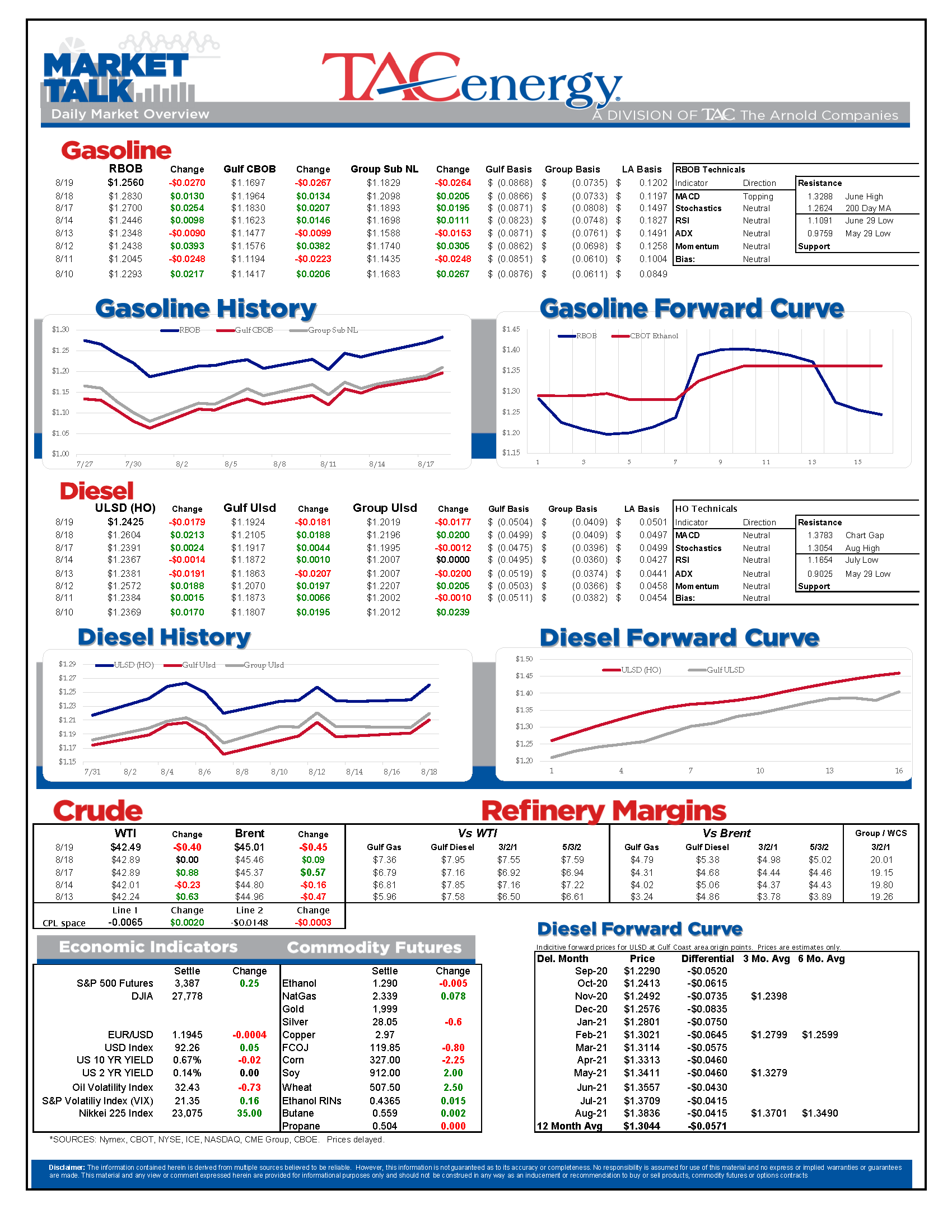

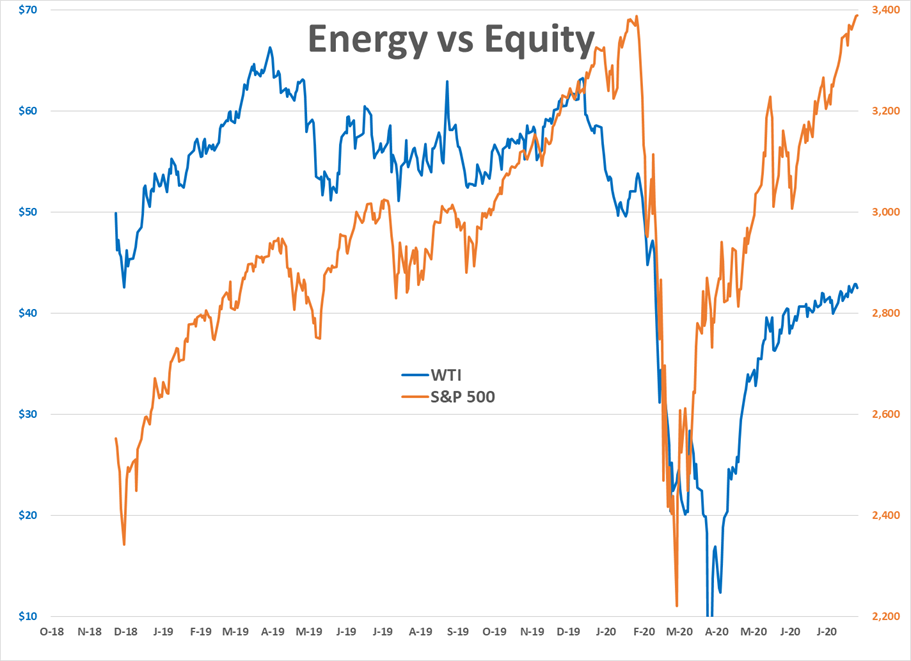

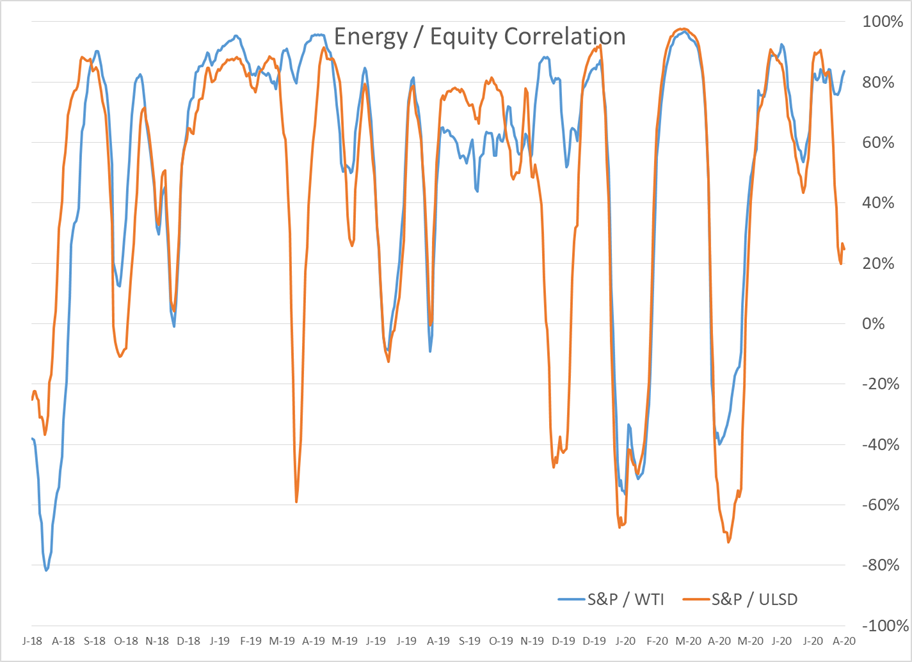

Yet another rally in energy futures has failed to sustain itself as prices start Wednesday’s session in the red, leaving prices stuck back in their sideways pattern, even as the S&P 500 rallies to new all-time highs this week.

The API was said to report a build in gasoline stocks last week of nearly five million barrels, which seemed to put immediate downside pressure on the entire petroleum complex that carried through the overnight session, even though crude and diesel stocks were estimated to have draws on the week of 4.3 and one million barrels, respectively. The DOE’s weekly report is due out at its normal time this morning.

As mentioned yesterday, both WTI and RBOB futures were looking toppy as they failed to break through the top end of their summer ranges, leaving them susceptible to a larger round of selling that could test the $40 mark for WTI and $1.16 for RBOB in short order.

OPEC & Friends are meeting today, but there’s a lack of chatter on new output quotas, with reports that the Saudi’s are more concerned with the cheaters in the group than making a new deal.

Colonial pipeline is still working to repair and re-open its main gasoline line that’s been shut for almost five days following a leak. While no specific timeline has been given, pipeline schedules and muted price action for both physical and futures contracts suggests they remain on track for reopening in the next few days. Allocations in markets north of the leak remain restricted as suppliers protect their contract accounts, but physical outages are not yet being reported.

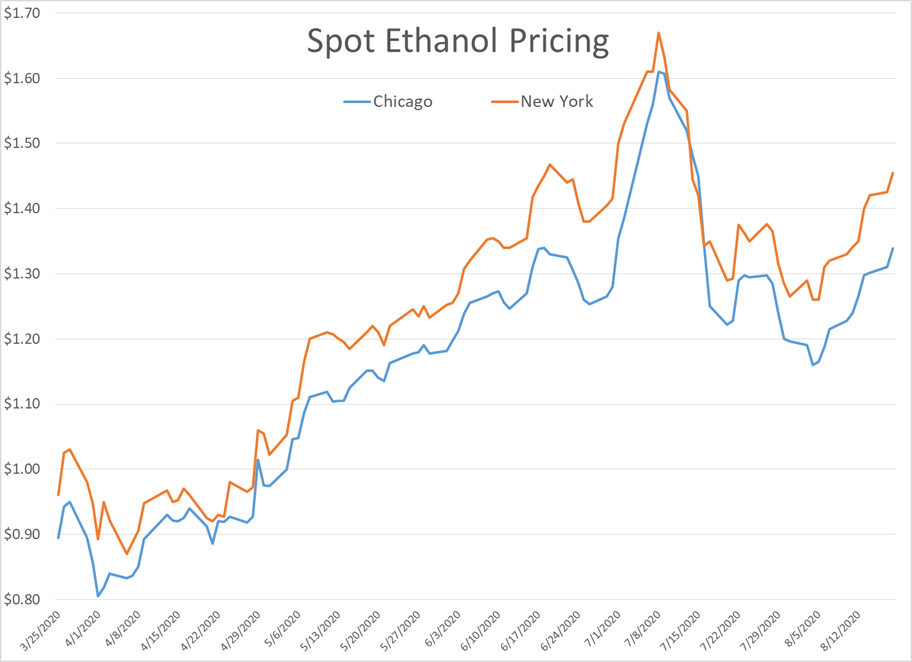

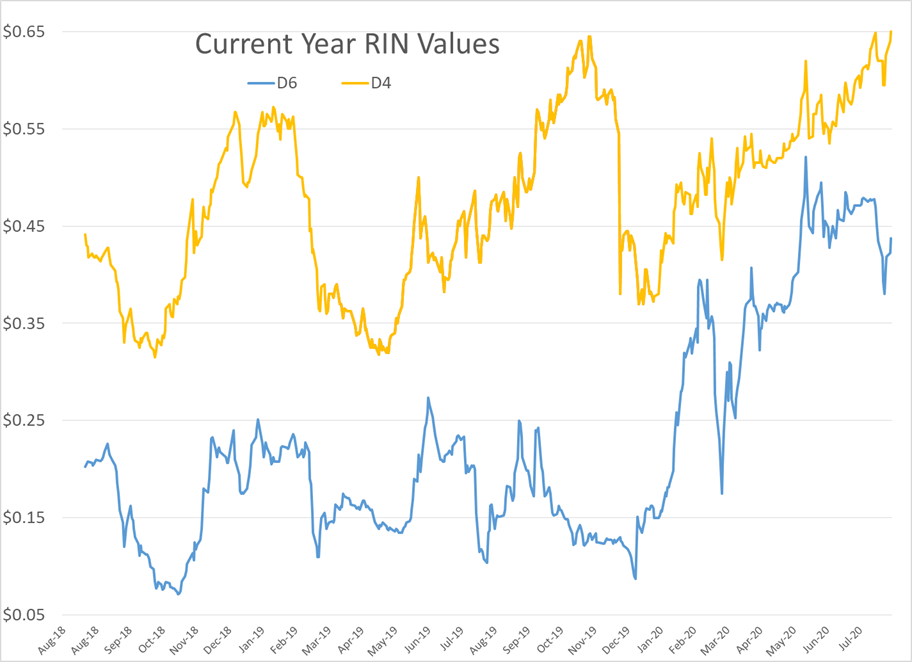

RINs continued to rally Tuesday, pushing D4 RINs to a 2.5 year high, after the President promised to talk to the EPA about small refinery exemptions during a trip to Iowa to survey the extensive fallout of last week’s derecho. The storms have damaged nearly half of the state’s crop, and sent ethanol prices rallying along with corn and soybean prices.

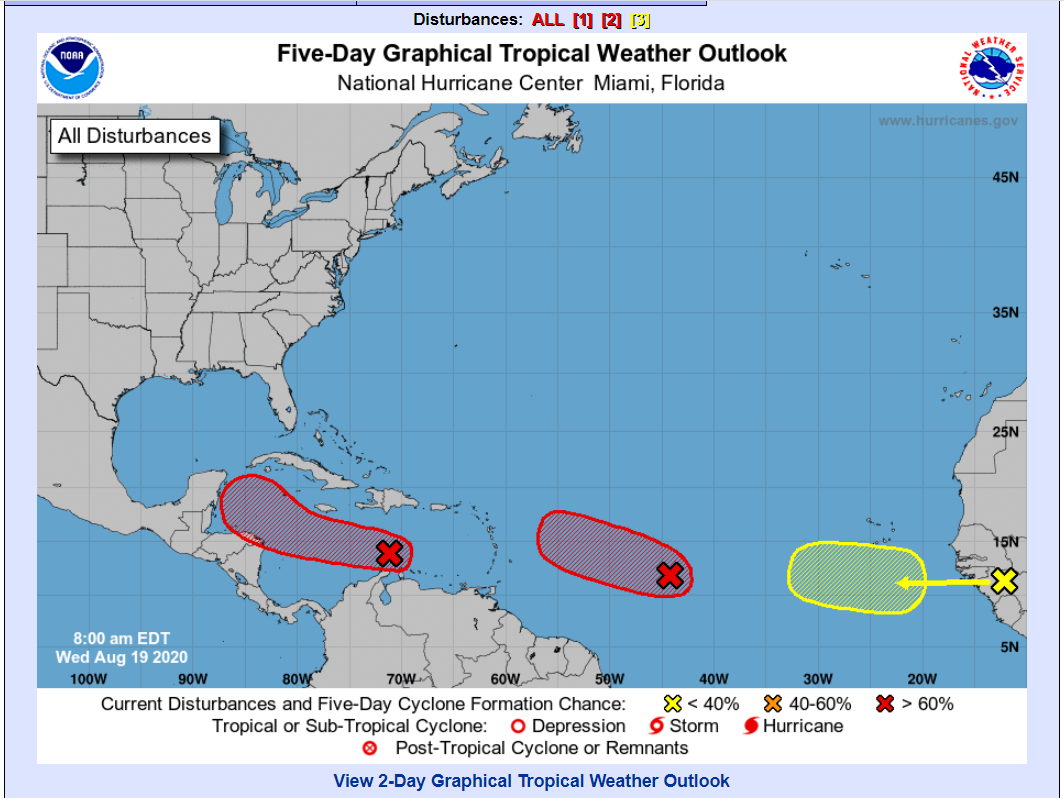

Speaking of storms, the NHC still favors two new names storms developing in the Atlantic basin over the next five days, both of which still have some potential to threaten the U.S. Coasts. The first system in line could potentially be a gulf coast threat if it can get past the Yucatan peninsula, and the second looks like it could be heading towards Florida next week. The names of these storms will depend on which develops first. There’s a third potential system coming right behind these two, and as we near the peak of this record-setting season, it’s likely we’ll see new potential systems 1-2 times per week as tropical waves move off the west coast of Africa.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Gasoline Futures Are Leading The Way Lower This Morning

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Social Media

News & Views

View All

Gasoline Futures Are Leading The Way Lower This Morning

It was a volatile night for markets around the world as Israel reportedly launched a direct strike against Iran. Many global markets, from equities to currencies to commodities saw big swings as traders initially braced for the worst, then reversed course rapidly once Iran indicated that it was not planning to retaliate. Refined products spiked following the initial reports, with ULSD futures up 11 cents and RBOB up 7 at their highest, only to reverse to losses this morning. Equities saw similar moves in reverse overnight as a flight to safety trade soon gave way to a sigh of relief recovery.

Gasoline futures are leading the way lower this morning, adding to the argument that we may have seen the spring peak in prices a week ago, unless some actual disruption pops up in the coming weeks. The longer term up-trend is still intact and sets a near-term target to the downside roughly 9 cents below current values. ULSD meanwhile is just a nickel away from setting new lows for the year, which would open up a technical trap door for prices to slide another 30 cents as we move towards summer.

A Reuters report this morning suggests that the EPA is ready to announce another temporary waiver of smog-prevention rules that will allow E15 sales this summer as political winds continue to prove stronger than any legitimate environmental agenda. RIN prices had stabilized around 45 cents/RIN for D4 and D6 credits this week and are already trading a penny lower following this report.

Delek’s Big Spring refinery reported maintenance on an FCC unit that would require 3 days of work. That facility, along with several others across TX, have had numerous issues ever since the deep freeze events in 2021 and 2024 did widespread damage. Meanwhile, overnight storms across the Midwest caused at least one terminal to be knocked offline in the St. Louis area, but so far no refinery upsets have been reported.

Meanwhile, in Russia: Refiners are apparently installing anti-drone nets to protect their facilities since apparently their sling shots stopped working.

Click here to download a PDF of today's TACenergy Market Talk.

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

The sell-off continues in energy markets. RBOB gasoline futures are now down nearly 13 cents in the past two days, and have fallen 16 cents from a week ago, leading to questions about whether or not we’ve seen the seasonal peak in gasoline prices. ULSD futures are also coming under heavy selling pressure, dropping 15 cents so far this week and are trading at their lowest level since January 3rd.

The drop on the weekly chart certainly takes away the upside momentum for gasoline that still favored a run at the $3 mark just a few days ago, but the longer term up-trend that helped propel a 90-cent increase since mid-December is still intact as long as prices stay above the $2.60 mark for the next week. If diesel prices break below $2.50 there’s a strong possibility that we see another 30 cent price drop in the next couple of weeks.

An unwind of long positions after Iran’s attack on Israel was swatted out of the sky without further escalation (so far anyway) and reports that Russia is resuming refinery runs, both seeming to be contributing factors to the sharp pullback in prices.

Along with the uncertainty about where the next attacks may or may not occur, and if they will have any meaningful impact on supply, come no shortage of rumors about potential SPR releases or how OPEC might respond to the crisis. The only thing that’s certain at this point, is that there’s much more spare capacity for both oil production and refining now than there was 2 years ago, which seems to be helping keep a lid on prices despite so much tension.

In addition, for those that remember the chaos in oil markets 50 years ago sparked by similar events in and around Israel, read this note from the NY Times on why things are different this time around.

The DOE’s weekly status report was largely ignored in the midst of the big sell-off Wednesday, with few noteworthy items in the report.

Diesel demand did see a strong recovery from last week’s throwaway figure that proves the vulnerability of the weekly estimates, particularly the week after a holiday, but that did nothing to slow the sell-off in ULSD futures.

Perhaps the biggest next of the week was that the agency made its seasonal changes to nameplate refining capacity as facilities emerged from their spring maintenance.

PADD 2 saw an increase of 36mb/day, and PADD 3 increased by 72mb/day, both of which set new records for regional capacity. PADD 5 meanwhile continued its slow-motion decline, losing another 30mb/day of capacity as California’s war of attrition against the industry continues. It’s worth noting that given the glacial pace of EIA reporting on the topic, we’re unlikely to see the impact of Rodeo’s conversion in the official numbers until next year.

Speaking of which, if you believe the PADD 5 diesel chart below that suggests the region is running out of the fuel, when in fact there’s an excess in most local markets, you haven’t been paying attention. Gasoline inventories on the West Coast however do appear consistent with reality as less refining output and a lack of resupply options both continue to create headaches for suppliers.