Big Swings Overnight Driven By Compromise News

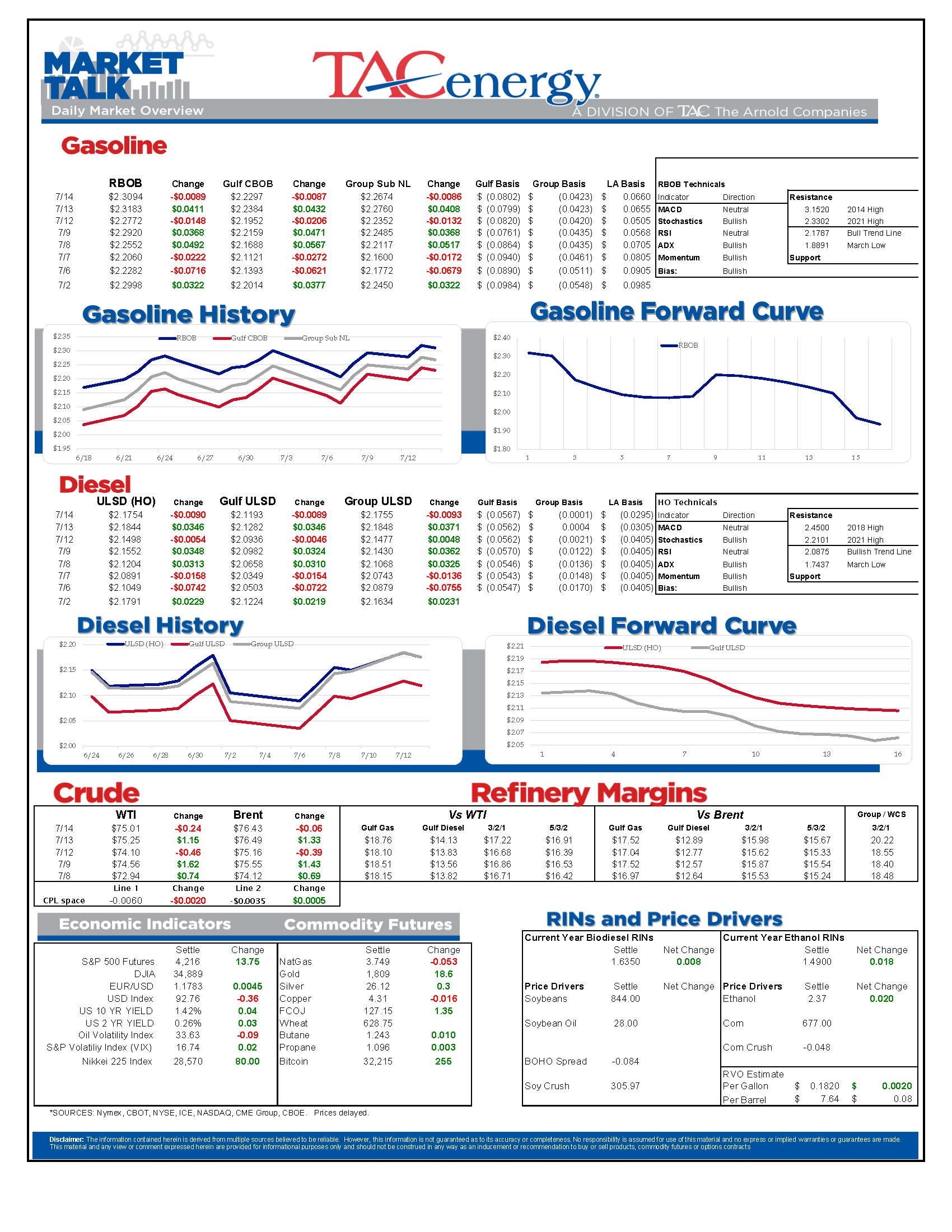

It looks like a quiet morning for energy futures that are holding near break-even for the day, and still hovering close to 6 year highs. Don’t be fooled into thinking the market isn’t still volatile however, as the current values don’t show that refined products dropped 4 cents overnight (wiping out Monday’s 3-4 cent gains) only to bounce back violently to erase those losses in a span of just about 20 minutes shortly after 6 a.m. central. For now, the charts continue to favor higher prices with the 8-month-old bull trend intact, but we’ll need to see last week’s highs taken out before month end or there’s a good chance that a big correction lower will come soon.

The big swings overnight appear to be driven by news that Saudi Arabia and the UAE have reached a compromise, which should eventually bring more oil to market. The eventually piece may be what encouraged buyers to step back in so quickly as the new output – IF the deal is confirmed - isn’t likely to come online for several more months.

As has become the pattern of late, the API reported another large draw in oil inventories last week at 4 million barrels. Gasoline stocks were also estimated to be lower, by 1.5 million barrels, but distillates increased by nearly 4 million barrels, which helps explain ULSD futures seeing the most downward pressure overnight. The EIA’s weekly report is due out at its normal time this morning. Last week’s report saw an all-time record for the gasoline demand estimate, which coincided with the pre-holiday rush now that most people are back to moving about. There’s evidence on the ground of a substantial holiday hangover with retail volumes dropping last week, but it’s hard to say if that will translate to the official numbers which only measure product removed from the bulk system.

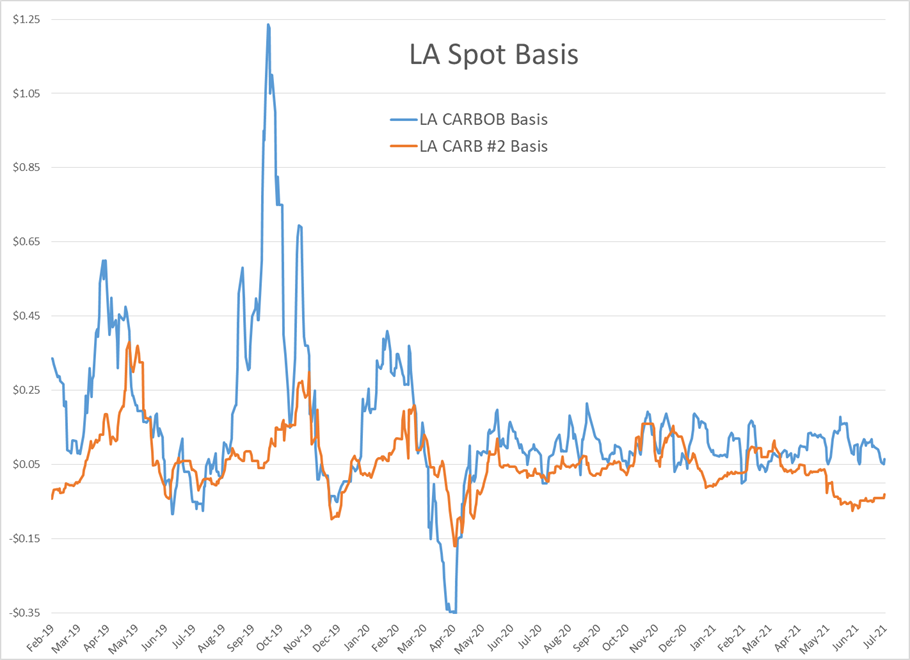

EIA prophecy? Monday the EIA highlighted its Southern California Daily Energy report, (which is ominously published at eia.gov/special/disruptions/summer/) and then Tuesday a refinery near Los Angeles was reportedly forced to shut most of its units due to a power failure. That news sparked a modest rally in LA spot diesel basis, which had been languishing in negative territory for the past 2 months. So far the moves are relatively minor, just a penny or two, nothing like the wild swings the LA Spot market has been used to in years past, but have gone dormant over the past year. (See chart below)

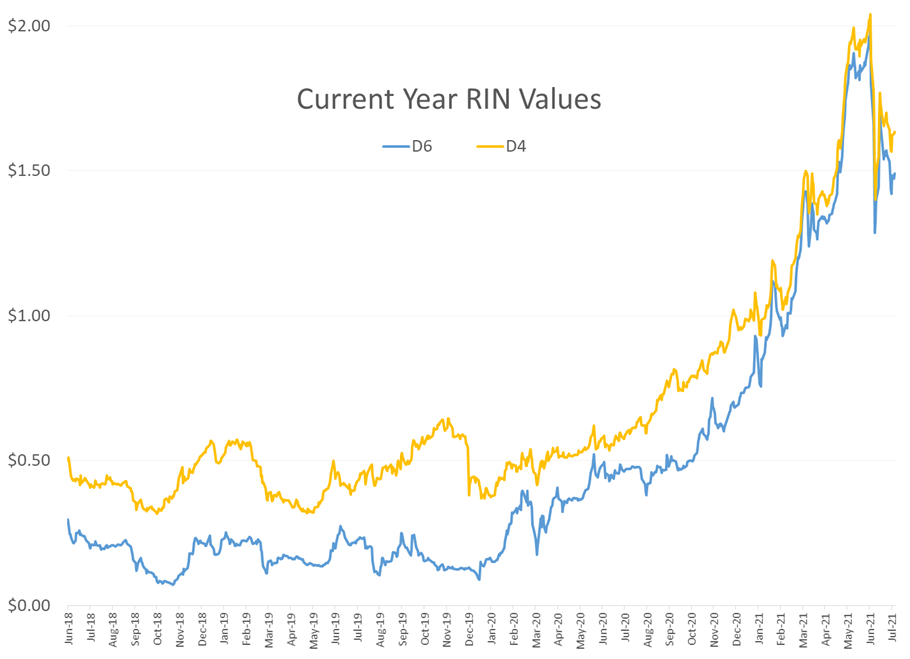

Caught short: A violent spike in corn prices had RINs rallying early in Tuesday’s session, but quickly gave up those gains when the grain rally proved short lived. It appears someone may have got caught short on the expiring July corn contract, which were up 80 cents (nearly 12%) at one point before giving up almost all of those gains later in the session, while the forward contracts did not move much at all. Not sure what that means? Think back to when crude went negative last April on the day before the May contract expired…it’s just like that, just less extreme and in reverse.

More big news in the Carbon markets this week. The EU is set to release 13 policies today aimed at combating climate change this decade. The centerpiece is an expansion of the Emissions Trading Scheme (their word not mine). China meanwhile is launching the world’s largest Emissions-Trading program this week, which sounds impressive but also makes sense because they’re the world’s largest carbon emitter. Not sure what these various programs mean or how they work? You’re not alone, the segmentation in this rapidly expanding and evolving space is creating plenty of confusion, and like we saw in with the Renewable Fuel Standard, will likely attract plenty of fraudsters making up fake credits.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

Social Media

News & Views

View All

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

The sigh of relief selloff continues in energy markets Tuesday morning, with gasoline prices now down more than 20 cents in 7 sessions, while diesel prices have dropped 26 cents in the past 12. Crude oil prices are within a few pennies of reaching a 1 month low as a lack of headlines from the world’s hot spots allows some reflection into the state of the world’s spare capacity for both oil and refined products.

Gasoline prices are trading near a 6-week low this morning, but still need to fall about another nickel in order to break the weekly trendline that pushed prices steadily higher since December. If that trend breaks, it will be safer to say that we saw the end of the spring gasoline rally on April 12th for the 2nd year in a row. Last year RBOB futures peaked on April 12 at $2.8943 and bottomed out on May 4th at $2.2500. The high (at this point) for this year was set on April 12th at $2.8516, and the low overnight was $2.6454.

It’s not just energy commodities that are seeing an unwind of the “flight to safety” trade: Gold prices had their biggest selloff in 2 years Monday and continue to point lower today. Just how much money poured into commodities in the weeks leading up to the direct confrontation between Israel and Iran is unclear, but we have seen in year’s past that these unwind-events can create a snowball effect as traders can be forced to sell to cover their margin calls.

Supply > Demand: The EIA this morning highlighted the record setting demand for natural gas in the US last year, which was not nearly enough to offset the glut of supply that forced prices to a record low in February. A shortage of natural gas in Europe was a key driver of the chaotic markets that smashed just about every record in 2022, and an excess of natural gas supply in Europe and the US this year is acting as a buffer, particularly on diesel prices.

The struggle for renewable producers continues as a rapid influx of supply and crashing credit prices make Biodiesel, RD and SAF unprofitable for many. In addition to the plant closures announced in the past 6 months, Vertex Energy reported Monday it’s operating its Renewable Diesel facility in Mobile AL at just 50% of capacity in Q1. The truly scary part for many is that the $1/gallon Blender's tax credit ends this year and is being replaced by the “Clean” Fuel production credit that forces producers to prove their emissions reductions in order to qualify for an increased subsidy. It’s impossible to say at this point how much the net reduction will be for domestic producers, but importers will get nothing, and at current CI values, many biodiesel producers may see their “blend credit” cut by more than half.

Click here to download a PDF of today's TACenergy Market Talk.